Lululemon Athletica, Inc. – Misunderstood and now an absolute bargain!

This apparel brand is still one of my favorite investment opportunities out there today.

Hi everyone,

Welcome back! We appreciate you taking the time to check out this analysis, and we are glad to see this community and reader base still growing quickly!

This week, I have just a quick and relatively short update from my side since I am working hard on two extensive deep dives coming out next week and later this month and a portfolio update to be published in the next few days (with plenty of buy and sell activity again!).

So, plenty to look forward to - Stay tuned!

Besides, Lululemon is one of my key holdings, among my favorite companies, and a top long-term buy for me. Additionally, it’s the company I have discussed most frequently here on Substack, so reviewing its quarterly results and recent developments is pretty close to mandatory.

Therefore, in this week’s post, I want to examine Lululemon’s quarterly results closely and update my expectations and thesis, telling you all you need to know!

Let’s dive right in!

Are you here for the first time? Then go ahead and check out all our previous [FREE] content as well, like our recent coverage of adidas and Uber! You can find it all through the button below! (and, of course, subscribe;))

“Rijnberk InvestInsights is a publication for investors and those looking for easy-to-read and in-depth stock analysis!

We provide your weekly dose of investment ideas, analyses, and updates on some of the most exciting and best opportunities in the financial markets.”

Introduction

Whereas all eyes were focused on Nvidia’s results last week (and maybe some on Crowdstrike after the outage), and rightfully so, it was the highly anticipated Lululemon results reported last Thursday that drew my attention.

You see, this company is one of my larger positions and one of my absolute favorite long-term investments. Lululemon has an incredibly strong brand (In the top 100 most valuable brands globally, according to Kantar), a differentiated business model through a focus on high-end apparel and innovation, and an insanely long runway of growth ahead thanks to very low unaided brand awareness and expansion opportunities outside of North America and into other product categories like Men’s apparel.

Besides this, it has a capable management team and healthy financials and continues to grow strongly while delivering industry-leading margins, quarter after quarter. As it is taking market share from Nike and other peers and is a leading innovator in fabrics (which I absolutely love), it has a clear runway for many more years of double-digit growth, making it one of my top picks and favorite brands.

It is definitely worth looking into for any investor. You can find my deep dive right here:

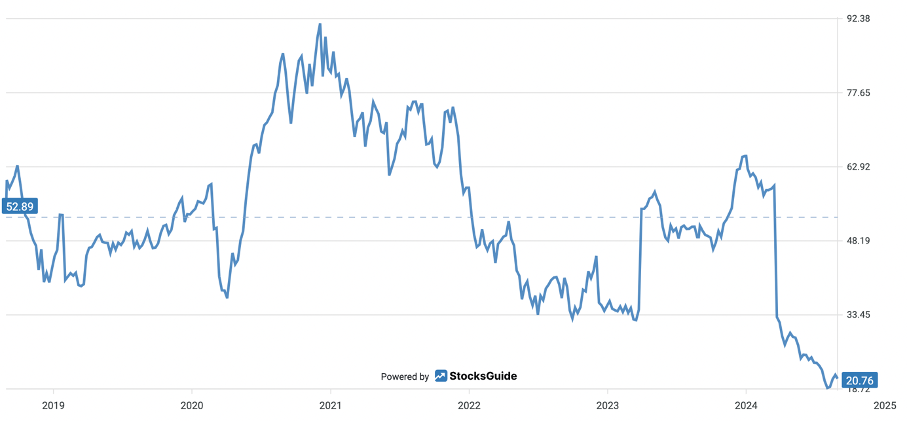

However, despite all these compelling factors, shares have lost a staggering half their value since the start of the year, making them one of the biggest large-cap underperformers this year, which is mainly driven by an industry-wide slowdown, some mishaps by management, but mostly by poor sentiment coming from Nike’s significant struggles to keep up with innovation and consumer trends.

Granted, growth for Lululemon has been slowing down as well, and management hasn’t been on its A-game this year, so at least in part, I can see why shares have underperformed. However, a 50% drop in share price is nowhere near justified in my view, even as shares traded at a premium.

Crucially, the company is still taking market share and outgrowing peers in revenue dollars, gaining popularity among younger generations, and focusing on international expansion and innovation. It remains favorably positioned to benefit from the long-term growth expected for the athleisure market, which is projected to grow at a CAGR of 9.3% through the end of the decade, according to Grand View Research.

Even in the face of near-term headwinds and struggles, this company remains a massive growth opportunity and a top pick. Don’t forget that Lululemon is still in the early stages of its growth story, with brand awareness even in its most saturated regions sitting at only 30% and below 10% outside of the U.S.!

On that note, let’s take a closer look at the Q2 results and put things into perspective, making up the balance.

A mixed earnings report that needs perspective

Lululemon reported its second-quarter results last Thursday, and while the quarterly results were a bit mixed looking at the top-line numbers, the underlying trends in the business are still solid.

Yes, the performance of this rapidly growing brand and business is down. However, the long-term narrative is still more than intact, even as management was, unsurprisingly, forced to lower its FY24 outlook after several product mishaps so far this year and a cautious consumer in the U.S.

One thing is for certain: this year’s sell-off cannot be fully explained by performance but more so by sentiment. Generally, poor sentiment translates into opportunities for investors.

So, as for the Q2 results, Lululemon missed the top-line consensus by $40 million or just below 2%, which isn’t overly meaningful. However, the bottom-line performance was quite impressive, especially considering the top-line miss, as Lululemon beat estimates by 8%, driven by continued margin gains.

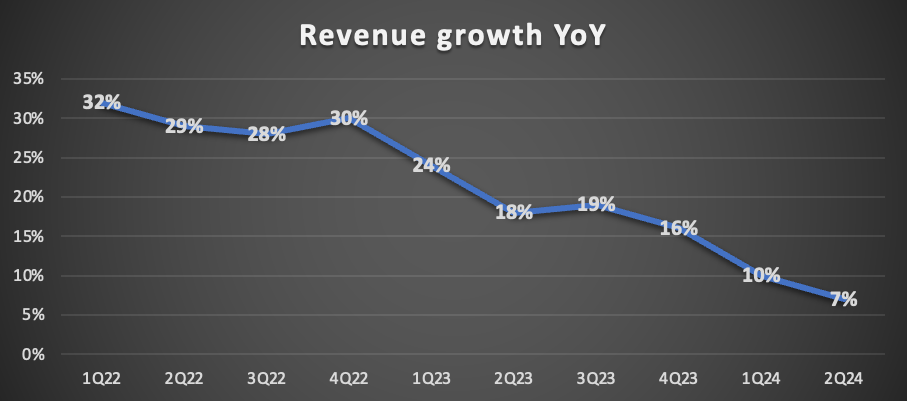

In terms of revenue, Lululemon reported a revenue increase of 7% YoY in Q2 to $2.4 billion, slowing down further from prior quarters. For reference, this is the first quarter in a long time in which LULU didn’t report double-digit growth, but positively, growth is expected to stabilize here.

Also, don’t forget that LULU is still lapping an impressive 18% growth from last year and doing so in a challenging operating environment with cautious consumer spending, especially on discretionary items.

It is important to consider the underlying narrative here before criticizing the company for slowing growth. You see, the sports apparel industry, in general, has been performing quite poorly this year due to cautious consumer spending and maybe an overall lack of innovation. Both Nike and adidas, the industry’s leaders, have reported mixed results in recent quarters, with especially Nike, arguably LULU’s closest competitor, struggling significantly with declining or flat revenues.

LULU has long been able to offset this weakness thanks to higher exposure to higher-income individuals and rapid international and product expansion, but it has now reached a size where there is no way of avoiding these cyclical headwinds any longer.

Still, I will admit that growth did slow down more than I initially expected, with my estimate sitting closer to 8-9% growth last quarter. From that standpoint, LULU did fall short, which, according to management, can be blamed mainly on some product and inventory mishaps.

Similar to Q1, LULU faced headwinds in Q2 from a lack of innovation and new products, as well as an inventory misjudgment for surprisingly popular products, which made the company miss out on potential revenue, and it often didn’t offer enough “newness” to convince consumers to buy its products and keep it relevant.

During the earnings call on Thursday, LULU management acknowledged that newness and innovation are below historical averages, which has impacted conversion rates, especially in the women’s segment. This includes a failed launch of Breeze Through, a new product offered this quarter for consumers who participate in hot yoga and other heat-intensive workouts. Long story short, it didn’t take off at all.

Honestly, this is quite disappointing, but also not the biggest issue, in my opinion – it certainly is nothing new or surprising.

Back in Q1, management already announced a C-suite change with the departure of its Chief Product Officer and a reorganization that will see a new leadership structure comprised of leaders from its Merchandising and Brand units, which should allow for a more direct and better-streamlined process to bring products to market.

Driven by this, as well as a focus on fast-track design, management believes the newness of its offering should be back to normal levels no later than spring 2025. So, while this may drag on the business for the remainder of 2024, management has a clear strategy in place to revitalize growth and optimize product development by 2025.

Therefore, I am not overly worried – this short-term mishap isn’t a thesis breaker.

Finally, in terms of top-line growth, I want to highlight that international growth remained impressive last quarter, with revenues outside of North America up 29% YoY. Back in 2021, management set itself the ambitious target to quadruple international revenue by the end of 2026, and so far, it remains well on track to meet this target.

Growth was especially strong in China, with revenue up 34% YoY, which is far more impressive growth than we have seen from adidas and Nike in recent quarters, indicating LULU is doing something right and taking market share, which will benefit it long-term in one of the largest apparel markets globally.

Meanwhile, the rest of the world, which includes the EMEA and APAC regions, also continues to grow strongly, with revenue up 24% in Q2. This was helped by solid expansion efforts by the company, growing its presence in Southeast Asia with a second store in Thailand and a fourth in Malaysia.

Across the board, international growth remained strong in Q2. This global expansion remains one of LULU’s most significant growth opportunities, with the majority of its revenues currently coming from North America and the brand still having very minimal presence on other continents, especially in Europe and APAC.

For reference, as of FY23, only 21% of revenues came from outside of North America, and 64% of the company’s physical stores are located in North America, followed by China at around 20%. Obviously, this leaves it with plenty of room for global expansion, and management believes this can easily grow to 50% in the coming years, driven by effective merchandising and higher penetration.

Therefore, with the room for international expansion significant still, this will remain a massive growth driver.

Looking to do your own stock analysis? Consider using StocksGuide, which is my go-to stock and business analysis tool. Go and check it out! Many of its features are FREE.

The bottom line performance is straight-up impressive.

While the top-line performance might have disappointed somewhat, the bottom line certainly didn’t, as it blew past Wall Street estimates.

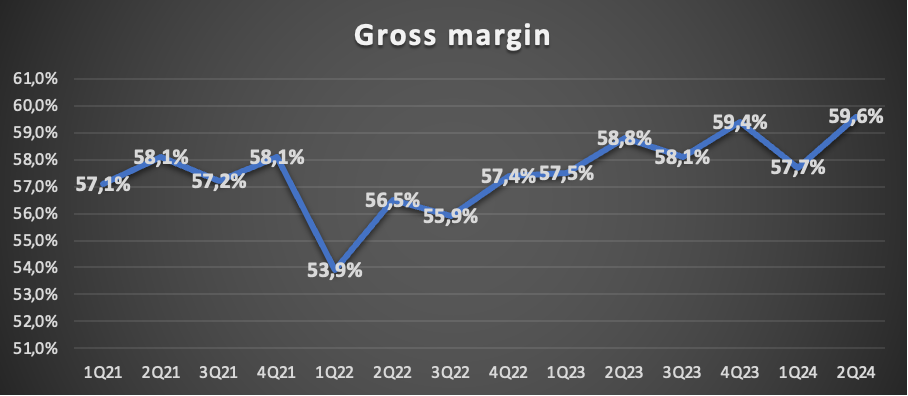

Gross profit came in at $1.4 billion, translating into a gross margin of 59.6%, a new all-time high and up 80 bps YoY. Indeed, LULU is setting new record high margins despite dealing with cyclical headwinds and slowing growth. Quite impressive!

Also, this was way ahead of what management guided for, as it entered the quarter expecting the gross margin to drop by 100 bps. This was mostly thanks to a 130 bps increase in product margin thanks to markdowns being flat YoY, partially offset by an FX headwind.

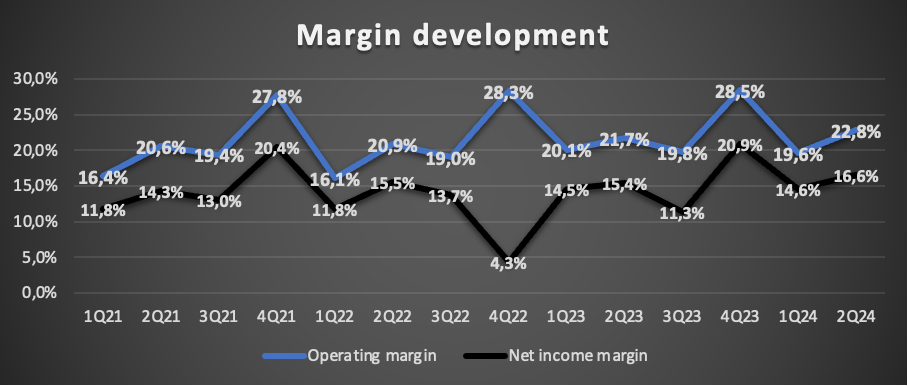

Meanwhile, further down the line, management also continued to manage its expenses strictly, with SG&A down to 36.8% of revenue from 37% last year, allowing the operating margin to grow 110 bps YoY to 22.8% and the net income margin to expand by 120 bps YoY to 16.6%.

This resulted in an 18% increase in EPS to $3.15.

Overall, it was just a really strong performance, highlighting the company’s pricing power and cost control.

Furthermore, with cash flows remaining strong, so did the balance sheet. LULU ended the quarter with total cash on the balance sheet of $1.6 billion, against $1.5 billion in debt, leaving it in a healthy net cash position. Furthermore, inventories declined 14% in Q2, returning to normalized levels.

This healthy balance sheet, solid cash flows, and management’s confidence were reflected in share buybacks, with LULU buying back $584 million worth of shares in Q2, bringing the YTD total to $1.2 billion, not fully covered by FCF, but management can afford it. Especially at current share price levels, this seems worth it.

Moreover, management still has $1 billion at its disposal to keep buying back shares, and I expect this to be fully utilized by the end of the year.

In terms of financial health, there is little to complain about here.

We try to keep all our analysis free for all of you to enjoy and benefit from! Want to support our work a little bit more and show your appreciation? Consider upgrading to paid ($5 monthly).

This allows us to push out even more content and gets you access to our exceptionally performing portfolio and premium subscriber chat!

Outlook & Valuation

Probably the biggest negative in the Q2 earnings report was the FY24 outlook cut, even though this was already very much anticipated.

Starting with the Q3 guidance, management now expects revenue to grow between 6-7% to $2.34 billion to $2.37 billion. The gross margin is expected to decrease by about 50-60 bps, and EPS should come in between $2.68 and $2.73, translating into EPS growth of just 7%.

Obviously, this isn’t the most bullish outlook as it reflects a lot of economic uncertainty in the U.S. and the continued effect of management’s earlier product mishaps. Nevertheless, this is below expectations.

For the full year, management cut its guidance, now expecting revenue growth of 8-9% or 6-7%, excluding the 53rd week, showing a relatively steady performance in the second half of the year and a more conservative approach from management.

This means management now expects to report revenue of $10.38 billion to $10.48 billion, a gross margin decline of roughly 20 bps YoY, and an operating margin of 10-20 bps below last year’s level, which is fairly respectable.

Of course, this guidance cut isn’t great, but I am happy management anticipates a stabilization in H2 and now takes a more conservative approach. Honestly, I think there is some upside to these estimates, but even if there isn’t, this is more than priced in by now.

Furthermore, despite current headwinds, management remains very committed to its Power of Three x2 growth targets, still expecting to meet its 2026 revenue target of $12.5 billion. Even after last week’s guidance cut, we are looking at a three-year revenue growth CAGR of 19%, comfortably ahead of the 15% target.

Finally, management also gave some insight into next year and communicated that it is optimistic it can revitalize growth in its women’s business in 2025 and continue to deliver strong growth in men’s and international, potentially guiding for growth to accelerate in 2025.

Overall, we can safely say the FY24 guidance cut isn’t great, but also no reason for concern for long-term investors as long-term growth expectations remain positive, although also somewhat uncertain in the medium-term.

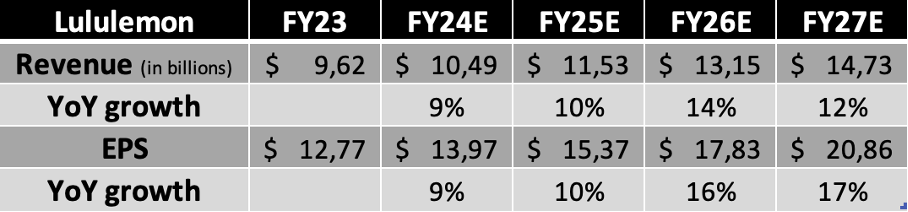

For now, I have cut my FY24 expectations to match the high-end of management’s guidance and have lowered my FY25 expectations as well, now anticipating only a slight acceleration in growth and continued economic uncertainty.

Longer-term, I am not anticipating LULU to return to its previous growth levels, but these to normalize in the low-teens, with EPS growth coming in slightly higher. However, I do foresee many more years of double-digit sales growth for this company, also beyond this decade.

This translates into the financial projections below.

Now, despite an overall solid financial performance so far this year and last quarter, shares have absolutely been one of the worst to hold this year, with these down a staggering 49% so far this year. Indeed, shares have halved in value YTD.

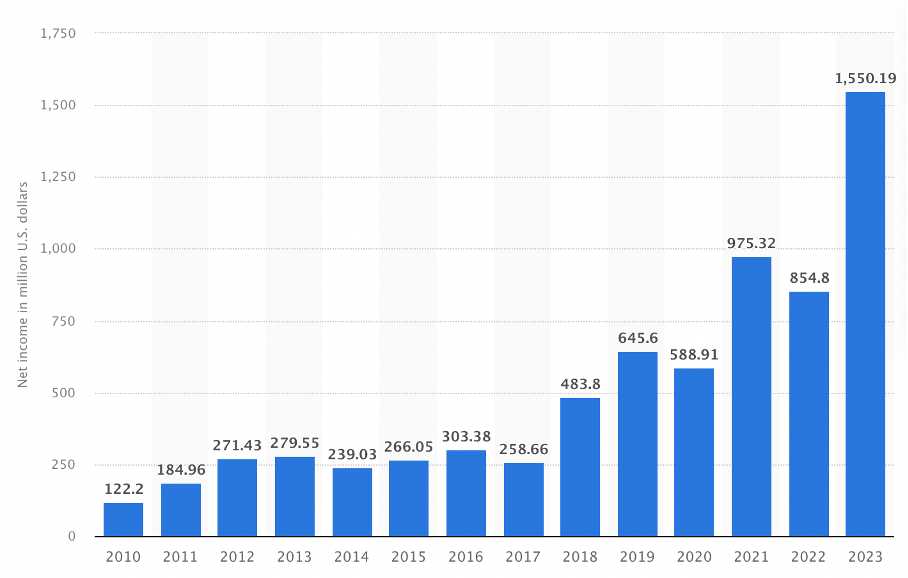

Furthermore, this means shares are also down 37% over the last three years, even as revenue has more than doubled and grown at a 30% CAGR, and net income has almost tripled!

In other words, the valuation of shares has come down significantly. And indeed, On a TTM basis, Lululemon shares now trade near the lowest P/E/ level they have ever traded on. In fact, this is more than a 50% discount compared to the 6-year average.

Of course, as I wrote a second ago, I don’t expect previous growth to return, so a lower valuation multiple makes sense. However, this seems to have been overdone by now.

At this point, despite the projection for long-term double-digit sales and EPS growth, LULU shares trade at a forward P/E multiple of just 18.5x, compared to 26.5x for Nike. Furthermore, this translates into a PEG of only 1.4x, which is a 50% discount to the 5-year average, in line with the sector, and far below Nike’s 3x.

At this point, the share price doesn’t seem to reflect any future growth at all.

Long story short, LULU shares are trading at a ridiculous discount, not at all reflecting its high quality and long-term growth prospects.

While I agree that the current economic and growth uncertainty coupled with slowing growth and some mishaps by management justify a discounted multiple, this has now gotten ridiculous.

Personally, to give you an indication, I believe an earnings multiple of roughly 20x FY26 earnings is more than fair and leaves plenty of downside. Once growth returns for LULU, I expect a sharp revaluation in which shares could easily return to a mid-20s multiple, closer to Nike’s current multiple, but I want to be conservative here.

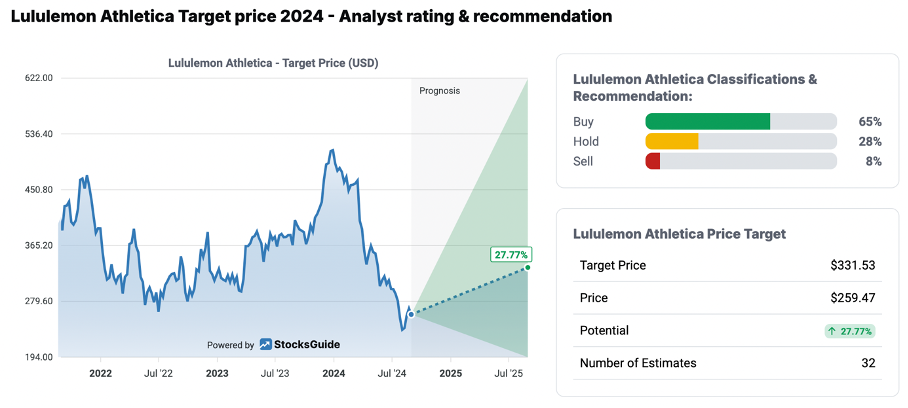

Using this 20x multiple of my FY26 EPS estimate, I end up with an end-of-2026 target price of $357, translating into potential annual returns of roughly 14% or 38% in total upside at an extremely favorable risk-reward profile.

Do Wall Street analysts agree? Yes, they do!

65% of analysts covering LULU have a Buy rating on the company with an average 12-month target price of $331, translating into a 28% upside from current levels. Clearly, Wall Street is feeling the same.

Overall, I continue to view Lululemon as a very attractive investment at current bargain prices of around $260 per share. At this point, LULU is undoubtedly one of the most compelling opportunities in the market and one I am buying hand over fist.

It remains one of my favorite brands and top picks for long-term investors.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Weekly sentiment meter!

Are you bullish or bearish in today’s market?

Before leaving, let me know where you stand today! Are you bullish or bearish? Optimistic or careful? Buying or selling? I would like to know your stance on the financial markets and your sentiment for the months ahead!

Are you bullish? → Expecting the markets to return 3%+ in the three months ahead.

Are you neutral? → Expecting the markets to return between -3% and +3% in the three months ahead.

Are you bearish? → Expecting a negative return of more than -3%.

(This poll will return every week to measure investor sentiment. Results and trends will be shared with you all!)