TSMC ($TSM) Is Too Cheap to Ignore – I see room for 16% annualized returns

Strong earnings, unbeatable tech, and still undervalued — here’s my updated thesis on TSMC.

On Thursday, one of my absolute favorite investments for the decade ahead, semiconductor manufacturing giant TSMC, released its second-quarter results, and it impressed with a beat-and-raise. The company delivered absolutely stunning results that exceeded the consensus profit estimate and achieved incredible revenue growth, enabling it to meaningfully raise its FY25 outlook to well above my previous estimates.

As a result, shares registered a notable gain of 4% in the following trading session, which propelled $TSM shares to a new all-time high, allowing it to briefly join the $1 trillion market cap club.

For reference, TSM shares are now up 25% YTD, 33% over the last twelve months, and 39% since my last “Buy” call in early March. I have been advocating for TSM for years now, and its shares are finally starting to receive some much-deserved investor love.

You see, about every quarter, I once again argue that the company is one of the highest-quality and best-positioned businesses globally. The company absolutely dominates the semiconductor manufacturing market, accounting for over 50% of all semiconductors produced.

That dominance alone already makes TSMC a compelling investment. In a world increasingly defined by semiconductors—whether in AI, smartphones, data centers, or electric vehicles—TSMC is the irreplaceable backbone. Its foundries aren't just big; they're the most advanced on the planet.

At the leading edge (3nm and 5nm nodes), TSMC’s market share climbs even higher, to over 90%(!), solidifying its role as the sole enabler for companies like Apple, Nvidia, and AMD. In this category, no peer, including Samsung and Intel, can match TSM’s chip quality and capabilities, practically making it the industry standard. The company is leaving competitors in the dust with far better processes and technological dominance, resulting in products that no peer can match.

In fact, most of these peers are at least 2-4 years behind TSM in terms of node quality and performance. With TSM operating as perfectly as it does, catching up is practically impossible, especially considering the capital expenditure intensity and reliance on research and development in the industry. I mean, TSM spends roughly $30 billion to $40 billion in CapEx annually… good luck even matching that, let alone catching up.

In effect, TSMC has become the default manufacturing platform for the entire high-performance computing ecosystem, without having to compete with its own customers, as it’s a fab-only company. That’s a rare and powerful position.

Meanwhile, with a powerful moat, an advanced node monopoly, and booming demand for these nodes, TSM is excellently positioned for rapid growth in the years or even decades ahead, as proven by management’s confidence and guidance, now pointing to a five-year revenue growth CAGR of close to 20%, driven by a mid-40s CAGR in AI-related revenue and a long-term gross margin of at least 53%, no matter the circumstances.

That is nothing short of excellent. All things considered, I have no doubt that TSMC is one of the best investments for the decade (or two) ahead.

Yet, even with shares at an all-time high, (spoiler) these remain incredibly cheap, as TSMC’s medium-term outlook is improving even faster than its share price.

Today, I will take you through all the Q2 numbers and update my TSMC thesis. Let’s delve right in!

TSMC’s Q2 earnings report didn’t disappoint

TSMC really nailed it with its second-quarter earnings report, released on July 17, showing rapid top-line growth and expanding margins, all driven by the proliferation of AI and the subsequent incredible demand for TSMC’s advanced nodes.

You see, since TSMC is essentially the sole high-volume manufacturer of 5nm and 3nm nodes, capturing a market share of over 90% in everything below 7nm, it effectively captures all of this AI-related demand, being constrained only by limited production capacity. And as TSMC is heavily expanding its 3nm capacity globally, revenue is growing rapidly quarter after quarter.

This enables TSMC to significantly outpace the broader foundry (semiconductor manufacturing) industry. For context, while the overall foundry market grew just 13% YoY in Q1—held back by sluggish demand in consumer electronics and legacy nodes—TSMC grew 35% YoY in Q1, thanks to its dominant position in advanced technologies.

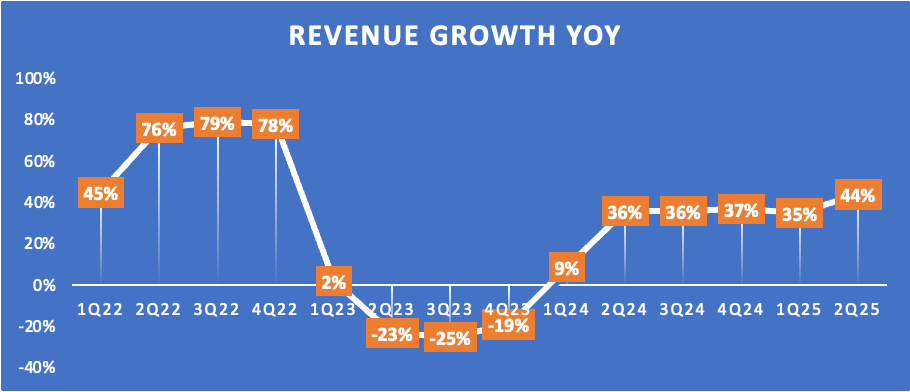

In Q2, revenue in USD grew another 18% sequentially and 44% YoY to $30.1 billion, handily beating management’s own guidance.

As shown below, this marks the fifth consecutive quarter of 30%+ YoY growth, and momentum is only building. Demand remains exceptionally strong, particularly from AI-related workloads, and it's arguably running well ahead of earlier expectations. TSMC continues to surprise to the upside, signaling that the industry, investors, and TSMC itself are still underestimating the scale and durability of this demand cycle, as AI momentum continues to build.

TSMC is fully benefiting—and is positioned to continue doing so.

Breaking down revenue by technology, 3nm is becoming an increasingly large part of the pie, driven by rising capacity and surging AI-related demand. As of Q2, 3nm accounted for 24% of total revenue, up from just 15% in the same quarter last year. Meanwhile, advanced nodes (sub-7nm) now contribute 74% of total revenue, up from 67% a year ago.

This shift underscores TSMC’s growing reliance on its most advanced technologies—a structurally positive development. Not only do these nodes carry higher margins, but they are also tied to secular growth drivers such as AI and high-performance computing, reducing TSMC’s exposure to more cyclical and commoditized end markets, which should help offset some of the industry's cyclicality.

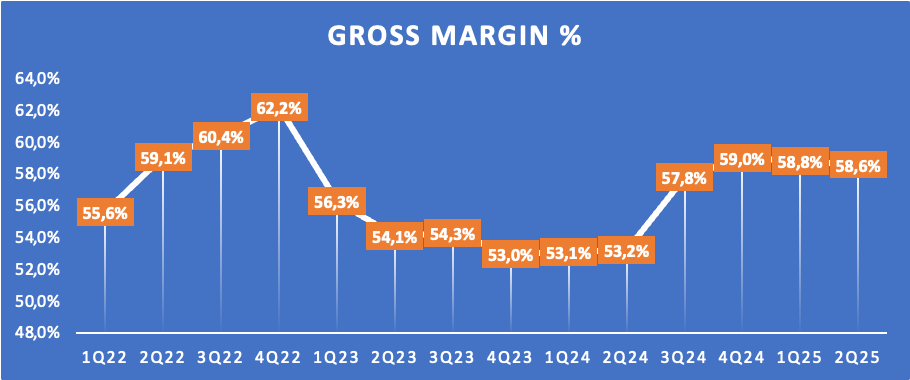

Moving to the bottom-line results, the top-line outperformance led to healthy margin expansion. TSMC’s gross margin was 58.6%, up 540 bps YoY but down 20 bps from Q1, which was mainly the result of foreign exchange headwinds and some margin dilution from overseas expansion, offset somewhat by higher capacity utilization and cost improvement efforts.

For reference, foreign exchange was a 220 bps headwind, while the ramp-up of overseas fabs, primarily in Arizona, created a 100 bps headwind to the gross margin.

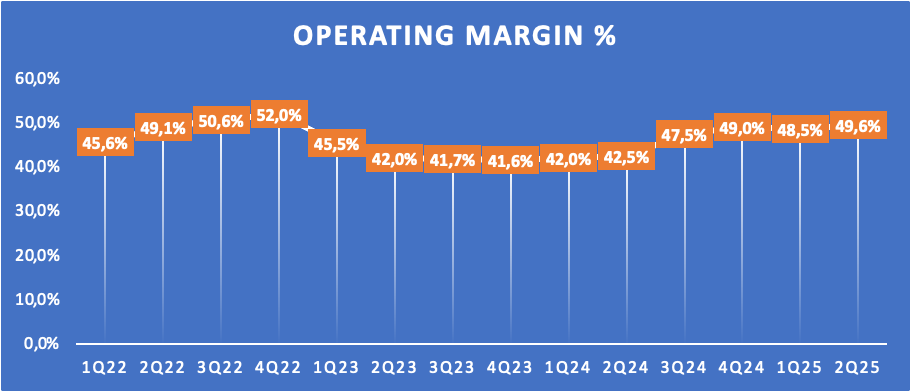

Moving further down the line, better operating leverage driven by rapid top-line growth and slower operating cost growth of 20% allowed for healthy operating margins expansion of 110 bps sequentially and 710 bps YoY to 49.6%, which are extremely strong margins.

Ultimately, this operating margin expansion also allowed for growth in net income and EPS, up 61% YoY. Also, TSMC maintained a strong TTM ROE of 34.8%, which continues to trend up.

Moving to cash flows, TSMC reported a cash flow from operations of just below $17 billion, and correcting this for a CapEx of $9.6 billion, the company generated a very solid $7.5 billion in FCF in Q2.

This allowed it to further strengthen its already extremely strong balance sheet. As of the end of Q2, TSMC held a total cash position of $90 billion and total debt of $32.5 billion, leaving it in excellent financial health.

Honestly, the cash-generating abilities of this business are truly exceptional, placing it in the same league as Apple, Google, and Broadcom. In the last full fiscal year, TSMC generated a whopping $26 billion in FCF at a 30% FCF margin. Don’t forget that it is net of incredible capital expenditures (CapEx) of $30+ billion annually as well.

That really is exceptional – this company is able to realize tens of billions in annual FCF even as it invests $30+ billion in CapEx to maintain its technological edge and fuel long-term growth. Meanwhile, it has a war chest with $90 billion in cash.

There is just no company like it, and we can safely say this business is currently firing on all cylinders.

TSMC is betting heavily on overseas capacity

One of the most important arguments of TSMC bears continues to be its considerable exposure and presence in Taiwan, which is consistently facing geopolitical pressure from China.

The geopolitical tension between China and Taiwan stems from China’s long-standing claim that Taiwan is a breakaway province that should eventually be reunified with the mainland, by force if necessary. Taiwan, however, functions as a fully self-governed democracy with its own political system, military, and economy. Over the past few years, these tensions have escalated, particularly as the United States has increased its diplomatic and military support for Taiwan, and as China has ramped up military exercises around the island in response.

This uncertainty weighs heavily on TSMC’s shares because the company is based in Taiwan, with the vast majority of its most advanced manufacturing capacity located there. In the event of a military conflict, not only would TSMC’s operations be directly threatened, but global semiconductor supply chains would be severely disrupted. For investors, this introduces a geopolitical risk premium: no matter how strong the business fundamentals are, the possibility of geopolitical disruption forces markets to discount the stock accordingly.

However, I have been arguing quarter after quarter that the geopolitical discount on TSMC shares appears overdone when you consider the actual risk dynamics. While tensions between China and Taiwan are real, the likelihood of a military conflict in the near to medium term remains low. An invasion would severely damage China’s own economy and tech sector, as well as its relations with the Western world. It’s a lose-lose scenario that gives all sides strong incentives to maintain the status quo.

The market seems to be pricing in a worst-case scenario without fully appreciating how unlikely and mutually destructive that scenario would be.

Additionally, TSMC is rapidly expanding its overseas presence and capacity, thereby reducing its dependence on Taiwan for advanced nodes and subsequently decreasing the geopolitical risk that should be factored in.

For starters, the company is heavily investing in the U.S., recently confirming its intention to invest a total of $165 billion in advanced semiconductor manufacturing in the country. This includes plans for six advanced wafer manufacturing facilities in Arizona, two advanced packaging facilities, and a major research and development center. Through these investments, TSMC is catering to the needs of its Western customers, who prefer locally produced chips to mitigate the geopolitical risks associated with their own supply chains, as well as the wishes of investors.

Meanwhile, TSMC’s investments in Arizona are already showing results, with its first Arizona fab having successfully entered into high-volume production in Q4 of last year, fabricating N3 nodes with a yield comparable to Taiwan facilities, which is great to hear.

Meanwhile, the construction of its second fab, which will produce 3nm technology, is already complete and fully sold out, with Apple accounting for a significant portion of its capacity. Additionally, construction of the third fab, designed for 2nm and A16 processes, has begun and is on schedule. Finally, the third fab to be built in Arizona will utilize N2 and A16 process technologies, while the 5th and 6th fabs will use even more advanced technologies, but these will only be completed toward the end of the decade.

Ultimately, when it also adds two new advanced packaging facilities and establishes an R&D center besides these six new fabs, TSMC will have a full supply chain GigaFab cluster in Arizona, focused on the production of its most advanced technologies. Upon completion, this GigaFab will account for approximately 30% of TSMC’s advanced node capacity. In other words, 30% of its most important capacity will be outside of Taiwan, significantly reducing geopolitical risk.

This is much better than previously expected.

And this isn’t all, as TSMC is also investing in Japan and Europe. In Japan, the company is also receiving significant government support. It already has its first specialty technology fab in Kumamoto operating at full capacity, and the construction of a second fab is scheduled to start later this year. Meanwhile, in Europe, the company has received a strong commitment from the European Commission and the German federal, state, and city governments, and is progressing smoothly with the build-out of a specialty technology fab in Dresden, Germany.

At the same time, the company isn’t moving away from Taiwan, which remains its focus. Here, the company plans to build an additional 11 fabrication sites and four advanced packaging facilities over the next several years to meet the growing demand for advanced wafers.

However, the most important takeaway from these strategic updates provided by TSMC management is that the company is expanding significantly overseas, significantly lowering geopolitical risk, which I already deemed overestimated.

TSMC continues to out-innovate peers

As clearly laid out in the introduction to this write-up, TSMC is technologically years ahead of its peers, and it continues to widen this gap, driven by significantly higher R&D and CapEx budgets, and technological and process dominance.

In its latest strategic update, the company reaffirmed its technological roadmap, which remains highly promising.

While 3nm is still ramping up to satisfy AI demand, the company is already making great progress on its N2 and A16 technologies, which will further address the industry’s insatiable demand for energy-efficient computing. The technology is on track to reach volume production in the second half of 2025.

Crucially, management already indicates that 2nm is shaping up to be its most successful technology ramp yet, with a far better tape-out than 3nm and 5nm, fueled by both smartphone and HPC applications. For reference, N2 will deliver a power benefit of 10-15% at the same power or a 20% to 30% power improvement at the same speed, and a more than 15% chip density increase over the latest and most advanced 3nm node.

This is a very strong jump. No surprise that demand is high – this is precisely what the likes of Nvidia and AMD are looking for, for their most advanced data center chip designs.

Additionally, the company has its A16 technology in the pipeline, which is expected to provide an additional 8% to 10% speed improvement at the same power, or 15% to 20% power improvement at the same speed, along with an additional 7% to 10% chip density gain over N2. This makes it even better suited for specific HPC products with complex signal routes and a dense power delivery network.

This technology is expected to reach volume production in the second half of 2026, indicating rapid technological development by TSMC.

And that’s not all. During the earnings call, management also provided commentary on A14, which represents another technological advancement over A16. Compared to N2, A14 will provide a 10% to 15% speed improvement at the same power or a 20% to 30% power improvement at the same speed, and approximately a 20% chip density gain. This technology is on track for volume production in 2028.

This might seem like a lot of technical talk that doesn’t matter too much to investors, maybe, but what I am trying to illustrate is that TSMC is not slowing down and is further growing its technological dominance with a best-in-class technology roadmap.

TSMC remains at least 2-4 years ahead of any of its peers, and this gap is only widening. This means there is no risk of disruption – its moat remains massive, and TSMC will be the backbone of the semiconductor industry for at least the next decade and likely many more, considering the simple fact that its financial resources are multiple times larger than any peer.

While scale is not the only factor—execution, process reliability, and customer neutrality matter too—it is the foundation that enables everything else. Without scale, it’s nearly impossible to compete at the highest level in this industry.

Before we move on, just a quick word…

Want more out of your subscription? Even more content like this on a weekly basis?

InvestInsights PRO - $7.50/month ($70/annually)

An additional 2-5 paid exclusive stock analysis monthly.

Full insight into my own portfolio (14% return CAGR since 2022).

Monthly portfolio updates + Instant transaction alerts (Fully transparent)

A complete overview of all my target prices and ratings (online available).

Exclusive access to the PRO subscribers Discord channel

Instant access to earlier premium analysis on, for example, Adobe, Thermo Fisher, Spotify, and The Trade Desk.

Outlook & Valuation

Probably most important to investors, let’s jump into guidance and the medium-term financial estimates.

Starting with guidance, management guides for Q3 revenue of between $31.8 billion and $33 billion, pointing to 8% sequential growth and growth of 38% YoY at the midpoint, suggesting the company is seeing no slowdown whatsoever.

Furthermore, management expects the gross margin to be between 55.5% and 57.5% and the operating margin to be between 45.5% and 47.5%. This suggests some additional margin compression compared to prior quarters, driven primarily by the continued unfavorable foreign exchange rate and more pronounced dilution from overseas fabs in Japan and Arizona.

This gross margin compressions will last for the next 5 years, according to management, as the ramp-up of overseas fabs dilutes it by 2-3% over the next 2-3 years and this will widen to 3-4% in the years that follow, as particularly its operations in Arizona scale, which carry lower margins, particularly in the early stages.

Positively, management still guides for a long-term minimal gross margin of 53% through headwinds and cycles, so there is not much for investors to be concerned about.

Moving to the FY25 guidance, management indicates it is seeing no change in customer behaviour so far, leading to optimism for H2. Growth will continue to be driven primarily by incredible AI-related demand; however, management also expects a mild recovery in the overall non-AI end market in 2025, despite concerns about tariffs.

Thanks to this strong demand, management has raised its FY25 revenue guidance, now pointing to 30% YoY growth in USD, compared to a prior 25%.

Furthermore, megatrends remain in place. Most importantly, the usage and adoption of AI models continue to grow, meaning that more and more computation is required, leading to an increased demand for leading-edge silicon. This, in turn, bodes very well for TSMC's outlook through the end of the decade, as it remains the undisputed leader in leading-edge silicon.

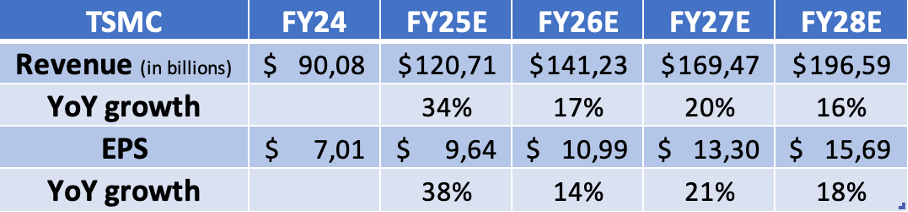

As for my projections, I have raised both my revenue and EPS projections for 2025 considerably following the Q2 outperformance and management’s confidence for H2, signaling no slowdown in demand. For FY26, I am slightly more cautious, as tariffs and global macroeconomic uncertainty may put pressure on demand, but I expect TSMC’s exposure to the AI expansion to enable it to continue delivering strong numbers. For FY27 and FY28, I expect growth to accelerate again.

As for profits, we are likely to see some pressure on margins in 2026 and 2027 due to gross margin dilution from lower-margin operations in the overseas fabs. However, I expect cost control to allow the operating and net income margins to hold up better, still enabling mid-to-high teens EPS growth.

Ultimately, these expectations are reflected in the financial projections below.

Following the strong share price performance since my last coverage of TSMC in early March, shares are no longer as cheap as they were, although I would argue that they continue to trade at a very compelling discount, even at a 40% higher share price.

You see, medium-term expectations have risen just as quickly as the share price, so on a multiple basis, shares haven’t even become significantly more expensive, with less than a 10% multiple expansion since early March.

At a current share price of $240, $TSM shares trade at roughly 25x this year’s earnings, which is anything but expensive. For reference, this is still a 22% discount to the sector median and only 10% above its own 5-year average. Meanwhile, considering TSMC’s overseas expansion and geographical diversification, as well as its medium-term outlook, which continues to strengthen, I strongly believe the shares deserve less of a discount than ever before.

Considering the sheer quality of this business, its mega outlook, and the improving risk profile, I have a hard time justifying a 25x earnings multiple, even when factoring in lasting geopolitical risk.

Furthermore, if we adjust for forward growth, we end up with a 3-year PEG of 1.4, which is 24% lower than the sector median. This suggests to me that investors continue to award a 30%+ discount to TSMC at its current share price, which is unreasonable, especially considering the company's exceptional quality.

To put it simply, TSMC continues to trade at incredibly compelling levels. While shares have become less of an absolute bargain, I still believe the value on offer is excellent below $250 per share.

For reference, using a 26x exit multiple and my current FY27 EPS estimate, I calculate an end-of-2027 target price of $346 per share. From a current share price of $240, we are looking at annualized returns of 16% without even factoring in the dividend.

These are excellent potential returns. Especially with TSMC’s history of conservative guidance and outperforming estimates, I believe the risk-reward remains excellent.

Therefore, TSMC remains a good buy today. Anywhere below $250 per share, I will continue to accumulate. If we drop below $230 again, I will add more aggressively.

Looking for more earnings review like this one during this Q2 earnings season?

Make sure to upgrade to paid, and receive 2-3 more [PAID] earnings reviews per week during the season peak + all the other paid/premium benefits!

Upgrade now!

Do you think China could be an issue? Any action by China on Taiwan could lead to the stock falling a lot. How does China influence the risk-reward on TSM?

How do you view the cycle in 2028/2030? For sure AI is still going to grow, but wondering this myself