Last week was another solid one for Wall Street as optimism continues to rule and sentiment appears to be unbreakable. Measurements by the American Association of Individual Investors showed that investor optimism remained solid, with 49% of voters in a survey saying they feel optimistic about where the is headed over the next six months.

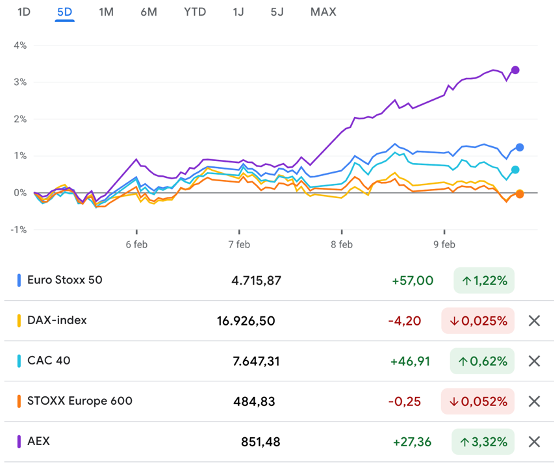

Looking at last week, the Dow was up another 0.5%, followed by the S&P500, up 1.6%, and the Nasdaq, which was up a very solid 2.5%, with the latter one being helped by a solid performance by index heavyweights Amazon and Meta, who delivered excellent Q4 results. Meanwhile, European indices were somewhat more mixed, with the German Dax and Stoxx Europe 600 down marginally, while the Euro Stoxx 50 and tech-heavy AEX were up solidly by 1.2% and 3.3%, respectively.

Overall, not much has changed from last week. In fact, every single week in our weekly insight, we once more conclude that sentiment on Wall Street is unbreakable, even in the face of significant macroeconomic and geopolitical headwinds. Every single week, we conclude that the upside seems limited, that the market is getting ahead of itself, and that optimism rules with too many rate cuts being priced in for 2024.

And yet, in every week that follows, markets are green and reach new all-time highs. So, has anything changed with regard to this over the last week? Well, no. If you are looking for this conclusion, we will save you the time of reading this post. Our opinion remains unchanged, and markets meanwhile continue to set new all-time highs nevertheless.

Though, of course, we will still show you why there is plenty of reason for concern and why some slight pessimism might be warranted by diving into last week’s macroeconomic numbers, commentary, and market performance.

And well, we already touched on last week’s performance by global indices above, but what we haven’t highlighted yet is that the S&P500 finally breached the 5,000 level as it hit a new all-time high. Kim Forrest, Bokeh Capital’s chief investment officer, highlights that these new all-time highs, market gains, and investor optimism are driven by better-than-expected Q4 earnings, solid guidance, and healthy economic growth. All these factors have so far been able to offset the headwinds mentioned before, which is great but, at the same time, also makes this optimism rather sensitive to bad news.

According to Kim Forrest, the rally is “earnings driven, but it’s bleeding over into other companies that may not have announced,” opening up a big chance for disappointments, especially into the next earning reporting periods when an economic growth slowdown could kick in.

We have raised these questions before, but whether current guidance and expectations for an earnings growth acceleration are realistic is highly questionable. This is an issue that JPMorgan analysts also raised.

Analysts from JPMorgan might be the largest bears right now, stating that they expect stocks to fall from a 2024 peak by 20-30%. According to the analysts, markets have now run too far ahead of themselves, already fully pricing in optimistic rate cut scenarios, meaning there is absolutely no upside left over the remainder of 2024.

The analysts highlighted several concerning discrepancies in the market, like an inverted yield curve that sharply contrasts the Wall Street analyst estimates for accelerating earnings growth. This is what they added:

"In our 25-year career, we have seen equity markets behave irrationally before, and these were always times to act with caution as 2 + 2 ALWAYS ends up being 4."

No matter what way you look at it, and even as JMP analysts might be overly bearish, they do make some good points and, like we have been saying over the last couple of weeks, the combination of geopolitical issues, macroeconomic headwinds, and expectations for slower economic growth do not align with current optimism and accelerating earnings growth for the broader market.

While we do not share the view of JPMorgan for significant downside, we agree that, based on these factors, there is not much upside left in the market and that now is the time to act cautiously. While the market can be irrational, it won’t stay this way forever.

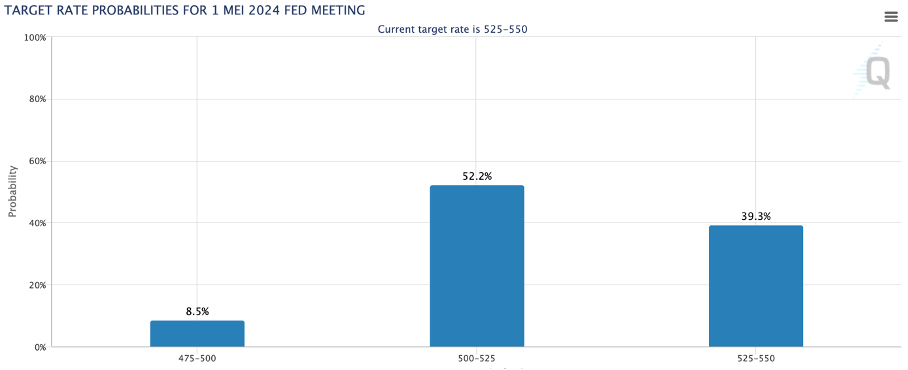

Meanwhile, one of the leading subjects on Wall Street and on investors’ minds remains to be the current U.S. interest rates and the rate cut trajectory from the Fed. Markets currently continue to price in a first rate cut in May as Fed chair Jerome Powell ruled out a cut in March last week. However, this might still be too optimistic.

After keeping rates steady in the prior week, Fed chair Jerome Powell last week once more confirmed that the Fed is not eager to lower rates. According to the chairman, the Fed has room to be careful with lowering rates due to the economy and labor market remaining very resilient.

For reference, on the one hand, lowering rates too early could lead to inflation settling above the 2% target while lowering rates too late could lead to a recession. So, what this very resilient labor market and economy means for the Fed is that it has room to wait for that sweet spot.

As a result, the Fed chair is referring to a higher for longer period as the Fed can afford to wait for inflation to come down closer to the 2% level. Furthermore, Powell said that the Fed remains fully focused on economic data and does still expect to cut rates later this year.

This was confirmed by Boston Federal Reserve President Susan Collins, who claimed that the Fed should start cutting rates later this year as inflation is coming down in line with expectations, which could point to the three rate cuts targeted by the Fed for 2024 still being the most realistic scenario.

However, Minneapolis Fed President Neel Kashkari said that on Wednesday that he also still sees the possibility for fewer than three rate cuts in 2024 as the labor market remains solid and inflation could turn out to be sticky.

Later on Thursday, Richmond Federal Reserve President Tom Barkin said that the Fed will need to build confidence before starting the process of interest-rate cuts as a tight labor market remains a threat. With this, he again indicates that a rate cut in May or even June isn’t a certainty.

Based on these comments and recent macroeconomic data, we remain of the opinion that markets continue to price in too much optimism, with a May rate cut priced in for 52% and data from CME Group pointing to traders currently pricing in 125 bps in rate cuts throughout 2024, which is much higher than the 75 bps the Fed guided for earlier.

In our view, too much optimism continues to be priced in, and based on recent comments, no more than 3-4 25 bps rate cuts seem to be the most likely scenario. Therefore, we continue to expect a first cut in June and 75-100 bps in cuts in 2024, which is based on comments from Fed officials and the most recent macroeconomic data.

On the note of macroeconomic data, while there was little data released last week, we do always have the weekly U.S. Jobless report, and these once again came in lower than expected at 218k, down 9k from the previous week and below the 222k consensus. This points to strength in the underlying labor market in the face of record layoffs.

There was also some positive and surprising news last week with regard to U.S. inflation as the government released some revised statistics on Friday, which showed that the broad basket of goods and services measured increased 0.2% in December compared to the earlier reported 0.3%. Now, while this is in no way a massive difference, it does once more confirm that inflation is trending down, which will support rate cuts by the Fed.

Crucially, the most important indicator for the Fed - the so-called core CPI – was still up 0.3% in December, in line with prior reports. Nevertheless, this is also actually good news as Paul Ashworth, chief North American economist at Capital Economics, wrote that “Since some Fed officials were apparently worried about a repeat of last year — when the revision pushed up the monthly changes in core prices in the final few months of last year — the lack of any meaningful change this year, at the margin at least, supports an earlier May rate cut.”

Ultimately, we urge you, our readers, and other retail investors to act cautiously in this heated market. While optimism rules on Wall Street right now, this can easily be broken. While we believe all-time highs in themselves are no reason for concern, all-time highs in the face of above-average headwinds from geopolitics, an economic slowdown, and high interest rates definitely are.

Next week’s most anticipated earnings

As always, we aim to keep you informed on the most notable earnings releases during the week, so stay tuned for our stock coverage posts and dedicated earnings reviews.

Thank you for reading this newsletter. Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.