I am buying LVMH shares today, and here’s why! (Q3 Earnings Analysis)

Here it is: My analysis of the LVMH Q3 numbers and a quarterly update!

The earnings season has kicked off again, and there is plenty to look closely at! I am trying to provide you with as many analyses as possible, and this time out, I am providing a quarterly update on LVMH.

In case you missed it, my analysis of the following earnings reports has also come out recently! Make sure to check those out as well, with plenty of valuable insights and top buying opportunities.

Alright, let’s get to it now!

LVMH, one of my core holdings, accounting for over 5% of my portfolio, was one of the first large caps to announce its Q3 earnings last week. Sadly, the luxury conglomerate, home to 75 of the world’s most prestigious brands like Louis Vuitton, Dior, Tag Heuer, and Tiffany’s, was unable to please investors with its Q3 numbers. Shares declined 2% for the week after selling off by as much as 7% initially, hitting a 12-month low.

Long story short, the company reported a somewhat unexpected sales decline due to worsening consumer confidence in China and lingering weakness in consumer spending in Europe and the U.S. As a result, actual sales numbers fell well short of the consensus, and there is still no real visibility of an improvement in the operating environment, making investors and Wall Street analysts rather cautious.

However, I would argue that with shares hitting a 12-month low last week and once again dropping below 20x earnings, despite all the fear of a prolonged “luxury winter,” now is not the time to be more cautious but rather to pick up shares in a brilliant business at a discount.

Time to become a contrarian, I would say.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to the occasional premium analyses and full insight into my personal portfolio!

Weakness is visible all over the Q3 results

Looking at the numbers, LVMH reported Q3 revenue of €19.08 billion, falling well short of a €19.94 consensus. This reflects a 3% YoY organic revenue decline and highlights a sequential weakening in sales growth compared to the first half of the year.

After reporting impressive double-digit growth in recent years coming out of the pandemic, LVMH shareholders (me included) have had a bit of a reality check in recent quarters as growth slowed from double digits in 2023 to low single digits in the first half of 2024, now dropping into negative territory as we have entered a mild luxury winter amid poor consumer confidence and spending.

In the end, the luxury industry is a consumer-focused one that is exposed to the cyclicality of consumer and economic health, although to a far lower extent than other consumer-focused sectors due to its higher exposure to high-income individuals who tend to be much more resilient.

Nevertheless, LVMH's operating environment has continued to weaken in key regions this year and in the most recent quarter, particularly in China.

LVMH is feeling the clear impact of Chinese consumers facing growing macroeconomic headwinds, which weighs on their discretionary spending, and with China accounting for 29% of revenue and being the company’s largest region, this has quite a heavy impact on its results.

As a result, Asia (ex-Japan) revenue was down 16% YoY in Q3, worsening from a 14% decline in Q2 and 6% in Q1.

On a positive note, LVMH is seeing fairly dynamic demand and demand in Western countries has improved sequentially in Q3, although very gradually. However, inflation remains relatively high, as do interest rates, which continue to impact consumer spending.

Looking at the different regions, growth in Japan remains impressive at 20% YoY growth, helped by a lot of purchases being made by Chinese customers abroad. Meanwhile, growth in Europe and the U.S. remained stable compared to previous quarters and flat YoY as cautious consumer spending in response to stubborn inflation and high interest rates remains a challenge.

Regarding LVMH’s different operating segments, there were two standouts to me. First of all, it was the Fashion and Leather goods segment, which houses brands like Dior and Louis Vuitton, that stood out negatively. Revenue from the segment came in at €9.15 billion, well short of expectations, missing the Wall Street consensus by over €0.5 billion and recording a revenue decline of 5%.

For reference, this segment was one of the fastest growing ones in prior quarters, with demand for Louis Vuitton products exceptionally strong. However, the current weakness in China is having a big impact here, which could very likely continue to persist in the coming quarters.

On the other hand, it was the Selective Retailing segment that continued to stand out positively, growing revenue by 2% in Q3, mostly thanks to a continued incredible performance by beauty retailer Sephora. The brand continues to make massive market share gains globally, helping this segment outperform the underlying industry.

Thanks to the massive success here, I expect the Selective Retailing segment to remain a standout in the short term, offsetting weakness elsewhere, and probably remain a long-term growth driver. I really like the foundation here!

Nevertheless, LVMH continues to struggle as a result of these dynamics. Growth turned negative in Q3 (flat YTD), and there is little visibility on a potential recovery, which explains and somewhat justifies the sell-off that followed post-earnings.

There is definitely a reason for short-term skepticism here with the company’s underperforming expectations.

Margins likely to decline further in H2

Unfortunately, there is not too much to discuss as for the bottom-line performance at this time since LVMH only releases a sales update and no earnings update for its first and third quarters, as many European companies do.

However, following an analyst question during the earnings call, we did get a little insight into what to expect. Crucially, but also not too unexpectedly, management indicates margins are trending down due to continued top-line weakness, but costs are growing despite tight cost control. Here is a quote from the call":

“If your question is whether, with the declining level of sales, as we've seen in Q3, we can match it with lower cost. The answer is certainly not.”

In the H1 report, we already saw that for the first half of the year, LVMH saw the operating margin drop 180 bps YoY and operating income fall 8% YoY on a 2% revenue increase, so obviously, with revenue now, somewhat surprisingly, turning negative, I do expect this will have a pronounced impact on the margins in the second half of the year with these certainly declining further.

Outlook & Valuation

Turning to the outlook, there isn’t too much to be excited over in the short term. During the Q3 earnings call, LVMH management was very clear in its message that the timing of the recovery remains very uncertain due to poor visibility, and with Chinese GDP numbers coming in short of expectations last week and Chinese government stimulus plans disappointing, there isn’t too much reason to expect a recovery any time soon, putting pressure on sentiment.

According to LVMH management, Chinese consumer confidence recently hit a low in line with the all-time low reached during the COVID-19 pandemic… at least, it seems like the only way from here is up. One thing is for sure: with this backdrop, an improvement in consumer spending is unlikely.

Not a lot of good news indeed, and from all the information and data we have today, I would expect weakness to persist well into 2025 before we’ll see the first signs of a recovery, which pressures short-term projections.

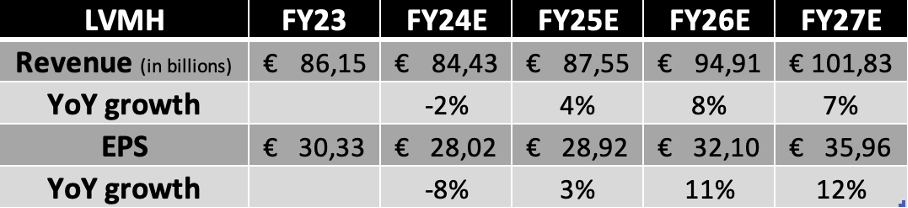

Taking the most recent results and management’s commentary into consideration, I have updated my financial expectations, revising these quite a bit lower for 2024 and 2025, in particular. For reference, I have lowered my FY25 revenue estimate by 8% and EPS by almost 14% to account for lingering consumer weakness.

Most importantly, even after lowering my medium-term expectations after disappointing financial results in recent quarters, I still see no reason for long-term-oriented investors to worry or sell any shares. In fact, I am actively buying at these levels as the long-term setup is excellent.

Ultimately, it is important not to forget the great foundation here for LVMH. This remains one of the most powerful conglomerates in the world, with an unequaled collection of high-end brands. This company has incredible longevity, a great growth runway through continued M&A activity, and a solidly growing underlying market.

According to Grand View Research, the luxury goods market should continue to compound at a 7% CAGR through the end of the decade. With LVMH's proven ability to outpace the underlying market, the long-term outlook for it is pretty sublime.

Once economic and consumer sentiment and spending improve, LVMH is very well positioned to fully benefit and return to normal growth rates in the high-single digits.

Meanwhile, the recent sell-off has made shares significantly more attractive once more.

Shares got a great boost after the Chinese economic stimulation reports, with these gaining a whopping 20% in the span of a few days. However, excitement quickly disappeared as the actual stimulus plans failed to please investors, with shares shedding pretty close to all those gains in the week that followed, hitting a new 12-month low intra-day post earnings.

Currently, with shares still trading at just €623, we are looking at a 21.5x earnings multiple based on depressed FY25 projections, which is in no way expensive for a company such as LVMH. Once growth normalizes, this is almost certainly going to return to historical multiples of closer to 23-24x, making the current discount a great opportunity.

I mean, keeping a long-term view, there is no way I am not buying at these levels.

For example, assuming my FY26 EPS projections above and a more normalized 23x earnings multiple, which is more than fair for this business, possibly still somewhat conservative, I calculate an end-of-2026 price target of €738, which represents potential annual returns of 8% or 10% including a sweet 2% dividend.

Considering the type of business we are looking at here, current struggles, and a de-risked outlook, I believe these are more than sufficient returns, offering a favorable risk-reward opportunity.

I am still buying. If we would see shares drop below €600 again, I will be adding shares more aggressively.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.