Synopsys: A Truly Unique Company Worth Your Consideration

Synopsys benefits from the semiconductor revolution through an incredible market share, leading to mid-teens growth. Yet investors should treat carefully amid sky-high valuations.

(Note that this article can be truncated in an email. By clicking "View entire message" you can view the entire post. Alternatively, you can view this post in the Substack app)

Article Thesis

Synopsys SNPS 0.00%↑ emerges as a standout investment in the booming semiconductor industry, set to reach $1 trillion by 2030. The company's leadership in Electronic Design Automation (EDA), with a 32% market share, positions it uniquely, benefiting from the anticipated 10% CAGR in the EDA market through 2030. In addition, its strong presence in the semiconductor Intellectual Property (IP) sector, capturing a 20% market share, adds to its growth potential.

Synopsys' revenue stream is characterized by its high quality, rapid growth, and resilience to industry cyclicality. The company's recurring revenue model, non-cancellable backlog of $8.6 billion, and diversified geographic revenue distribution contribute to its stability. Additionally, Synopsys strategically leverages Artificial Intelligence (AI) to enhance its products and address the workforce gap in chip design engineers, further solidifying its position in the industry.

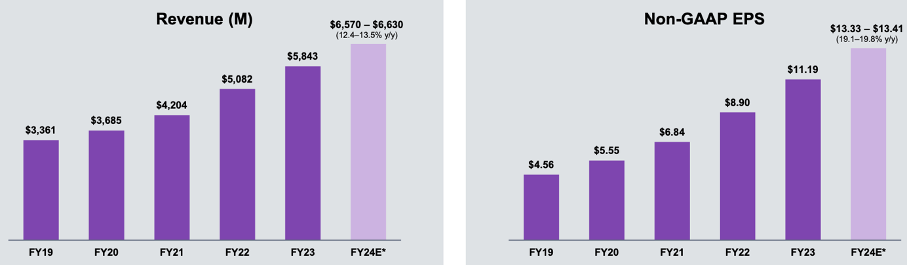

The recent fiscal year's exceptional growth, with a 15% YoY increase in revenue to $5.84 billion, demonstrates Synopsys' ability to outperform in a dynamic semiconductor landscape. The company's commitment to innovation, reflected in its substantial R&D investments, has translated into margin expansion and a strong balance sheet. Furthermore, the company seems well positioned to continue accelerating growth in the double digits for both top and bottom lines.

However, while the future for Synopsys is bright, the current valuation is demanding, reflected in the forward P/E multiple of 38x. And yet, we believe shares might nevertheless offer decent value to investors. Considering its incredible revenue and earnings outlook, anti-cyclical business model, strong backlog, leading position, strong competitive positioning, and, of course, accelerating growth, the current premium seems justified at slightly above its historical multiples. Based on a 38x fair value multiple, we believe shares have become attractive today, following a 10% share price correction in recent weeks.

The semiconductor industry continues to present a compelling investment opportunity

The semiconductor industry is anticipated to experience significant growth through the end of this decade and likely beyond, posing a significant growth opportunity for investors after already delivering stellar returns over the last ten years.

Firstly, the relentless pace of technological advancement is driving demand for more sophisticated and powerful electronic devices. As consumers and businesses alike seek improved performance, efficiency, and functionality in their gadgets, the need for advanced semiconductors continues to grow. As society becomes increasingly digitized and interconnected, the semiconductor industry is poised to play a pivotal role in shaping the technological landscape.

Now, there are many other factors to name for the growing demand for semiconductors in the long run, but the short summary is that the continued digitalization globally requires more (advanced) semiconductors, driving incredible growth, and unlike something like solar energy, this one is hard to argue against. As a result, McKinsey expects the semiconductor industry to hit the $1 trillion market value mark before 2030, which indicates a growth CAGR of between 8%-13%, depending on which market research source you go with.

As a result, I believe the semiconductor industry is one of the most attractive industries for investors with a long-term time horizon. However, even this industry isn’t perfect, and investors will have to deal with, for example, significant cyclicality, high capital expenditure requirements, and intense competition. Therefore, picking out the winners can still make a big difference in your investing success.

We are bullish on many players in the semiconductor space, including the likes of ASML ASML 0.00%↑, Taiwan Semiconductor TSM 0.00%↑, KLA KLAC 0.00%↑, Qualcomm QCOM 0.00%↑, and many more. All these companies are attractive in their own way, operating monopolies, being anti-cyclical, or highly innovative.

Meanwhile, Synopsys, a largely unknown player in this industry, is one that possesses all of those qualities named above due to its unique product offering and dominant market position. As a result, the company is very well positioned to benefit from the semiconductor industry's growth, leading to a stellar growth outlook.

Synopsys, Inc. – All you need to know

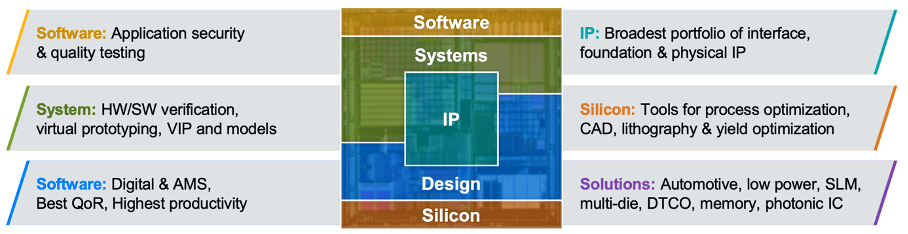

Synopsys is a company that specializes in electronic design automation (EDA) software and hardware, as well as semiconductor intellectual property (IP). Simply put, the company provides tools and services that help semiconductor manufacturers, designers, and engineers in the development and verification of integrated circuits (ICs) and electronic systems.

As a result, the company plays a significant role in the semiconductor industry by providing the necessary tools and technologies to enable the design and development of complex electronic systems and integrated circuits. Synopsys reports across three categories, which are Electronic design automation (ETA), Semiconductor Intellectual property (IP), and Software security and quality.

Synopsys is a leader in the highly lucrative and crucial EDA industry

The company’s leading product is its EDA (Electronic Design Automation) software, opening it up to a $9.9 billion market. Synopsys covers a wide range of EDA software solutions, supporting semiconductor and electronic system designers throughout the entire design flow—from initial concept to fabrication. This includes tools for designing and simulating digital, analog, and mixed-signal circuits, as well as tools for physical implementation, verification, and testing. Through these software solutions, the company helps customers automate various aspects of the semiconductor design process, helping to improve efficiency and reduce time-to-market for products.

Currently, the company holds the top position in the EDA industry with a 32% market share, as reported by IDC, following 35 years of development. Practically, the company supplies these solutions to all leading semiconductor companies in the world due to its superior offering.

The significance of Synopsys' EDA tools lies in their capability to streamline and enhance the semiconductor design process. By automating complex tasks, facilitating thorough simulations, and contributing to power optimization, these tools are instrumental in maintaining the competitiveness of semiconductor companies in a rapidly evolving industry.

The complexity of modern semiconductor devices, coupled with the demand for increased performance and efficiency, necessitates advanced EDA solutions. Semiconductor companies face the challenge of designing intricate integrated circuits (ICs) with millions or even billions of transistors. EDA tools play a vital role in automating and optimizing the design process, enabling engineers to create complex chip architectures, ensure functionality, and meet performance specifications. This level of automation is essential for managing the intricacies of semiconductor design, reducing time-to-market, and enhancing overall design quality.

As a result, demand for the software is high, and Synopsys, as the industry leader, is a primary beneficiary. Furthermore, due to the importance of EDA software, Synopsys customers most often prioritize EDA investments through any business cycle. As a result, this product category is far less cyclical than many other semiconductor industry aspects. Synopsys customers are unlikely to cut costs on its products as it potentially jeopardizes their semiconductor developments and quality, creating a massively reliable revenue stream for Synopsys.

On top of this, and driven by the push for more advanced semiconductors, the EDA market is projected to grow at a CAGR of 10% through 2030, according to GMI.

Overall, while the EDA industry, at just under $10 billion, is not that meaningful, it is massively important to all semiconductor companies and is expected to grow meaningfully going forward. Synopsys, being the industry leader, is perfectly positioned to benefit. With 65% of the company’s revenues coming from its EDA offering, the majority of revenue should grow strongly going forward while being largely anti-cyclical.

As a result, Synopsys management projects this segment to grow by double digits in the long term, driven by industry growth and slight market share gains. Stellar, indeed.

Synopsys is rapidly gaining share in the semiconductor IP market, boosting growth

And that’s not all to be enthusiastic about, as the company’s second-largest segment (25% of revenue) – semiconductor IP – gives it exposure to another impressive industry. Synopsys provides pre-designed and pre-verified intellectual property blocks that semiconductor designers can integrate into their chip designs. This can include processor cores, memory, interfaces, and other common building blocks.

Using the semiconductor IP can significantly reduce the time, effort, and risk associated with designing complex integrated circuits, as designers can leverage proven and standardized functionality. A great example is the ARM designs used for Apple’s M-chips for Mac. Using ARM IP saved Apple a load of money and time in chip design.

Synopsys is a key player in the semiconductor IP market, providing a diverse and high-quality portfolio of IP blocks that enable designers to accelerate the development of custom integrated circuits while maintaining reliability and adherence to industry standards. This is why the likes of Samsung and Intel INTC 0.00%↑ use Synopsys IP, amongst many others.

Synopsys is the second largest in the IP industry, trailing only ARM ARM 0.00%↑ in terms of sales. Its market share currently stands at nearly 20% as the company has been outgrowing its larger peer by a significant margin since 2016, closing the market share gap by 13.6 percentage points in just six years. Furthermore, its IP revenue growth rate sat 10.8 percentage points above that of ARM in the same period.

Synopsys estimates this industry to be worth around $6.7 billion, and the industry is expected to grow at a CAGR of 6.7% through 2032. However, we can safely assume Synopsys will easily outgrow these industry growth rates with its excellently positioned IP offering, allowing it to continue taking market share. The company is on course to catch up with ARM in just a few years as it is able to report far superior growth. As a result, management believes it should be able to grow its IP revenues at a mid-teens CAGR, which is ambitious but not impossible.

Software integrity is Synopsys’ smallest but fastest-growing segment

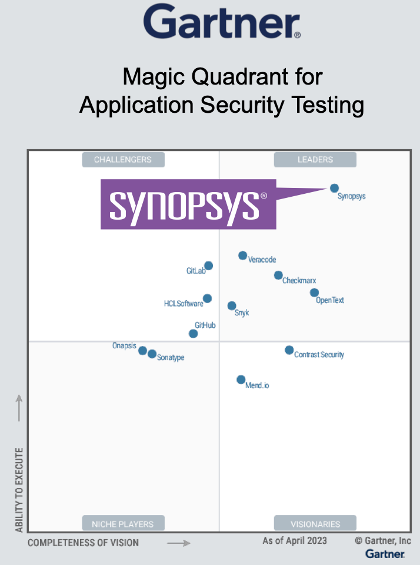

Finally, the company also has a significant presence in the field of software integrity, providing solutions and services aimed at enhancing the security and quality of software development. Software integrity accounts for just 10% of revenue, but again, the company is the industry leader, offering the broadest portfolio of solutions. Synopsys receives among the highest scores in market presence and is ranked second for its current offering.

By offering a comprehensive suite of tools and services in the field of software integrity, Synopsys aims to help organizations build more secure and reliable software, reducing the risk of security breaches and ensuring the overall integrity of software applications throughout their lifecycle.

Synopsys offers solutions for functional verification and hardware/software co-verification, helping designers ensure that their designs meet specifications and are free of bugs. In addition, the company offers tools for static code analysis, a process that analyzes the source code of an application without executing it. SAST tools help identify potential security vulnerabilities, coding errors, and compliance issues early in the software development lifecycle. This enables developers to address issues before the code is even compiled. This also includes a focus on security solutions for software development, providing tools and services for identifying and addressing security vulnerabilities in software.

The data Integration and Integrity Software Market is projected to grow at a CAGR of 12.6% through 2030. However, with Synopsys mainly exposed to faster-growing categories of this market, management believes this portion of revenue should grow at a long-term CAGR of 15-20%, making it the company’s smallest but fastest-growing segment.

Synopsys’ revenue stream is high quality and fast-growing.

Overall, looking at the company’s growth outlook for each operating segment, management aims to grow revenues at a long-term CAGR in the double digits, most likely in the 11-15% range. Synopsys should have excellent revenue visibility, so we believe this long-term outlook is something investors can go on with excellent reliability. This belief is driven by the company’s market leadership, decades of experience in each of its end markets, and the fact that the majority of the company’s revenues are recurring.

Looking at the company’s product and solutions portfolio, it is easy to see why Synopsys expects to keep growing revenue at a rapid clip. The company has excellent exposure to the global digitalization trend. Both EDA technology and IP stand at the center of accelerating electronics innovation, and through an excellent product offering, Synopsys is at the heart of chip design, from silicon to software. As a result, Synopsys’ semiconductor customer base consists of practically all semiconductor companies globally, including the top 20.

Also worth noting is that the company is a primary beneficiary of the growing demand for AI and innovations in this technology. On one hand, the company is poised to benefit from the ever-increasing demand for advanced semiconductors to power AI. However, it can also leverage AI to make its products more valuable through increased productivity and automation. Synopsys is already deploying AI to boost the productivity of its products, rolling out AI integration to 90% of its semiconductor customers.

As the semiconductor industry is developing rapidly to keep up with computing demand, its complexity is also increasing. Meanwhile, Synopsys management points out that it continues to see a 15-30% workforce gap for chip design engineers by 2030, which increases demand for IP and automation, which is where AI-driven design functionalities can step in.

Synopsys has already released its own AI-driven design EDA suite in the form of Synopsys.AI, which should help relieve some of this shortage in specialized personnel. Furthermore, Synopsys continues to work on expanding its AI offering, collaborating with Microsoft to integrate generative AI capabilities such as conversational intelligence into its software suite. For now, it is hard to put concrete numbers to it, but AI will undoubtedly turn out to be a growth driver for Synopsys, and management is already proactive in its approach toward the technology, which should help it maintain its lead.

In addition to a promising revenue growth outlook, the company’s revenue stream is also of remarkably high quality, resulting in an attractive risk profile. For starters, the company has a recurring revenue model, with most of its software and IP solutions sold as a subscription model or revenue based on contract fees. This means the company has incredible revenue visibility, and its offerings are very sticky. Furthermore, the company has a non-cancellable backlog of $8.6 billion, providing it with an additional buffer to create stability in a cyclical downturn. In the end, this means that Synopsys is able to drive very consistent growth and should hardly see any significant impact from the cyclicality of the semiconductor industry.

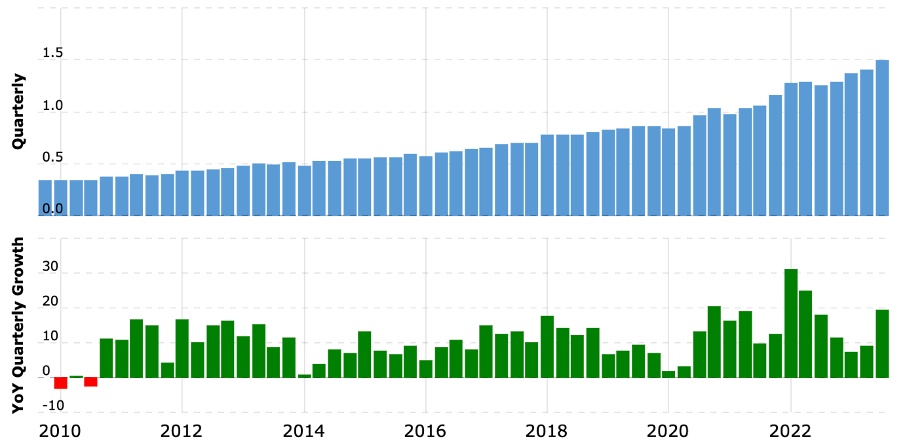

Furthermore, in semiconductors, the company’s offering, including IP and EDA, is perfectly positioned within the customer’s R&D priorities. According to Synopsys management, its products are a top investment priority for customers in all phases of the economic cycle, meaningfully lowering its cyclicality further. This has allowed the company to report incredible growth over the last decade and to do so with incredible consistency. Synopsys has grown revenue at a CAGR of slightly over 11% over the last decade and has not reported a single quarter of negative YoY growth, which is a very impressive feat and a testimony to its revenue consistency.

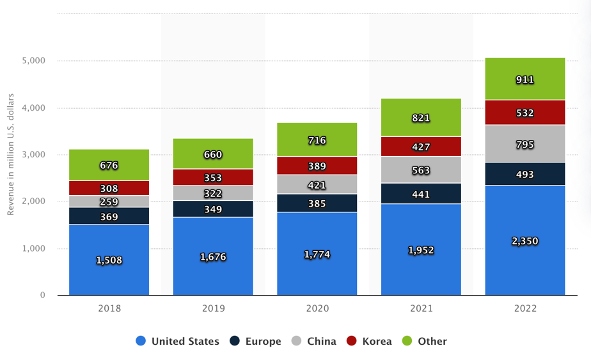

Finally, in addition to recurring revenue and exposure to non-cyclical elements, the company’s revenue is tremendously well diversified geographically, with no single region accounting for over 50% of revenue. This means the company is not overly exposed to local headwinds, improving its risk profile and allowing the company to report steady growth.

Furthermore, unlike many semiconductor peers, the company has limited exposure to Asia, which I also view as positive as it means the company derives most of its revenues from stable economies. As of FY22, Synopsys derives 46% of its revenues from the US and 10% from Europe. Meanwhile, China and Korea account for 26% of revenue, with the remainder being derived from “other.”

Ultimately, it is safe to say that the company’s revenue is incredibly high quality and should continue to grow rapidly for the foreseeable future. Meanwhile, investors do not need to worry about the cyclicality of the semiconductor industry, making this company a standout in the semiconductor industry and incredibly attractive to investors.

Synopsys reports remarkably strong fiscal FY23 growth.

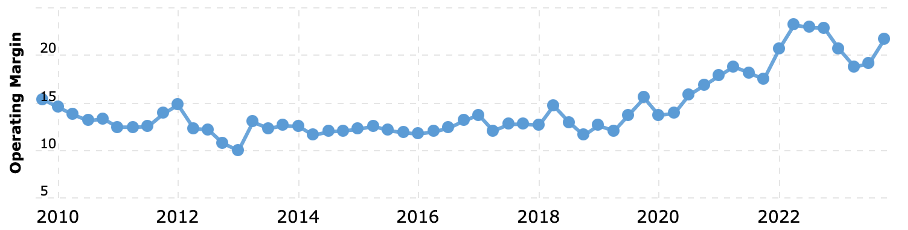

The company has seen great growth momentum in recent years, fueled by its strong market positions, favorable positioning within the semiconductor industry, and strong market shares. The company has been firing on all cylinders. It has grown revenues at a 13% CAGR over the last five years, expanded its operating margin by 13 percentage points, and grew EPS at a 23% CAGR, outpacing peers across all segments.

The latest quarter and fiscal year were no different, with growth sitting even above these 5-year averages. This outperformance, even compared to its own previous years, is driven by multiple factors. Most importantly, the AI revolution is reshaping industries and providing breakthrough solutions for intractable challenges, like the 15% to 30% percent design resource shortage the semiconductor industry is facing this decade. As we mentioned before, Synopsys is a primary beneficiary of this revolution and has already introduced AI software functionalities to power semiconductor design and more, driving growing demand for the company’s solutions.

In addition, the company continues to see great adoption of its IP portfolio, with all three leading-edge foundries making Synopsys the advanced node IP vendor of choice to minimize risk and accelerate silicon success. According to Synopsys, customers prioritize scarce design resources to focus on their critical architectural differentiation, leveraging Synopsys IP as an integral part of their chip design development. This is driving growing demand for Synopsys.

Synopsys reported Q4 earnings on November 29 and managed to beat the Wall Street consensus on both top and bottom lines, although only by a thin margin. The company reported revenue of $1.59 billion, up 24.2% YoY and exceeding the high end of management’s guidance with new highs. The fact that this company continues to report new highs through operations in the semiconductor industry, which is projected to contract by double digits in 2023, shows us how anticyclical its operations really are and how strong demand for its solutions remains.

The strong final quarter of the fiscal year led to total FY23 revenue of $5.84 billion, up 15% YoY and driven by all product segments and geographies. In addition, even as revenue grew rapidly, the company also reported growth in its backlog, which has grown by $1.5 billion over the last 12 months to $8.6 billion. This provides the company with some additional leverage to offset any demand weakness, but above all, once more, it shows how strong demand remains.

As of fiscal FY23, design automation remains the company’s largest segment, reporting revenue of $3.78 billion, up 14% YoY, driven by strengths in EDA software and hardware. Meanwhile, IP revenue was up 17% to $1.54 billion, and software integrity revenue was up 13% to $525 million.

This strong top-line growth also gave the company strong bottom-line leverage as the operating margin expanded further to 35.1%, up 210 basis points YoY. This led to a 26% growth in EPS to $11.19. Synopsys has been steadily improving margins over the last decade as revenue growth consistently outpaces growth in expenses, even as the company invests 33% of revenues into R&D or about $2 billion in fiscal FY23, which is a staggering amount, which speaks to the company’s drive for innovation.

With revenue growth expected to remain strong and potentially accelerate further, it is safe to assume further margin improvements in the next few years, driving even faster EPS growth. Management targets consistently driving margin expansion of around 100 basis points annually. Therefore, management expects EPS growth at a CAGR of the mid-teens, potentially driving stellar returns for investors.

This also leads to significant improvements in cash flows with the company generating $1.7 billion in operating cash flow in fiscal FY23, allowing it to maintain a pristine balance sheet. The company currently reports a total cash position of $1.9 billion and practically no debt, even after completing $1.2 billion in buybacks or 80% of FCF.

Outlook & Valuation

Following a very strong fiscal FY23, Synopsys management now guides for this momentum to continue going into FY24 as it guides for revenue between $6.57 and $6.63 billion, up 13% at the midpoint. With operating expense growth expected to be less pronounced, management guides for operating margin expansion of around 200 basis points to 37%, leading to EPS of between $13.33 and $13.41, up 19.5% at the midpoint.

These FY24 estimates include the expectation for revenue of between $1.63 billion to $1.66 billion in Q1 and EPS of between $3.40 to $3.45. Considering this guidance, the strong Q4 results, and our in-depth research and expectations of the company, we now expect the following financial results through FY27.

Based on these estimates, shares are now valued at a forward P/E multiple of 38x, which is a significant premium to peers and slightly above its own historical averages. Shares have traded at an average earnings multiple of 36x over the last five years, which means these now trade at a premium of around 8%.

And yet, we believe shares might nevertheless offer decent value to investors. Considering its incredible revenue and earnings outlook, anti-cyclical business model, strong backlog, leading position, strong competitive positioning, and, of course, accelerating growth, the current premium seems justified at slightly above its historical multiples.

Therefore, we believe a 38x multiple is fair for this incredibly high-quality company. Based on this belief, we have determined a $707 target price based on our FY26 EPS projection. From a current share price of $515, after a 10% share price correction in recent weeks on some M&A rumors, investors can look forward to 11% annualized returns.

As a result, we believe the current risk/reward profile is looking quite favorable and we view Synopsys shares as attractive. Synopsys shares tend to consistently trade at a premium, so buying these high quality shares on a pullback seems like the best way to go. As a result of the recent pullback, in our view, Synopsys shares offer decent value today.

Thank you for reading this research report. Make sure to stay tuned for more investment content, including our weekly newsletter and extensive stock and industry research reports. Want to receive our research conveniently in your email and stay updated on new content? Subscribe using the button below.

Also, please share this completely free content with your friends and family!

Disclosure: We have no stock, option, or similar derivative position in any of the companies and stocks mentioned. This article expresses our own opinions and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. This is no financial advice or recommendation and is for informative purposes only.

Still looks pretty expensive even with recent drop

This is truly a great company - Synopsys EDA tools and IP are vital in the chip design process. The main driver behind this stock is design starts. Slightly nervous to see how things pan out with the new CEO, Sassine Ghazi, who has just taken the helm. SNPS is one of my core holdings, I'm in for the long term.