Comcast Corporation – All you need to know about this media giant

Comcast Corporation deep dive

After covering a relatively unknown small high-growth company last week with Monday.com, which is founder-led, has only a little over 1800 employees, was founded in 2014, has a $10 billion market, and incredible growth prospects (make sure to check this one out using the button below), today we are going in a completely different direction, diving into an industry stalwart with a $167 billion market cap and decades of history.

Comcast Corporation, the undisputed media and connectivity leader in the U.S., is well known, at the very least, being one of the top brands globally, capturing the 29th spot on the Fortune 500 list. The contrast with Monday.com couldn’t be any more significant.

The company has over 52 million customer relationships, with an average monthly payment of over $100, allowing it to generate over $13 billion in FCF annually. The company is a real FCF machine and is eager to return the majority of this to its shareholders.

In terms of growth, Comcast has been able to grow revenues at a 6.5% CAGR over the last decade, while profits, measured in EPS, have grown at a faster CAGR of 11%, which is solid.

On top of this, the nature of its business also makes its cash flows incredibly resilient, resulting in the company performing through the cycles. In an uncertain environment, as we have seen over the last few years and still experience today, Comcast stands as a cornerstone in a portfolio.

And yet, Comcast hasn’t been one of the best investments over the last decade, with shares up only 65% over the last ten years and a meager 8.5% over the previous five years. Furthermore, so far this year, shares are down over 4% against a 7% positive return for the S&P500. Why?

Starting with the elephant in the room here, investors generally perceive Comcast as having its best years behind it, with it increasingly facing headwinds in its most important and largest operation, broadband connectivity. On top of this, the shift to streaming from cable or pay TV is also hurting the media leader, as its pay TV subscriber numbers have plummeted over recent years.

Fewer and fewer people are actually interested in pay TV as streaming is becoming the new normal, even for sports broadcasting, which is pretty much the single reason pay TV hasn’t completely disappeared yet. I mean, who still watches their favorite shows on TV with commercial breaks every 5 minutes?

Sure, this all sounds pretty bad, even more so, as these operations account for the majority of revenue and even a larger share of EBITDA. And yet, we are still optimistic about the company’s prospects and actually believe Comcast shares are very compelling at current levels. This is due to a combination of investors underestimating the company’s ability to adapt and misunderstanding its operations, excellent brand collection, and IP portfolio.

Importantly, and unlike what many people believe, the company isn’t just a broadband and pay TV company but owns many leading news and media platforms, some of the best movie and TV studios, and massive amusement parks that see tens of millions of people coming through its doors annually.

Comcast is much larger than many believe it to be and is well-positioned for the future. While many are skeptical about the company's future prospects due to its dependence on a deteriorating broadband and pay TV market, there is no denying the company operates in very profitable industries and owns many leading entertainment and connectivity brands and platforms, through which it remains a leader in these respective industries.

This is Comcast Corporation

Understanding this business is crucial to identifying its hidden value and growth potential, so let’s start with the basics. Comcast Corporation is a global telecommunications conglomerate headquartered in Philadelphia, Pennsylvania. Established in 1963, Comcast has evolved into one of the largest media, entertainment, and technology companies worldwide, being the undisputed home internet and broadband provider in the U.S.

A significant milestone in Comcast's history came with its acquisition of NBCUniversal in 2011. This landmark deal solidified Comcast's position as a major player in the media and entertainment industry, giving it ownership of renowned assets such as NBC, Universal Pictures, and numerous cable networks.

Through NBCUniversal, Comcast has considerable influence in film and television production, content distribution, theme parks, and digital media. Just last year, its studios were the top performer in terms of box office revenues while its theme parks are some of the most visited globally.

As a result of the acquisition, Comcast's primary businesses today encompass cable television, broadband internet, telephone services, and content distribution through its NBCUniversal media assets. This makes the company a real media and connectivity giant with many different operations.

Still, Comcast's foundational pillars are its cable television services and broadband offering, which have grown to encompass tens of millions of subscribers across the United States. Comcast operates under several brands, including Xfinity for consumer services and Comcast Business for commercial clients.

Leveraging its extensive infrastructure, Comcast delivers high-speed internet connectivity to residential and commercial customers alike. The company's commitment to innovation has seen it continuously upgrade its network capabilities, introducing advancements such as fiber-optic technology and gigabit internet speeds.

Meanwhile, through its subsidiary Xfinity, Comcast offers a vast array of cable TV packages, delivering diverse content ranging from news and sports to movies and original programming.

On top of this, one of the latest introductions by Comcast in terms of connectivity is Xfinity mobile, which is the company’s mobile 5G offering, using the Verizon network and its own Wi-Fi hotspots. Comcast has steadily expanded these operations and seen solid subscriber growth, but more on this later!

Finally, Comcast's strategic vision also extends beyond its core businesses into emerging sectors such as streaming media. In 2020, the company launched its own streaming service, Peacock, offering subscribers access to a vast library of movies, TV shows, and exclusive original content.

Diving deeper, the company splits its revenue into two main categories: Connectivity & Platforms and Content & Experiences. In terms of revenue, Connectivity & Platforms is the largest segment, accounting for 65% of annual revenue compared to 35% for Content & Experiences. In terms of cash flows, the segment becomes even more important to Comcast, with Content & Experiences accounting for a whopping 83% of EBITDA.

Connectivity & Platforms segment

The company’s Xfinity and Comcast Business offerings and other similar connectivity platforms fall under the Connectivity & Platforms segment. Residential connectivity is the largest within this segment, accounting for 41% of revenue, followed by video at 35%.

Broadband

While many view the company’s broadband operations as a deteriorating business that is only growing through price increases, Comcast management remains very confident in the long-term growth opportunity of the business, which is mainly driven by network expansion and the use of new technologies.

For reference, in 2023, Comcast added passings (broadband availability or potential customers) to 1.1 million households, up from 840k in 2022. Management is confident it can equal or even top this in 2024, further expanding its network and potential user base.

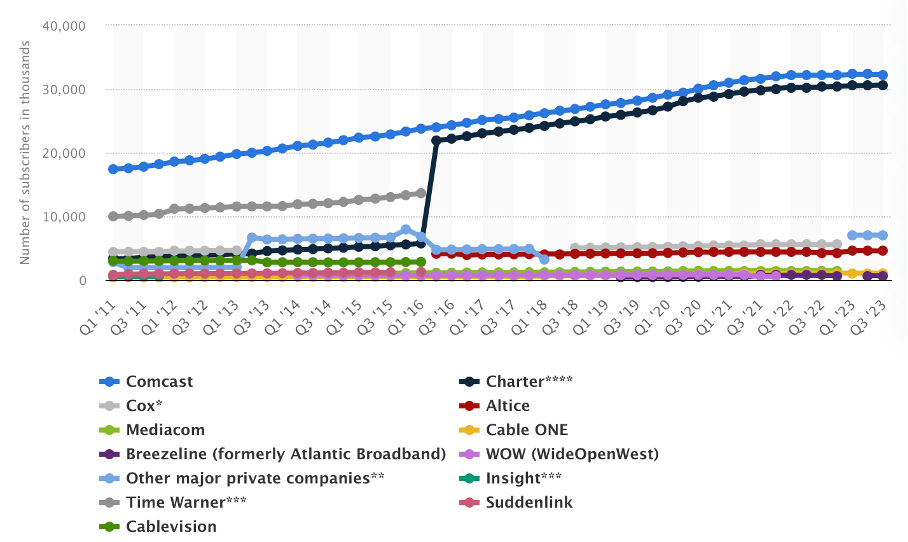

At the end of 2023, Comcast counted 32.3 million broadband customers, up marginally from 32.1 million in 2021 and roughly flat from 2022. This included a loss of 34,000 subscribers in Q4. While this trend is far from great, I don’t believe it is as worrying as some think.

Meanwhile, during the latest earnings call, management indicated that it does not expect these subscriber trends to improve over the next few quarters but is more optimistic in the longer term. They point to a positive macro environment, with several secular drivers and positive consumption trends, like customers connecting more devices, requiring more capacity, faster speeds, and lower latency. These are trends working in Comcast’s favor as its superior network will remain in relatively high demand.

However, we expect minimal subscriber growth for Comcast anywhere in the near future, even as these trends work in its favor and it expands its network. We believe these factors will be able to offset the rise in wireless internet and keep Comcast’s broadband business going, but it will not drive real growth, in our view. Therefore, we can see where investor worries come from, though we aren’t overly worried about this.

For one, the company has plenty of faster-growing and more promising operations to offset this weakness and is working on making its offering more sticky. However, more importantly, broadband revenue and EBITDA should keep growing due to growth in ARPU.

Broadband ARPU (Average Revenue Per User) grew by 3.9% in 2023, mainly fueled by price increases to offset inflation but also signaling that the business remains quite solid. 3.9% ARPU growth sits at the high end of management’s historical target range of 3-4%, and they expect this to remain solid going forward, even as inflation eases.

This is, again, driven by the earlier mentioned several secular drivers and positive consumption trends, such as customers connecting more devices, requiring more capacity, faster speeds, and lower latency. These factors contribute to more expensive contracts, driving growth in ARPU and offsetting subscriber weakness.

The improvement in ARPU in 2023 against flat subscriber levels led to Broadband revenue growth of 4.2% in 2023 and solid EBITDA growth, with these operations now reaching a margin of around 40%.

Meanwhile, the underlying U.S. broadband market is also expected to keep growing quite steadily at a CAGR of 4.2% through 2028, according to Verdict. As mentioned before, Comcast remains the leading cable provider with the most subscribers and fastest internet speeds. Comcast has been the market leader since 2011 and holds a market share of over 40%. As a result, it will fully benefit from this industry growth.

All things considered, we believe this largest segment and operation for the company should be able to keep growing at around 2% to 4% in the medium term, driving significant cash flows and offering a steady basis. We are not all that negative.

Wireless operations

The company has plenty of other operations to offset any weakness (or slowing growth) in broadband. Its efforts in wireless through Xfinity Mobile, particularly, look extremely promising. The company’s mobile offering is pretty unique. It only offers the service to cable subscribers, offers bundling discounts, and offers the services at incredibly low prices, undercutting the top 3 providers by a mile.

Simply put, Comcast offers its existing customers a reliable 5G network at a lower price (The best unlimited plan according to Tom’s Guide), promising the same quality through Verizon, or even better, as its service leverages its incredible hotspot network, offering even better speeds. It's no surprise that the service has seen amazing adoption.

In terms of pricing, Comcast offers unlimited plans for as low as $30 per month, compared to $50 at T-Mobile, $66 for AT&T users, and $65 at Verizon.

Comcast added 1.3 million lines in 2023 to this relatively young but up-and-coming wireless business, up 24% YoY to a total now of 6.6 million subscribers. This led to revenue growth of 19% in 2023, eclipsing a $4 billion annual run rate as of Q4.

Xfinity Mobile has grown impressively over recent years, steadily adding over 300,000 lines every quarter over the last two years. In Q4, Comcast added 310,000 Xfinity mobile lines. We can safely say momentum is impressive, but the company still reports only 11% penetration of its broadband customers, leaving it with a long runway for growth. We believe this operation holds significant potential and believe growth in the high teens over the next few years remains likely.

Meanwhile, this adoption of Comcast’s wireless services also ensures longevity and lowers the churn of its cable business, as users can only use Xfinity mobile as cable subscribers. This is quite a favorable strategy move from Comcast, indeed, not only generating additional revenue streams but also locking in its customer base.

Sky and video

Moving on to the final operations within the connectivity & platforms segment, the company is also quite successful outside of the U.S. with its Sky subsidiary. Sky drove $4.2 billion in revenue in 2023, up 23% YoY, through its 7.1 million broadband subscribers and 3.5 million wireless subscribers.

The company continues to invest heavily in Sky and believes it has plenty of room for continued growth. As a result, this should remain a growth driver.

Finally, there is video or pay-TV, which accounts for around 35% of Connectivity & Platforms revenue, a percentage that is dropping rapidly. These operations are a massive drag on growth in Connectivity & Platforms as subscriber numbers are plummeting.

For reference, Pay TV is a television service requiring a cable, satellite, or phone company subscription. In the case of Comcast, these are its video or cable TV revenues. Comcast is the U.S. pay-TV industry leader, holding a significant portion of the market. As of 2020, this market share was estimated at around 20% and is likely to hover around a similar level today.

However, the pay-TV market is deteriorating as streaming is rapidly taking over.

Even as Comcast is a leader in the pay TV space, the company has been bleeding subscribers in recent years as more people shift from traditional cable TV to streaming services. In the third quarter of 2023, the company recorded about 14.5 million pay-TV subscribers, down by over two million in just one year. Clearly, this is a dying market, and the segment will likely remain a drag on growth for Comcast in the near to medium term.

As for growth in the underlying industry, Straits Research points to a very limited CAGR of 1.5% through 2030, offering minimal growth below the average GDP growth and rate of inflation, mainly due to the rise of streaming.

Overall, we believe the Connectivity & Platforms segment should continue to deliver growth at a CAGR of 1-3% in the medium term, which is very much dependent on broadband subscriber trends and the rate of subscriber losses in video. This could fluctuate a bit, with growth improving toward the decade's end.

Content & Experiences segment

Content & Experiences include all the company’s TV channels and entertainment platforms like NBC, CNBC, MSNBC, Sky Sports, and Peacock. Furthermore, it also includes the company’s amusement parks and studios like Universal, Illumination, and Dreamworks. Within the Content & Experiences segment, media accounts for the majority of revenues at 55%, followed by studios at 25% and theme parks at 19%. However, in terms of profitability, the theme parks excel, accounting for 44% of EBITDA. In terms of profitability, the segment did better than Connectivity & Platforms in 2023, growing EBITDA by 5.4% despite rising losses from its Peacock streaming service.

Studios

Comcast owns renowned studios like Universal, Illumination, and Dreamworks, through which it has a strong foothold in the movie and TV production industry. And the segment is firing on all cylinders as well. Where some are struggling to push out solid content, like (arguably) Disney and Warner Bros in recent years.

In 2023, Comcast Studios released three of the top five box office movies and the #1 horror movie. Oppenheimer was especially well received. Let’s be clear: Comcast owns some of the most successful movie and TV studios and regularly releases blockbusters. Don’t underestimate this part of the business.

This box office success led to EBITDA growth in 2023 of 32% YoY to $1.4 billion. Of course, we should remember that these numbers fluctuate heavily, depending on production costs and box office revenues. In 2023, the impressive EBITDA and growth were driven by the success of the Super Mario Bros and Oppenheimer movies, which were received incredibly well.

In terms of content production, Comcast aims to keep its annual spend on content around the $20 billion mark. This is similar to rivals like Netflix (stabilized around $17 billion), Warner Bros (down to $20 billion), and Disney (leading with $27 billion). Obviously, it is here to compete.

The movie and entertainment market is also poised for significant growth at a CAGR of 7.2% through 2030, helped by growth in streaming. Comcast is here to benefit, and we believe this segment should continue to perform well, estimating revenue to grow at a CAGR of 6-9% in the medium term.

Media

Another big part of Comcast is its media operations. Within its media portfolio, the company has some of the most watched platforms and programs (think, CNBC, NBC, and Sky Sports), including the most-watched news channels in the U.S. and the most-watched prime-time show through Sunday Night Football for 13 years straight now. Through these channels, the company reaches over 100 million households every quarter, definitely making it a significant player in the industry.

Overall, Media revenue was up 3% in 2023. Internationally, the company is also doing well, mainly through Sky Sports, growing revenue by 17%. This was specifically driven by more sports content and a positive foreign currency translation.

However, the most promising platform in its media portfolio is the streaming service Peacock. Comcast launched the platform in 2020 and has seen incredible adoption in the first three years. Peacock reached 31 million subscribers in Q4, including 10 million net additions in 2023, as the streaming service continues to grow rapidly, driven by live sports and exciting movie releases.

Streaming ARPU increased to $10, supported by healthy trends in engagement and churn. This led to revenue growth of 62% to $3.4 billion for FY23. Peacock crossed the $1 billion in quarterly revenue mark in Q4. Peacock advertising was also up 50% YoY.

While Peacock is very often underestimated by analysts and disregarded due to its limited size, I am very much bullish on the streaming service as a part of Comcast. Yes, it is very small within the Comcast organization and has little impact on growth due to the size of its connectivity segment. However, Peacock has seen very solid adoption, and Comcast has a robust IP portfolio through its leading studios, an incredible track record, and success in TV shows, and is well positioned to move live sports to streaming as well.

The company is already slowly moving its sports content from cable TV to streaming. It broadcasted the NFL Wildcard game between the Chiefs and the Dolphins exclusively on Peacock, attracting nearly 23 million viewers and consuming 30% of internet traffic in the U.S.

As a result, we expect the streaming service to keep growing rapidly, at least partially offsetting some of the declining revenue from its pay TV business. The service definitely has a lot of potential.

Furthermore, the company expects more success in 2024, with Oppenheimer exclusively streaming on Peacock, originals like Ted attracting many viewers, and the Summer Olympics streaming later this year. On top of this, Comcast also estimates that 2023 was the peak in terms of EBITDA losses ($2.7 billion) as it will start to improve the service’s profitability in 2024, mostly due to size advantages. This is far ahead of schedule and should make the service much more accretive to Comcast as a whole.

Now, while this all sounds great, there is also a significant risk to highlight here. This is the recently announced joint sports streaming platform by Walt Disney’s ESPN, Fox, and Warner Bros. The platform is intended to create a more streamlined and straightforward sports platform consisting of all the sports content owned by these three parties.

This joint effort could end up hurting Comcast. The expectation is that the streamlined bundle platform will chip away some subscribers from Comcast as it simply offers a more affordable, all-in-one approach. In addition, the joint force could have the edge when bidding for broadcasting rights. This could make it more challenging for Comcast to compete in the sports arena, which is one of the pillars of its media portfolio and potential growth drivers of Peacock.

However, Paramount Global is facing a similar faith, which once more spurred rumors of a potential takeover or merger of both companies’ streaming services. Most importantly, such a merger could mitigate the threat from the joint venture. According to reports, both parties are already in talks to combine both streaming services – Paramount+ and Peacock – which could give it a much stronger market position in streaming overall and could result in significant cost savings, according to the Wall Street Journal. We, for one, would be very much in favor of such a merger due to the apparent benefits.

Now, not incorporating such a merger or the potential result of the joint platform between Disney, Warner Bros, and Fox, with much of this still uncertain, we are bullish on the company’s media business, although we acknowledge the uncertainties involved.

Considering Peacock's potential growth ahead and the continued solid performance of its sports and news platforms, we strongly believe the company’s media revenues should continue to grow at a 7-9% CAGR at the very least, driven mainly by growth in Peacock.

Theme Parks

Comcast’s theme parks returned to new highs in 2023, with record revenue, EBITDA, and attendance numbers. Revenue increased 19% in 2023 to $8.9 billion, while EBITDA improved by 25% to $3.3 billion.

With its Universal parks and Nintendo World, the company is a fierce competitor of Disney in the theme park industry, with excellent momentum. Comcast CEO Brian Roberts back in 2022 stated that the company’s theme park business is doing exceptionally well and is taking share from Disney, thanks to the strong IP portfolio it can leverage, including names like Harry Potter and Mario Bros.

The company also remains ambitious with its amusement parks, planning to open several new parks and attractions over the next few years. Universal Epic Universe is scheduled to open in 2025 in Orlando, and Donkey Kong Land will open in Osaka next year, expanding Nintendo World by another 70%.

Clearly, the company has a significant presence and quite some potential within this industry. With the underlying industry projected to grow at a CAGR of 5.5% through 2032, we believe the company’s expanding IP portfolio and solid expansion plans should allow it to gain market share and outgrow the underlying industry. Positively, this is also a high-margin business, so a strong performance here should also boost earnings growth.

Making up the balance

Overall, we now have a pretty good understanding of the business, knowing all its aspects, dimensions, and operations. This also gives us a pretty good sense of the company’s growth potential and weaknesses.

We believe the skeptical view of its broadband business is based on overstated risks and underestimating the industry’s potential. Furthermore, we like the company’s wireless, theme parks, studios, and media operations, which are solid growth drivers.

As for management, it focuses investments on six elements of the business where it sees the most growth potential. As per its most recent investor presentation, investment focus areas for Comcast are its residential broadband, which remains a massive EBITDA driver, wireless technologies, theme parks, streaming, and its film and television studios.

These focus areas now account for 55% of revenue, but this percentage should grow quickly. In 2023, these focus areas already grew at a faster 8%, and this trend should persist. Ultimately, we believe the company remains well-positioned for growth through the end of the decade, or at least a lot better than perceived.

Balance sheet and shareholder returns

Besides strong fundamentals and a stable growth outlook, the company also looks good financially and doesn’t shy away from rewarding its shareholders.

Despite operating in a massively capital-intensive industry, the company has a respectable balance sheet and massively rewards its investors. It has brought its net leverage ratio down to 2.3x from 3.3x just five years ago.

Since 2018, the company has refinanced $40 billion of debt, or around 40%, reducing its net debt from $108 billion to $88 billion. While this might still sound like a lot, it is better than many of its connectivity peers. In the meantime, the company has also meaningfully lowered the weighted average cost and extended the life of its debt, resulting in a very respectable balance sheet.

This not only leaves it in a far healthier position to keep investing in its business but also puts the company in a much better position to consistently return capital to its shareholders, something it already excelled in over the last decade, returning the majority of its FCF consistently.

Comcast has returned $89 billion to shareholders over the last decade, including $16 billion in 2023 through $4.8 billion of dividends and $11 billion worth of share repurchases. This has led to an impressive 24% reduction in outstanding shares over the last decade, meaningfully increasing shareholder value.

Meanwhile, the company has also been growing its dividend for 16 consecutive years at a staggering CAGR of 15%. Though, this has slowed down to 9% over the last five years, which is still very much decent.

As a result, shares now yield 3%, which is 27% above its 5-year average and a very respectable yield. Furthermore, the payout ratio still stands at a very conservative 29%, leaving the company with plenty of room to keep growing the dividend at or slightly above the EPS growth rate. This should please dividend (growth) investors and add to a solid investment case for Comcast.

Bottom line performance

To complete the financial picture, let’s examine the company’s bottom line. In 2023, Comcast reported flat revenue of $121.6 billion but managed to grow its EBITDA by 3% to $37.6 billion. This was driven by cost discipline and technological advances, allowing Comcast to keep improving its bottom line and profitability.

Over the years, Comcast has reported relatively stable EBITDA margins, with these weakening slightly from 32.3% in 2018 to 31% in 2023. However, on a more positive note, the EBITDA margin has been improving steadily from a 2020/21 low of 29.8%, which is a positive.

Furthermore, with broadband ARPU growing and Peacock losses expected to ease, there should be room for some margin improvement, even after considering significant investments in its media, parks, and studios business. According to management, the earlier-mentioned cost discipline and technology advances alone should allow it to improve its margin in 2024 and the foreseeable future. As a result, the company will most likely hit 2018 levels again in the next couple of years, supporting bottom-line growth.

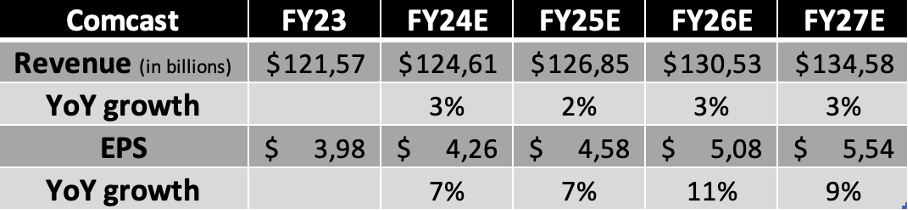

In 2023, the company grew its bottom-line EPS by 9% to $3.98. Furthermore, it generated an FCF of $13 billion, translating into $3.13 in FCF per share, up 10% YoY. Management achieved this growth by strengthening its broadband network and scaling its streaming business, even in the face of meaningful capital investments and theme park expansions (this drove capital spending up 13% YoY).

Overall, Comcast's 2023 performance was excellent, and we expect these operational improvements to continue driving bottom-line growth in 2024 and beyond, leading us to our financial projections.

Outlook & Valuation – Are Comcast shares attractive today?

Comcast management rarely discusses its outlook, so we have to go with our own estimates here. Regarding revenue growth, we are not expecting too much from the company, primarily due to the impact of the deteriorating pay-TV business, which is dragging on overall growth. Therefore, low single digits will remain the most likely scenario.

However, we are more optimistic about EPS growth. The company should have plenty of room for margin expansion while continuing to retire significant amounts of shares. As a result, EPS is most likely to stay in the mid-single to high single-digit range. Overall, we now project the following financial results through 2027.

In terms of valuation, this means shares are now trading at slightly below 10x this year’s earnings, which is just cheap, considering the quality and longevity of this business. Shares now trade at a 30% discount to its 5-year average valuation, a similar 31% discount to the sector median, and we already mentioned that the dividend currently sits 27% above the 5-year average.

Clearly, shares are far from expensive, and we strongly believe this company is trading at quite a discount to what it deserves after considering everything discussed throughout this post/analysis. Taking everything into consideration, we believe shares deserve to trade at a minimum of 12x this year’s earnings, which is still a discount but better reflects its fundamentals.

Assuming this multiple and our FY26 EPS, we calculate a target price of $61 per share, reflecting potential annual returns of over 13%, excluding dividends, which sits far above the average return from the S&P 500. Furthermore, if shares were to return to their 5-year average valuation, which they arguably deserve, this would present an even larger opportunity to investors with annual returns exceeding 19%.

Ultimately, we believe Comcast shares are trading below fair value and, as a result, offer significant value to investors with potential market-beating results over the next three years coming from this defensive giant. Therefore, we will likely add Comcast shares to our portfolio at current prices of around $42 per share, as we believe this offers a favorable risk-reward profile with limited downside.

We put a “Buy” rating on the shares.

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which I hope will be insightful!

Disclosure: I/we do not have a beneficial long position in the shares of CMCSA, either through stock ownership, options, or other derivatives. This article expresses my own opinions, and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Now this is a DEEP dive. Amazing value in here!