Uber shares remain a bargain, and I am buying.

After a solid Q4 and a quarter full of AV fears, Uber shares remain a bargain. Let me explain why!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Let’s start this post with a clear statement: Uber is a slam dunk buy, especially after last week’s unjustified sell-off after the Q4 earnings. However, I remain bullish on Uber shares even after a solid recovery on Thursday and Friday.

I have been pounding the table on Uber for quite some time now. Thanks to its dominance and massive moat in the ride-hailing and food delivery markets, both in the U.S. and internationally, I view the company as one of the best positioned for the decade ahead. For reference, according to Bloomberg, the company now has a 25%+ market share in the highly fragmented global ride-hailing and taxi industry and a 76% market share in the U.S. ride-hailing market.

That is absolutely massive. Due to the low industry margins, high brand trust, and Uber’s massive and unparalleled network of drivers and users (171 million of the latter), all of which create high barriers to entry, the company is impossible to disrupt by peers and continues to gain market share across all regions, every quarter. This is absolutely mind-blowing and a testimony to the company’s quality.

This dominance in compelling markets and moat allows Uber to keep growing its gross bookings and revenue at a minimum of the high teens, quarter after quarter, driven by trip and user growth – a powerful double growth engine.

Meanwhile, the company is rapidly expanding margins as costs trend down. By now, it can deliver GAAP profitability each quarter and significant amounts of FCF.

To me, Uber really is the complete package for investors and one of my highest-conviction plays for the next decade. An FCF machine with a healthy balance sheet, a massive moat, expanding margins, and consistent high-teens top-line growth—what more can you wish for?

Yet, in recent months, the market has failed to recognize the company’s quality and growth ahead amid fears over the rise of autonomous vehicles and driverless taxis potentially disrupting the company’s business model.

However, while I understand the source of these fears, they are completely unwarranted. Uber is more likely to massively benefit from the rise of AVs thanks to its unequaled mobility platform. With 171 million users and a tested and well-developed architecture, Uber is the perfect platform for AV players like Waymo or Tesla to go to market and reach a large audience at minimal cost or effort.

But let me get deeper into the AV details in a bit.

However, for now, I will say these fears are massively overblown, and it’s a matter of time before Wall Street recognizes this and values the company accordingly.

On top of these fears that pressured shares for months now, Uber released its Q4 earnings report earlier this week, and despite delivering a pristine quarter with accelerating growth across the board and expanding margins, it wasn’t as well received by investors, with shares selling off almost 9% in Wednesday’s trading session.

Alright, yes, the guidance was a bit light, but management gave a very clear explanation, so this reaction was, once again, completely unnecessary. Uber is guiding mostly for stable underlying growth and delivered excellent Q4 financials.

In other words, while Uber is delivering on all fronts, investors continue to punish its shares, creating great opportunities for us to benefit from long-term.

The combination of these AV fears and this week’s overreaction has pushed Uber into true value territory. Yes, shares are up 24% so far this year but still up only 5.5% over the last twelve months, even as Uber has executed perfectly, growing its revenue at an 18% clip in 2024, expanding its EBITDA margin by 400 bps, and growing its FCF by 105% to almost $7 billion.

As a result, shares now trade at a P/E well below 30x the FY25 consensus and a staggering PEG well below 1.

This is nothing short of an excellent opportunity, and I am buying... aggressively.

In the remainder of this post, let me review all the important Q4 numbers, put them into perspective, explain why AV is an opportunity instead of a risk, and discuss the company’s outlook and forward growth expectations.

Let’s delve in and see for yourself!

Uber reports healthy and steady growth in Q4

Uber reported its fourth-quarter results on Wednesday pre-market, and like I said, these weren’t very well received by investors, with shares selling off by 9% in the following trading session.

Meanwhile, Uber delivered its best quarter to date, reaching all-time highs for trips, gross bookings, users, and EBITDA. Growth also accelerated across the board compared to the previous quarter.

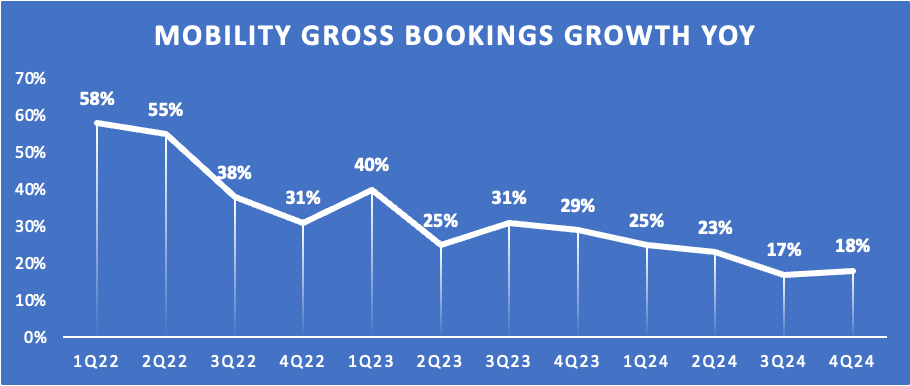

Uber reported gross bookings growth of 18% year over year or 21% in constant currency, which was ahead of the high end of management’s guided range. This resulted in total gross bookings of $44.2 billion. In constant currency, this shows that growth remains remarkably stable. Uber delivered 21% YoY growth in four of the five last quarters, speaking to its consistency and excellent execution.

In dollar terms, however, growth has not been as stable as Uber, due to its global operations, has been dealing with quite some FX headwinds due to a strengthening dollar. Last quarter, this was a 300-bps headwind, which was 100 bps worse than anticipated and translated into a $1.1 billion headwind, and it isn’t quite easing either.

Yet, it is important to note that this has nothing to do with the health or performance of the business itself. This is simply the result of a strengthening dollar against foreign currencies such as the Argentine peso, Brazilian real, and Mexican peso.

Anyway, even after incorporating those significant FX headwinds, Uber still delivered a very solid gross bookings performance, with growth of 18% year over year, accelerating from 16% last quarter and remaining steadily in the high teens. Even more impressive, Uber delivered an FY24 gross bookings growth of 21% in constant currency, which is an acceleration from the already impressive growth we saw in 2023.

This demonstrates that, despite its size, Uber continues to drive significant booking growth—truly remarkable.

Two growth engines are driving this growth: a growing number of users and a growing frequency of usage. Indeed, Uber is growing both its number of users and the number of times they use the Uber mobility or delivery platforms.

Last quarter, the number of monthly active users, or MAPCs (as Uber refers to them), grew by an impressive 14% to 171 million. This is steady from recent quarters and remains incredibly impressive. To be able to keep growing users this quickly at this size is undoubtedly an impressive feat, driven by the company’s continued expansion into underpenetrated markets and growth in its offering, including the addition of grocery in its delivery network or the addition of Uber Black and Uber for Teens in Mobility.

This way, Uber is simply expanding its offering to meet any type of demand and create a service that attracts a larger audience. Meanwhile, Uber estimates it is seeing less than 20% penetration among adults, even in its most saturated countries. In massive growth markets like Europe or India, this percentage is below 5%, leaving it with a long runway for growth and plenty of room to keep rapidly growing MAPCs.

While dominating the industry, Uber certainly is still far away from its mature stage and remains a pure-play growth business/stock with plenty of levers to pull, which is precisely why I view it as one of the more interesting investments for the decade ahead.

In addition to this solid MAPC growth, Uber continues to see growth in the frequency of its app usage, leading to even faster growth in trips or the total number of delivery and mobility bookings. Contributing to this is growth in multi-product usage. As of Q4, a total of 37% of Uber users use multiple products, “driving retention and increased spend, as consumers who use multiple products on average spend three times as much as those who don’t,” as explained by management during the earnings call.

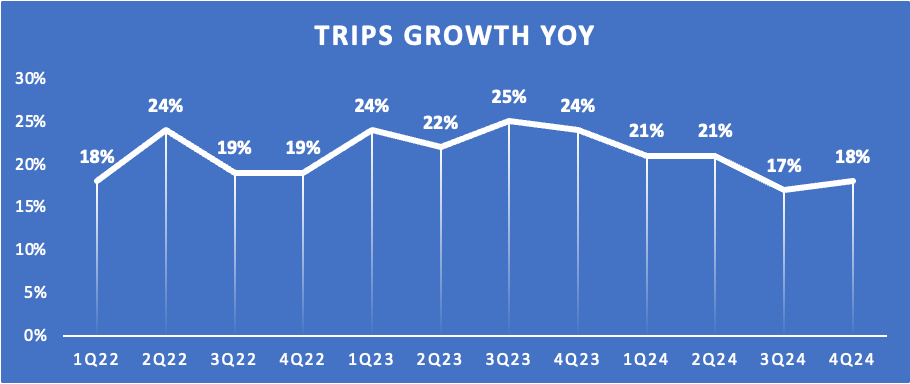

Last quarter, trip growth hit 18%, up from 17% in Q3, due to a similar acceleration in MAPC growth. Growth here also remained steady in the high teens to low twenties. This is some healthy and consistent organic growth we’re seeing here.

Ultimately, this healthy underlying growth and subsequent strong and mostly stable gross bookings growth led to a 21% increase in revenue year over year to $12 billion. In dollars, this translates into 18% growth, also in line with gross bookings growth and suffering from a 300 bps FX headwind.

Like gross bookings, revenue growth in constant currency remained similar to recent quarters. In dollars, it is a bit more volatile but still very healthy and impressive.

Growth is driven by both the mobility and delivery segments

Taking a closer look at the two main operating segments, Uber delivered another great quarter in mobility. Gross bookings growth exceeded the high end of management's expectations, growing 24% year over year, driven by healthy trip growth. However, the segment suffered heavily from an FX headwind of 600 bps, resulting in dollar gross bookings growth of 18%, which is still pretty good but does not reflect just how strong actual growth really is.

Meanwhile, healthy supply and demand helped Uber further improve its take rate to 30.3%, up 160 bps year over year. This was driven by 26% growth in active drivers, who outgrew demand. This led to even lower costs for Uber, as this led to lesser bonuses and payouts.

A big driver of mobility growth continues to be a larger and more differentiated offering. For example, the company recently introduced Uber for Teens, which saw 50% sequential growth last quarter. Meanwhile, Uber for Business grew 50% year over year, and UberX Share, a more budget option, reached $2 billion in annualized Gross Bookings in less than three years.

It’s these kinds of new mobility formats that drive significant growth, playing into the needs of consumers.

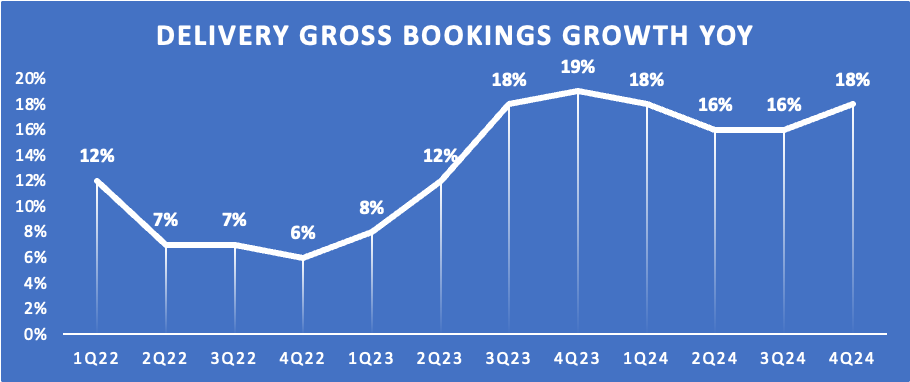

Moving to delivery, the story is much of the same. Here, gross bookings grew 18% YoY in both dollars and constant currency due to a lower FX headwind, accelerating from prior quarters and remaining remarkably strong, far ahead of any competition.

As a result, Uber continued to gain market share in each of its top 10 countries, a trend it has been following for many quarters.

Delivery also exceeded management’s expectations, which was helped by its expansion into grocery and retail and a strong holiday season. Meanwhile, after a small reset coming out of the Covid boom, Uber has now seen delivery MAPC growth accelerate for seven straight quarters, which is a very positive sign for long-term growth.

Finally, it is also worth pointing out that Uber continues to see impressive growth in its Uber One subscription. Its member base is now 30 million, up a whopping 60% year over year and growing by 5 million last quarter alone.

Uber’s bottom line performance might be even more impressive.

Similar to recent quarters, Uber's real highlight remains its bottom-line performance, and the rapid margin expansion management is able to deliver while maintaining impressive top-line growth.

Last quarter, Uber delivered an adjusted EBITDA of $1.84 billion, up 44% year over year. This reflected an EBITDA margin of 15.4%, up another 20 bps from the previous quarter and 150 bps year over year.

As shown below, Uber has been rapidly improving profitability and continues to make solid progress amid a rapidly growing top line, and cost growth well under control, even as management isn’t holding back on investments.

Furthermore, on a GAAP basis, Uber also delivered a solid operating profit of $770 million, driven by a strong operating performance and lower stock-based compensation.

Further down the line, Uber reported a net income of $6.88 billion, which is not representative of actual performance at all as this included a $6.38 billion one of tax valuation benefit and another $556 million net unrealized pre-tax gain related to the revaluation of its equity investments.

Due to these factors, net income varies heavily from quarter to quarter and is not very useful. To get a sense of bottom-line performance, it is more valuable to focus on Uber's EBITDA numbers, which look absolutely great!

Finally, cash flows also look excellent. On a TTM basis, Uber has now generated an impressive $6.9 billion in FCF and an EBITDA of $6.5 billion.

This allowed Uber to buy back its own shares, pay off debt, and further grow its cash position. As of the end of Q4, Uber held a total cash and short-term investments of $7 billion on the balance sheet. In addition, Uber still has a number of equity stakes in publicly listed companies worth roughly $8.5 billion.

This healthy financial position with plenty of liquidity allowed Uber to also opportunistically buy back its own shares, buying back $550 million worth of shares in Q4 alone, as part of its $1.5 billion accelerated repurchase program. Here is what management said during the earnings with regard to buybacks:

“We repurchased $550 million of common stock in Q4, and in January, with our stock trading at what we believe represents a significant discount to the value of our business, we announced an accelerated share repurchase (ASR) program to retire $1.5 billion of common stock.”

Therefore, going forward, management expects to remain opportunistic buyers of its own shares, with $2.75 billion remaining under its current authorization. At current prices, this seems like an excellent use of its considerable cash pile.

Uber just remains in excellent financial health!

Management is confident in Uber’s role in the AV revolution

Alright, let’s address the elephant in the room – Autonomous vehicles. A lot has been said and done about the subject, with every bit of AV news leading to a share price reaction for Uber, most often negatively, purely due to tension and uncertainty.

Therefore, I was glad Uber management addressed the issue very clearly during the earnings call. This has been the main reason its shares have come under such seemingly unjustified pressure over the last year.

Positively, management confirmed all my thoughts and ideas, hitting the nail on the head with its commentary.

First of all, according to Uber management, 2024 was a turning point for the AV industry, as the technology has started to mature, and more and more countries, regions, and cities are starting to allow fully self-driving trial runs from companies like Waymo, WeRide, Pony, and Baidu.

The ‘robotaxi’ dream has never been closer to reality, and it is leading to uncertainty in the ride-hailing market. Could Uber and its drivers be replaced by Waymo and Tesla with their own robotaxi platforms? It is an understandable fear, but it isn’t all that simple, and Uber’s moat isn’t that easily disrupted.

Here’s what we need to consider, as also pointed out by Uber CEO Dara Khosrowshahi during their Q4 earnings call.

First of all, the actual potential AV threat is still many years away, even as the industry has reached a turning point. It is worth pointing out that actual commercialization on a large and professional scale might still be quite a few years away due to the need to resolve safety issues, improve regulations, and take cost-effective measures.

For example, due to the many different technology platforms and different regulations across countries, regions, and cities, safety approaches differ significantly, increasing risk. There is still a lot of ground to gain here before full commercialization is possible and has earned the trust of consumers.

And then there is the cost. Currently, technology companies like Waymo or WeRide simply equip traditional vehicles with a sensor kit, which can cost up to $200k per vehicle. This is completely unsustainable on a large scale. Therefore, apart from Tesla, bigger moves by OEMs will be necessary for the commercialization of AVs.

For reasons like this, the potentially disruptive AV wave is at least a number of years away.

Furthermore, even when the revolution is here, Uber still seems like the prime candidate to bring AV technology in taxi format to market – to the consumer.

The reason is simple: Uber has the best platform for these disruptive AV players to bring autonomous taxis to market on a large scale, enabling cost efficiency, excellent on-the-ground operations, and offering up a high utilization network able to deal with variable demand and flexible supply, all of which are factors completely overlooked by many.

Let it be clear that it won’t be easy for any AV player, whether Tesla or Waymo, to build a network and app with the capabilities of the Uber platform. Uber has a staggering global reach, with over 170 million monthly active users in over 70 countries and 10,500 cities, and is a trusted brand by consumers.

Here is how management explained this during the earnings call:

“AVs need to be charged multiple times a day and serviced monthly. AVs will also require consistent cleaning and available parking, all of which Uber is uniquely equipped to manage. Uber also has 15 years of experience to support a host of other key operational issues like fare disputes, lost item returns, stranded vehicle rescue, and insurance claim resolution.”

Thanks to its massive, proven platform with an impressive global reach, Uber also delivers the lowest operational cost for AV partners. After years of development and processing over 12 billion trips annually, the company is “leaps and bounds ahead on every aspect of the go-to-market capabilities that are critical to commercialization,” as management explains.

Therefore, it is extremely compelling for upcoming AV players. These can simply plug into the Uber network, fully benefitting from all its well-developed platform capabilities at a favorable cost structure, instead of developing their own platform and having to go through the entire process of gaining consumer trust and developing a well-working platform with a global reach.

Here is how management put it:

“Our AV partners get to plug into that cost structure instantly—with advanced capabilities in customer acquisition, customer support, and the underlying technology and payments stack. Put simply, we are the players with the scale and expertise to run AV operations at the highest efficiency, period.”

From this perspective, it is apparent that Uber could benefit from the revolution rather than being disrupted.

In addition, these AV players have a massive hurdle to overcome, which might be impossible without Uber and its driver base: variable demand.

You see, ride-sharing demand is variable in nature. There are peak months and throughs and even big changes in demand on a daily or weekly basis. The issue for standalone players, say Waymo has its own platform with only Waymo AVs, is that “they will have to choose between running a highly underutilized network (if supply is built for peak demand) or a highly unreliable network at peak periods (if supply is built for anything less than peak),” as explained by Uber management during the Q4 earnings call.

In other words, either consumers will be frustrated with the platform as it’s impossible to get a car during peak periods, or Waymo has too many cars operational during non-peak moments, which is extremely expensive. Think of parking, maintenance, etc.

Meanwhile, Uber has a dynamic platform, using human drivers that can be activated during peak demand with additional bonuses, but it won’t cost Uber a single dime during through-demand periods as drivers simply take a break.

This makes the Uber platform far superior for both its users and the company itself from a cost perspective and consumer satisfaction, also making it much more compelling to these AV players. Again, the effort and cost of building and operating your own platform are significant, let alone making users like it. This is what Uber said with regard to this platform edge:

“This fact gives us confidence that the Uber network, with a hybrid of AV and human drivers, will deliver the highest asset utilization and revenue generation opportunity for our partners.”

I agree. It just makes no sense for these AV players, particularly the smaller ones, not to leverage platforms like Uber and Lyft.

As a result, especially with this revolution still some years away, I am not at all worried about potential disruption for Uber.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

Outlook & Valuation

Alright, with that out of the way, let’s discuss Uber's outlook, which remains tremendous longer-term. However, management’s short-term guidance fell short of expectations, leading to the post-earnings sell-off.

Yet, investors failed to recognize during a little panic selling amid tense sentiment that the drop in growth is purely due to the significant FX headwinds Uber is facing from a strengthening dollar. Looking at underlying growth, Uber is expected to keep growth quite steady in the high teens or low twenties while still expanding margins and growing cash flows.

Meanwhile, after a good Q4 and 2024, Uber is well ahead of delivering on its investor day growth targets. The company still aims for mid-to-high teens constant currency growth through 2026 (21% in FY24) and EBITDA growth in the high 30s to low 40s (60% in 2024). This outlook remains very bullish, and Uber is off to a good start, to say the least.

For 2025, management is also optimistic, driven by a positive macro backdrop in the U.S., with a healthy labor market and inflationary pressures easing. However, at the same time, the strengthening of the dollar is a significant headwind due to Uber seeing a significant portion of their cost and revenue in local currencies.

As a result, guidance for Q1 in dollars fell short of expectations, with gross bookings of $42 billion to $43.5 billion, reflecting a 550 bps currency-driven headwind. Meanwhile, constant currency growth is guided to be between 17% and 21%, falling only slightly from 21% growth in Q4.

Furthermore, Q1 Adjusted EBITDA is anticipated to be between $1.79 billion and $1.89 billion, growing 30% to 37% year over year. This is still quite impressive and points to continued market expansion.

As for the medium-term outlook, I remain optimistic. I expect Uber to maintain solid revenue growth through the end of the decade, although steadily slowing down from today’s high teens growth rate due to a higher revenue base and increasing penetration. It will simply be tough to keep growing at a high-teens rate at this size. However, I do expect revenue to keep growing at a double-digit rate through the end of the decade, driven by continued growth in trip frequency and user growth.

Meanwhile, I anticipate consistent margin expansion for Uber thanks to size benefits and steady growth in costs, which should lead to steady EBITDA growth in the high twenties. Note that I am still using EBITDA numbers in my projections as earnings per share aren’t representative due to Uber’s equity portfolio.

Also, in the projections below, I am not incorporating any potential benefit from growth in AV adoption. This could lead to additional top and bottom-line growth toward the end of the decade, but this is still highly uncertain.

Moving to the valuation, even after a recovery late last week, Uber remains extremely compelling, which actually urged super investor Bill Ackman to pick up over 30 million Uber shares, now making him one of the 15 largest shareholders. Here is what he said:

"We believe that Uber is one of the best managed and highest quality businesses in the world," Ackman wrote on X. "Remarkably, it can still be purchased at a massive discount to its intrinsic value. This favorable combination of attributes is extremely rare, particularly for a large-cap company."

I have been saying this for months now: Uber is one of the most exciting long-term opportunities, yet investors have completely misvalued it.

At a share price now just shy of $75 per share (earlier last week, you could pick them up for $65), Uber shares still trade at an EV/EBITDA of just 19x, a PEG of well below 1, and 24x a rapidly growing FCF, which is still compelling at the very least, maybe even a full-on bargain.

In my opinion, recent AV concerns have led to Uber trading at a considerable discount to its intrinsic value for quite some time now, making it a great buy today for long-term investors.

For reference, using a medium-term 18x EV/EBITDA multiple or a long-term PEG closer to 1, I calculate an end-of-2027 target price of $112 per share. From a current price of around $75 per share, this still represents annual returns exceeding 14%, which should easily beat the market at a favorable risk-reward balance.

Yes, I still remain quite bullish on Uber.

Below 65$ was a steal and I purchased quite a bit there. Now close to a 7% position in my portfolio. I'm looking forward for the next 2 years and see how AV will mostly all be on Uber platform.