MercadoLibre, Inc. - Showcasing its quality with a strong Q4 report

It's time to review MELI's Q4 earnings report + a quick repeat of my bullish investment case.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

In November, MELI shares sold off 17% after Q3 earnings. Investors overreacted to higher (previously announced) investments in logistics, pressuring profitability for the quarter, even as the Q3 report was strong overall. This was a completely unjustified sell-off, so I called it “a gift to investors.”

So far, it has turned out to be just that. MercadoLibre, the leading e-commerce and FinTech platform in Latin America reported its fourth-quarter results last Thursday and impressed investors with a more than solid top and bottom line beat, impressive continued growth, and margin expansion. This led to a 9%+ jump in its share price to a new intra-day all-time high of $2340 per share before dropping back to roughly $2220 today.

As a result, shares have returned 14% in the three months since that November Buy call. However, I will argue that this is absolutely not the time to take your profits.

Fundamentally, MELI is one of the best-positioned businesses you’ll find anywhere, which is precisely why this is one of my largest positions.

You see, MercadoLibre is not just any business. It is uniquely positioned as the leader in e-commerce and FinTech in Latin America, a rapidly emerging region still in the early stages of the digital revolution, which positions it extremely favorably.

The company operates the #1 e-commerce platform in LatAm and has been rapidly expanding it. Today, there are over 100 million unique buyers. By volume, its market share hovers around 21-22% and has grown in recent years.

Meanwhile, the industry still has significant growth ahead thanks to e-commerce penetration, which is still at a very low 10% on the continent. For example, only about 50% of the LatAm population has a smartphone, compared to 81% in the U.S., where e-commerce penetration currently sits at 25%. According to current estimates, the industry should continue to compound at a 22% CAGR through 2030.

However, that is not all, as the company also has an impressive FinTech platform called Mercado Pago, which has quickly become one of LatAm's leading digital wallets and payment processors. After rapid growth and expansion in recent years, Mercado Pago now has over 60 million users, more than double that of two years ago. Transaction volume has also doubled.

This has resulted in the company becoming a leading fintech player, holding the #1 position in Mexico, Chile, and Argentina and the #2 position in Brazil, some of the largest markets in Latin America.

Can you see why I am so bullish on MercadoLibre right now? You can’t be much better positioned toward secular growth drivers, and that in an emerging region.

As a cherry on top, the company is still (semi-) founder-led, with Marcos Galperin as chairman of the board. It is growing rapidly (and not slowing), rapidly improving profitability, and consistently delivering excellent financial metrics (ROE of 34% and ROIC of 24%).

Yes, to me, MELI is a no-brainer for the decade ahead and just an excellent, well-managed business.

However, so far my investment case – this isn’t a deep dive into MELI. If you are looking for more of a deep dive into the business, you can find mine through the link below!

Today, I want to focus on its quarterly results, which were announced last Thursday. Let’s examine the Q4 results closely to assess the business’s performance, what they mean for my investment thesis, and the medium-term outlook.

Without further ado, let’s delve in!

Q4 and FY24 results + highlights

Q4 revenue was $6.1 billion, up 37% YoY in dollar terms (which currently is most accurate due to extreme inflation) and beating the consensus by $120 million.

FY24 revenue was up 38% YoY to $21 billion.

These are solid numbers reported by MELI. Revenue growth in dollar terms remains stable in the mid-to-high thirties, which is nothing short of impressive given MELI's already considerable size. It seems like the secular trends in the region are more than strong enough to offset any “rule of large numbers” headwinds, at least for now, which speaks to its growth runway and great execution.

Furthermore, most key top-line metrics—GMV, acquiring TPV, credit portfolio, and assets under management—outpaced the underlying markets in Brazil, Mexico, and Argentina as MELI continues to realize significant market share gains in its commerce and fintech operations.

These market share gains translate into a continued strong performance in both its e-commerce and fintech operations, with e-commerce revenue up a whopping 44% YoY in dollars and fintech revenue up 29% YoY. A slight slowdown in growth in commerce revenues is nicely offset by accelerating growth in fintech revenues, where MELI saw the fastest growth of 2024 in Q4.

Revenue growth also looks good by region, with solid growth across all three main regions. In Brazil, growth continues to slow further but remains considerable at 38% YoY in Q4. Meanwhile, growth in Mexico is stable at 43%, and dollar growth in Argentina, which continues to be plagued by extreme inflation, recovered to 31% YoY, which is good news.

Overall, this remains highly impressive, with few negative factors to point out.

On that note, let’s examine the performance of each segment, starting with commerce.

E-commerce

Q4 GMV (gross merchandise volume) was $14.5 billion, up 8% YoY.

Q4 commerce revenue was up 44% YoY.

Q4 items sold grew 27% YoY.

Again, this is a really good performance, even as growth slows down slightly. By region, Q4 GMV growth looked good in Brazil and Mexico, at 13% and 11%, respectively. However, due to earlier mentioned reasons, a 5% decline in Argentina offset this.

In more detail, commerce growth continues to be driven by rapid growth in unique buyers, which hit 100 million in Q4, up 24% year over year. Notably, this is an acceleration from prior quarters and the highest in over a year, as MELI is able to attract more new users.

Again, this tells me something about the room for growth MELI has as e-commerce adoption in LatAm continues to grow from relatively low levels today. Even though 100 million is already really impressive, this can easily double or triple over the next decade, with an adult population (18-65) of 413 million in LatAm. I am confident MELI can keep growing unique buyers at an impressive rate of at least mid-to-high teens through the end of the decade.

Meanwhile, engagement among these users continues to rise, driven by record-high retention and ordering frequency numbers. This perfectly highlights the quality of the MELI commerce platform, as it can rapidly grow the number of users and engagement, which is a powerful double growth engine.

As a result, GMV hit a record high of $50 billion in 2024.

Fintech

Q4 TPV (total payment volume) was $58.9 billion, up 33% YoY.

Q4 fintech revenue was up 29% YoY.

Unlike commerce, MELI’s fintech business accelerated in Q4 and remains impressive.

Similar to commerce, growth here also continues to be driven by strong growth in the number of users MELI manages to pull in. Fintech users reached 60 million in Q4, up 34% YoY, with growth among heavy users even more impressive. This led to a 43% growth in total transactions and a TPV growth of 33% YoY.

MELI also did well with its credit card business, in which it is heavily investing. In 2024 alone, the company issued 5.9 million credit cards, more than doubling its credit portfolio, which hit $6.6 billion in Q4. The company is definitely making good strides toward its ambition to become the largest digital bank in Latin America.

Also, AUM grew 129% YoY to $10.6 billion.

Another strong quarter for MELI, as underlying metrics remain incredibly healthy, even improving in many instances.

Bottom line performance

The Q4 operating margin was 13.5%, a 60 bps comparable improvement, with income from operations of $820 million.

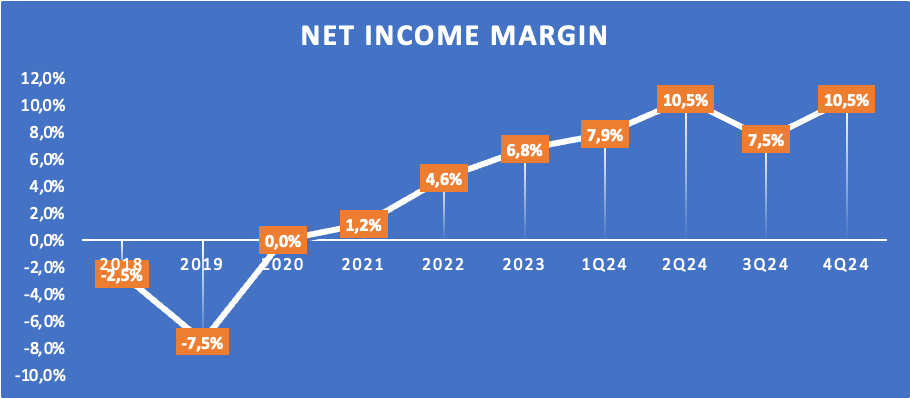

Q4 net income was $639 million, reflecting a 10.5% margin.

FY24 operating income was $2.6 billion, reflecting a 12.3% operating margin

FY24 net income was $1.9 billion, up 65% YoY.

FY24 FCF was $1.3 billion.

When it comes to margins, MELI has done extremely well in both Q4 and FY24, with margin expanding and cash flows improving, even amid heavy investments in R&D and its logistics network. The net income margin matched its all-time high from the second quarter.

Over recent years, both the operating and net income margins have been trending up nicely, as MELI is reaping the benefits from investments in recent years and scale.

FCF, in particular, was impressive, considering it includes $860 million in Capex, a considerable step up from last year, and nearly $3 billion in fintech funding, which supports growth in MELI’s credit book.

Looking ahead, management intends to continue heavily investing in its business, even at the cost of short-term margins, as we saw in Q3. It is important for investors to look past these near-term fluctuations and focus on the long-term trajectory.

Finally, in part driven by these impressive cash flows, management maintained a healthy balance sheet, with $7.1 billion in cash and a manageable total debt of $6.9 billion, leaving MELI in a healthy net cash position.

Honestly, I don’t think there is anything fundamentally negative to say about MELI’s Q4 report, which already explains investor enthusiasm after earnings.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and rating, and even more!

Outlook & Valuation

By now, you’ll understand that MELI has a terrific medium—and long-term outlook. Despite its 25-year history and considerable size—it is the largest company in LatAm—the opportunity ahead is still massive. Here is how management laid it out:

“The pillars of our long-term growth strategy are based on the relatively low penetration of e-commerce in our region, a huge opportunity to offer better financial products to large segments of the population that have been underserved by traditional banks, and the digitalization of cash for merchants and individuals.”

This keeps me very bullish on MELI’s long-term prospects, with at least another decade of significant growth likely ahead.

As for short-and-medium term guidance, MELI itself doesn’t provide any guidance, making any projections a bit more open to changes. Anyway, I was able to raise my own near-term projections after MELI outperformed my 2024 estimates by quite some margin, especially in terms of profits.

Meanwhile, in the medium term, my expectations have remained largely stable. I still expect revenue growth to remain in the twenties for the years ahead, slowing down toward the end of the decade as MELI faces its own size. However, I do still expect quite a bit of margin expansion, which should lead to rapid EPS growth, as visualized below.

For 2025, I expect solid revenue growth, albeit a slight slowdown compared to 2024, and some margin pressure amid aggressive investments in logistics and innovation.

That brings us to the valuation. After last week’s share price jump, shares have become a bit more expensive, and rightfully so. In my opinion, this is the market finally pricing MELI at its fair value again.

At a current share price of around $2220, MELI shares now trade at roughly 47x the FY25 EPS consensus, up from 40x when I last covered them. However, considering the growth ahead, they are still far from overvalued. For reference, accounting for the medium-term growth ahead, MELI shares now trade at a PEG of 1.6x, which is not too far away from the broader retail industry, and I will definitely argue that MELI has a far brighter future.

Ultimately, while shares are definitely out of the value territory they entered back in November, I believe these now still trade only roughly around fair value.

For reference, using a long-term earnings multiple of 38x or PEG of roughly 1.5x, which I deem more than fair considering the growth ahead and the secular growth drivers, I calculate an end-of-2027 target price of $3305. This reflects potential returns of 14% annually (CAGR), which is still enough to beat most global benchmarks.

Therefore, I still believe MELI shares are attractively priced after last week’s beat and better-than-expected profitability.

However, I am not too eager to buy right now. While attractively priced, I’d prefer a bit more of a margin of safety here due to the fact that management provides no near or long-term guidance, making projections less certain.

Therefore, to create this cushion, I will target a share price of below $2200 per share, which it is hovering right around currently.