Uber Technologies – This is why it remains my largest position

Uber is still my highest conviction long-term pick. Let me show you why!

Last week has been… hectic, to say the least, with global markets showing significant declines amid investor panic, leading to some markets declining by double digits. I mean, it doesn’t happen every day that all three of the U.S. indices trade 5% lower intraday. Not a single sector seemed immune to this global sell-off in response to some weak economic data a rapidly growing fears of a recession.

Now, I can’t tell you whether this recession is indeed around the corner (I wish I could), but honestly, I don’t really care either, or at least up to a point. You see, in building and managing my investment portfolios, the one thing I focus on is buying high-quality businesses with good growth prospects that can bring me above-average and market-beating long-term returns.

So, whether the market goes into a full panic moat or the economy ends up in a recession, I am pretty confident that all the companies I own shares in will eventually come out fine or, ideally, even stronger.

As a result, these sell-offs we have seen over the last week excite me instead of creating panic. Simply put, these days or weeks of panic selling offer me, and you the chance to pick up more shares and grow our positions in high-quality businesses with incredible moats. And I can tell you, I was happily buying over the last week as quite a bit of value became available.

Amid all of this, today, I want to revisit one of my favorite companies—Uber Technologies—which reported earnings over the last week and showed absolutely no weakness and once more proved it is a high-quality business with an insane moat, undisputed leadership position, and very favorable long-term prospects.

Combine this with an unjustified sell-off, with Uber shares down over 5% over the last month and 16% from an all-time high earlier this year, and I will argue that this leader has returned to value territory, where I am actively picking up shares again.

So, without further ado, let me take you through the numbers, highlighting why Uber deserves a spot in any portfolio.

Here is why I am bullish on Uber

Despite Uber shares starting the year off strong, reaching an all-time high of over $80 per share, Uber hasn’t been among the greatest investments in 2024, gaining “only” 12%, which is in line with the S&P500.

The business, however, is firing on all cylinders, performing tremendously well, and fulfilling all investors have been wishing for over recent years, including turning highly profitable, something many believed for a long time would never happen.

At this point, Uber is growing its top line by a very consistent high teens to low twenties percentage, EBITDA is rocketing higher in the 40% range, the company is GAAP profitable, sees rapid FCF growth, and amongst all this performs excellently, developing in all the right directions, growing its moat and market share in the ride-hailing and food delivery industry.

Uber is pretty much the only real player in the global ride-hailing market, only dealing with competition from Lyft in the U.S. market, which is finding it increasingly difficult to compete with Uber’s size and financial strength, which has become one of Uber’s greatest moats – due to the low margin business it operates in, its financial strength and cash flows make it close to impossible for smaller competitors to compete due to Uber’s attractive pricing and greater availability, as well as brand.

It is worth pointing out that Uber is now the most valuable mobility brand, with a brand value of $30 billion, up 28% YoY. Also, the company is the undisputed leader in the global ride-hailing and taxi market with a 25% global market share, far ahead of Lyft’s 8%, and expanding rapidly as more taxis worldwide join the platform.

While many believe Uber’s moat is weak, size is probably the strongest moat possible in this industry, and Uber reigns. This makes Uber the biggest beneficiary of the growth in the underlying industry, estimated to grow at roughly a 13% CAGR through the end of the decade. However, with Uber still gaining market share each quarter, I believe the mobility segment should be able to outgrow the industry, remaining in the mid to high teens.

In the delivery industry, the situation is not much different, with similar market dynamics. While Uber does face more competition in the form of industry leader Doordash in the U.S. and the likes of Just Eat, Deliveroo, DeliveryHero, and more in Europe, it still holds the #1 position in 7 of its top 10 markets and has been gaining market share in each of these in recent years.

Again, with Uber continuously gaining market share, it should outgrow the industry’s projected 9% growth CAGR through the end of the decade, most likely achieving double-digit growth.

Add to all of this the fact that the company still has plenty of room for expansion, with relatively low penetration across key markets, sees growing demand for its services, has plenty of cross-selling opportunities between its platforms, and has a rapidly growing advertising business.

For reference, Uber management claims that only 5% of the population aged over 18 in the countries in which it operates use its mobility and delivery services. Even in its most saturated countries, including the U.S., the mobility segment still only sees 20% penetration, leaving a lot of room for Uber to grow.

So, don’t make the mistake of thinking Uber has most of its growth behind it – data says otherwise. This was also confirmed by Uber management during the investor day earlier this year as it came out with a very bullish medium-term outlook, projecting revenue growth at a 3-year (through 2026) CAGR of mid- to high-teens and adjusted EBITDA growth in the high 30s to 40%, with FCF as a percentage of EBITDA being over 90%.

I hope that by now, it is pretty obvious why I am bullish on Uber and have the company as one of my largest positions. This is a true one-of-a-kind industry leader with a solid moat and terrific long-term growth prospects.

And yet, amongst economic headwinds and recession fears, shares haven’t performed overly well, offering investors a compelling buying opportunity, especially as Uber showed in its most recent quarter that it is still doing everything right – shares are up over 20% in a matter of days in response, after hitting a recent low after Monday’s sell-off.

Let me take you through the numbers and developments! But first…

We try to keep all our analysis free for all of you to enjoy and benefit from! Want to support our work a little bit more and show your appreciation? Consider upgrading to paid ($5 monthly).

This allows us to push out even more content and gets you access to our exceptionally performing portfolio and premium subscriber chat!

We appreciate you all!!

Uber delivered a simply brilliant Q2

Uber came out with earnings pre-market last Tuesday and delivered excellent financial results that beat expectations on all fronts! In response to this, shares gained over 10% in the following trading session and another 4% on Wednesday, gaining over 15% in the span of two days, and more than deserved.

With its Q2 results, Uber showed that its business isn’t slowing down in any way, and the company is still making great progress on all fronts. Trip growth (the number of deliveries and ride-hailing trips made) remained at over 20% for the sixth consecutive quarter, showing no slowdown at all. Trip growth in Q2 came in at 21% YoY, with Uber completing a whopping 2.8 billion trips in the quarter.

Gross bookings grew 19% YoY on a reported basis and 21% in constant currency to $40 billion, which is a mild slowdown from previous quarters, as visualized below, but absolutely nothing to worry about. In fact, in constant currency, growth has been flat at 21% for three consecutive quarters now. In the face of some cautious consumer spending, I am absolutely not disappointed with this growth.

Growth in trips and gross bookings continued to be driven by both growth in Uber users, or MAPCs as Uber calls them, and growth in the amount of trips each user makes. Last quarter, MAPCs grew 14% YoY to 156 million, and trip frequency grew by 6%, both hitting all-time highs. So, not only is Uber seeing its number of users grow at a brilliant pace, but it is also still seeing engagement grow over time, which is terrific. Indeed, Uber has two strong growth engines.

This is also supported by solid engagement by Uber drivers, with the platform now having 7.4 million monthly active drivers and couriers, which are also delivering more hours per driver on a monthly basis. This reflects a very healthy supply-demand environment for Uber, allowing it to limit offers and discounts.

In the end, these dynamics allowed Uber to report revenue growth of 16% or 17% on a constant-currency basis to $10.7 billion, which includes a 7 percentage point YoY headwind related to business model changes. These changes have been a headwind for quite a few quarters now but should ease as we exit 2024.

By segment, mobility continued to perform tremendously, seeing gross bookings surge by 23% YoY to $20.6 billion. This led to revenue growth of 25%, including an 8 percentage points headwind, helped by a take rate improvement of 50 bps YoY. According to management, growth continues to be driven by healthy demand, continued penetration into new geographies and use cases, and continued frequency growth.

Delivery also performed exceptionally well, far outpacing many of its peers, reporting gross bookings growth of 16% YoY to $18.1 billion and revenue growth of 8% due to a take rate decline of 140 bps, including a 230 bps headwind from business model changes.

Finally, worth pointing out as well is that Uber also continues to make great progress in the advertising industry, now reporting a revenue run-run rate of over $1 billion. Uber offers advertising capabilities on cars, on in-car displays, and through its apps, generating a steady recurring and rapidly growing additional revenue stream for itself and its drivers.

Across the board, Uber indicates that while there have been concerns over consumer health, the company isn’t seeing this reflected in its results or user demand. Overall, the business is doing extremely well on all fronts.

Besides impressive top-line growth, Uber also continues to make significant profitability gains, hitting record adjusted EBITDA and FCF levels. In Q2, adjusted EBITDA soared 71% YoY, reaching $1.6 billion and reflecting an adjusted EBITDA margin of 15% of revenue, up 510 bps YoY and 110 bps sequentially.

Uber’s profitability improvements in recent years have been nothing short of impressive, as the company shows all the bears that it is more than capable of delivering great operating margins and profitability.

GAAP operating income in Q2 was $796 million, another quarterly record and improving sequentially. Furthermore, net income came in at $1 billion, helped by a $333 million net unrealized pre-tax gain related to the revaluation of equity investments. Due to this, net income and EPS shouldn’t be valued too highly for now.

What is essential is FCF, and this was up 51% YoY in Q2, hitting $1.7 billion and bringing the TTM total to $4.8 billion, showing very solid cash flow improvements.

This allowed Uber to further strengthen its cash position to $6.3 billion, up $500 million from last quarter, and leaving the business in excellent financial health, especially as cash flows continue to improve.

All in all, just a spotless quarter from Uber.

Outlook & valuation

In terms of outlook, Uber also didn’t disappoint, even as the underlying economy might be weakening. Management maintains full confidence in the business, guiding for growth similar to last quarter.

For Q3, management now guides for gross bookings between $40.25 billion and $41.75 billion, growing 18% to 23% YoY, in line with last quarter. Furthermore, adjusted EBITDA is expected to be between $1.58 billion to $1.68 billion, which represents 45% to 54% YoY growth, showing further margin improvement.

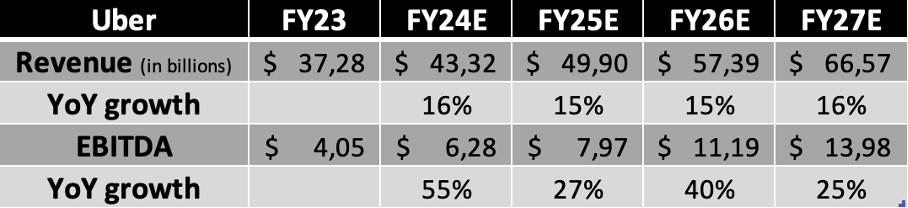

This guidance, overall, was ahead of both the expectations on Wall Street and my own, justifying some investor enthusiasm. It also allows me to somewhat upwardly revise my FY24 financial projections, especially in terms of EBITDA, as margin development continues to outpace my expectations.

However, at the same time, I have turned slightly less optimistic on the years ahead as I do expect a further slowdown in global economic growth and potentially even a shallow recession in some regions – the economic outlook definitely isn’t clear or bright. For this reason, I have slightly lowered my growth expectations for upcoming years, as well as a slight flattening the margin improvements in 2025 and 2026.

Still, the outlook for Uber remains excellent!

Based on these current projections, Uber shares now trade at an EV/EBITDA multiple of roughly 24x, which is also similar to a couple of months ago and not too crazy for a company like Uber considering the projected EBITDA growth ahead. While far from cheap, I do think the premium is justified.

This is still one of the most unique and promising businesses available on the market, and with it now reporting solid and rapidly improving profitability, current multiples might not be that ridiculous. As we argued last time out, “The company has a clear, long, and promising runway of growth ahead of it, which should be obvious after reading this post. Meanwhile, profitability should continue to improve over the coming years due to growth in advertising and Uber One, as well as greater operating leverage.”

At this point, I still believe Uber is a buy on weakness, even as global worries and a further deterioration of economic indicators can push global markets further down. This company is firing on all cylinders, and so shares deserve to come at a premium at any time. If you can buy a quality business like this at a discount, don’t miss out.

For now, I still believe an EBITDA multiple of around 11x is more than fair for this business, but to be somewhat more conservative and take into account current economic uncertainty, I will assume a 10x multiple in my calculations. Using this multiple and my FY25 EBITDA projection, I calculate a target price of $80, which, from a current share price of right around $69 per share, leaves investors with potential returns exceeding 12% annually.

Don’t forget Uber still has an extremely long runway of growth, so while a 12% annual return might not sound extremely attractive, longer-term these numbers can end up much higher and for a prolonged period. Uber remains early in its business cycle and is still very much a growth company and a potential multi-bagger.

To conclude, I can safely say Uber remains one of my absolute top picks, and I will continue to buy shares as long as these trade below $70-$72 per share. Though, after last week’s recovery, I will only buy more aggresively if shares fall back to the $60-$65 range.

For now, I rate Uber shares a “Buy.”

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Nice write-up !!

Great write-up! Uber has been on my watchlist for a while; great business model, holds market share with a nice competitive advantage, and has amazing fundamentals. Quick questions: What are your thoughts on the municipal/city regulation recently with Uber, DoorDash etc? (The minimum wages and such.) Also, what are your thoughts on Tesla's robotaxi as an Uber shareholder? I don't seem to view it as a threat even without being a shareholder.