ServiceNow, Inc. – I bought the post-earnings dip. Here’s why!

After dropping as much as 15% after reporting Q4 numbers last week, NOW shares finally show sufficient weakness to initiate a position. Let me show you why!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Back in November, I already explained in a ServiceNow Deep Dive that the company was on top of my watchlist as it’s a business I would love to own.

The company truly is a best-in-class enterprise software (SaaS) business with a mighty moat in certain enterprise software vectors through an incredibly technologically advanced platform. This has led to customer retention numbers always above 98%, and with these revenues recurring, revenue stability and reliability is at an extremely high level.

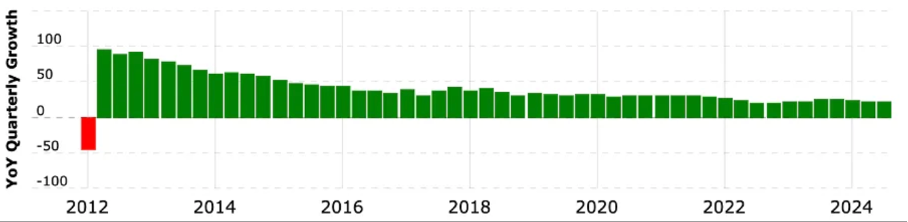

Highlighting this, it hasn’t shown a single moment of weakness for years, a testimony to its sheer quality. The company has shown an amazing ability to consistently beat expectations quarter after quarter and year after year, always overdelivering.

Just look at the graph below – it says it all. Not a single quarter of negative YoY growth, despite economic headwinds. Not even a single quarter with YoY growth below 20%! This company is consistently taking market share and is growing its top and bottom line by 20% + each and every quarter.

Furthermore, it has healthy financials, strong margins, a healthy balance sheet, and a mighty outlook thanks to its exposure to rapidly growing markets and its role in bringing functional AI features to customers, ranging from governments and institutions to over 90% of the Fortune 500.

In other words, ServiceNow, to me, is a must-own SaaS leader poised for at least another decade of rapid growth. The one issue is that Wall Street has long recognized its quality, consistently valuing the company at a demanding multiple, often approaching a 20x sales and 80x earnings multiple.

As a result, I have been on the sidelines for a long time, waiting for the right opportunity to initiate a position. However, shares never showed sufficient weakness in the months that followed to pull the trigger up until last week.

Last Week, ServiceNow reported its fourth-quarter results, and investors didn’t take them well. In the following trading session, shares sold off a considerable 15% mid-day, ending the day down 11.5%, even though NOW delivered numbers roughly in line with expectations. I guess that when trading at such high multiples, just matching expectations isn’t quite enough to satisfy Wall Street. Investors demand another solid beat, as they have gotten used to.

Nevertheless, I believe this sell-off was completely overdone and a massive overreaction to otherwise solid results and guidance. NOW continues to deliver impressive growth, expanding margins, excellent cash flows, and a healthy balance sheet. While the quarter might not have been as impressive as hoped for, it certainly wasn’t bad… like at all.

Yes, guidance was a bit light, but everything points to management being overly conservative and positioning itself for another beat-and-raise year.

Let me go over all the numbers and explain why I decided to finally buy NOW shares!

Let’s delve in!

NOW delivers healthy and sustainable top-line growth

Last week, NOW released its Q4 earnings report. At first glance, the company delivered good quarterly results, mostly in line with expectations. It still delivered revenue growth in excess of 20%, which is quite a respectable feat in itself.

Furthermore, NOW delivered top and bottom line growth that exceeded the high-end of management’s guidance by 50 bps, even as management already raised its guidance twice in 2024, keeping up its beat and raise track record.

Just to put this performance in a bit more perspective.

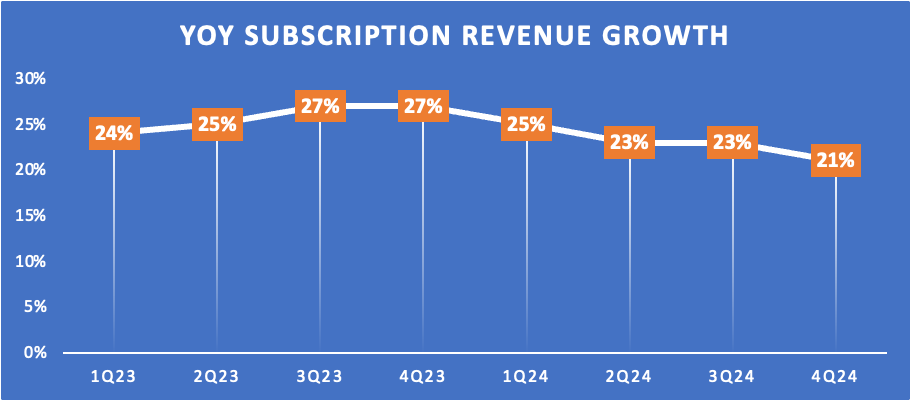

Getting to the numbers, NOW reported subscription revenue growth of 21% YoY to $2.87 billion, which was in line with consensus estimates. This does show a further growth deceleration from prior quarters as NOW is starting to show some weakness from the rule of large numbers as its revenue and customer base grow. On top of that, there is still no real improvement in the enterprise software macro, with IT budgets still seeming a bit pressured.

Therefore, in my opinion, this performance is still more than just respectable and quite impressive. This is especially true given that NOW still keeps its renewal rate at 98%, highlighting that customers are highly unlikely to leave, even as IT budgets are under pressure.

The NOW platform remains as valuable as ever, and its sticky subscription-based revenues add to this business's anti-cyclical nature.

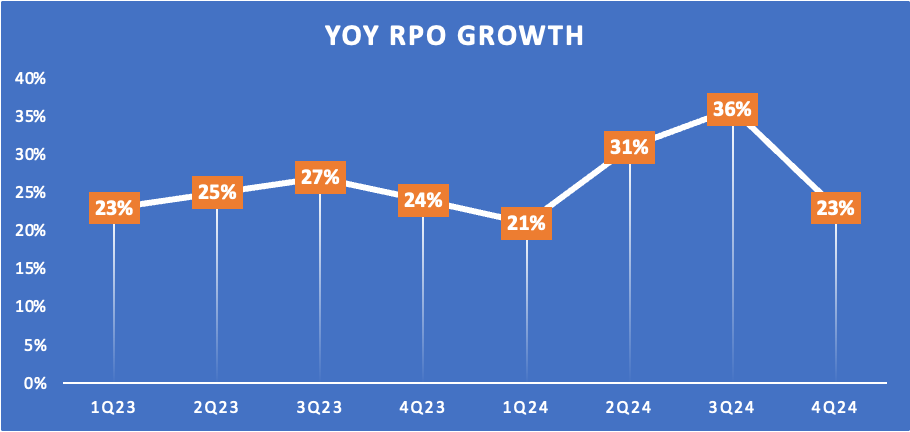

Meanwhile, the company’s RPO (remaining performance obligations) figures remained strong, with 23% year-over-year growth in RPO and 22% year-over-year growth in CRPO, double that of the IT sector, according to IDC data. This has pushed RPO to $22.3 billion at the end of the fourth quarter.

For reference, RPO represents the total value of contracted revenue that has not yet been recognized, including both billed and unbilled backlog. In other words, this revenue will be realized in the future under current and newly signed contracts.

This solid growth suggests continued strong demand for NOW’s software platform, with large deals still being signed. In fact, in Q4 alone, NOW signed a whopping 19 deals with an ACV greater than $5 million (annual contract value), and the company landed its largest single deal ever.

To add some perspective, NOW’s rapid platform expansion has been driving deal size growth, with the company adding more software layers. Last quarter, 15 of the top 20 deals included the ITSM, ITOM, ITAM, and Security and Risk programs. Customers, both existing and new, are increasingly adopting more features within the NOW platform, growing customer value.

As a result, more valuable customers (contributing at least $20 million in ACV) grew much faster last quarter, growing 35% YoY, fueled by this success in securing large deals amid incredible customer satisfaction and a strong value-adding track record.

I will say it again: the NOW platform truly is best-in-class.

Ultimately, the fact that RPO growth has remained as strong as it has for ServiceNow throughout macroeconomic uncertainty over the last few years should tell you something about how highly valued its platform is and the value it adds to customers.

Yes, RPO growth did meaningfully slow last quarter compared to Q2 and Q3, but it remains in line with the same quarter last year and well within historical and healthty levels. This also gives me confidence that the growth ahead will remain strong.

NOW will massively benefit from growth in AI adoption globally

That it will be tough for NOW to maintain 20% YoY growth every year for many more years is no secret, but thanks to the rise of AI, it isn’t that far-fetched, maybe even likely (to remain above 20% through the end of the decade)

You see, while it might not be as obvious as, say, Nvidia or Microsoft, NOW is one of the bigger beneficiaries of the AI revolution, and it is expected to drive significant growth. This is thanks to the company’s positioning in the midst of a company’s data management and workflow orchestration. Particularly as enterprises seek to automate workflows, improve efficiency, and enhance decision-making, NOW is perfectly positioned.

The company's AI-driven offerings, such as generative AI-powered virtual agents and intelligent workflow automation, are becoming increasingly valuable as businesses look to reduce costs and increase productivity. By embedding AI into its platform, ServiceNow enables organizations to streamline complex processes, minimize manual intervention, and enhance customer and employee experiences.

This can translate into significant efficiency gains for NOW customers. Management gave the following example during the earnings call:

“For example, a multinational conglomerate customer saw a 45% reduction in live chat from July to December with Now Assist, and the company is now targeting to save millions by the end of 2025.”

Considering this, it is no surprise NOW is already seeing considerable growth in AI revenues. In Q4, Gen AI ACV from its Now Plus package grew a whopping 150% sequentially. The number of customers buying two or more Gen AI capabilities also doubled from last quarter.

However, due to a specific strategy choice, we aren’t quite seeing this AI benefit translate into financial growth. Instead, it positions NOW for significant growth in the years to come, supporting my bullish expectations.

Let me explain!

Throughout its business, NOW uses a seat-based subscription model, charging customers based on the number of users who have access to the software. This fixed fee adds predictability. However, regarding AI, NOW has chosen a usage-based subscription model.

In other words, NOW is not just charging its customers for the AI functionality as an add-on, similar to Microsoft’s copilot, which is about $40+ per month per user, giving an immediate revenue gain. Instead, NOW decides to be patient and entirely rely on and benefit from the rise of AI and growth in usage, using a consumption-based model. This means that the AI functionalities themselves do not come at an initial and fixed cost, but you pay for what you use. Currently, this might not be as much but NOW will fully benefit as AI usage and functionalities grow and the technology gets implemented into workflows.

While a seat-based model provides revenue stability and encourages widespread enterprise adoption, a usage-based model is more flexible and can scale dynamically with customer needs. Currently, this means NOW is missing out on some instant revenue growth. Still, it allows its user base to adopt AI features more easily and monetize them over time, with significant potential.

Here is what management added during the earnings call:

“This approach ensures customers can access our AI capabilities as quickly and as seamlessly as possible while simplifying the sales process at the same time.

As the agents become increasingly productive, they will drive the consumption pricing meter. And that, of course, will be in addition to the seat-based licensing foundation; you'll get both.”

Pretty brilliant, right? I really love this approach by NOW management. It proves to me that management isn’t short-term-oriented but focuses on long-term success and value.

For reference, IDC forecasts worldwide revenue for AI platform software to grow at a 41% CAGR through 2028 and reach $153 billion. So, clearly, the growth runway for NOW, thanks to its brilliant positioning within enterprises and their IT architecture, is extremely promising and a big driver of my bullish thesis.

Bottom-line performance and financial health

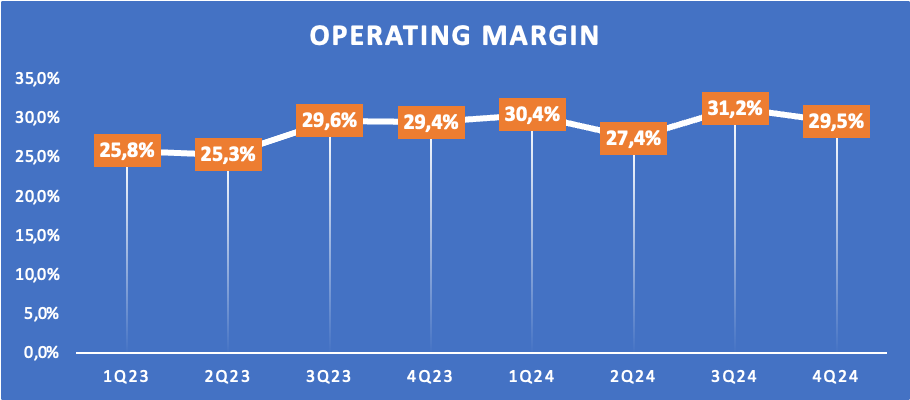

Finally, regarding bottom-line performance, NOW showed few surprises and performed well. The company reported an operating margin of 29.5%, up just 10 bps year over year but down from an all-time high last quarter.

OpEx efficiencies and the higher revenue drove the YoY increase.

Further down the line, this resulted in a Q4 EPS of $3.67, beating the consensus by $0.01.

This resulted in an operating margin of 29.5% for the full year, up a solid 200 bps. Furthermore, the company reported a full-year FCF margin of 31.5%, up 50 bps year over year, which is still massively impressive, especially considering the top line is also still growing by 20% +.

This resulted in an FY24 FCF of $3.5 billion, allowing the company to further strengthen its balance sheet further, even as it aggressively bought back shares during the year. The company ended the year with $10 billion in total cash and practically no debt.

Meanwhile, NOW has bought back close to $1.5 billion of its own shares over recent quarters, leaving only $266 million under its authorization. However, thanks to its pristine balance sheet, the board authorized another $3 billion share buyback program to make good use of its large cash pile.

Ultimately, my conclusion for the quarter is that NOW is still a brilliant business. It continues to deliver beat-and-raise quarters, grow at a 20%+ rate, expand margins, and remain a unique rule-of-50 business.

I know expectations are higher than projections, but investors have little to complain about last quarter.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

Outlook & Valuation

However, guidance may have been less great, leaving some for investors to nitpick about. Most importantly, Q1 guidance was slightly below expectations and did not impress anyone (relatively), with now guiding for $3 billion in subscription revenues, short of a $3.04 billion consensus.

However, this is due to management assuming no change in the IT macro, which is likely to improve throughout 2025, and AI revenue only kicking in, due to the aforementioned reasons, by the second half of the year and into 2026. Sadly, Wall Street is often very short-term oriented.

Meanwhile, management seems to be guiding very conservatively again, positioning itself for another beat-and-raise year.

Furthermore, the long-term outlook for NOW remains terrific. This is what management said during the earnings call:

“Even on this bigger revenue base, be assured, we will save the innovative fast, growth highly profitable company we are today.”

Looking at the fundamentals, I honestly don’t doubt it. The company remains excellently positioned, with a powerful moat and an incredible platform that allows it to gain market share across multiple verticals. AI is likely to be a massive growth tailwind in coming years, which should offset size headwinds.

As for short-term guidance, management now expects FY25 subscription revenue between $12.635 billion and $12.675 billion, representing 20% year-over-year growth at the midpoint but well short of a $12.87 billion consensus. Meanwhile, the operating margin should be around 30.5%, up 100 bps YoY thanks to expected OpEx leverage. Finally, the FCF margin should also expand further to 32%, keeping NOW a rule-of-50 business for another year.

The expectation is for growth to remain largely stable throughout 2025, with AI starting to meaningfully drive growth in the second half of the year. In the years that follow, rapidly growing AI revenues should offset other headwinds, keeping growth up around 20%. EPS is likely to grow slightly faster due to continued margin gains.

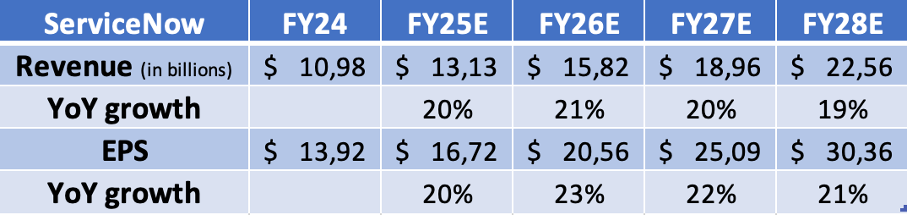

All things considered, I now anticipate the following financial results through FY28.

Now, as for the valuation, this remains the biggest hurdle for NOW shares – there is no way around it. Even after last week’s sell-off, NOW shares still trade at 61x the current 2025 earnings consensus, which is still an incredibly demanding multiple, even as it is a 20% discount to the 5-year average multiple.

NOW shares remain expensive, but these do now trade at the slight discount to historical multiples I was looking for to initiate a position.

Ultimately, NOW remains one of the best businesses you will find out there. It is a true rule-of-50 business with a pristine balance sheet and terrific outlook. Meanwhile, its growth drivers are still firing on all cylinders, and growth remains healthy and well-supported. With the upcoming push from AI, this will likely result in growth barely slowing at all through 2028, which explains why the company still trades at such high multiples.

It seems quite deserved to me, especially considering NOW has a strong track record of well outperforming expectations, even as guidance did fall short.

Therefore, with shares now trading at a small discount to the multiples I was aiming for before, I decided to pull the trigger and pick up some NOW shares, though I only initiated a small position to further DCA on potential further weakness.

At prices below $1,000, I believe NOW shares are worth buying, leaving enough room to deliver outperforming returns in excess of 11% annually (CAGR). I currently arrive at an end-of-2027 target price of $1505 per share.

Nice post! Thank you. This is a fantastic business, no doubt about it. Price needs to come down as it is projected to grow only 30% (!) in the next 5 years.

Ok, I’LL say it: out of my league.