Last week was definitely another exciting one, primarily due to the sheer wave of opinions, revised S&P500 end-of-2024 predictions, and warnings given by Wall Street analysts.

Bears have plenty to fall back on in the face of significant headwinds, including slowing economic growth, sticky inflation, and geopolitical tensions at a decade-high. However, with interest rates bound to be cut later this year, AI massively boosting earnings growth, and the labor market remaining solid, bulls are still very much here. As a result, discussions are heating up on whether this rally has gone on for too long or if there is still more to come…

First looking at the here and now, the S&P500 ended last week with a 0.8% gain, while the Nasdaq gained 1.6%. The Dow underperformed, ending the week down 0.3%. In Europe, the performance was rather boring, with most markets ending the week roughly flat. Only the German DAX 30 excelled by gaining close to 2% last week. Overall, it was another steady weak without significant catalysts.

What does jump out so far this year is the fact that European equities have outperformed U.S. equities. While the S&P500 and Nasdaq are up a solid 7% and 7.5%, respectively, the Stoxx 50 is up 8.5% this year. However, the performance of the Stoxx 50 so far this year was helped by several heavyweight outperformers like LVMH and ASML.

Ultimately, markets on both continents have done exceptionally well this year, performing far ahead of expectations, driven by the AI boom, the promise of interest rate cuts in 2024, easing inflation, and excellent corporate Q4 results reported so far. Investor sentiment is excellent, with short interest even hitting a decade-low. Everything looks great for investors!

And yet, we remain bearish, and we are getting more so by the week as markets keep putting down new all-time highs. We view the current valuations and market performance as unsustainable and keep urging investors to act carefully, not to buy into unsustainable sentiment and optimistic analyst projections.

Again, We will reiterate that there is still plenty of reason for concern, with markets facing significant headwinds and investors pricing in opportunistic (goldilocks) scenarios. The market is heated, and we believe we are in for a correction soon.

To support this view, Goldman Sachs CEO David Solomon said last week that markets are failing the price in the incredible uncertainty we are facing, something we have been writing pretty much every week – consider geopolitics, sticky inflation, decade high-interest rates, slowing economic growth… does the simple promise of interest rate cuts sometime this year, and the AI boom really offset all of that? We highly doubt it.

For reference, according to John Williams, the president of the Federal Reserve Bank of New York, U.S. GDP growth should continue to slow down over the next couple of quarters as the Fed maintains a relatively restrictive policy. He expects GDP growth to slow down to 1.5% this year and unemployment to peak at 4%. Meanwhile, GDP growth in Q4 was revised to 3.2% from a previous 3.3% and a 3.3% consensus. Overall, the revision isn’t overly meaningful, and GDP growth still slowed from 4.9% in Q3.

Furthermore, Goldman Sachs CEO David Solomon is (even) still uncertain whether the U.S. economy will avoid a recession, something that the market is pricing in with a lot of confidence. Also, JPMorgan CEO Jamie Dimon said last week that he sees a better-than-even chance that the U.S. is heading for a recession. Again, the CEO believes that markets still aren’t properly pricing in the strong probability that interest rates will remain higher for longer, even as markets now price in a first rate cut as late as June or July and three this year, half of what was expected at the start of the year.

Simply put, the JPMorgan CEO believes markets are pricing in a too high probability of the U.S. economy avoiding a recession – markets are pricing in too much optimism. He said the following:

“The market is kind of pricing in a soft landing. That may very well happen. But the [market’s] odds are 70 to 80 percent. I’ll give you half that, that’s all.”

Yeah… leading Wall Street CEOs aren’t all that optimistic at this point. Evercore analysts are also not at all optimistic and have so far maintained their end-of-year S&P500 prediction of 4,750, even as we have already breached the 5,100 level. The analyst points out that we have now seen four months of gains, with 15 out of 17 weeks ending in the green. According to the analysts, “[These are] the kinds of things that you haven’t seen more than once or twice in an investing life’s time.” Just take that in for a second… we are experiencing unique conditions right now.

Evercore points out that it is about time to catch a breath and realize that a lot of good news is now baked into the markets, an opinion we share. Notably, short interest at a decade-low in the face of significant headwinds clearly indicates that the market is experiencing FOMO (fear of missing out). This momentum we are seeing now is, therefore, most likely unsustainable and not here to stay for the entirety of 2024.

Sevens Market Research added that any “bad” news at this time, with markets trading at incredibly intense valuations and driven by positive momentum, can easily result in a 10% drop. According to the analysts, the current rally has gone far beyond the actual improvement in fundamentals. With the S&P500 trading at 22x earnings, it seems priced for perfection. Honestly, there is no way the positives outweigh the negatives right now.

The analysts and economists at JPMorgan share this bearish view, noting that while investor sentiment is predominantly bullish right now, pricing in a goldilocks scenario, this could rapidly change. Economists at JPMorgan believe we are in for stickier inflation numbers fueled by “too lenient financial environments, strong labor markets, and generous government spending policies,” something we very much agree with.

According to the JPMorgan strategists, this could result in a significant shift in asset allocation in global equity markets. Meanwhile, they believe there is no upside related to U.S. elections, “as the outcome is either status quo or increased uncertainty related to global trade and geopolitical/domestic tension,” the strategists added.

However, we should point out that not all big banks and Wall Street analysts have a bearish view, as Bank of America analysts don’t quite share this opinion. Analysts see the S&P500 push to above 5,400-5,600 this year. They point to historical data, which indicates that in 80% of the years when January and February were green, the market ended the year positively with an average return of 13.8%. Moreover, when this occurred in an election year, the market ended the year up 10 out of 11 times and averaged an annual return of over 14%. All in all, this points to a pretty bullish scenario, although we do not rate this data very highly.

Bank of America analysts added that we could see a tactical pullback in upcoming months, as some investors and traders might be urged to take some profits in overbought securities, potentially to the 4,800-4,600 level. In addition to this, due to the elections, analysts expect quite some volatility in the next few months before entering a “nice summer rally.”

Analysts from Barclays also upped their S&P500 price target, accounting for the rally in the first two months. The analysts believe that if Big Tech extends its beat-and-raise streak from Q1 and we have seen a bottom in negative revisions for S&P500 companies, something which is very much unlikely, the S&P500 could end the year at over 6,050. As for the bear case, the analysts argue that if Big Tech begins to fall short and the macro backdrop softens, the index could fall to 3,500. As a result, Barclays has now set its price target at 4,300, offering a couple more percentages of upside.

Clearly, there are plenty of bull and bear cases to be found on Wall Street.

Meanwhile, one of the leading reasons for our concern and bearish view on the market right now remains the priced-in rate cut expectation, which we believe might still be too bullish, considering recent inflation data. Looking at all the macroeconomic data that we have seen over recent weeks, we are getting increasingly more concerned about the downtrend in inflation levels and believe that we could be in for stickier-than-expected inflation numbers in coming months, which could urge the Fed to postpone its first rate cut to July or September, something that is looking increasingly more likely.

According to the most recent “inflation” report, which came out last week, “the personal consumption expenditures price index excluding food and energy costs increased 0.4% for the month and 2.8% from a year ago,” as reported by CNBC. This was in line with expectations from Dow Jones analysts but not much of an improvement from December when the monthly gain was just 0.1% and 2.9% from the year prior.

Furthermore, headline PCE was up 0.3% monthly and 2.4% on a 12-month basis. This slightly disappointing performance in January resulted from an unexpected jump in personal income, which was up 1% against the expectation for a 0.3% gain. According to economists at Societe Generale, “[the report] is meeting the expectations, and some of the worst fears in the market weren’t met.” As a result, markets were mostly unchanged following the report.

In other interest rates-related news last week, Federal Reserve Bank of New York President John Williams once more confirmed on Thursday that he expects interest rates to be cut later this year, although he did not give any sort of timeframe. He did add that the Fed sees no urgency to bring down rates, once more confirming that we will most likely have to wait for a first cut until the second half of the year. Meanwhile, Atlanta Fed President Raphael Bostic gave some more clarity, stating that a cut in the summer seems likely.

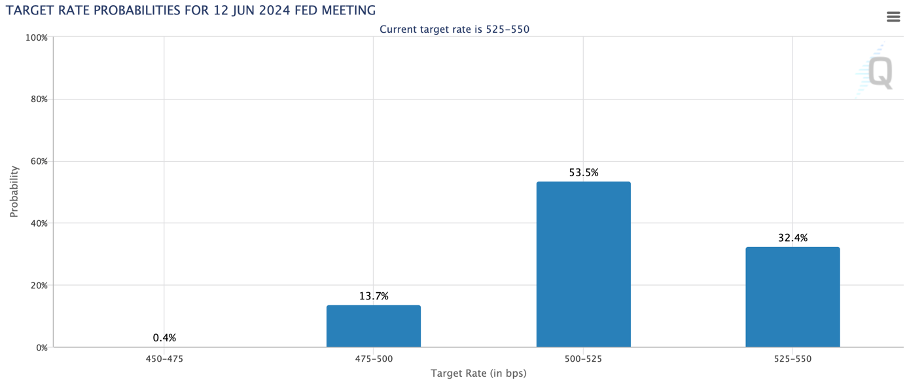

Meanwhile, according to data from CME Group, expectations by the market remain similar to last week, with a rate cut in March and May pretty much entirely out of the question and the market pricing in a 53% likelihood of a first 25 bps rate cut in June.

However, throwing some oil on the fire and creating some additional uncertainty, Randy Kroszner, University of Chicago’s Booth School of Business economics professor, said last week that a June cut is far from a certainty. The professor and former Fed official states that while inflation is coming down, we could see a flattening in the downtrend in upcoming months, mainly due to wages not moving down as rapidly.

As a result, Kroszner believes the Fed will need more signs of a weakening labor market before cutting rates, which could push a first 25 bps rate cut to July or September. Still, the former Fed official believes three rate cuts are still a realistic scenario to price in.

Taking into consideration the latest bunch of data, we can only agree with the former Fed official. Earlier, we viewed June as the most likely moment for a first 25 bps rate cut, but as inflation isn’t trending down as strongly and data keeps coming in hotter-than-expected, we are not so sure any longer.

We now believe June is the most optimistic scenario, requiring positive inflation trends over the next few months. However, it seems increasingly likely that inflation will turn out to be stickier than expected due to a very resilient labor market and growing wages. As a result, we are starting to view a first cut in July or even September as more likely by the day and aren’t even sure we’ll get to see 75 bps worth of cuts in 2024.

Again, this depends on inflation and labor market data over the next few months, so everything is on the table for now. However, we believe markets are still slightly too optimistic at this point, which could lead to some disappointments in upcoming months, resulting in increased volatility and downside.

Meanwhile, in Europe, inflation has also proven to be more sticky than anticipated. The latest number over February came in at 2.6%, which is down but above expectations with a consensus of 2.5%. Core inflation, an even more important benchmark for the European Central Bank, came in even more resilient at 3.1%, compared to a 2.9% consensus.

Clearly, inflation in Europe isn’t coming down as quickly as ECB officials would have hoped, which could make an expected June rate cut unrealistic.

All things considered, we remain net sellers in this market and keep looking for value opportunities and misunderstood companies lacking peer performance. Ultimately, we continue to urge caution – this is a true “be fearful when others are greedy” situation in our view.

In other news…

Boeing’s push for quality improvement is deemed insufficient by the FAA

Boeing has struggled with reliability and its quality control over recent years, highlighted by the Alaska Air incident earlier this year when a door plug blew out mid-flight. This has led to several regulatory headwinds for Boeing, with the most recent being an independent report from the FAA confirming that “there were gaps between Boeing’s stated goals to improve quality and making sure that workers understood how safety culture applied to their work.”

Simply put, Boeing still does not have its quality control in order, which is an issue that should have been resolved after the Boeing Max-8 incidents back in 2018 and 2019, which led to the death of hundreds of passengers.

The FAA has now given the plane maker a 90-day deadline to fix the “systemic” deficiencies with quality control. According to the FAA, “Making foundational change will require a sustained effort from Boeing’s leadership, and we are going to hold them accountable every step of the way, with mutually understood milestones and expectations.”

The general expectation on Wall Street is for Boeing to keep facing significant regulatory hurdles in upcoming years, which will be a drag on manufacturing expansion, the approval process of new aircraft, and the overall manufacturing output.

Boeing has already told suppliers that it will be delaying plans for a supply chain ramp-up for its 737 jetliners as a result of this scrutiny. While production should be raised from 38 to 42 per month from February, this has now been pushed out to June, meaning a production boost to 47 jets per month will be postponed to January from August.

One thing is certain: Boeing isn’t out of the woods yet, and these recent incidents will have a long-lasting impact on financials and growth.

Microsoft’s ad opportunity is massive

According to Barclays, Microsoft’s investments in its advertising business over recent years could give it a potential $50 billion opportunity. The company is now integrating its generative AI features in this part of the business, and with Google increasingly facing antitrust concerns, particularly in Europe, Microsoft is exceptionally well positioned to compete.

As a result, Barclays analysts believe advertising could become a massive cash generator for Microsoft.

Snowflake stock tumbles

Snowflake shares fell by over 20% last week in a single day as the cloud giant announced its CEO is stepping down and issued weak guidance for its fiscal 2025.

Snowflake’s Chief Executive Frank Slootman is retiring effective immediately. While this came unexpected to many, Citigroup analysts argue that it doesn’t come as a total surprise, given that reports have said he was looking to step down. Still, this negative surprised investors.

On top of this, the company guided for a weak first quarter of its fiscal FY25 and points to only 22% growth in the entirety of the year, well below the reported 38% growth in fiscal 2024. Also, the adjusted operating margin is expected to decline by 200 bps YoY to just 6% as a result of rising costs amid a growth slowdown.

While this certainly does not sound good, such a slowdown in growth should not come as a surprise to investors. The operating environment for these companies is getting tougher by the day, and due to tight IT spending, 2024 will likely be a tough year.

However, we expect a growth recovery in 2025 and 2026. On top of this, management’s fiscal FY25 guidance seems quite conservative, so we do believe that the recent share price drop could end up being an extremely favorable entry point for investors with a long time horizon.

Dell shares put down the best day in six years

Dell just put down the best day since it went public again in 2018, gaining a staggering 31% on Friday after the company reported quarterly results and was bullish on its potential gains from AI.

Dell reported revenue of $22.32 billion, which was still down 11% YoY. However, net income surged by 89% YoY to $1.16 billion. Yet, this wasn’t the highlight, as investors got really excited from management’s commentary on the robust demand it sees for its AI servers. According to Morgan Stanley analysts, “AI server commentary stole the show,” as Dell is massively benefitting from the booming demand for AI through its on-premises server offering and partnership with Nvidia.

On top of this, the company also boosted its dividend by 20%, further fueling investor enthusiasm for the shares, which are now up a staggering 200% over the last year and 230% since we first publicly rated these a “Buy” back in November 2022.

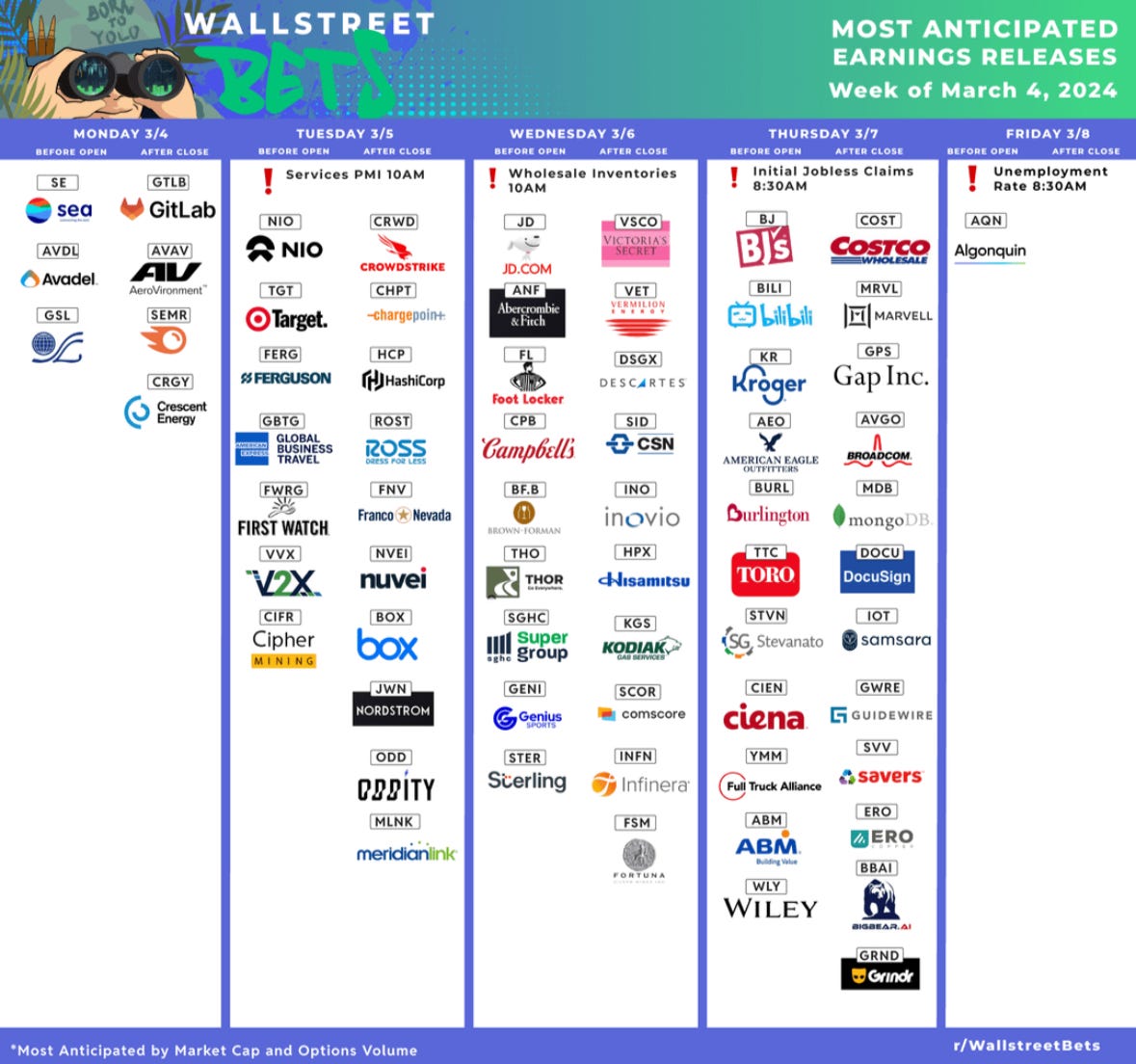

Next week’s most anticipated earnings

As always, we aim to keep you informed on the most notable earnings releases during the week, so stay tuned for our stock coverage posts and dedicated earnings reviews.

Thank you for reading this newsletter. Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Please make sure to like, restack, and share this post to increase our reach and support our work. Thank you!

Not subscribed yet? What are you waiting for?!

Disclosure: No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Completely agree re markets being on the edge. It's just this AI revolution is something we've never seen before, and likely something we may never see again in the markets. It's almost impossible to predict what's going to happen. I mean $SMCI is up 17% today...