The solar energy market still has a tremendous growth outlook, whether you like it or not

Solar energy is seen as one of the most promising sectors for the future (or least promising by some others) due to the simple fact that we need to move to alternative energy options over time. For the oil lovers out there, I am not saying oil will disappear any time soon, but we do need to keep investing in renewable technologies as well!

According to the SEIA, annual solar installations will continue to boom through the end of the decade and most likely beyond. Important drivers of this are that solar energy is the most accessible clean energy solution and that the prices of solar installations and equipment are rapidly dropping. For reference, the cost of installing solar panels has fallen by more than 40% over the last decade, making it more accessible to consumers and shortening the payback time.

As a result, solar has been the most significant contributor to grid capacity over the last five years, accounting for 5% of electricity generation, up from just 0.1% in 2010. Yes, growth has been astronomical. Just consider that 53% of all new electric capacity added to the grid in 2023 came from solar, marking the first year a renewable energy source accounted for the majority of new capacity.

Furthermore, solar accounted for 75% of renewable capacity additions in a year when solar installations grew relatively slowly. With interest rates expected to come down in Europe and the U.S. later this year and into 2025, it is safe to assume solar demand will grow more explosively.

Solar adoption is expected to accelerate in the coming years. The SEIA expects the solar fleet in the U.S. alone to quadruple over the next decade, helped by the IRA. Meanwhile, the total renewable energy market is projected to grow at a CAGR of 17.2% through the end of the decade. Assuming solar can continue to account for over 75% of renewable energy capacity additions, this once more shows the outlook remains strong.

There is no denying solar is a rapidly growing and incredibly promising market in the long run, whether you believe it is the future or not. This drove up stocks like Enphase, First Solar, and SolarEdge to record highs and arguably insane valuations.

However, while the long-term outlook is mostly unchanged over the last year(s) and remains incredibly promising, the short-term outlook took a massive hit in 2023, primarily due to rising interest rates, which destroyed demand for solar installations.

Explaining this as straightforward as possible, residential solar installations most often require a large upfront investment from the consumer to install. The average cost is $15,500. The idea is that the solar panels pay back this investment indirectly, as the owner has a far lower utility bill. The average payback time sits at 6-10 years, meaning that after an average of 8 years, you have earned back the investment and will benefit financially going forward while also not depending on grid reliability.

That’s great, and in a zero- or low-interest-rate environment, one can take out a loan and reap the benefits. However, interest rates boomed in recent years and completely destroyed solar demand, as consumers could no longer take a cheap loan to make the investment.

This has resulted in residential solar demand plummeting, as did the shares of leading solar companies, as their sales also fell. Positively, this has brought these shares to multiyear lows. With interest rates expected to be cut later this year and into 2025 in both Europe and the U.S., we could be looking at quite a favorable investment opportunity, especially when considering solar will remain a significant growth opportunity in the long haul.

Enphase is one of the highest-quality stocks in this industry, so let’s take a much closer look at this company!

Enphase Energy is still a top solar pick

Enphase Energy has probably been one of the most volatile stocks over the last year. In the previous 12 months, the shares fell from a high of $228 by 66% to a low of $76, only to recover by 80% to $137 and then fall back to $118 today, down 14% again.

It is quite volatile, indeed. As a result, shares now sit 65% below their all-time high but are still up almost 1,200% over the last five years. Meanwhile, looking through all the noise, the business remains as incredible as ever.

Enphase Energy is a pioneering company in renewable energy technology, particularly renowned for its innovative microinverter systems. Established in 2006 and headquartered in Fremont, California, Enphase has been at the forefront of transforming solar energy generation, management, and utilization.

At the heart of Enphase's offerings are its advanced microinverters. Solar microinverters are devices used in photovoltaic (PV) systems, or those ugly things called solar panels, to convert direct current (DC) electricity generated by solar panels into alternating current (AC) electricity suitable for use in homes or businesses. Unlike traditional string inverters, which are connected to multiple solar panels in series, microinverters are attached to individual panels. This means that each solar panel operates independently, optimizing energy production and minimizing the impact of shading or panel malfunctions on the overall system's performance.

By allowing each panel to operate independently, microinverters eliminate the "Christmas light effect" seen in string inverter systems, where shading or malfunction of one panel can significantly reduce the output of the entire string. Another advantage of microinverters is their ability to simplify system design and installation. Since microinverters are installed on each panel, there is no need for complex string sizing calculations or worrying about panel orientation and shading. This makes designing solar systems for roofs with irregular shapes or obstructions easier.

In other words, these are the top technologies for solar panels and a crucial component. Technologically, the company is the leader in the solar microinverter industry, ahead of its closest peer, SolarEdge.

Enphase’s early focus on this technology and leadership has allowed it to grow rapidly. The company has grown revenues at a CAGR of a staggering 48% over the last five years, including the revenue decline in 2023, and it did so profitably, which is rare. This has earned it a $16 billion market cap today and over $2 billion in annual revenue.

Over recent years, the company has expanded its product offering beyond inverters, in part through acquisitions. It now offers a comprehensive ecosystem of products and services aimed at providing customers with a complete energy system. This includes intelligent monitoring and control solutions, energy storage systems, automotive chargers, and advanced software platforms that enable seamless integration and management of solar arrays.

Through these product additions to its portfolio, the company can now earn much more revenue from each inverter sale. Simply put, residential customers installing a solar system with Enphase microinverters are probably best off getting their battery and car charger from Enphase as well. This allows them to monitor their entire energy system in a single app, providing convenience and a top-notch system.

These product additions have boosted revenue growth in recent years, and Enphase remains ahead in terms of growth potential through these cross-sell opportunities. I expect it to remain a crucial growth driver, in addition to continued growth in its incredible inverter product, which continues to give it a global presence in the solar industry.

For reference, microinverters are one of the most promising growth verticals in the solar industry. The global market is projected to grow at a CAGR of 24% through 2031 or a 14% CAGR in the U.S. This leaves Enphase with plenty of room for growth through the end of the decade, boosted by the company’s continued international expansion. As the undisputed industry leader, it is well positioned, at the very least.

Considering the growth of the solar industry and the microinverter market and the company’s additional growth efforts through new products and international expansion, we have a very clear growth and investment thesis.

Now that we have established the outlook for the underlying industry and Enphase’s business fundamentals and growth potential, it is time to examine its financials. To better understand its financial health, recent performance—impacted by the earlier discussed headwinds for the solar industry—and outlook, let’s examine the most recent financial results, developments, and management commentary.

Headline numbers are deceiving

It will not come as any surprise that Enphase’s latest financials are far from pretty. They reflect the significant weakening of the solar industry compared to last year. In December, Enphase announced that it planned to reduce its workforce by 10% or lay off 350 employees to align its operations with the current demand environment.

The company also stopped its manufacturing in two locations – Romania and Wisconsin – and is moving equipment to its facilities in South Carolina and Texas to lower operating expenses. As a result, management expects total microinverter production capacity to hit 7.25 million by the end of Q1, down from a previous 10 million, preventing a further oversupply.

These are no half measures taken by management, and for good reasons. Enphase went from reporting 65% growth in Q1 of 2023 to reporting a revenue decline of 58% YoY in the latest quarter—a truly insane slowdown in just a few quarters.

Enphase released its most recent financial results in early February and missed the consensus on both top and bottom lines as it continues to surprise investors… negatively. The slowdown or decline in the industry has turned out much more significantly than expected and a recovery seems to take longer as well.

Enphase reported Q4 revenue of $302.6 million, down a whopping 58% YoY and 45% sequentially. Again, this decline is mostly the result of significantly lower demand for residential solar installations, leading to lower demand for the company’s microinverter and battery products.

In Q4, the company shipped just approximately 1.6 million microinverters, down significantly from the 4.9 million units shipped one year earlier. Battery shipments were also down YoY, to 80.7MWh from 122MWh last year.

However, this revenue and unit decline is somewhat of an exaggeration of the actual demand decline. Enphase is also working hard on lowering channel inventory after an oversupply at the start of the year due to the very sudden and aggressive demand correction. This has resulted in installers and Enphase customers sitting with high microinverter inventory, which forced Enphase to under-ship demand.

This correction amounted to $147 million in Q4, meaning revenue could have been realistically 50% higher in terms of demand. This difference is further highlighted by the fact that actual sell-through (from Enphase customer/partner to the consumer) was only down (sequentially) 9% in the U.S. and 20% in Europe. This points to a roughly low-double-digit decline for the entire business, which is significantly below the over 45% sequential revenue decline reported by Enphase.

In reality, Enphase management called the current demand environment “stable.” Once Enphase has brought down channel inventory, most likely after H1, it should be in for a significant growth acceleration, especially with demand expected to at least return to a certain degree later this year, with interest rates coming down.

Therefore, the current situation looks far worse than it actually is, and we are simply seeing the effect of near-term headwinds on the business. However, neither the underlying industry nor this company is in such a bad state as it might seem. This is very important to understand!

Looking at the revenue split by region, we can see that the European solar market is experiencing significant weakness after blowout growth over the last two years. Revenue here declined by 70% sequentially(!), which is again mostly due to Enphase's under-shipping customer demand. As mentioned, sell-through was down just 20% sequentially, driven by a 23% decline in microinverter sell-through and 2% for batteries.

Meanwhile, the company is still expanding its European business to fully benefit from the continent's energy transition, entering the U.K., Sweden, Denmark, Greece, Switzerland, Austria, Italy, and Belgium markets in recent months with its IQ8 microinverters and IQ batteries.

Nevertheless, following the underperformance in Europe, international now accounts for only 25% of revenue (down from a peak of roughly 50%), while the U.S. now accounts for 75%.

However, unsurprisingly, the business did not do much better in the U.S., with revenue also declining by 35% sequentially. Though, a sell-through decline of 9% is far from terrible. Demand in non-California states was quite resilient, with overall sell-through down just 1% compared to Q3.

Meanwhile, the shift to NEM 3.0 continued to impact demand in California, one of Enphase’s largest markets. In straightforward terms, the NEM 3.0 is a new solar energy legislation in California that lowered the reduction in export rates, which refers to the value of excess electricity pushed onto the grid by solar systems, by 75%. This reduced the overall base savings and increased the payback period of home solar, which obviously impacted demand.

The new legislation aims to incentivize homeowners to add a battery pack to their solar installation to become more self-sufficient and contribute to a more resilient electricity grid. Due to lower costs, the eventual package payback period should be roughly equal to the prior system.

Therefore, in the long haul, it should not impact solar demand in California, and with most new systems now also adding a battery, revenue potential for Enphase has even grown. This is what management said with regard to this:

“Third-party data shows that the battery attach rate for NEM 3.0 systems is over 80%. Based on our system activations in January last month, approximately half of our solar installations in California were NEM 3.0. Of our NEM 3.0 solar installations, about half of them use Enphase batteries. Our revenue per NEM 3.0 system is approximately 1.5x our average NEM 2.0 system.”

Management indicates that installers will still need a few more quarters to fully transition to NEM 3.0 and normalize sales and demand, but eventually, this should turn into quite the tailwind for Enphase.

However, the transition is still a short-term headwind for now. It led to overall sell-through down 7% in Q4 compared to Q3, with a 27% decline in microinverter sell-through. Positively, the sell-through of batteries did grow by 58% as a result of NEM 3.0, showing us a blink of potential.

Enphase is benefiting from the IRA

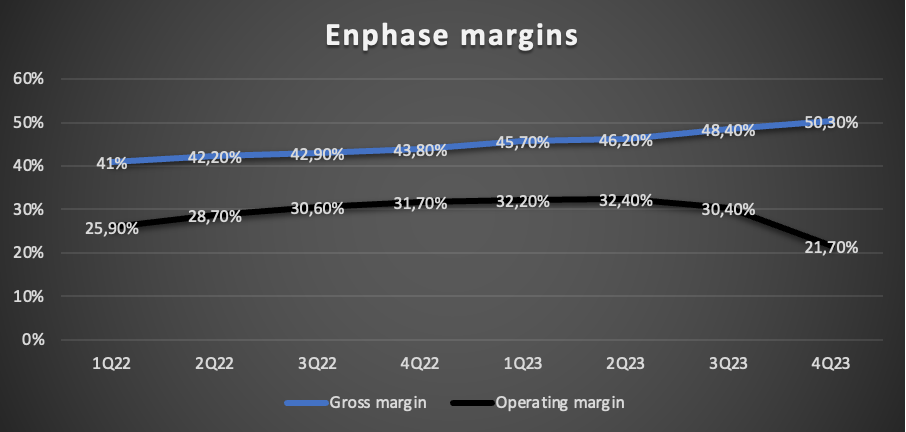

Moving to the bottom line result, Enphase reported a gross margin of 50.3%, which actually is a 190 bps improvement sequentially and a whopping 650 bps YoY, despite the significant top-line decline.

Impressive, right? Well, we should add that this does include a significant tailwind from IRA benefits, which were $25.8 million in Q4. For those unfamiliar with this, this is the U.S. Inflation Reduction Act, which basically offers Enphase incentives for every solar product produced and sold in the U.S., supporting solar adoption and domestic investments.

For Enphase, this turned out quite meaningful last quarter. Excluding the IRA benefits, the gross margin would have been 41.8% or down 400 bps sequentially and 200 bps YoY.

The top line weakness was better reflected in operating income, which came in at $65.6 million, reflecting an operating margin of 21.7%, which is down 10 percentage points YoY. This reflects roughly flat operating expenses YoY and the significant gross profit decline.

Positively, the earlier-mentioned restructuring efforts are expected to be completed in H1 and to be reflected in the financials of Q1 and Q2. Management believes these restructuring efforts will bring down operating expenses to a range of $75-80 million a quarter, still up YoY but down 5% from last quarter.

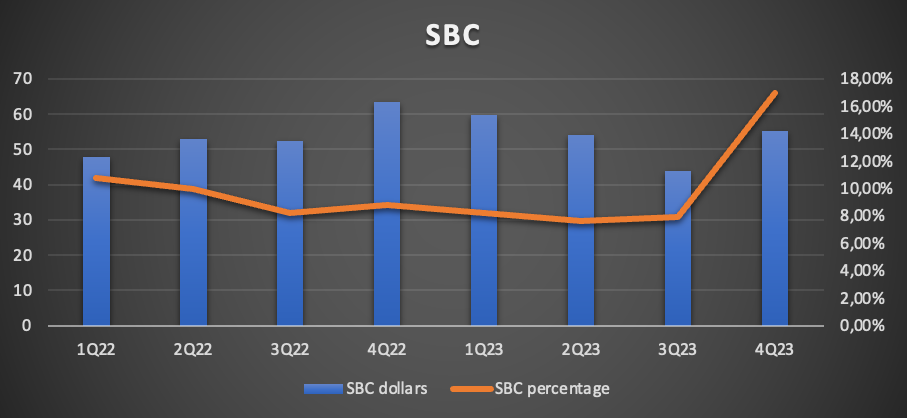

EPS was $0.54, down 47%. GAAP EPS declined to $0.15, down 81% YoY. The discrepancy here is mainly due to stock-based compensation. SBC stood at 17% of revenue, resulting in a negative GAAP operating income. However, while this might sound bad, SBC dollars declined 19% YoY, which is a positive development, and the number to focus on here as the significant top-line decline exaggerates this number.

Enphase has been reducing SBC in recent years, hitting a more realistic low of 7.6% just two quarters ago. Therefore, this is not a concern, and once revenue bounces back and management continues to reduce SBC, this number should decline quickly.

Finally, FCF was $15.4 million, compared to $237 million last year, even as this included an income tax payments benefit. Excluding this, FCF would have been negative. While this definitely isn’t great, I am pleased to see the company continues to report positive cash flows across the board, even as it faces significant headwinds.

Also, over 2023, the company still reported a very solid FCF of $586 million, including the H2 decline. This allowed it to fully cover $410 million worth of share repurchases in 2023, offsetting any SBC, which management intends to keep up. The company ended the year with $1.7 billion in cash and investments, up marginally YoY, against total debt of $1.3 billion, leaving it in solid financial health.

Finishing up with some final FY23 numbers:

FY23 revenue declined 1.7% to $2.3 billion.

FY23 gross margin was 47.1%, up 450 bps YoY.

FY23 operating margin came in at 30.4%, up 80 bps YoY.

FY23 EPS was $4.41, down 4.5% YoY.

Outlook & Valuation

Alright, so for those looking for some good short-term news right here, I may have to disappoint you as it remains rather mixed. Although, on a positive note, management believes to see a bottom in Q1. Management now guides for revenue of $260 million to $300 million in Q1, which at the midpoint points to a YoY decline of 61%.

Management expects sell-through to be impacted by seasonality in Q1 and will continue to under-ship the market, as reflected in its guidance. This will be by approximately $130 million in Q1, which is less of an impact than the $150 million in Q4.

Management also expects this to continue in Q2 but moderate further as channel inventory normalizes. By the end of Q2, management believes it should have returned to healthier levels, potentially allowing it to see a recovery in H2.

As a result, management now expects shipments to remain depressed in H1 and to grow in H2 as inventories have normalized and solar demand improves, assuming the Fed and ECB lower interest rates.

Furthermore, management now projects the gross margin to be within a range of 44% to 47%, including the IRA benefits, which at the midpoint is down roughly 20 bps YoY and quite a bit from the 50% reported in Q4, although seasonality plays a role here.

Also, the IRA benefit in Q1 will be less pronounced as estimated shipments of 500,000 units of U.S. microinverters are far below the close to 1 million reported in Q4. Obviously, this results in fewer IRA benefits.

Overall, management indicates that Q1 will be the bottom, and financials should improve in the second half of the year. They are seeing early signs of a recovery in Europe and expect non-California states to bounce back relatively quickly once interest rates go down.

Meanwhile, management continues to execute rather well, focusing on product development and operational excellence, reducing expenses, and maintaining margins rather well considering the circumstances. The company continues to execute its strategies, expanding into new regions and countries, adding products to its portfolio, and expanding manufacturing capabilities. Across the board, it is doing the absolute best it can.

So, what is the takeaway here? Well, I think the most important thing is to realize that there is still a lot of uncertainty to account for in the near term. While a bottom in Q1 is likely as management brings down channel inventories quickly and aggressively, sacrificing near-term performance, the demand environment remains tricky.

Yes, interest rate reductions in Europe and the U.S. should help improve demand. However, I am not expecting this to be explosive in any way. Economic growth is expected to remain subdued for the time being and stay at relatively low levels for the next two years, limiting solar investments. So, while the lower interest rate environment is definitely a positive and should drive a recovery, just how strong this is going to be remains a big question mark, and recent quarters have shown that there is little visibility.

Therefore, I remain somewhat conservative in my estimates. Yes, I expect a bottom in Q1 and a recovery in H2 driven by lower interest rates and healthy channel inventory levels. But I also expect the solar industry to continue struggling through mid-2025 in a challenging operating environment. However, more importantly than these short-term impacts, I believe this company still has a massive runway of growth ahead of it, and everything points to it being an excellent long-term investment.

Based on the short-term market dynamics discussed and management’s guidance, I now project the following financial results through FY27. This reflects my expectation for continued revenue declines of over 50% in H1 and a slight improvement in H2, though likely to remain negative. In 2025, growth should improve more aggressively, driven by very easy comparable quarters, lower interest rates, and a healthy channel inventory. I then expect growth to ease through the end of the decade but remain in double-digit territory.

Based on these estimates, shares now trade at roughly 33x this year’s earnings, which definitely isn’t cheap. However, we can safely say these numbers are an exaggeration of reality due to channel inventory corrections, and once the underlying industry improves, growth should return quite aggressively, and so will profits.

Therefore, it is better to look at the multiples ahead. Enphase shares now trade at just below 20x next year’s earnings estimate and a PEG of 1.39, which is much more reasonable. While this is still ahead of its peers, we must also consider that none of these is as profitable as Enphase or as well positioned.

Looking at the company’s revenue potential, profitability, and competitive edge, I am willing to pay somewhat of a premium, so I assume a rather conservative earnings multiple of 23x is fair for this business. Based on this and my FY26 EPS estimate, I calculate a three-year target price of $166, which, from a current price of right around $116, points to potential returns of over 12.5% annually.

This means that based on conservative multiples, shares should still easily beat global indices over the next three years, and considering their growth potential, probably also in the years after.

Another factor worth considering is that Enphase holds the #3 spot in shares with the most insider buying over the last six months, including purchases from its CEO. This indicates that its C-suite also believes in its growth potential and believes shares are favorably priced right now. Insider buying is always a positive!

All things considered, we view the current share price as favorable and rate shares a “Buy.” At this time, we believe Enphase shares offer excellent value.

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Thanks a lot! Is it more reliable to just buy TAN or ICLN ETF and hold or DCA until 2030 and beyond? Also, your thoughts on FSLR? Valuation is better than ENPH.