Analog Devices vs Texas Instruments - Which one is superior?

A comparison between Analog Devices and Texas Instruments in collaboration with Heavy Moat Investments

After a few discussions with Heavy Moat Investments, we have decided to write this post to find out which of the two analog semiconductor leaders is superior and should be on your watchlist.

Notably, whereas I bought Texas Instruments over Analog Devices several years back and still hold the shares, Daan and Luuk did the exact opposite, with Analog Devices as a meaningful holding today.

But which should you be looking at? In this post, we’ll each make the case for our pick and tell you exactly why!

Analog Semiconductors - Underappreciated but Essential

Analog semiconductors, which handle continuous signals to interface with the real world, are not just vital but indispensable for the operation of various digital devices. They convert real-world data, such as temperature and sound, into digital information that can be processed by computers. This essential role ensures steady demand for analog components, even as the digital semiconductor sector garners more attention.

Remarkably enough, while discussed much less often, analog has even outperformed digital in terms of industry growth over the last decade. Let that sink in for a second. Going forward, the outlook for analog semiconductors remains attractive, with Mordor intelligence pointing to a 7.3% CAGR through 2028.

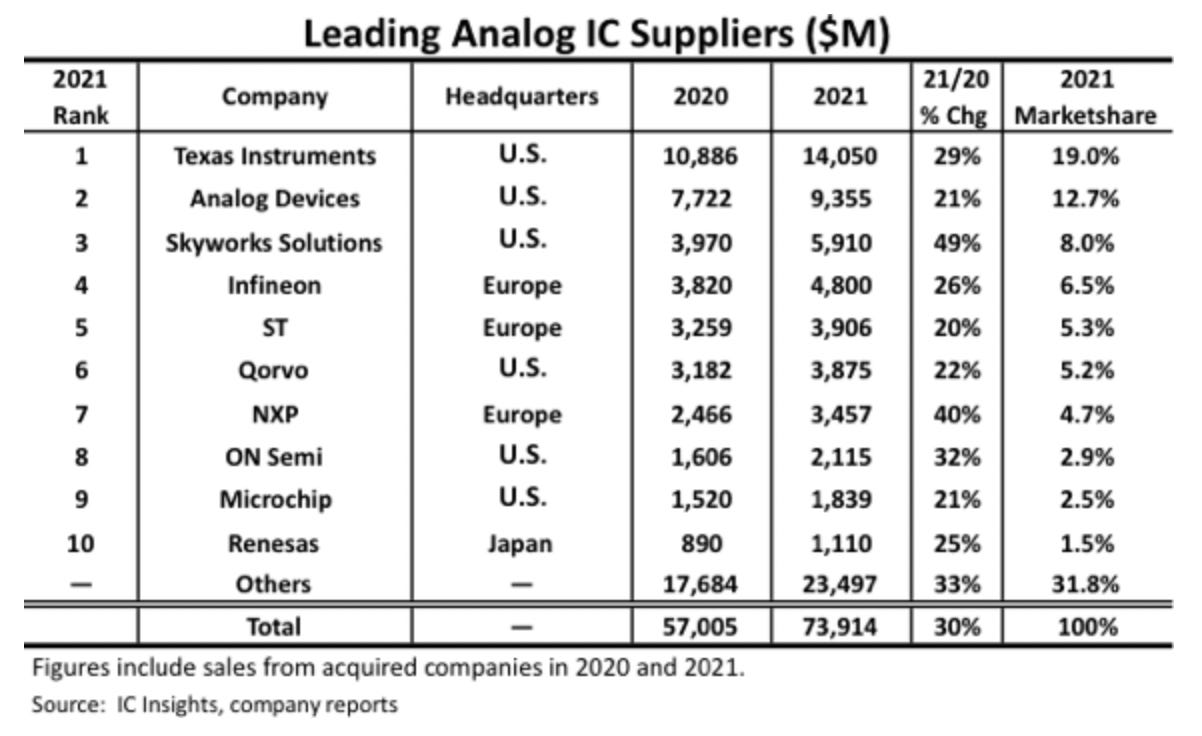

To benefit from this growth, there are two industry leaders that jump out right away – Analog Devices (ADI) and Texas Instruments (TXN).

But which one of the two is the best pick today and worth putting on your watchlist? We’ll tell you all about both. Let’s dive in!

Rijnberk InvestInsights analysis and opinion:

Analog Devices, a leading player in the analog semiconductor market, offers a compelling investment opportunity characterized by robust historical performance, crucial industry positioning, and promising future growth prospects. Despite not being as high-profile as digital semiconductor giants like Nvidia or AMD, ADI has demonstrated consistent outperformance and stability, making it an attractive investment for those seeking long-term value.

The company has a proven track record of delivering value, with shares having gained 350% over the last decade, easily outperforming the S&P500. This outperformance was supported by strong financial results as ADI has compounded revenue at a 16% CAGR and EPS at a 12% CAGR.

Looking at the future, I see no reason for this to change, driven by the earlier pointed-out bullish outlook for the underlying industry and ADI’s incredibly favorable positioning with exposure to several high-growth industries and trends like digitalization and sustainability. Notably, 25% of ADI’s sales are from markets expected to grow at over 20% CAGR, including renewable energy and electric vehicles. ADI's technologies are critical in energy storage systems and automotive battery management, positioning it to capitalize on the shift towards greener technologies and smart transportation.

ADI also excels in risk management. It has an extensive product portfolio and caters to diverse applications across industrial automation, automotive, communications, healthcare, and consumer electronics. This diversification, combined with a broad customer base of over 125,000 end customers, reduces dependence on any single market or client, thereby lowering business risk. Furthermore, ADI’s in-house manufacturing capabilities provide greater control over production, enhancing cost management and innovation potential.

This allows it to consistently achieve a gross margin above 70% and an operating margin near 48%, which is industry-leading, thanks to its high-value products and efficient operations.

As a result of this all, ADI's growth prospects are very favorable, even though it is currently experiencing a downturn. Wall Street analysts currently project ADI to grow revenues at an 11.5% CAGR and earnings at a 23% CAGR through 2027, which is just stellar!

As a result, I am very much bullish on the company, which holds a special place in my portfolio. It is just a tremendous compounder.

And then I am yet to discuss its tremendous capital return policy. Remarkably, ADI is committed to returning 100% of free cash flow to shareholders through dividends and share buybacks, which amounts to $3.5-4 billion annually. This commitment to return value to shareholders and its earnings consistency has allowed it to grow its dividend for 20 consecutive years and at a very impressive 12% CAGR over the last 5. Shares now yield a respectable 1.5%, which is a 5% premium to the sector median, and based on a conservative payout ratio of just 50% based on depressed earnings. This leaves it with plenty of room to keep growing its dividend!

Simply put, Analog Devices is a tremendous compounder and a beautiful dividend growth stock. What more do you want? As a result, Analog Devices presents a compelling investment case with its essential role in the semiconductor ecosystem, strong historical performance, diversified business model, and strategic positioning for future growth.

Despite current industry headwinds, ADI’s resilient margins, robust financial health, and significant shareholder returns make it an attractive long-term investment. Investors can expect steady returns, supported by ADI's solid growth prospects and commitment to shareholder value.

So, why do I own ADI and not TXN?

First of all, there is very little difference between the two. Both companies are very much alike, but TXN is a bit more mature, pays a higher dividend, and is expected to grow slightly slower. ADI also tends to invest a higher percentage of revenue into R&D and has slightly better margins historically due to a higher share of customer products.

The companies are nearly identical in revenue diversification, end markets, and China exposure, so there is little to distinguish them. What does jump out is a slightly different strategy in manufacturing, with TXN producing almost entirely in-house and committed to significant investment in capacity expansion in the U.S. (Roughly $30 billion) to lower geopolitical dependence.

Meanwhile, ADI uses outsourcing in addition to its own facilities. This gives them slightly more production flexibility in a downturn and more resilient margins, less control over expenses, and dependence on production partners. This makes ADI somewhat more risky from a geopolitical standpoint.

Overall, fundamentally, I might actually like TXN just slightly better, thanks to a more favorable strategy, which was better explained by Heavy Moat Investments later on. Still, both companies are tremendous, and either will make an excellent investment when bought at the right price. TXN tends to trade at a higher multiple as it is more mature and has a yield almost double that of ADI, making it a bit harder to find an attractive entry point.

Also, looking at growth potential, I don’t believe this premium is fully justified, which is why I bought ADI a couple of years back at an attractive price. This has paid off, with ADI returning 130% over the last five years versus 85% by TXN (excluding dividends).

But again, you’ll be good with either going forward if you can lock in a good price, which we aren’t seeing today. At 24x and 26x forward earnings and at PEG of 1.7 and 1.8 for ADI and TXN, respectively, I am not an active buyer of either at this time.

An analog semiconductor company I am actively buying is Infineon Technologies. You can find my in-depth coverage of that one below!

Heavy Moat Investments analysis and opinion:

Texas Instruments is a company focused on operating excellence and the long term. The strategy is simple, in the words of previous CEO Rich Templeton:

The best measure to judge a company's performance over time is the growth of free cash flow per share, and we believe that's what drives long-term value for our owners.

As the introduction states, TXN develops, manufactures and markets analog and embedded semiconductors. There are several secular tailwinds like digitalization, electrification and automation pushing for more semiconductor content in appliances, manufacturing facilities and every aspect of our life. While flashy GPUs or AI chips get most of the attention, without analog chips, no such device would run. Every time a button is pushed, we need an analog chip. The demand for analog chips is strong, especially in the automotive and industrial sectors, showing some of the highest growth rates in the teens. These two segments account for 75% of TXN’s revenue after years of investment in R&D.

Unlike digital, analog does not have the same arms race, and products can be sold for much longer (up to 20 years usually), making R&D and manufacturing investments highly lucrative for long-term investments. TXN has a durable and widening competitive advantage for the following reasons:

Large product portfolio in attractive end markets

Cost advantage through vertical integration

Geopolitically dependable manufacturing

The company uses the US Chips Act to more than double its manufacturing capacity and to serve the need for geopolitically dependable capacity. Following the COVID-19 supply chain disruptions, many companies are pushing to localize their supply chain again. Globalization is on the decline, driving the demand for US manufacturing. This is just a small overview of the TXN investment case; you can read the full deep dive here.

So, why do I own TXN and not ADI?

Let me start off by saying that both are wonderful companies that generate high margins, have long-term secular tailwinds and have good balance sheets. There are a few differences between the two:

Types of products manufactured

Vertical integration vs outsourcing

Growth strategy

TXN produces almost no custom products but universal chips: 75% of products can be sold to different customers in different end markets. This means there is hardly any risk of inventory obsolescence. ADI, on the other hand, has a higher mix of custom chips, which in turn sell for higher margins.

TXN has a much higher percentage of in-house manufacturing at around 80% and is actively investing billions into its manufacturing facilities in the US to produce geopolitically dependable semiconductors. It also pushed its D2C business in recent years and, through its investment into Ti.com, now generates around 75% of sales directly. This focus on vertical integration gives them better control of their destiny and opens them up for large operating leverage once the semi-cycle turns, resulting in higher margins. It also enables TXN to continue producing products and increasing its inventory. This way, the facilities aren’t standing still, and once the cycle turns, they’ll have the inventory to please demand and take market share. While gross margins are similar for both companies, TXN generates 38% EBIT margins, compared to 25% for ADI (we are talking trough margins, but I’m sure TXN will see a higher operating leverage in the upswing). ADI outsources a lot more of its manufacturing to companies like TSMC. I prefer TXN's vertical integration strategy.

TXN grows organically, with the last acquisition after the GFC, while ADI is a much more active acquirer. This fits with ADI’s strategy of outsourcing production. TXN generates much higher ROIC, largely because of ADI's large Goodwill position.

To conclude, both companies are great, but I prefer Texas Instruments's vertical integration and organic growth focus.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe to Heavy Moat Investments.

I've just published my own take on this industry - I like TXN and AVGO, but I'm holding STM, predominantly for the SiC exposure

I'd be interested in your thoughts on my article? Anything you think I've overlooked?

https://showmethevalue.substack.com/p/industry-dive-analogue-semiconductors?r=1ukiw6