TSMC – Let’s be realistic; this is a no-brainer today

In this post, we take a closer look at semiconductor giant TSMC, discussing its recent results, the threat from competition and China, and its growth prospects.

TSMC TSM 0.00%↑, or Taiwan Semiconductor Manufacturing Company Limited, is one of the greatest and most successful companies worldwide. The company is the go-to for all fabless semiconductor manufacturers, including almost every high-end semiconductor designer today, including Apple, AMD, and Nvidia. It has grown into one of the largest companies globally, with a market cap of $600 billion.

In fact, it can easily be named one of the most essential companies globally, just like ASML, which we covered last week (post found here). I mean, countries are willing to start the next world war to keep access to this company’s resources. Without it, Apple, Nvidia, and the like would be unable to produce the semiconductors used in almost everything nowadays, from your mobile phone and your car to Lockheed Martin’s F-35. This should tell you pretty much all you need to know.

This company should be in your portfolio if you believe in the future of semiconductors—and let’s be honest, there is no going around that.

Now, I bet the majority of you are thinking either, “What the hell is TSMC exactly?” or you will probably have some worries regarding competition from Intel and the threat from China—just how strong is its moat, and what would the consequences of a Chinese invasion be?

Fair enough. I will discuss all you need to know, from its basics to these much-discussed risks, to allow you to (re)consider whether you want to own shares in this semiconductor giant—I certainly do. The company reported its Q1 results last week, so there is no better time to take another close look at this company!

Taiwan Semiconductor Manufacturing Company Limited

Starting at the basics, for those not so familiar with this name, TSMC is a titan in the semiconductor industry through its leading semiconductor fabrication capabilities. Established in 1987, TSMC has continuously pushed the boundaries of technology, earning global acclaim for its cutting-edge semiconductor manufacturing processes.

Headquartered in Hsinchu, Taiwan, TSMC operates as the world's largest dedicated independent semiconductor foundry. The company is a pure-play foundry, which, in simple terms, means a semiconductor manufacturer entirely focused on manufacturing for fabless clients without making any self-designed semiconductors.

While this might sound unimpressive and relatively straightforward, few companies are as technologically advanced as TSMC. Semiconductor manufacturing is one of the most complex and technologically advanced processes you will find. Fabricating semiconductor chips involves a series of intricate steps, including photolithography, etching, doping, and metallization, which require significant expertise.

TSMC didn’t become the leading manufacturer overnight, but decades of R&D and experience made it possible. TSMC's facilities have state-of-the-art equipment and infrastructure to execute these processes with unmatched accuracy and reliability. Additionally, TSMC employs advanced materials and techniques to overcome the challenges posed by the shrinking dimensions of semiconductor components, ensuring the production of chips with ever-increasing transistor densities at a level not a single competitor can match.

Over the years, it has turned into a real force in the industry, to the point today where the company produces the chips for pretty much every high-end fabless semiconductor company as it simply is the most advanced and the only one capable of mass producing the quality and dimension chips needed by Apple and Nvidia.

As a result, today's company holds an insane 67% market share in advanced nodes (everything below 7nm), poised to grow over 70% in the first half of 2024, driven by a growing 3nm capacity and insane demand.

Furthermore, as of Q4, it holds a market share of 61.2% across the entire foundry or semiconductor manufacturing industry, meaning that over 60% of all semiconductors manufactured globally are made by TSMC. This market share is the highest level it has ever been at, which is a testimony to the company’s extraordinary performance and technological development.

Since 2019, it has grown its market share by a very significant 13.1 percentage points, manifesting its dominance and growing its global importance. Also, looking at its technology pipeline, which I’ll get to later in this post, we can safely assume it will keep growing its market share through at least 2027.

As mentioned in prior posts, the semiconductor industry is in for another significant growth cycle through the end of the decade. Current projections point to the industry reaching a total size of comfortably over $1 trillion, driven by the booming demand for advanced technologies like AI, IoT, autonomous driving, decarbonization, and the overall trend of digitalization. Just consider that smartphone penetration is still reaching new highs each year.

Obviously, this leads to a far higher demand for semiconductors in terms of numbers and capabilities, fueling a lot of growth for TSMC as the leading provider of these. As a result, PR Newswire expects the foundry industry to grow at an 8.1% CAGR through the end of the decade, with the industry projected to more than double in value.

TSMC remains in the prime position to fully benefit from this growth as the go-to manufacturer, making it a very promising investment.

On that note, let’s take a closer look at its latest financials.

TSMC delivered excellent Q1 results

We can safely say the results for the first quarter reported by TSMC last week weren’t very well received by the market, with shares down by double digits, despite the company beating expectations and maintaining its outlook.

Now, whether this is due to the results or the general poor sentiment in the financial markets is hard to tell, but it seems to be a combination of things. Though, one thing is for sure: the sell-off is overdone.

TSMC reported revenue of $18.87 billion, up 12.9% YoY, as the underlying industry is recovering, and TSMC is seeing significant demand for 3nm chips. Sequentially, revenue was down 3.8%, reflecting smartphone seasonality, partially offset by strength in advanced node demand.

By technology, advanced nodes (nodes below 7nm) continue to grow as a percentage of total revenue. In the latest quarter, this accounted for 65% of total revenue, up significantly from 51% last year. Looking more closely, we can see that 3nm is a rapidly growing technology for TSMC as it continues to be fully booked here, no matter how fast it grows capacity. This now accounts for 9% of revenue, followed by 5nm at 37% and 7nm at 19%.

Obviously, AI, which falls under the HPC (High-Performance Computing) banner at TSMC, continues to be a significant contributor to this advanced node growth. TSMC is the only foundry able to manufacture 3nm nodes at a large scale and at the highest quality, making it the go-to for Nvidia for its most advanced GPUs, fueling growth for TSMC.

Management now forecasts AI revenue to double in 2024 and start accounting for a low-teens percentage of revenue. Furthermore, management forecasts a 50% CAGR in AI revenue over the next five years, with the technology growing to 20% of revenue by 2028.

This shows us that AI is already fueling TSMC's growth today and will be even more of a growth driver as it expands its advanced node capacity.

Speaking of capacity, TSMC is working hard on growing this and expanding further outside of Taiwan. In recent months, the company has once more increased its projected investment in Arizona, committing to up to $65 billion of investment into a total of three new manufacturing facilities or fabs, significantly increasing its manufacturing capacity in the U.S.

Positively, TSMC has been awarded $6.6 billion in grants for its efforts to grow semiconductor manufacturing capacity in the U.S. The U.S. government has also committed to up to $5 billion in loans for TSMC to boost capacity expansion, further helping the company expand its footprint.

For now, the company remains well on track with realizing these fabs. The first one, focused on 4nm chips, is expected to become operational in the first half of 2025. A second fab, producing more advanced 3nm and 2nm chips, will become operational in 2026. Finally, a recently announced third fab will be realized by 2028, making 2nm and more advanced nodes.

Not only do these Arizona facilities significantly grow overall capacity, but they also bring the company closer to most of its largest customers, like Nvidia and Apple. In fact, Apple is already working hard to secure capacity in these facilities to ensure that high-end chips are closer to home.

Meanwhile, TSMC is also building new facilities in Japan and Germany, for which it receives funding. However, Taiwan remains its key focus, and the company is not planning on moving away from the peninsula. Overall, the company is showing good progress, and these expansion efforts allow it to keep growing strongly.

Moving back to the Q1 results and focusing on the bottom line, we can see the company is still facing quite some headwinds and will continue to do so throughout 2024.

For starters, electricity costs continue to rise rapidly in Taiwan, which is impacting the company’s bottom line quite a bit. On top of this, it is also still seeing lower margins on its advanced nodes as it is still very much developing these processes, and as this grows as a percentage of revenue, this is another short-term margin headwind.

Even as management controls its costs tightly and growth accelerates, it still sees its margins struggle. In Q1, the gross margin was down 320 bps YoY to 53.1% from exceptional highs last year. The operating margin fell by an even more significant 350 bps to 42%, reflecting 18.2% growth in operating expenses, outgrowing top-line growth. However, this should change from next quarter as top-line growth accelerates.

Moreover, these margins remain industry-leading by some margin and are tremendous, even in the face of headwinds. The company also continues to operate excellently and is fully investing in expansion. Capex in Q1 totaled $5.77 billion, and management continues to guide for FY24 Capex of $28 billion to $32 billion, which is down from last year but still significant.

Furthermore, ROE remained at an excellent 25.4%, and TSMC still generated $7.83 billion in FCF, up significantly from Q1 last year. This also allowed it to maintain a pristine balance sheet with $53 billion in cash and a manageable and well-covered $30 billion in debt.

Now, let’s shift our focus to the longer-term opportunities and risks, which are most important for investors.

The threat of competition is nonexistent

One key aspect that has made and still makes TSMC such a compelling investment opportunity is its sheer dominance in semiconductor manufacturing, which, as discussed before, is an incredibly promising market.

However, this also makes losing this dominance a massive risk. With Intel spending tens of billions in recent years in an effort to compete with TSMC and Samsung improving its processes, the future of TSMC’s dominance is often questioned.

Positively, any concerns here seem completely unnecessary. First of all, the company's significant edge in experience in massive-scale semiconductor manufacturing should not be underestimated. The company’s many years of manufacturing for clients have allowed it to specialize in this craft and optimize its processes.

This is also one of the most notable reasons it is technologically ahead of the competition. As pointed out earlier, TSMC is the only manufacturer currently able to manufacture 3nm chips on a large scale, which is why the likes of Apple, Nvidia, and AMD are fighting for capacity at the company as it is fully booked.

Samsung is the only one that is even coming close to TSMC in 3nm technology, but it is nowhere near TSMC’s scale or efficiency. For example, most recent reports state that Samsung still only has a yield of below 60% in 3nm technology, which is like a manufacturing success rate. Meanwhile, TSMC is already aiming for 80%, which makes its operations much more profitable and efficient.

Moreover, we already discussed the company’s upcoming fab openings, but the company also has an impressive roadmap of new technologies. The company consistently invests billions in R&D to maintain its technological and operational edge, protecting its moat.

Notably, whereas this year it is fully focused on scaling its 3nm production, TSMC is already on track to have mass production of 2nm chips fully operational by 2025. The chips will offer “a 10% to 15% higher performance at the same power and complexity as well as a 25% to 30% lower power consumption at the same frequency and transistor count” when compared to TSMC’s most advanced 3nm nodes.

The expectation is that TSMC will continue to lead the market in the quality and capacity of these next-generation chips once more, with management itself saying it will be the most advanced technology by 2025. Apple is mentioned as the first customer to adopt these new nodes.

Meanwhile, TSMC also, for the first time, spoke of the next generation of technology to follow after 2nm, which is its A16 node, as TSMC calls it, which will go into production in the second half of 2026. This node should be a significant technology for AI-dedicated designs as it leverages the backside of the chip, which helps speed up AI processes.

Meanwhile, Intel, which can be seen as the biggest threat right now to TSMC’s domination, reportedly remains on track to compete with TSMC’s 2nm node with its own 1.8nm node in 2025 and is set to release a smaller 1.4nm node in 2027, potentially ahead of TSMC. With its 18A or 1.8nm technology, Intel believes it is poised to retake the technology lead in 2025 from TSMC.

The new technology has already brought Intel a massive customer in Microsoft, which plans to use Intel’s 18A technology for its data center chips—a deal said to be worth around $15 billion.

Now, this might not sound great for TSMC. However, this roadmap from Intel doesn’t tell the whole story. Most notably, even if Intel could meet its roadmap goals and get on par in terms of size, it is most likely still far away in terms of technology, let alone operational processes in terms of node quality, yield, and costs.

Most importantly, while Intel is flashing around impressive node sizes by 2025 or 2027, TSMC management claims that Intel’s 18A or 1.8nm technology is only as good as TSMC’s 3nm technology, which has already reached mass production for months. According to TSMC management, its measurements show that its latest 3nm technology can achieve a similar PPA (power, performance, and area), a leading measurement variable for semiconductor performance, as that of the Intel 18A, despite its smaller size. It does so with a better technology maturity and a much better cost profile.

Now, once more, consider that Intel’s 18A node is only bound for late 2025, which is the same time TSMC will be producing 2nm nodes at mass scale, which it says will give a 10% to 15% higher performance at the same power and complexity as well as a 25% to 30% lower power consumption compared to 3nm and so also Intel’s 18A, we can safely assume.

Knowing how TSMC management operates, these aren’t the kind of statements they throw around without much consideration, so this is a solid indication of where both companies will be by 2025, and Intel will be nowhere close, it seems. Looking at these numbers and roadmaps, Intel still appears to be at least two years behind by 2025, which is a significant gap in this performance-focused industry.

Really, this is all you need to know about competition coming from Intel, which is rather close to nonexistent. For now, I do not see much reason for TSMC customers to jump to Intel, at least when it comes to the most advanced nodes.

This also still leaves out the consideration that it will remain an uphill battle for Intel, making it increasingly unlikely it will compete on the highest level soon. Intel is nowhere close to TSMC’s economies of scale, which allow it to drive down production costs while maintaining superior quality and reliability.

This is also giving TSMC a growing and increasingly important financial edge, which is quite important in a capital-intensive industry such as this. For reference, TSMC generated a whopping $70 billion in revenue in 2023, spent $30.5 billion on Capex, $6 billion on R&D, and still generated $9 billion in FCF in a very challenging year (FCF in Q1 already beat that number).

Meanwhile, Samsung reported a negative FCF of $12.5 billion, and Intel reported a negative FCF of $14.3 billion. I think you can see where I am going here—TSMC’s dominance also gives it incredible cost advantages, making it hard for competitors to compete. There is the uphill battle.

Current expectations are that Intel Foundry will continue to report significant losses for the next couple of years and is many years away from TSMC’s profitability level. In 2023, Foundry losses for Intel grew to $7 billion, up from $5.5 billion in 2022. In fact, Intel expects or aims for its Foundry segment to achieve break-even operating margins only by 2030, which means Foundry investments need to be fully funded by its chips business. While significant, I can’t imagine it will be a sustainable strategy, especially as it also faces competition from AMD on that front.

Now, I am not here to destroy Intel or look at its investment case, but I am trying to show just how strong TSMC’s moat is and how hard it will be for Intel to compete. Based on what we know today, I can see no scenario in which Intel will be able to compete on the highest level with TSMC before 2030, and even then, I am not sure.

As a result, I continue to view TSMC’s moat as strong and believe it will be able to at least maintain its current market share through the end of the decade, with some potential for market share expansion.

Fun fact: Intel even placed $4 billion worth of 3nm orders at TSMC for 2024, highlighting that its foundry isn’t quite there yet and making the cash flow difference even larger. Furthermore, the expectation is for another $10 billion worth of orders to come in by 2025. Simply put, if Intel doesn’t want to fall further behind AMD in the CPU space, it has to leverage TSMC’s superior nodes, which is a bit painful…

What to think of the “China-Taiwan conflict” and risks

Another risk that is most often mentioned when investing in TSMC is that China still argues that Taiwan is a breakaway province that belongs under the control of Beijing. Now, I am not going to give you a history lesson, but the point of it all is that China has regularly stated that it intends to peacefully retake control of Taiwan, which it owned for most of history. In fact, Taiwan is only officially recognized as a separate country by 12 nations, so you can see where this debate is coming from.

Obviously, an invasion or the risk of it is quite a big thing and would be detrimental to TSMC. It is one of the leading reasons why the company has consistently traded at a discount to its U.S. peers. Investors are simply scared of such an invasion, which would probably bring its stock price close to zero, and understandably so.

However, experts agree that the chance of a Chinese invasion of Taiwan is very low, so these concerns might be overblown, or at least that is what we believe. See, Taiwan has the U.S. on its side.

The U.S. knows how important Taiwan is to them and the rest of the world due to TSMC and its facilities. I mean, almost all of Nvidia’s incredible GPUs and Apple’s silicon are manufactured there.

For this exact reason, the U.S. has stated that in the event of an invasion, it will defend Taiwan. Therefore, an invasion from China would almost certainly end up in a China-U.S. war, something that nobody benefits from, including China.

The experts argue several other cases, but the overall conclusion is that an actual invasion isn’t likely, surely not any time soon. Of course, this doesn’t mean TSMC won’t stop trading at a discount, but, in our view, it surely isn’t a reason not to buy the shares as the actual threat is relatively low.

Also, if China were to try and invade Taiwan and start a war with the U.S., this would impact the whole world and some of the most popular companies. The issue would be far more widespread than just TSMC. While it isn’t as black and white, ask yourself this: Would you avoid investing in any of the companies dependent on TSMC for this reason?

Outlook & Valuation

With those risks out of the way, let’s focus on what to expect from the company in the future.

First of all, there are positives and negatives in the short term. Most importantly, management expects advanced node demand to support the business throughout the remainder of 2024, driven by 3nm and 5nm technologies.

For Q2, management now guides for revenue of between $19.6 billion and $20.4 billion, representing YoY growth of 27.6% at the midpoint, as growth continues to accelerate, reflecting an improving demand environment and growth in 3nm capacity.

Furthermore, the Q2 gross margin is expected to be between 51% and 53%, which at the midpoint reflects a contraction of 210 bps YoY. The operating margin is expected to be between 40% and 42%, down 100 bps at the midpoint.

This shows us that margin pressures persist, but this should not be a surprise. Electricity costs keep rising in Taiwan, going up another 25% as of April 1 after a 17% increase last year, impacting the company's margins negatively. This impact is estimated to be around 70 to 80bps. These higher electricity costs are expected to keep negatively impacting the gross margin throughout 2024, which management expects to be roughly 60-70bps in the year's second half.

In addition, Taiwan also experienced its heaviest earthquake in decades earlier this year. Although the earthquake has had no major impact on any of the company’s facilities, it will have a slight negative impact on the gross margin in Q2, mainly due to losses from wafer scraps that occurred during the earthquake itself and material loss. This impact is estimated to be about 50 bps.

That means these two factors together already account for the majority of the margin contraction, and positively, these are only temporary issues. Notably, despite the near-term margin headwinds, management remains committed to its long-term target of a gross margin of over 53% in a normal operating environment, which remains excellent. This also includes the expectation for more overseas fabs, which is impressive, to say the least.

Probably the most significant and only real negative during the earnings call, and the reason TSMC shares fell during the following trading session, together with the semiconductor industry as a whole, was TSMC management's lower revised growth projection for the semiconductor industry.

Management now expects the industry, excluding memory, to only experience a mild and gradual recovery in 2024, guiding for growth of approximately 10%, while it previously guided for growth of over 10%. This new guidance better reflects the continued geopolitical and demand uncertainty.

Positively, management does guide the Foundry industry to grow by mid-to-high teens, fueling growth for TSMC, which should continue to outperform. Especially thanks to its advanced node dominance, management maintains its FY24 revenue guidance, pointing to low to mid-20% growth.

Overall, this still presents a pretty compelling picture for the remainder of 2024, with TSMC expecting solid growth after a lesser year in 2023, and the same can be said for the years after. As discussed earlier, the Foundry industry is expected to keep compounding strongly, with TSMC most likely growing even faster as it should continue to gain share thanks to its technological edge.

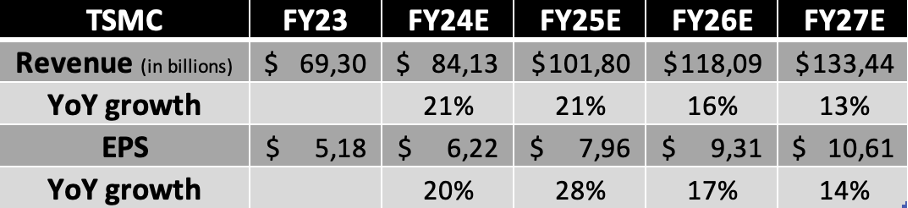

As a result, and looking at the industry and demand dynamics today, we estimate revenue growth of just over 21% in 2024 and growth to remain strong in the following years as the industry goes through a new upcycle. On the margin front, 2024 will be slightly weaker, but margins will bounce back strongly in 2025 and 2026 as the 3nm process matures and cost growth slows.

This results in the following financial projections.

Based on these estimates, TSMC shares are now trading at 22x this year’s earnings, which is right around its 5-year average and a 10% discount to the sector median. The company itself arguably is one of the highest-quality and fastest-growing picks in the sector. Just check out the growth outlook above… its growth forecast is quite impressive.

Now, of course, we have to consider the “Taiwan discount,” so shares might be right around fair value today. I would probably say a multiple of 22-24x is fair for this business. And still, even based on this conservative multiple, there remains significant upside.

Obviously, yes, you should have bought shares back in September when these were a ridiculous bargain (I made my case here on Seeking Alpha in September). Yet, missing out on that buying opportunity is no reason to avoid the shares right now.

Let’s assume a 22x multiple, which I believe is rather conservative. Still, This translates into a 2-year target price of $175 or potential returns exceeding 17% annually from a current price of $133 per share. This means that from current prices, shares still offer tremendous upside and significant potential to outperform the market by some margin (other valuation methods like a DCF point to an even higher upside, so this is already quite a conservative price target).

All things considered, I believe we can safely say that TSMC remains not only one of the most important and high-quality companies in the world but also one of the most compelling investments, with the potential to outperform in the long run.

Therefore, we rate shares a buy and have added some TSMC shares to our portfolio on current weakness.

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

I'm long TSM with some LEAPS. Think it has room.

It’s worrying how people dismiss geopolitical risk so readily. That was the case in Europe before Russia’s full scale invasion of Ukraine. The abrupt and shocking geopolitical reversal in Europe led to a drastic reevaluation of the associated risk, but by then it was too late for anything but a rushed, reactive response. Many people lost a lot of money.