Brilliant Q2 results and a 12% sell-off – TSMC is still a bargain!

After some comments from Trump sent shares down 12% in a week, despite great Q2 results, it is about time we revisit TSMC.

TSMC announced its Q2 earnings last week, which were well received by investors. Shares gained 2% in the trading session that followed. This appreciation seemed more than justified as the company continues to fire on all cylinders, and the semiconductor industry is slowly and steadily recovering from a year of declines, partly driven by significant AI spending.

Positively, TSMC's growth is accelerating rapidly, thanks to AI, which drives insane demand for the company’s most advanced nodes. This helped it outperform both top and bottom-line estimates on Thursday.

For those not entirely familiar with the company, TSMC is the world’s largest manufacturer of semiconductors or chips, holding a staggering 61.2% market share across the entire foundry industry. This means that over 60% of all semiconductors worldwide come from TSMC, a Taiwanese company with factories all over the world.

Moreover, in advanced nodes, defined as everything below 7nm, TSMC’s market share grows even further to around 70% and is growing rapidly, helped by the company being the sole high-end supplier of the most advanced 3nm nodes at full scale. For reference, these are the ones used by Nvidia and Apple, among others, to make their most advanced products, including the GPUs used for AI computing.

This company's dominance is insane and still growing. Consider that over the last five years, since 2019, TSMC has expanded its market share by a staggering 13.1 percentage points, manifesting its dominance and growing its global importance. Its technological progress and global relationships are unmatched.

I believe this is pretty much all you need to know to know this is a company you need to own.

Moving back to the Q2 results, long story short, the company delivered once again in Q2, remains exceptional, and investors have nothing to complain about. It was pretty much a perfect beat-and-raise earnings report.

However, even after Thursday’s small share price jump, shares were down quite significantly for the week, declining by over 11%. On Wednesday, news broke that the U.S. is looking to add new semiconductor export restrictions for China, and Trump made some comments regarding the defense of Taiwan.

Unsurprisingly, this sent the entire semiconductor industry down by almost double digits, including TSMC. However, I would argue that the share price reaction was overdone and simply an overreaction to (mostly) irrelevant news, potentially offering investors an interesting buying opportunity, even as shares have gained a whopping 25% since I last rated these a buy in my April deep dive. This means shares outperformed the S&P500 by 15 percentage points and much deserved as well!

In fact, shares even temporarily exceeded my 2025 target price. Clearly, it is already time for a much-needed update, especially as the influence of AI is exceeding my expectations.

Therefore, in this post, I will give you an update on the latest around TSMC, building on my April deep dive and reflecting on the Q2 earnings, developments, and Trump's comments.

For those not entirely familiar with the company or looking to learn more, make sure to first check out my previous post on the company, linked below!

Trump’s comments should be taken with a massive grain of salt

I want to start off with the elephant in the room by reflecting on the comments made by Trump and the subsequent panic it led to among investors.

Last Wednesday, in an interview with Bloomberg Businessweek, Trump mentioned that Taiwan should be paying for the defense provided by the U.S. While this might seem small at first, it suggests that he might be open to taking a step back from defending Taiwan if he gets nothing in return, or at least that is what investors fear.

“You know, we’re no different than an insurance company. Taiwan doesn’t give us anything,” the former President and potential next president added.

As I discussed more extensively in my last post on TSMC, the U.S. is Taiwan's and, therefore, TSMC’s most important line of defense against a potential invasion from China.

To give you a bit more background here, China still argues that Taiwan is a breakaway province that belongs under Beijing's control. China has repeatedly stated that it intends to “peacefully” retake control of Taiwan, which it has owned for most of history.

Obviously, with most of its operations and factories in Taiwan, an invasion would be detrimental to TSMC. This is one of the leading reasons why the company has consistently traded at a discount to its U.S. peers. Investors are simply scared of such an invasion, which would probably bring its stock price close to zero, and understandably so.

Crucially, the U.S. knows how important Taiwan is to them and the rest of the world due to TSMC and its facilities. For this exact reason, the U.S. has stated that in the event of an invasion, it will defend Taiwan, no matter what. In fact, President Biden confirmed this once more not so long ago.

As a result, by how things stand right now, an invasion of Taiwan would mean a war with the U.S. for China, which would, of course, be detrimental to all parties involved. This is most likely the most significant reason China hasn’t made any big moves yet.

However, you can now imagine what it means the U.S. would pull back, explaining the backlash following Trump’s comments since there is a good chance he will reclaim the presidency in January.

So, does this then justify the sell-off? Well, no, not at all, most notably because these are hollow comments. There is close to no chance the U.S. would just drop Taiwan, risking losing access to its facilities, which are of incredible importance to the U.S. economy, technological progress, and even its defense sector.

And then I a not even mentioning the fact that this would give China control over some of the most advanced technologies in the world, something the U.S. has been trying very hard to avoid with export restrictions.

All in all, I understand the panic, but the former president's comments are unfounded and unrealistic and shouldn’t bother shareholders too much. It sure as hell changed nothing for me.

If anything, this short-term panic, which will fade soon, offers the possibility of picking up some shares after a 12% drop

Let me finally add that TSMC has already been expanding overseas for multiple years with new fabs under construction in the U.S. and Japan, which is somewhat decreasing geopolitical risks. At the same time, management has also repeatedly confirmed that it is not planning on moving away from Taiwan anytime soon. In fact, according to management, its infrastructure in Taiwan is impossible to move to another location, mostly due to the technological complexity of its manufacturing sites.

Of course, geopolitical tensions and risks will continue to weigh on TSMC and its share price/valuation, but in my personal opinion, the risks are low enough to still consider TSMC a viable investment. In the end, if an invasion occurred, the problems would stretch much further than only TSMC, as many of the largest technology and chip companies are 90% dependent on this giant.

Now, I am not trying to dismiss the geopolitical risks here, as these are very real, but I also wouldn’t overestimate them. It is important to weigh the risks here for yourself and determine whether it fits your risk profile.

On that note, let’s focus on the business itself and its performance, moving to the Q2 results, which were once again excellent!

A perfect quarter from TSMC

As I said already, TSMC nailed it once again in Q2, with the company outperforming expectations, raising its guidance, and showing why this is one of the most supreme businesses in the world.

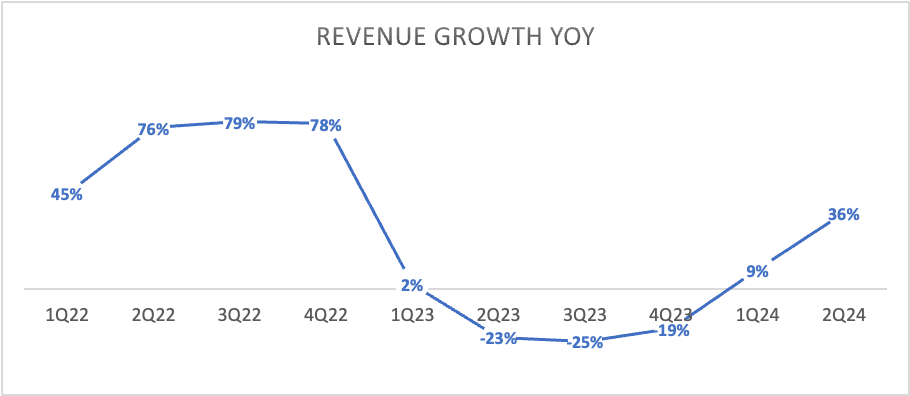

TSMC reported Q2 revenue of $20.8 billion, which is an increase of 36% YoY and 10% sequentially, driven by a rapid improvement in semiconductor demand. For reference, just two quarters ago, TSMC still reported a 19% revenue decline due to the industry’s cyclicality, so calling this a rapid improvement is much of an understatement.

Notably, this improvement in demand and bounce-up is mostly company-specific and far from an industry-wide phenomenon. TSMC’s rapid improvement in recent months can be mainly attributed to the strong demand for its advanced nodes—3nm and 5nm – in which it is damn close to holding a monopoly at this point.

You see, TSMC is the only foundry able to manufacture 3nm nodes at a large scale and at the highest quality, making it the go-to for Nvidia for its most advanced GPUs, fueling growth for TSMC. The same goes for other customers and AI leaders like AMD and Intel, for that matter.

In other words, the company is benefitting massively from the booming demand for AI and this is clearly visible in the Q2 results.

Just take a look at the company’s revenue split by technology, with advanced nodes (defined at everything of 7nm and below) now accounting for 67% of revenue, up from 65% in Q1 and just 52% in the same quarter last year.

3nm technology has grown from 0% last year to 15% in the most recent quarter, brilliantly highlighting the insane demand and TSMC's rapid production capacity growth. Meanwhile, 5nm now accounts for 35% of revenue, up from 30% last year, and 7nm accounted for 17%.

Positively, this is not a temporary blip, but TSMC management expects this to remain a significant tailwind for the foreseeable future. For 2024, AI-related revenue is expected to double, accounting for a low-teens percentage of revenue. However, this should continue to grow at a CAGR of over 50% for the next five years, bringing AI-related revenue to 20% of total revenue by 2028.

Quite a compelling outlook, which even might turn out somewhat of a conservative outlook from management.

Anyway, this allowed TSMC to report staggering Q2 revenue, even as it saw continued cyclical weakness in consumer electronics, which was also not helped by smartphone seasonality.

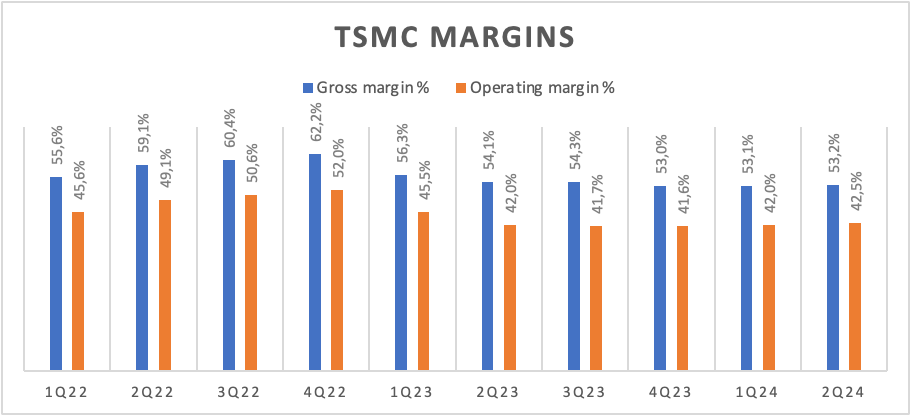

Moving to the bottom line, the company also performed strongly, although it may have impressed a little less due to significant capital spending and investments. In Q2, the gross margin was up 10 bps sequentially to 53.2%, though this also reflects a YoY decline of roughly 90 bps.

This YoY decline can be easily explained by a change in the foreign exchange rate and TSMC’s significant investments in scaling its 3nm production capacity to satisfy demand. As with any new generation, in the initial years, production scaling leads to somewhat lower margins due to lower efficiency, but this is mostly as expected.

Positively, these headwinds were offset by higher capacity utilization, which helped TSMC outperform its own bottom-line guidance.

On the operating margin front, however, the picture is a bit more positive, with this one up 50 bps from last year. This is because TSMC is still closely monitoring its expenses, down to 10.5% of revenue from 12.1% one year ago. This was due to operating expenses growing by “just” 20%, growing slower than blockbuster revenue.

Meanwhile, management continues to spend heavily on global expansion, now projecting to spend between $30 billion and $32 billion. Between 70% and 80% of this is allocated to capacity expansion and development of advanced nodes, for which TSMC is currently still capacity constraint.

Finally, on the bottom line, EPS was $1.48, up 36.3% YoY thanks to the strong top-line growth and minor operating margin improvement.

This strong bottom-line performance also allowed TSMC to maintain a pristine balance sheet, even as it invests over $30 billion annually in capital expenditure. As of the end of Q2, TSMC held a total of $55 billion in cash on its balance sheet, up $12 billion from the end of 2022, only 16 months ago, which is pretty insane considering the industry and the company’s cash flows went through a massive downturn in 2023.

This highlights how supreme this business is and how much cash it generates. Furthermore, with “only” $30 billion in debt, the company holds a solid net cash position of over $20 billion, which is just brilliant. This leaves the company in excellent financial health and with great capital flexibility, as opposed to many of its peers.

This also allows TSMC to pay shareholders a nice 1.2% dividend, which is well covered by the company’s cash flows, with a payout ratio of 39%. The dividend has grown at a 5-year CAGR of roughly 10% and taking into account the expected growth for the industry and TSMC, Wall Street currently expects it to grow its dividend at a 14.5% CAGR for the next three years.

While the company has no history of great dividend consistency (it is no priority for management, or at least wasn’t), shareholders can count on great dividend growth going forward. With a nice starting yield of 1.2% today, that isn’t a bad outlook at all.

TSMC reports solid progress on its roadmap and competition remains mostly non-existent.

Before moving to the revised financial projections, outlook, and valuation, it is worth looking at other important developments over the last quarter, especially regarding the company’s technology roadmap and progress as it determines its ability to maintain its current dominant position.

However, there wasn’t a lot of news over the last three months with the business performing as expected. The most notable was some more commentary from management on its technology roadmap with management shining some light on its progress for the roll-out of 2nm nodes and A16 technologies.

While TSMC is currently fully invested in the roll-out and scaling of its 3nm nodes, the next technology has already lined up and is expected to be launched in 2025. TSMC’s 2nm technology is designed to lead the industry in addressing the insatiable need for energy-efficient computing and AI.

According to management, “N2 will deliver full load performance and power benefit, with 10 to 15% speed improvement at the same power, or 25% to 30% power improvement at the same speed, and more than 15% chip density increase as compared with the N3E.”

Management stated that development is going well and slightly ahead of track, with volume production expected in 2025. Highlighting the importance of this technology and the already significant demand for it, Apple COO Jeff Williams recently visited TSMC’s headquarters in Taiwan to ensure access to its 2nm technology once manufacturing starts.

Meanwhile, TSMC is also already working on the generation after 2nm with its A16 technologies, which “provides a further 8% to 10% speed improvement at the same power, or 15% to 20% power improvement at the same speed, and additional 7% to 10% chip density gain.” This specific node should be fully targeted at specific HPC (high-performance computing) products like AI. A16 is expected to enter high-volume production in the second half of 2026.

Long story short, TSMC remains well on track development-wise, and it looks like it should be able to easily maintain its lead in the industry, if not expand it further.

I already made very clear in my post last time that, while many see Samsung and especially Intel as a real threat to TSMC’s dominance, real competition is pretty much nonexistent – don’t fall for Intel’s pretty stories as it won’t be able to compete any time soon or maybe ever.

You see, TSMC’s significant edge in experience in massive-scale semiconductor manufacturing should not be underestimated. The company’s many years of manufacturing for clients have allowed it to specialize in this craft and optimize its processes.

Yes, Intel’s roadmap looks impressive as well, but even if it manages to deliver in terms of size, by current projections and benchmarks, the company will be nowhere near TSMC in terms of technology and actual performance.

Intel plans to launch its 1.8nm node in 2025 and a smaller 1.4nm node in 2027, which seems slightly ahead of TSMC. However, flashing around small node sizes isn't going to cut it.

Crucially, Intel’s 1.8nm node is only expected to be as good as TSMC’s current 3nm node. This is what I wrote before:

“According to TSMC management, its measurements show that its latest 3nm technology can achieve a similar PPA (power, performance, and area), a leading measurement variable for semiconductor performance, as that of the Intel 18A, despite its smaller size. It does so with a better technology maturity and a much better cost profile.

Now, once more, consider that Intel’s 18A node is only bound for late 2025, which is the same time TSMC will be producing 2nm nodes at mass scale, which it says will give a 10% to 15% higher performance at the same power and complexity as well as a 25% to 30% lower power consumption compared to 3nm and so also Intel’s 18A, we can safely assume.”

This means Intel won’t be anywhere near TSMC in terms of node performance. Don’t overestimate the competition!

Intel can throw around pretty numbers all it wants, but as long as its technology and efficiency are nowhere near that of TSMC, the likes of Nvidia, AMD, Apple, and Qualcomm won’t be looking Intel’s way, at least not for their highest-end products, which are becoming increasingly important and are the most important growth drivers for TSMC.

Intel just remains at least two years behind TSMC technologically, and that is without incorporating the fact that TSMC management tends to downplay its progress while Intel has a rich history of underdelivering.

As a result, I do not view Intel as a competitor to TSMC for the time being, and I highly doubt the company will be able to catch up with a company with significantly better financial resources and many more years of experience in this highly technical and complicated industry.

On that note, let’s move to the outlook and valuation! But first…

We try to keep all our analysis free for all of you to enjoy and benefit from! Want to support our work a little bit more and show your appreciation? Consider upgrading to paid ($5 monthly).

This allows us to push out even more content and gets you access to our exceptionally performing portfolio and premium subscriber chat!

We appreciate you all!!

Outlook & Valuation

Let’s now finally take a look at what we can expect from this company going forward.

Yet, before we get to management’s guidance, it is worth pointing out that TSMC recently announced a number of interesting price hikes. It announced that it plans to raise the price of its 3nm chips by over 5%, while advanced packaging prices are expected to increase by 10% to 20%, as soon as next year.

This will obviously be great for margins and should give growth a boost.

In terms of guidance, management now expects third-quarter revenue between $22.4 billion and $23.2 billion, representing another quarter of solid growth, expected to be around 32% YoY. Furthermore, the gross margin should be between 53.5% and 55.5%, and the operating margin between 42.5% and 44.5%. This represents some solid margin improvement YoY, especially regarding operating margin.

These expected margin improvements are primarily thanks to “the higher overall capacity utilization rate in the third quarter and better cost improvement efforts, including productivity gains, partially offset by continued dilution from N3 ramp up, N5 to N3 tool conversion costs, and higher electricity prices in Taiwan,” according to management.

For FY24, management maintained its industry guidance for growth of around 10%, but for the company specifically, management turned a little more bullish, raising revenue guidance to above a mid-20s percentage, which is pretty damn impressive and significantly above my 21% estimate from three months ago.

This makes it a pretty perfect beat-and-raise quarter for TSMC.

Obviously, this raise in guidance also requires me to up my financial projections. I underestimated the influence AI was going to have on TSMC's growth, both this year and in the medium term. Therefore, we have upped our long-term financial projections quite a bit, better taking into account the contribution of AI and a stronger-than-expected upcycle in the semiconductor industry. With TSMC as the undisputed manufacturing leader, it is the biggest beneficiary of this upcoming boom.

This all results in the following projections.

Based on these estimates and after a 12% correction last week, TSMC shares now trade at 25.4x this year’s earnings and roughly 20x next year’s earnings, which is a relatively rich valuation for TSMC compared to its historical averages. Though, its market share is also stronger than ever as is its outlook, so the premium makes sense.

Furthermore, on a PEG basis, which much better takes into account its future growth, we are still only looking at a PEG of 1.2x, which isn’t that far from deep value territory. In fact, the average PEG in the semiconductor sector is closer to 2x, so that should tell you something about what a bargain TSMC still is, even after gaining close to 60% YTD.

So, in conclusion, TSMC remains excellent value and a tremendous business with a stellar outlook. Were this company located in the U.S., it would be trading at premiums much closer to that of Nvidia and Synopsys (30-40x earnings), which is funny considering that without TSMC, Nvidia is a lost cause as well…

However, the company is located in Taiwan and exposed to significant geopolitical risks, whether you believe an invasion is imminent or not. A discount is therefore justified. However, I believe this business is still being discounted too much and underappreciated by Wall Street.

If we would assume a PEG of closer to 1.5x, which is still a significant discount to the sector as a whole, and a P/E of around 25x, which is also still a 20% discount to the sector, I calculate an end-of-2026 target price of $238. This represents potential annual returns exceeding 15%, with which it should easily outperform most benchmarks.

Overall, I continue to view TSMC as one of the strongest businesses in the world and one that is once again unjustly discounted after some panic selling last week. With its global importance, this remains a company I love to own.

With my projections pointing to outperformance and 15% annual returns, I maintain my buy rating. Current weakness does indeed present a compelling opportunity to add to a position or initiate one in TSMC.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.