ASML Holding N.V. – The 11% post-earnings sell-off is (mostly) justified

Its time to revisit ASML after shares sold of 11% after earnings, which seems justified considering circumstances.

Yesterday, ASML announced its Q2 results, which beat the Wall Street consensus and my estimates on both top and bottom lines. Furthermore, the order intake recovered strongly from a weak Q1, showing demand remains resilient, and management remains upbeat on its long-term guidance as a recovery in the semiconductor industry seems imminent later this year and into 2025.

So far, this all sounds pretty damn great.

Yet yesterday, ASML shares lost a staggering €50 billion in market value after being sold off by 11%. Thus, they have only returned 5% since I rated them hold in April, underperforming the S&P500 by 11 percentage points.

Were earnings that bad after all? Absolutely not. Rather, blame extremely high expectations, red-hot valuation levels, and the fear of even more Chinese export restrictions.

Let’s examine this in more detail and determine whether now is the time to load up on ASML shares once again or whether you would be best off staying on the sidelines.

We try to keep all our analysis free for all of you to enjoy and benefit from! Want to support our work a little bit more and show your appreciation? Consider upgrading to paid ($5 monthly).

This allows us to push out even more content and gets you access to our exceptionally performing portfolio and premium subscriber chat!

We appreciate you all!!

ASML really delivered across the board

I should start by saying that, as an analyst and a shareholder, I was positively surprised by the ASML Q2 earnings report, even if the title of this post or the share price movement after earnings says differently.

Honestly, investors had little to complain about in the results, apart from the fact that they were unsurprising in most ways.

ASML reported revenue of €6.2 billion for Q2, down 10% YoY but €100 million ahead of my projection and the analyst consensus. This is also quite an improvement from the 18% revenue decline reported in Q1, and management expects significantly better results in H2, confirming a comforting trend and a recovery that is ahead of expectations.

While headwinds like lower customer Capex budgets and continued delays in fab completions, which led to delivery delays for ASML, continue to impact revenue growth, management indicates that the operating environment is improving steadily.

Already halfway through last calendar year, ASML management warned that these headwinds would impact the business in the short term as the semiconductor industry temporarily slowed down, which led to ASML customers postponing machine deliveries. As a result, 2024 is a so-called “transition year” for the company, according to management, in which it is focused on capacity expansion and R&D investments to prepare itself for an imminent recovery.

Considering this, looking at the relative performance and underlying trends, ASML is actually doing quite well. It is outperforming expectations and seeing demand improve gradually and faster than I expected.

A notable standout on the top line was the higher service revenue, which was the most meaningful contributor to the outperformance last quarter. These service revenues aren’t as exposed to the cyclicality of the semiconductor industry as they are based on recurring service contracts for ASML’s machines operating worldwide, creating an anticyclical and reliable revenue stream.

Service revenue now accounts for 24% of revenue and is a great revenue stabilizer, especially as it grows steadily as ASML grows the number of operational EUV and DUV machines globally.

Moving to the bottom line, ASML continues to impress. The gross margin came in at 51.5%, ahead of the guided range of 50% to 51% and up a marginal 20 bps from last year despite the revenue decline. Of course, it is no secret that ASML has incredible pricing power and cost control, and this was perfectly highlighted in the most recent quarter. Nothing short of impressive!

This also led to a better-than-expected net income of €1.6 billion, also €100 million ahead of expectations, and translating into a net income margin of 25.3%, which is quite a bit better than the 23.8% I expected. This led to an EPS of €4.01, beating my estimate by €0.33 or 9%. Excellent, really!

Finally, TTM FCF now stands at €2.9 billion, which is also pretty great.

So far, everything is looking pretty damn good, and ASML performed well across the board. The company is seeing demand recover faster than expected and can maintain high margins despite lower revenue. In other words, it outperforms expectations while positioning itself for a strong growth recovery in the year's second half and into 2025.

Order intake improved significantly from Q1 – ahead of expectations

Probably one of the focus areas for ASML analysts and investors each quarter is the order intake, as this is the best indicator of current demand and future growth.

Positively, after a very weak Q1 order intake of €3.6 billion, ASML reported a very solid €5.6 billion net order intake in Q2, of which €2.5 billion came from EUV machines. This was way ahead of the €5 billion expected by Wall Street analysts, and, most importantly, it shows that demand for ASML’s equipment remains significant and that customers are increasing orders once again.

Supporting this is the significant demand ASML sees for its next generation of EUV machines—High-NA EUV. This next generation of technology should help customers like Samsung, Intel, and TSMC manufacture even smaller nodes, crucial for high-end technologies like AI. This explains why demand is extremely high.

In Q1, ASML shipped the first system to Intel, and the company now confirmed that it shipped a second one to another customer. Furthermore, all three of its largest customers will receive the new generation by the end of 2024, which is sooner than earlier anticipated.

Crucially, these machines have a price tag double that of the prior generation, significantly boosting ASML’s revenue and margins, as well as its order book.

Looking forward, I do, nevertheless, expect order intake to remain quite lumpy and unpredictable, especially for the remainder of 2024, as customers adjust their Capex budget. Overall, we should see a positive trend here, which further solidifies ASML’s long-term growth trajectory.

We also shouldn’t forget that it still has a €39 billion backlog, which is more than one full year of revenue and enough to fuel many years of growth ahead, especially if orders continue to grow as well.

ASML shares drop on a rich valuation and concerns over Chinese export restrictions.

However, while this all sounds pretty great and like a perfect earnings report, ASML shares lost a whopping 11% yesterday, or close to €50 billion in market cap. It was the stock’s largest decline since March 2020, when Covid-19 lockdowns were introduced.

Let that sink in for a moment. With ASML as one of my key holdings, I actively avoided looking at my brokerage account yesterday.

The sell-off could be attributed in part to investors' heated expectations. Just consider that ASML shares have been among the outperformers so far this year, gaining roughly 40% YTD. This is helped by the global enthusiasm and significant investments being made in AI, which is expected to boost the semiconductor industry.

You see, ASML is the world’s largest semiconductor equipment manufacturer, with a $420 billion market cap and almost €30 billion in annual sales. More importantly, it is also the only manufacturer of EUV machines, giving it an incredible monopoly and making it one of the most important companies in the world. These machines are required to manufacture the world’s most advanced semiconductors used for AI, IoT, and electrification, among other things.

This is what I wrote regarding these previously:

ASML is the only company with the supply chain and technical knowledge to make these advanced machines, giving it an incredibly powerful monopoly. When we say the world would be different without ASML, we are saying that without the company’s EUV machines, we would simply not have been able to create the advanced chips we use in all our electronic devices today, like smartphones, cars, solar systems, and data centers.

As the only one able to build these machines, it holds an unparalleled monopoly that has allowed it to become an amazing compounder over the last decade, growing revenues at a CAGR of nearly 19%.

So, obviously, as demand for semiconductors grows in a digitalizing world, demand for ASML machines is also expected to continue growing rapidly. This makes it easy to understand why ASML has been popular among investors this year.

(For a more detailed look at ASML and its products and technology, I recommend checking out my previous post, in which I touch on those subjects in greater detail)

However, this optimism led to shares trading at over 50x this year’s earnings prior to the Q2 results, which is just an insane multiple to pay for a company expected to grow earnings at roughly mid-teens. This is rich even for ASML, which is a company of the highest quality.

It at least seems like the reason for the sell-off after earnings has nothing to do with the actual earnings but rather with the valuation shares are trading on; there were too few positive surprises in the report, leading to shares blowing off some steam and relieving some of the pressure yesterday.

But that isn’t the most important reason, at least not given the severity of yesterday's sell-off. The semiconductor industry as a whole was down yesterday, with most semiconductor stocks down 5%+ and the SOXX ETF losing over 6%. This is quite significant indeed.

You see, during the trading session, ASML shares, and that of its peers, continued trading lower as the day progressed, and this was due to investors digesting a Bloomberg report claiming the U.S. might be actively looking to implement the most severe trade restrictions available in its chip crackdown on China, specifically naming ASML.

The U.S. wants ASML and Tokyo Electron, in particular, to limit Chinese access to chip technology more than they do right now. As a last measure, the U.S. is now considering imposing “a measure called the foreign direct product rule, or FDPR, according to Bloomberg. “The rule lets the country impose controls on foreign-made products that use even the tiniest amount of American technology.”

Whereas ASML previously communicated that no more than 15% of its sales generated in China are at risk due to restrictions, which is more than manageable, this potential measure could significantly increase this risk.

With 49% of ASML’s sales coming from China as of the most recent quarter, I can see why there is some panic among investors. However, we should not forget that the current number is significantly inflated due to headwinds in other/western regions, which allowed ASML to ship much more of its capacity to China.

In a more normalized environment, as we saw in 2022, China only accounts for 10-20%, making the potential impact much less significant. In addition, for now, these are only unconfirmed rumours, with nothing confirmed by U.S. officials or ASML and Tokyo Electron.

For now, I believe the panic here, while understandable, is very much exaggerated and not entirely justified. While additional measures could impact ASML, it is unlikely to change the long-term thesis here.

Outlook & valuation

Before we take a look at the valuation after yesterday’s sell-off, let’s consider management’s guidance.

For Q3, management now guides sales to be between €6.7 billion and €7.3 billion, which at the midpoint points to a shift to positive growth again, sitting at roughly 5%. However, this guidance seems somewhat conservative, as it fell short of Wall Street estimates and my own projection for revenue closer to €7.4 billion.

Positively, ASML has a history of guiding somewhat conservatively. Furthermore, the gross margin is once more expected to be between 50% and 51%, although I expect this to be slightly higher.

For the full year, management left its guidance unchanged, still expecting revenue to be similar to last year, which, while not bad, was somewhat disappointing. However, I expect management to announce an upward revision to full-year guidance next quarter. Again, there is some conservatism here.

Overall, management continues to see a solid recovery in the year's second half, helped by enthusiasm for AI. Furthermore, 2025 should be a great year for ASML due to the many fab completions that are bound to use ASML equipment and a strong recovery in semiconductor demand.

Beyond 2025, the outlook also remains as solid as ever, with the energy transition, electrification, and AI all boosting semiconductor demand in the medium term. This means ASML still sticks to its 2025 revenue forecast of between €30 billion and €40 billion, while 2030 revenue should be between €44 billion and €60 billion.

These will be updated during the next investor day in November, and honestly, I believe we could see management announce some upward revisions to these estimates, in part thanks to AI and the general push for more advanced chips and greater quantity.

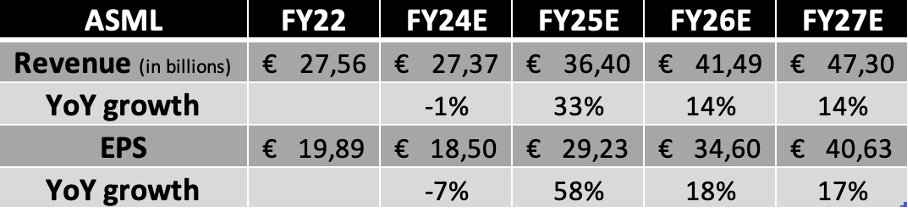

Overall, the medium-term outlook for ASML remains very bright. Following yesterday’s results, I have slightly upped my FY24 revenue and EPS estimates, although only marginally. However, with AI expected to boost the semiconductor industry, I think there is room for a slight upward revision of FY25 and FY26 revenue and EPS as well.

At the same time, I have incorporated a small additional revenue loss due to additional Chinese export restrictions. This results in the following financial estimates.

Based on my projections above, ASML shares, after yesterday’s share price slump, are now trading at roughly 47x this year’s earnings, down from 54x before, which is slightly better but still quite rich, especially considering its average over the last six years was closer to 40x.

As I said before, it seems like shares had just run up way too high, leading to unreachable expectations and ridiculous valuation levels. Therefore, I deem yesterday’s sell-off justified—ASML simply didn’t outperform enough to justify the share price, especially with lingering Chinese concerns.

Positively, after the share price has corrected a bit, and if we look forward to next year when earnings are expected to bounce back, we can see shares are trading at around 30x earnings, which is much more reasonable and a lot better than two days ago.

Of course, this still is a significant premium to pay, but you do get a brilliant business in return with one of the strongest and most crucial monopolies in the world, a relatively steady revenue stream, and industry-leading margins. ASML is a true one-of-a-kind and one I very much like to own.

Also, looking at its long-term prospects, especially with AI expected to give the industry an additional growth boost, I am quite optimistic and believe there is plenty of upside to my current estimates. Of course, there is a need for some margin of safety in the face of potential further Chinese export restrictions. Still, I feel like a 32x multiple, compared to a 40x multiple on average over the last six years, leaves plenty of downside protection.

Using this multiple and my FY26 EPS projection, I calculate a target price of €1107, representing potential annual returns of around 10% or closer to 11%, including the 0.7% dividend.

As a result, I believe ASML shares have become much more attractive again after an 11% correction yesterday. At current prices of below €900, I am willing to add to my position carefully. Though, I would start buying more aggressively only if the price continues to fall below €850 and closer to €800.

For now, I am rating shares a careful buy!

Want to support our work and receive much more like it? Make sure to subscribe!

We try to keep all our analysis free for all of you to enjoy and benefit from! Want to support our work a little bit more and show your appreciation? Consider upgrading to paid ($5 monthly).

This allows us to push out even more content and gets you access to our exceptionally performing portfolio and premium subscriber chat!

The sell off was purely geo political. Valuations are still rich looking at just the x30 you mention. But one can argue that in a persistent higher inflation world and the turmoil around chips the US needs their own Chip production excellence. Just like they have an energy advantage today, they need a technological advantage for the future, this can not be done by simply restricting china’s use of ASML (or any other machine from other manufacturers). So whether china will buy them, or someone else, the US is going to need to buy these machines. So I reckon ASML is pretty well suited to run up to 1300 per share in the not so distant future. If the Dutch government doesn't clunk up the tech sector that is.

Thanks!