Texas Instruments Inc. – Can current multiples still be justified?

Last week was a disaster for TXN, as its Q4 results and Q1 guidance fell short of expectations. Let's delve into all the details and answer the question above!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Jumping right into it, Texas Instruments reported results last Thursday, and it disappointed – simple as that. There was just no denying its guidance, in particular, fell short of expectations, as analysts were looking for signs of a bottom and sequential improvement, which seems to stay out for now as the company continues to navigate its way through a tough operating environment.

Following the disappointing earnings report, TXN shares lost over 7% of their value during Friday’s trading session and seemingly much deserved, especially considering TXN shares already traded at well over 30x the FY25 EPS consensus, which is a hefty premium, to say the least.

So, where does that leave us today? Following this minor sell-off, is Texas Instruments an interesting buy and a great long-term investment, or is it time to reconsider the investment thesis as results keep falling short quarter after quarter?

Well, that is not an easy question to answer. As I explained in my Deep Dive back in October, TXN is still a tremendous business with a long runway of growth ahead of it. This is due to its dominant market position as the industry leader in analog semiconductors, technological leadership, and de-risked nature, which is due to in-house manufacturing located primarily in the U.S.

Due to this and the solid growth through the cycles in the analog chip market, this company has been a great long-term compounder. Its returns generally outpace the S&P500, and it offers a steadily growing and sweet dividend. It seems well-positioned to remain so in the decade ahead. It most certainly has plenty of secular drivers working in its favor, which is why its growth outlook remains solid.

All things considered, TXN shares have arguably always deserved somewhat of a premium, also compared to peers. I understand. That is why I really like to hold shares in this business.

However, last week’s results were concerning, to say the least. The company failed to impress with its Q4 results and guided for another weak Q1 as revenue is expected to decline sequentially again, highlighting demand remains lackluster and the recovery is far slower than anticipated.

However, we should add that this is mainly due to weakness in TXN’s two primary end markets, automotive and industrial. In my opinion, this makes the current weakness seem like much more of a problem than it really is.

Nevertheless, the quarterly performance has raised serious concerns over TXN’s medium-term growth potential, as weakness might continue. In response, Wall Street analysts have significantly cut medium-term growth expectations, and arguably, rightfully so. Growth and management’s guidance simply fell short.

However, this then further increases valuation concerns, with the argument of the company growing into its multiple no longer holding up, and the 7%+ sell-off really doesn’t quite reflect how poor this report was for TXN and the subsequent consensus cut, as historical investor goodwill limits a larger slump.

Indeed, this is not a great set-up. So, where does this leave us today?

Let’s delve into the results and outlook and find out!

TXN fails to impress with its Q4 results

Texas Instruments reported its fourth quarter results on January 23, and while it managed to beat the top and bottom-line consensus estimates with mostly okay results, the company failed to impress in any way.

After a cyclical downturn in 2023, a recovery so far has been less swift than anticipated, as TXN continues to face demand weakness in its two largest end-markets, Automotive and Industrial, leading to lackluster revenue growth, which also translated into continued bottom-line weakness amid an elevated spending cycle.

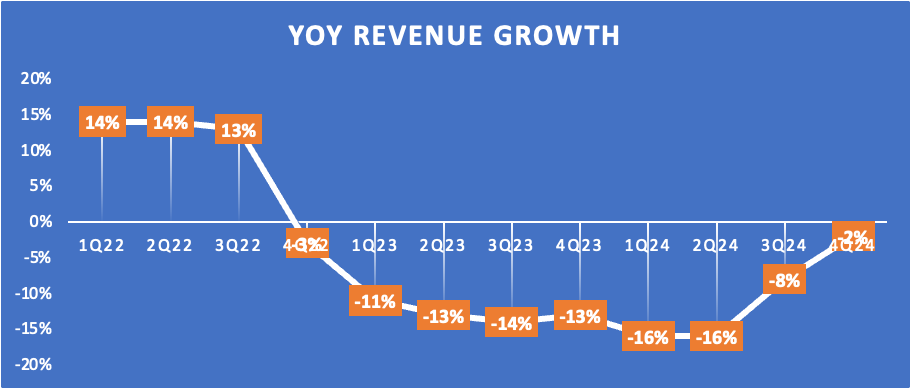

For Q4, TXN reported total revenue of $4.01 billion, down 2% year over year. This shows an improving trend and recovery in growth and demand. However, sequential growth turned negative at -3%, which is somewhat disappointing as it shows a recovery much slower than previously hoped. Weakness remains, though this seems to be an industry-wide phenomenon, particularly in TXN’s largest end markets. Nevertheless, TXN beat the Q4 revenue consensus by $140 million.

Less impressively, revenue growth weakness was visible across all of TXN’s segments, with each operating segment dipping sequentially. Analog revenue did show some improvement, turning positive for the first time in eight quarters. Meanwhile, embedded revenue still declined another 18% YoY.

As said, this weakness reflects the poor performance of TXN’s Automotive and Industrial segments, which both saw modest sequential declines. With these end markets accounting for about 70% of revenue, this hurts the overall performance considerably.

For reference, Industrial revenue declined sequentially in the low single digits, and automotive revenue declined in the mid-single digits. This was offset by mid-single-digit growth in personal electronics revenue and high-single-digit growth in communications equipment.

Now, while this performance isn’t any good news and this over-exposure to Automotive and Industrial worked against the company in Q4, in the longer term, this exposure is expected to benefit the company, with industrial and automotive two of the fastest-growing analog semiconductor markets, so I wouldn’t be overly concerned right now.

Opportunities in these markets remain considerable thanks to the continued transition to automated and electronic systems in industrial and automotive applications. For example, a modern battery-powered car with all its electronics and modern features has roughly four times as many semiconductor products on board as a traditional ICE-powered car, so the growth potential for TXN remains considerable.

Therefore, I don’t mind this overexposure, even though it is a short-term headwind. Furthermore, I do believe this overexposure currently makes the results look worse than they are, but I’ll be closely looking at what peers will report in the weeks ahead.

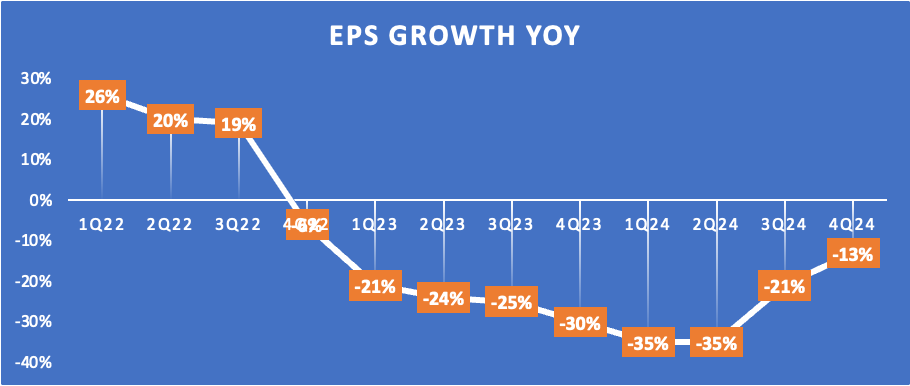

Moving to the bottom line, the top line weakness is clearly reflected.

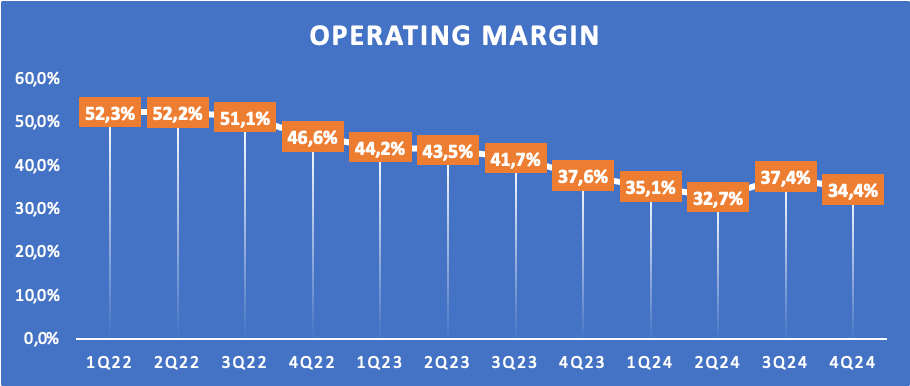

TXN reported a Q4 gross profit of $2.3 billion, reflecting a gross margin of 58%, which is down 190 bps sequentially due to rising costs and lower revenue. Further down the line, this results in an operating profit of $1.4 billion, down 10% YoY and reflecting an operating margin of 34.4%, down 300 bps from last quarter and down 320 bps YoY, which is rather poor but not a massive surprise either.

TXN’s operating margin has been trending down for a few years now, as shown above. This is due to struggling top-line numbers and high costs amid a multi-year investment cycle to position the company for the next upcycle.

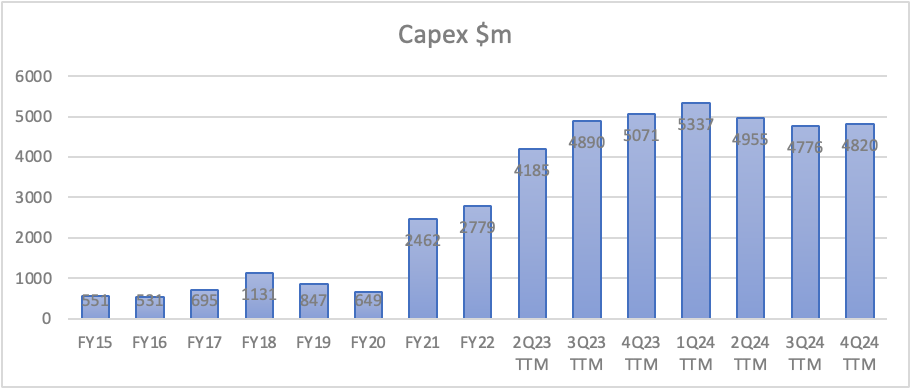

Last quarter was no different. Operating expenses were $937 million, up 4% year over year, and TTM OpEx of $3.8 billion represented 24% of revenue, an elevated number. Furthermore, Capex in 2024 totaled $4.8 billion, as expected. Positively, management is now 70% through its six-year elevated investment cycle, which means cost growth should ease a bit in the coming years, benefitting FCF growth, particularly, thanks to lower Capex.

For Q4, these lower margins resulted in a net income of $1.2 billion or an EPS of $1.30, down 13% YoY but still $0.10 ahead of the consensus.

Finally, for the full year, TXN generated a meager $1.5 billion in FCF, reflecting a 10% FCF margin that does not nearly cover its annual obligations.

On an annual basis, TXN pays out about $5 billion in dividends and has continued to buy back stock, buying back roughly $500 million worth of stock in Q4 alone, which I have a hard time explaining currently. It doesn’t seem like an effective use of capital to me.

Nevertheless, TXN does still have a relatively healthy balance sheet, with $7.6 billion in cash and short-term investments and a total outstanding debt of $13.7 billion, which is healthy enough, especially assuming FCF should recover relatively quickly as spending eases off and revenue rebounds in coming quarters and year.

Again, I am not worried yet.

Meanwhile, investors do still receive a sweet dividend, with TXN shares now yielding 2.9%. As said before, this isn’t very well covered by FCF or earnings currently, with a payout ratio of 102%, but this is mostly due to the earlier explained short-term dip in earnings.

Meanwhile, TXN continues to grow its dividend steadily throughout the cycles. It has realized a 10% growth CAGR over the last five years and raised its dividend by 5% this year, marking the 21st consecutive increase. Not too bad, right?

Indeed, while far from ideal, the quarter itself wasn’t all that bad from TXN, all things considered. However, its outlook was.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

Want to try our paid tier for free? Simply get three of your friends and family to join Rijnberk InvestInsights and receive one free month!

Outlook & Valuation

The outlook was the real issue in the TXN Q4 earnings report.

Delving right into it, TXN now guides for a Q1 revenue in the range of $3.74 billion to $4.06 billion, which, at the midpoint, is only in line with a conservative Wall Street consensus and reflects another sequential decline of 2-3%. TXN blames this on quarterly smartphone cyclicality, which clearly isn’t being offset by any sort of recovery in other segments, meaning TXN continues to guide for persisting weakness in key end markets.

As for the bottom line, the top-line weakness is expected to continue pressuring these results, with TXN guiding for an EPS between $0.94 and $1.16, short of a $1.17 consensus.

This poor guidance has forced Wall Street and me to reset our medium-term expectations, as a recovery will not follow the previously thought trajectory. Furthermore, margin weakness isn’t expected to ease anytime soon. Morgan Stanley analysts even predict gross margin weakness in 2026, putting pressure on EPS guidance.

Now, management claims it remains committed to its long-term strategy by investing in its “competitive advantages, which are manufacturing and technology, a broad product portfolio, the reach of its channels, and diverse and long-lived positions.”

And, honestly, I do believe TXN remains well-positioned toward long-term secular trends, with its dominant position in analog semiconductors, reliable manufacturing capacity, and exposure to faster-growing verticals, which should allow it to drive solid growth once end markets recover and deliver solid FCF growth and earnings growth in due time.

The issue is that this will take time—more than previously thought—and with shares priced for perfection, it will hurt investor returns, raising concerns. The way I view it right now, it will take a significant time for TXN to grow into its current multiples, massively limiting medium-term returns.

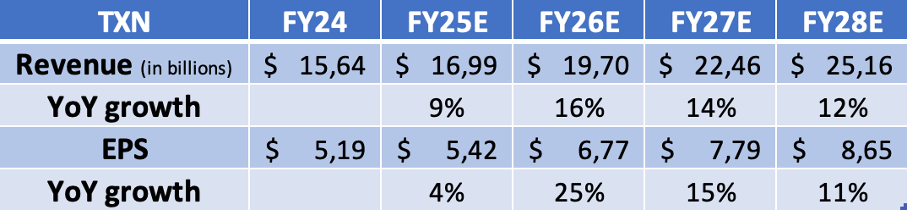

But first, current projections. As I said, this is quite a reset. Here are my current projections, which include high investments through 2026 and a gradual top-line recovery.

This then brings us to the current valuation, which isn’t mild, even after last week’s 7%+ sell-off. Based on current projections, TXN shares now trade at 34x this year’s earnings, which is a bloody high multiple to pay, even with this recovery-driven outlook and the company’s long-term growth potential.

With current growth projections, it will take quite some time for TXN to grow into its multiple. For reference, the company has historically traded at an already quite high earnings multiple of 24-26x. Were the company to return to this long-term multiple over the next three years, by which growth should have normalized, this would translate into an end-of-2027 target price of $195, which is only 5% away from today’s share price of $185.

In other words, unless the company continues to trade at a ridiculous multiple by the time growth has normalized and recovered, there is barely any upside here due to the current extremely rich valuation.

Yes, this is a very high-quality business with a lot of investor goodwill, but I just can’t justify current valuation levels in any way after last week’s expectations reset.

Therefore, the answer to the title of this article is “no.”

At this time, I can’t see any realistic scenario in which TXN shares are a good buy, and I expect shares to remain volatile and trade flat in the years ahead.

For me, the share price would have to fall much further, closer to $155 per share, to make this an okayish buy.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Businesses in cyclical industries demand a longer-term perspective when evaluating their worth. Typically, these are commodity-driven sectors—whether or not semiconductors are truly "commodities" is up for debate, but they're undeniably cyclical. The opportunity for long-term wealth lies in identifying great businesses and entering at the trough of the cycle. Remember, though, it’s crucial to be clear on *why* you’re buying. Companies in cyclical sectors PAY YOU to take on the volatility. In simple terms: you invest in them because they compensate you for enduring the ups and downs of the market cycle.

Many thanks for this. Is there any way of working out what recovered earnings are? I.e. is it peak multiple on trough earnings. From what I can read, it doesn't sound like the end prize has changed or they've lost any competitive positioning - those downgrades can reverse pretty quickly if cycle recovers.