These are the top 3 stocks to buy today

This is a collaboration between Rijnberk InvestInsights, The Simple Side, and Capitalist Letters. In this post, we will each give you our top pick in today's market and tell you exactly why!

Markets at all-time highs, interest rates at multi-decade highs, inflation sticky, economic growth slowing down… we can safely say this isn’t the easiest time for investors, even as the SPY is up 26% over the last twelve months.

It is under these circumstances that picking out the winners among hundreds or even thousands of stocks becomes even more of a challenge. Therefore, in this collaboration between Capitalist Letters, The Simple Side, and Rijnberk InvestInsights we will give you three of the best stocks to buy today, in our view.

Before getting right into it, make sure to subscribe to each of these excellent platforms for much more investing-related content!

Rijnberk InvestInsights’ top idea

Lululemon Athletica Inc.

Company description

Lululemon Athletica Inc. LULU 0.00%↑, a Canadian athletic apparel retailer, is globally renowned for its high-quality yoga-inspired clothing and accessories. Its product line includes yoga pants, sports bras, running gear, outerwear, and everyday clothing, all designed for functionality and aesthetic appeal.

What sets it apart from competitors like Adidas and Nike is Lululemon’s focus on premium products and materials, and craftsmanship. This results in the company pricing its products slightly higher than its main peers, but this has made it especially popular among higher-income consumers.

Furthermore, Lululemon's distinct yoga-inspired image has resonated with younger generations, fueling its impressive revenue growth of nearly 20% over the past decade. This robust growth has solidified its position as a key player in the athletic apparel market, demonstrating its competitive advantage.

Key historical data

5-year revenue growth CAGR: 24%

Net income margin: 16,1% vs sector average of 5.8%

ROIC: 38.2%

ROE: 29%

FCF margin: 17%

Investment case in 5 points

Dominant Position in Premium Apparel Segment: Lululemon's unparalleled focus on product quality, material innovation, and aesthetic appeal has solidified its position as a leader in the premium athletic apparel market. With a robust product line and a loyal customer base willing to pay premium prices, the company enjoys high margins and exceptional profitability.

Massive Growth Potential: Despite its current success, Lululemon has significant room for expansion, both geographically and within product categories. The company's Power of Three 2x growth strategy, focusing on product innovation, market expansion, and enhancing guest experience, positions it for substantial revenue growth, aiming to double its revenue by 2026. Initiatives like expanding into the men's segment and increasing brand awareness through strategic marketing efforts, such as sponsorship deals with sports organizations, underscore its commitment to growth.

Strong Financial Performance: Lululemon's financial performance is impressive, with consistently growing revenue and industry-leading margins. Despite a temporary slowdown in revenue growth due to external economic factors, the company maintains solid profitability, supported by a healthy balance sheet with a net cash position. Its ability to generate strong cash flows and deploy capital effectively, including share repurchases, demonstrates sound financial management.

Continuous Product Innovation: A core driver of Lululemon's success is its relentless focus on product innovation. The company's commitment to introducing new fabrics, expanding product lines, and staying ahead of consumer trends ensures its relevance and competitiveness in the market. With a pipeline of innovative products, including footwear, and a track record of delivering high-quality offerings, Lululemon is poised to capitalize on evolving consumer preferences.

An impressive outlook: Looking at current consensus estimates through FY27, Wall Street expects this company to keep growing its revenues by low-teens and EPS by low-to-mid teens, which is sublime.

Why are shares a top pick today

As laid out above, Lululemon is a fantastic company with a bright future and a clearly different strategy. And yet, while it is projected to easily outgrow any of its larger peers and will continue to grow by double digits, shares are currently trading at only 21.5x this year’s earnings, which is 52% below its 5-year average.

Furthermore, this translates into a PEG ratio of only 1.6x, which is only a 7% premium to the sector.

All in all, I strongly believe Lululemon shares are undervalued today after being down 39% so far this year and 6% over the last twelve months, while the S&P500 has gained significantly.

Based on our in-depth analysis, which can be found through the button below, we now believe investors are in for annual returns exceeding 14%, with a lot of room for further upside.

The Simple Side’s top idea

What type of device are you reading this on? A phone? A computer? A tablet? What brand is that device? Apple? Microsoft? Google? Well, no matter the type or brand of device, one thing is guaranteed: it has a screen.

Don’t “yeah, no s**t Sherlock” me yet, I have a point.

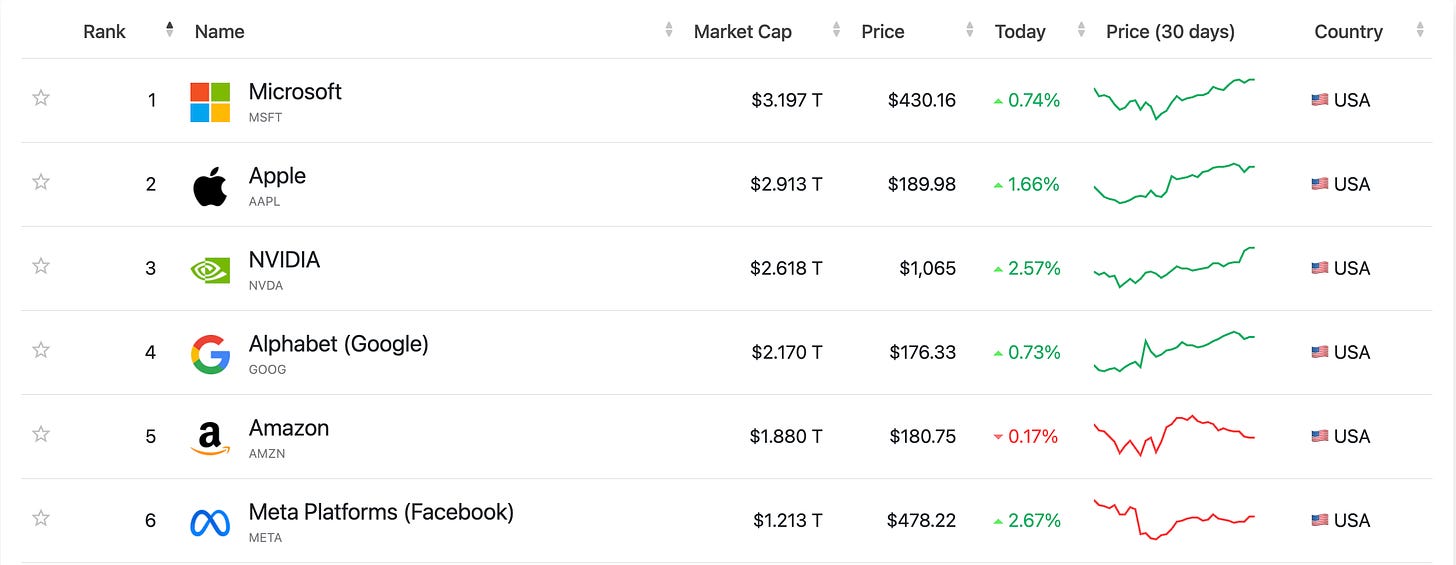

Nvidia has become one of the most valuable companies in the world because they sell ‘shovels’ to ‘gold miners’. The shovels in this case are AI chips and the gold miners are companies creating AIs. Nvidia sells what other companies are reliant on. Interestingly, investors have refused to take this same investing strategy one step deeper: screens.

The top 6 companies in the US are worth nothing without screens. Every last one of these companies needs you to access their product through a screen. Think about how many products you use daily that require those sweet eyes of yours to stare at a screen. This mental model is what has led me to find a new hidden ‘shovel’ company.

Universal Displays

Universal Displays (ticker: OLED) sells exactly what you would expect: OLED displays.

Key Metrics

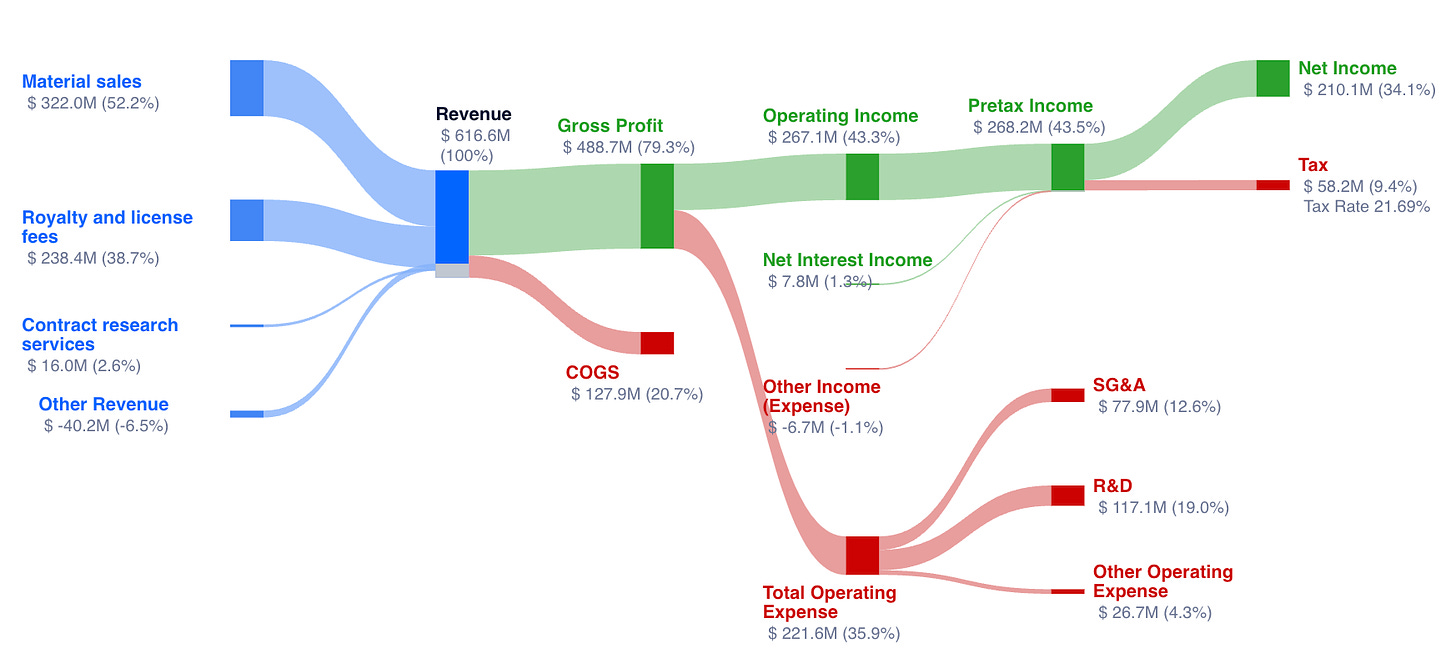

Revenue from material sales is up +19% YOY

Revenue from royalty and license fees is up +9% YOY

Revenue sources aren’t diverse,

Net operating income, as a percent of revenue, is +43%: outstanding!

This one is scary: DCF puts the stock valuation at $143 as opposed to the current price of $175.

Gurus buying the stock outnumber the number of gurus selling by 10:1 over the past 3 years.

To qualify as Guru one must have the following:

Long-term outstanding performance

More than $1 billion under management

Low portfolio turnover.

Incredibly profitability compared to industry standards:

I like to see all of that green! However, this isn’t the only green signal I see with OLED! Let’s check out some earnings:

Here are the past 7 earnings estimates and as you can see they have beat earnings every. single. time (except Q1 2023). This is one of my favorite metrics when looking at investable companies. I find it to be underutilized and quite valuable. It’s like a middle finger to all the analysts who predicted the lower revenue. Typically a revenue beat translates to higher stock movements as well — as all investors enjoy.

However, revenue beats are not the only place where OLED looks to be full of value. Analysts currently have the stock rated at a strong buy with a 4.57/5 rating which is no surprise given the results of their Q1 2024 earnings. They touted multiple impressive stats including +26.7% YOY revenue growth and a +43% YOY net income growth. Market cap growth came in at an impressive +8.8 YOY increase and if all of this is any indication of upcoming performance, investors are in luck. Not to mention that their total liabilities have been decreasing yearly along with total debt decreases.

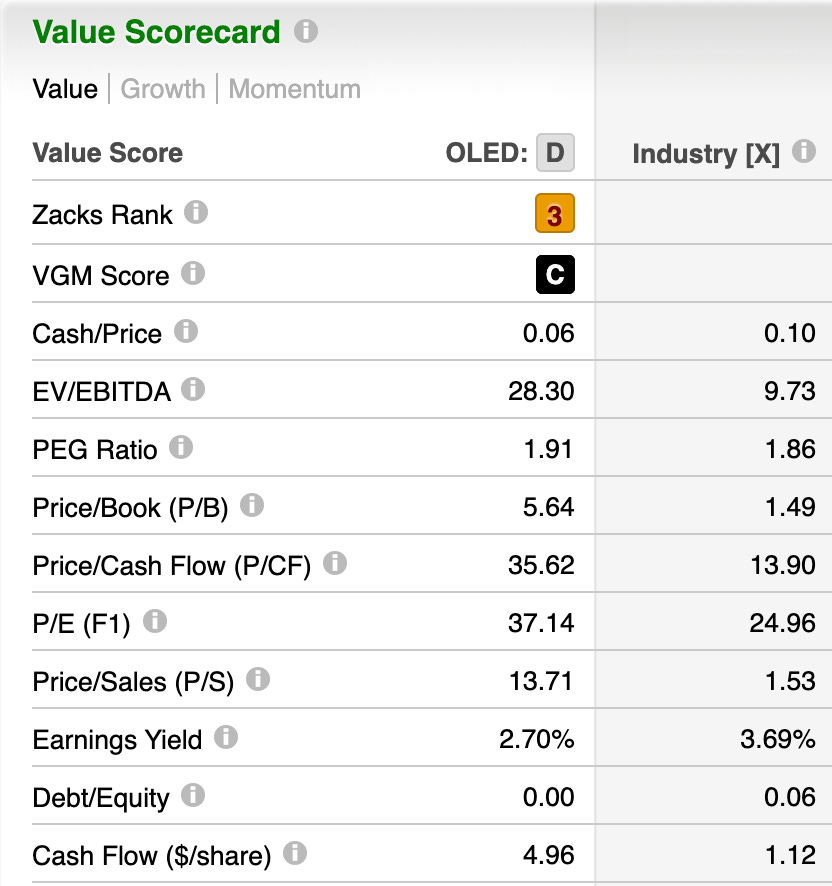

All that being said, the stock is trading at premium prices relative to the industry. All of the ‘intrinsic value’ ratios are rough for the stock. P/B, P/CF, P/S, and P/E ratios are all much higher than industry according to Zack’s data. This, however, is one of the only places where the stock is an issue. I don’t mind paying premiums when there is a dividend offered — it feels like a little kickback for buying at premium prices. The good news is that the cash flow per share is 4x that of the industry. Something I love to see especially with the economy on such rocky ground.

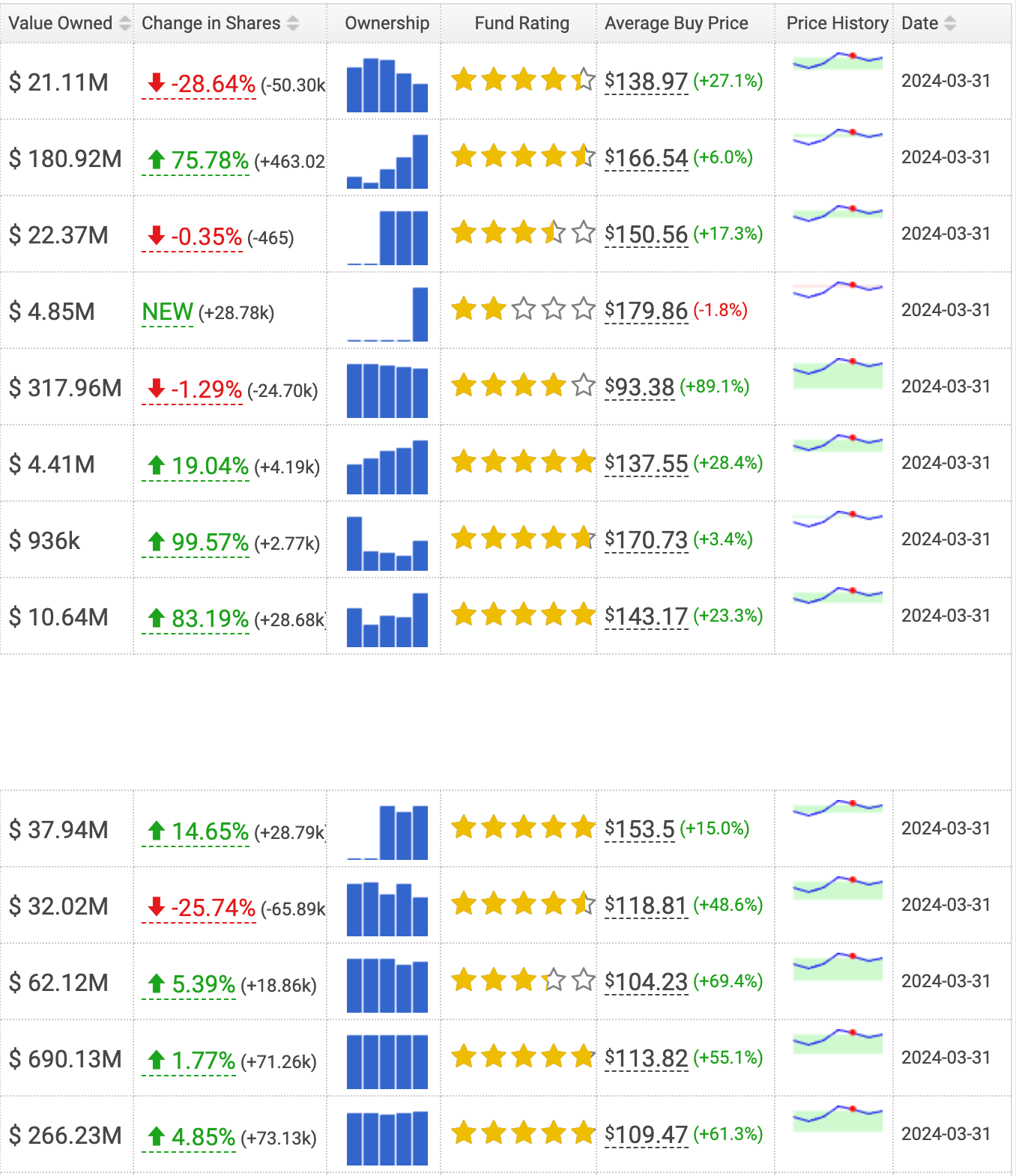

In other news, recently (early 2024) there has also been LOTS of hedge fund buying — which is extremely promising due to the rising amount of funds keeping cash and buying bonds recently. This really needs no explanation, just shows how all the nerds like the stock as well.

I personally have the stock in my portfolio, however, I am not sure if I would recommend the stock to be bought right now. The reality of the situation is that OLED is trading at a PREMIUM relative to the market. While many of the signals look good for OLED, I would strongly argue that they look good for OLED stock owners, not prospective buyers. That being said, if you plan on long-term holding (10 years or more), this could end up being a very valuable move.

Capitalist Letters’ top idea

SoFi Technologies

Company Description

Sofi can be very hard to understand, or very easy. It all depends on your perception. I actually thought a lot about how I can best explain what Sofi does. I asked myself: What would I say if I was pitching this company to one of my friends so he wouldn’t get confused and scared away? This is the solution I found: Sofi is a one stop shop for all financial services you need.

They are a fintech with online brokerage, they are a lender, they also own and operate a bank but they also license their tech stack to third parties like an enterprise SaaS. You now know 50% of what you need to know about this company.

If I asked you how they make money, you could easily reason on the definition and say:

SOFI makes money in three ways:

by lending.

by selling its tech infrastructure.

by traditional banking i.e earning interest on deposits.

Easy right? I think so.

By emphasizing its generous capabilities, Sofi positions itself as a visionary fintech company that sees its customers as “members” and reinforces its ecosystem and network effects by enhanced capabilities for financial education and audience building, allowing them to create a tightly knit community on the platform.

One of the main reasons I like this company is its ability to constantly renew itself in a changing marketplace and economic conditions. Sofi wasn’t envisioned as this integrated business. It was first built as a peer-to-peer lending platform to enable students to skip banks and directly borrow from the wealthy alumni. It was all arranged in person first and even that was a phenomenal success! As the business grew they shifted interactions to online so it was even easier now to access loans. As the demand increased they started to offer personal loans, home loans, insurance and even an investment platform!

This is extremely important to me? Why? It’s simple. Finance has traditionally been more resistant to disruption than other industries. This is why the ability to adapt to market conditions & changing demands is crucially important to me in this industry. Sofi has it!

Key Financial Data

5-Year Average Annual Member Growth Rate: 49%

5-Year Revenue CAGR: 39%

Price-to-Book Ratio: 1.25

Profit Margin: 13.6%

Investment Thesis in 5 Points

Sofi may not have a moat as lender. It may not have a moat as a bank or a broker. However, when you combine all these services in one platform that is extremely easy to use and reinforce an ecosystem through financial education tools and also create a SaaS business that licenses its technology to third parties, this is something rare and highly irreplicable. The question is simple here, you can build the Sofi platform with probably a $50 million invested, but can you compete with Sofi? I don’t think so. This is a wide moat around Sofi as a one stop shop for financial services, especially among the younger generation.

Sofi management is extremely competent. You can see Noto being completely poker face in the earning calls and this may completely drive you crazy as an investor but this is actually a very good thing. I have invested in probably hundreds of different companies and thus followed hundreds of different earnings calls. The best management? It’s the one that under-promises and over-delivers. They act with extreme prudence in their estimates and they also run the business in the same way. Result? I don’t remember when it missed earnings last time.

Another factor is that all of its operations are profitable and growing. Its lending grew 81% last year, tech business 12% and financial services segment 160%. These numbers are no joke. Most of the young businesses just have one profitable operation, proceeds from which are used as investments in the other operations. Sofi is not like this. All of its operations are profitable and it sustains what we call “profitable growth” dreams of investors.

Another good reason: Its high margin tech & financial services now make up 42% of the gross revenue. What does this mean and why is it important? Simple. As the higher margin parts of the business contribute more to the revenue, overall margins go up significantly that will eventually result in multiple expansion for the stock. Consequence: Higher the margins and you are a tech company, lower the margins and you are a bank and you will be valued like one!

Last but not least, its finances are very strong. The company has $5.8 billion in equity vs $3 billion debt. What is better? These figures were $5.2 billion in equity and $5.3 billion debt in the previous quarter and it only issued $79 million new shares which is roughly valued at $600 million.

Why Top Pick?

Personally, I have every reason to love Sofi:

One stop shop for all financial services.

Growing financial services & tech business.

It is hard to replicate what it has pulled off so far.

Extremely good management.

Conservatively managed balanced sheet.

All the qualitative features that I seek in a potential investment are present in Sofi. But what about the quants? What about the valuation?

For 2024, the company expects a full year EPS of $0.08 which means that the company is now trading around 80-90 PE.

However, this is just the beginning.

For the period beyond 2024 and until 2026, the company expects 20-25% compound annual revenue growth. This is expected to drive between $0.55 and $0.80 in GAAP earnings per share in 2026.

Let’s act moderately conservative and say that the company will deliver $0.70 in EPS for the full year 2026. This means that the stock now trades below 10 times 2026 earnings. This is very impressive. What’s even more impressive? The company expects 20% sustained growth beyond 2026. Now that’s huge! This company now trades at just 10 times 2026 earnings at 0.5 2026 PEG ratio. This is an irresistible opportunity to me! And it apparently is a very good opportunity for the CEO Anthony Noto too because lately he has been buying whenever the price drops $7. And now it’s below $7!

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe to The Simple Side and Capitalist Letters.

It was a pleasure working with you all!

Interesting collaboration, teamwork. Great idea!