Thermo Fisher Scientific Inc. – Uniquely positioned for long-term success (A Deep Dive)

Here it is: My Deep Dive into TMO!

Thanks to its unique positioning, Thermo Fisher is probably one of the highest-quality companies and most impressive compounders in the healthcare and pharmaceutical industry. The company is the perfect way to benefit from the compounding growth of healthcare and pharma due to an aging population and growing need for health solutions without any real exposure to consumers, expiring patents, or the need for breakthrough medicines (the result of years of excessive R&D) to drive growth – those factors keeping me away from investing in pharma in the first place.

Thermo Fisher is a true industry giant with a massive, impenetrable, and expanding moat and de-risked revenue stream, thanks to terrific diversification and over 80% recurring revenues. Meanwhile, the company also has a strong track record of growth and pristine execution. And this isn’t expected to change, with management pointing to high-single-digit revenue and mid-teens EPS growth well into the next decade!

What more can you wish for?

This all has made it an investor favorite for much of the last decade, delivering returns well above those of the S&P500 and most peers, even though the last couple of years have been less good.

And yet, despite all of this, it is one of those companies that has been on my watchlist for probably forever, yet I had never really looked into it in great detail (something I deeply regret), partly due to the industry it operates in but also mainly due to the consistent premium it trades on, though rightfully so.

However, since the COVID-19 crisis, the company and its share price haven’t had the easiest of times. While shares quickly more than doubled from an early 2020 dip to an all-time high at the end of 2021, they have been trading flattish since, with ups and downs.

You see, during the COVID-19 boom, TMO played a pivotal role in global efforts to combat the virus, leveraging its extensive portfolio to support testing, research, vaccine development, and manufacturing. Initially, Thermo Fisher supported vaccine development by supplying critical materials and tools, such as reagents, instruments, and laboratory consumables, to support the development of vaccines, in which billions were invested in a short time frame.

Additionally, Thermo Fisher developed and distributed COVID-19 test kits, including PCR tests, which became the gold standard for virus detection. The surge in testing requirements from governments, healthcare systems, and private organizations generated substantial revenue for the company, with its Specialty Diagnostics segment witnessing unprecedented demand.

This led to a 26% revenue rise in 2020 alone, with COVID-19-related products and services contributing significantly. Hence, its late 2021 share price all-time high.

However, as the pandemic eased off, these revenues slowly started to disappear, impacting TMO’s revenue growth in the years that followed. While growth in other segments remained healthy and partially offset some of these losses, it couldn’t fully offset them. As a result, revenue growth rapidly slowed in 2022 and has been mildly negative for most of 2023 and 2024, as COVID revenues have practically disappeared by now.

Wall Street responded accordingly. While the S&P500 delivered two years of 20%+ returns in 2023 and 2024, TMO shares have been flat since. They have delivered a flat return over the last 12 months and are still some 15% shy of that late-2021 all-time high.

Positively, as a result, its valuation has also come down somewhat from recent highs, even as the company fundamentally remains unchanged and, thanks to a great business model and massive moat, is positioned to remain a compounder for probably many more decades.

Therefore, I believe now is the perfect time to spotlight this terrific business. In this post, I will explain the business and its fundamentals, examine its recent performance and financials, and discuss its growth prospects and valuation, hopefully giving you a thorough understanding of the company and its attractiveness.

Is now the right time to buy TMO shares? Let’s find out!

This is Thermo Fisher Scientific

Starting at the foundation, Thermo Fisher Scientific is a global leader in the life sciences and pharmaceuticals industry. It provides innovative solutions that enable advancements in research, diagnostics, and laboratory operations and is renowned for its contributions to drug development and manufacturing, genomics, proteomics, and molecular diagnostics.

Its operations are structured into four key segments: Life Sciences Solutions, Analytical Instruments, Specialty Diagnostics, and Laboratory Products & Biopharma Services. These divisions work synergistically to offer a wide range of products, including leading research reagents, laboratory equipment, consumables, best-in-class bioprocessing products and equipment, and a full suite of genetic analysis platforms.

In other words, the company is the picks and shovels in the biopharma, clinical diagnostics, healthcare, and life sciences industries, catering to diverse industries, ranging from pharma and biotech giants to governments, academics, and healthcare institutions. With its innovative products, TMO enables the next generation of healthcare solutions and drug discovery.

Its products enable biopharma R&D and drug manufacturing and discovery, improve diagnostics for patient care, achieve scientific breakthroughs, solve analytic challenges, and conduct life sciences research. However, this stretches beyond serving healthcare and pharmaceuticals, as the company also supplies solutions for air quality monitoring and equipment to allow regulators to ensure a safe drug and food supply.

Through a massive suite of products servicing multiple end markets, the company acts as a one-stop shop for a customer’s entire workflow, from lab supplies to services.

This way, and after more than a century of R&D, Thermo Fisher has established itself as a vital partner to researchers, clinicians, and pharmaceutical and Life Sciences leaders worldwide. It has a remarkable commitment to innovation and an extensive customer network.

As a result, the company is an industry leader in most of its end markets, claiming a very impressive 15% market share in the total life sciences market, which is especially impressive considering this is a very fragmented industry. Interestingly, Thermo Fisher and Danaher together control 35% of the market, and both have a massive and pretty much impenetrable moat.

Thermo Fisher Scientific has a mighty moat and de-risked revenue stream

Indeed, TMO won’t easily be disrupted.

For starters, TMO leads in innovation and has exceptional commercial reach, unique customer access, and an unequaled global footprint, with customer service centers in over 50 countries. For reference, over the past five years, TMO has worked with all 50 of the top pharma businesses globally and with 2,700+ biotech companies.

These are partnerships and customer-client relationships that have existed for decades and won’t easily be broken. These close relationships might be among the stronger factors solidifying its moat.

Also, thanks to its unique scale in the industry and the depth of its product portfolio, the company is extremely relevant to its customers, giving it an edge over the competition. Why get your equipment from many different manufacturers when you can get it from a single one as well?

Size, relationships, and decades of industry know-how rule!

Further adding to its moat is the fact that Thermo Fisher is extremely deeply embedded throughout a drug's life cycle. Once an instrument is specified in the design and development/manufacturing of a drug, the cost of switching out that instrument is significant due to regulatory requirements for consistency in drug development.

In other words, regulatory oversight is giving TMO a massive moat thanks to high switching costs, but it is also creating extremely high barriers of entry for peers.

In addition, many of these instruments feature a closed system. This means they can only operate using their own branded consumables.

In other words, when using TMO equipment, a customer is often also forced to use TMO’s consumables. Laboratory consumables refer to items that are essential for operating various instruments and procedures but are used up or require regular replacement. These include pipette tips, filters, and reagents and chemicals.

This then creates a very attractive recurring revenue stream from selling high-margin consumables for instruments that tend to have an average life of 5 to 12 years, also locking in customers for a long time.

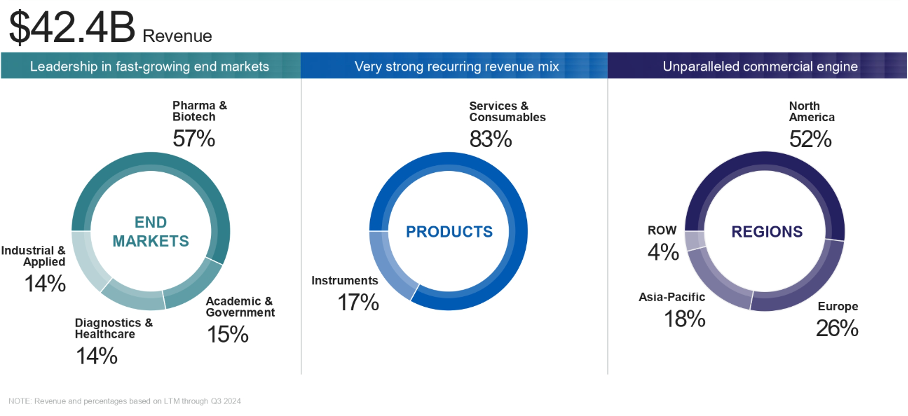

As a result, some 83% of TMO’s revenue stream is recurring, with the company generating only 17% of its revenues from actual equipment. Unlike most pharma or healthcare peers, this makes TMO’s revenues remarkably reliable and relatively stable, meaningfully lowering risks.

Adding to this resilient and de-risked revenue stream is the great diversification. TMO’s largest customer base operates in the pharma & biotech industry, accounting for about 57% of revenue, followed by academic & government at 15%, diagnostics & healthcare at 14%, and industrial at 14%, showing solid diversification and exposure to compelling markets.

The company also has a good global exposure, with 52% of its revenues coming from North America, followed by Europe at 26% and Asia at 18%.

TMO is able to deliver impressive growth, consistently

Ultimately, as of FY23, this translates into over $42 billion in annual revenue for TMO, making it a real giant in the industry, with a market cap of $200 billion.

More impressively, the company's revenues grew at a 13% CAGR from 2013 through 2023 and at a 10% CAGR from 2009 through 2019, excluding any COVID benefits.

Furthermore, pre-covid, the company rarely reported a quarter of negative growth thanks to the anti-cyclical nature of the industries in which it operates. For reference, prior to 2023, when COVID revenues eased off, the company had only reported a total of three quarters of negative YoY growth since 2009, with its worst quarter coming in at -4%.

That is some impressive resilience and a testimony to the sheer quality of this business!

It is worth noting that a crucial driver of this growth has been acquisitions – a strategic focus for TMO. As mentioned, the life sciences industry is highly fragmented, creating ample opportunity for M&A activity and making it an important lever to pull to strengthen a moat and drive growth.

Over the last decade, TMO has acquired 28 businesses, spending well over $30 billion on M&A. Most of these acquisitions have been successful, thanks to the company’s strict acquisition criteria. These acquisitions have allowed TMO to strengthen its market position and expand its capabilities.

Going forward, management has indicated it remains committed to this strategy. M&A will remain the primary focus of its capital deployment strategy. The company aims to use 60-75% of its FCF for M&A, with the remaining 25-40% used to return capital to shareholders. According to management, this could translate into another $40 billion to $50 billion spent on disciplined M&A in the years ahead.

While generally, I don’t favor M&A as a strategy to drive growth, in the case of TMO, I like management’s approach, in part thanks to its flawless acquisition and strong track record of successfully integrating these businesses and turning them into strategic market share gains in a highly fragmented market.

Highlighting the efficiency of these acquisitions is the fact that EPS has even outgrown revenue over the last decade, growing at a 15% CAGR from 2013 through 2023 and a 16.4% CAGR from 2009 through 2019. Also, FCF has grown at a 14% CAGR from 2013 through 2023.

Looking ahead, growth projections for TMO remain impressive thanks to secular drivers and a brilliant business model, especially with Covid headwinds now mostly out of the way.

Ultimately, management indicates it currently serves a total market worth $235 billion, which is anticipated to keep compounding at a 4% to 6% long-term CAGR.

This is driven by several factors, including favorable demographics. An aging population requires more significant healthcare solutions and investments (1.2 billion people over 65 are expected by 2035, up from 0.8 billion in 2023). As a result, the global drug pipeline is growing (currently, there are 21k drugs in development), with an increased mix of biologics driving growth in demand for TMO’s products.

Furthermore, the development of increasingly complex therapeutic modalities leads to customers seeking increasingly deep expertise from companies like TMO. Finally, the growing government funding for academic research and the rise of AI-enabled drug discovery also contribute to industry growth.

In other words, the company is fully benefitting from attractive end markets that are fueled by enduring long-term trends. This all translates into a compelling and consistently growing market.

Adding to this solid underlying industry growth are TMO’s consistent market share gains, which further improve the company’s own growth expectations. Driven by these market share gains through its massive moat and continued M&A activity, management now expects revenue to keep growing at a long-term CAGR of 7-9%, which is impressive and compelling.

Meanwhile, with management guiding for consistently expanding margins at a rate of about 40-50 bps YoY, EPS and FCF are likely to grow at an even more impressive mid-teens CAGR long-term.

I mean, what is there not too like here?

Thermo Fisher Scientific is an industry giant in a very compelling market, with a de-risked revenue stream and mega moat, and it is projected to keep growing strongly well into the next decade thanks to secular growth drivers and impressive execution.

Can you see why this company tends to trade at a premium? You won’t find them much better.

But more on the outlook in a bit. First, let’s check out the company’s financials and its recent performance.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to even more premium analyses (3 per month), full access to my own outperforming portfolio, immediate trade alerts, and a full overview of all my price targets and rating, and even more!

Thermo Fisher reports accelerating growth with better times ahead

Thermo Fisher reported its most recent financial results on October 23, 2024, and while the headline numbers were roughly in line with the consensus, the company delivered pretty good results as growth continues to accelerate after a rough 2023 and 2024 due to the loss of its covid-related revenues.

Positively, the company is delivering a strong and resilient overall financial performance that continues to beat the underlying market. Thanks to its strong customer relationships and competitive positioning, the company has continued to gain market share even under challenging conditions. As a result, the company has also continued to deliver accelerating growth throughout 2024, with sequential growth in every quarter so far and growth expected to turn positive again in Q4.

In other words, the company’s roughest times seem to be behind it, and a growth recovery is in full motion. For Q3, this resulted in revenue roughly in line with expectations and a more impressive EPS performance, even allowing the company to raise its guidance for a third time in 2024.

Taking a closer look at the results, the company delivered quarterly revenue of $10.6 billion, which was flat YoY on both a reported and organic basis but up sequentially for the third consecutive quarter. As said before, revenue growth for TMO heavily decelerated as the covid-boost from 2020-2021 disappeared as revenue from vaccines and tests eased off, resulting in negative growth throughout 2023 and 2024.

For reference, at its peak in 2021, COVID-related revenue contributed about 25% to the company’s total revenue, contributing some $2.5 billion. In the most recent quarter, this dropped to just $100 million, so you can imagine the headwind this has caused the company’s top line. Last quarter, this was still a three percentage point headwind to growth.

Positively, revenue is showing a clear uptrend throughout 2024 as these headwinds ease. This uptrend is anticipated to persist in Q4 and as we enter 2025.

By region, North America continued to be the weakest performing, with revenue declining low-single digits, somewhat offset by flattish growth in Europe, Asia-Pacific and China.

By customer base, pharma & biotech saw a revenue decline in the low-single digits in Q3, which included a considerable five percentage point headwind from the drop off in COVID-related revenue. Positively, this did mark the third consecutive sequential increase as headwinds ease and the operating environment improves.

Meanwhile, in academic and government, the company reported positive growth in the low single digits, thanks to its strength in the microscope, research, and safety businesses. Industrial revenues also grew low single digits. Finally, diagnostics and healthcare revenue were flat YoY, though also facing a considerable impact from COVID-19 revenue losses.

Overall, there are not too many surprises here, and the performance is roughly in line with expectations.

Meanwhile, the company continued to perform really well in terms of innovation and execution, reeling in multiple prices for scientific innovation and showing it can continue to gain share under challenging conditions. The company’s unparalleled customer access, the depth of its capabilities, and its incredible level of innovation continue to translate into commercial wins and market share gains.

Moving to the bottom line, the company also continues to perform well, beating earnings expectations.

TMO reported a gross margin of 41.8%, down 20 bps YoY. Furthermore, it reported an operating income of $2.36 billion, translating into an adj. operating margin of 22.3%, down 190 bps YoY but still slightly ahead of expectations.

This margin decline was the result of flat revenues against growing costs across the board as the company continues to invest heavily in its business. For reference, the company still increased its R&D expense by 8.5% year over year in Q3, now accounting for 7.3% of its manufacturing revenue.

Innovation is critical in this industry, so I don’t mind these growing expenses at all. However, I would be more concerned if management didn’t continue to invest, as this could cost long-term market share gains. Therefore, I don’t mind the short-term margin dip.

Anyway, margins remain in line with its longer-term average and are quite healthy, as shown below.

Moving further down the line, TMO delivered an EPS of $5.28 per share, beating the consensus by a marginal $0.03 and $0.06 ahead of management’s guidance. Furthermore, the company reported a 22% increase in FCF, bringing its YTD total to $5.4 billion or $4.5 billion net of capital expenditures.

A pretty good performance overall.

For what it’s worth, TMO’s free cash flow have remained steady after COVID-19 and have remained around the $7 billion mark. These are very healthy levels at an FCF margin of around 16-17%.

Furthermore, the company has a healthy balance sheet, with $6.6 billion in cash and $35.3 billion in debt. This translates into a net debt to adjusted EBITDA ratio of 2.7x, which is healthy enough. Also, the company has shown an impressive ability to generate profits from its investments, as reflected in a ROIC of 11.4%. This all earns it an A- credit rating from Fitch.

These cash flows and balance sheet health allow TMO to remain committed to its capital return program and M&A strategy. For reference, the company aims to use 60-75% of its FCF for M&A, with the remaining 25-40% used to return capital to shareholders, primarily through share buybacks.

Share buybacks are expected to remain the primary means of returning capital to shareholders in the near future, but it is also worth noting that TMO pays a minor dividend, which it consistently grows.

Currently, we’re looking at a very minimal yield of 0.3%, which is neither significant nor exciting. However, the positive is that this is based on an extremely low payout ratio of 7%, and it is growing at a mid-teens CAGR, which is compelling.

Now, I don’t expect dividends to become much more meaningful here anytime soon. TMO wants to keep a flexible capital return program to allow for M&A, which is why it prefers much more flexible share buybacks.

Therefore, the payout ratio will likely remain very low here, but at $600 million in annual dividends, at least its capital obligations remain low with room to grow, especially considering the profit and FCF ahead. This should allow the dividend to grow double digits for many more years, nevertheless.

Not much to complain about here!

Outlook & Valuation

I have already discussed the outlook and growth expectations extensively, and this looks terrific for Thermo Fisher, with exposure to compelling markets driven by secular growth drivers.

In the near term, management expects growth to accelerate or recover further in Q4, likely turning positive again for the first time in two years. For the full year, this results in revenue ranging from $42.4 billion to $43.3 billion, reflecting flat YoY growth at the midpoint. This assumes a total of around $400 million to $500 million in COVID-related revenue in 2024, down roughly $1.4 billion from last year, or roughly a 300 bps growth headwind.

Meanwhile, management indicates that the underlying industry as a whole is expected to decline in the low single digits, meaning TMO expects to continue outperforming thanks to continued market share gains.

Furthermore, after a strong Q3, management raised its FY24 EPS guidance for the third time this year. It now expects EPS to be between $21.35 and $22.07, up roughly 1% at the midpoint of the range. This reflects an operating margin of 22.5% to 22.8% and should result in an FCF of between $6.5 billion and $7 billion.

In the longer term, as pointed out before, management guides for a 7-9% long-term organic revenue growth CAGR, driven by 4-6% growth in the underlying market, which is pretty sublime! Acquisitions could add a bit to this, potentially pushing growth into the double digits at times.

Meanwhile, management believes it should be able to realize 40-50 bps of organic margin expansion a year, which should push up EPS and FCF growth into the mid-teens. Again, that is incredibly impressive!

All things considered, I now project the following financial results and growth through FY27.

That then brings us to valuation, and positively, this situation has improved a bit due to recent share price pressure. Over the last twelve months, TMO’s share price has been flat, compared to a 20%+ gain for the S&P500, in part due to some post-election pressures.

The election of Donald Trump has put considerable pressure on the sector, with worries over his proposal to impose heavy tariffs on goods imported from China and his selection of Robert F. Kennedy Jr., a well-known vaccine skeptic, as his nominee for HHS Secretary.

While this share price pressure is understandable, I don’t anticipate any real long-term consequences for TMO. Therefore, this price weakness does look at least a bit compelling, as the price has yet to recover sufficiently.

Nevertheless, TMO shares remain far from cheap. Historically, the company’s shares have traded at quite a hefty premium, and rightfully so. By now, you should understand just how high-quality this business is, thanks to its significant moat, strong competitive position, consistent performance, and compelling growth outlook. A business like this will always trade at demanding multiples, and it is well deserved. This is an all-weather business growing at an impressive rate with limited operational risk.

Based on the projections above, shares currently trade at a 24.5x earnings multiple, which is roughly in line with the historical average of around 25x. Considering the state of the business and its outlook, I don’t believe that is a ridiculous multiple to pay.

In fact, based on most calculations, I would say shares trade roughly around fair value. But does that make them a good buy today? Given the current weakness, they might!

For reference, using a 25x long-term multiple, roughly in line with historical averages, and my FY26 EPS projection, I calculate an end-of-2026 target price of $668. This translates into potential annual returns (CAGR) of about 11%, including dividends.

Considering the type of business, the industry it operates in, and its operational resilience and reliability, this presents a solid risk-reward opportunity.

Therefore, I deem TMO shares currently worth buying. I view recent weakness as a solid opportunity to initiate a position in this high-quality, long-term compounder.

Below $540-$550 per share, I like this business a lot!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Did you take a look at Judges Scientific?

Great read and overview of the company! Working in the field of R&D for the last 10 years, I can say that TMO is a mammoth compare to others suppliers and have a clear competitive moat. I've started accumulating shares around 515$ and I will like to add more below 530$ if possible. Long term this is a safe and reliable company.