Welcome to Rijnberk InvestInsights - This is what you can expect from us and 2024!

In this first-ever post, we introduce our new platform and shortly look forward to 2024 - Of course, we wish all of you a happy 2024!

Before we get into anything, we first want to recommend subscribing to this platform. For now, InvestInsights is entirely free of cost and without any obligations, so really… what do you have to lose?

To make this easy, you can use the button below! Also, make sure to share us with your friends - everybody likes some completely free content, right? There you go… another button;)

First of all, who are we, and what do we offer?

With an incredible passion for the financial markets, with all its highs and lows, as well as a deep interest in economic trends and business developments, we (Daan Rijnberk and Luuk Rijnberk) share our vision, opinion and factual research here on Rijnberk InvestInsights to keep investors updated and support well-informed investing. We are both the founders and operators of this platform.

Together, we have over a decade of investing experience, including both bull and bear markets. We are committed to using this experience and knowledge to provide investors with all the information they need to make well-informed investing decisions while always aiming for the highest possible returns.

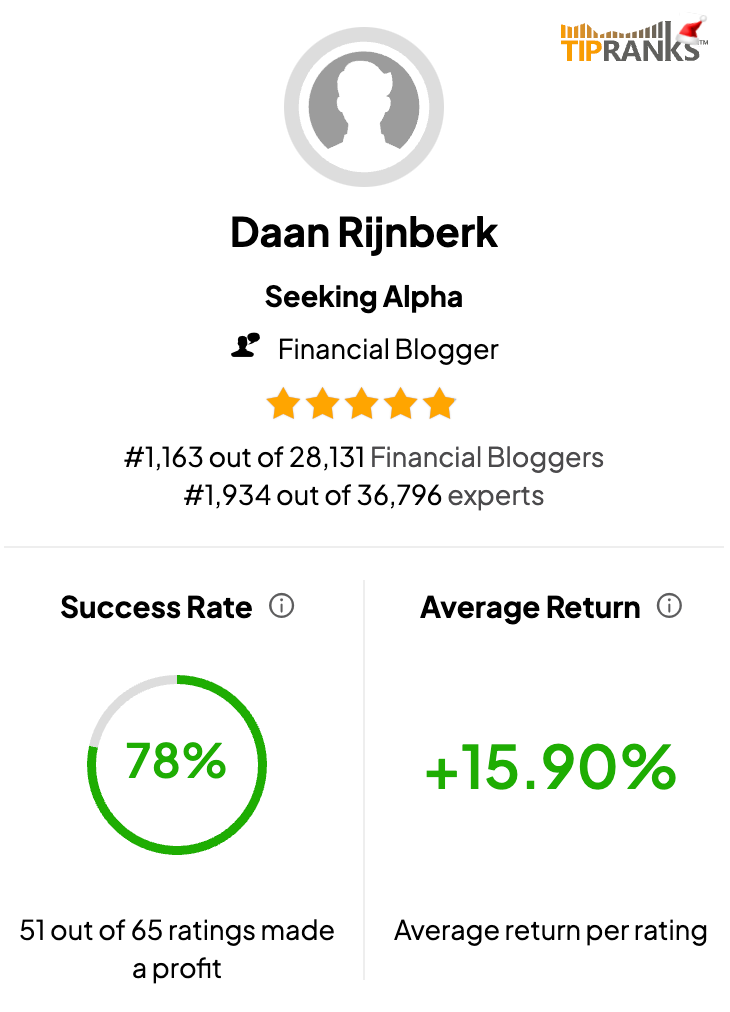

While we do not claim to be established names in the world of finance and investing in any way, we do have a strong public track record of recommendations. At the time of writing, Daan Rijnberk’s work on Seeking Alpha has earned him a place in the top 5% of TipRanks' financial analyst ranking with average annual returns of 15.9% and a success percentage of 78%.

Following our buy recommendations on Seeking Alpha in the calendar year 2023 alone would have resulted in the following returns, among many others.

Start of the year calls:

Nvidia Corporation (NVDA) → +241%

Uber (UBER) → +125%

Crowdstrike (CRWD) → + 87%

Broadcom (AVGO) → +76%

Microsoft (MSFT) → +52%

Lululemon (LULU) → +50%

Recommendations made after June 1st:

Dell (DELL) → +43%

Qualcomm (QCOM) → +29%

Philips (PHG) → +28%

American Express (AXP) → +25%

ASML (ASML) → +25%

1. Why did we decide to start InvestInsights, and why now?

The reason for starting this platform is quite simple: we wanted to offer more to the investment community and are determined to make Wall Street insights available to everyone without spending hundreds of dollars annually.

It is no secret that the financial markets are a complicated and fast-moving machine, involving many aspects. Understanding all these dynamics and following all developments is a challenging task, even for the most hardened analysts on Wall Street, let alone individual retail investors. Moreover, high-quality information and news hardly ever come cheap.

At Rijnberk InvestInsights, we aim to provide a platform and content that allows every investor or analyst to stay updated on the most notable market, economic, and company-specific developments, all in one place and through one weekly read. In addition, we also provide high-quality, comprehensive research reports on individual stocks or industries to give investors all they need to make well-informed investment decisions through premium insights.

Meanwhile, no expensive subscriptions are needed to receive all this information conveniently in your email, as InvestInsights is completely free for the time being, and we do not intend to charge investors multiple hundreds of dollars or euros a year anywhere in the future. We want to make Wall Street quality content, news, and research available to everyone, affordably.

Note that we are not here to offer you financial advice. We simply want to provide our subscribers with all the information they need to make the best investment decisions by staying informed and receiving detailed reports on individual stocks and industries.

2. Why should you subscribe, and what can you expect?

Investors can expect, on a weekly basis, a maximum of 5 posts, including:

One weekly newsletter every Monday containing all investors need to know from the prior trading week.

Two or three important news updates during the week (this can range from crucial stock movements or earnings updates to other investing tips or tricks)

Minimal of one or two comprehensive Wall Street quality equity research reports of individual stocks and/or industries published on Wednesdays and/or Saturdays.

In more detail:

Discover the power of informed investing with our free weekly market updates, offering a snapshot of key market and economic developments, analyses of these developments, as well as some of the most exciting news items of the last week. Our weekly newsletter also contains the most notable company-specific news from markets worldwide and the possible implications these have for investors. This ranges from IPOs, bankruptcy, and acquisitions to earnings or other notable news items that can impact a stock or industry.

This also includes any transactions we have personally made and our top 10 stock picks at the moment to maintain full transparency and offer even more insights.

Simply put, we aim to report everything investors might want or need to know and break this down into understandable and actionable matters.

And that's just the beginning – dive deeper into the world of finance and investments with our in-depth stock reports. We publish a minimum of one or two in-depth research reports every week on individual stocks and/or industries, including detailed financial projections, company details, financial analyses, and fair value price targets, presenting a full investment case and company overview. These reports provide investors with all the information to determine whether the company is a match for their investment portfolio and strategy (or could be shorted).

(Disclaimer: No investment advice is provided, and all information is for informative purposes only.)

3. For who is InvestInsights?

Rijnberk InvestInsights is a platform for everyone, whether focused on European, U.S., or Asian markets, yield-seeking investors, dividend growth investors, or growth-oriented investors; we aim to offer value for everyone and all investment strategies.

Furthermore, we believe that financial knowledge should be open to all, and our commitment is to simplify the intricacies of investing. Whether you're a seasoned pro or just starting, our content is crafted to be easily understood by everyone.

Thoughts and predictions for 2024

2023 was outstanding for (most) investors.

Before we get into the 2024 projections and predictions, it is worth highlighting the success investors experienced in 2023. It has turned out to be an incredible year.

The Nasdaq 100 was up 44.5%.

The S&P500 was up almost 25%.

The Dow Jones was up almost 14%.

The same can also be said for the largest European markets, with 2023 turning out to be one of Europe's best years in recent history.

The Euro STOXX 50 was up over 17%.

The STOXX Europe 600 was up close to 12%.

The DAX (German index) was up over 19% - its best year since 2019.

It is safe to say that European and U.S. stock markets delivered an excellent performance in 2023, making up many of the 2022 losses, even as inflation remains persistent, economies falter, and interest rates are at their highest levels in many, many years.

But 2023 is now behind us, and it is time to shift our focus to 2024. So, what can we expect from the markets this year… another move to new highs, or will the struggling economy, threat of a recession, and possibly more hawkish central banks throw a spanner into the works?

Shifting our focus to 2024

While I am very much against predictions, as the financial markets have proven to be an unpredictable machine, there is still some value in looking at the forecasts of leading financial institutions and their reasoning. Ultimately, these big banks and funds have the most significant supply of information and, as a result, the greatest insight into the financial markets and economic developments.

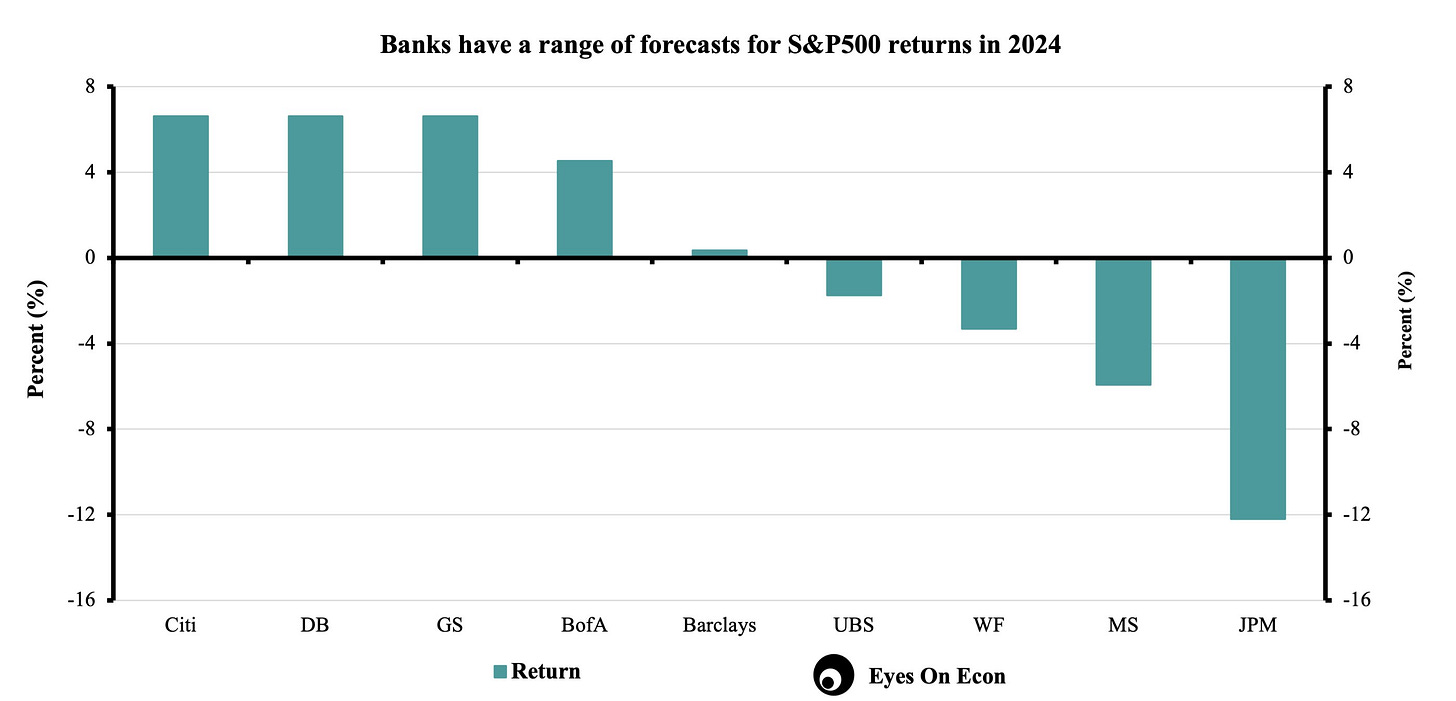

According to Wall Street’s largest financial institutions, the picture is somewhat mixed, with S&P500 projections falling within a range of a 7% increase and a 12% decline for the world's most important benchmark. Surely not the most optimistic predictions right there.

Somewhat more positively, according to Investor’s Business Daily, their data derived from a larger number of Wall Street banks points to the expectation of 8%-9% gains, only slightly under the index's historical average of about 10%.

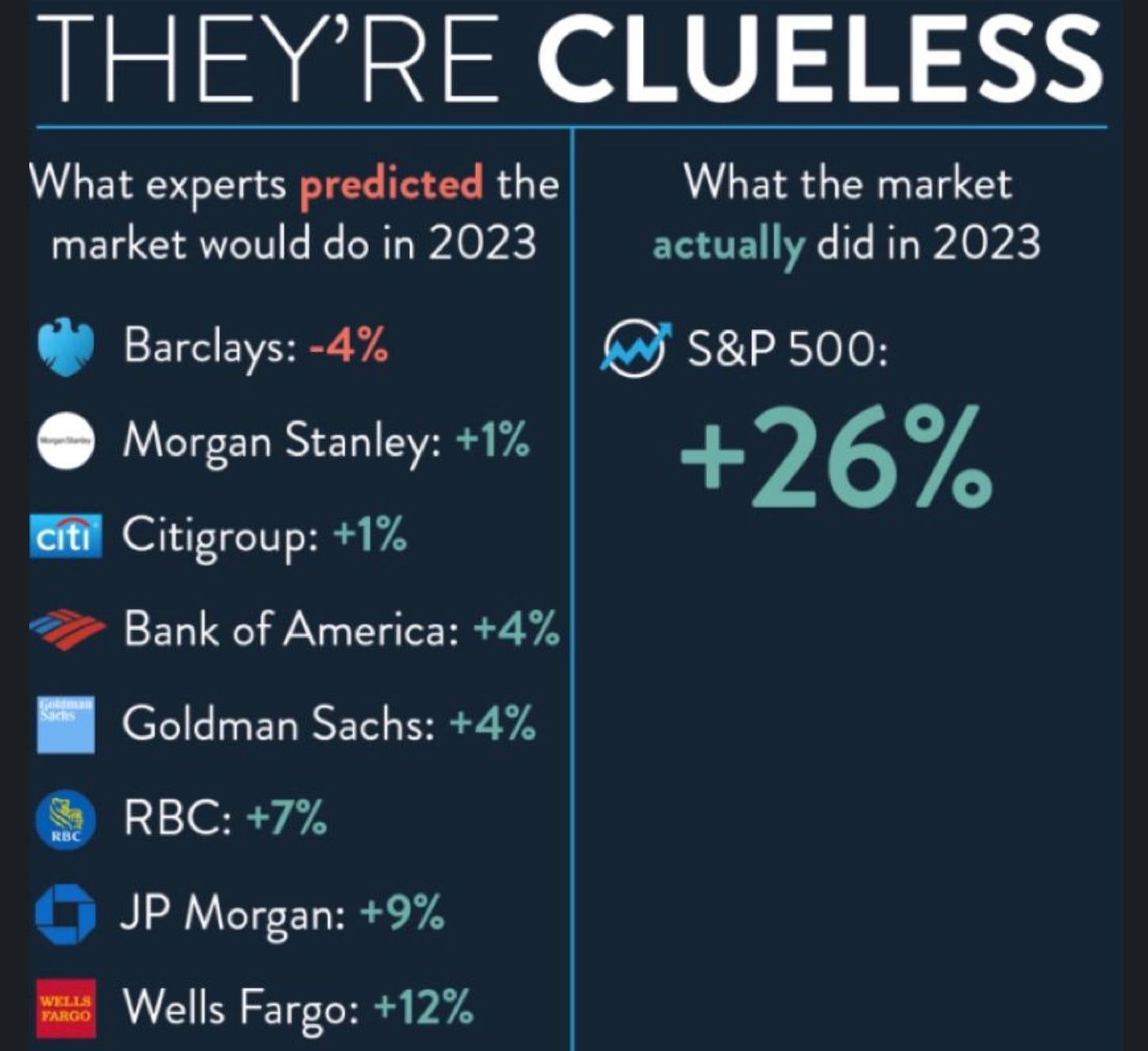

However, it is also worth noting that these Big Bank projections are rarely a great indicator of actual market performance. Just look at the S&P500 predictions from leading Wall Street banks at the start of 2023 - not a single one was even close to the gains made.

Source: https://www.linkedin.com/in/thomas-laureys-5a3b6b153/

Even if we give these banks a break and look at their predictions as of June 1, halfway through the year, not a single one was really close.

Goldman Sachs: 4,500

Deutsche Bank: 4,500

Bank of America: 4,300

JP Morgan: 4,200

UBS: 3,900

Barclays: 3,725

Therefore, don’t award too much value to these projections - they are not a reason to make moves. Much more interesting are their underlying motives for these projections and recent economic developments.

Most importantly, in our eyes, investors should not try to time the market (unless they are active traders). Just as these leading institutions cannot predict market moves despite all their intel, timing the market is an impossible feat, and missing out on 30 days of trading can make a huge difference in your long-term returns. Just stay put and manage your funds wisely. Only a few of us will be successful traders, so focus on staying invested in the right funds and remember: most of the time, doing absolutely nothing in difficult moments is more important than doing something in the great times.

Morningstar explains why that is right here.

In addition, with the market proving to be hard to predict, make sure to stay updated on all financial, economic, and company-specific developments throughout the year. In case this is not clear yet, one way to stay updated is by subscribing to Rijnberk InvestInsights!

So, what can we really expect from 2024, and what factors are at play?

Whereas many of Wall Street’s largest banks were unable to predict the S&P500’s rally in 2023, one financial institution was more bullish than most and quite accurately predicted the S&P500 gains. Fundstrat Global Advisors actually predicted the S&P to reach 4,750, which is surprisingly accurate.

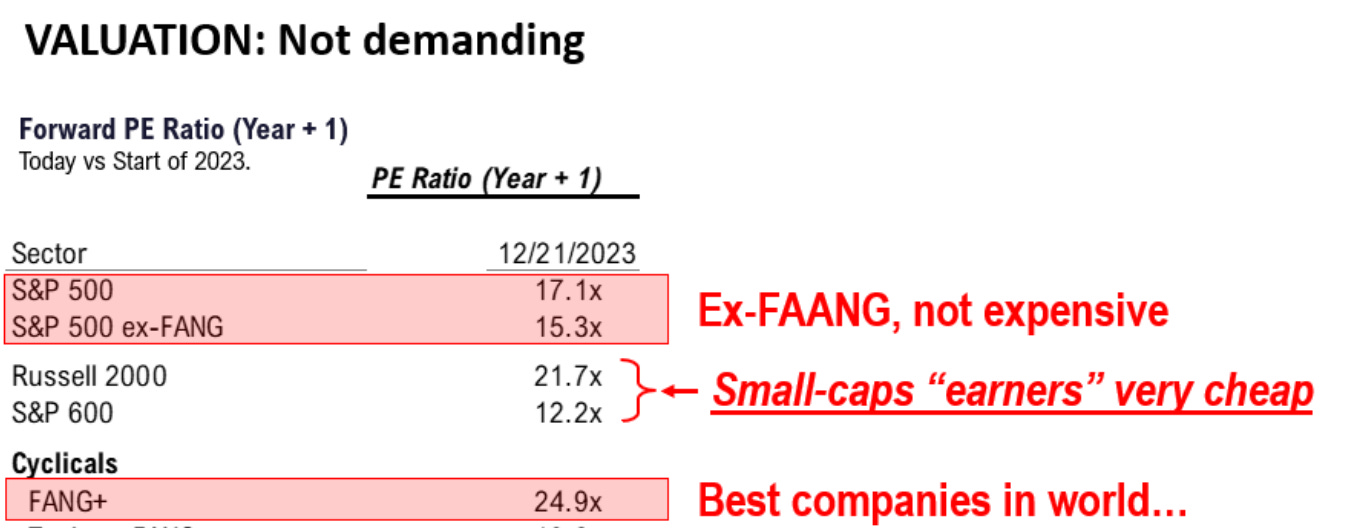

Therefore, I also believe it is valuable to look at their 2024 expectations and projections, and according to CEO Tom Lee, stocks remain attractive in 2024 with a favorable risk/reward profile. Tom Lee points to multiple factors, but the key is that he continues to see room for P/E expansion driven by the expectations for “easing financial conditions plus better economic momentum.” Crucially, he points out that the S&P500, excluding FAANG, still trades at a P/E of just around 15x. Meanwhile, FAANG also still trades at a favorable P/E of 25x, which is far from ridiculous considering the quality of these companies. The Magnificent Seven are expected to post 22% earnings growth next year, twice the S&P 500’s advance, data compiled by Bloomberg Intelligence show. This is also why we at Rijnberk InvestInsights continue to be shareholders of Microsoft (MSFT), Apple (AAPL), Meta (META), and Amazon (AMZN).

Meanwhile, according to Tom Lee, reasons for the P/E expansion include easing inflation, lower interest rates, global growth with Europe and China emerging from stagnation, 10% profit growth, and investors allocating out of cash and into equities.

More notably, CEO Tom Lee sees small caps as a massive opportunity with these trading at a price/book at 1999 lows, positioning these for a 12-year outperformance cycle, according to the CEO. King Lip, chief strategist at BakerAvenue Wealth Management, shares this opinion, at least up to a point. He believes small-caps will do better in 2024, compared to last year, and large-caps, as interest rates fall.

At this point, markets seem to be pricing in earlier and deeper rate cuts, “with swaps traders wagering that the central bank will reduce rates by roughly 150 basis points next year, double the forecast of Fed officials,” as reported by Bloomberg. Moreover, according to the CME FedWatch tool, traders are pricing in a nearly 75% chance that the Fed will deliver a 25 basis point rate cut at its monetary policy meeting in March.

Our most important takeaway is that the markets might be pricing in a somewhat bullish narrative here, which is why we urge investors to be careful adding at current highs.

Nevertheless, these rate cuts should have a broadly positive impact as they should slowly allow for more impressive economic growth. This is partly why analysts at Citi are upbeat on U.S. stocks in 2024. Citi analysts currently project S&P 500 earnings per share to rise 10.4% in 2024 and the leading benchmark to make solid gains as the rally should persist. However, the bank did warn of significant volatility and stated that investors should prepare to buy on pullbacks.

It is also worth considering that 2024 is a U.S. election year. According to Bloomberg, “an election year with a sitting president running is historically a bullish scenario for US stocks.” This is confirmed by the fact that since 1949, the S&P 500 has averaged a gain of nearly 13% in those election years.

Not all will be positive in 2024

Despite all the positivity so far, Fidelity's Jurrien Timmer also didn’t back down from pointing out some worrying factors. Most importantly, he believes that most of the soft-landing narrative may already be priced in as the S&P500’s P/E ratio has gained 5.5 points since its low of 15.3x in October 2022 in anticipation of an earnings recovery. Timmer says that while such a recovery is happening, some margin compression might offset this.

Even Fundstrat's Tom Lee isn’t solely bullish, and even as he expects the S&P500 to reach new highs in the second half of the year, he doesn't expect the stock market to go up in a straight line and deems a negative first quarter as likely.

According to the fund CEO, new highs are likely to be made in January, followed by a correction of around 5% in February and March. This will be driven by equity markets consolidating the incredible gains from late 2023 and the market getting ahead of the Federal Reserve in terms of interest rate cuts.

Ending with the negative Nancy in the room but also the largest Western bank, JPMorgan is one of the largest skeptics when it comes to the equity markets in 2024. While its analysts believe a recession is unlikely to occur in 2024, the bank believes the “stubborn inflation, above central bank comfort zones, is expected to keep rates higher for longer.” Under the bank’s current economic projections, inflation remains sufficiently sticky at around 3%, forcing central banks to maintain higher-for-longer policy stances. This means that traders betting on an early start to easing cycles will likely be disappointed, resulting in quite some downside with a lot of positivity already priced in.

Furthermore, the analysts believe “lackluster earnings growth and geopolitical risks are set to weigh on the outlook for stocks,” which should result in S&P 500 earnings growth of just 2–3%, far below the expectations from many other Wall Street banks. Marko Kolanovic, Chief Global Markets Strategist and Global Co-Head of Research at JPMorgan states that “the decline in inflation and economic activity they forecast for 2024 will at some point make investors worry or perhaps even panic,” creating a very unfavorable mix of conditions.

As a result, JPMorgan is also still considering the chance of a recession as likely at some point, stating they “see a 25% chance of recession by the first half of 2024, 45% by the second half of 2024, and 60% by the first half of 2025.” U.S. GDP growth is projected to be far from impressive in 2024, with the Congressional Budget Office projecting economic growth of just 1.5% and the Factset consensus pointing to growth of 1.2%.

So, what should investors take away from this?

So, what have we learned from this? Well, not that much, as it remains hard to predict market movements, even when you possess all the available data. In particular, 2024 will be a tough one to predict, considering all the uncertainties we continue to face, including interest rates, inflation, and multiple geopolitical conflicts.

All parties discussed make convincing cases; only time will tell who is right. However, we have determined the leading themes in 2024, including interest rates, inflation, economic growth, multiple expansion or contraction, and the impact of AI and politics.

All things considered, we at InvestInsights expect quite some volatility in 2024, especially in the first half of the year. This will be mainly due to conflicts in the Middle East and Ukraine developing and the FED’s plans for bringing down rates taking form. With the markets facing all these uncertainties, we are taking a more careful stance by projecting an end-of-2024 S&P500 value of 5,000, representing a 4-5% increase. However, if inflation does come down, interest rates drop in line with what is currently priced into the market, and global conflicts don’t take a turn for the worse, we acknowledge there is much upside and room for margin expansion. This could lead to the S&P500 gaining as much as 9% to 5,200.

Overall there is plenty to pay attention to, and at InvestInsight, we are determined to keep you updated on each of these important themes and developments. As we likely face a very volatile and mixed 2024 with a recession still a possibility at some point and all narratives possible, it is more important than ever to make well-informed investment decisions and pick out the right stocks at the right time. At InvestInsight, we are determined to help you do exactly that, so make sure to subscribe!

For now, we wish all investors and future subscribers a very happy, healthy, and, of course, profitable 2024.