ServiceNow, Inc. – An astonishing business I would love to own

ServiceNow might be one of the best businesses globally, delivering Rule of 50 numbers year after year. Does perfection exist? ServiceNow comes pretty close.

Thank you for reading Rijnberk InvestInsights!

For all of you reading this through e-mail, did you know we also have an active subscriber chat [FREE]?

In this chat, we post regular updates throughout the week, like standout news items, with plenty of room for discussion and questions from all of you!

Definitely go check it out, and feel free to ask me anything there! Don’t miss out on these daily subscriber features!

If there is one business that has executed flawlessly in recent years, it is, without a doubt, enterprise software leader ServiceNow.

Really, this is an astonishing business.

For years, this best-in-class SaaS business has been firing on all cylinders. It has grown rapidly and is now one of the most dominant enterprise software businesses globally, with a $200+ billion market cap and showing no signs of slowing down.

Notably, since early 2019, the company hasn’t missed either the top or bottom-line consensus in any quarter, consistently outperforming the street’s expectations. Despite its tremendous track record, Wall Street continues to underestimate this business.

ServiceNow has been consistently delivering some of the most impressive financial metrics out there in recent years. Proving the rather insane quality of this business, consider the following:

Over the last 5 years, it has grown revenue at a 30%+ CAGR.

YoY revenue growth hasn’t dropped below 20% in any quarter over the last decade, including the COVID-19 pandemic and hyperinflation combined with tight IT budgets in recent years.

Neither has it ever seen a single quarter of negative sequential growth.

Close to 100% of this revenue comes from recurring subscriptions

The renewal rate is consistently over 98%, with a net retention rate well over 100% and, in most quarters, in excess of 120%, thanks to significant cross-selling and usage growth.

ROE has consistently been in the high-teens to high-twenties.

The company is rapidly becoming more profitable. Whereas it reported a net income margin of -30% in 2016, this increased to 4% in 2021 and 19.3% in 2023.

Its FCF margin has consistently remained at 30% in the last four years, which, combined with minimal growth of 20% year over year in any given year, makes it a consistent Rule of 40 business!

This is probably as good as metrics get, to be honest. Convinced of its quality and appeal yet?

Well, there is more, as ServiceNow also has ample room to continue growing rapidly well into the next decade, thanks to the significant growth expected for its respective enterprise software markets, ranging from a low teens to high teens CAGR through the end of the decade.

Thanks to its broad platform offering and great global penetration, the company already holds either the #1 or #2 position in each of its targeted markets and is still gaining market share. Thus, it is perfectly positioned to fully benefit from and even outpace this underlying industry growth.

I mean, the company has been defying the rule of large numbers for years now, and driven by the dynamics explained above, analysts expect it to keep this up, maintaining top-line growth of above 20% in the 3-4 years ahead, which is absolutely sublime.

At this point, in my humble opinion, there is no arguing against the fact this business is probably the highest-quality pure-play SaaS company out there today.

It is no surprise that shares have far outperformed over the last decade, returning close to 300% over the last five years and a whopping 1550% over the last ten years.

Anyone should want to own shares in this company. But… is now a good time to buy them?

To answer this question, let me introduce you to the business in greater detail, dive into its latest financial results, and consider its growth prospects.

In order to know if something is a good investment, we should first understand it!

This is ServiceNow!

ServiceNow, headquartered in Santa Clara, California, is a globally renowned SaaS (Software as a Service) leader specializing in enterprise cloud platforms that streamline and automate enterprise workflows.

ServiceNow offers its services through a single flagship product: the Now platform. This comprehensive solution allows businesses to manage digital workflows across IT, employee, customer, and creator workflows.

The company is most well-known for its IT Service Management (ITSM) and IT Operations Management (ITOM) solutions, which help streamline IT processes, manage service requests, and ensure system reliability. In other words, through ServiceNow’s Now platform, customers can manage a big chuck of their IT stack through a single platform, with, for example, its employee-aimed services designed to improve employee experiences by automating HR service delivery, managing onboarding processes, and streamlining workplace services, and its low-code no-code development tools allowing organizations to create custom applications tailored to their unique needs.

Its portfolio of services is broad, but it all targets the IT stack of businesses, ranging from employee services to optimizing customer service operations. In key, leveraging automation and AI-driven insights, the platform streamlines repetitive tasks such as ticket management, service requests, and data processing, lowering labor costs and boosting productivity for its users. Predictive analytics and proactive issue resolution further help organizations avoid costly downtime and improve resource utilization.

The Now platform consolidates multiple disconnected tools that require extensive manual effort into a single, unified system, reducing the need for multiple software licenses and minimizing maintenance overhead. In other words, the Now platform should allow businesses to save money compared to traditional solutions, replacing fragmented, manual, and inefficient processes with an integrated, automated solution.

I hope you can see how this is extremely attractive to larger and more complex businesses and how this has become an enormous success.

Today, the company’s solutions are widely adopted across industries worldwide, with the NOW platform serving enterprises of all sizes. After years of innovation, development, and global penetration and cross-selling, ServiceNow’s NOW platform has pretty much become the enterprise IT standard. For reference, its platform is used by more than 8,100 businesses globally, including 85% of the Fortune 500.

Unsurprisingly, ServiceNow has also become a true force within its respective markets, claiming a dominant market position across the board. As highlighted below, according to Gartner, the company claims the #1 or #2 position in most of its respective end markets. In fact, the company is called a market leader across a whopping 20 verticals!

For example, within the ITSM market, it claims a demanding 45% market share, well ahead of any of its peers.

On top of holding an impressive share in each of these markets, these are also mostly still high-growth industries. You see, the enterprise software industry as a whole still has very great prospects thanks to the growing demand for automated and integrated IT solutions and a search for “streamlined, reliable software to reduce reliance on human resources, automate routine tasks, and minimize manual errors,” as reported by Grand View Research.

This should translate into growth at a CAGR of 12.1% through 2030, which definitely isn’t a bad backdrop from which to work.

Meanwhile, ServiceNow’s primary market – ITSM or IT Service Management – is expected to grow at an even faster 15.9% CAGR through 2030, thanks to the growing demand for cloud-based ITSM solutions as well as the search for solutions to reduce overhead and increase automation.

Of course, this is great for ServiceNow, which is the leader in this market and is growing its market share thanks to a dominant and broad service offering. This, in combination with even faster growth in newer segments and the continued expansion of its platform by adding new software layers, gives ServiceNow a tremendous growth outlook well into the next decade. For reference, the company is targeting a $275 billion 2026 TAM, up from $165 billion in 2023, reflecting an 18.5% expected CAGR.

Meanwhile, ServiceNow only has a 5% TAM penetration, so there is truly no lack of room for growth. The company is sublimely positioned for success, and management is also executing flawlessly.

To highlight this, let’s delve into the company’s most recent financial results to take a closer look at its recent performance, company-specific growth drivers, and financial profile.

Another flawless quarter for ServiceNow

ServiceNow reported its latest Q3 earnings not too long ago on October 23rd, and not to anyone’s surprise, delivered another beat-and-raise quarter, sailing past the consensus estimates and delivering another quarter of perfect execution that allowed it once more to raise full-year guidance.

While many companies, including ServiceNow’s SaaS peers, have struggled in recent quarters due to the tough and complex macroenvironment and lower IT budgets, ServiceNow’s performance has been sublime. Its results have shown no sign of weakness, and the company continues to constantly deliver beyond the Rule of 50.

That is pretty impressive, indeed.

This resilient performance is probably the biggest testimony to the importance and quality of the Now platform. Apparently, even when IT budgets are tight, businesses still prioritize the Now platform. A great indicator of long-term success, I would say. This is how management explained it:

"Given tightening budgets and shrinking workforces, it has to be more efficient. But their mounting needs and challenges cannot be addressed by traditional ways of operating, they have to digitize and adopt new technology including AI. Our US Federal business continues to shine."

Returning to the Q3 results, as said, the company delivered another quarter of strong execution. Subscription revenues came in at $2.72 billion, up 23% YoY. Notably, this growth was also a whopping 200 basis points above the high end of management’s guidance, thanks to above-expected demand and the signing of significant U.S. Federal contracts, where ServiceNow continues to see great traction.

RPO (Remaining Performance Obligations) growth also remained remarkably strong, growing 36% YoY to $19.5 billion, accelerating both YoY and sequentially. This was well ahead of guidance and a great indicator of future growth, continued traction, and demand.

You see, RPO refers to the total value of a company's contracted revenue that has yet to be recognized. In other words, this is future revenue. The fact that this number is growing and growth is even accelerating well above current revenue growth indicates strong demand for the company’s products or services and a growing pipeline of contractual obligations. It reflects that customers are committing to multi-year deals or larger contracts, providing ServiceNow with greater longer-term visibility.

Once again, ServiceNow shows no weakness in demand and is able to sign longer-term contracts, even as the operating environment remains treacherous.

The results demonstrate that ServiceNow's growth drivers remain robust and highly effective. Even after rapid expansion and growth over the last decade, ServiceNow still has plenty of levers to pull to drive growth, including international expansion and growing value per customer by adding new software solutions to its Now platform and by cross-selling these.

Cross-selling and platform expansion, in particular, has been a significant driver of growth. A decade ago, the Now Platform included only a handful of core software solutions. Since then, ServiceNow has dramatically expanded its offerings, as illustrated below.

As its portfolio of solutions grows, ServiceNow continues to extract more value from both new and existing customers while also increasing its total addressable market (TAM). For example, the number of customers generating over $1 million in annual revenue has doubled since 2020, and those generating $10 million or more annually have tripled in the same timeframe.

This trend is further reinforced by ServiceNow’s exceptional net retention rate, which consistently exceeds 120%. This indicates not only strong customer retention (98.5%) but also significant growth within its existing customer base as customers adopt additional products. For reference, roughly 70% of customers increased their ACV (Annual Contract Value) in 2023 by adding more products.

Furthermore, about 85% of ServiceNow customers use five or more products from the Now Platform, and this number is steadily increasing. This is still driving significant growth for ServiceNow, and the company is still adding new products every quarter to keep this engine running.

Truly, ServiceNow’s customer retention and cross-selling abilities are unequaled, driven by a tremendous platform valued highly by its users.

The latest of these revolutionary solutions is the addition of GenAI features. AI's contribution should not be understated. It allows ServiceNow to drive even more automation within its software stack, meaningfully increasing the user’s value and effectiveness.

For reference, using the company’s AI-equipped Pro Plus package, businesses were able to drive a 30% productivity improvement in ITSM and an 80% improvement in employee self-service defection.

According to management, the revenue opportunity for ServiceNow with GenAI among existing customers alone is over $1 billion in revenue. So far, it is the company's fastest-growing product ever and it is accelerating cross-selling opportunities.

Ultimately, everything points to ServiceNow's ongoing success. It continues to outperform expectations, and nothing suggests a slowdown anytime soon.

While top-line growth remains impressive, so does the company’s margin development. Last quarter, ServiceNow reported an operating margin of 31.2% year over year, some 170 bps above management’s guidance, thanks to the timing of spending, a better-than-expected top-line performance, and OpEx efficiencies.

This was also up 160 bps year over year as ServiceNow continues to improve margins and cash flows across the board as it grows and realizes additional efficiency gains.

From 2019 through 2023, the operating margin expanded by 700 bps, leading to operating income growth at a CAGR of 35% over the same period. Management continues to see plenty of room to keep expanding margins, likely expanding them another 200 bps this year and targeting 50 bps of expansion per year in the years ahead.

Meanwhile, ServiceNow has also consistently reported impressive FCF margins of at least 28% over the last five years and is likely to report a staggering $3+ billion in FCF this year. This is truly best in class and immensely impressive.

As a result, the company is also able to maintain a healthy balance sheet. It currently holds $5.3 billion in cash and short-term investments against only $1.5 billion in long-term debt, leaving it in a very healthy financial position.

All of this is absolutely great.

However, there is one big negative for investors to point out here, and that is SBC. In recent years, ServiceNow has been spending a high percentage of revenue on SBC, which is exceptionally high and arguably way too high compared to the stage the business is in today and its growth rates.

Personally, while I am not necessarily against the usage of SBC, this high percentage is worrying. However, putting things into perspective, I wouldn’t see it as a deal-breaker here. Moreover, annual dilution is dropping below 1% this year, down from 1.5% in 2019, and SBC as a percentage of revenue is trending down as well, declining from 19% of revenue in 2022 to 18% in 2023 and heading for a sub-15% in 2026.

Yes, this remains higher than I would like to see, but considering the growth this business is still realizing and its sheer quality, I am willing to accept it, assuming SBC does indeed continue to trend down.

Ultimately, this is a business performing at an extremely high level, realizing rapid growth in combination with growing margins and great financial health.

A brilliant business.

But first, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to the occasional premium analyses and full insight into my personal portfolio!

Outlook & Valuation

Following the impressive Q3 results, ServiceNow management was able to once again raise FY24 guidance. Management now expects to report FY24 subscription revenue to be in the range of $10.655 billion to $10.66 billion, reflecting a YoY growth of 23% YoY.

Furthermore, it expects a gross margin of 84.5%, an operating margin of 29.5%, up 150 bps YoY, and an FCF margin that remains above 30% at 31%. In other words, ServiceNow will deliver another Rule of 50 year.

Looking at the medium-term prospects, I anticipate ServiceNow will be able to maintain its Rule of 50 streak for a few more years, with growth unlikely to decelerate any time soon. The secular tailwind for the business remains significant. With the IT spending environment expected to recover in 2025 and 2026 as businesses start to invest more significantly, the macroeconomic backdrop for ServiceNow should only improve, offsetting any rule of large numbers tailwinds. In addition to this, AI should be another tailwind helping ServiceNow keep up its 20%+ YoY growth for a few more years before eventually slowing down into the teens.

At the same time, I expect margin gains to slow down slightly compared to prior years. Significant investments by the business will be required to maximize growth, and efficiency gains seem to be plateauing. Therefore, I expect marginal operating margin gains in the four years ahead before potentially accelerating again toward the end of the decade.

Nevertheless, this still means ServiceNow is likely to keep growing its top and bottom line at a 20%+ rate in the next 4 years, which is still pretty brilliant

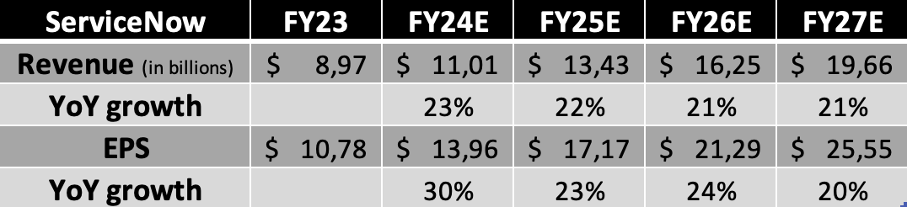

Ultimately, this results in the following financial projections through the end of 2027.

Considering the sheer quality of this business, its high growth, growth resilience, and its strong track record of execution, it will be to nobody’s surprise that it tends to trade at quite a hefty valuation, and currently, that is no different.

Based on the projections above, NOW shares trade at a whopping 62x next year’s earnings and a demanding 42x the current 2027 EPS consensus. On a PEG basis, incorporating future growth, this still is a 2.6x multiple, which is rather expensive for any business.

At the same time, all these metrics are roughly in line with the company’s 5-year averages, which makes sense given that growth is not slowing down and the business is performing really well.

This is one of those situations where I have refused to pick up any shares for years due to valuation concerns, and in the meantime, shares have continued to outperform as the business has. Investors seem to still be willing to pay a massive premium for this business, and I can see why. It truly is best-in-class and continues to (out)perform.

However, I would still argue against buying shares today at a price of around $1070. Simply put, I will only buy shares if these at least trade at a discount to their 5-year average multiples to optimize future returns.

You see, even if shares continue to trade at a 60x multiple by the end of 2026, which I don’t deem unlikely, this will translate into a P/E-based target price of $1277 per share or annual returns (CAGR) of only 8%, which isn’t enough to beat the market, especially not at those valuation risks.

However, if you could buy shares at a discount of only 5% to historical multiples or at a current share price closer to $1000, your returns would jump to 11% per year. This offers a much more favorable risk-reward scenario, even when considering that ServiceNow is likely to outperform the projections set above.

Ultimately, I conclude that now is not the time to buy shares after they have gained almost 50% YTD.

Yes, I adore this business and would love to own some shares. ServiceNow is positioned for long-term success well into the next decade and is likely to become another $1 trillion business in due time, driven by its incredible platform, the growing need for it, and its extremely favorable positioning.

However, the current risk-reward scenario is not favorable enough to pull the trigger. Personally, I am aiming for a slight pullback toward the $1000 per share mark, ideally below it.

For now, I am hold-rated.

Worth noting as well is that there has barely been any insider buying over the last twelve month and a decent amount of selling, although nowhere near worrying.

I am waiting for a pullback.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Yeah, i just dont seem to be able to find a good entry point. A good one was a few months ago in the 600s and missed that one sadly.