Here are two under-the-radar stocks that may be worth buying today!

+ an honorable mention for one not-so-under-the-radar stock that is still a great bargain

After the correction in recent weeks, plenty of great businesses are now trading at much more compelling, often even great, prices. Today, I want to point out two (or, actually, 3) of these great businesses, which I believe are great buys right now.

And, unlike much of the stuff you read out there, I won’t be focusing on the headline-grabbing technology stocks like AMD, AMZN, UBER, MELI, or much-discussed bargains like HIMS or NU. Instead, I want to highlight two really high-quality businesses that aren’t headline-grabbing or discussed that often but are of insane quality and are now trading at compelling price levels.

At these prices, I am happy to argue that these two businesses are a great long-term buy. They have the potential to outperform the broader market at a low-risk profile.

BUT… let me also very briefly address one more stock that is not so under the radar but an often headline-grabbing growth stock now trading at a ridiculous discount. This really is a bargain.

Let me show you why! Let’s delve in.

LVMH Moët Hennessy Louis Vuitton – A defensive gem trading at a fair price

Let’s start with some key data:

Performance

TTM share price return: -29%

1-month share price return: -13%

Valuation

FWD P/E: 22x

FWD PEG: 2x

Growth projections

Expected 4-year revenue growth CAGR: 6.4%

Expected 4-year EPS growth CAGR: 11.4%

Dividend

Current yield: 2.1%

Payout ratio: 43%

5-year CAGR: 17%

Other financial metrics

ROIC (2020-2024 average): 15.4%

ROE (2020-2024 average): 26.1%

WACC: 9.6%

The sell-off has been overdone…

I am here to argue that LVMH – the most powerful luxury conglomerate in the world, home to 75 of the world’s most pristine brands, including Louis Vuitton, Dior, Tiffany, Moet & Shandon, and Hennessey – is trading at extremely compelling levels after shares have sold off over 2024, as the company is facing considerable short-term headwinds and concerns.

LVMH shares have absolutely plummeted over the last year, which matches the company’s financial performance, which has been far from great at the same time.

You see, the company performed extremely well coming out of the COVID-19 pandemic, registering rapid double-digit growth as demand for luxury items was booming. Subsequently, LVMH shares did just as well, hitting new all-time highs of just over $900 per share, shortly making CEO and majority owner Bernard Arnault the richest man in the world.

However, in 2024 and so far in 2025, LVMH shares haven’t been quite so loved, with shares underperforming considerably in response to the company’s “struggling” financial results amid a luxury demand slowdown in response to high rates and lower consumer confidence.

As a result, LVMH's growth slowed considerably in 2024, dropping from double digits into negative territory in Q3, as shown below.

In response, LVMH shares have shed almost a third of their value over the last twelve months, shedding some $100 billion in market value. This includes a considerable 13% drop in share price over the last month alone, as a potential U.S. recession is most certainly bad for LVMH's business.

When consumer confidence is low, luxury items aren’t at the top of shopping lists, not even for the rich and famous, so the company does not have the greatest time right now nor a great short-term outlook.

Now, I know that all sounds pretty poor and like the drop in share price is quite justified. And up to a certain level, it is. Amid these kinds of headwinds and uncertainties, a correction is inevitable, even for the highest-quality businesses.

However, in my opinion, this correction has now been well overdone, with the decline over recent weeks going too far. What investors tend to overlook in times of adverse conditions is the sheer quality of this business and its high-end luxury brands, and its ability to bounce back rapidly once sentiment improves, driven by its dominant position in the luxury sector, incredible pricing power, and the resilience of its high-end brands.

There simply is no business just like LVMH. Today, it dominates almost 25% of the luxury goods market, giving it significant size advantages and making it impossible to disrupt with a massive moat (there is nothing better than brand strength in combination with incredible size advantages)

Yes, this is one of those businesses I can assure you will still be around in a decade or two and will be just as strong, if not stronger.

Meanwhile, the growth outlook for the luxury sector is great. While the industry faced headwinds in 2024, with luxury goods spending down 2% to roughly $363 billion (31% market share for LVMH), the long-term outlook remains great, with Bain & Company pointing to a 4-6% CAGR through 2030, to a total value of $460 billion to $500 billion, driven by an expected 5-9% CAGR in total luxury spending to almost $2 trillion.

That is just an excellent backdrop for LVMH as the largest luxury goods player. With the company constantly taking more market share, in part fueled by blockbuster acquisitions, we can safely assume LVMH to continue outpacing the industry, likely growing at a 6-8% rate (current consensus of 6.4% over next three years), which is exactly what LVMH management guides for in the long run.

So, we have a mighty business with an impenetrable moat in a steadily compounding industry, constantly gaining market share. Isn’t that just a great investment situation?

For a business like this, a 6-8% revenue CAGR is excellent.

However, it gets even better!

On top of excellent compounding top-line growth, LVMH is also steadily growing its margins by about 50-80 bps annually on average.

This is driven by LVMH’s excellent and unequaled pricing power allowing for price increases without a risk for demand destruction, rapidly growing operating leverage thanks to solid top line growth, and LVMH’s excellent capital allocation (strategic acquisitions + share buybacks), as highlighted by very healthy ROIC and ROE levels.

Thanks to these constant margin gains, LVMH is able to grow EPS even faster than revenue, leading to the current consensus pointing to an 11.4% CAGR over the next four years, which is nothing short of sublime.

So, ultimately, despite these short-term external headwinds, LVMH remains as strong as ever fundamentally, poised to deliver steadily compounding growth in the decade ahead, with expanding margins leading to likely excellent double-digit EPS growth.

And yet, you can pick up shares at just 22x earnings right now…

Outlook & Valuation

Like I said, LVMH’s long-term outlook remains strong, driven by excellent execution, a dominant position, and constant market share gains in a steadily growing industry.

As a result, I anticipate LVMH to grow revenues at a 6-8% CAGR through the end of the decade and EPS to grow at a slightly faster 9-12% CAGR. This includes the expectation for somewhat subdued growth in coming years – 2025 and 2026 – amid mixed economic conditions. However, I expect better economic condition from 2027 onward, which should lead to faster and healthier growth for LVMH.

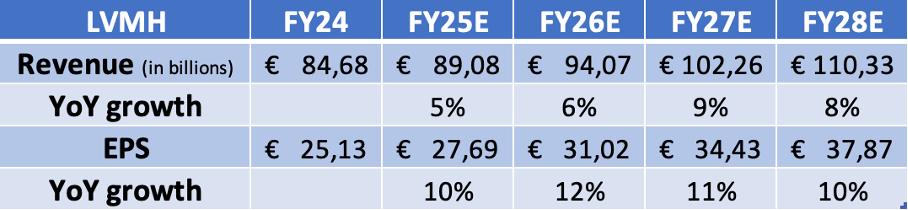

This results in the following projections:

This leaves LVMH in a great and attractive spot valuation-wise. At a current share price of around $610, LVMH shares trade at 22x my FY25 EPS projection, which is far from expensive for a business of this quality.

I mean, paying 22x earnings or a PEG of 2x for a business as powerful as LVMH and compounding revenues and profits as consistently as it does is far from ridiculous. In fact, I will call it really compelling.

Looking at all the fundamentals, the current growth outlook, and the sheer moat and strength of LVMH in a really compelling sector, I believe it deserves to trade at a long-term earnings multiple closer to 24x, at the very least, with a 26-28x multiple still not anywhere near ridiculous.

However, assuming a still conservative 24x multiple and my current FY27 projection, I calculate a medium-term price target of $826. From a current price of roughly $610, this represents potential returns of about 12.5% annually when including a current 2.1% dividend yield.

In my view, those are excellent returns coming from a defensive cornerstone, and more than enough to justify a buy rating here. The risk-reward is really compelling.

Anytime you can pick up LVMH shares at a discount and with above-average return potential, this should be a no-brainer.

This time is no different.

Northrop Grumman Corp. – Should you bet on Defense?

Let’s start with some key data:

Performance

TTM share price return: 6%

1-month share price return: 5%

Valuation

FWD P/E: 17.5x

FWD PEG: 2.5x

Growth projections

Expected 4-year revenue CAGR: 5%

Expected 4-year EPS CAGR: 7%

Expected 4-year FCF CAGR: 14%

Dividend

Current yield: 1.7%

Payout ratio: 31%

5-year CAGR: 9%

Other financial metrics

ROIC (3-year average): 9%

ROE (2020-2024 average): 28%

WACC: 5%

A top pick in defense!

This one might be a bit of a surprise on this list, and definitely not for everyone, with many avoiding it for ethical reasons.

You see, Northrop is one of the world’s largest defense contractors, generating over $40 billion in revenue, of which the far majority comes from defense contracts with the U.S. and its international allies.

Northrop leads in several big defense and aerospace markets. In fact, with its product portfolio, the company covers the entire range of defense, from nuclear deterrence to space missions. It operates across multiple business segments, including Aeronautics Systems, Defense Systems, Mission Systems, and Space Systems. The company's portfolio includes the B-21 Raider stealth bomber, Global Hawk and Triton unmanned aerial systems, and various cybersecurity and missile defense solutions. Additionally, it contributes to space exploration through partnerships with NASA, notably developing components for the Artemis program and the James Webb Space Telescope.

Roughly 87% of Northrop’s revenue comes from long-term Pentagon programs, with the remaining 13% coming from military exports to U.S. allies and NASA contracts, with Northrop also one of the biggest players in the space industry.

So, yeah, quite an interesting business.

Meanwhile, the company is an even bigger standout on this list because Northrop has been largely isolated from the sell-off in recent weeks. The company generally benefits from global conflicts and is anti-cyclical due to the nature of its business and the defense industry. While usually great, in this case, it means Northrop shares have actually outperformed over recent weeks.

Nevertheless, I believe the company does deserve a spot on this list, being an under-the-radar stock trading at potentially compelling levels. Shares have traded practically flat since early 2022 and trade 10% below a recent all-time high after some recent headwinds coming from light guidance issued by management and Trump making claims over defense spending cuts.

As a result, Northrop shares are up just 6% over the last 12 months and 5% so far this year, even as the company performed pretty well in 2024, growing sales by 4%, operating income by 65%, and FCF by 25%, executing very well across the board.

More importantly, the company is poised for some great years as the global outlook for defense spending is excellent amid current conflicts and a big push for defense investments in Europe. Take the recent €800 billion package set up by the EU or the recent defense spending bill approved by the German parliament set to unleash hundreds of billions in additional investment.

Safe to say the defense spending outlook is promising and this leads to the expectation for the defense industry to grow at an 8.2% CAGR through 2030, according to projections by Zion Market Research.

Yes, growth for European peers might be more considerable, but I can assure you Northrop is well positioned to benefit as well, being one of the leading and most innovative players in the industry.

For the record, innovation-wise, Northrop is unequaled. The company is more innovative than most cutting-edge tech companies. The company builds cutting-edge bombers that are undetectable by radar, provides the nav systems for the F-35 jet, and was one of the main developers of the James Webb Space Telescope, to just give you three examples.

That demand for Northrop’s business is high is highlighted by a consistently high book-to-bill ratio of above 1.0, suggesting Northrop is receiving more order dollars than it generates in sales on a quarterly basis. For reference, its 2024 book-to-bill ratio was 1.23, which means that for every dollar generated in sales in 2024, the company received another $1.23 in orders, which is a great indication of strong demand and future sales growth.

Meanwhile, international book-to-bill was even more impressive at 1.4, confirming strong demand from NATO countries. Ultimately, this grew Northrop’s backlog to $91.5 billion, or over 2x annual sales.

Given this, Northrop is expected to keep compounding revenues at a constant and reliable mid-single-digit rate, which is quite solid.

On top of a great revenue outlook, Northrop’s profit and cash flow outlook is even better. In 2024, operating income already soared by 65%, mainly driven by the B-21 program, which led to some margin volatility over recent years due to high development costs, but with first deliveries now out, margins are starting to recover.

Crucially, this, in combination with general efficiency gains, is expected to keep driving considerable profit growth in the years ahead, with FCF guided to grow at a 14% CAGR through at least 2027, which is by far the fastest growth in the defense sector (among large players)

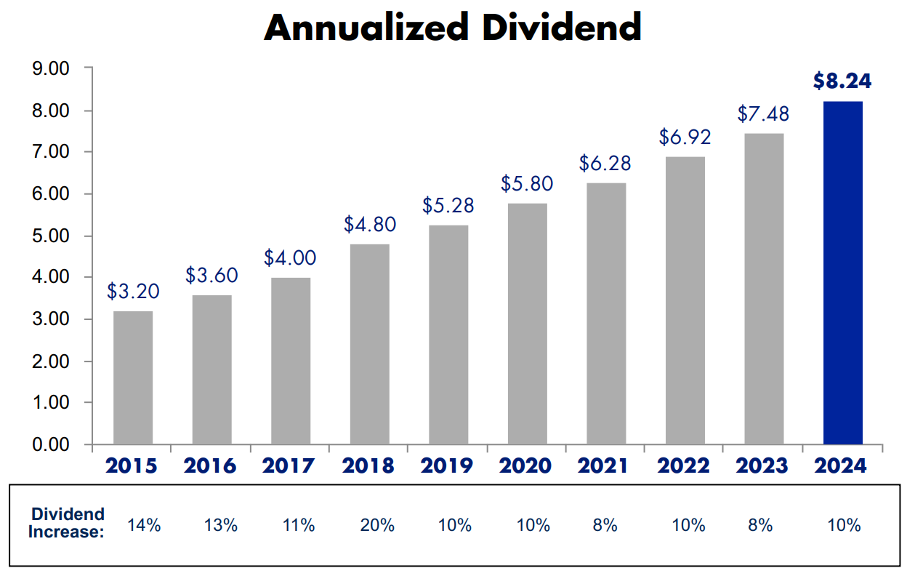

And crucially, Northrop management is big on rewarding shareholders, with management aiming to consistently return 100% of FCF to shareholders, boosting EPS growth further and allowing it to keep growing its dividend at a great pace.

Northrop now pays a 1.68% yield, and while not that compelling at first glance, Northrop has been growing this for 21 consecutive years and at an 11% CAGR since 2015. Meanwhile, the payout ratio remains low at 31% and with a lot of FCF growth ahead, Northrop will continue to raise its dividend at a great pace, making it really compelling.

Furthermore, with the remaining FCF, Northrop is actively buying back its own shares. Since 2015, the company has reduced its share count by a staggering 27%, significantly boosting shareholder value and EPS growth.

With this capital allocation strategy still in place and margins expanding, Northrop should be able to realize EPS growth at a high-single-digit rate.

All things considered, I view Northrop as a really compelling long-term investment, with secular drivers and innovation leadership in growing markets working in its favor.

However, amid recent skepticism and Wall Street heavily focused on technology stocks, this great backdrop might not be fully prices into Northrop shares yet.

Outlook & Valuation

Alright, by now, most about the company and its prospects have been discussed.

As I said, the general consensus is for Northrop to grow its revenues at a mid-single-digit rate and for EPS to grow at a high-single-digit rate, thanks to margin expansion and continued buybacks. Also, management guides for FCF growth at a 14% CAGR through 2027.

All in all, this results in a very solid outlook (current Wall Street consensus + current FCF guidance), as shown below. Arguably, the current consensus is even somewhat conservative still.

With shares having traded practically flat over the last 12 months and Northrop delivering excellent financial results, the company’s valuation seem about fair, especially considering the outlook above.

At a current share price of roughly $490, Northrop ($NOC) shares trade at roughly 17.5x the current 2025 EPS consensus, which isn’t at all that expensive considering Northrop’s resilience, reliability, and the fact that it should grow earnings at a high-single-digit rate and FCF at a double-digit clip.

Paying 17.5x earnings for a business of this quality isn’t expensive at all. Meanwhile, this is also a solid 14% discount to the peer average of 20x, with Northrop trading at a lower multiple than peers like Lockheed, L3Harris, or Raytheon, even as its profit outlook is quite a bit better.

Ultimately, I believe investors are yet to fully price in Northrop’s profit and cash flow growth ahead, resulting in a compelling opportunity today.

While Northrop won’t be a multi-bagger again anytime soon, its shares are poised to outperform broader market returns from current levels.

For reference, assuming a 20x long-term earnings multiple, which is in line with the sector and more in line with close peers, I calculate an end-of-2027 price target of $587. This translates into potential returns of roughly 10% annually when including dividends.

I believe this is likely to be enough to outpace the S&P 500 index through the end of 2027, even as this is based on what I believe to be a very cautious current consensus, so I do see some additional return upside.

However, at the same time, it is worth pointing out that this target price does reflect a 2027 FCF multiple of 25x, which is a hefty premium, with the sector historically trading at 14-18x and NOC shares at a 15-20x multiple.

Are we to factor in the solid growth, reliability premium, and interest rate adjustment, as well as the sector median, a 20x multiple would reflect a much better risk-reward balance. Yet, this would drop my target price to $500 per share, leaving barely any upside.

Honestly, I think the sweet spot might be somewhere in the middle, but it really depends on the metrics you favor and your risk appetite. While I believe NOC shares are compelling right now, I also believe that a small drop in price would considerably improve the risk-reward ratio here.

Ideally, I hope to pick up NOC shares below $450 per share sometime in the near future, which isn’t an unlikely scenario. For reference, in mid-February, NOC shares dropped below $540 per share on some Trump commentary.

If such a drop occurs again, I believe NOC shares are a great buy. Right now, I am a bit more cautious but keeping a close eye on price movements.

I believe this is still a great long-term pick.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

The Trade Desk ($TTD) – This is getting ridiculous

Now that we are at it anyway, I might as well very briefly point out one more brilliant business, which I believe to be trading at a considerable discount to fair value and poised for long-term success – programmatic advertising leader The Trade Desk.

Let’s start with some key data:

Performance

TTM share price return: -30%

YTD share price return: -52%

Valuation

FWD P/E: 30x

FWD PEG: 1.3x

Growth projections

Expected 4-year revenue CAGR: 21%

Expected 4-year EPS CAGR: 24%

Other financial metrics

ROIC TTM: 28%

ROE (2020-2024 average): 26%

WACC: 10%

This sell-off is well overdone…

Without any doubt, I can say that $TTD shares are currently one of the biggest bargains you can find out there, with shares punished heavily after a minor Q4 earnings miss and some signs of a more challenging 2025 ahead. Suddenly, it seems like investors believe TTD has lost its entitlement to a premium multiple, at which it traded for most of the last, let’s say, five years.

The market couldn’t be more wrong.

This is one of those typical situations where a sell-off goes way too far amid negative sentiment, which now goes combined with a general market sell-off, in which tech is once more the weak link. As a result, TTD shares have received a double whammy, losing a whopping 55% of their value so far in 2025, dropping 60% below their December all-time high.

Has the business really turned that much worse? Not at all.

Yes, the company is facing a slightly more challenging 2025, with growth expected to slow to the high teens and higher investments putting margins under pressure. However, fundamentally, the Trade Desk remains extremely healthy and very well positioned for long-term success.

For reference, the Trade Desk has established itself as a key player in the digital advertising ecosystem. It offers advanced, data-driven solutions that help brands and agencies optimize their ad spend and maximize reach through its cloud-based programmatic advertising platform.

As I explained last time, “Programmatic advertising automates ad buying across the open web, using real-time bidding to place ads on various websites, apps, and connected TV platforms. It relies on demand-side platforms (DSPs) to access diverse inventory beyond a single ecosystem. In contrast, Google and Meta operate as walled gardens, where ads run exclusively within their networks using first-party data. Unlike programmatic, which offers broader reach and flexibility, walled gardens keep advertisers within their closed ecosystems, limiting external data access and cross-platform targeting.”

(check out my recent coverage of TTD for much more information about this business!)

Through this differentiated open internet approach, the Trade Desk has been able to rapidly gain market share in the advertising industry, and this isn’t expected to change anytime soon, with the industry pushing more and more to the open internet, like through streaming, favoring TTD’s approach.

Therefore, even while 2025 isn’t expected to be great, TTD’s long-term outlook remains excellent, with current estimates pointing to a 21% revenue CAGR over the next four years and an even better 24% EPS CAGR.

As I already said, while investors treat TTD as if the entire narrative has changed, TTD remains extremely well-positioned and in great financial health, with great reinvestment metrics, a pristine balance sheet, and healthy cash flows.

Long story short, I simply can’t justify this 52% sell-off in any way.

TTD shares now trade at just 30x earnings, which makes absolutely no sense for a business of this quality, perfect financials, an extremely long runway of growth, and expected to grow at a 20%+ rate well into the next decade.

Better reflecting the fact that shares are trading at a discount is a PEG of 1.3, which reflects great value, sits roughly in line with the sector median (even as TTD grows much faster) and this is a 60% discount to the company’s 5-year average PEG.

At current levels around $55, $TTD shares are a bargain.

For reference, even if we assume a 35x earnings multiple as fair value, which arguably is still far from expensive for this business, I calculate an end-of-2027 target price of $104. This represents potential returns of 24% annually (CAGR), which is absolutely blinding.

At these levels, The Trade Desk is a no-brainer – an absolutely terrific buying opportunity.