Starbucks & Booking earnings reviews

Here is my analysis and take on the Starbucks and Booking quarterly results, plus a comprehensive thesis update, updated projections, and new target prices.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Starbucks Corp. – A very poor quarter, but some promise on the horizon

Last week, on Tuesday, April 29, Starbucks released its fiscal Q2 results, and while CEO Brian Niccol was optimistic during the earnings call on turnaround developments, the results couldn’t count on any enthusiasm from either Wall Street or investors.

We can safely say these weren’t well received. Shares initially dropped 9% in the following trading session and ended the day with a considerable loss. By the end of the week, some of those losses were regained, but Starbucks shares still ended the week 5% lower, a drop that is very easily justified as Starbucks continues to struggle. In fact, I would have expected a larger drop, considering just how poor the results continue to be and considering the considerable headwinds Starbucks is facing from tariffs and slowing economic growth.

While I remain optimistic about this turnaround story and confident in Brian Niccol’s ability to bring Starbucks back to its former glory under his current strategy, we need to acknowledge that macro conditions will likely delay the realization of such a turnaround. Tariffs and slowing economic growth will undoubtedly impact Starbucks’s business in the coming quarters, and uncertainty will weigh on the business.

Meanwhile, the current performance remains lackluster. With its fiscal Q2 results, Starbucks once again missed both the top-line and bottom-line consensus. The company is barely seeing any sort of comparable sales recovery, and operating costs remain high due to restructuring costs and higher investments to realize much-needed changes. As a result, both top-line growth and profits fell short of expectations.

Yet, despite a poor financial performance and no clear recovery in sight, Starbucks shares are very pricy at 32x this year’s earnings. Of course, once demand improves, investments ease off, and the company is better positioned for the future under Brian Niccol's vision, the profit recovery should be quite aggressive, which somewhat justifies the multiple under normal circumstances.

However, with the uncertainty coming from a potential trade war, slowing economic growth, and sticky inflation/high interest rates, pricing in so many assumptions is tricky, and paying this much for future profits is a tough ask.

So, all things considered, are Starbucks shares a good buy right now at a share price of around $84? Is it worth paying 32x this year’s earnings and 25x next year’s earnings for the promise of this potentially successful turnaround in the face of current uncertainty?

Let’s delve into the results and make up the balance!

Fiscal Q2 results + highlights

Q1 revenue was $8.8 billion, up 3% YoY but missing consensus estimates by $70 million.

To start off positively, Starbucks is seeing a continued recovery in its revenue growth numbers. Revenue growth accelerated to 3% in Q1, turning positive again for the first time in over a year, signaling some improvement in traffic, although weakness clearly persisted.

While traffic improved compared to previous quarters, this remained down YoY. Global comparable store sales continued to be negative, declining 1% YoY, driven by a 2% YoY decline in transactions, which simply indicates that store traffic growth remains negative. This weakness was partly offset by a 1% growth in average ticket, driven by price hikes.

For me, these comparable transaction numbers remain the most important indicator of strategic success and business health, with this number literally indicating the number of people transacting at Starbucks. Now, as we can see below, some of the traffic heat Starbucks faced in 2024 due to a combination of boycotts, economic pressures, and a simple loss of customers due to strategic mishaps is easing off. Comp. transaction growth is slowly showing an uptrend as headwinds ease and strategic measures kick in, but weakness persists.

As always, this weakness was offset by solid net new store growth of 7% YoY, with 213 cafes opened in Q1, of which most are in the U.S. and China. However, notably, these were the fewest quarterly additions in years, as management is in the process of evaluating its global store portfolio and is not looking to rush anything.

Ultimately, this still led to a global comparable store sales decline of 1% YoY, showing mild improvement from previous quarters, but remaining down YoY due to lower traffic numbers.

Looking at regions, the U.S. continues to show the most weakness, which is no surprise considering the economic challenges. U.S. comparable sales were down 2% YoY, driven by a 4% decline in transactions. Transaction growth did improve slightly from last quarter. This was offset by a 3% growth in ticket size, mostly reflecting price increases and fewer discounts.

Positively, there are some early indicators of a recovery in North America, despite short-term economic pressures. Management points to improving partner engagement, with turnover dropping to a record low of below 50%. Also, transaction declines are slowing across the day, and the customer experience is improving.

Internationally, Starbucks is doing slightly better, with eight out of the top 10 markets delivering positive comparable sales growth. Overall, international comparable store sales grew 2% YoY in Q1, driven by 3% growth in transactions, offset by a 1% decline in ticket size.

China comparable sales were flat YoY, driven by positive transaction growth but offset by pricing measures to make Starbucks more competitive. However, the positive transaction growth does indicate improved traffic, which is driven by product innovation and value improvement.

Moving to the bottom line results, we can clearly see top line weakness and heightened investments reflected in the numbers:

The fiscal Q2 operating margin was 8.2%, down another 450 bps YoY.

The fiscal Q2 EPS was $0.41, down 38% YoY and missing estimates by $0.07.

Starbucks is currently making considerable investments in its Back to Starbucks strategic plan, which, combined with continued top-line weakness, is really hurting its profits.

The 450 bps decline in operating margin was primarily driven by deleverage and additional labor, which led to a 9% increase in operating expenses. These are necessary expenses to maximize the upcoming opportunity and return to growth. Over time, these investments should ease, and as top-line growth accelerates, this should lead to rapidly improving margins.

However, for now, Starbucks’ bottom line is suffering.

Ultimately, this led to a 38% decline in EPS and a miss of consensus estimates, with costs higher than anticipated earlier. Starbucks is really trying to take the pain right now for a gain in the years ahead. Ultimately, long-term investors will need to look through this near-term weakness.

Yet, right now, Starbucks is simply underperforming, as acknowledged by management:

“In summary, our Q2 results are disappointing, especially as measured by EPS. These results are far below our capability.”

Indeed, the results themselves gave very little reason for optimism.

At the same time, new CEO Brian Niccol was rather positive during the earnings call. Niccol is pleased with the progress made in his time with the company so far, and he indicates that the first positive results from the measures taken are starting to appear.

He argues that while current results are only temporary, the investments being made should reap long-term rewards.

Improvements in the background look promising

“I've led other turnarounds and everything I've seen tells me we're on the right track.” Starbucks CEO Brian Niccol

Now, I have to give it to them; the company is slowly making progress on its Back to Starbucks strategy, which I have cheered on in my previous articles. Niccol's comments during the earnings call do tell me a turnaround is in the making, and as I alluded to in the introduction, I remain confident in management’s ability to turn this ship around—this commentary only strengthened my confidence. Brian Niccol has a very strong and proven track record and seems to be immediately focusing on the right aspects – the factors he can change right away to make a quick impact.

Now, I don’t want to go over the entire strategy again, but let me highlight some notable developments and improvements.

First of all, the company is investing heaps of money into its partners (personnel) to considerably improve the customer experience, something that has worsened significantly over recent years. Ultimately, at the center of this improvement are the baristas themselves.

For example, management updated its shift marketplace, now allowing baristas to pick up and trade shifts within their district. This is improving last-minute shift changes by as much as 10 times and has resulted in record-high shift completion, with 0.5 million more shifts filled year over year. In other words, this simple improvement is leading to an increase in store occupancy and, subsequently, customer experience, with waiting times under control.

This is a simple but effective improvement. It has led to the lowest shift turnover ever, higher employee satisfaction, and increased transaction capture at Starbucks.

This way, investing in its staff alone is already improving throughput and customer satisfaction, without the need for massive store upgrades or expensive equipment.

In fact, through a pilot in 700 stores, management has found that investment in labor rather than equipment is more effective at improving throughput and driving transaction growth. This is what management said:

“Learnings last quarter came from a 700 coffeehouse staffing and deployment pilot. It confirmed that the right staffing, combined with the right deployment, improved speed of service and connection while growing transactions. We also began testing a new order sequencing algorithm. It proved effective in reducing in-cafe and drive-thru service times without impacting the mobile order experience. In test locations, average cafe wait times drop by an average of two minutes, bringing 75% of cafe order wait times under four minutes at peak.”

These are brilliant, capex-light improvements, showing immediate progress. Beginning in May, Starbucks will scale this idea and these actions across more than 2,000 U.S. company-operated locations and to more than a third of all its U.S. stores by the end of this fiscal year.

Such measures take time, but initial results look promising.

These actions also include a pause in the rollout of the Siren system and the choice not to move forward with the deployment of cold-press, cold-brew equipment. The Capex requirements simply don’t weigh up to the reward right now, so this will lower near-term Capex requirements.

On the marketing front, Starbucks is also delivering rapid improvements. Whereas the company had started to only focus marketing investments on high-value Starbucks members in recent years, completely neglecting the average Starbucks customer, under Brian Niccol, the company is once again aiming at the broader public with its campaigns and is reaping rewards.

Starbucks Rewards member traffic has stabilized, and people are returning to stores, as highlighted by solid transaction growth, especially in the morning daypart. So far, Starbucks is seeing indications that customers are responding to ads. For example, consumer approval ratings are at their highest in two years.

Apart from this, other developments, such as digital menus, maximizing the beverage pipeline, and fresher food options freshly baked on location, are all underway, but these take time to realize.

So, slowly but steadily, improvements are becoming visible, but it takes more time to really be reflected in the financial results. However, I will say that initial data and developments do look promising.

Outlook & Valuation

Usually, this is where I would start by lining up management’s guidance, but with Starbucks, there isn’t any. With a CFO who only started recently, and the company facing quite a bit of macro uncertainty, Starbucks has decided not to issue any guidance.

However, there were some important comments regarding tariffs. Crucially, Starbucks has quite a bit of exposure to China in multiple ways. First of all, of course, there is the import of coffee beans into the U.S., sourced from 28 different countries, the majority of which come from Latin America. One way or another, Starbucks will face a 10% tariff on these imports into the U.S., which will hurt margins, with Starbucks having no room to raise prices considerably.

On top of this, the actual largest tariff exposure comes from merchandise, as Starbucks currently sources this from China, which still faces 100%+ tariffs from the U.S. This won’t easily be replaced and will be a considerable headwind. Currently, Starbucks is looking to strengthen this part of the supply chain by moving production elsewhere over time, but this is a multi-year plan. In the near term, this part of the business will be hit. Luckily, this isn’t a very large part of the overall business. This, again, will weigh primarily on margins.

Combined with the potential impact on U.S. economic growth, Starbucks' operating conditions have gotten quite a bit worse since I last covered shares in late 2024, especially on the margin/cash flow front.

I expect a few more very tough quarters for Starbucks and a very poor 2025. Revenue growth will likely remain in the low single digits in the second half of its fiscal year, with economic weakness likely offset by improving underlying operations, while profits will continue to plummet under cost and tariff pressure.

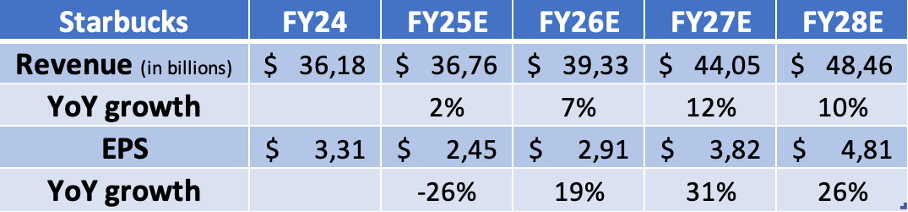

As a result, I have considerably lowered my FY25 profit outlook, while my revenue growth projections remain roughly the same.

Looking ahead, as I said before, I remain confident in management’s ability to turn this business around, especially as we are already seeing very positive signs and management seems to be on the right track. However, assuming some economic pressure in 2025 and 2026 and assuming 10% global tariffs remain in place, I believe a strong recovery might take longer than previously hoped.

I now expect growth to accelerate to the mid-to-high single digits in 2026 and into the low-double digits in 2027, as I assume Starbucks reestablishes itself. Meanwhile, profits should start recovering from 2026 onward, driven by falling costs and a recovering top line. Again, in my projections below, I do still account for some tariff pressure on margins.

Ultimately, this results in the projections below!

Based on these projections and a current share price of $84, Starbucks shares now trade at a whopping 34x this year’s earnings. Now, I think we can all agree that this year’s profits are completely unrepresentative, so I prefer to look beyond this year, but even if we use the 2026 projection, we are still looking at a 29x P/E, which is rich, at the very least.

Yet, accounting for the earnings recovery, we are looking at a PEG of only 1.15x, which is very close to value territory (below 1x), which makes it actually look rather interesting.

However, with Starbucks also issuing no guidance and economic uncertainty at a high, these projections by me and Wall Street analysts are a little bit of a shot in the dark. Starbucks is facing a very high level of uncertainty right now.

As a result, while underlying developments look promising and I remain confident in a successful turnaround here, a worsening economy and operating environment for Starbucks will complicate things and could lead to a prolonged period of weakness. This will make it still very hard to pay current multiples based on the turnaround promise, even as growth-adjusted multiples look good.

In other words, I need more of a margin of safety to account for the risk here.

If we assume a 26x long-term P/E, which seems fair for the brand equity and earnings growth we potentially got here, I calculate an end-of-fiscal 2027 target price of $99 per share. From a current share price of $84, this reflects potential returns of roughly 10% annually (including dividends), which isn’t the risk-reward I am looking for, especially at a 26x long-term P/E.

Personally, I am looking to buy below $80 per share. This would bring annual returns to over 12%, which are much more favorable returns with better downside protection.

For now, I am on the sidelines.

The remainder of this post - the Booking Holdings earnings review + thesis update - is for paid subscribers only. To access this and many more premium analyses and insights, please consider upgrading to the paid subscription tier (only $7.50 monthly or $70 annually).

In addition to this analysis, upgrading also gets you access to:

Even more premium analyses like this one (an additional 3-6 per month).

Full access to my own portfolio allocation, transactions, and thoughts, including immediate trade alerts in the subscriber chat.

A full overview of all my price targets and ratings.

And even more!

(New subscribers can use a one-time unlock on this post. Simply subscribe and unlock this premium analysis.)

Booking Holdings Inc. – Another brilliant quarter

Last week, on April 29, travel accommodation giant Booking Holdings released its Q1 results and once again blew past both top and bottom-line consensus estimates for an impressive eleventh straight quarter. Indeed, Booking has a strong track record of delivering excellent financial results and beating estimates.

This should not be surprising, as, like I said last time out, this is one of the best-managed and highest-quality businesses out there. Booking is a brilliant compounder with a solid moat, a proven management team, an excellent financial profile, a bulletproof balance sheet, and a brilliant long-term outlook.

This is one of my absolute favorite and highest conviction long-term investments.

Last quarter, the company once again delivered excellent results amid healthy travel demand, helped the company’s excellent global diversification. Meanwhile, Booking continues to execute its long-term strategy, deliver excellent cash flows and expanding margins, and remains committed to rewarding shareholders handsomely.

These quarterly results and management’s commentary once again confirmed that Booking is by far the best player in the OTA or travel accommodation market, and a long-term winner, as proven by constant market share gains and premium growth.

Let me review these excellent results, breaking them down and putting them into perspective. Let’s delve in!