Starbucks Corporation – Don’t be fooled by the earnings miss

In this post, we review Starbucks' fiscal Q1 results and provide our medium-term financial estimates for the company in order to determine whether they are attractively valued.

Starbucks shareholders have had a challenging year. Shares are down 13% over the last 12 months, which contrasts sharply with the stunning 20% increase of the S&P500. Even as the company still reached record-high revenue levels in fiscal FY23, which it reported in November, the company has been facing several headwinds, leading to some investor concerns.

For one, the company introduced a new CEO. It once more said goodbye to long-term CEO Howard Schultz, who is replaced by Laxman Narasimhan, the previous Chief Commercial Officer of PepsiCo and Chief Executive Officer of Reckitt. As always, a new CEO change brings with it some additional risks, especially if it’s the man who led this company for decades leaving (again).

On top of this, Starbucks also faced a slowdown in its U.S. operations, scrutiny from its statements with regard to the Israel/Gaza conflict, and unionization efforts by its employees caused additional headwinds. Safe to say, Starbucks faced its fair share of challenges over the last year, and investors could really use some good news - us included.

We have been bullish on Starbucks for quite a while now. In prior coverage of the company on Seeking Alpha, we named Starbucks a prime investment opportunity for long-term investors, especially those focused on dividend growth. We saw a clear runway of growth, driven by its expansion plans, remarkable stickiness, and unwavering brand loyalty, and provided the following insights:

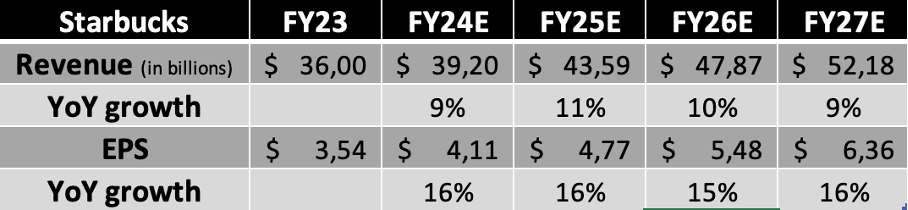

“Driven by this brand strength, global popularity, and resilience, as well as growth in the number of Starbucks stores, the company should be able to drive revenue growth of above 10% and EPS growth exceeding 15%, according to management and my financial models.”

Even as the Q1 results announced on Tuesday led to mixed opinions on Wall Street and a flat share price in response to an earnings miss, an outlook downgrade, and another number of headwinds, we are still optimistic and believe investors are discounting Starbucks by unreasonable levels, presenting an opportunity. We recommend investors look past near-tern headwinds and focus on long-term opportunities.

Starbucks Q1 results

Importantly, a big part of the Q1 miss can be attributed to unexpected near-term headwinds. For one, Starbucks saw quite a negative impact from the Middle East conflict, in part due to its own doing. Now, I am not going to discuss the entire story (you can read it here), but the short-term result was that Starbucks became the center of Pro-Palestine campaigns and faced boycott efforts, which led to a notable decline in U.S. traffic numbers.

Ultimately, this turned out to be quite the headwind for Starbucks last quarter. Positively, Starbucks has been working on removing some misconceptions about its position, which led to a rebound in occasional customer volumes in December. Therefore, this headwind should largely disappear in Q2.

On top of this headwind, Starbucks also faced a slower-than-expected recovery in China, driven by a more cautious consumer. More on this later, but the result of these headwinds led to a slight revenue miss of $230 million, limiting revenue growth at 8% YoY to a record $9.4 billion.

All in all, it's still quite solid growth. I mean, common, reporting 8% growth in the current operating environment is really solid and deserves some compliments. Growth was organically driven by 5% growth in comparable sales growth globally and 8% net new company-operated store growth.

This was driven by solid performance in the U.S., where revenue increased to $7.1 billion, up 9% YoY. The international segment grew revenue by a faster 12% to $1.8 billion, driven by a 12% growth in net new company-operated stores (compared to 4% in the U.S.). This was helped by a slight rebound in China, where revenue grew 20% YoY, driven by 25% new store growth and a 10% increase in comparable store sales.

The company also continues to steadily grow its store count (yes, this is still possible even though there is a Starbucks on every street corner in the U.S. – don’t make the mistake of thinking it has no room to grow). In the U.S., the store count grew by another 4% YoY on a base of 16,000 stores. Internationally, the company also opened another 420 stores, bringing the total to 20,600, of which nearly 7,000 are located in China.

And in China, in particular, the company is still far from done growing. The company aims to grow its Chinese store count to 9,000 by 2025 as management continues to have full confidence in its Chinese growth ambitions, even in the face of a weak consumer. Management continues to see enormous potential in China as a growing coffee market and is best positioned to benefit.

Starbucks successfully leverages growth opportunities

Other growth drivers for Starbucks outside of China and store count expansion, which are often overlooked, are convenience and accessibility solutions like mobile orders and delivery. For reference, mobile orders now account for a record-high 30% of all transactions, and Starbucks continues to drive growth on this front by improving the user experience. For example, in Q1, it reduced the downtime of mobile orders and cut additional costs for consumers in half.

In addition, the company also saw record high numbers in delivery, with these up 80% YoY due to the new partnership with Doordash. The company continues to see incremental growth opportunities on this front, with delivery still accounting for only 2% of transactions.

Member growth also remained solid, with 90-day active reward members growing 13% YoY to a record 34.3 million, which is incredibly important for Starbucks as these members are great growth drivers as they spend more per visit and more regularly. This number, still growing by double digits, is a significant growth indicator.

Simply put, the company still has plenty of levers to pull to accelerate growth outside of store growth, which is clearly reflected in its Q1 results. Furthermore, with an average ROIC of 18%, Starbucks has proven to be a great capital allocator, so investors can count on the investments to pay off in the long term.

Q1 margins impress

Whereas Starbucks disappointed somewhat with its Q1 revenue, which is the result of temporary headwinds, the bottom line performance impressed analysts. One of the company’s priorities in its reinvention plan is unlocking $3 billion in efficiencies. While that is nothing new, the progress and margin benefits it led to in Q1 were impressive.

Starbucks reported a 130 bps YoY gain in its operating margin to 15.8%, leading to EPS growth of 20% to $0.90, which, again, is really impressive. Starbucks achieved this by “in-store operational efficiencies, such as standards, equipment innovation, and scheduling improvements,” according to management.

This led to a 230 bps margin improvement in the U.S., but these gains were partially offset by the international operating margin contracting by 110 bps. According to management, “the contraction was primarily driven by investments in partner wages and benefits and business mix shift as a greater portion of the segment's revenue was generated in our company-operated markets versus the prior year and strategic investments, partially offset by sales leverage.”

All in all, Starbucks delivered a very decent Q1 performance. But what does this mean for its outlook and valuation?

Outlook & Valuation

On a more negative note, even as management is confident that Q1 headwinds should ease going forward, the lower Q1 results did lead to a lower FY24 revenue guidance. Management now expects revenue growth of 7% to 10%, down from a previous 10% to 12%.

Nevertheless, management still aims for 7% global store growth in 2024 and progressive margin expansion despite the lower expected revenue level. As a result, management also maintains its EPS guidance, which points to EPS growth in the range of 15% to 20%, which is still very impressive.

Still, the lower Q1 results and slow recovery in China did urge us to lower our FY24 revenue and EPS expectations. Yet, we did maintain our long-term targets as Q1 also showed significant underlying improvements, especially on the margin front. Therefore, we remain bullish.

We now expect the following financial results through FY27.

Based on these revised estimates, Starbucks shares now trade at around 22.5x this year’s earnings, which, arguably, is quite a discount for Starbucks shares. For reference, this is a 37% discount to the 5-year average, and its forward PEG ratio has now fallen to 1.6x, which is also a 37% discount.

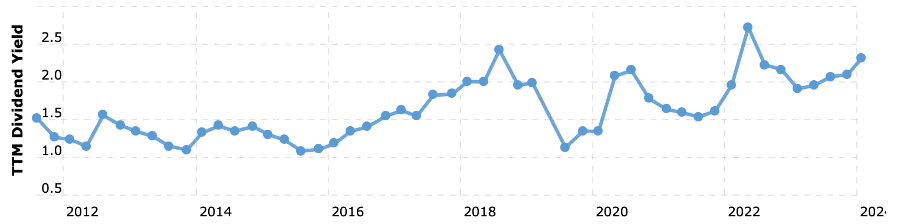

Meanwhile, Starbucks should still be able to consistently grow its revenue by high-single to low-double digits and EPS by mid-teens. Furthermore, the dividend yield is now closer to 2.5%, which is close to a decade high. Meanwhile, the dividend payout is still safe at below 60%, and investors can look forward to many more years of double-digit dividend growth, making it one of the best dividend growth stocks on the market.

Therefore, at just 22.5x earnings, we are confident shares are overly discounted by the market on a number of disappointing earnings reports and headwinds. We believe current pessimism toward Starbucks offers investors a great entry point to take a position in this incredible compounder with a solid growth outlook.

We believe it is a matter of time before Starbucks’s valuation multiples return to its historical levels again. Yet, for now, we will assume a conservative 25x multiple, which leads to a target price of $119 per share, which would position investors for annual returns exceeding 15% annually. Quite attractive, to say the least.

Yes, we remain bullish and active buyers of Starbucks stock. Therefore, we rate it a Buy and strongly believe investors should focus on the company’s long term potential.

Thank you for reading this post. Enjoyed it? Please leave a like to let us know!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: I/we do have a beneficial long position in the shares of SBUX, either through stock ownership, options, or other derivatives. This article expresses my own opinions and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Very interesting write-up. Good work!