This is a true one-of-a-kind business and one of our largest holdings.

An LVMH Deep Dive

Don’t make the mistake of thinking this is a clickbait title because it is nothing but the truth. French luxury conglomerate LVMH truly is a one-of-a-kind company and also one of our largest holdings at around 4% of our portfolio.

For those who do not know the company, I am sure you all know luxury brands like Louis Vuitton, Dior, Givenchy, Fendi, Dom Pérignon, and Tiffany. Yet, most people do not know that all these brands, while operated as individual companies, are owned by luxury conglomerate LVMH.

LVMH, or Moët Hennessy Louis Vuitton SE, is a renowned multinational conglomerate with a global presence in the luxury goods sector. Established in 1987 through the merger of Moët et Chandon and Hennessy, LVMH has since evolved into a prestigious entity with a diverse portfolio of high-end brands.

Currently, the company houses 75 prestigious brands, or houses as they are referred to by LVMH. The company reports and operates across five primary segments, including Wines and Spirits, Fashion and Leather Goods, Perfumes and Cosmetics, Watches and Jewelry, and Selective Retailing.

And the company isn’t done building its luxury empire as it has acquired premium brands like Dior and Tiffany as recently as 2017 and 2021. As a result, LVMH now owns eight of the top 20 luxury brands, including brands like Dior, Louis Vuitton, Fendi, Tiffany & Co., Loewe, Celine, Bulgari, and Givenchy.

This has earned it a market cap of just below $420 billion, making it Europe’s second-largest company. For reference, Louis Vuitton is the company’s flagship brand, with a brand value comfortably above $75 billion, more than double the value of #2 Chanel and #3 Hermes at around $47 billion. This makes Louis Vuitton by far the largest luxury goods company globally.

This incredible portfolio of brands earned the company a total 2023 revenue of a massive €86.2 billion, which means it holds a market share of around 20-22% in the personal luxury goods market, which is incredible considering the size of this market. Even more impressively, the company has doubled this market share from 12% in 2018, partly due to the acquisition of Dior and Tiffany and the company’s excellent execution.

Due to its significant size, no company has as much data or insight into the luxury goods market as LVMH. Combine this with the incredible vision of CEO Bernard Arnault, and you get a sublime company.

Regarding size benefits, it is worth noting that LVMH's success is also attributed to its global distribution network, ensuring its products reach discerning customers worldwide. The company has played a pivotal role in shaping the luxury landscape and continues to be a symbol of sophistication, exclusivity, and timeless style in the competitive world of high-end goods and services.

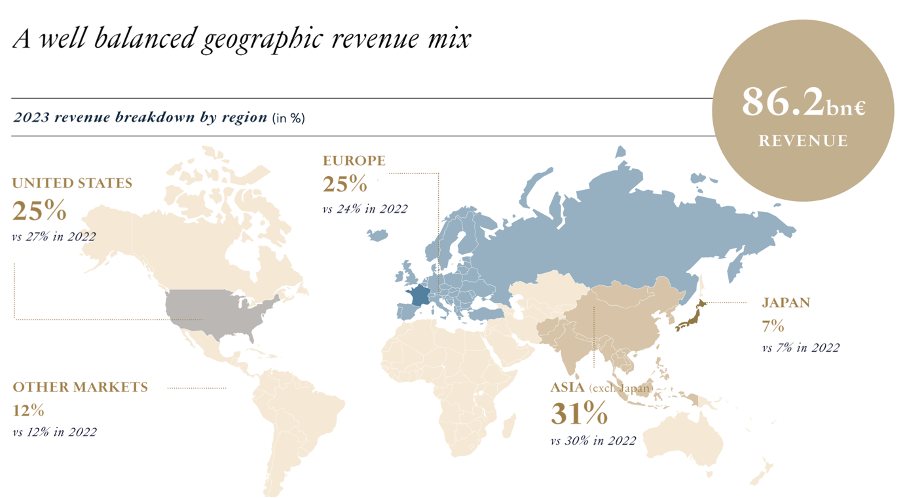

And that’s not all. There is even more to be excited about. This company has an excellently diversified revenue stream as well, making it a quite well de-risked investment. For reference, it derives around 57% of revenue from developed and stable economies, including 50% from the U.S. and Europe. The remaining 43% is derived from Asia, mostly China, and “other markets,” including South America, Canada, and Africa. This means the company is able to rely on stable Western economies for stability and growth while boosting growth through its operations in faster-growing economies like China, which is excellent.

Furthermore, the company is also looking (mostly) well-diversified in terms of product segments or business groups. 49% of revenues are generated by its highly regarded Fashion and Leather Goods segment, which also happens to be the fastest growing one over recent years, registering 14% organic growth in 2023 due to the popularity of brands like Louis Vuitton and Dior. This is followed by selective retailing at 21%, and the remaining segments account for 30%.

In terms of profits, the importance of the Fashion and Leather Goods segment gets even more pronounced as it accounts for a staggering 74% of net profits as of 2023, which might seem somewhat concerning in terms of diversification.

However, while I would certainly like this to be better split across its segments to make the business less sensitive to headwinds for this particular segment, I am not overly worried about this for LVMH. This is due to 1) this particular product category being incredibly resilient through the cycles, with LVMH holding the majority of the market, 2) this segment consists of some of the most valuable and prestigious brands in the world, and 3) this segment is better diversified by region. As a result, this shouldn’t worry investors too much.

Now, before we move on to the industry outlook and the company’s financial profile, let me quickly touch on some final things, starting with once more highlighting the company’s uniqueness.

Notably, LVMH might be one of the only companies worldwide that actively avoids most synergies. Why? Well, the concept of synergies typically involves the idea that combining different businesses can create efficiencies and cost savings, leading to improved overall performance. However, the main priority for LVMH is to preserve each brand's individual identity and autonomy within its portfolio and maintain the aspects that make the brand exclusive and special, which requires this unique strategy of limiting synergies.

Of course, the company’s conglomerate structure allows for sharing resources, expertise, and best practices among its various brands. This can include distribution networks, supply chain management, and marketing strategies – in other words, it has to carefully consider what damages the distinctiveness and exclusivity of the brands, something LVMH has excelled in through the vision of CEO and founder Bernard Arnault.

Another factor making this a unique company is that it does not want to grow too fast. CEO Bernard Arnault indicated that he is most comfortable with a growth rate in the high single digits. Crucially, if the company were to grow faster, this would change the demand and supply dynamic. In order to keep a product highly desirable and special, you need to create a sort of undersupply, so LVMH can’t outgrow demand, even as this sits above actual current demand. This led to the following quote from Bernard Arnault during the Q4 earnings call:

“We need to put the brakes on a bit because I'm often told that growth rates, why are you only delivering 8% to 9%? Well, I find that's pretty good. And I hope that we won't exceed that. I'd rather slow than push.

But at least for the brand, for the desirability of the brand, our main asset really midterm, it's perfectly adequate.”

This means investors shouldn’t expect the company to consistently report double-digit growth but manage the supply and demand dynamic, keeping growth steady at around 8-9%. Truly unique, right?

Of course, some will say that Kering has a similar business profile, also containing several high-end luxury brands like Balenciaga, Gucci, Saint Laurent, Alexander McQueen, and many more. Still, once we dive deeper into the business fundamentals and performance of both companies and compare them in all aspects, it will quickly become apparent that these are very different companies operating a similar model. Now, this is no compare article, but to prove my point, please consider the following data and facts:

Revenue of $79 billion against just over $20 billion as of 2022.

Revenue growth CAGR of 11% for LVMH against just 7.7% for Kering.

75 houses/brands against just 15

213,000 employees against just 47,000

6000 stores globally against 1659 for Kering

Clearly, the two companies are incomparable in terms of size and performance. Building a luxury conglomerate as large as LVMH is no easy feat and quite simply impossible to replicate in terms of success. So, yes, there is nothing like LVMH globally, and this company is just mighty impressive on all fronts.

Now that we have established that LVMH is a true one-of-a-kind (which should already attract your interest) and have discussed what LVMH is and does, already making a pretty strong investment case for the company, let’s dive a bit deeper and look at the company’s underlying growth drivers before we get deeper into the financials, recent financial performance, and of course growth expectations, financial projections, and valuation.

The industry outlook is looking good and even better for LVMH.

The personal luxury goods market has grown steadily at a CAGR of 5.5% over recent years, creating an almost perfect graph from the bottom left to the top right. Of course, this is no stellar growth, but as explained before, the industry isn’t supposed to grow much faster.

In the end, the graph above shows us that the industry is incredibly consistent in its growth and hardly shows any significant drops. This is due to the simple reason that luxury products are most often bought by high-income individuals, who are less prone to an economic slowdown or recession. This creates very impressive consistency and low risks.

However, the industry isn’t untouchable. Following a dip in 2020 due to COVID restrictions, the industry has rebounded impressively over the last 2/3 years and, in the face of a slowdown in consumer spending, is now facing an imminent slowdown in growth, as we have already seen in the second half of 2023. For 2024, consulting firm McKinsey & Co. now projects growth of just 3-5% in luxury fashion, which sits below the average of 5.5% over the last decade.

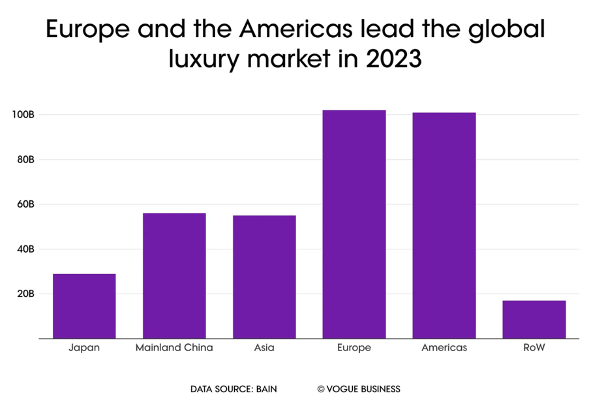

Meanwhile, though, the long-term outlook remains strong, and this is what is much more important to investors. According to projections by Bain, GlobeNewswire, and Vogue, the personal luxury goods industry is expected to reach a value of €570 billion by 2030, translating into an expected growth rate of just below 7%, which is a strong indicator of growth for LVMH.

Several factors drive this growth, including the growth in global wealth and high-net-worth individuals and the rising demand for personal luxury goods among millennials, Gen Z, and Gen X. In addition, GlobeNewswire points to “rapid population growth, emerging markets (Southeast Asia, Korea, India, Middle East), rise in luxury brand awareness through promotions and social media campaigns, expanding travel retail, and growth in online luxury shopping.”

In addition, the growing wealth of the Chinese consumer is also expected to be a significant driver of growth in this industry over the remainder of the decade. The US is currently the largest luxury market, accounting for around 30% of all luxury spending. Yet, while demand will remain solid, the US luxury market is already very mature and will probably not be a growth driver for the luxury industry.

A region that is much more interesting from a growth perspective is China, which currently accounts for slightly above 20% of global luxury spending but will grow to account for 25-27% by 2025 as the growing middle class and increasing wealth in the country are a solid driver of luxury spending. Notably, the majority of this growth will be driven by younger generations, with these already accounting for 40% of luxury spending in the country.

Crucially, LVMH is also a leading force in these regions and owns some of the most popular brands among younger generations. Brands like Dior, Louis Vuitton, and Bulgari are among the most popular ones in China.

Meanwhile, a survey by Ypulse among 13-39-year-olds shows that both Dior and Louis Vuitton are among the top 10 luxury brands for both Gen Z and Millenials globally, clearly illustrating that LVMH is incredibly well positioned globally to benefit from all these growth trends even better than its competitors.

Add to this the fact that LVMH is fundamentally also better positioned than its competitors with much greater financial resources, a very strong distribution network, and much more consumer data due to its sheer size, which all gives it an edge over the competition.

Meanwhile, the company also has no trouble keeping up with its time, with its more modern Dior brand taking up the #1 spot in online luxury goods sales and actively leveraging AI and the digital environment to enhance the brand and customer experience. As a result, I don’t doubt that LVMH will continue to steadily grow market share over the next few years, allowing it to keep outgrowing the market. In the end, LVMH has shown over recent years that it is simply the best at successfully executing in the luxury market, consistently driving market share gains and enhancing the value of its brands.

Just read into the progress it has made with Dior, Tag Heuer, and Tiffany over recent years – it’s staggering. Frédéric Arnault has turned Tag Heuer into a billion-dollar brand and Dior’s revenue has doubled since the acquisition, as has Tiffany’s.

Doing some simple math, assuming LVMH keeps gaining market share due to its superior positioning, incredible brand portfolio, and strong track record, it should be able to take up at least 26% of this market by 2030 without any additional acquisitions. This is a safe estimate but would still result in 2030 revenue of €148.2 billion or growth at a CAGR of 8%.

Clearly, growth should not be a problem for LVMH, and investors can safely count on this company to keep its annual growth above 7-8%.

LVMH delivered excellent FY23 results

In order to get a clear picture of its financials and performance, let’s look at the company’s FY23 financial results, which it reported last week and led to a 12% jump in the share price.

The company reported a massive €86 billion in revenue for FY23, which was up 9% YoY or 13% organically. While this was a slowdown from prior years, it is closer to its growth averages and a much healthier level for LVMH. For reference, over the last 35 years, the company reported annual organic growth of 9.1%, which is precisely what management aims to achieve.

As explained before, if the company were to grow faster, this would change the demand and supply dynamic. In order to keep a product highly desirable and special, you need to create a sort of undersupply, so LVMH can’t outgrow demand.

Positively, while the company did experience a slowdown in growth in H2 compared to H1, LVMH did report a growth acceleration in Q4. Especially in the U.S., LVMH experienced challenges as a result of macroeconomic headwinds. This led to little growth in Q3, but this accelerated in Q4.

Still, the U.S. was the only region in 2023 that did not grow by double digits (up only 4% organically) due to some weakness in the luxury market. Meanwhile, organic growth in Japan was impressive at 28%, followed by Asia at 18%, and Europe with 13% growth.

By segment, growth in selective retailing was the highest in 2023, with growth of 20% YoY or 25% organic. This was driven by Sephora's exceptional performance. However, most impressive was that its largest segment - Fashion & Leather Goods – could deliver 9% growth or 14% organically, which is incredible at a $42 billion run rate. Louis Vuitton once again had an excellent year.

The only segment underperforming was Wines and Spirits, which was down 7% YoY due to weakness in the U.S. cognac market, reflecting a year in which inventories were too high and comparisons too challenging. Still, the company continued to deliver steady and impressive growth across the board, driven by most regions and segments.

On the bottom line the company also performed well. A stable performance in the Fashion and Leather Goods segment led to a stable bottom-line performance, with the gross margin up 40 bps YoY to 68.8%.

The biggest margin and cash flow driver was selective retailing, for which the 20% top-line growth led to significantly improved leverage and a 76% profit surge. This led to an operating profit of €22.8 billion, up 8% YoY, growing slightly slower than revenue due to overall expenses growing at a faster 10% YoY. This led to a minor drop in the operating margin of 10 bps to 26.5%.

However, this was mainly due to investments and inflationary pressures in H1, in which operating expenses rose by 18% compared to just a couple of percentages in H2. Again, this points to some operational, demand, and inflationary improvements as the year progressed.

Ultimately, this led to a net profit of just over €15 billion, up 8% YoY, and EPS of €30.33, also up 8% YoY. Overall, LVMH delivered a very decent performance on the bottom line as well, with steady margins despite inflationary pressures, rising costs in H1, and a growth slowdown in H2.

However, it is worth pointing out that management indicated that it is not actively looking to improve margins meaningfully in the next couple of years but aims to keep these steady and grow investments and costs in line with sales. Still, we should see some margin improvements YoY over the next few years, but nothing too meaningful.

As shown above, LVMH has kept margins steady over the last seven years with only minor improvement YoY, which is not expected to change. Therefore, EPS growth will remain roughly in line with revenue growth.

On a more negative note, due to a 50% growth in operating investments, FCF was down YoY by about 20% to €8.1 billion, but this should improve in upcoming years. Also, LVMH has achieved a very decent ROIC of 14% over recent years on average, which sits roughly in line with the industry and closest peer, Kering.

For those unfamiliar with the term (ROIC), this indicates that the company is well able to turn its investments into profits at a later stage. This also compared well against a WACC of just below 10%, indicating that LVMH creates shareholder value through its investments.

Furthermore, the company ended the year with a healthy balance sheet with total cash of $8.6 billion and long-term debt of $12.5 billion. This leaves the company with plenty of cash to invest in its business and keep paying a growing dividend, even in the face of lower FCF levels. Furthermore, debt should be no problem when considering the company’s cash flows.

This also allows it to keep growing the dividend. Management plans to propose a dividend of €13, which is up 8% YoY, in line with profit growth, and results in a forward yield of 1.7%. This new dividend proposal would result in an annual dividend payout of €6.5 billion, which is 80% of 2023 FCF levels, although these are somewhat depressed. Furthermore, this represents a healthy and conservative EPS payout of 43%.

Management aims to keep growing the dividend annually in line with profit growth, so investors should count on annual dividend growth in the high-single digits, which is quite decent considering a starting yield of 1.7%.

Outlook & Valuation

While LVMH management did not give any concrete guidance for 2024, CEO Bernard Arnault did say he is confident in the current year’s performance and expects growth to be in line with what the company achieved in 2023, indicating both top and bottom-line growth to likely be in the 7-9% range. While H2 was somewhat soft last year, the uptick in Q4 has given management confidence in the upcoming year, and the CEO indicated that the effect of interest rate cuts should positively affect demand.

Right now, we choose to stay slightly more conservative, assuming revenue growth of 7.2% in 2024, resulting in revenue of €92.35 billion. In addition, we expect margins to fall another couple of basis points, leading to EPS growth of 7% to €32.45.

Considering everything, we now project the following financial results through FY27. This includes our expectation for LVMH’s targeted growth rate of 7-9% and some margin fluctuations.

That brings us to the valuation. Based on our current FY24 estimates and a share price of €771, shares trade at around 24x this year’s earnings, which is not cheap. However, considering the uniqueness of LVMH, its incredible global strength, collection of high-end brands, stellar track record, and all other factors pointed out throughout this report, including a very steady and decent growth outlook, we could argue it deserves to trade at quite the premium.

In fact, shares look rather cheap compared to some historical averages. For example, LVMH shares have traded at an average P/E multiple of 26x over the last five years, and the average yield is just below 1.4%. This could indicate shares are actually trading at a discount at a 24x multiple and a yield of 1.7%.

And yes, we believe they do. LVMH shares have fallen over recent months on overly negative sentiment and the fear of a “luxury winter,” and even after the 12% share price jump after very bullish H2 results and 2024 guidance, shares continue to trade at levels from August 2023. As a result, shares remain attractive in our view.

We believe its historical 26x multiple is more than fair, considering this is one of the highest-quality businesses in the world. As a result, we calculate a target price of €921 per share (DCF calculations point to a similar price target), which translates into annual returns of 9.2% or closer to 11% when including the dividend.

Therefore, we believe shares remain attractive today and continue to add to our position as long as the share price continues to sit below €800 per share. Crucially, we are comfortable with growing our LVMH position further due to the quality of the business. From current prices, shares are poised to outperform global indices while offering a very favorable risk/reward profile.

We are “Buy” rated on LVMH.

Thank you for reading this post. Enjoyed it? Please leave a like to let us know!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?

Disclosure: I/we do have a beneficial long position in the shares of LVMH, either through stock ownership, options, or other derivatives. This article expresses my own opinions and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.