ServiceNow - One of the Best Tech Stocks to Own for the Next 10+ Years

Unpacking the numbers, the moat, and the AI strategy behind this unstoppable compounder - A must own for the decade ahead!

Without a doubt, ServiceNow is one of the highest-quality businesses money can buy.

With its industry-leading NOW platform, it dominates the enterprise IT industry through a combination of mission-critical workflows, exceptional renewal rates, substantial operating leverage, and a deeply embedded, cloud-native platform. With powerful land-and-expand economics, a clear runway for durable growth, and a first-mover advantage in agentic AI, ServiceNow is exceptionally well-positioned to keep compounding value, not just for years to come, but for decades.

This really is a best-in-class $200 billion SaaS business that simply continues to defy the Rule of large numbers and outperform even the most bullish consensus estimates – expectations have been high for years, yet the company hasn’t missed estimates a single time since 2019.

Here are some numbers and facts to consider:

Over the last 5 years, it has grown revenue at a 24% CAGR.

Revenue growth has dropped below 20% only once in its history, including the COVID-19 pandemic and hyperinflation combined with tight IT budgets in recent years.

Never reported a single quarter of negative sequential growth.

Roughly 95% of revenue comes from recurring subscriptions and long-term contracts, creating incredible visibility.

A renewal rate consistently over 98%, with a net retention rate in excess of 120% in most quarters, highlighting both upsell and land-and-expand success.

The company already holds either the #1 or #2 position in each of its targeted markets and continues to gain market share. In fact, the company is recognized as a market leader across a whopping 20 verticals by Gartner.

Within the ITSM market, it holds a commanding 45% market share, significantly ahead of its peers.

ROE has consistently been in the high-teens to high-twenties.

The company is rapidly becoming more profitable. Whereas it reported a net income margin of -30% in 2016, this increased to 4% in 2021, 19.3% in 2023, and over 26.4% in 2024.

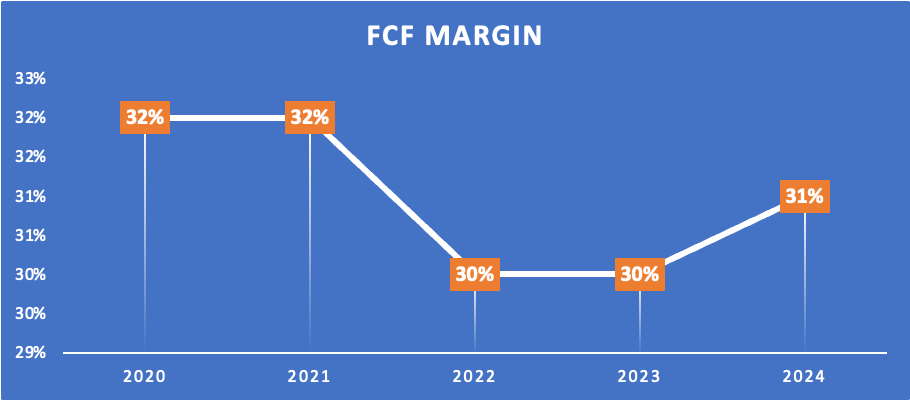

An FCF margin consistently over 30%.

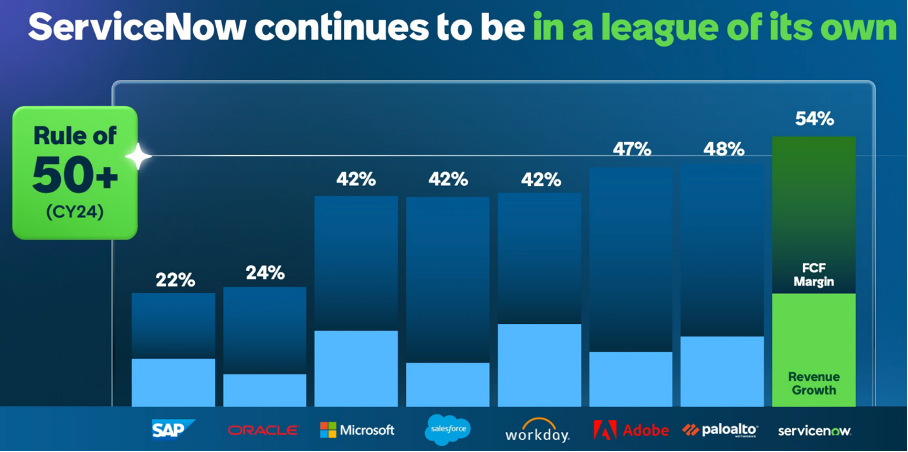

A consistent minimal Rule of 50 business.

An excellent visionary CEO with Bill McDermott.

ServiceNow is the kind of high-quality compounder that long-term investors dream of owning. Really, this is an astonishing business, combining sustained hyper-growth, expanding margins, dominant market positions, and near-perfect customer retention – by now, the NOW platform is not just “nice-to-have” — it’s too critical to cut, and the numbers reflect it.

I mean, the company has been defying the rule of large numbers for years now, and it doesn’t seem to be slowing down. Its evolution from an ITSM tool to an AI-powered workflow platform has dramatically expanded its relevance, deepened its moat, and unlocked new growth vectors across every enterprise function. With a $250B+ TAM, unmatched customer loyalty, and a relentless pace of innovation, ServiceNow still has ample room to run. For long-term investors, this is one of the clearest “buy-and-hold” opportunities in enterprise software today.

Yet, in recent weeks, NOW shares have experienced some weakness, falling 19% from recent highs and trading almost 30% below their all-time highs.

A rare opportunity to buy shares in a brilliant business?

To find out, today, I want to go over NOW’s most recent financial results, which once again confirmed its sheer quality and ability to maintain incredible growth rates. Additionally, I will delve into the company’s most important growth driver and its incredible AI potential – NOW might just be the best AI play out there.

Ultimately, I will update my financial estimates, calculate a 3-year price target, and determine a good buy price today.

Let’s delve right in!

Still not a paid subscriber? Here’s what you have missed out on these last 2 weeks alone:

American Express – Great Business, Good Quarter, Less Attractive Price

PayPal is a Bargain – A Rare Chance for 19% Annualized Returns

Massive Moat, Relentless Growth, and a Bright AV Future — Uber Is Still a Buy

Join the InvestInsights paid community now and get many more high-quality stock analyses (at least six high-quality analyses per month) + all the other paid benefits!

ServiceNow once again delivers exceptional results!

ServiceNow released its latest financial results on July 23 and once again impressed, blowing past consensus estimates and delivering another beat-and-raise quarter, which is becoming the standard for NOW, as Wall Street continues to underestimate it. Additionally, it is especially impressive today, considering there is some pressure on IT budgets, particularly down-market.

Yet, NOW seemed to be feeling none of this, as it even accelerated growth, and headline numbers came in well ahead of management’s own guidance, both in terms of growth and profitability.

ServiceNow CEO Bill McDermott put it well in his opening remarks during the Q2 earnings call:

“ServiceNow's Q2 results were outstanding.”

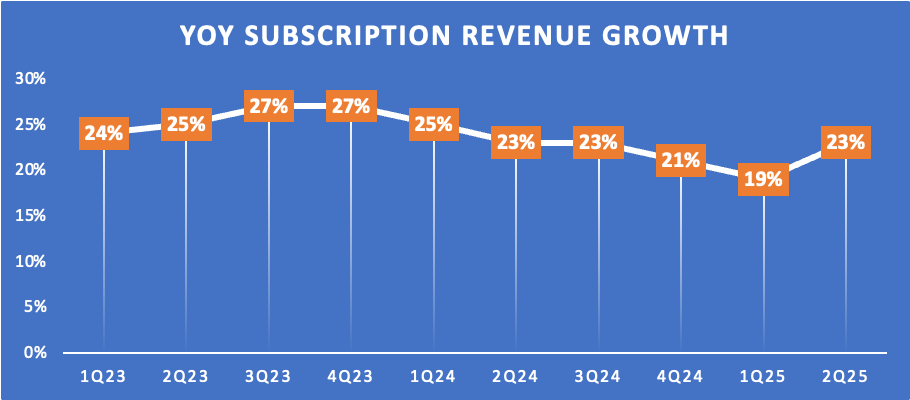

Starting at the top, NOW reported subscription revenue growth of 23% or 22% in constant currency to $3.1 billion, which beat management’s own guidance by a whopping two percentage points, driven by strong execution, better-than-expected AI-related demand, and some early on-prem renewals. This translated into total revenue of $3.22 billion, up 22.4% YoY and beating consensus estimates by $100 million.

However, while the beat was nice, it was the growth acceleration that stood out. Despite NOW’s considerable size and some undeniable broader IT market headwinds, the company accelerated revenue growth in Q2, as highlighted above. In contrast, the expectation was for NOW's growth to finally drop structurally below 20% amid the aforementioned headwinds and its size catching up to it. Hence, this acceleration is a massive positive and a testament to the quality of the NOW platform.

Additionally, its Q2 TTM renewal rate remained excellent at 98%.

This combination of excellent growth and retention showcases the strategic importance of the NOW platform to users. It’s not just a nice-to-have tool; it’s increasingly becoming mission-critical infrastructure for global enterprises.

These kinds of numbers in a challenging operating environment (I mean, most of its smaller peers report decelerating growth) tell you that customers are not just staying—they're expanding their usage and prioritizing NOW.

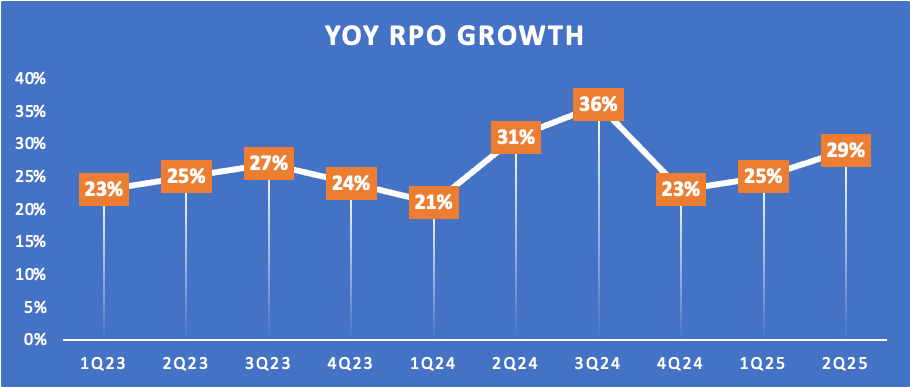

We saw similarly strong performance in RPO, which reached $24 billion by the end of Q2, up 26% YoY in constant currency and 29% on a reported basis. This beat the midpoint of guidance by 200 basis points and marked a sequential acceleration, signaling robust, broad-based demand.

Such acceleration at ServiceNow’s scale is particularly notable. It reflects not just renewals, but larger, longer-term commitments across more product areas. Customers are signing multi-module, multi-year deals, boosting both platform stickiness and long-term revenue visibility.

You see, RPO is a forward-looking signal of growth. When it accelerates like this — even in a tight IT spending environment — it reinforces the view that ServiceNow isn’t just holding up in this macro, it’s outperforming. The NOW platform is becoming increasingly embedded, strategic, and indispensable.

It’s further evidence that ServiceNow is evolving from a best-in-class IT platform into the operating system of the modern enterprise — and customers are betting on that future with their budgets.

Headline numbers are great, but it’s these underlying signals of strength that should matter to long-term oriented investors.

I’ll say it once more: these are exceptionally strong numbers, highlighting the sheer quality of this company.

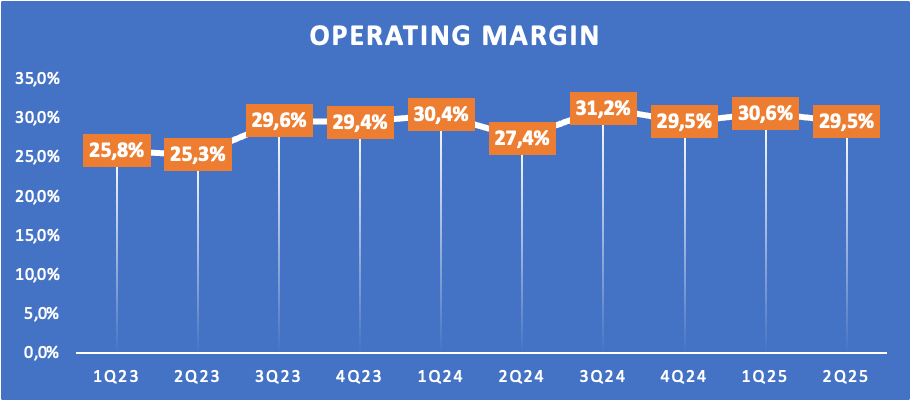

Moving to the bottom-line results, NOW clearly benefited from a combination of strong top-line growth and efficiency gains. Its operating margin was 29.5%, which came in 250 bps above management’s guidance and shows healthy YoY margin expansion of 210 bps.

This beat and strong YoY gain was driven by the top-line outperformance, AI OpEx efficiencies, and the timing of marketing spend. Interestingly, NOW is already seeing considerable results from its own AI innovation within its own operation, for example, leveraging tools like CodeAssist and CodeGeneration to unlock significant capacity for software engineers, and it’s resulting in cost efficiencies of an expected $100 million in 2025.

Further down the line, these gains translated into an EPS of $4.09, up 31% YoY and beating consensus estimates by a considerable $0.52.

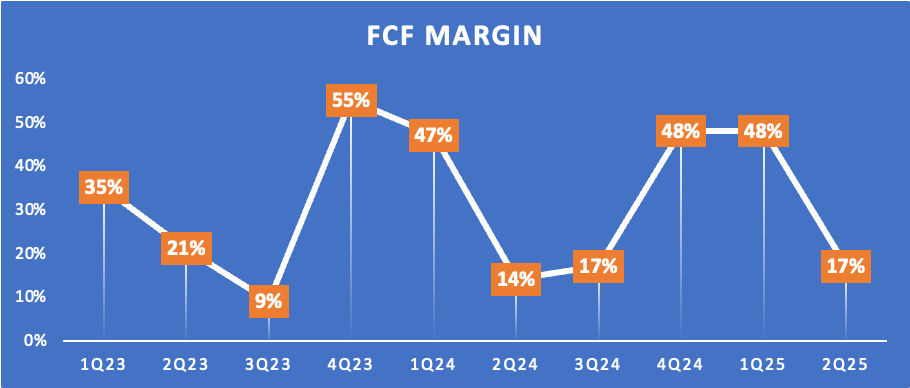

Finally, NOW reported a healthy FCF of $535 million, up 49% YoY. This translates into an FCF margin of 16.5%, up 300 bps YoY.

I know, 17% might not seem that impressive, but, as highlighted above, it is worth considering that FCF fluctuates heavily from quarter to quarter due to seasonal payments. Therefore, it is more valuable to consider annual FCF numbers, and as shown below, this has been sublime for NOW over the last 5 years, with a FCF consistently above 30% ($3.5 billion as of FY24).

Combined with revenue growth of at least 20%, this makes NOW a Rule of 50 business in any given year, putting it in a small list of extraordinary companies and putting it in a league of its own compared to its similarly sized SaaS peers.

Anyway, thanks to these strong cash flows, NOW also maintained a fortress balance sheet, holding $10.8 billion in cash and equivalents against just $2.4 billion in debt. This leaves it in a great net cash position with plenty of liquidity.

This is what allows management to consistently buy back its shares to offset dilution, which remains one of the main negatives in the NOW investment case, with SBC (stock-based compensation) still hovering between 15% and 20%, which is just too high for a mature business.

Positively, for one, management now commits to bringing this to below 15% of revenue in 2026, which is a solid improvement. Additionally, actual investor dilution should be limited thanks to constant buybacks. Management aims for an annual dilution of below 1%, which isn’t too bad at all.

Therefore, I don’t view SBC as a thesis breaker here.

To conclude this part of the article, I think it’s safe to say NOW continues to fire on all cylinders, delivering exceptional growth and doing so while expanding margins and delivering excellent cash flows.

Honestly, what is not to like?

On that note, let’s delve a little deeper into NOW’s fundamental growth drivers – what has allowed it and will continue to allow it to defy the rule of large numbers?

Platform expansion is a mega growth driver!

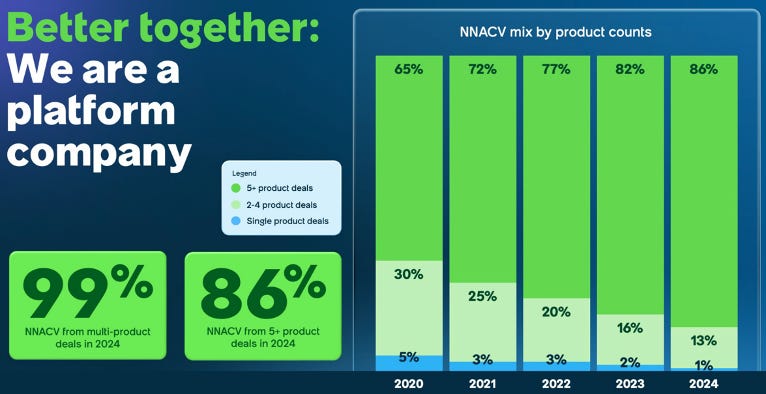

One of the key enablers of NOW’s success is growing module adoption. This is not just a secondary growth lever—it’s the core of ServiceNow’s land-and-expand strategy and one of the biggest reasons the company continues to outperform even as it scales. By expanding its platform into new areas and steadily increasing the number of modules each customer uses, ServiceNow has turned its business into a compounding growth engine.

Crucially, NOW is executing this strategy to perfection.

Over the years, NOW has demonstrated an exceptional ability to innovate and expand into other enterprise software markets through platform expansion, achieving incredible success and quickly becoming a fierce competitor or even an industry leader. Consider that the company has expanded from leading 6 IT verticals in 2019 to 33 today and has released a staggering 6,000 features in the last 12 months alone, demonstrating remarkable platform innovation.

As a result, a whopping 99% of net new ACV now comes from multi-module deals. Furthermore, 86% comes from customers signing a contract for five or more modules, which is up from 65% in 2020, showing very impressive progress in customer adoption and average contract size, which is entirely driven by this incredible platform innovation and expansion.

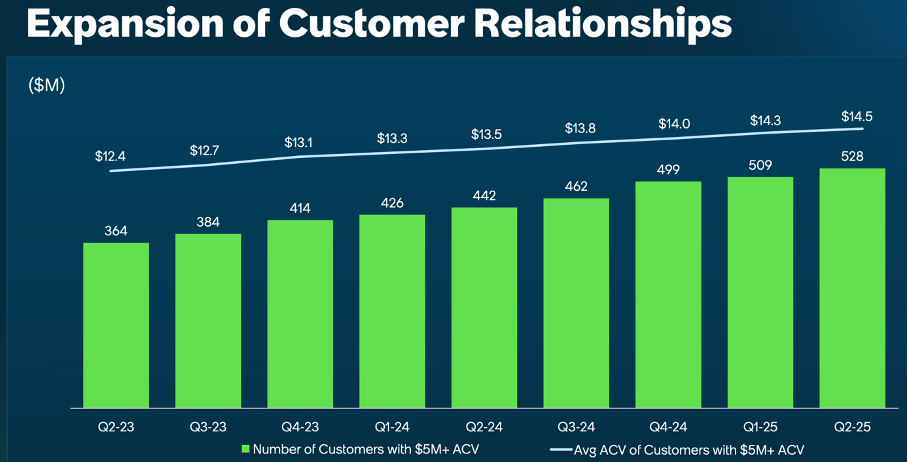

For reference, ServiceNow now has 528 customers generating over $5 million in ACV, and the number of customers contributing over $20 million has grown 30% YoY in Q2 and has tripled since 2021. This illustrates not only strong net new growth but also substantial expansion within existing accounts, driven by the platform’s increasing relevance across multiple enterprise functions.

This scale and breadth of platform adoption were further demonstrated by other numbers in Q2, as all of the top 20 deals included five or more products, highlighting the strength of the multi-product strategy. As a result, average ACV per new logo more than doubled year-over-year, further proving that as customers commit to ServiceNow, they’re doing so in increasingly meaningful and scalable ways, and this is what is driving incredible growth.

For further reference, the average value of $5+ million ACV customers has grown from $12.4 million in ACV in Q2 2023 to $14.5 million today. That is an average 17% higher contract value, and that is just from platform innovation and expansion.

So, simply put, NOW’s platform expansion is driving larger deals for both new and existing customers, which is a considerable growth driver.

This flywheel—platform breadth driving deeper adoption, which in turn fuels faster growth at scale—is precisely what makes ServiceNow a rare exception to the rule of large numbers. Most enterprise software companies see growth decelerate as they mature. ServiceNow, by contrast, is compounding faster as it gets bigger, as every new module increases the surface area for expansion, not saturation.

NOW’s brilliant execution on this front is what allows it to keep delivering exceptional growth, quarter after quarter.

Take NOW’s recent success in CRM, which perfectly illustrates its ability to expand into new verticals with considerable success, driving substantial contract value.

NOW’s relatively new CRM module is growing at an exceptional pace, and the company has entered the market as a serious competitor with remarkable speed. Whereas the company wasn’t on the Gartner Magic Quadrant for CRM software in 2021, it quickly entered as a challenger in 2023 and has, as of 2025, moved into the leader section on the quadrant, now only just trailing Microsoft and Oracle, and closing in on undisputed leader Salesforce.

ServiceNow has quickly become a strong CRM player by focusing on customer service operations rather than sales. Unlike traditional CRMs like Salesforce, which center on lead management, ServiceNow excels at resolving issues, managing complex workflows, and coordinating service across departments. Its workflow-driven architecture gives it an edge in handling post-sale support, where real customer experience happens. This makes it especially valuable for large enterprises with complex, cross-functional needs.

In short, ServiceNow’s rise in CRM has been powered by its operational DNA, its ability to handle complexity, and its alignment with the modern enterprise’s need to orchestrate—not just track—customer relationships.

Today, NOW continues to gain market share in CRM, and the module continues to grow at a rate of over 30% and has already exceeded $1.4 billion in AVC.

And it’s not just CRM. IT Asset Management is another rapidly growing module, having grown at a 55% CAGR since 2020 and still sitting at just 25% customer penetration, leaving it with a long runway of growth.

It’s this consistent expansion of the NOW platform that fuels my confidence in its ability to sustain elevated growth for years to come. I mean, it’s clearly working – the numbers speak for themselves, and NOW is not slowing down on platform innovation.

Ultimately, as more customers adopt more modules, average contract values rise, stickiness increases, and ServiceNow becomes even more embedded in the enterprise tech stack. This expanding footprint not only drives near-term growth—it also builds long-term resilience, giving the company multiple levers to keep compounding at scale, even as it gets bigger. In a space where most peers begin to slow down, ServiceNow is somehow still just getting started.

And then we still haven’t even really addressed NOW’s most essential and promising expansion opportunity, which is AI, so let’s get to that next!

ServiceNow might be the best AI play!

Without a doubt, the most important and promising long-term growth opportunity for NOW is AI, one that is already rapidly materializing.

In simple terms, ServiceNow utilizes AI to enhance its platform's speed, intelligence, and user-friendliness. AI can automatically understand and summarize issues, suggest solutions, and even take action without human input—like closing tickets, answering employee questions, or routing requests to the right team. This saves time, reduces errors, and helps companies work more efficiently.

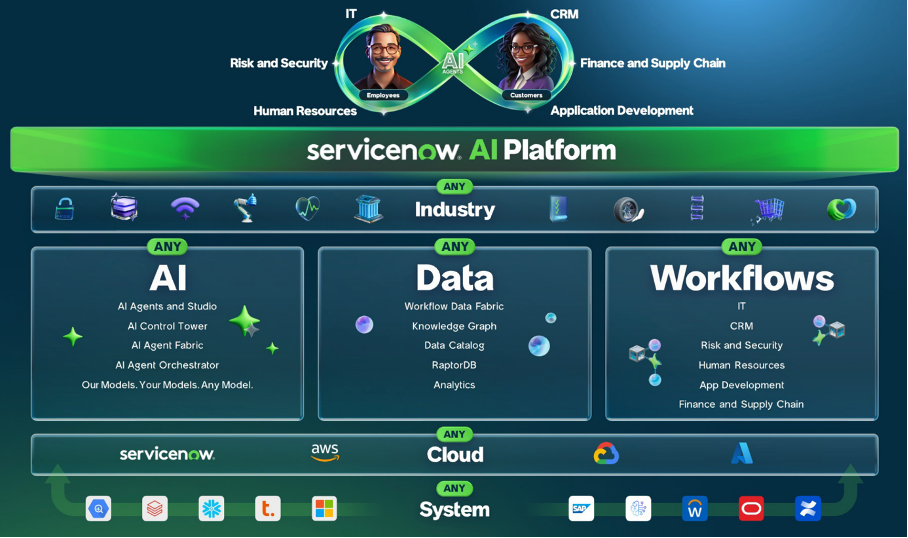

However, NOW’s AI opportunity goes beyond automation. Similar to Salesforce’s Agentforce, ServiceNow is entirely focused on agentic AI. Agentic AI elevates ServiceNow’s platform to the next level by not only helping users but also acting on their behalf.

Instead of just suggesting actions, an AI agent in ServiceNow could fully handle a task from end to end. For example, if an employee’s laptop breaks, the agent can open a ticket, check inventory, order a replacement, notify the employee, and close the ticket—all without requiring human intervention. For ServiceNow, agentic AI means turning workflows into intelligent, self-driving processes, saving even more time and making operations truly autonomous.

These are quite literally AI-driven employees, capable of carrying out repetitive or complex tasks at scale, around the clock, without fatigue or errors, which could drive incredible efficiencies across an enterprise’s entire tech stack.

This opportunity for NOW is massive. The agentic AI market is expected to experience significant growth over the next decade, with research firms projecting annual growth rates of 40-50%.

Crucially, I view ServiceNow as the best-positioned to benefit from the agentic AI revolution across the entire industry, especially given its core role as a workflow orchestration engine across IT, HR, customer service, and governance domains. The nature of agentic AI—autonomous systems that can reason, plan, and execute tasks—fits exceptionally well with ServiceNow’s architecture, which is already built around structured, goal-oriented workflows.

ServiceNow is practically made for the next generation of Agentic AI, given its infrastructure and cloud-native platform. Most important to this is ServiceNow’s interoperability and neutral positioning.

ServiceNow has intentionally branded itself as the “platform of platforms”—a neutral layer that connects systems from Salesforce, SAP, Oracle, and Microsoft. This strategic neutrality becomes incredibly powerful in an agentic AI context, where AI agents need cross-domain visibility and orchestration.

While Microsoft may dominate productivity and infrastructure, and SAP may own ERP, they tend to operate within their respective ecosystems. ServiceNow is more horizontally integrated by design, which could make it the default agentic execution layer for many enterprises, overlapping all these systems.

To be clear, Microsoft has the advantage of distribution, and Salesforce brings rich customer data, while SAP and Oracle dominate transactional core systems. But in terms of agentic execution, cross-system automation, and AI maturity in real workflows, ServiceNow arguably holds a more focused and advanced position.

The NOW platform can operate with any AI model (including ChatGPT, Gemini, Meta’s Llama, or Claude), with any cloud provider (such as AWS, Google Cloud, Azure, or ServiceNow’s own cloud), and any database or system provider, thanks to prebuilt integrations and connectivity.

This exact (neutral) positioning is a massive difference maker. Ultimately, businesses don’t want to operate AI agents separately for each system they use. They want a unified layer that can orchestrate tasks, automate workflows, and execute decisions across the entire enterprise stack. That’s precisely where ServiceNow fits in.

And that’s still not all. Through its cloud-native and one-platform approach, NOW’s AI agents can collaborate across any of its applications. Since all its applications run on the same underlying architecture, AI agents don’t operate in isolated silos; they can easily access data and workflows across the entire platform. So, an AI agent helping with an IT issue can also trigger an HR task or notify a customer service rep, all within the same system. This unified design allows ServiceNow’s AI agents to collaborate seamlessly across departments, making them far more powerful and efficient than agents built on disconnected systems.

This maximizes customer ROI and makes the entire AI strategy incredibly future-proof.

So, I’ll say it again: In my view, ServiceNow is by far the best-positioned company to benefit from the Agentic AI revolution, which, when executed correctly, could propel it to become a $1 trillion business in the early 2030s – the potential here is immense, considering the growth in this market and its long-term potential.

Meanwhile, focusing on today, ServiceNow is already showing it understands the opportunity. Its native AI features, such as Now Assist, strategic acquisitions like Element AI, and partnerships with NVIDIA and Microsoft, demonstrate a strong commitment to embedding intelligence throughout its platform, and it has done so successfully already.

The company’s AI agents and features are already being used by some of the largest enterprises in the world, across all industries, including ExxonMobil, Merck, Standard Chartered, Intuit, Starbucks, Nvidia, and government organizations like the State of California and the North Carolina Department of Transportation.

Today, ServiceNow offers AI through its Now Assist on its platform, which embeds generative AI across key workflows like IT, HR, and customer service.

So far, NOW Assist has been scaling well ahead of expectations amid incredible demand, with it already exceeding 2025 targets on certain metrics. It now has over 1,000 users, deliveres over $250 million in ACV, and usage grows by 50% month over month, showing stellar adoption.

New deals further reinforce this. NOW’s ITAM Now Assist net new ACV grew nearly 6x quarter-over-quarter in Q2, with average deal sizes more than tripling, and NOW Assist for SecOps and risk combined for net new ACV that more than doubled quarter-over-quarter.

Furthermore, Pro Plus deal count, which is NOW’s most advanced AI package, was up 50% sequentially in Q2, and the company signed its largest NOW Assist deal ever at over $20 million. Also, Now Assist products were included in 18 of its top 20 deals in Q2, showing very healthy adoption, with growth fueled by both deal volume and size.

Crucially, customers upgrading to Pro Plus lead to 60% higher contract value compared to NOW’s base package, which highlights just how much upside and growth AI integration brings for NOW!

This all shows NOW is already seeing excellent traction for its AI features, and management indicated momentum is showing no weakness.

All things considered, I believe AI will allow NOW to keep defying the rule of large numbers for many more years. AI is slowly turning into a strong revenue growth driver with room to keep growing well into the next decade.

This is what makes NOW one of the most appealing long-term tech investments.

Want more out of your subscription? Even more content like this weekly?

Consider InvestInsights PRO - $7.50/month ($70/annually)

This gets you:

A guaranteed 6+ stock analyses every month (roughly 2-4 paid-exclusive).

Full insight into my own portfolio (14% return CAGR since 2022).

Instant transaction alerts anytime I make a move (Fully transparent).

A complete overview of all my target prices and ratings (online available).

Exclusive access to the PRO subscribers Discord channel.

Outlook & Valuation

Moving to the outlook, the great news was that NOW lifted its FY25 guidance after a strong Q2 beat and optimistic outlook for H2, despite some tightening in federal budgets.

Management now guides for FY25 subscription revenue of between $12.78 billion and $12.8 billion, up $125 million from its prior guidance and representing YoY growth of 20%, which is really impressive and much better than previously expected. Furthermore, management expects its subscription gross margin to be 83.5% and its operating margin to be roughly 30.5%.

Combine this with an expected FY25 FCF margin of 32%, and NOW should deliver another year with Rule of 50 metrics (52), which is exceptional.

Meanwhile, looking ahead to 2026 and 2027, management remains very confident in its earlier communicated targets. In fact, looking at current momentum and its outperformance YTD, NOW seems well on track to far exceed these metrics, but as always, management’s guidance is conservative.

The company still guides for over $15 billion in subscription revenue in 2026, which it should easily surpass, and $1 billion in Now Assist ACV, which, again, it seems well on track to exceed. The Knowledge 2025 event alone created a $1.2 billion AI pipeline, and the company appears well on track to grow Now Assist ACV to at least $500 million in 2025, so I expect these targets to remain relatively conservative.

On top of this strong top-line growth, management also expects to realize 100 bps of operating margin expansion in 2026, pushing this to roughly 31.5%, and its FCF margin by 50 bps to 32.5%. Meanwhile, in FY27, management expects its operating margin to grow towards 33% and its FCF margin toward 34%, which is robust guidance, especially considering management’s track record of conservatism.

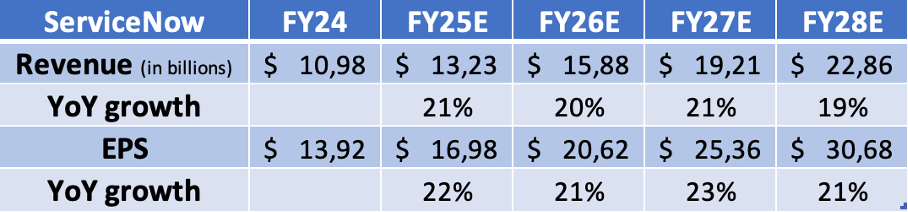

As for my projections, the strong Q2 results and guidance urge me to raise my revenue estimate slightly, now pointing to 20.5% YoY growth in 2025. Furthermore, NOW’s strong margin performance allows me to increase my EPS estimate by a solid margin, now pointing to 22% YoY growth, up from a prior 19%.

Meanwhile, for FY26, I expect the company’s AI revenues to ramp up, but cautious IT spending due to broader macro concerns will slightly pressure demand, though I do expect growth to remain above 20%. For the years after, I expect this momentum to persist, with growth unlikely to fall below 20% before 2028, as rapid AI-related revenue growth offsets slowing growth in its core business. With these estimates, I remain conservative on my AI estimates, indicating there is room for upside.

Additionally, the healthy margin expansion management guides should translate into steady EPS growth just above revenue in the low-twenties. This combination of margin expansion and impressive top-line growth should allow NOW to remain a Rule of 50 business for years to come.

So, where does this leave NOW valuation-wise?

Unsurprisingly, NOW shares tend to consistently trade at a considerable premium, with a 5-year average P/E multiple of 73x and a cash flow multiple of 44x. Yet, interestingly, NOW shares have been experiencing some weakness in recent weeks amid broader weakness for software stocks, falling 19% since early July and sitting almost 30% below their January 2025 all-time high, even as consensus estimates for NOW through 2028 only continue to rise.

That is an interesting discrepancy, pointing to some re-pricing. And while this might be justified for the broader software sector, with many smaller, weaker peers trading at exorbitant multiples, I don’t believe the same can be said for NOW.

As a result of recent weakness, NOW shares currently trade at 50x this year’s earnings and 37x FWD cash flow. Additionally, adjusting for forward growth, we are looking at a 2.3x PEG, which is roughly in line with its 5-year average.

Now, I know, this is still anything but cheap. Yes, you can question whether 20% growth, in isolation, can justify the multiples NOW shares trade at. Yet, you’d then be overlooking its robust operating metrics (Rule of 50, growing operating leverage, 98% renewal rate, rapid AI growth), as well as its near-perfect fundamental positioning, which will benefit it for at least the decade to come – NOW will not just be delivering strong growth through 2028, but I am confident it will do so well into the 2030s, making it much easier to justify paying a hefty premium.

You’re paying up for quality, longevity, and scalability, just as investors did with L’Oréal, Nestlé, or Microsoft decades ago – one could have paid well over 100x earnings for L’Oreal in the previous century and still have realized double-digit annual returns. Not because of extraordinary growth, but because it has kept delivering healthy growth for decades.

In the same way, ServiceNow offers a rare combination of long-term relevance, operational excellence, and consistent innovation that positions it to be a compounding machine for years to come. This isn’t a story about chasing short-term momentum—it’s about owning a structurally advantaged platform with the potential to deliver high-quality growth well into the 2030s and beyond. When a business can compound at a high rate for a very long time, the price you pay matters far less than the runway ahead. That’s exactly the kind of setup ServiceNow offers today.

So, while the headline multiples are high, they’re reasonable for a company with ServiceNow’s combination of quality, scalability, and long-term visibility. The PEG of 2.3x reflects a premium—but for a business of this caliber, it may still offer strong risk-adjusted returns, especially if you’re thinking like an owner, not a trader.

Long story short, while its valuation might seem hefty, NOW is one of those few companies that is worth paying this kind of premium, and I believe NOW will continue to earn its current premium for the foreseeable future.

For reference, assuming a 50x FY27 exit multiple, similar to today, I calculate an end-of-2027 target price of $1,268 per share. From a current share price of $851, this represents potential annualized returns of just over 17% annually.

Especially considering there is plenty of upside to my estimates, I believe this reflects a very favorable risk-reward balance.

So, in conclusion, I believe the current weakness presents us with an excellent buying opportunity in one of the most compelling long-term tech investments out there. Below $900 per share, I’m happy to keep accumulating shares, growing this to one of my largest positions.

📌 Analysis Summary

ServiceNow continues to defy the rule of large numbers, accelerating revenue growth in Q2 to 22.4% YoY despite its $200B+ scale and broader IT budget pressure — a clear sign of platform stickiness and expanding enterprise relevance.

The company is executing flawlessly on its land-and-expand strategy, with 99% of net new ACV coming from multi-module deals and 86% of customers now using five or more modules — highlighting platform breadth, depth, and upsell efficiency.

Strong customer retention and platform expansion continue to drive exceptional financial performance, with a 98% renewal rate, expanding margins, and over 30% FCF margins — keeping NOW firmly in Rule of 50 territory.

Agentic AI is a generational opportunity, and ServiceNow is uniquely positioned to lead due to its neutral, workflow-centric architecture, cross-domain orchestration, and deep enterprise integration. Early traction from NOW Assist shows meaningful adoption and significant ACV uplift.

With a net cash balance sheet, growing EPS, and a 5-year track record of consistent execution and consensus-beating results, NOW is a rare high-growth compounder with structural resilience and a multi-decade runway.

Despite recent weakness in software stocks, NOW trades at 50x earnings and a 2.3x PEG — a premium, but justified by unmatched quality, strong operating leverage, and its positioning as the future “operating system of the enterprise.”

Based on a 50x FY27 exit multiple, the stock offers an estimated target price of $1,268, implying 17% annualized returns and a compelling long-term setup for patient investors.

Rating: Accumulate below $900

2027 Target Price: $1,268

Implied CAGR: ~17%

Great analysis on $NOW, I've added to my position few days ago. 👍

Thanks for your analysis! I think that the FCF should should always be reported without SBC, so, for example, the Rule of 40 would actually be 54 minus 20 % is only 34 %. But I agree with you that this doesn’t really matter if they continue growing at this pace and can steadily increase adjusted FCF. It’s also important that they’re now aiming to push SBC below 15%.

I hadn’t even considered the CRM angle, and that explains why the market values NOW significantly higher than HUBS at a similar valuation and cash flow trajectory.

The current weakness is probably also related to the seat-based billing model. Do you think they’ll switch future contracts to per-ticket billing—or is that already happening? For example, AI-automated ticket resolutions being billed instead of seats? That would tie revenue more closely to the economy. At least the pricing approach will likely change so they’re not too dependent on seats. But creativity here is virtually unlimited, and anyone who already uses NOW isn’t going to abandon it just because of new pricing.