Texas Instruments – A Large Moat, Low Risk & Double-Digit FCF Growth Ahead

An updated look at the financials and outlook of one of the strongest and highest-quality semiconductor companies!

It is unlikely you’ve never heard of semiconductor giant Texas Instruments (TXN). From its 1930 roots in Dallas, TX, the company has grown into the world’s largest supplier of analog semiconductors, with a market capitalization of roughly $150 billion and annual revenue of nearly $20 billion.

You may know it for calculators, but its true power lies in the analog chips embedded in virtually every industrial machine, car, and electronic system worldwide.

Yes, TXN is a true giant and one of the highest-quality, lowest-risk picks in the semiconductor industry, and one of the best-managed businesses, with a management team truly focused on long-term shareholder value over short-term performance.

Over the last decade, TXN has compounded revenue and cash flows at a high single-digit rate through the cycles, driven by a steadily growing industry, consistent market-share gains from moat and brilliant execution, and a business model built for durability rather than explosive growth.

For one, unlike most semiconductor companies, Texas Instruments manufactures roughly 90% of its products internally, in its own fabs. This in-house manufacturing infrastructure, primarily located in the U.S. with minimal exposure to Asia and almost none to China, provides cost advantages, supply-chain control, geopolitical insulation, and access to meaningful tax incentives. Yes, it makes it more capital-intensive, as evidenced by considerable capacity investments in recent years, but in a world increasingly defined by supply risk, TXN has become one of the least risky semiconductor names, with a supply chain that is practically entirely de-risked.

Meanwhile, its moat extends well beyond manufacturing. TXN benefits from the industry’s broadest analog portfolio, comprising ~80,000 products and more than 100,000 customers, with no single customer accounting for more than 10% of sales. This gives the business incredible product breadth, channel reach, and diversification, making its revenue base both sticky and exceptionally resilient.

This makes it almost impossible to disrupt.

Furthermore, Texas Instruments leads the analog market with a commanding 19% share in its core segment and holds a solid position in embedded processing (~11% share), both of which are cyclical but highly profitable and predictable markets with little risk of structural disruption. Analog and embedded products can remain in the market for 10–15 years, providing strong protection, outstanding ROI, and long-term earnings power.

Meanwhile, the industries’ prospects remain strong, as digital systems increasingly rely on analog chips to interpret real-world inputs such as light, sound, pressure, and temperature. As TXN states, “Every time a system is digitized, there is a growing need and opportunity for analog chips.”

And with TXN’s strategic focus on fast-growing industrial and automotive end markets (now ~75% of revenue, up from ~40% in 2014), it is particularly well positioned for profitable compounding for many years to come.

No, Texas Instruments is not the most exciting semiconductor stock; instead, it is the most dependable one.

With an irreplaceable manufacturing moat, deep customer diversification, leadership in critical analog markets, and exposure to long-duration growth trends, TXN remains one of the best long-term compounders in the sector. Its business is built not for hype cycles, but for decades of steady cash generation, growing dividends, and resilient share-owner returns.

In short, TXN is a brilliant business.

Yet, it is not all plain sailing. TXN shares are down 16% over the last 12 months and 10% in 2025. Even more, this has practically been dead money over the last 5 years. The reason is a combination of the biggest investment cycle in its history and a much prolonged cyclical weakness in the analog industry following the COVID-19 boom, which has resulted in negative growth for eight straight quarters and cash flows and margins evaporating.

Yes, the company has had a tough few years behind it, but we have seen improvement in recent quarters, though nowhere near as much as Wall Street had hoped. TXN’s results in recent quarters have remained somewhat lackluster, and guidance continues to disappoint, as the analog recovery has been much slower and more gradual than expected.

The result is extremely poor sentiment toward TXN shares, and arguably rightfully so, especially given TXN's regular valuation at a massive premium to reflect its quality and anticipated margin/cash flow recovery.

Positively, amid its recent sell-off (shares down 24% since a July high), multiples have finally come down, and we might be looking at better value, with shares finally not too far away from my earlier set $150 fair value target.

Therefore, this seems like the perfect time to revisit my TXN investment thesis and assess whether TXN shares are finally worth investing in again.

Today, I want to assess its recent performance, dive into its financials, and update my medium-term outlook based on macro and industry trends, before updating my fair value estimate.

Without further ado, let’s delve in!

🔔 Reminder: Black Friday deal — 40% OFF, only 2 days left!

Yesterday, you received a one-off Black Friday Deal, my one attempt a year to offer even better premium value. This gets you all the premium content at a deeply discounted rate in your first year.

Get the full premium experience for just $43 (€34) or just $0.58 per analysis!

You can find the full offer and all the details right here! Or, take the deal right away using the button below!

Looking for FREE investment content like this, but not yet a subscriber? Make sure to subscribe using the button below and don’t miss any of my weekly free content!

Texas Instruments is struggling for traction

Texas Instruments reported its latest results on October 23, and again fell short of investor expectations. Earnings missed Wall Street estimates, and management’s guidance signaled that current demand weakness may last longer than previously expected. The update added pressure to the company’s premium valuation and outlook. Shares dropped roughly 6% the following session and have since fallen about 12% in total.

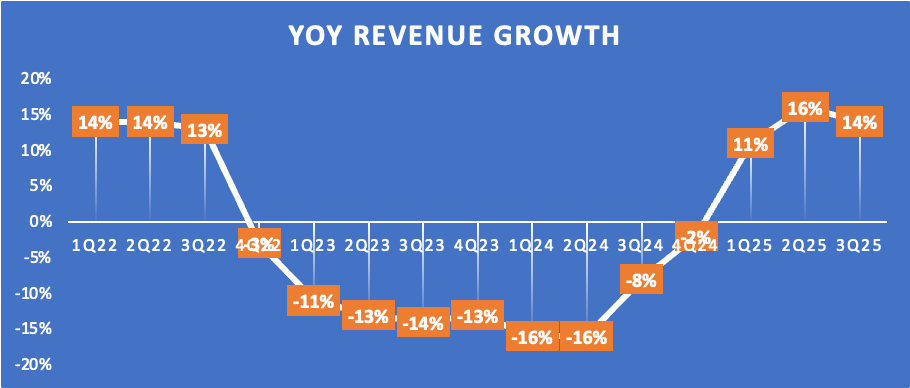

Delving right into the numbers, TXN reported a Q3 revenue of $4.7 billion, beating consensus estimates by $100 million and up 14% YoY and 7% sequentially. As highlighted below, TXN’s top-line growth has recovered in 2025, driven by a gradual improvement in analog and embedded demand. However, that is mainly driven by customer inventories finally being depleted. These numbers still reflect very cautious customer orders, and the 14% growth in Q3 is far from impressive, given it follows a negative 8% last year and a slowdown from 16% in Q2.

This shows that demand remains lackluster, falling short of expectations, with this recovery still very slow.

According to management, the broader semiconductor market recovery continues but at a slower pace than previously expected, likely due to broader macro dynamics and global uncertainty, particularly from tariffs. Customers are simply not eager to build inventory in advance amid tariffs and the threat of economic weakness, which means the entire supply chain remains cautious, as is evident in TXN’s results.

On the one positive note, TXN does indicate that customer inventory is down, and this depletion cycle is now entirely behind us, meaning growth should at least remain well within the positive numbers in the quarters ahead.

Breaking down revenue by technology, TXN reported analog revenue growth of 16% YoY, embedded revenue growth of 9% YoY, and other revenue up 11% YoY, indicating growth across all technologies.

Breaking down revenue by end market, TXN reported personal electronics revenue growth in the low single digits YoY, enterprise systems revenue up 35% YoY, and communications equipment up 45% YoY, with each of these consumer-facing technologies finally recovering more strongly from their lows last year.

Another notable standout was data center revenue, which, although only a small percentage of total revenue, was up more than 50% YoY, making it the only end market where TXN sees strong customer demand and no signs of caution.

However, all these end markets together still make up only under 30% of group revenue. Much more important are the industrial and automotive end markets, which together account for over 70% of revenue, up from 40% in 2013, as TXN is fully committed to these markets in the long term.

Semiconductor content in both markets is expected to keep growing strongly over the decade ahead, which should bode well for TXN. Both markets were down last year due to an extensive inventory correction, but they still grew at a 7% CAGR between 2013 and 2024. They should be able to keep this up over the next 10 years, if not grow even stronger amid an accelerating push for automation and digitalization.

Starting with industrial, TXN reported 25% YoY growth and low single-digit sequential growth, as customer inventories are down and demand is improving from depressed levels last year. For reference, industrial revenue is derived from a range of industrial applications, such as industrial automation, robotics, medical, building automation, and energy infrastructure.

Meanwhile, automotive revenue was still disappointing in Q3. While this is its most exciting long-term opportunity, struggles in the broader automotive market continue to pressure demand for TXN. As a result, revenue was up in the high single digits YoY and roughly 10% sequentially, with growth across all regions.

On the note of its long-term opportunity, the semiconductor content growth in cars should continue to grow strongly over the next decade, thanks to the addition of fully autonomous driving, electrical systems, advanced connectivity, etc. As this content expansion persists across all types of vehicles, TXN is poised to benefit as one of the leaders in automotive.

Ultimately, to make up the balance, this quarter clearly showed that TXN continues to see very cautious demand, and while revenue has improved from last year’s lows, it is still well below Wall Street’s expectations. So, a reset of expectations does seem justified. At the same time, the company continues to strengthen its competitive position and maintain exposure to exciting long-term opportunities in automotive, data center, and industrial.

In other words, TXN’s long-term thesis hasn’t weakened – long-term demand isn’t going anywhere, and TXN continues to lead – it’s just facing prolonged near-term headwinds that justify a near-term multiple reset, especially amid poor visibility of a stronger recovery.

On that note, let’s get to the bottom-line results.

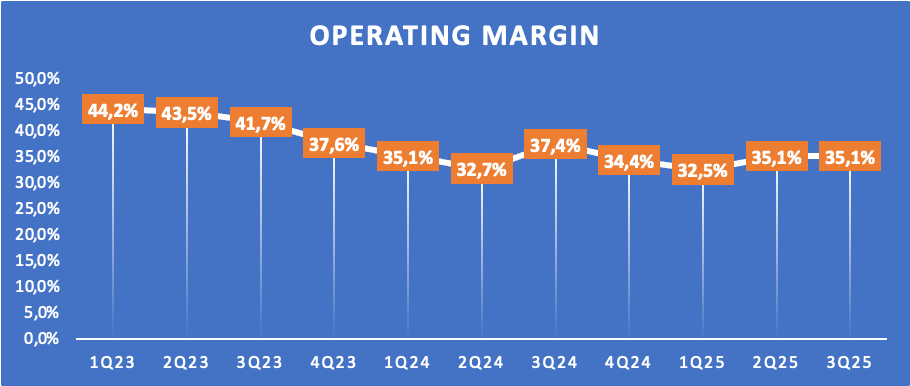

TXN reported a gross profit of $2.7 billion, reflecting a gross margin of 57%, down 50 bps sequentially and down 260 bps YoY. Positively, operating expense growth was limited in Q3, up 6% YoY to $975 million, bringing the TTM total to $3.9 billion or 23% of revenue.

TXN continues to invest in manufacturing and technology through the cycles to strengthen its competitive position and long-term opportunities, but it manages expenses tightly overall.

Ultimately, this resulted in a Q3 operating profit of $1.7 billion, reflecting an operating margin of 35.1%, still down 230 bps YoY, driven by the lower gross profit, offset by slower cost growth.

While TXN reports improving revenue, margins are still lagging and haven’t quite recovered yet. The primary reason is higher depreciation and lower loadings, which remain a temporary headwind that will ease over time, especially as revenue improves.

So, what does this higher depreciation and lower loadings mean, and what causes it? In very simple terms, Texas Instruments has invested heavily in new U.S.-based factories and equipment, and those costs are spread out over many years through depreciation. At the same time, these factories are not yet running at full capacity (lower loadings), meaning fewer chips are being produced. Because the company still has to pay for the equipment whether it’s fully utilized or not, each chip ends up carrying a higher share of those costs, temporarily pressuring margins, particularly gross margin, as this reflects the cost of revenue.

So, as depreciation from investments in recent years is off a peak and loadings go up, the gross margin will improve.

Further down the line, lower margins put pressure on EPS, which came in at $1.48, up only 1% YoY and missing consensus estimates by $0.01. This had a $0.10 impact that wasn’t accounted for in guidance, including $0.08 in restructuring charges related to the planned closures of its last 250-millimeter fabs.

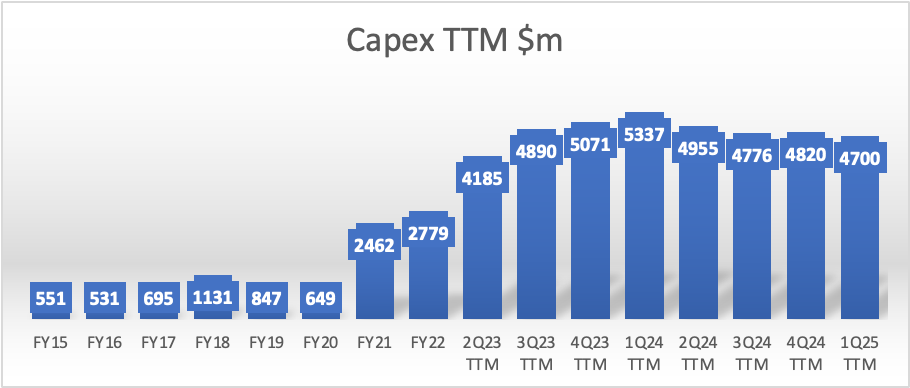

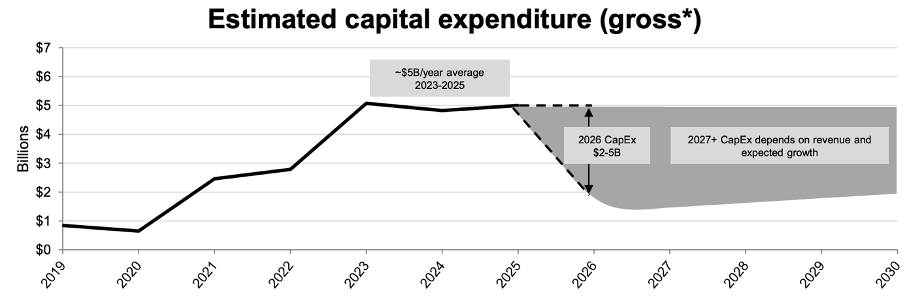

Turning to cash flows, TXN reported Q3 capex of $1.2 billion, bringing the TTM total to $4.8 billion, which is still elevated but is flattening. TXN is now roughly 80% through a six-year elevated CapEx cycle, which should position it with plenty of low-cost 300-millimeter capacity for the next upcycle, giving it a cost advantage in the years ahead and greater supply chain control, with more than 90% of wafers produced in-house. For reference, 300mm provides 40% lower cost and 2.3x more chips per wafer compared to the previous 200mm fabs.

Therefore, while the elevated capex cycle has massively pressured cash flows in recent years, it does position TXN for massive efficiency and cash flow improvements in the years ahead.

For now, we do still see high CapEx, but this will trend down more strongly in 2026 and moderate further in 2027, so this is important to keep in mind.

This translated into a TTM FCF of $2.4 billion, including a $637 million incentive from the CHIPS Act for U.S. capacity investment. This reflects a 14% FCF margin, which is trending up thanks to slowly moderating CapEx and a return to positive FCF growth. The FCF margin was up 300 bps sequentially and 500 bps YoY.

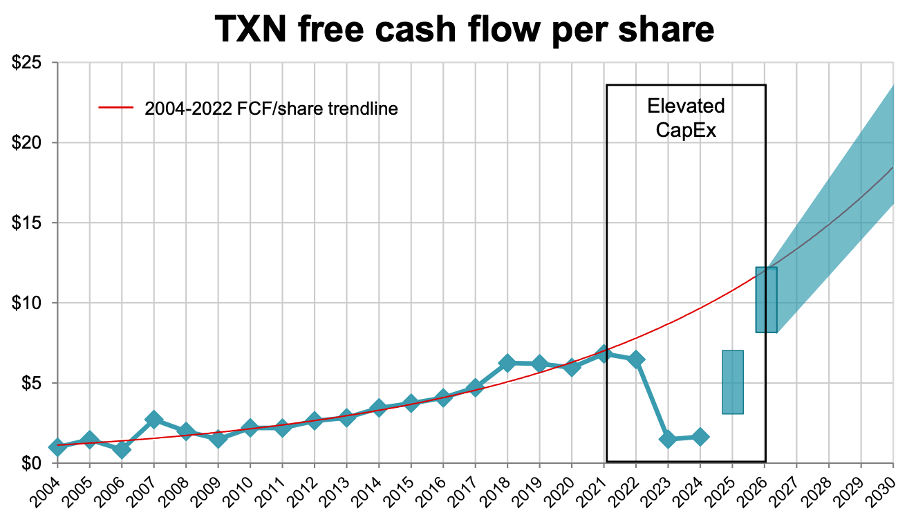

As I alluded to before, TXN is one of the few businesses truly managed with a long-term investor mindset. This is evidenced by management’s view that FCF per share is the best way to manage performance, or literally the amount of cash your shares spit out.

And we should see TXN return to the norm for this metric in the coming years. As visible in the graph below, TXN’s FCF was nicely in line with its trend line, set at 11% annual FCF per share growth, through 2021. However, as it entered its investment cycle and saw revenue plummet, FCF per share collapsed, falling to $1.64 per share in 2024.

However, the graph also shows TXN’s expectation that this will return toward the norm from 2026 onward, driven by anticipated CapEx moderation, expected revenue growth, and improving margins. Management sees room for FCF per share in 2026 to improve to $8 to $12, massively up from 2024 and 2025 levels.

So, while these numbers may not look impressive right now, we should see massive improvement from 2026 onward, which is promising. This perspective matters when reviewing these TTM numbers, as it’s these current investments that allow for this return to a targeted 11% annual FCF per share growth.

On that note, I finally want to address capital returns. TXN is still one of the most shareholder-friendly businesses, committed to returning 100% of FCF to shareholders. In fact, it has returned over 120% of FCF to shareholders over the last decade.

In Q3, TXN returned another $1.2 billion to shareholders through dividends and repurchased $119 million of stock. While share buybacks are down right now amid depressed cash flows, this has been a powerful lever for TXN over the last two decades, with the company having retired 47% of its shares since 2004!

On top of that, TXM has raised its dividend for 22 consecutive years and grown it at a 23% CAGR over the same period. Growth has held up well over the last years, at an 8% CAGR, and investors now receive a very juicy 3.5% yield. On a TTM basis, this does represent a 98% payout ratio, but this is based on depressed earnings, so we should see this normalize to the 50-60% range in the coming years, which is healthy and leaves room for continued growth, especially with FCF growth at an 11% CAGR.

This remains very appealing.

Finally, all these returns continue to be supported by an okay balance sheet. TXN ended the last quarter with $5.2 billion in cash and $14 billion in debt at an average coupon of 4%. This translated into $9 billion in net debt.

TXN’s balance sheet has worsened significantly in recent years due to lower revenue and very high CapEx, going from $2 billion in net cash at the end of 2021 to $9 billion in net debt as of Q3, which is very poor and primarily due to continued cash returns to investors despite depressed cash flows.

Positively, this trend should reverse from 2026 onward. For reference, the lower end of management’s current FCF projections for 2026 points to $7.3 billion in FCF, which still leaves it with $2.5 billion in FCF after dividends, which can be used to bring down net debt, so this is really manageable, especially as this number should continue to grow rapidly in the years that follow.

Therefore, I see the current balance sheet as healthy, with the expectation that net debt will decline sharply from 2026 onward.

With that, let’s move to the outlook!

Want more out of your subscription? Even more content like this weekly? Consider InvestInsights PRO - now available at 40% OFF for two more days!

If you’ve waited to go premium, this is by far the best moment.

Premium gets you:

A guaranteed minimum of 6-8 stock analyses every month (of which at least 3-4 are paid-exclusive).

Full insight into my own portfolio, including allocation, transactions, watchlist, and performance (16% annualized return since January 2022).

Instant transaction alerts anytime I buy or sell any shares (Fully transparent).

An overview of all my target prices and ratings (available online, updated weekly).

Access to the InvestInsights Hub, containing all of the above in a single online sheet, updated constantly!

Outlook & Valuation

Starting with management’s near-term guidance, it now guides Q4 revenue in the range of $4.22 billion to $4.58 billion, suggesting 15% YoY growth, in line with recent quarters and reflecting depleted customer inventories but cautious demand trends. So, still not really the improvement many hoped for, with a midpoint shy of a $4.5 billion consensus.

Furthermore, management guides for Q4 EPS of $1.13 to $1.39, reflecting a 3% YoY decline, including changes related to the new U.S. tax legislation. This was well short of a $1.39 consensus.

Additionally, management guidance suggests gross margin will decline another 250 bps to around 55%. Management is adjusting loadings down in Q4, which will further pressure margins compared to Q3, due to heightened depreciation, which is in large part why EPS growth is growing much slower than revenue – margin weakness persists.

For FY25, the midpoint of guidance translates to revenue of $17.66 billion, up 13% YoY. Additionally, EPS is expected to be $5.43, up 4% YoY, reflecting some margin pressures.

Moving to CapEx, this is expected to total $5 billion in 2025, which is still an elevated number, but easing. Positively, management now guides for this number to ease off in 2026, dropping to a range of $2 billion to $5 billion. For 2027 and beyond, CapEx will depend on revenue growth, but will ease further as a percentage of revenue, while recent investments in low-cost manufacturing and technology will support healthy margin expansion.

On a TTM basis, the improvement in revenue growth and the easing of CapEx have already translated into 65% YoY growth in FCF, and this recovery should continue to strengthen in the years ahead. Management points to a return to its trend line, suggesting a commitment to an 11% FCF per share CAGR, which is a combination of FCF growth and a lower share count resulting from buybacks.

Assuming this trend line, we get to a 2026 FCF per share of $8 to $12, which is what TXN management is now guiding for.

Moving to my own projections, I am pricing in more caution for Q4 and early 2026 amid recent questions about the U.S. economy and continued global trade pressures. Therefore, I am now assuming revenue growth of just under 13% in 2025 to $17.63 billion and margin pressure to persist as guided, leading to 6% EPS growth.

Looking ahead to 2026, I expect some U.S. economic weakness to drag on demand, but TXN to see a gradual improvement in demand, allowing for continued double-digit growth. Furthermore, improving depreciation and loadings should allow for margins to recover somewhat, leading to a mild EPS recovery.

I expect these same trends to persist through 2028. Revenue growth should remain in the low double digits, thanks to gradually improving demand, while EPS will recover more aggressively as gross margins and subsequently earnings improve.

This leads to the expectations below.

On top of these, TXN’s FCF per share trendline points to rapid growth through 2030, amid a recovery from 2024 lows. For FY27, this could very well improve to $13.50, $15 by 2028, and $16.50 by 2030. Assuming the midpoint of management’s 2026 guidance, this suggests a 13%+ FCF per share CAGR through the end of the decade, which is really quite impressive.

Moving to valuation, the sell-off YTD means TXN shares have at least declined from the elevated valuation multiples seen at the start of the year, when shares traded over $200 per share. Today, at a share price of $168, shares look much better priced, though still not a bargain.

We are now looking at:

31x this year’s earnings and 26x next year’s earnings, a 30% premium to the sector median.

A growth-adjusted PEG of 1.8x, in line with the sector median.

17x next year’s guided FCF per share.

While TXN is still far from a bargain, today’s valuation looks far more reasonable than earlier in the year. That said, it is not fully de-risked. Near-term fundamentals remain soft: revenue growth is slow, margins are suppressed by depreciation and low loadings, and visibility into a stronger recovery has weakened. On a snapshot of current earnings alone, TXN could still appear expensive.

But viewing TXN purely through today’s earnings misses the broader context. The business is nearing the end of its largest investment cycle. As 300-mm fabs ramp, capex moderates from 2026 onward, and loadings normalize, margin expansion should accelerate, and free cash flow per share should rebound sharply. With customer inventories now fully depleted and less macro or geopolitical risk than most chip peers, the medium-term setup looks far stronger than the recent results suggest.

Amid an expectation for a 17% EPS CAGR through 2028 and similarly strong FCF per share growth, a 26x earnings multiple isn’t that rich, nor is 17x FCF per share. In other words, these multiples are less about current earnings and more about future cash generation backed by an increasingly dominant low-cost manufacturing footprint and strong long-term positioning.

So, do TXN shares at current prices finally reflect good enough value? Well, not quite yet.

Assuming a 26x 2027 earnings exit multiple, which is what TXN has historically demanded on average, I calculate a $202 per share price end-of-2027 price target. Similarly, a reasonable 15x FCF per share translates into a 2027 price target of $202, leading to an average 2027 target of $202.

At a current share price of $168, this translates into an annualized return of 12.5% (including dividends), which does reflect a decent risk-reward, but not quite what I am personally aiming for, as I am looking for a bit more downside protection, considering the risk of further economic turmoil to drag on growth.

In short, TXN is around fair value but is not at an attractive risk-reward point. A slight pullback to $162 would better align long-term returns with TXN’s quality, durability, and upcoming cash-flow inflection, at which point I would view the stock as an excellent long-term compounder.

For now, I remain on the sidelines, but I will continue to monitor this top-quality business closely.

Rating: Hold - Accumulate below $162

FY27 Target Price: $202

Implied CAGR from the current price: 12.5%

Agreed.

.

MoAT

= ROA

= 14.3 %

.

It's a large MoAT.

.

But at what price is the MoAT?

.

When ROA rises, the ROIC follows.

.

You need a ROIC Weight Machine:

.

PEROIC Weight Ratio.