Significant Growth Opportunities Are Often Overlooked For This Resilient Player

A Comprehensive Exploration of Investment Opportunities in the Sportswear Industry

Nike Inc. – An introduction

It is safe to say that Nike shareholders haven’t had the best of years in 2023, with Nike shares down 18% over the last 12 months against a 24% increase for the S&P500 and over 40% returns from the Nasdaq. And this isn’t just, an industry-wide underperformance, with close peers Lululemon and Adidas shares up 57% and 30%, respectively. Moreover, Nike shares now sit a staggering 41.6% below their ATH.

Safe to conclude that Nike quite significantly underperformed in 2023. However, this is also the reason I am taking a close look at the shares once more. Especially in times like today, in which everything looks expensive after the rally at the end of 2023 and technology stocks looking vastly overbought on overly positive momentum, it is worth checking out underperformers. One of them is Nike - a company that historically outperforms the market under most circumstances and is of tremendous quality.

Nike has grown revenues at a decent CAGR of 7.3% over the last decade, doubling its revenues from $25 billion in 2013 to over $51 billion in fiscal 2023. While this growth might not seem incredible in itself, the consistency makes this really impressive. Nike has reported just three quarters of negative revenue growth since 2010, which is quite remarkable and a testimony to Nike's enduring popularity.

Of course, Nike is a company that needs minimal introduction. The Swoosh logo is globally well-recognized, potentially even one of the most recognized fashion brands ranked among the likes of Gucci and Louis Vuitton.

The company is a globally renowned American multinational corporation that dominates the sportswear and athletic footwear industry. Established in 1964 as Blue Ribbon Sports and later rebranded as Nike in 1971, the company has evolved into an iconic symbol of athletic excellence and innovation. With its distinctive swoosh logo, Nike has successfully positioned itself as a trendsetter in the fashion and sports domain.

The company's product portfolio spans across various sports, catering to diverse preferences and performance needs. Beyond its products, Nike has cultivated a powerful brand identity that transcends sports, resonating with individuals who embrace an active lifestyle. There is a reason the brand has earned a place in the top 10 most valuable brands in the world, according to Interbrand. Nike takes the #9 position with a nearly $54 billion brand value. A big part of the brand’s success is its collaborations with elite athletes, celebrities, and designers, contributing to its status as a cultural phenomenon and shaping the intersection of sports, style, and lifestyle.

However, even mighty Nike is not untouchable and has been facing significant headwinds in recent months, explaining the poor share price performance. Nike had been dealing with a challenging macro environment plagued by rising interest rates, falling consumer spending, and high inflation. This has put pressure on its top-line growth and resulted in elevated operating costs.

In the most recent quarter, Nike missed the revenue consensus and even lowered its fiscal FY24 outlook as the macroeconomic environment continued to put pressure on the business, disappointing investors. As a result, analysts have been downgrading their FY24 estimates for Nike with 25 downward revisions on EPS and 29 on revenue.

This comes on top of worries about Nike’s long-term growth potential. We should, of course, not forget that Nike is a mature company operating in a mature industry, leaving it with limited growth in its existing markets and brands. This raises the question of how much growth is left.

Meanwhile, the company continues to be priced at quite a premium, currently trading at 28.5x this year’s earnings, an 82% premium to the consumer discretionary sector, and a 21% discount to its own 5-year average. Nevertheless, recent struggles have created doubts among investors about whether its premium valuation is still deserved. This explains the underperformance of the shares in 2023, as investors were focused on picking up beaten-down tech stocks – not arguably overpriced Nike shares.

However, my research and deep dive into Nike’s operations and fundamentals shows that it, in fact, still has plenty of growth drivers and remains arguably exceptionally well positioned for solid growth going forward as its positioning, from all perspectives ranging from demographics to market share and geographically, is looking exceptional. As a result, I argue that there is still plenty to be bullish about for Nike shareholders, and I see quite a bright future for the shares.

Let’s dive into each of these growth factors before we take a look at the company’s recent performance and financial profile.

Nike still has plenty of levers to pull to accelerate growth

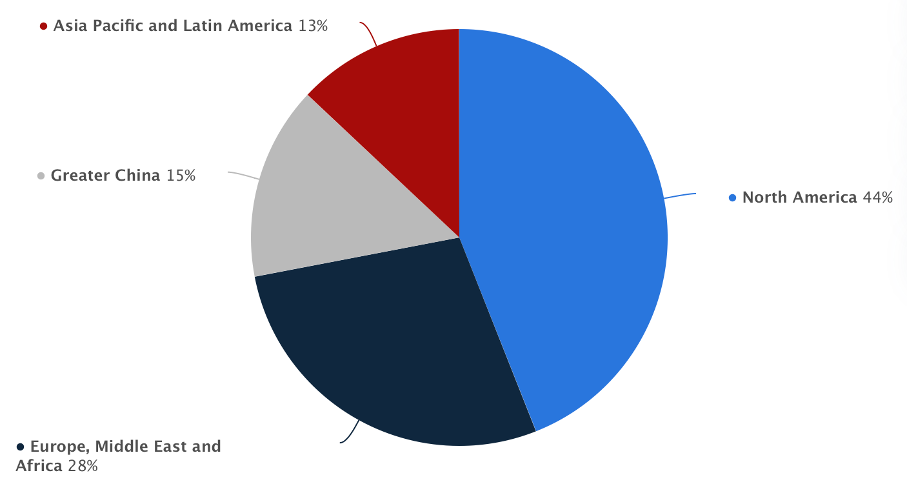

In terms of diversification, Nike is looking excellent. In terms of geographies, the company is looking quite good, with North America being the company’s largest segment at 44% of revenue, followed by the EMEA at 28%. This means the company derives 72% of its revenue from mature and stable markets. While these might not present the most outrageous growth, this does make its revenue stream highly reliable with minor sensitivity to geopolitics.

The remaining 28% of revenue is derived from Asia, with China accounting for 15%. These markets have the potential for faster growth but have also proven less reliable. Therefore, I quite like Nike’s current revenue balance between growth and stability.

By product segment, Nike continues to be mostly exposed to the footwear industry, accounting for 68% of revenue as of the company’s fiscal year 23. This is followed by apparel at 28% of revenue and equipment at just 4%.

According to statistics, as of 2022, Nike holds a market share of around 38% in the footwear industry, with a 30% market share in athletic footwear and 38.5% in sneakers, making it the undisputed industry leader.

Furthermore, in terms of revenue, it’s safe to say Nike dominates the footwear industry with over $30 billion of revenue annually. For reference, industry #2 Adidas reports just over $13 billion of footwear revenue, less than half that of Nike. This makes Nike the largest footwear manufacturer globally and a primary beneficiary of growth in the footwear industry.

However, this industry is very mature, so no rapid growth should be expected. According to Grand View Research, the footwear industry is projected to grow at a CAGR of 4.3% through 2030, with the more mature U.S. footwear market projected to grow at a CAGR of 3.2%, driven by the growing e-commerce market, extensive spending on advertising, and rising demand for athletic footwear.

This means we don’t have to expect double-digit growth in Nike’s footwear segment, or at least not from its existing brands. As for its market share, this has been stable over the last few years and I do not expect major changes here, either to the up or downside.

However, Nike has some levers to pull here, particularly through its ownership of the Jordan brand. The Jordan Brand is part of Nike, Inc., and it is named after legendary basketball player Michael Jordan. The brand was established in 1997 and has since become one of the world's most iconic and successful athletic shoe and apparel lines.

However, Nike still sees great potential in the brand as it is on the path to becoming the second-largest footwear brand in North America and the biggest brand apart from Nike. Yet, internationally, the brand still has a lot of ground to gain, as well as in the women's category. Therefore, Nike plans to significantly increase investments in the brand in terms of merchandising and marketing. Through these efforts, I believe Nike could be able to give its footwear a push to a mid to high single-digit CAGR when considering the Jordan brand already accounts for around 15% of Nike’s footwear sales.

Meanwhile, the expansion of the Jordan brand also goes beyond just shoes, as Nike is also increasingly leveraging the Jordan brand’s strength in appeal for apparel. As Nike puts it: “Jordan can be more than retro, more than footwear, more than men's and more than North America.” Jordan apparel is already approaching a $1 billion annual run rate, averaging almost 20% growth over the past three years. It will likely remain an apparel growth driver.

Another lever Nike plans to pull to boost growth in apparel and footwear is an increasing focus on investments in the women’s segment. Today, about 40% of Nike members are women consumers, so they make up a significant portion of the Nike member community, and this group is outgrowing men.

Despite this, Nike’s product offering for men remains more extensive. Just check out the Nike website and look at their Air Force sneakers. 9/10 times, you’ll find that the men’s offering is far more extensive, with more colors and patterns.

However, Nike has now decided to turn this around and is introducing new products to serve their female customers better. Women’s is a roughly $9 billion business for only the Nike brand, accounting for approximately 18% of fiscal FY23 revenue, clearly still leaving much room for growth. Just consider that women globally account for 60% of activewear purchases. This highlights that this is a largely underpenetrated market for Nike, leaving it with a significant upside across its business.

Nike is already making moves to increase its women’s offering by expanding products in its existing product lines but also introducing new markets, penetrating an entirely new market by, for example, introducing a collection of bras and leggings across different price points.

These opportunities in both the Jordan brand and female apparel market are often overlooked by investors, but these give Nike quite some potential to outgrow industry growth projections.

Moving back to the apparel market for Nike, it is currently estimated to hold a market share of approximately 13% in athletic apparel, which means it’s the leader in this highly fragmented industry, where it actively competes with the likes of Lululemon, Puma, Adidas, and many more brands. Meanwhile, this market is expected to grow slightly faster compared to footwear at a CAGR of 6% through 2032. This should drive decent growth for Nike. While it is perceived as a mature company, it, remains a growth company by nature.

Another factor often overlooked by investors is that Nike is no longer just an activewear brand. The company is so much more than that. The company is increasingly becoming a real fashion brand, with people wearing the brand's clothes not just for their workouts but in their everyday lives.

This shift is helped by trends from the COVID-19 pandemic turning out not to be trends but a mainstay. As reported by Kantar, “consumers are seeking comfortable clothing to wear for workouts but also around the house where they may still be working at least part-time. Even as people returned to schools, offices and other social settings, many continue with their relaxed clothing options and favor sneakers and stretchy pants.” This is helping Nike become an everyday brand, giving it a much larger market to benefit from.

Furthermore, some even see Nike as the next luxury fashion house, driven by its low-key high-end fashion products and incredibly strong premium brand name, comparable in strength to the likes of Louis Vuitton and Gucci. While the company might not have the same high-end pricing power, special edition Nike sneakers selling for thousands of dollars are definitely not a standout.

Nike can leverage its incredible brand to enter the luxury fashion market. According to Bloomberg, “by making its hottest sneakers harder to find, it’s on its way to becoming more a top-end name, like Gucci or Louis Vuitton, than a mainstream product.”

An important move supporting its premium nature is the shift to DTC. By not selling its most-wanted models through wholesale channels, Nike keeps its pricing power and brand cachet intact, a move it stole from the luxury playbook.

While Nike will remain a mainstream retailer, it could increase its brand allure by selling more aspirational and expensive sneakers and apparel at the top end of its range. According to Bloomberg, “demand for the luxury brands’ own casual footwear collections — popular with those young buyers — demonstrates that there is ample room to do this.” Clearly, Nike has a lot of room to play with here and a lot of directions to steer its brand to open up new revenue streams.

Now, there is one final factor I want to point out that contributes to Nike’s growth outlook before we get into concrete growth estimates. This is Nike’s popularity among younger generations. Recent surveys taken by Piper Sandler analyzed discretionary spending patterns, fashion trends, technology, and brand preferences. Among these key findings was the fact that Nike emerged as the #1 brand for all teens in both apparel and footwear.

I believe this positions Nike incredibly favorably for long-term continued and potentially even accelerating growth. Younger generations’ purchasing power is rapidly growing, and these consumers are becoming increasingly more important in today’s market. With Nike being popular among these generations, the company most certainly had an edge.

Overall, all these factors discussed further add to my belief that investors overlook many important growth opportunities and factors for Nike. Simply put, the company’s growth potential is underestimated in our view, and we believe that based on these fundamentals and growth drivers, the company is poised to grow its revenue at a CAGR of 6-9% in the medium term.

Share buybacks, cost savings, and the shift to DTC should allow Nike to grow EPS even faster

While I am already quite bullish on Nike’s revenue growth, as explained above, I am even more so on its EPS or earnings growth potential. Historically, Nike has not been able to grow its bottom line much faster than its top line. Yes, it was slightly faster at a CAGR of 10.6% from 2012 to 2022 (not using 2023 due to inflation causing a unique situation), but considering Nike’s top-line growth, its margin and cash flow improvements have been far from impressive.

For reference, the gross margin has only improved by one percentage point from 2012 to today, and the net income margin by only 230 bps. This is even as 2012 was a somewhat negative year in terms of profit. If we compare this to 2011, margins have even worsened, which is quite shocking for a company with incredible pricing power like Nike, considering that the higher revenue levels should have given it some operating leverage.

However, while revenue more than doubled between 2012 and 2023, so did the cost of sales. Furthermore, while demand creation expenses (including marketing and merchandising) did not grow as fast, operating overhead expenses grew by a staggering 161% over the same period, meaningfully outgrowing revenue growth and dragging on the bottom line. Clearly, Nike is not operating as efficiently as it should.

Luckily, the company acknowledges this and introduced a savings plan during the most recent earnings call, which should lead to a cumulative $2 billion in cost savings over the next three years. With this plan, Nike aims to fuel its profitability while still investing in growth. This is what management said in terms of where these savings will come from:

“Areas of potential savings include simplifying our product portfolio, increasing automation and the use of technology, streamlining our organization, and leveraging our scale to drive greater efficiency.”

Management is actively looking to identify opportunities across its business to deliver these cost savings up and down the P&L and across the value chain. This also includes simplifying the product assortment and focusing investments on the best-performing product segments, as well as “improving supply-chain efficiency, leveraging our scale to lower the marginal cost of operations, increasing automation and speed from data and technology, streamlining our organizational structure, reducing management layers and enhancing our procurement capabilities,” as management explained during the earnings call.

All things considered and looking at current inefficiencies, management should have no trouble delivering on its cost-saving target, and this could result in $1 billion in cost savings in fiscal FY26 alone. This means that even without growing the top line, management should be able to deliver a net income margin improvement of 220 bps, which is quite significant.

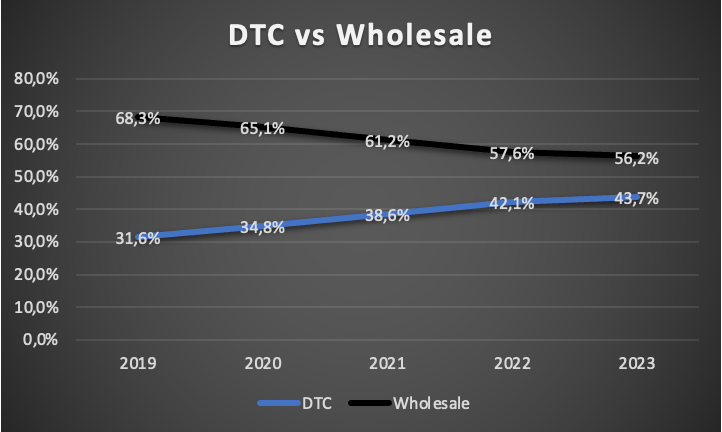

And this is not all, as Nike’s continued shift of focus to DTC should also contribute to margins over the next few years. Nike has been working over the last few years to decrease its dependence on wholesale channels and to increase direct-to-consumer sales through its Nike stores and digital channels.

This has worked out quite nicely, with Nike growing DTC sales at a CAGR of 17% compared to 7.3% for total revenue over the last decade. As a result, DTC accounted for 43.7% of sales in fiscal FY23, compared to just 31.6% in 2019.

Why is this shift important to margins? Well this allows it to control margins and prices better and keep the full profit of the sale to itself instead of having to pay a percentage to the wholesaler. Furthermore, it also allows Nike to create a higher sense of exclusivity. Nike often purposely creates shortages in popular products to be able to charge a premium. I mean, not many wholesale brands can charge over $100 or $150 for a pair of sneakers, but Nike can, and it does so on a massive scale. This further drives up margins.

So, overall, it is easy to see how this is the better strategy. However, so far, this has not yet resulted in the margin improvements you might expect, and this is due to Nike having to invest heavily in building the digital ecosystem and new operating capabilities to handle this shift.

Simply put, it has added complexity and inefficiency. Positively, Nike has now got most of these investments behind it, and with its member base now expanded to tens of millions, it is able to shift its focus to realizing these efficiencies, which should now finally allow it to expand margins more meaningfully.

Finally, regarding EPS growth, which might be one of the most important financial indicators for investors (besides FCF), Nike has done quite well over the last decade, growing this at a CAGR of over 12%, growing faster than profits. This is essentially the result of Nike retiring significant amounts of shares over the years through buybacks.

Over the last decade, Nike has retired 16% of outstanding shares, which has boosted EPS growth quite meaningfully. Going forward, I see no reason for this to change as Nike’s profits grow. Therefore, taking everything into consideration, from improving margins, costs, efficiencies, and share buybacks, I expect Nike to grow EPS comfortably in the double digits for the foreseeable future, with this likely sitting closer to the mid-teens over the next couple of years as Nike achieves its planned efficiency gains.

Nike is facing headwinds, but its performance shows resilience

Nike received quite some criticism following its Q2 earnings as it missed the revenue consensus and was forced to lower its FY24 outlook. A double-digit drop in the share price following the earnings release says it all.

Nike reported earnings on December 21 and delivered fiscal Q2 revenue of $13.4 billion, up 1% YoY but down 1% on a currency-neutral basis, which shows growth continues to slow down for Nike.

It is important to note, though, that Nike is operating in a very challenging operating environment as a result of lower consumer spending and elevated inflation while also facing very tough comparable quarters, lapping the 27% growth in Q2 of last year.

Revenue growth was further dampened by Nike's focus on liquidating excess inventory and reducing wholesale sell-in in 1H24. Positively, this did result in a 14% decline in inventories, or about $1.5 billion down from the peak in Q1 of last year.

Considering the business was facing all these headwinds, I believe the reported revenue growth wasn’t as bad as it may seem. Moreover, Nike’s currently low reported growth is mainly the result of a challenging operating environment, so circumstances should improve as inflation comes down and economic growth remains solid. Nevertheless, Q2 still fell short of Nike management’s expectations, even as Nike’s store traffic grew.

Nike Direct revenues grew 4%, with Nike stores up 9% and digital channels down 1%. Meanwhile, wholesale was down 3%. By region, Asia was the only growth driver as the region continued to recover, with especially China taking the lead. Revenue from China grew 8% YoY, primarily driven by 19% growth in wholesale. Meanwhile, growth in both North America and the EMEA was down 3% YoY, with wholesale down by high-single digits and Nike direct revenues up 4% and 7%, respectively. These declines in the more mature markets are no surprise, with these regions also dealing with high inflation and rising interest rates.

However, while top-line growth disappointed somewhat, Nike beat the EPS consensus by a solid margin and reported EPS growth of 21% to $1.03, which is impressive considering price pressures and slow top-line growth. Yet, whereas the top line comparison was challenging, the bottom comparison with last year’s Q2 was much easier due to Nike facing much more significant pricing pressures in fiscal 2023.

Driven by this easy comparison, “strategic pricing actions, lower ocean freight rates, improved supply-chain efficiency and modest markdown improvements,” as reported by management, Nike was able to expand gross margins by 170 basis points to 44.6% in Q2. This was despite a highly promotional marketplace and headwinds from foreign exchange rates. Clearly, management has its costs well under control, reflected in its resilient bottom line, which impresses.

These improving margins also led to improved cash flows, which allowed Nike to strengthen its balance sheet. Nike reported $7.92 billion of cash on the balance sheet at the end of Q2 against $8.93 billion of debt. This is a slight improvement from the start of May 2023, leaving Nike in a very healthy financial position. Crucially, it leaves it with plenty of cash to keep investing in the business and repurchasing its shares.

Finally, the improving cash flows also support a growing dividend; Nike shares currently yield 1.43%, which is 38% higher than its 5-year average and offers a very decent starting yield, in my opinion. Furthermore, the dividend is well covered by a 40% payout ratio and has grown rapidly at a 5-year CAGR of 11%. Nike has now raised its dividend for 11 straight years and does not plan to stop anytime soon. Its latest increase was 8.8% in November.

Considering the projected EPS, cash flow growth, and its conservative 40% payout ratio, I expect Nike to remain a desirable dividend growth company, most likely constantly growing its dividend by double digits once the operating environment improves. At a current yield 38% above its 5-year average, shares are looking quite appealing right now.

Outlook & Valuation

I already mentioned it, but following a Q2 that sat below Nike management’s expectations, it was forced to lower its FY24 outlook as it continues to face a soft demand environment.

Management now expects fiscal Q3 revenue to be slightly negative as the company faces tough comparable quarters of double-digit growth. Positively, it does expect Q4 revenue to be up by low-single digits, resulting in FY24 revenue growth of approximately 1%.

On a more positive note, management now projects an improvement in the gross margin in the second half of the year, with Q3 margins expected to be up 160 to 180 bps YoY and Q4 margins to improve by 225 to 250 bps. This should result in FY24 margin expansion of 140 to 160 bps, reflecting “benefits from strategic price increases, improved ocean freight rates and supply chain efficiency, partially offset by higher product input costs and approximately 60 basis points of impact from foreign exchange headwinds,” according to management.

This means management expects cost-saving efforts to offset the weak expected revenue growth, which is a big positive. Yet, we should note that Nike anticipates a restructuring charge of $400 million to $450 million in the year's second half. Nevertheless, Nike's cost-saving and efficiency efforts should allow EPS growth to remain positive in the double digits for FY24. Based on this outlook and my analysis and growth expectations discussed, I now project the following financial results through FY27.

Based on these estimates, Nike shares are valued at close to 29x this fiscal year’s earnings, which is no bargain. Even as shares trade at a 20% discount to the 5-year average, paying 29x earnings is quite demanding for a company projected to grow revenue no faster than high-single digits.

However, Nike is not just any company but one of the world's most popular, valuable, and well-known brands. As laid out in this article, the company still has plenty of room for growth, and driven by a cost savings plan, its shift to DTC, and continued repurchases, EPS growth will be comfortably in the double digits for at least the next few years.

Nike shares rarely trade at a discount, and rightfully so. Even as many investors and analysts might start to doubt the company’s room for growth and fail to see its potential, Nike remains one of the most formidable compounders and will remain this for many more years in our view.

As a result of the sheer quality of this company, the promising EPS outlook, and plenty of room for dividend growth, we believe Nike continues to deserve its premium valuation. The company, together with Lululemon (for those looking for faster growth but less brand strength), remains our top pick in both fashion and apparel.

While it is unreasonable to expect Nike shares to return to their 5-year average valuation, even in the best of times, a 28x multiple seems very fair. Based on this multiple and our FY26 EPS projection, we arrive at a target price for Nike of $142 per share. From a current share price of $106, this translates into potential annual returns of 12.5% or close to 14%, including dividends.

Therefore, we believe Nike shares are looking very attractive today. We continue to be buyers of the shares at any price below our current fair value estimate of $112 per share, indicating that shares are now valued 5.5% below fair value. As a result, Nike shares receive a “Buy” rating from us.

Thank you for reading my research on Nike. Please remember that this is no financial or investment advice and is for educational and informative purposes only. I am simply sharing my views and actions, which I hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: I do have a beneficial long position in the shares of NKE either through stock ownership, options, or other derivatives. This article expresses my own opinions and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.