MercadoLibre – A deep dive into this Latin American industry leader

A deep dive in MercadoLibre.

Investing in emerging markets isn’t easy. These countries tend to be far less economically and regulatory predictable, making it challenging to pick out the right companies at the right time. I mean, those who have tried to invest in China, one of the most prominent and promising emerging markets out there, have barely seen any success over the last 4-5 years. Even well-positioned giants like Alibaba have had a tough time, with shares down a staggering 54% over the last five years.

These difficulties, significant challenges, and increased risks are why I decided to focus on developed markets for most of my investing journey. I still do and very much believe that the European and U.S. economies have plenty of solid growth ahead of them.

Yet, there is no denying that underdeveloped countries and economies like those in South America and Asia offer far more significant growth potential, especially if you are able to identify the right industries and companies within them. Just consider that these economies grow 2-3x faster than developed economies.

One of the companies I believe is probably best positioned to benefit from this economic and development growth, focusing on the right industries in these emerging markets, is MercadoLibre MELI 0.00%↑ (or MELI). This one is among the only companies I am willing to make an exception for—I own shares in this South American giant, and for very good reasons!

In this deep dive, I will show you why MELI is one of the best long-term investment opportunities and one of the best ways to add emerging markets exposure to your portfolio.

Let’s get to it!

MercadoLibre is, without a doubt, one of the best-positioned companies you’ll find.

Let’s start by highlighting how brilliant and successful MercadoLibre has been over recent years. Consider the following:

Its market cap is just below $90 billion, making it the third-largest company in South America.

The company has earned a place in the top 100 brands in the world.

Revenue has grown at a CAGR of 41% over the last ten years and 26% over the last five years.

MELI has grown revenues sequentially every quarter since 2018, except for Q1 2020, when COVID-19 hit. This shows that the business has been able to grow incredibly consistently.

ROE = 34%

ROIC = 24%

The company has been consistently reporting growing profits over the last two years.

The net income margin has expanded from 1.2% in 2021 to 4.6% in 2022 and 6.8% in 2023, showing solid progress.

Clearly, this company has been firing on all cylinders, and it continues to have plenty going for it.

Getting into more detail, MercadoLibre, Inc., often referred to as the "Amazon of Latin America," is a leading e-commerce and technology company that operates across 18 countries in Latin America, including its core markets of Argentina, Brazil, and Mexico. Founded in 1999 by Marcos Galperin, MercadoLibre has grown to become the largest online commerce ecosystem and one of the leading FinTech companies in Latin America, offering a wide array of services designed to facilitate online shopping and digital transactions, making it one of the key enablers of the transition to digital in the region.

E-commerce

At the center of the business sits its online marketplace, which allows millions of individuals and businesses to buy and sell products, which is very similar to Amazon. The platform's user-friendly interface and comprehensive search functionality make it easy for customers to find and purchase a wide range of goods, from electronics and fashion to home goods and automotive parts. This marketplace model not only connects buyers and sellers but also supports third-party merchants, contributing to a diverse product offering that caters to a vast audience.

With its platform, MELI can cover a vast region. 90% of GMV is 3P, with the remaining 10% coming from MELI itself as it fills in gaps in certain regions with its own products.

With its excellent e-commerce platform, early mover advantage in the region, and superior strategy, MELI has been able to grow the platform at a staggering pace. GMV has grown at a CAGR of 28% since 2016, and the number of unique buyers has almost doubled from 2019 to 2023, hitting 85 million, which is seriously impressive growth.

This has allowed it to become the largest e-commerce platform in LatAm by quite some margin, capturing a market share that has consistently hovered around the 21-22% mark in recent years, while it has been gaining share for the last few years.

While this doesn’t quite give it the market position the likes of Alibaba and Amazon have in their key regions, it shows that it is by far the largest player in a highly fragmented and still underdeveloped market.

Market share in key markets:

Brazil in the mid-20s

Argentina roughly 70%

Mexico around 13%

This is a solid market share in a massive, rapidly developing market. For reference, the markets in which MELI operates consist of 500 million consumers and a GDP of $5 trillion. Obviously, the company still has a massive opportunity ahead of it, especially considering that e-commerce remains a massive growth market in LatAm, with e-commerce penetration only sitting at just over 10%.

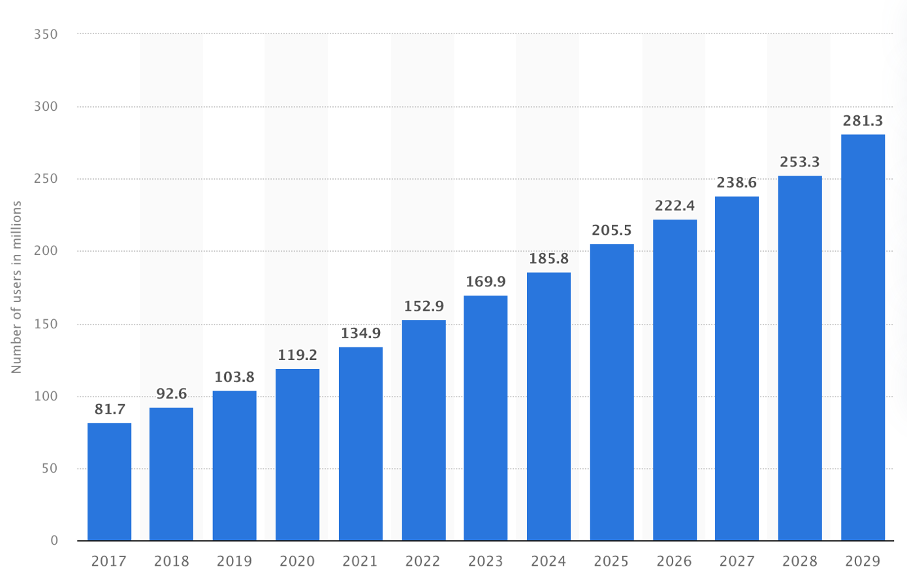

You see, LatAm is quite a bit behind more developed markets like North America and Europe when it comes to digitalization. For example, only about 50% of the LatAm population has a smartphone, compared to 81% in the U.S., where e-commerce penetration currently sits at 15%.

Clearly, this leaves MELI with a massive runway of growth as e-commerce penetration grows, driven by increasing digitalization and smartphone adoption. According to estimates by PCMI, these underlying shifts translate into a projected growth CAGR of 22% for the LatAm e-commerce market, which is over twice as fast as expected for North America.

Again, with MELI holding a steady market share of roughly 22%, it is a massive beneficiary of this underlying growth. Also, market share gains are quite likely as MELI is fully committed to investing in future growth and market share gains, and it has a strong operational advantage thanks to its superior network, but more on that in a bit.

Simply put, the company is exceptionally well-positioned with its e-commerce operations. We have seen this in Amazon’s early days, and MELI looks like it can repeat the feat.

Mercado Pago – The payments platform

However, MercadoLibre doesn’t have just one industry-leading platform through which it is massively benefiting from the growth in LatAm and the increasing digitalization; it has two. Whereas Amazon has its cloud platform AWS, MercadoLibre has FinTech.

Complementing its marketplace, MercadoLibre operates Mercado Pago. This integrated digital payments solution has become a cornerstone of the company's ecosystem and one of LatAm's leading digital wallets and payment processors.

Initially developed to enhance the security and efficiency of transactions within the MercadoLibre platform, Mercado Pago has expanded its reach beyond the e-commerce site. It now offers a comprehensive suite of financial services, including mobile point-of-sale systems, QR code payments, credit and debit cards, and digital wallet functionalities, enabling users to conduct online and offline transactions. This service plays a critical role in driving financial inclusion in a region where traditional banking services are often limited, allowing it to gain popularity at a staggering pace.

Mercado Payo today has 49 million monthly active users, double that of two years ago. Its transaction volume has also doubled over the last two years while still growing rapidly and is about double that of the popular NU Bank, driven by 400% growth in the number of processed transactions since 2020. Yeah… we can safely say the payments platform is growing at a blinding pace.

Due to its growing popularity, the business has gained significant market share in recent years, taking customers away from traditional banks. For reference, the company’s investing service already has $5.5 billion in assets under management, up 90% YoY as of the most recent quarter. That's just insane.

Regarding market share, the service is looking great in key growth markets, with it holding the #1 position in Mexico, Chile, and Argentina and the #2 position in Brazil. This positions it extremely favorably to benefit from strong underlying secular trends.

As already pointed out, this region is rapidly digitalizing, which is more than visible in the financial industry. You see, the digital payments system isn’t anywhere near as advanced as in the U.S., Europe, and even Asia. According to a report by McKinsey, “Latin America is still predominately a cash-based market with a high rate of informal labor. Many people are still paid in cash and use it for a lot of transactions, as many small merchants take only cash.”

As a result of this, the growth in FinTech solutions has been relatively limited so far. However, this is quickly changing now, in part thanks to COVID-19. For reference, whereas in 2020, only 50% of all merchants accepted a form of digital payment, today, this is closer to 90%, highlighting a significant shift.

Furthermore, in just the last two years, digital payments have replaced cash as the preferred payment method, and mobile payments are quickly gaining ground, in part thanks to growing smartphone adoption, which, as pointed out earlier, is far below developed market levels (50% vs 81% in the U.S.).

As a result of these dynamics, digital transaction volume has risen 100% since 2019, creating a very favorable environment for Mercado Payo. Going forward, the digital payment industry in LatAm is projected to keep growing between 10-15% through the end of the decade, with mobile payments growing much faster.

With MercadoLibre as one of the leading FinTech players with its Mercado Payo platform, the company is one of the lprime beneficiaries of these developments and trends. It results in an extremely favorable growth outlook!

Additional business segments – Delivery and advertising

In addition to these two main segments, MELI also operates its own logistics network, which complements its e-commerce operations and strengthens its moat.

Mercado Envios, MercadoLibre's logistics arm, enhances the user experience by offering seamless shipping and delivery solutions. This service manages warehousing, packaging, and last-mile delivery, ensuring that products reach customers promptly and efficiently. The logistics network leverages a combination of in-house operations and partnerships with third-party carriers, covering vast geographical areas and addressing the unique challenges of delivering goods in Latin America.

Through this network, MELI can improve the user experience and realize faster delivery times, which obviously creates a sort of virtuous cycle in which better, more convenient, and faster deliveries please both merchants and consumers, leading to more of both on the platform, strengthening the company’s moat. Amazon has shown how successful this strategy can be, and in a region where delivery networks are far less optimal, this moat and competitive advantage is even stronger! I am a big fan of this strategy and am sure it will pay off over time.

Finally, further diversifying and optimizing its revenue stream, MercadoLibre has ventured into the advertising sector with Mercado Ads, a platform that allows brands to promote their products to the millions of users visiting the site daily, again similar to Amazon. This service provides sellers with targeted advertising solutions, leveraging data analytics to optimize ad placements and drive higher engagement and sales.

MELI has quickly grown to become the #3 advertiser in LatAm with a 5% market share and has seen ad revenue hit a pretty significant $705 million already in 2023, up from $79 million in 2019.

As we are seeing for Amazon right now, advertising can become a significant part of the business. Again, with digitalization still having to materialize here fully, the runway of growth is long here as well. For reference, digital advertising has only just overtaken traditional advertising in terms of spending in LatAm at 52%, while this will hit 72% in the U.S. this year.

Therefore, we should see significant growth continue here as well, with advertising becoming a larger and fast-growing part of MercadoLibre. Do not underestimate the opportunity it has here.

Making up the balance so far

It shouldn’t be too hard to see why I am so bullish on MercadoLibre – the business is among the most favorably positioned you’ll find out there. It has seen incredible success in recent years, showing its ability to win in both e-commerce and FinTech.

Positively, management is very committed to continuing to grow and take market share. It claims the best is still ahead, and I certainly agree.

Highlighting management’s commitment to continued growth and innovation, MELI has seen its number of developers grow by a staggering 8x in just five years. Meanwhile, it is also far from done growing its workforce, as it plans to hire a massive 18k people in 2024 alone, growing its workforce by 30%.

The majority of these additions will be used to drive growth in Mexico and to expand its logistics department, further differentiating itself and improving the customer experience. As of 2023, the company is investing $1.5 billion annually in product development, a number that is up 3x from 2021 and management has no plans of slowing down, which is great as this should allow it to fully benefit from the growth that’s ahead and take more market share.

Also worth pointing out is that the company is looking pretty damn well diversified with multiple solid revenue streams. While e-commerce is by far the largest, this only accounts for just over 50%, while its rapidly growing fintech business accounts for the remainder.

Overall, yes, I am very bullish. Given the company’s current position in the market, its efforts to gain market share, and the incredibly promising underlying growth dynamics, I can easily see this business maintaining a growth rate above 15-20%, primarily as market conditions improve in Argentina, its main market.

I think that projecting 15-20% growth is still rather conservative, but we should also not forget that things can be a bit unstable in these less developed economies, so that is important to keep in mind as well.

On that note, let’s take a closer look at its most recent financial performance, financial profile, and margins.

MercadoLibre reported sublime Q1 earnings

Meli reported its latest financial results on May 2nd, not so long ago, and managed to beat the Wall Street consensus convincingly. It reported revenue of $4.3 billion, up 37% YoY, beating the consensus by an impressive 12%. Meanwhile, FX-neutral growth even came in at 94% due to the severe currency headwinds in Argentina, which is somewhat of a drag on the business overall due to the significant devaluation of the Peso.

Positively, revenue from Brazil grew by 57% YoY and Mexico by 59% YoY, and this strength offset a very challenging inflationary environment in Argentina, where revenue declined by 22%. As a result, growth across the board remained very resilient and actually quite impressive.

As highlighted below, top-line growth has been pretty stable in the 35-45% range, even as it is lapping very strong comparable quarters. Meli has been able to offset weakness in some regions with impressive strength in others, although this should not entirely come as a surprise considering the strength of its underlying business, expansion efforts, and significant growth of the underlying industry.

Across the board, trends remain pretty damn strong, with e-commerce revenue continuously accelerating, hitting 49% growth in Q1. This was driven by 20% growth in e-commerce GMV to $11.4 billion, which in turn was driven by a higher number of items sold and 15% growth in unique buyers to 53 million. Unique buyers grew especially strong in Mexico (25% growth) and Brazil (18% growth) as the company is still rapidly expanding its footprint here. These regions are going through a strong transition to digital.

This drove 36% GMV growth in Brazil and an even more impressive 43% growth in Mexico. This offset weakness in Argentina, where GMV contracted by 28%.

Growth in commerce revenue was further helped by a strong performance in the advertising business, where revenue grew by 64% YoY in the quarter, reaching a penetration of 1.9% of GMV, up 50 bps YoY. This shows strong adoption of the service.

Meanwhile, Fintech is experiencing a much-anticipated slowdown due to more careful consumer spending trends and tough comparable quarters. Still, growth of 22% is nothing to complain about and should start to stabilize from here on out.

Underlying, the company’s fintech operations continue to grow nicely, with payment volume growing an excellent 35% YoY or 86% on an FX-neutral basis to $40.7 billion. The payment platform also continues gaining market share, growing monthly active users by 38% in Q1 to 49 million after growing this number by 32% in Q4. Management is also seeing better retention and an increase in the average number of products used on the platform. This led to transaction growth of 55% YoY.

For example, its credit portfolio grew to $4.4 billion in Q1, up 46% YoY, and it issued 1.5 million cards in the quarter, which led to 133% YoY growth in credit card TPV to $1.9 billion, showing really impressive adoption of its services.

This is looking pretty damn good across the board.

Meanwhile, on the bottom line, this solid top-line performance is also clearly reflected. Operating income grew strongly YoY, driven by a combination of growth, scale, and cost efficiency that drives operational leverage. This came in at $528 million, up 26% YoY or 136% excluding Argentina.

This reflects an operating margin of 12.2%, up 120 bps YoY. However, excluding the headwinds in Argentina, this would have expanded by 560 bps thanks to “higher Ads penetration, better profitability in Credits and 1P, and dilution of Sales & Marketing, G&A and Product Development expenses,” according to management. These same trends should continue to help MELI expand margins in future quarters and years as leverage grows.

Over recent years, it has been expanding margins strongly thanks to the earlier mentioned growing operating leverage, from a negative 6.7% in 2019 to 14.5% in 2023. This is looking rather impressive!

Further down the line, we are seeing a similar trend, with net income growing by 71% in Q1 to $344 million, reflecting a net income margin of 7.9%, up 130 bps YoY. Furthermore, this shows that the net income margin has expanded by 500 bps in just two years thanks to a doubling in revenue, which has created quite a bit of operating leverage, especially in relatively new regions like Brazil and Mexico. This is nicely visible below.

In Q1, this translated into an EPS of $6.78, beating the consensus by 14%.

This improving operating leverage and the growing cash flows have also meaningfully benefitted the company’s financial health. Over the last twelve months, it has improved its balance sheet significantly. It now holds total cash and short-term investments of $6.3 billion, which stands favorably against $2.1 billion in long-term debt.

This should give it plenty of cash to invest in growth and possible M&A.

Guidance & Valuation

MercadoLibre is undoubtedly one of the most attractive long-term investments, with a significant runway of growth and expansion ahead of it thanks to its two very nicely positioned platforms.

It also has a very capable management team to execute its growth plans and benefit from secular trends. Its founder, Marcos Eduardo Galperin, still functions as the company’s CEO, Chairman, and President. Considering where the company is today, there is no need to convince you of his track record.

The majority of the remaining management team has also been with the company for over a decade, and they have a strong track record. Considering how well this company has developed itself in recent years, I have no worries here.

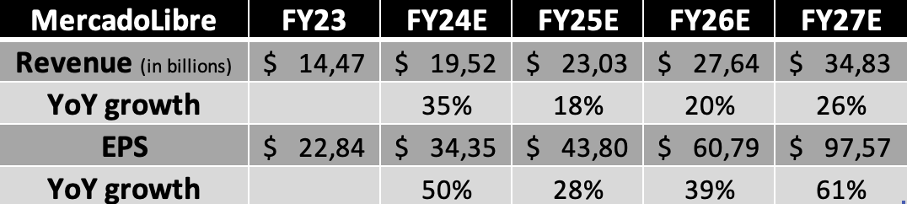

I continue to believe this company is poised for significant growth ahead. Based on everything discussed so far, I think it should be able to keep growing strongly, with top-line growth sitting above 15-20%. Meanwhile, continued margin expansion should drive even more meaningful EPS growth, most likely closer to the 35-40% range.

Below, you can see our more detailed projections.

Based on these estimates, shares are now trading at roughly 51x this year’s earnings, which isn’t cheap but also far from expensive, considering we expect this company to grow earnings at a 4-year CAGR of 44%. This translates into a PEG of 1.16, which is definitely attractive!

There aren’t really any peers to compare this to, but I can with quite some certainty say there aren’t many companies with an outlook as promising as this one and a market position as strong as MELI, not even many of the very promising technology companies in the U.S.

Meanwhile, I still don’t feel like MELI is priced as such, even as shares have gained 25% over the last month, 32% over the last 12 months, and almost 2,000% over the last decade.

In terms of insider transactions, there are also no red flags. There have only been seven transactions over the last 12 months, all of which were buys.

Therefore, I view shares as very favorably priced and MELI as a great investment opportunity. Even if we assume a conservative 40x multiple on our FY26 EPS projection, this translates into a two-year target price of $2432 or potential annual returns of almost 13% annually.

Overall, we remain very bullish on the company’s prospects and believe shares are favorably priced at current prices of around $1750. We remain active buyers, although we would start accumulating shares more aggressively if these would return to prices below $1500-1600.

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

thank you so much

Great analysis. Meets my criteria too when it comes to ROIC and earnings growth but it isn’t U.S. headquartered.