This stock is a true value opportunity at a 25% discount - I am buying

FedEx presents itself as a tremendous value opportunity in a market that is, in our view, somewhat overbought. Yet, FedEx shares are trading at an unjustified discount of 25% to fair value.

Article Thesis

FedEx is a global leader in the courier and logistics industry. With operations spanning 220 countries and territories, it boasts an extensive network of transportation and distribution facilities, providing efficient and timely deliveries worldwide.

Despite operating in a cyclical industry, the company achieved a revenue CAGR of 7.5% over the last decade, showcasing consistency and resilience in the face of industry challenges. And now, it is better positioned than ever.

FedEx stands to benefit from increasing volumes driven by the growing e-commerce market. The e-commerce logistics market is expected to grow at a CAGR of 22.3% through 2030, providing significant growth opportunities for FedEx.

While facing increased competition, particularly from Amazon, FedEx Ground has demonstrated resilience. Despite challenges, FedEx Ground gained market share, with an estimated 19.4% in 2023. The company's strategic moves, such as capitalizing on UPS’ labor issues, indicate its ability to navigate challenges and maintain growth in the 4-5% range.

FedEx has struggled with rising costs and margin challenges over the last decade. However, through its transformation initiatives, it aims to achieve substantial cost savings, streamline operations, and reverse declining margins, targeting an adjusted operating margin of over 10% by 2025. I am projecting EPS growth comfortably in the double digits as a result.

FedEx's shares, currently trading at just below 14x this fiscal year's earnings, present an attractive opportunity with a significant discount compared to peers. Despite concerns about operational risks, the company's robust growth outlook, expected cost reductions through initiatives like the DRIVE program, and substantial market share justify a higher multiple. Supported by management's commitment, including insider buying, the undervaluation estimate and a target price of $409 suggest significant upside potential for investors. Shares are trading at a 25% discount to fair value.

Introduction

In my experience, finding undervalued stocks or value opportunities in the market has become increasingly more difficult in recent months. The European and U.S. indices rallied strongly at the end of 2023, with the S&P500 and the Nasdaq now arguably trading at elevated valuations. This is such a moment in which I am close to saying I hardly see great opportunities in the market at all and would rather wait for a downturn and sit on cash.

Most stock valuations have run too high for my taste, even for my higher convictions. Technology, in particular, has gotten quite expensive. I am just not willing to pay exorbitant multiples. As a result, I have shifted my view from technology to value, looking for great companies with a reliable growth outlook, strong market position, and at a good price. Tough criteria, indeed.

However, one such value opportunity and attractive buy popped up on my radar in recent weeks in the form of the Federal Express Corporation, also known by the public as FedEx FDX 0.00%↑, one of the world’s largest freight and logistics companies. Why did it pop up on my radar? Well, the company is trading at a 25% discount to the sector and roughly in line with its 5-year average. However, the company is going through a transformative multi-year reorganization, which, according to the current analyst consensus, should result in significant profitability gains and EPS growth at a mid-teens CAGR through its fiscal FY26 and probably beyond.

Meanwhile, the company remains a leader in the freight and logistics industry, is poised for decent revenue growth, and pays a respectable 2% dividend based on a very conservative 30% payout ratio. Overall, I think a company possessing these qualities, and with this growth outlook is quite cheap at just 14x this year’s EPS, even considering the risk involved in a massive reorganization.

Let’s dive deeper into the details.

FedEx Corporation – A global leader

FedEx Corporation is a global courier and logistics company established in 1971 by Frederick W. Smith. Now, while I am not going to bore you with its entire history, the company has expanded its operations quite a bit since it started in 1971 as a company providing overnight air freight services.

Today the company provides all sorts of freight and package delivery services through a multitude of segments. Furthermore, while FedEx is mostly known for recognizable vans on U.S. streets, the company has operations across 220 countries and territories, giving it incredible global exposure. By revenue, the company is the third largest (as of 2022), trailing German Deutsche Post $DHL and U.S. competitor UPS UPS 0.00%↑.

One of the hallmarks of FedEx is its extensive and well-developed network of transportation and distribution facilities. The company operates a fleet of aircraft and vehicles strategically positioned to ensure efficient and timely deliveries across the globe. This logistical prowess has been instrumental in meeting the demands of an increasingly interconnected and fast-paced world, and its network has given it an edge over the competition. It has made it impossible for newcomers to penetrate this giant, capital-intensive market.

Once more proving its massive size, FedEx reports a staggering $90 billion in annual revenue as of fiscal FY23 and has 520,000 employees globally. It operates over 5,000 facilities worldwide and processes an average of 14.5 million shipments daily. Let the numbers speak for themselves, right?

While FedEx is not a real Wall Street darling (the same can be said about the freight and logistics industry), the company has delivered excellent financial results over the last decade. The company has grown revenue at a decent CAGR of 7.5%, including the fiscal 2023 dip in revenues. On top of this, its consistency in a relatively cyclical industry is also remarkable, reporting only seven quarters of negative growth since 2010. While not a high-growth stock, the company has plenty going for it.

Furthermore, FedEx's commitment to delivering packages swiftly and reliably has made it one of the most prominent, largest, and most recognizable names. Over the years, the company has expanded its services to encompass a comprehensive range of shipping solutions, including international shipping, ground delivery, and express services.

In addition to its core courier and delivery services, FedEx has diversified its offerings to provide end-to-end logistics solutions for businesses. The company's logistics capabilities include supply chain management, customs brokerage, and e-commerce fulfillment services. FedEx plays a vital role in supporting global trade and commerce by adapting to evolving market demands.

Nevertheless, the company’s most significant operations today (by segment) remain Express and Ground, which are responsible for global air transport and ground deliveries. Together, these two segments are responsible for 84% of all revenues as of fiscal year 23. Moreover, while FedEx might be best known for its vans, the ground operations account for just 37% of its fiscal FY23 revenues and isn’t its largest segment.

Its largest segment is Express, accounting for 47% of revenue. This is followed by ground and freight, which accounts for 11% of revenue. Finally, “other & eliminations,” which includes revenue from FedEx Logistics, FedEx Office, and FedEx Dataworks, accounts for the remaining 4%.

The entire US freight and logistics market, in which FedEx has a strong foothold, is projected to keep growing at a 4% CAGR through 2029, offering very decent growth through the cycles. This is, of course, driven by increasing volumes, which is, in large part, the result of a growing e-commerce market. For reference, the e-commerce industry is projected to grow at a CAGR of close to 9% through 2028.

According to Grand View Research, this growth in e-commerce should fuel significant growth in the e-commerce logistics market, which is projected to grow at a CAGR of 22.3% through 2030. This involves providing warehousing, transportation, value-added services, and packaging services. FedEx should be a beneficiary of this growth in the coming years.

With the basics now out of the way, let’s dive deeper into its largest segments individually to determine what growth to expect.

FedEx should be able to keep up growth in ground operations despite increasing competition.

I will start not with its largest segment but with the most controversial and visible one – FedEx Ground. FedEx Ground operates in the U.S. and Canada and is the delivery service as we all know it. With 700 facilities, FedEx covers most regions in the U.S. and Canada and works on delivering all our packages to our doorsteps.

However, whereas the U.S. logistics market was once a duopoly between FedEx and UPS, competition has been increasing over the last few years, primarily due to the entry of Amazon AMZN 0.00%↑. The world’s and North America’s largest e-commerce platform has long been building on its own logistics network to cut out the expensive but also unmissable services offered by the likes of UPS and FedEx. And it has done so successfully.

Crucially, with Amazon responsible for almost 40% of all U.S. e-commerce deliveries and now able to handle most of its own deliveries, it is able to take such a massive share of the delivery market that it becomes increasingly difficult for FedEx and UPS to grow revenues – Amazon is simply taking up too much with its own deliveries due to the sheer size and market share of its retail e-commerce operations. FedEx and Amazon separated ways in 2019. UPS still deliveres packages for Amazon, but this accounts for only 11% of its operations.

On top of this, Amazon has relaunched its shipping service in September, which means that sellers on Amazon can use its delivery service for products they sell on other platforms as well. This means that if an Amazon seller also uses other platforms like Shopify, he can still use Amazon’s delivery service, eating further into the market dominated by FedEx and UPS. Amazon’s efforts in delivery are no longer limited to just its own website but to the broader e-commerce market, further eating into the markets of FedEx and UPS, functioning as a massive headwind for these.

Remarkably enough, but also to no one’s surprise, as of the end of November, Amazon has even overtaken both UPS and FedEx in terms of market share in the US. Amazon is expected to deliver around 5.8 billion packages by the end of 2023. Meanwhile, based on data as of the end of November, UPS is unlikely to have exceeded its 2022 total of 5.3 billion, and FedEx is even further behind.

Just a quick reminder: in 2016, during a conference call, then FedEx CEO Fred Smith called the idea of Amazon disrupting the industry “fantastical,” saying that “in all likelihood, the primary deliverers of e-commerce shipments for the foreseeable future will be UPS, the U.S. Postal Service, and FedEx.”

It's safe to say he was wrong.

Meanwhile, going by 2022 volumes, UPS is the third-largest delivery provider in the US, with a market share of around 24.5%, followed by FedEx at about 20%. However, going by delivery volumes from the first half of 2023 and the significant impact of a labor strike at UPS, FedEx has been winning some market share this year.

UPS was forced to shift “volume to alternate carriers ahead of the Aug. 1 expiration of the contract covering its unionized workforce. UPS union members ratified a new labor contract on Aug. 22, averting a potential strike,” as reported by Reuters.

As a result, FedEx Ground could pick up 400,000 additional packages per day, while the bankruptcy of trucking firm Yellow added an additional 5,000 packages to the Freight unit. As a result of this and FedEx closing several new multi-year agreements with customers walking away from UPS, FedEx has likely closed the gap somewhat in 2023.

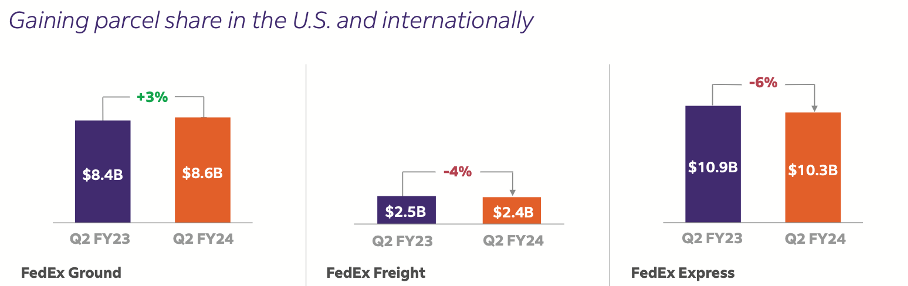

Going with the data we have from UPS’ labor issues in August, I am expecting its volumes to come in at around 5.1 billion, down slightly from 2022. Meanwhile, FedEx has seen volumes grow throughout the year, with ground revenues up 3% over the last two quarters. However, this included a 2% decrease in revenue per package, so I am assuming FedEx grew volumes by around 4% in 2023, also taking into account the slower growth at the start of the year. Based on the estimates from Pitney Bowes Inc. for 2023 package volumes of 22 billion, this would indicate that FedEx has gained 40 bps of market share in 2023.

Furthermore, this would put FedEx Ground’s market share at 19.4%, up 120 bps from 2020, and did so despite Amazon rapidly gaining market share simultaneously. Meanwhile, UPS lost 90 bps of market share to 23.2% this year. Amazon now sits at 26.4%, up 570 bps over the last four years.

Essential to add to this is that market shares in terms of revenue are much different, primarily due to Amazon logistics barely making any revenue due to a lot of free shipping for prime members and USPS deliveries also consisting of many small deliveries like letters. These bring in far less revenue. Therefore, by revenue, USPS only held a market share of 16% in 2022, with Amazon coming in at just 12%. Meanwhile, UPS led with 37%, followed by FedEx with 33%. From this perspective, FedEx might have closed the gap by around 1 percentage point in 2023, trailing UPS by around 2 percentage points.

In terms of industry growth, Research by Pitney Bowes points to US package volume growth at a CAGR of around 5% through 2028. Meanwhile, the last-mile-delivery market is projected to grow at a CAGR of 8-9%. According to Grand View Research, “key drivers propelling the market growth include rising consumer expectations for same-day or next-day deliveries, the imperative for real-time tracking and visibility, the ascent of on-demand services, and the challenges posed by urban congestion and sustainability considerations.”

All things considered, I remain quite upbeat about FedEx’s Ground segment. It performed strongly in the most recent quarter, with revenues up 3% YoY in its fiscal Q2, driven by a higher yield and growing volume, partly due to the market share gains mentioned earlier. The yield, which refers to the average revenue generated per unit of transportation capacity, was up 1% YoY, which is decent considering the challenging operating environment.

Overall, it should be able to keep up growth in the 4-5% range, assuming UPS will be able to hold onto its market share and Amazon continues to gain share. At the same time, we could see UPS lose some share once it loses the remaining 11% it derives from Amazon, but this won’t benefit FedEx.

While the picture painted here looks quite negative overall, FedEx should be able to hold onto its market share essentially, supporting a decent mid-single-digit growth outlook for its second-largest segment. Moreover, the successful execution of its reorganization plans could offer an additional boost of customer wins, offering additional growth upside, but more on this later!

FedEx leads the Express market but faces cyclicality

The FedEx Express segment specializes in providing express transportation and logistics services. Its focus extends beyond domestic boundaries, as FedEx Express specializes in international shipping, ensuring that packages reach their destinations quickly and efficiently across the globe.

In fact, FedEx is the largest express transportation company in the world. The world’s largest cargo airline and express transportation company services more than 220 countries and territories. Whereas the earlier discussed Ground segment focuses on North America and ground transport, FedEx Express is focused on global transportation through its fleet of aircraft.

The express segment relies on an extensive transportation infrastructure network, including a fleet of aircraft and ground vehicles. FedEx currently operates 711 aircraft. For comparison, UPS has only around 300 aircraft in service. Meanwhile, DHL also operates slightly over 300 aircraft, highlighting FedEx Express’s sheer size. Safe to say, the company plays a crucial role in facilitating global trade and commerce by enabling the quick and secure movement of goods across borders.

Mordor Intelligence estimates that the global express delivery market is poised to grow at a CAGR of over 6% through 2029. This is again driven by strong growth in e-commerce volumes and demand for cross-border and international delivery. From its leading position, FedEx should be able to fully benefit from this growth, supporting mid-single-digit growth.

However, we also must acknowledge that the express delivery industry is highly cyclical, which poses some challenges for FedEx to navigate in times of lesser economic growth. In the most recent quarter, revenues fell by 6% as a result of significantly lower volumes and some additional yield pressures.

The express market contracted in recent quarters following decreased global shipment volumes, which is reflected in FedEx transportation volumes. Volumes were down 18% YoY, driven by “lower Postal Service volume as well as the weakness in industrial production,” according to management. FedEx is navigating the challenging environment well and continues gaining market share globally. This solidifies my belief in solid growth going forward.

Freight has potential

Finally, the company’s third largest segment – Freight - is geared towards providing comprehensive freight transportation and logistics services. Unlike the Ground segment, which primarily focuses on rapid small package delivery, the Freight segment handles larger and heavier shipments, catering to the needs of businesses with substantial cargo volume. This segment is characterized by its emphasis on less-than-truckload (LTL) and truckload freight services, accommodating both partial and full truckload shipments in the U.S., Canada, Mexico, Puerto Rico, and the U.S. Virgin Islands.

In essence, the Freight segment of FedEx centers around the reliable and economical transportation of larger shipments, offering businesses a comprehensive suite of freight services to meet diverse logistics needs. This positions it well to benefit from the projected growth of the freight industry, with Grand View Research pointing to a CAGR of 11.3% through 2030. This is driven by several factors, of course, also including growth in e-commerce volumes. This presents a promising outlook for FedEx’s freight segment as well.

In Q2, the most recent quarter, FedEx reported a revenue decline of 4% in the freight segment as lower shipments offset an increase in yield. This shows FedEx was able to offset most of the industry decline. This was primarily due to FedEx being able to offset lower fuel surcharges and weights.

Overall, FedEx maintains a strong position in the freight industry and is even gaining market share amid a challenging operating environment. Therefore, I continue to expect this segment to continue reporting strong growth.

Across its segments, I believe FedEx is very well-positioned, with it gaining market share, holding strong market positions, and overall well-positioned to benefit from growth in the underlying industry. Overall, it is a safe assumption/estimate to expect it to grow revenues at a CAGR of 4-6% in the medium term.

Transformation and reorganization plans drive the bull case

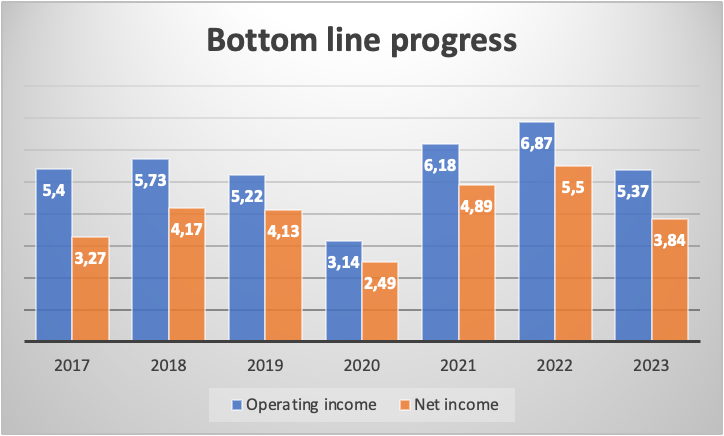

Whereas I mentioned earlier that revenue growth has been relatively stable over the last decade and, at 7.5%, also far from bad, the share price underperformed the S&P500 by quite a significant margin over the previous decade. This is mainly attributable to the disappointing bottom line performance as both operating income and net income dollars are not far from 2017 levels, despite the significant revenue growth FedEx witnessed over the last five years with a 50% increase.

The falling margins reported by FedEx easily explains the dispersion between growth in revenue and profits. For reference, the operating margin in FY23 sat at by far the lowest level (excluding 2020 due to COVID), and the story for the net income margin is no different.

Operating costs have ballooned over the last several years. While revenue grew by a very impressive 50% from 2017 to 2023, operating expenses grew by 53%, showing absolutely no benefits from the higher revenues or any operating leverage.

The growth in operating expenses was primarily driven by a 60% growth in annual transportation purchases and fuel costs skyrocketing by 113%, with all other factors growing in line with or below revenue growth. While two line items may not seem significant, these multiple billions of increases greatly impact a company with a relatively thin bottom line. Fuel as a percentage of revenue is now 6.6% compared to just 4.6% in 2017. Transportation costs increased to 24.2%, up from just 22.6% in 2017.

And these increases are not just attributable to higher costs in 2023 due to inflation. This was already set in motion between 2017 and 2019, with fuel and transportation costs as a percentage of revenue increasing by 130 bps. Simply put, FedEx is operating much less efficiently than it used to, which is visible in its bottom line.

This might be the most essential part of this report as this is where it gets really interesting. Positively, inefficiencies can be resolved, and management has acknowledged this.

In response to a challenging operating environment post-COVID and elevated operational costs, FedEx is targeting billions in cost savings. FedEx aims to implement major changes in its Express, Ground, and Freight segments through its DRIVE program. CEO Raj Subramaniam said, “FedEx is in the midst of transforming into the most flexible, efficient, and intelligent supply chain for its customers.”

It is this transformation that attracted my initial attention to FedEx again.

FedEx targets initial cost savings of over $4 billion by fiscal 2025 and another $2 billion by 2027 as a result of its Network 2.0 program, in which the company will consolidate stations and delivery routes. The adjustments made by FedEx to achieve these savings are quite straightforward, as highlighted in the image above.

Most of the program is focused on achieving efficiencies in the Express segment and restructuring its operation by reducing routes and deploying crews, aircraft, and commercial linehaul more efficiently. Meanwhile, the largest cost-saving initiative is lowering the number of flights by focusing on cheap transportation options instead of fast delivery, in line with the priorities of FedEx customers. I am pretty happy about this approach from FedEx.

It is worth noting that FedEx has been trailing UPS in terms of efficiency for decades despite its rival having a far more expensive union labor force. A big part might be attributable to the slow and struggling integration of its acquisition of European TNT. Still, the business needed to catch up to UPS's efficiencies, largely due to its ineffective structure highlighted below. The graph below highlights that apart from labor force costs, FedEx is less efficient in every way.

Through the Network 2.0 program, FedEx aims to “ultimately bring FedEx Express, FedEx Ground, FedEx Services, and other FedEx operating companies into Federal Express Corporation, becoming a single company operating a unified, fully integrated air-ground network under the respected FedEx brand,” as reported by FedEx.

This means that all these operations will start functioning as one large collaborative to bring packages from A to B, which should lead to significant efficiencies that are not hard to see. Meanwhile, FedEx freight will continue to operate as a stand-alone company under Federal Express Corporation due to its differentiated model.

While this kind of massive transition is not without risks and has a high probability of setbacks, Dean Maciuba, managing partner at Crossroads Parcel Consulting and former FedEx sales executive, said that “if they do it right, they can evolve as a lower-cost service provider than UPS,” and we, at InvestInsights believe there is plenty of potential for cost-savings far over management’s current projections.

Nevertheless, the current cost savings projected by FedEx should already result in an adjusted operating margin by 2025 of over 10%, a 400 basis points improvement from the 6% reported for fiscal FY23 and even 260 basis points above the record year fiscal FY22 operating margin.

Besides offering significant cost-saving benefits, I also believe the second stage of the reorganization – Network 2.0 – could bring with it significant operational results, allowing for faster delivery times and a more attractive network for clients, potentially resulting in new customer wins.

FedEx’s three largest segments – Express, Ground, and Freight – together cover pretty much all a customer could possibly need in terms of freight and logistics services, whether domestic, international, over the ground, or through the air, packages large or small, FedEx can serve customers with all their needs.

Furthermore, all three of these segments complement each other in the sense that at least two segments will handle a package from China to the U.S., for example. However, it requires no rocket science to figure out that operating these segments separately with their own management, as FedEx does, is not the most effective way, as you’ll clearly miss out on many efficiencies. Therefore, it will transform into one unified delivery network by 2027, much like its closer and more effective peer, UPS. This is what I view as a significant driver of the bull case.

In addition to significant cost savings, this should also result in operational improvements, leading to improved delivery times and other benefits that could give it the edge in contract negotiations with customers. Therefore, I also expect it to benefit it ever so slightly in growing its top line in addition to significant bottom line improvements, which should, assuming FedEx meets its current cost-saving targets, result in EPS growth comfortably in the double digits once the underlying freight and logistics market improves.

FedEx is facing soft demand

FedEx reported fiscal Q2 earnings on December 19 and missed both the top and bottom line consensus. This resulted in the shares falling by double digits in the following trading session.

Revenue was down 2.6% YoY to $22.2 billion as market conditions remained soft, primarily in the Express delivery market. According to FedEx, “the industry has now experienced ten consecutive quarters of decline in US domestic average daily volume, putting significant pressure on FedEx and its peers. Additionally, international market pressure continued.

On the bottom line, however, FedEx delivered a solid performance as the first incremental cost improvements from the DRIVE program are translating into improved operating income. Whereas the top line contracted by 2.6% YoY, FedEx was able to report a 17% improvement in adjusted operating income and a margin improvement of 110 basis points to 6.4%. It managed this despite margin headwinds, including “an ongoing volume mix-shift and related yield headwinds,” as reported by management.

Nevertheless, management delivered significant cost reductions with approximately $200 million in its Surface Network and $115 million across its air network and international operations, among many more. Given the substantial progress so far this fiscal year, management believes it remains on track to deliver $1.8 billion in cost reductions, in line with its goals.

In the FedEx Ground segment, the operating income skyrocketed by 57% YoY, driven by an operating margin expansion of 370 basis points to 10.4%. Of course, as opposed to the other segments, cost reductions in Ground were not offset by a declining top line and were further supported by a higher yield.

Meanwhile, operating income from the Freight segment was up 11% YoY despite declining revenue. According to management, “the profit increase was driven by higher yield and increased efficiency, partially offset by lower shipments.” The operating margin expanded by 270 basis points to 20.6%.

Finally, the Express segment, the company’s largest segment, was the only one of the big three not to report an operating income improvement YoY, as the adjusted operating income declined by 49% YoY. The profitability of this segment stood under pressure as a result of the earlier reported revenue decline as FedEx faces softening demand, which DRIVE cost reductions could only partially offset. As a result, the Express segment operating margin fell to just 1.3%, down from 3.1% in the same quarter last year.

Despite the weakness in its largest segment, the bottom line performance is very respectable and clearly shows that FedEx is making significant improvements in its cost profile. This also supports management’s efforts in rapidly buying back its own shares.

FedEx has a strong liquidity position, with $6.7 billion in cash against long-term debt of $19.8 billion on its balance sheet, providing it with plenty of cash and a manageable debt position. This has allowed management to announce another accelerated buyback program of $1 billion, which will lower the share count by another 1.6%.

This comes on top of the $2.5 billion management deployed over the last 18 months to buy back shares and increase shareholder value. FedEx has already lowered its share count by 25% over the last decade but remains committed to rewarding shareholders.

And this is not all, as FedEx also continues to pay a very respectable dividend. Shares currently yield just over 2%, which sits 36% above the sector average but, more importantly, also 22.5% above its own 5-year average.

Yes, shares yield significantly lower than its closest peer, UPS, whose shares currently pay over 4%, but FedEx’s payout ratio is considerably lower at just 30%, compared to 64% for UPS. And yes, UPS also wins in dividend consistency, but what attracts me to FedEx’s dividend is its significant growth potential.

With a payout ratio of just 30%, the current dividend has plenty of upside for significant growth in the medium term, especially when considering the expectation for double-digit growth in cash flows over the next few years. Therefore, FedEx should be able to grow its dividend meaningfully faster than UPS at a pace most likely in the mid-teens.

With a starting yield of 2% and an outlook for mid-teens dividend growth, I am even more impressed by these shares.

Before we get into the valuation, subscribe for more free investing content and support our work! We have a lot more exciting content coming up, so stay tuned.

Outlook & Valuation

Management now guides for a revenue decline of single digits and EPS of $17.00 to $18.50. This is down from an earlier expected flat revenue level as Q2 sat below management expectations. Nevertheless, the strong cost reduction progress has allowed management to stick with its EPS guidance.

It is safe to assume the freight and logistics industry will remain weak, probably throughout calendar 2024, and only show improvement by 2025. This is why I stay quite bearish on FedEx’s top-line growth throughout its fiscal FY24 and the first half of its fiscal FY25. I do expect FedEx to keep growing its bottom line as cost reductions will offset top-line weakness.

Furthermore, in the long term, I am very bullish on FedEx’s prospects and continue to expect medium-term revenue growth at a 4-6% CAGR and EPS growth comfortably in the double digits. This results in the following financial projections.

Based on these expectations, shares are currently trading at just below 14x this fiscal year’s earnings, which is quite a discount to its closest peer, which trades at 18x earnings. This is also a 25% discount to the sector median and only a 6% premium to its 5-year average.

However, the growth outlook is better than ever, as well as its fundamentals, driven by its DRIVE program. Considering the company’s growth outlook, the significant expected cost reductions, and the strong market share it holds across its operations, I believe FedEx deserves a significantly higher multiple and is currently underestimated by the market.

To me, the shares are currently valued as if its cost reduction and reorganization plans are going to be entirely unsuccessful. While I agree that they bring with them significant operational risks that do not warrant a premium in line with UPS, a 14x multiple is bargain territory for this high-quality industry leader.

My confidence here is further solidified by the fact that management has shown that it is incredibly eager to buy back its own shares with accelerated repurchase programs, indicating that it believes shares are undervalued.

On top of this, CFO John Dietrich bought 1,000 shares worth $252,000 at the end of December at an average price of $252 per share. I have yet to come across a situation where insider buying of top executives is a negative indicator.

All things considered, valuing FedEx at a long-term multiple of 16x is more than fair. Using my fiscal FY26 EPS projection and a 16x multiple, we end up with a target price of $409. From a current share price of just $247, this reflects potential annual returns exceeding 22%.

Furthermore, assuming 12% annual returns as decent, I believe that shares’ current fair value sits around $308 per share, indicating that shares are undervalued by 25% right now.

Following this conclusion and bullishness towards the company’s long-term growth potential, I have, in fact, acquired some FedEx shares in my personal investment portfolio, which I intend to hold for many years.

In this market, where it is increasingly hard to find value opportunities, and most are focused on high-growth technology, I am not going to let a great value play such as this pass. I believe that at current valuations and based on the data available today, FedEx is a wonderful company trading at an even more wonderful price.

Therefore, FedEx is currently on my high-conviction list as I view it as a strong buy opportunity.

Thank you for reading my research on FedEx. Please remember that this is no financial or investment advice and is for educational and informative purposes only. I am simply sharing my views and actions, which I hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: I do have a beneficial long position in the shares of FDX either through stock ownership, options, or other derivatives. This article expresses my own opinions and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Life After Stratton Oakmont - Still Making Money https://open.substack.com/pub/michael880/p/life-after-stratton-making-money?r=3b6pw1&utm_campaign=post&utm_medium=web