August 1st portfolio update - I exited PayPal and First Solar, added 10 new positions

An interesting monthly update of my personal portfolio with 2 positions sold and 10 new initiated! A busy month July has been...

Welcome back to our monthly portfolio update!

As always, at the start of the new month, we will share our current portfolio, its performance over the last month, and any changes and additional commentary.

Feel free to ask me anything in the comments!

But first things first. As we are planning our analysis for July, this is your chance to let us know what you’d like us to post about. Fill in the poll below to cast your vote!

So, let’s start with the elephant in the room here: July was an absolute disaster for me. For my portfolio, it was the worst month since April 2022, which was in part driven by a not-so-great performance by stocks in general but mostly due to an underperformance of some key holdings and focus sectors.

In more detail, it was mostly the significant losses in the semiconductor industry that hurt my performance over the last month. For reference, semiconductor companies represent roughly 20% of my invested capital as it is one of my absolute favorite industries thanks to a very clear and long runway of growth ahead.

However, as the industry lost 10% of its value in July, as measured by the SOXX ETF… yeah, that didn’t quite boost my performance in a positive way.

Positively, for those who missed it, Reuters reported early this morning that the new semiconductor export restrictions package by the Biden administration to be announced next month, causing shivers through the industry and being the main reason for the sell-off, is said to exempt certain countries including Japan, the Netherlands and South Korea.

This is a massive relief for the industry. In other words, giants like ASML and Tokyo Electron will NOT be affected by this new package. This makes last week’s sell-off, at least in large part, unjustified.

Many semiconductor stocks made up a lot of those losses in today’s session, but I expect more upside in the coming days as investors digest the news.

Moving back to last month’s performance, on top of the semiconductor weakness, there was also a very tough last couple of weeks for Crowdstrike, which lost close to 40% in value. Crowdstrike is one of my largest holdings and has been for years, accounting for roughly mid-single digits.

(For those who didn’t follow the whole Crowdstrike situation,

from High Growth Investing explained it nicely in this post!)Eventually, these two factors combined meant my portfolio didn’t have the greatest of months. In the end, my portfolio value declined by 7.7%.

Putting this into contrast:

The S&P500 was down roughly 1% for the month, which isn’t that bad at all considering the load of tough earnings reports during the month.

Less impressive was the Nasdaq 100, which lost 3% over July, not coming as a massive surprise as weakness was focused on technology and semiconductors in particular

The Dow, a much more value-focused index, therefore performed much better, actually gaining 3.5% in July.

Finally, the Euro STOXX 50 didn’t do very well either, losing close to 2%.

Crucially, the underperformance in July and losses don’t bother me in the slightest. In fact, I am happy with the sell-off as, for certain large holdings, it allows me to add some shares at better valuations, which is why I took the opportunity to make quite a few additions over the month, exiting two positions and starting one in 10 other companies.

Instead of selling on weakness, I am using the situation to strengthen my position in some of my favorite companies in the face of near-term headwinds or overreactions in other instances.

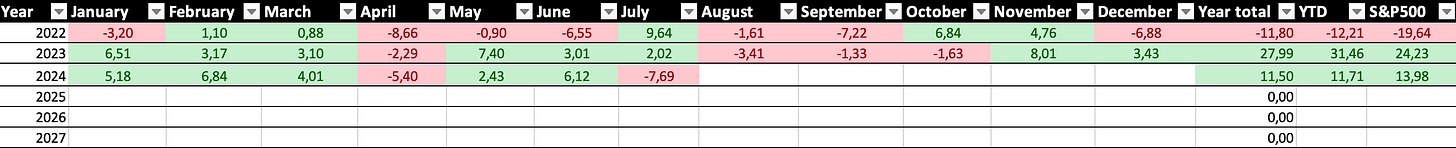

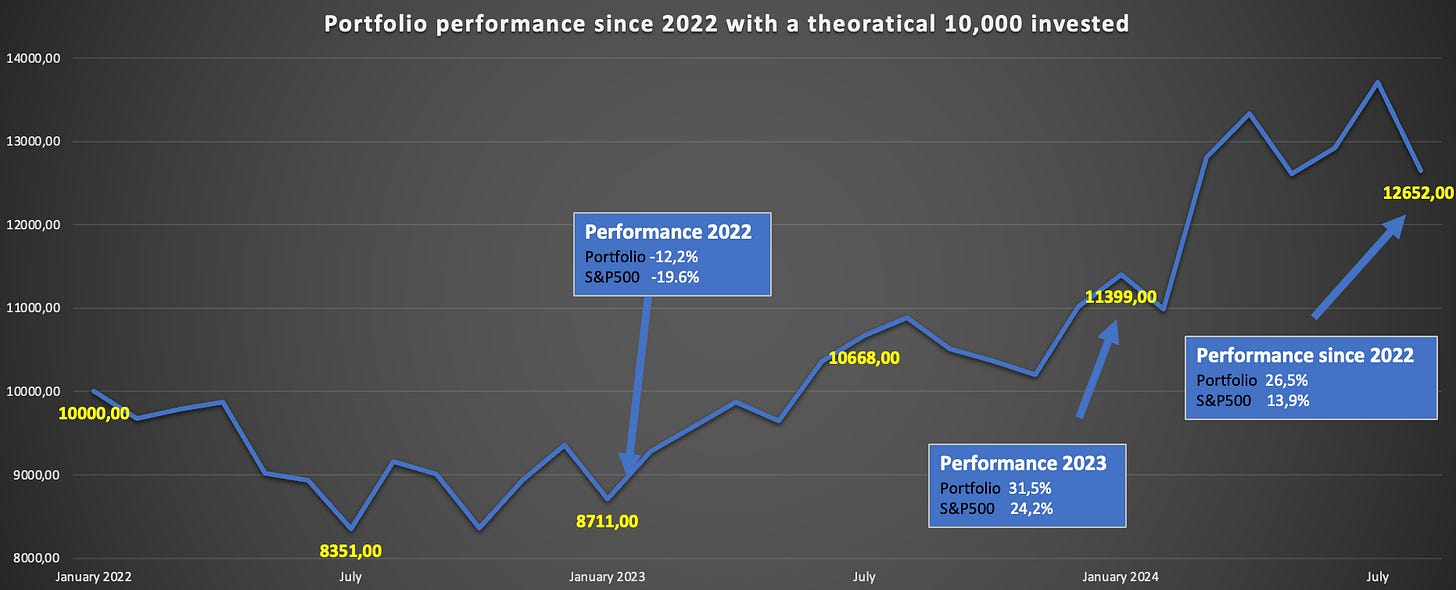

Also, it is worth pointing out that my portfolio has still done tremendously over the last 2.5 years, even as it is slightly falling short of the S&P500 this year so far. For reference, the portfolio has returned close to 12% so far this year against a 14% gain for the S&P 500.

Positively, since the start of 2022, when I set up this portfolio, it has delivered more than 2x the return of the S&P500, gaining 26.5% against 13.9% for the S&P500.

In the end, I am investing for long-term gains, so I am not too focused on my YTD or monthly performance.

On that note, let’s delve into the portfolio. There are plenty of changes to discuss, with 10 new additions and 2 exits.

As always, this next part of our monthly update is exclusively for our premium/paid subscribers. If you are new here, don’t worry—pretty much all our other content is FREE!

Want to support our work a little bit more, show your appreciation and get access to our full portfolio and transactions? Consider upgrading to paid ($5 monthly).

We appreciate you all!!