Spotify Technology S.A. – A Deep Dive

High growth, profitable, a great moat, and dominant market position. What is there not to like for investors about Spotify? Let me tell you all about it in this Deep Dive!

Did you know music streaming revenues have multiplied by about 15x over the last decade?

Yes, the growth in this industry has been absolutely mind-blowing. While the music industry has experienced ups and downs over recent decades, from a high in the 1990s to a low in the early 2010s, it has entered a clear upward trajectory over the last decade or so, thanks to the emergence of music streaming (under the lead of Spotify)

Today, streaming is by far the largest source of music consumption, having far surpassed digital downloads and all physical music formats. After streaming subscribers have soared rapidly in recent years, data suggests there are now more than 700 million people with a music streaming subscription.

However, did you also know that streaming penetration in the music industry remains remarkably low?

Yes, while you might presume everyone streams his music by now, global streaming penetration remains remarkably low, especially in less developed markets. While in the U.S., penetration is decent at 42% (though with plenty of room to run), in markets like Brazil or China, it is still at a very low 13%, and India, another massive growth market, only sees a 1% penetration.

As a result, the industry keeps up an impressive growth rate and is expected to keep compounding well into the future at a double-digit rate.

Indeed, it is safe to say music streaming is a hugely compelling market.

The dominant leader in the industry?

Spotify Technologies S.A., a Swedish technology company founded in 2006 and a pure-play audio streaming business, capturing a very significant portion of this rapidly growing market.

As a result of the streaming revolution and Spotify’s early-mover advantage and close-to-perfect execution over the years, few companies have delivered as good a performance over the last decade as Spotify, as it has emerged as a dominant force in the fastest-growing piece of the very compelling music industry.

Here are some Spotify numbers to consider:

640 million users and 252 million subscribers in 183 countries.

A demanding 32% market share, almost double that of its closest Western peer, and stable over recent years.

Subscribers have grown at a 30% CAGR over the last decade.

This has led to a 33% revenue growth CAGR

Meanwhile, 2024 will mark the first year in which the company generates an operating profit (18% operating margin as of the most recent quarter)

It generates almost $2 billion in FCF annually.

Realizes an ROIC of 20% (TTM)

And on top of all that, Spotify is expected to keep growing its top line at a double-digit rate well into the next decade and to keep rapidly expanding margins in the meantime.

Interested in the business and its prospects yet? How can you not be? This is a pure-play founder-led business operating in a highly compelling industry with a dominant market position, which is translating into impressive financial growth.

But is it a compelling investment? That is where it gets tricky.

Despite its impressive growth and terrific performance over the last decade, the company is struggling to deliver consistent profits and trades at very demanding valuation multiples, especially after its shares gained 142% over the last 12 months.

Nevertheless, let’s learn all about this company by thoroughly dissecting its business and discussing its fundamentals, moat, financials, and outlook. Indeed, this is my Spotify Deep Dive.

Let’s delve in!

An introduction to Spotify, the music streaming leader

Spotify is a company that needs very little introduction. If I am supposed to believe the data out there, a large number of the music streamers among you are Spotify subscribers, whether free or paid.

Nevertheless, let me tell you all you need to know!

Spotify Technology S.A., founded in 2006 and launched in 2008 by Daniel Ek and Martin Lorentzon, is the global leader in the audio streaming industry. Over the last two decades, the company has revolutionized how people consume music by introducing a subscription-based streaming model that provides on-demand access to a rich catalog of licensed content. Spotify truly was a first-mover in streaming.

Through its platform and app, Spotify offers users, through both free, ad-supported tiers and premium subscription options, an industry-leading library of music (100 million tracks), podcasts (6 million titles), and other audio content, such as audiobooks (350k). Headquartered in Luxembourg, Spotify operates across numerous markets worldwide, with its app available in an industry-leading 184 countries, making it a household name for audio enthusiasts or pretty much everyone who listens to music. (The annual Spotify wrapped is a global phenomenon by now)

Thanks to its combination of free and premium tiers, Spotify has always given subscribers the chance to try it risk-free. Thanks to its great streaming platform, it funnels these subscribers toward premium tiers, a strategy that also translates into high retention rates and low churn, as consumers know what they’re getting. This strategy has also allowed Spotify to rapidly enter new markets at low cost, growing from 65 countries in 2018 to 183 four years later.

Meanwhile, thanks to this early-mover advantage and great go-to-market strategy, as well as an excellent personalized listening experience, tremendous global reach, and a well-recognized brand name (Spotify is now the #65 most valuable brand globally), Spotify has grown into the undisputed leader in the music streaming industry.

And by undisputed, I mean Spotify absolutely dominates. The company has a whopping 640 million monthly active users and 252 million subscribers across its 184 markets. With this, it claims a demanding 31.7% market share in the music streaming market (by subscribers), more than double that of its closest peer, Tencent Music, at 14.4%, and almost three times more than its closest non-China peer, Apple Music, with only 12.6%, followed by Amazon Music at 11.1%.

Meanwhile, the company is said to have an even higher market share of global paid subscribers, closer to 35%, while it also claims a whopping 60% market share in global hits streams.

Meanwhile, these numbers have been growing and continue to grow at a stellar rate. For reference, subscribers have grown at a 30% CAGR over the last nine years, with not a single quarter of negative sequential growth, highlighting the consistent adoption of the platform and the high retention rates, despite price increases.

Furthermore, Spotify’s total monthly users have grown at a 26% CAGR over the last nine years and have doubled over the last four years. Notably, these users are also well-spread worldwide, with a roughly equal split between Europe, the U.S., LatAm, and the rest of the world, showing no overdependence on a single region.

And finally, Spotify’s user demographics are also really great, with most of its users, roughly 55%, below the age of 34 and 71% below 44. These are extremely favorable long-term demographics, suggesting Spotify has a young user base with great lifetime value, and it clearly attracts new generations with its innovative and well-recognized platform.

Spotify has been pretty sublime so far, and there is more to come. It also has a respectable moat and has shown a pretty good ability to fight off the competition. At times, Spotify has extended its lead to its closest competitors, but over the long haul, it has kept its market share relatively steady.

Spotify has grown its subscribers at a 22% CAGR over the last five years, compared to an 18% CAGR for its closest competitor, Apple Music. Meanwhile, emerging players such as YouTube Music, Amazon Music, and Tencent Music in China have grown at a more rapid rate over the last five years, but this is from far lower levels. Spotify has seen impressive growth at a much more significant scale, still consistently adding more subscribers quarterly than most of its competitors combined.

For reference, Spotify has added a swopping 137 million subscribers from 2018 through the end of 2023. Meanwhile, here are the additions for its closest competitors:

Apple Music -> 53 million

YouTube Music -> 90 million

Amazon Music -> 64 million

Pretty impressive, right? Yes, Spotify is fighting off much larger companies with far more significant R&D resources, but its nimbleness and pure-play nature work in its favor. It also has a significant headstart, which gives it multiple lasting advantages.

Spotify has a bigger moat than you might think!

Helping its strong performance compared to the emerging competition is Spotify’s relatively impressive and underestimated moat. Spotify's competitive moat stems from its combination of technological innovation, extensive content library, and strong network effects.

From its early days, Spotify has led the industry with its excellent algorithms, which power its personalized listening experience, modified playlists, and industry-leading recommendation features tailored to individual tastes.

Today, this remains one of the platform’s most substantial advantages and gives it a surprisingly strong moat. Most importantly, with its significant leadership, Spotify has the largest supply of data to fuel and optimize these algorithms. This improves the user experience as listeners find music or audio they resonate with, fostering loyalty and higher retention rates.

In other words, these algorithms create a profoundly personalized user experience, which not only keeps listeners engaged but also differentiates Spotify from competitors, as its algorithms consistently remain the best in the industry, in part thanks to Spotify’s far larger data supply compared to competitors. This is a lasting advantage.

For reference, 81% of music streamers claim personalization or discoverability as the biggest reason to sign up for a service and remain subscribed. So, this is a considerable advantage, to say the least.

In addition, the company is not sitting still. It is growing its content library by diversifying and aggressively investing in other audio formats. This will increase its appeal to consumers as the go-to platform with the broadest offering and strengthen its moat.

Whereas the company started out focusing on music and was still a music-only platform when it went public in 2018, it has diversified its offerings over recent years, investing heavily in exclusive podcast content and, quite recently, audiobooks.

And with great success!

Today, the company already claims an 11% market share in audiobooks in the U.S., already getting ahead of Apple but still trailing Amazon’s Audible. Positively, it is still capturing share at a solid rate.

Meanwhile, Spotify and Apple Podcasts are the two most popular podcast platforms among global listeners. Spotify is used by 37% of all podcast listeners, while Apple Podcasts is used by 32.9%. Together, Apple Podcasts and Spotify hold 69.9% of the listener share.

Spotify has been doing well in the podcast market, gaining market share. By securing deals with high-profile creators and producing original programming, like the Joe Rogan podcast, Spotify offers content that users cannot find elsewhere. This strategy attracts new subscribers and enhances the value proposition for existing users.

Finally, Spotify benefits from its sheer scale and global reach, which allow it to negotiate favorable licensing agreements with record labels and other rights holders. Its massive user base reinforces network effects, where the platform becomes increasingly valuable as more users, creators, and advertisers participate.

To give you a sense of these network effects, Spotify has grown from approximately 250 partners four years ago to more than 2,000 today, with integrations ranging from wearables like watches to cars and kitchen appliances. This growth in reach leads to significant growth, with Spotify claiming 28% of new registrations come through these partnerships, up from 14% in 2018.

Ultimately, I am comfortable saying Spotify has a more than solid moat that shouldn’t be underestimated, and thanks to its already dominant position in music streaming and growing share in podcasts and audiobooks, the company seems very well positioned for many more years of considerable double-digit growth.

For reference, the global music streaming market is expected to keep compounding at a 14% CAGR through 2030 and likely well beyond, driven by the growing popularity, reach, availability, and adoption. With its 31% and mostly stable market share, Spotify is very well positioned to capture this growth.

Meanwhile, the audiobook market is expected to grow at a 26% CAGR due to the rapidly growing popularity of the format, and the global podcast market is expected to grow at an even more impressive 28% CAGR, also due to the growing popularity and adoption.

With solid positions in each of these formats and Spotify heavily investing to grow its presence and appeal to these markets, there truly is no lack of growth potential here.

We can safely say Spotify should be able to grow revenue at a double-digit rate well into the next decade.

Compelling, right?

Spotify delivers solid growth and improving margins in its latest quarter

Spotify released its latest earnings report (Q3) in early November. While it fell short of the consensus headline numbers, the company impressed analysts and investors alike, with shares gaining roughly 14% in the following two trading sessions, mostly thanks to a big margin outperformance.

You see, one of the biggest negatives about Spotify in recent years has been its lack of profitability despite it no longer being anything near a start-up. Up until its most recent full fiscal year, Spotify has yet to report an actual full-year profit, as it has historically continued to invest heavily in growth. 2023 was a record year in MAU and subscriber additions as a result of these significant investments in growth.

However, management refers to 2024 as the year of monetization, which has translated into 2024 becoming its first full year of profitability, which has been improving rapidly.

Meanwhile, while this has had an unavoidable effect on user and subscriber growth in 2024, which has been decelerating throughout the year, it remains pretty solid, with revenue growth particularly remaining impressive, though in big part due to price increases late in 2023.

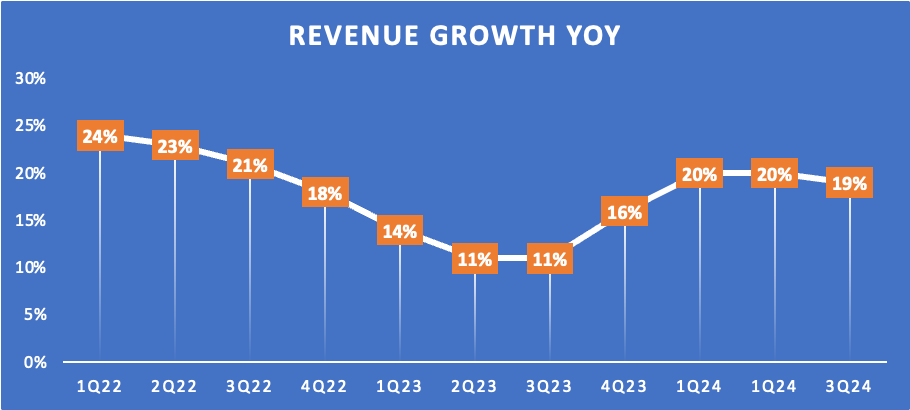

In Q3, management delivered revenue that was both in line with management’s guidance and analyst expectations. Spotify reported quarterly revenue of €4 billion, up a still impressive 19% YoY, still seeing some of the benefits from the late 2023 price increases, which in large part explain the revenue acceleration after mid-2023.

Furthermore, in Q3, management still delivered an outperformance in both subscriber additions and MAUs, beating expectations on both fronts by roughly 1 million. MAUs grew by 14 million to 640 million, while subscriber net adds came in at 6 million, bringing this to a total of 252 million. This reflects a 12% growth in paid subscribers, which sits relatively in line with prior quarters, though also showing a steady decline as a result of Spotify focusing more of its efforts on monetization.

However, considering this change in focus, I think it is safe to say growth remains quite resilient, not showing too much of a slowdown. This is helped by continued conversions from free to paid, which are reflected in higher ARPU. This growth in subscribers, combined with last year’s price increases, drove premium subscription revenue up a solid 24% year over year.

Meanwhile, advertising revenues from ad-supported subscriptions were up 7% YoY, reflecting continued volatile market spending on brand-related campaigns, as well as slowing growth in ad-supported MAUs.

As shown below, growth on this front has slowed considerably. This is seeing far more of an impact from management’s shift in focus to monetization and a headwind from the rule of large numbers. With 640 million users, it is simply not as easy to grow this base as quickly as before, especially amid a slowdown in promotion spending to improve profitability.

Knowing the situation, this doesn’t worry me yet, but I would like to see growth to stabilize a bit here, to see Spotify maintain its market position. Yes, profitability is important, but its competitive market position and share might be more crucial in the long term.

Again, I am not worried yet, but I will be monitoring this closely going forward.

Though, overall, I would say Spotify continues to show very healthy growth across the board, but this isn’t the biggest bullish sentiment driver right now.

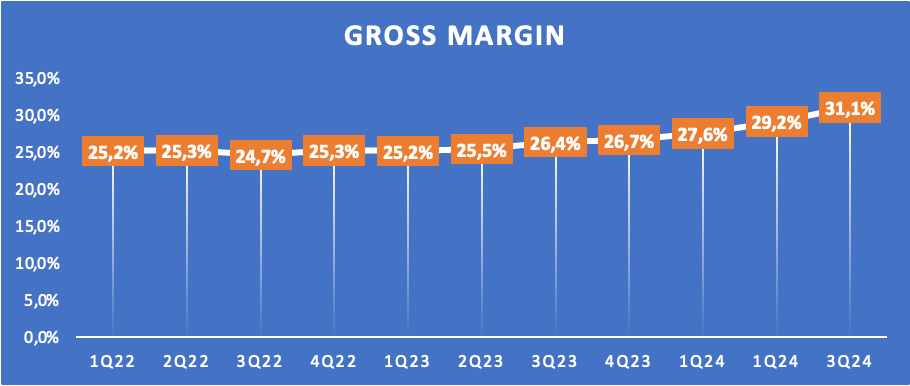

In terms of profitability, Spotify impressed investors in 2024, showing rapid progress amid its shift in focus. In Q3, Spotify delivered a significant margin beat. After rapid progress in 2024, Spotify has already surpassed its 2022 investor day margin targets, sitting slightly ahead of schedule.

Last quarter, the company delivered a record-high gross margin of 31.1%, ahead of its 30% medium-term target and 90 bps ahead of guidance, thanks primarily to content cost favorability. As visualized below, Spotify has consistently improved its gross margin over the years, but this has accelerated in 2024. It has hit all-time highs in each quarter and improved at an impressive rate as management focused on bringing down costs.

This gross margin strength, together with a focus on monetization and bringing down operating costs, also translated into a record-high operating income of €454 million or an operating margin of 11.4%, up from just 1% in the same quarter last year.

Spotify's operating margin performance in 2024 is nothing short of impressive. The company has rapidly become a fully profitable business, poised to deliver its first full year of operating profitability.

Clearly, if management wants to, it can generate a significant profit, proving many critics wrong.

Finally, FCF also hit an all-time high in Q3 of €711 million.

As a result, Spotify also maintained a healthy balance sheet, with a very solid €6.1 billion in cash and €1.3 billion in debt. With a TTM FCF of $1.8 billion, Spotify’s current debt is fully covered by its annual FCF, which is sublime. This, combined with a considerable cash position, leaves Spotify in an excellent financial position to keep investing.

And management has shown a great ability to create value using its cash. Its TTM ROIC sits at a healthy 20%, well ahead of a WACC of 13%, indicating Spotify management is well able to generate shareholder value through its investments.

Pretty neat.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

Want to try our paid tier for free? Simply get three of your friends and family to join Rijnberk InvestInsights and receive one free month!

Outlook & Valuation

Alright, it’s time to look ahead again. We already determined that Spotify has a bright future, so let’s move on to the outlook, which is excellent.

Starting with management’s own near-term guidance, it now expects MAUs to increase to 665 million and subscribers to 260 million in Q4, up a good 25 million and 8 million, respectively. This should further translate into €4.1 billion in Q4 revenue, up roughly 11% year over year. This shows a significant growth deceleration from prior quarters as Spotify starts to lap last year’s price increases. No surprises there.

On the bottom line, management anticipated a gross margin of 31.8%, likely resulting in an operating income of €481 million, pointing to Spotify’s first full year of operating profitability, likely generating €1.4 billion in operating income in 2024.

Meanwhile, management continues to see “a substantial runway to grow margins and income over the long run,” driven by a focus on improving its business with targeted investments and disciplined cost management amid improving monetization, something that seems likely indeed.

Ultimately, as established earlier, Spotify seems tremendously well-positioned for long-term growth. This is driven by considerable room for growth in the underlying markets, the company’s strong market position, and the payoff of its investments in other audio formats. Driven by these fundamentals, double-digit revenue growth is almost a certainty in the medium to long term, even as management has shifted its focus to profitability, helped by continued subscriber growth and retention.

Management shares this conviction. A while back, management revealed its belief in achieving €100 billion in annual revenue over the next decade while also realizing a 40% gross margin and 20% operating margin, which now seems quite likely.

Ultimately, based on all that was discussed, I now project the following financial results in the medium term. This includes the expectation that growth will accelerate in the years ahead and remain in the mid-teens through the end of the decade. However, I also anticipate that management will move its focus back to growth beyond FY25, which will result in a slowdown in EPS growth and stabilizing margins.

Now, so far, there has been a lot to be excited about. Spotify is a great business with a terrific platform and a more-than-solid moat, poised for significant long-term growth. Without a doubt, Spotify is one of the more exciting and compelling long-term technology investments, in my view.

However, that does come at a price, with Spotify consistently trading at very demanding multiples. Or, well, close to consistently. You see, after rallying during COVID-19, reaching all-time highs in 2021, shareholders quickly got a reality check, with shares losing 80% of their value to a late 2022 low, reaching bargain territory amid overly negative market sentiment.

However, since then, Spotify shares have known only one direction, and it’s straight up, gaining a staggering 478% since. Were you lucky enough to pick up shares near its low? Congrats! That is a jackpot – you’ll see in another decade.

I was lucky enough to buy some shares at just over $100 per share, but nowhere near as many as I wished I had.

Amid this year’s turn to profitability, this pristine share price performance has been no different. The share price performance over the last 12 months has been nothing short of sublime, maybe as deserved (I’ll leave it up to you to judge that). No real dips, a straight line upward.

However, while this has been great for existing shareholders so far, it has made shares rather expensive, even as the company is rapidly becoming profitable.

Based on a current share price of around $460, shares now trade at 77x this year’s EPS estimate or 47x next year’s earnings, which in no way is a bargain, as expected. Although, with a PEG of closer to 1.5x, it also isn’t necessarily an exorbitant price to pay.

So, is now the right time to pick up some Spotify shares? The short answer is no.

While I am absolutely a fan of this business and its durability, as well as the Spotify platform itself, I just can’t quite justify the current multiples. Yes, this is a business in which I would love to hold some shares, but I need the price to cool off a bit before I would consider buying.

Personally, I am aiming for a share price of below or at least closer to $420 per share, which represents roughly a 16% dip from today’s prices, something that is definitely not unlikely to appear at some point. Meanwhile, this will allow me to pick up shares at a long-term multiple of roughly 40x, a PEG of closer to 1.2x, representing a much better risk-reward profile and superior long-term return potential.

Until then, I will keep monitoring the situation and remain patient. Let’s hope for a little share price weakness, shall we.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Hi Daan. DMed you. Could you please take a look. Thanks.

I should have taken a deeper look at SPOT once it ended up being my favorite after trialing other services. Sometimes opportunities are so close.