Uber Technologies – A Brilliant company that comes with a hefty price tag

In this post, we reassess the Uber investment case following the company's Q4 earnings report and the investor update call.

While you are likely familiar with it, Uber is a multinational transportation network company that revolutionized ride-hailing and transportation. Founded in 2009, Uber provides a platform connecting riders with drivers through its app. Offering various services ranging from ride-hailing to food delivery, Uber has expanded its presence globally, operating in over 900 metropolitan areas worldwide.

Uber has been a key holding in our portfolio since mid-2022, when we aggressively bought the shares at a significant discount to their IPO price. Shares were sold off in 2022 due to a lack of profitability and the significant doubts on Wall Street on whether the company would ever be able to drive substantial profitability due to its business model and doubts on whether the company could maintain solid growth. In our view, this led to a significant opportunity, and we were right.

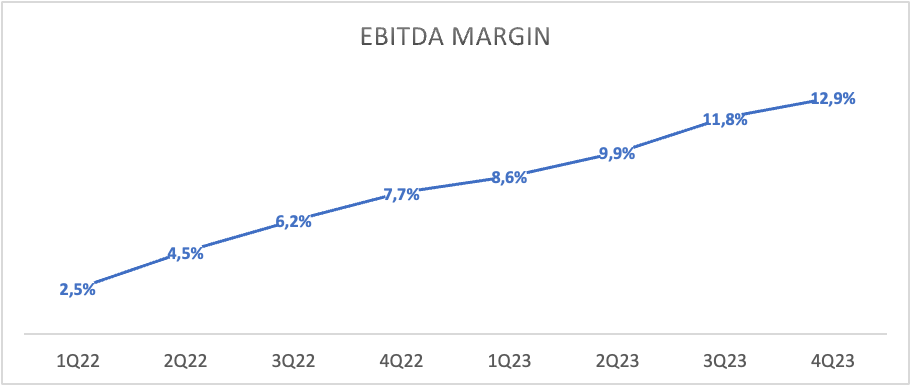

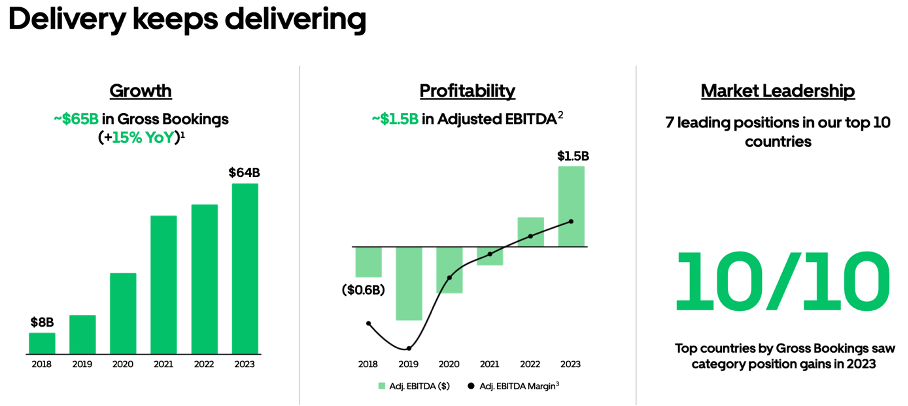

Fast forward a few quarters and shares are up almost 200% from our first purchase. Uber has proven everybody wrong by driving solid and rapidly improving EBITDA margins and reporting its first-ever GAAP profit halfway through 2023. Moreover, gross bookings and revenue growth remain solid in the mid-to-high teens, and Uber is still not guiding for a significant slowdown, even with it lapping a very strong 2023 this next year.

Now, two years after our initial buy, we still remain very bullish on Uber, and the company remains one of our larger positions. The company released its Q4 results earlier this month and held an investor update event earlier this week, which gave much more insight into its growth trajectory over the next three years and its growth drivers, which impressed Wall Street.

Financially, Uber continued to outperform expectations in Q4 and guide for solid growth as it still has plenty of growth levers to pull and reports solid growth and health in pretty much all metrics. As will become apparent throughout this earnings and investor event review, Uber still has plenty of going for it. However, this does come at a price, and with shares jumping 15% following the investor event last Wednesday, these have become even more pricey than they already were, now at $81 per share.

Uber has plenty going for it.

Uber reported its most recent earnings – the Q4 FY23 results – on February 7, beating the consensus on both the top and bottom lines. The company reported healthy demand worldwide and is seeing growth accelerate as consumers shift their spending from retail to services.

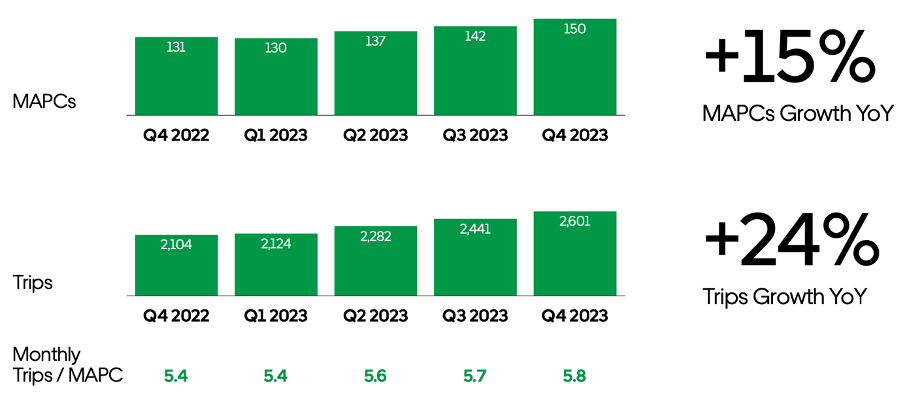

This led to solid growth in all underlying metrics for Uber in Q4, with MAPCs (Monthly Active Users) and frequency hitting new all-time highs as Uber is not only very well able to attract new users to its platform but also sees its existing user base order more frequently, which is also driven by the company constantly introducing new functionalities. This led to the following quote from management:

"Our audiences are larger and more engaged than ever.”

With this solid growth, monthly active users on the Uber platform hit a staggering 150 million, up 15% YoY. Add to this growth in frequency, and trips in Q4 were up a very impressive 24% YoY to 2.6 billion or approximately 28 million trips per day. Yeah… don’t underestimate the size of Uber.

Meanwhile, Uber still only believes that 5% of the population aged over 18 years in the countries in which it operates are users of its mobility and delivery services, which indicates it still has a lot of room for growth in its key regions. This, in combination with expansion to new regions, countries, and cities, should give it a massive runway of growth ahead of it. So, don’t make the mistake of thinking Uber has most of its growth behind it – data says otherwise. It should be able to keep growing user numbers strongly.

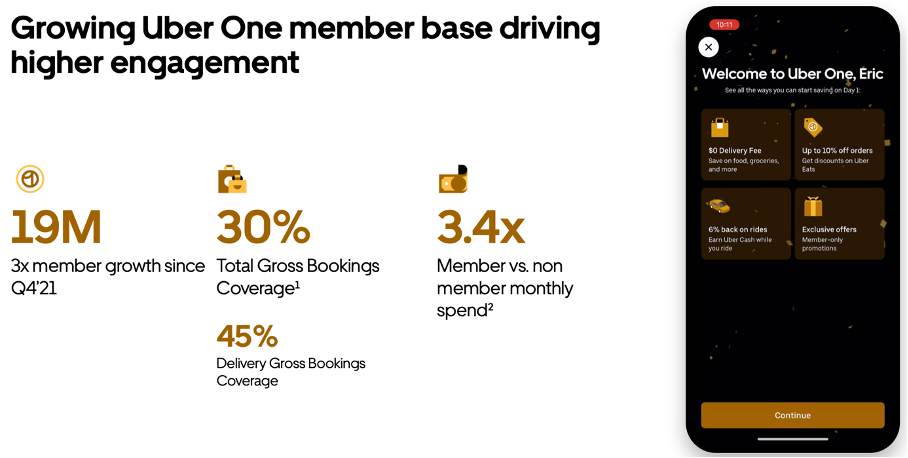

Meanwhile, another important, and possibly the most important, growth driver is the company’s ability to convert users of mobility or delivery to multi-product users. This way, the company can leverage its existing user base to drive growth through higher activity. Also, according to Uber, consumers who use multiple products spend 3.4x more than those who don’t.

Uber is making great progress on this front but still has plenty of room for growth on this front as well. For reference and to highlight the significance of this, in the latest quarter, a third of new Uber Eats users came from the rides app, and more than 20% of first-time mobility users came from the Uber Eats app. Again, don’t underestimate Uber’s room for growth.

On the note of growth drivers, let’s highlight a few other levers Uber management can pull to boost growth before we get to the Q4 results. These include the introduction of new products, advertising, and its Uber One membership, which were once more growth drivers in Q4 as trends remain strong.

As for the Uber One membership, this is seeing great adoption, as highlighted by the fact that Uber One members accounted for almost 50% of Delivery gross bookings in the U.S., up 10 percentage points YoY in Q4. Moreover, members now account for 30% of total gross bookings, up a very meaningful 700 bps YoY, showing the significance of the membership program and solid adoption.

Crucially, as with any comparable membership form, these members have a far higher lifetime value due to a higher usage frequency and higher spending, driving growth for Uber.

The platform now has over 19 million members across 25 countries, spending $10 monthly, generating a steady, reliable, and high-margin income stream for Uber. Meanwhile, the company is still expanding the membership format to many more countries, which should result in continued member growth. The UK is a region where Uber relatively recently introduced the membership option and grew members there by a whopping 50% quarter over quarter in Q4. Ultimately, this will remain a great growth driver for Uber.

Another growth driver that has been performing well is advertising. Uber now has a $900 million advertising revenue run rate as of Q4, which has been growing rapidly. According to Uber, the advertising business continues to scale profitably and will remain a significant revenue growth driver. According to management, driven by the growing number of tools for advertisers and the integration of AI, advertising is a multi-billion dollar opportunity for the company. It is only scratching the surface at this point.

Moreover, it will also be an important profitability driver, with this business carrying far higher margins than its main operations. For reference, Uber generates advertising revenue by showing ads in its app but also by mounting advertising screens on and in its drivers’ cars. This is still a rapidly growing business for Uber as the company is also expanding these operations into more and more regions.

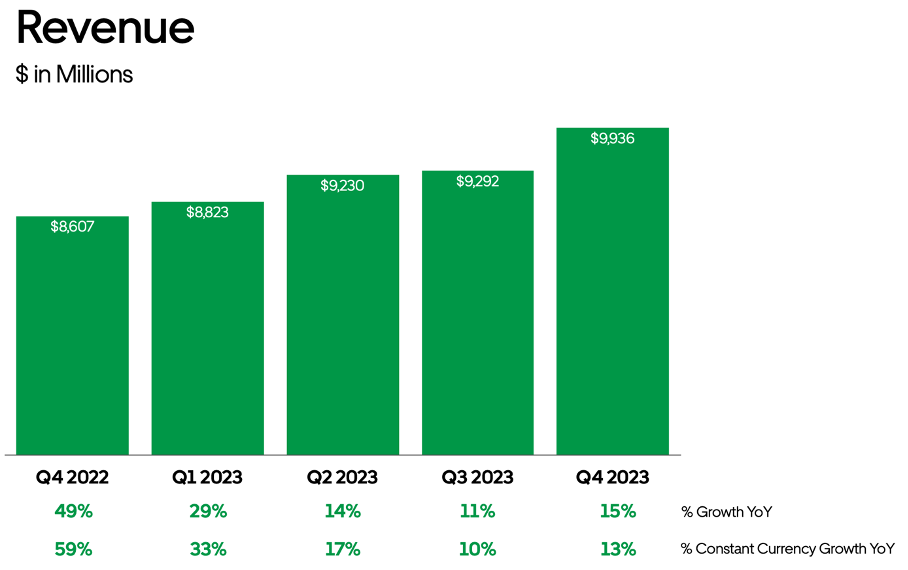

Driven by these solid developments and trends in Q4, Uber was able to report gross bookings growth of 22% YoY (21% on constant currency) to $27.6 billion. This sat comfortably above the $27.2 billion consensus and was the second quarter in a row in which gross bookings growth accelerated YoY.

Meanwhile, revenue growth came in slightly lower at $9.9 billion, up 15.1% or 13% in constant currency. According to management, the difference between revenue and gross bookings growth was due to “certain business model changes, which have no real economic impact to profitability, negatively impacted revenue reporting by $529 million and combined Mobility and Delivery YoY revenue growth by approximately 7 percentage points.” Therefore, excluding these changes, comparable revenue growth sat closer to 20% in constant currency, roughly in line with gross bookings growth. All in all, a very solid performance that reflects a very healthy demand environment.

On the bottom line, Uber also performed very well, with profitability improving further, which was once deemed impossible. Of course, Uber’s legacy business remains a low-margin one, but by combining these revenues with higher margin operations like advertising and subscriptions while at the same time reaping the benefits from a healthy supply-demand environment and benefiting from scale advantages, the company is now able to deliver solid GAAP profits, which are rapidly growing as well.

In Q4, Uber reported an EBITDA of $1.28 billion, up 93% YoY, which was the result of continued operational efficiency and disciplined expense management. Uber has been rapidly improving its EBITDA margin over the last two years, growing it by 1040 bps since the start of 2022 and 520 bps YoY in Q4 to 12.9%. This is quite an impressive profitability development, to say the least. Notably, the EBITDA improvement over recent years was driven by more than just the U.S., as it is able to report profits in 7 out of its ten key regions.

Meanwhile, the company is now also able to report a positive GAAP operating income, which came in at $652 million in Q4 at a GAAP operating margin of 6.6%. This is up from $394 million in the previous quarter and a negative $142 million in the same quarter last year. Management achieved these improvements primarily by cutting back on stock-based compensation expenses, which were down 3% in Q4 against the strong top-line growth.

Now, while these are still in no way incredible numbers, the amount of improvement Uber has achieved in a relatively short time is impressive, and we believe there is much more to come.

This also resulted in a net income of $1.4 billion reported by Uber, which includes the benefit of a $1 billion tailwind from the company’s net unrealized gains related to the revaluation of equity investments. These numbers highly fluctuate every quarter, so investors are best off focusing on growth in EBITDA and operating income to monitor margin improvements.

Finally, FCF in Q4 was $768 million, which compared favorably to a negative $244 million one year ago. Furthermore, on a TTM basis, the company generated $3.4 billion in FCF. This has allowed it to maintain a healthy balance sheet with $5.4 billion in total cash and $6.1 billion in equity stakes against $9.5 billion in debt.

There's not much to complain about across the board.

Both the Delivery and Mobility segments are performing well

Looking at each of the two segments, we can see the performance is driven by both its leading segments (Mobility and Delivery), although the mobility segment is growing much faster and is more profitable. This can be attributed to the simple fact that Uber faces far less competition in this area compared to food delivery. In Mobility, its only real competitor in the U.S. is Lyft, which is much smaller and has had difficulty competing with Uber for years now. As a result, Uber holds the leading position in each of its 10 largest markets and in the majority of the 70 countries it operates in.

Meanwhile, its food delivery faces competition from industry leader Doordash in the U.S., as well as Grubhub and a number of smaller players. In Europe, it has to compete with the likes of Just Eat, Deliveroo, DeliveryHero, and more, which is why it only holds the #1 position in 7 out of its top 10 markets, which is still very respectable.

Also, over the last year it was able to gain market share in every single one of these same top 10 markets. Nevertheless, the significantly more intense competition does impact margins and growth. As a result, Uber is able to grow mobility much faster and more profitable.

In Q4, Mobility gross bookings were up a very impressive 28% on constant currency to $19.3 billion. A big positive was a healthy supply-demand environment, which drove an increase in the revenue margin or take rate by 90 bps YoY to 28.7%, which led to revenue growth of 31%.

With the “supply-demand environment,” we talk about the health of the Uber platform and the dynamics of driver and trip growth. Positively, Uber saw a very healthy supply-demand environment on its platform in Q4, with growth in the number of active drivers outpacing growth in trips. The number of active drivers on the platform was up by 30% YoY to 6.8 million, while driver engagement (defined as monthly supply hours per active driver) was also up 10% YoY. For reference, these drivers made a staggering $62 billion in total earnings in 2023, which is also up 24% YoY.

These are incredibly important statistics for Uber, and for those of you less familiar with the company, you might wonder why. Well, apart from the fact that more drivers are always great for Uber, Uber’s platform also functions as a sort of marketplace, and in order to satisfy trip demand by customers, the company is often forced to offer incentives to drivers, like during holidays. However, with a healthy marketplace in which driver supply growth outpaces growth in trip demand, Uber can cut on its incentives and improve its take rate, which is crucial for its actual revenue growth and margins.

Luckily, Uber has seen strong improvements in its driver supply over recent quarters, which has allowed it to improve its take rate. For reference, the Mobility take rate has improved from 20.1% in 4Q21 to 28.7% in the most recent quarter. These are solid fundamental improvements reported by management.

Back to the results, growth in Mobility was driven by a strong performance in Latin America and Asia Pacific in particular, where Uber saw outsized trip growth on strong holiday travel trends but also strong adoption in its non-UberX portfolio.

Uber has been expanding its offering from the traditional ride-hailing (by car) service to many more alternatives like Reserve, Taxi, Moto, Uber for Business, and Shared Rides, which in these regions, in particular, have seen great adoption. In fact, these UberX alternatives grew by 80% YoY in Q4 across all regions, generating $11 billion in annualized gross bookings (or 14% of Mobility Gross Bookings). This shows that, by expanding its offering Uber is able to drive additional growth.

Another big part of this is the adoption of the Uber platform by taxi drivers. While Uber hasn’t always had a great relationship with taxi drivers around the world for numerous reasons, the company is now seeing more and more drivers join the platform. At this time, the company has already welcomed iconic taxis in some of the world’s largest cities to its platform, including in Hong Kong, Tokyo, and New York.

As a result, there are now over 235,000 taxi drivers active on the Uber platform in over 33 countries, which has led to these drivers accounting for 5% of the overall driver base and growing rapidly. This is great for Uber as it drives solid growth in driver supply, but it also takes away a lot of resistance.

As mentioned before, growth in the number of active drivers is the first step in driving growth. And on that note, I once more want to highlight that Uber is far from done growing its mobility segment. In fact, management believes it is still in the very early stages with it, as even in its most saturated countries, it is seeing less than 20% penetration under adults. For this reason, Uber continues to see massive upside and room for growth in its mobility operations, especially with several trends working in its favor, including decreasing car ownership. This is what management said regarding the potential upside from increased penetration:

“We think the ceiling is much higher, but even just getting the U.S. to match our existing UK penetration rate, for example, represents a $13 billion incremental opportunity. Reserve gives us a strong tool to drive this growth.”

Add to this the earlier mentioned growing adoption, cross-selling, and rising frequency, and we end up with a favorable outlook for Uber. Meanwhile, profitability is also rapidly improving. Mobility EBITDA was up 43% YoY as the margin improved to 7.5% of gross bookings in Q4, which compared favorably against the Delivery segment with an EBITDA margin of 2.8% of gross bookings, even as this led to EBITDA growth of 98% YoY.

A big driver of these profitability improvements was the improving supply-demand and solid market share gains, as this allowed Uber to dramatically reduce Uber-funded promotions, which allowed it to invest more in technology improvements like machine learning and automation, which resulted in lower costs from operations.

Delivery gross bookings growth was also less impressive but still solid at 17% YoY to $17 billion. Notably, this was the third quarter in a row in which YoY growth accelerated. In fact, delivery gross bookings growth was the highest in over two years, indicating that Uber also faces healthy and growing demand in this segment.

So far, so good. However, the delivery take rate was down 220 bps YoY due to increased driver incentives and growing costs from expansion efforts. Though, we should add that this did include a 190 bps headwind from business model changes. Still, this led to revenue growth of just 4% YoY.

With regard to growth, Uber explained during its investor presentation that one of the strongest growth opportunities comes from consumers already on the platform. Management believes that a growing ordering frequency is the best path to doubling or tripling the size of this segment. As of today, still, only 35% of delivery users use the service every month, and Uber sees a lot of room to grow on this front.

One of the methods to grow ordering frequency is by growing the platform offering, which it is doing by focusing on Grocery and Retail. The company has been heavily investing in Grocery & Retail (formerly referred to as New Verticals), which also includes categories such as convenience and alcohol. This segment has been growing rapidly and grew 40% YoY in Q4, boosting overall growth. It is now good for $7 billion in gross bookings annualized or around 10% of delivery gross bookings, making it a meaningful contributor. Still, only 14% of delivery monthly consumers place grocery orders every month, which leaves Uber with a lot of room to grow once more.

The most important takeaway from this is that Uber does not even need to grow its user base to grow bookings and revenue but simply needs to increase ordering frequency by growing its service offering and through its Uber One subscription service. Meanwhile, however, the company still sees plenty of room to grow the user number as the current number of annual consumers in its 20 largest markets still only represents about 15% of the TAM, leaving plenty of room for growth.

Outlook & Valuation

In terms of the outlook and guidance from management, we can keep it quite short when it comes to 2024, as Uber does not provide a lot of insight. For Q1, management now guides for gross bookings of $37.0 billion to $38.5 billion, up 18% to 23%, with an EBITDA of $1.26 billion to $1.34 billion. Assuming the revenue take rate remains similar to Q4, this should point to an EBITDA margin of 13%, up slightly from Q4, on revenue of $9.97 billion.

Meanwhile, Uber also provided longer-term guidance during its investor update and provided valuable insight into the next 3 years. Uber now expects to be able to grow gross bookings at a CAGR of mid to high-teens through the end of 2026, which is roughly in line with our expectations. However, much more impressive is the EBITDA guidance, as management now guides for adjusted EBITDA growth in the high 30s to 40% and FCF as a percentage of EBITDA to be over 90%, which is far ahead of what analysts guided for, explaining the jump in share price.

Management believes that it can leverage the benefits of scale to grow profits faster than the top line, targeting EBITDA growth at more than two times gross bookings growth. The company will continue to drive efficiencies in both variable and fixed costs across the P&L. Eventually, this should allow FCF to grow even faster.

As a cherry on the cake, management believes the rapidly improving cash flows warrant it to start its first-ever share repurchase program worth up to $7 billion, which will be deployed over the next few years. For reference, based on our current estimates below and management’s guidance, we estimate Uber to report a total FCF of over $20 billion over the next three years, easily paying for this program.

Meanwhile, when we initially heard the news, we had some mixed feelings. On the one hand, it is great for shareholders that management wants to focus on its shareholders and wants to stop diluting these. However, at the same time, shares are trading at an all-time high and are up over 130% over the last year. Arguably, this is not the best time to start buying back shares as it could turn out to be a waste of financial resources.

Positively, management has said it will be thoughtful with this buyback, initially only using this to offset stock-based compensation, driving down the share count over time. It sounds like management realizes now is not the time to start buying back shares opportunistically, which is great.

Now, taking all of this into account, we upgrade our outlook and expect solid growth and accelerating profitability from Uber through 2027. Taking into account the improving demand environment and resilient economic data, we believe Uber’s Q1 guidance might be slightly conservative. Nevertheless, to leave a bit of a margin of safety, we use the midpoint of management’s Q1 guidance in our projections.

As a result, we now expect Uber to grow revenues by 16.4% in 2024, assuming a slight slowdown in growth due to the projected slowdown in economic growth and Uber lapping a strong performance in 2023. Meanwhile, we expect margins to improve further and now project an EBITDA margin of 14% in 2024, which should result in EBITDA growth of 50%. You can find our full projections below

Based on these estimates, shares now trade at an EBITDA multiple of 13x, which definitely isn’t cheap. Moreover, whatever valuation multiple you pick, Uber is in no way cheap at a share price close to $81.

However, we would argue that Uber is one of the most unique and promising businesses available on the market, and with it now reporting solid and rapidly improving profitability, current multiples might not be that ridiculous. The company has a clear, long, and promising runway of growth ahead of it, which should be obvious after reading this post. Meanwhile, profitability should continue to improve over the coming years due to growth in advertising and Uber One, as well as greater operating leverage.

Also, competition from Lyft and the large number of food delivery platforms are no meaningful risks for Uber and its shareholders at this point. Uber has a massive size advantage over most of these peers, which allows it to offer better pricing and this gives it a meaningful data advantage to drive more efficient pricing, matching, and incentive spend.

Ultimately, Uber won’t become as cheap as it has been in recent years anytime in the near future, and we believe this is one of the most promising and underrated companies available on the market. This company is firing on all cylinders, and so shares deserve to come at a premium.

At this time, we believe an 11-12x EBITDA multiple on our FY25 estimate is fair for Uber, all things considered. As a result, we now put a 12-month price target on the shares of $96, which leaves us with a limited upside of 9% annually from a current price of around $81.

Based on this, we conclude that shares aren’t attractive enough to warrant a buy rating after the recent jump in price and believe these do not leave enough downside protection for a favorable risk-reward profile. We believe we are better off buying shares below $76 - $77 per share after Uber’s very respectable Q4 results and positive investor update, which left little to nitpick about.

As a result, we rate shares a “Hold” at this time.

Please let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: I/we do have a beneficial long position in the shares of UBER, either through stock ownership, options, or other derivatives. This article expresses my own opinions, and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Thank you for a great review, definitely worth reading. I hope I am wrong but this may fall into the category of "good company, not so good stock." If there's a market downturn in the next year or so, this stock may suffer, but.....what a great time to buy it back!