Last week was another solid week for U.S. indices, even as the Fed indicated that it is not looking to lower interest rates anytime soon, about which more in a bit. Nevertheless, the Dow was up 1.2% over the last week, as was the S&P500. The Nasdaq came in slightly lower at just below 1%, with this underperformance the result of the reaction to Fed statements on Wednesday.

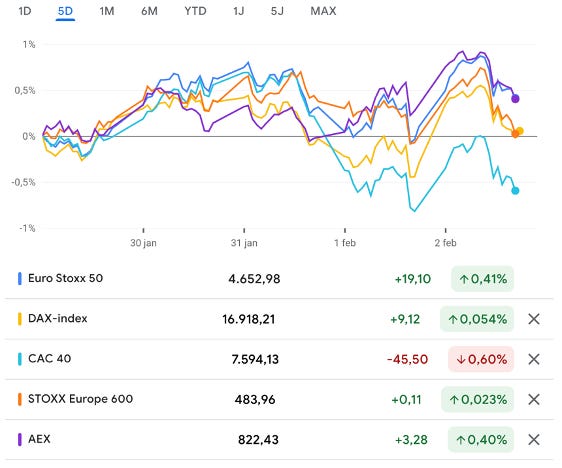

Meanwhile, European indices experienced a slightly more challenging week after the outperformance in the week before, with most benchmarks up between 0.1% and 0.5%.

The end of last week also marked the end of the longest (at least mentally) month of the year – January – and it is safe to say that it was another excellent start to the year. U.S. indices were up strongly over the first month of 2024, with the Dow, S&P500, and Nasdaq up 2.5%, 4.6%, and 5.6%, respectively. Clearly, markets are just continuing their excellent end-of-2023 run into the new year against expectations.

Those who thought there was no upside left in the market, us included, are left surprised. Even in the face of significant headwinds and bad news, the market seems to be unbreakable, fueled by solid economic data and strong corporate Q4 earnings, which largely beat expectations. As a result, markets keep setting new highs, as do plenty of stocks.

However, this led to concerns among UBS strategists, who now believe the coming period might be less fruitful. According to these strategists, an economic slowdown in 2024 is imminent, which makes the current revenue gains and expectations unsustainable. Earnings disappointments are, therefore, quite likely in Q1 and Q2 reports, “largely due to a combination of rising wages and the delayed effects of higher interest rates.”

We believe these are valid concerns. Any way you look at it, markets are getting more and more expensive as stocks and indices set new all-time highs. Meanwhile, economic growth will slow down, and as of now, interest rates are not coming down either. Earnings expectations just can’t keep up, at least not sustainably.

Analysts at JPMorgan also continue to view current valuations and expectations as stretched. The analysts warn that markets might still be pricing in lower than realistic inflation levels by the end of H1 and too many interest rate cuts, something we have been saying since the start of the year. With the current overly optimistic sentiment, now might once more be the time to be careful as retail investors.

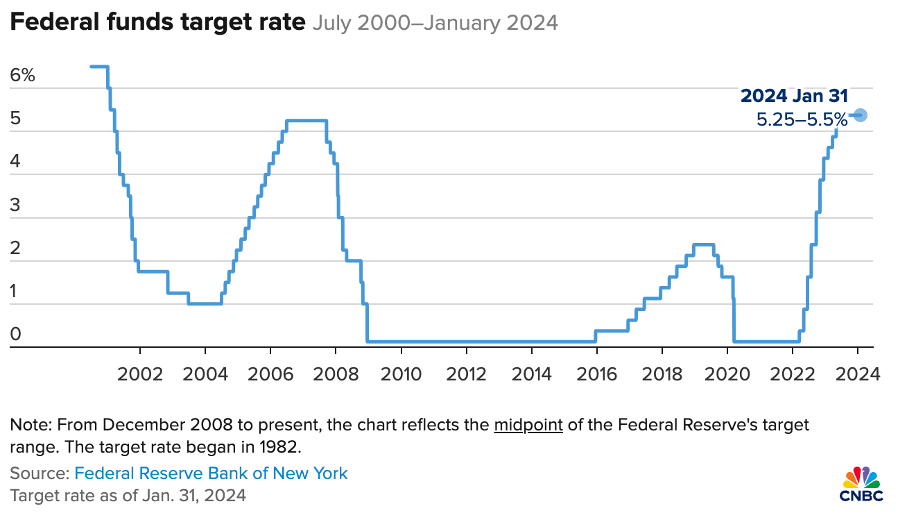

Last Wednesday, we saw what these overly optimistic expectations could mean for the markets as U.S. indices fell by over 1-2% after the Fed indicated that it is not planning on lowering interest rates any time soon. It kept rates flat after its January meeting, which was a unanimous decision. Though, this did not come as a surprise.

However, what surprised the markets more was Jerome Powell’s hawkish stance, indicating that a March rate cut is also unlikely. The Fed stated, "The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2%." With this, it points to a higher for a longer policy.

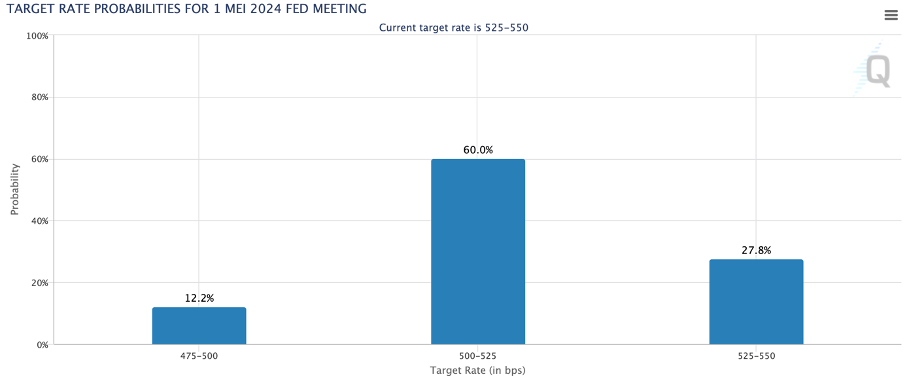

As a result, according to data from CME Group, the market now prices in a 79% likelihood of the Fed keeping interest rates flat in March but announcing a 25 bps cut in May. As we indicated last week, we continue to guide for a first 25 bps rate cut in June as our basic scenario but believe that improving economic data over the next few months could lead to a first cut in May as the most optimistic scenario.

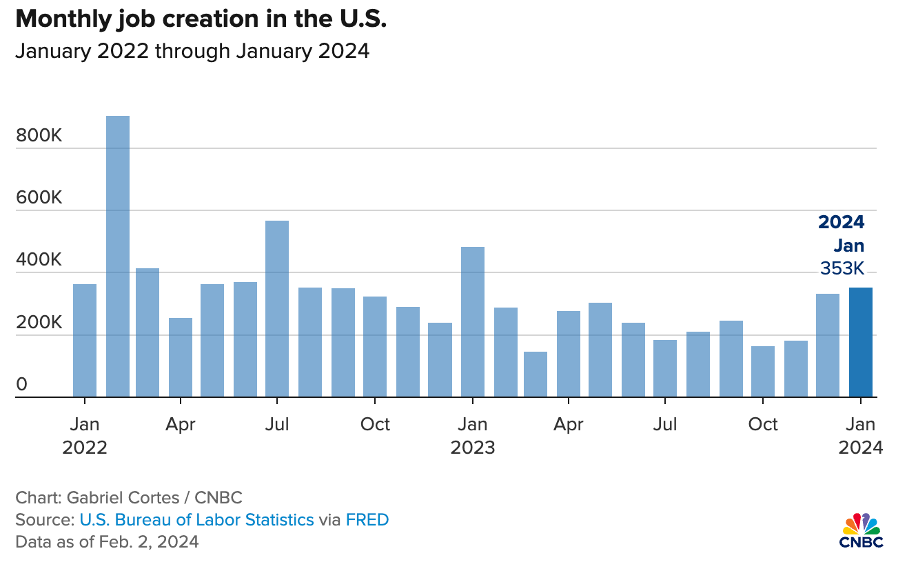

However, making this bullish scenario less likely was the Nonfarm payrolls report that came out on Friday. Nonfarm payrolls expanded by 353,000 in January, much better than the Dow Jones estimate of 185,000. Meanwhile, the unemployment rate held steady at 3.7%, against the estimate of 3.8%. Wages also continue to grow by 0.6%, double the monthly estimate, and grew by 4.5% YoY, far ahead of the 4.1% forecast.

This indicates two things. For one, it reinforced the belief that a soft landing is the most likely scenario and that a recession should be avoided. However, it also strengthens the Fed’s position to keep rates higher for longer as the labor market remains solid, and wage growth could lead to more stubborn inflation levels. According to George Mateyo, chief investment officer at Key Private Bank, “strong job gains combined with faster than expected wage gains may suggest an additional delay in rate cuts for 2024 and should cause some market participants to recalibrate their thinking.”

This further solidifies our belief that a June rate cut is still the most likely scenario. While GDP growth proved resilient at 3.3% in Q4, driven by a strong labor market and resilient consumer spending, we should not get caught up in the positive sentiment and forget inflation remains far above the 2% target.

Furthermore, according to Neal Keane, head of Global Sales Trading at ADSS, “Amid a stellar jobs market, we can expect further upside in bond yields, a stronger dollar, and with the stock market at all times highs, the bar now becomes even higher to maintain upside momentum without the support of imminent rate cuts."

On a more positive note, consumer confidence in the U.S. remained solid in January, reaching 114.8, up from 108 in December but below the 115 consensus. Still, this was the highest reading since December 2021 and reflected the falling inflation, anticipation of lower interest rates, and resilient labor market.

Meanwhile, in other news, the Euro Zone is only narrowly dodging a recession, with GDP growth in Q4 coming in at 0%, somewhat stabilizing after 0.1% growth in Q3. According to analysts at ING, the Euro Zone is entering a phase of prolonged economic weakness, driven by industrial giant Germany, which saw a 0.3% contraction in GDP in Q4.

In a preliminary estimate, the Euro Zone is expected to deliver 0.5% growth over the whole of 2023. Positively, inflation in the Euro Zone eased in January, which aligned with expectations. Headline price increases came in at 2.8%, down from 2.9% in December but still above the 2.4% reported in November due to a wind-down of energy price support measures. Core inflation fell slightly to 3.3% from 3.4% in December, which disappointed slightly as Reuters guided for 3.2%.

As a result, the report was received quite mixed. While the headline inflation is trending down, which is positive for the ECB, the downtrend in core inflation disappoints. According to Kamil Kovar, senior economist at Moody’s Analytics, a cut in June remains the baseline forecast, with a small probability for a cut in April.

Now, neither we nor Wall Street analysts can know for sure where markets are going this year. Financial markets have once more proven to be unpredictable last month. While we believe it is essential to consider all facts and opinions of financial professionals with more insights and data, the direction of the markets and economy remains uncertain.

However, what we can say for sure is that the economy and financial markets will face significant headwinds in 2024, which will present challenges. Furthermore, publicly available economic data tells us a slowdown is imminent and that the Fed might be forced to keep interest rates higher for longer. Ultimately, we continue to believe markets are pricing in an overly optimistic sentiment, which will lead to a correction and increased volatility, potentially once we get to the Q1 and Q2 reporting periods.

While all-time highs in themselves are no reason to be careful, this, in combination with an extremely challenging operating and macroeconomic climate, very much is.

Notable stock news

Citi turns more positive on Volkswagen

Citi analysts have raised their price target on German car manufacturer Volkswagen to $158 as they believe the company has changed. According to Citi, the company’s board and management are working better together, and the new CEO is “making more pragmatic strategic decisions." This should result in better sales and earnings. The analysts now expect the company to grow global volumes by 7-8% in 2024.

LULU tumbles on falling sales data

Lululemon shares are down almost 10% YTD, significantly underperforming the S&P500. A big part of this decline can be attributed to new data from research firm Yipit pointing to a slowdown in growth. According to the firm, growth in January slowed to just 11% YoY. Meanwhile, Q4 results are still expected to come in above expectations.

United Airlines looks to replace Boeing

United Airlines is reportedly discussing replacing United’s Boeing Max-10 orders with Airbus as the company expects Boeing to face certification delays. United Airlines expects 107 aircraft deliveries in 2024, but with 31 of these being Boeing Max-9 planes, the company does not expect to receive these as planned. Furthermore, it also has 277 Max-10 orders outstanding, but CEO Leskinen already stated that the company is working on changing its fleet plan, including lower orders and deliveries from Boeing.

In response to recent incidents, Boeing did not issue any financial guidance for 2024.

Spotify receives a rating upgrade

Spotify received a rating upgrade from UBS as the analysts see the potential for margin expansion and improving financials in the near term.

The analysts believe “efficiency initiatives remain the focus and have increased conviction on sustainable margin expansion and stronger bottom line trends in the coming years. This, coupled with solid sub/MAU growth, a steady cadence of price increases, and advertising growth, should lead to an improved EBITDA trajectory (UBSe ~30% higher than the Street in '24-27E)."

UBS upgraded its rating on Spotify from neutral to buy and boosted the target price to $274 per share, leaving an upside of 23% from Friday’s closing price.

What to expect of Apple’s Vision Pro

Apple launched its Vision Pro headset last Friday, and analysts from Wedbush now expect Apple to ship around 600,000 headsets in 2024, up from an earlier 460,000. This increase is driven by strong pre-order numbers and the growing number of apps available. Wedbush says there are roughly 230 native apps available on the platform today but believes this will grow to over 500 by the summer, which should improve demand.

Based on these estimates from Wedbush and the $3500 starting price, the product is set to bring in over $2.1 billion in revenue for Apple in 2024, which would be a strong start.

Meanwhile, research by CNBC shows that this product could be the future of computing and entertainment. Read the product review here.

Next week’s most anticipated earnings

As always, we aim to keep you informed on the most notable earnings releases during the week, so stay tuned for our Market Insight posts and dedicated earnings reviews.

Thank you for reading this newsletter. Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.