Weekly Insight #3 - Markets continue to price in a lot of optimism

Market Resilience Meets Economic Realities: Unbreakable optimism, driven by tech and AI, faces scrutiny amidst global uncertainties. Caution urged as strong data clashes with potential downside risks.

As always (from now on), in the weekly insight, we will review last week’s economic news/developments as well as the market performance, and we look forward to the upcoming week with our top 10 stock picks and the upcoming earnings releases.

Luckily, we have plenty to discuss, with rate cuts remaining one of the leading subjects on Wall Street and the direction of the economy still being a big question mark. This makes it even more important to keep a close eye on any commentary from Fed officials, Wall Street analysts, and macroeconomic data to give us a sense of what to expect.

Sentiment is seemingly unbreakable

However, whatever way the economy is headed and whatever the Fed plans to do in its upcoming meetings, the markets seem unbreakable, fueled by investor optimism with regard to technology stocks, a rebound in semiconductor growth, and the impact of AI.

In week #3 of this year, technology was once more the driver of success. All major US benchmarks ended the week in the green, with the Dow gaining 1.17% and the S&P500 gaining slightly over 1.5%. However, the Nasdaq once more led with a 2.5% gain. This was primarily driven by a strong bounce in semiconductor stocks in response to very bullish 2024 guidance from TSMC, giving the SOXX ETF an incredible boost as it was up 8% over the last week—more on the TSMC results in our Business Insight of Tuesday.

Meanwhile, European markets were less impressive in week #3, with the majority of these ending in the red, with the Euro Stoxx 50 and Stoxx Europe 600 down 0.79% and 1.71%, respectively. This can, in part, be attributed to these indexes containing far less technology. The Dutch AEX index, one of the most technology-heavy European indexes, performed slightly better, down 0.67% last week.

Nevertheless, market sentiment seems unbreakable across the board, with global indices reaching new highs with ease, even as economies continue to face significant headwinds, interest rates remain high, inflation is sticky, and geopolitical tensions are at a multi-decade high.

At the same time, though, as stated by CNBC, “economic data outside of manufacturing and housing has been mostly solid, particularly where it concerns the seemingly unbreakable labor market.” This fuels optimism even in the face of a seemingly imminent economic slowdown.

Macroeconomic data remains strong

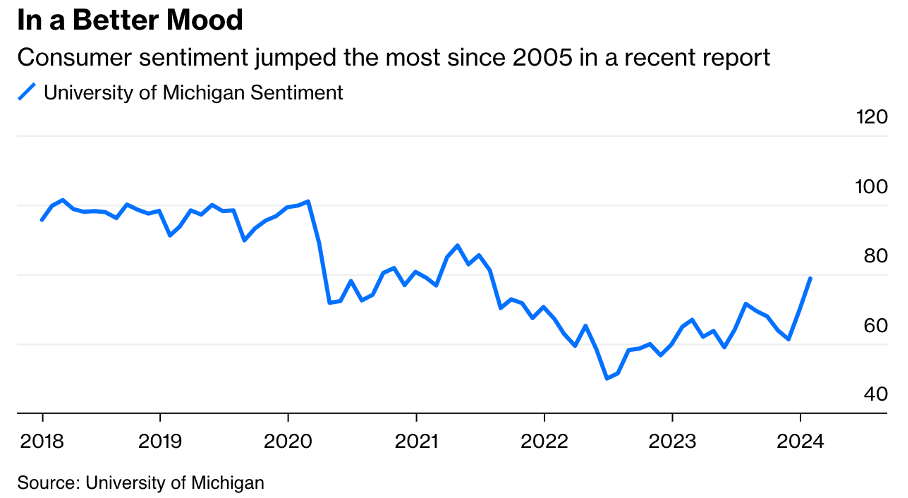

For reference, retail sales came in better than expected last week over the month of December, rising 0.6% month over month, topping the consensus of a 0.4% increase. This indicates that sentiment remains positive, and consumers continue to spend more. On top of this, consumer sentiment jumped to the highest level since July 2021 in December to 78.8 in January, according to The University of Michigan Consumer Sentiment Index, now sitting just 7% below the average since 1978.

Furthermore, the initial jobless claims (from the week ended January 13) once more came in below expectations at 187,000, far below the Dow Jones estimate of 208,000, indicating that the labor market continues to impress with its resiliency—obviously, plenty to drive investor optimism.

A lot of optimism remains priced in, leading to significant downside risk

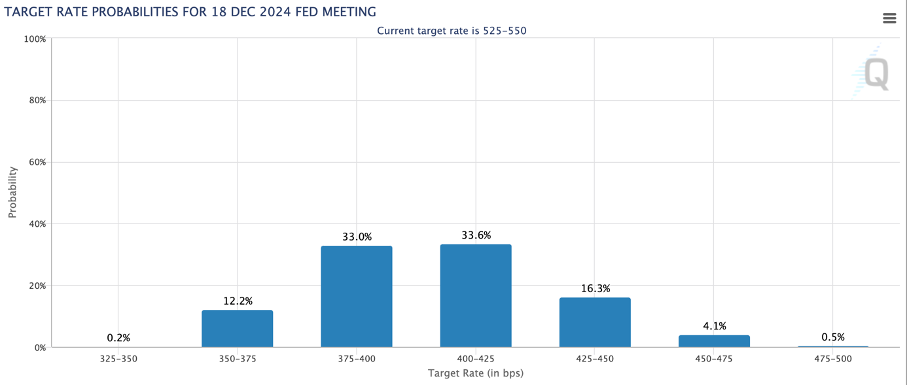

However, while this confirms investor confidence in a resilient labor market, it also might urge the Fed to keep interest rates higher for longer, disappointing investors, even as expectations have eased. Whereas a rate cut was 77% priced in slightly over a week ago, this has now fallen to below 50%, and the market is now counting on U.S. interest rates to remain flat in March as inflation turns out to be stubborn and the labor market incredibly resilient.

At the same time, the market still prices in five or six 25 bps rate cuts this year, which might still be too optimistic. Federal Reserve Governor Christopher Waller indicated that “incoming economic data will drive the timing and number of cuts.” His comments countered the market’s expectations for aggressive easing starting in March and indicated that the Fed officials continue to expect three to four 25 bps cuts to be most likely in 2024, which is 25 to 50 bps less than what the market currently has priced in. Meanwhile, going by the data we have seen so far, nothing points to a more bullish scenario like the one currently priced in by the markets.

Meanwhile, we continue to expect the first rate cuts to be announced in June and a total of four 25 bps cuts throughout 2024. At the same time, Atlanta Federal Reserve President Raphael Bostic indicated that he expects the Fed to start cutting rates by Q3 or in June at the earliest.

JPMorgan Chase CEO Jamie Dimon also indicated some caution in an interview with CNBC. He noted that the U.S. economy could face significant headwinds over the next two years due to financial and geopolitical risks. In his view, “the relatively buoyant stock market of recent months has lulled investors on the potential risks ahead,” an opinion we most definitely share.

We turn more cautious

We believe current optimism is very much unsustainable. As we have indicated in prior articles, we expect significant volatility throughout Q1 and into Q2 as markets and investors will continue to weigh off economic and geopolitical developments.

Simply put, in our view, markets are getting ahead of themselves, and a lot of optimism continues to be priced in, resulting in a market priced for perfection in an environment where perfection is very much a long shot.

We should, of course, also add to this that if inflation does trend down above expectations and the labor market starts softening, there is more room for current optimism, but still, the upside from this point forward is limited with most of this bullish scenario already priced in after the S&P500 has now returned 38% from an October low. Yet, so have analysts’ profit estimates for 2024 and 2025. While the S&P500 is trading at a premium based on TTM profits at a P/E of 20x above the 2017-2019 average of about 17, it trades in line with pre-pandemic averages on a forward P/E basis of 16x, as pointed out by Bloomberg. This shows the market is not as expensive as it might seem.

However, just how much upside or downside is left will heavily depend on macroeconomic data trends, interest rate cuts, and profit levels from S&P500 companies, the magnificent 7 in particular. Therefore, quite some volatility is expected over the remainder of Q1 as investors weigh Q4 results and upcoming macroeconomic data.

We urge investors to invest cautiously and look for value opportunities misunderstood by the market instead of buying technology companies at sky-high valuations to be somewhat isolated from a potential correction. Crucially, we remain net buyers, opening or increasing positions in value opportunities like Nike, FedEx, Apollo Global, Warner Bros, and Delta Air Lines, to name a few value or turnaround opportunities.

Our Top 10 stock picks for week #4

Picking individual stocks is never an easy feat. While we all aim to outperform the market and achieve the highest returns possible, history has proven this to be a hard task. In fact, approximately 90% of retail investors underperform or even lose money in the stock market over the long run.

On top of this, we must also consider that active equity funds and fund managers mostly underperform the global indices as well. Barron’s explained that “over the past 10 years, less than 7% of U.S. active equity funds have beaten the market.” Furthermore, CNBC reported that “almost 80% of active fund managers are falling behind the major indexes.” Clearly, outperforming the markets is no simple task, especially in the current challenging environment with markets trading at all-time highs.

In order to help you find the right stocks at the right time, each week we present to you our weekly Top 10 stock picks, which we believe present the best buying opportunities right now. Of course, we recommend you do your own research into each of these companies before making any investment decisions.

This is our top 10 for week #4:

FedEx -> This company is a real value opportunity right now. From current levels, investors are poised for 22% annual returns. Make sure to read our coverage of FedEx published two weeks ago.

PayPal -> A turnaround story. The company has been completely destroyed by investors, with shares now trading at a ridiculous discount of just 12x this year’s earnings. Meanwhile, the new CEO has promising plans to shift the company’s focus to serving small and medium businesses, potentially giving it a new growth spurt. All things considered, we believe PayPal should be able to grow revenue by high-single digits and EPS by double digits. PayPal is one of our top picks for 2024 and is attractively priced.

Nike -> Nike is often misunderstood by investors, strangely enough. The company is perceived to be a mature company with little growth left. However, we see plenty of growth opportunities for Nike and believe it more than deserves its premium valuation. Following the Q2 sell-off in December, shares are still attractively priced.

Synopsys -> Synopsys is one of the highest quality companies investors can buy in the semiconductor industry, and with shares now down over 20% from ATHs, these are trading below fair value, which does not happen often, making it a top pick before it bounces back up.

Starbucks -> While the company has been facing its fair share of headwinds and might see somewhat lower growth over the next 12 months, we believe this is now fully priced in. With shares trading at just 22x earnings despite the high-teens EPS growth outlook, a 37% discount to its 5-year average, we believe these present a very compelling investment case. A clear opportunity right now.

Infineon -> Infineon has been on our strong buy list for over a year now and continues to present excellent value as one of the best-positioned European semiconductor stocks. The company is incredibly well positioned for strong growth due to its exposure to Automotive and still trades at a discount below 14x this year’s earnings.

NN Group: This insurance company is trading at a low price compared to competitors like ASR. In our view, NN Group is a clear buy opportunity right now following the settlement of a recent dispute. As a result, all downside has been priced into the shares, and these remain an attractive option in the European insurance market.

Warner Bros -> We view Warner Bros as a speculative buy right now. While the company’s financial position or growth outlook is far from impressive, its IP portfolio is arguably worth more than its current share price, making it ripe for a takeover. Otherwise, we believe the current undervaluation should nevertheless result in decent returns of the company continues to successfully execute its strategy.

Delta Air Lines → While we are no fans of the Airlines industry, we believe Delta Air Lines is the superior pick in the industry by a distance, positioning it favorably for long-term growth. Meanwhile, the company is rapidly improving cash flows and continues to be valued at bottom prices. Shares offer significant upside from this point in our view.

Chevron -> We believe Chevron is relatively cheap right now, with analysts expecting a 21% upside. The upside plus the dividend presents a very solid return potential over the next 12 months, especially as oil prices remain high due to the Middle East conflict.

Next week’s most anticipated earnings

As always, we aim to keep you informed on the most notable earnings releases during the week, so stay tuned for our Business Insight articles on Tuesdays and Thursdays.

Thank you for reading this newsletter. Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.