Weekly Insight #4 – Solid Economic Data Spurs (justified?) Optimism

We take a look at last week's most notable economic headlines and what these mean for investors and potential rate cuts by the Federal Reserve

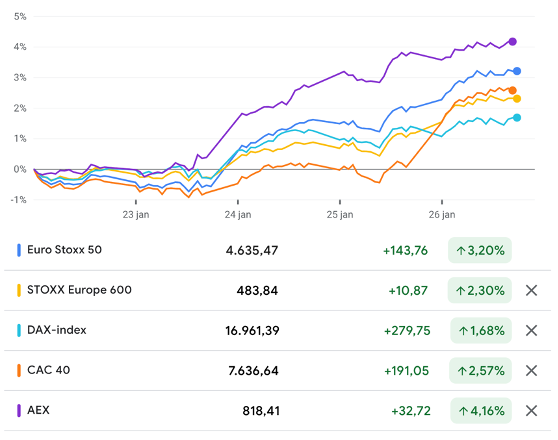

Last week was another solid week for the global stock markets, to say the least. However, this time out, it were the European indices that outperformed. US benchmarks all posted green weeks, with the Dow up ever so slightly and the Nasdaq and S&P500 up closer to 0.5% after posting new all-time highs halfway through the week.

Meanwhile, the major European indices posted incredible gains of multiple percentages, which were helped by great results from European heavyweights ASML and LVMH, jumping over 10% on their blowout earnings. As a result, the Euro Stoxx 50 gained over 3% and the Euro Stoxx 600 closer to 2.5%. However, the real European standout was once again the Dutch AEX, which gained over 4%, driven by the performance of ASML, which has a significant 15% weight in the index.

All in all, it is quite a solid performance, especially considering the headwinds global economies and companies continue to face. Whenever you think there is no more upside, the market finds a reason to put down new all-time highs. It just once more proves that the Mr. market is irrational and, above all, completely unpredictable.

Yet, we will add that our view of the markets remains the same. We continue to view current optimism as overdone and expect the markets to show some volatile reactions on important quarterly results and economic data throughout the remainder of Q1 and into Q2. The broader upside is most likely limited.

At the same time, though, there is room for optimism as economic data from last week points in the right direction, making the likelihood for a 25 bps rate cut as early as May somewhat more likely.

The Commerce Department’s personal consumption expenditures price index for December, which is the most crucial inflation indicator for the Federal Reserve, increased by 0.2% month over month and 2.9% YoY, which is roughly in line with projections from Dow Jones analysts.

The 12-month rate is the lowest since March 2021, down from 3.2% in November. So, what does this mean for the Fed and interest rates?

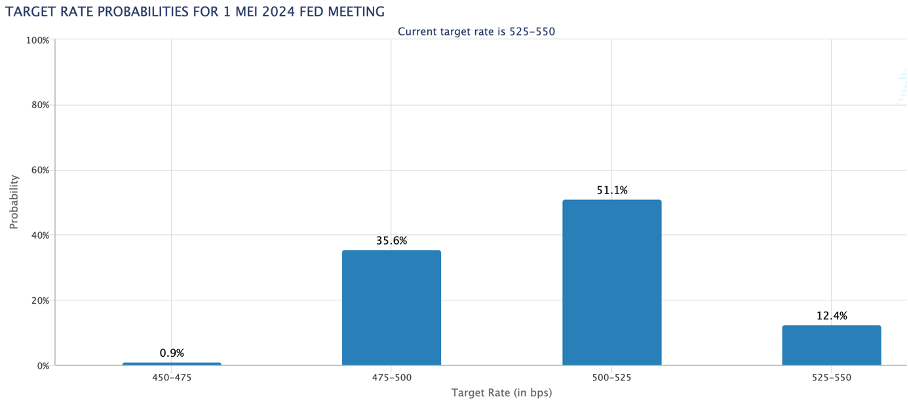

Well, this report confirms that while inflation is certainly sticky and remains elevated, it is trending down progressively and should indicate to the Fed that it can start lowering rates later this year. However, it is no reason to become more bullish than we already were, and a first interest rate cut in June still seems like the most viable option in our eyes.

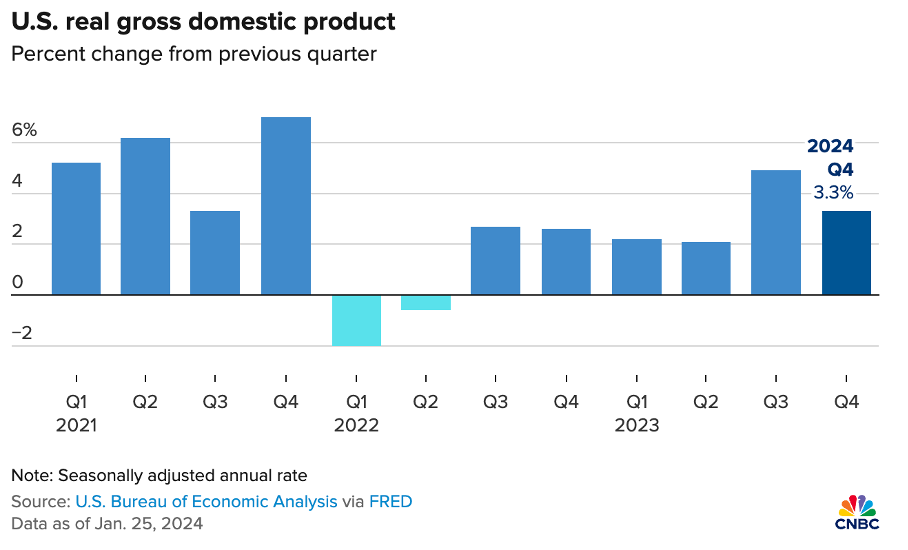

However, there is room for more positivity, as, on Thursday, a report showed that the U.S. economy grew much faster than expected in the final months of 2023, with GPD growing by 3.3% in Q4. This compared favorably to a Wall Street estimate for just 2% growth and is no massive slowdown from the 4.9% reported in Q3.

This highlights that even in the face of high-interest rates, the U.S. economy continues to fire on all cylinders. Meanwhile, inflation is trending down strongly, with the PCE price index rising 2.7%, down from 5.9% a year ago, while the core figure posted a 3.2% increase annually, compared with 5.1% one year ago.

While the markets showed little response to these numbers due to the data being backward-looking and the market being a forward-looking machine, this could bode well for the Fed’s commitment to lower rates. According to the CME Group, the Fed will almost certainly keep rates flat in both the January 31st meeting and the March 20 meeting.

However, the market does still price in a high likelihood for the Fed to announce the first rate cut in May, which might still be slightly too optimistic, though not impossible, looking at these December numbers, assuming inflation data in upcoming months shows solid progress.

Even more positive news for the Fed was the surprising weakness in the labor market, with initial jobless claims data for the week ending Jan. 20 coming in surprisingly high. Initial jobless claims totaled 214,000, up by 25,000 from the prior week and above the Dow Jones estimate of 199,000. For a while now, the Fed has been looking for some softening in the labor market, and while this single week is no real solid indication, this will be what officials are looking for.

Positively, with regard to the tight labor market, tech layoffs ballooned so far in January, with over 23,500 employees laid off from 85 different technology companies, which is massive, as reported by CNBC. That is the highest number since March 2023.

Meanwhile, unsurprisingly, the European Central Bank held rates steady on Wednesday and gave little insight or indication of future rate cuts. It said that recent data had broadly confirmed its previous inflation outlook and that a declining trend in underlying inflation had continued. Like the Federal Reserve, the ECB indicated that its decision-making will be data-driven, fixating on economic data.

As of Thursday morning, markets were pricing in a 62% probability of a rate cut in April, according to LSEG data.

On another positive note, while we pointed out in an earlier Weekly Insight post that the World Bank projects slow economic growth for at least a number of years, Citi analysts expect economic growth to accelerate next year and to return to healthy levels relatively quickly. According to Citi analysts, the U.S. should be able to avoid an economic collapse.

Furthermore, Citi also believes the S&P500 is not as expensive as it seems and blames the rather high valuation of 22x trailing earnings on the magnificent 7, painting a misleading picture. According to its equal-weight calculations, the index is realistically trading closer to 19x earnings, which is not as concerning.

Yes, this sounds a bit like they are looking for the bright spots to stay optimistic, creating their own valuations, but they also make a fair point. While technology and the largest S&P500 stocks are trading at very demanding valuations, most of the companies in the S&P500 aren’t all that expensive compared to historical multiples.

Still, our recommendation remains the same, and we believe investors should shift their focus to value opportunities as opposed to investing in the tech industry at all-time highs and extremely demanding valuations.

Next week’s most anticipated earnings

As always, we aim to keep you informed on the most notable earnings releases during the week, so stay tuned for our Market Insight posts and dedicated earnings reviews.

Thank you for reading this newsletter. Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.