MercadoLibre, Inc. – This 17% sell-off is a gift to investors (Stock Analysis)

After reporting Q3 results last week, $MELI shares sold off by 17.5%, and unrightfully so. Let me show you why this is the time to start buying again!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

I often get asked to recommend one stock or business to buy now and hold forever. Obviously, this is a tough choice because it is not only difficult to project what will happen in 10-20 years (Shifts and revolutions are hard to predict – take these predictions always with a grain of salt), but there are also many great businesses out there to choose from.

Are you going with a business that has a rich history, a great moat, a popular and well-recognized brand, and fulfills a consistent role in people’s lives? Those are generally the right and safe choices. Think about Coca-Cola, American Express, or LVMH. I can assure you these will still flourish in 10-20 years, each for its own reason and strength.

However, these are not guaranteed to beat the market; it may even be unlikely.

More exciting might be the question of picking one business that will most certainly be a multi-bagger in 10-15 years. Yes, it’s even harder to predict, but it is a much more valuable prediction for those looking for outperformance and hidden gems.

If I were to pick one in this arena, Latin American e-commerce and FinTech leader MercadoLibre would make my shortlist and potentially even top it. This is a stunning business!

You see, MercadoLibre is not just any business but uniquely positioned as the leader in e-commerce and FinTech in Latin America. In this region, the digital revolution is still in its very early stages, positioning MercadoLibre extremely favorably.

With a $107 billion market cap, it is also the largest business in Latin America, and after rapid expansion and growth in popularity in recent years, it has already taken a place in the list of the 100 most valuable brands globally.

The company operates in 18 countries, with Argentina, Brazil, and Mexico as key markets. Founded in 1999 by Marcos Galperin, MercadoLibre has grown to become the largest online commerce ecosystem and one of the leading FinTech companies in Latin America. It offers a wide array of services designed to facilitate online shopping and digital transactions.

At the center of the business is its online marketplace, which allows millions of individuals and businesses to buy and sell products, similar to Amazon. Thanks to its early mover advantage in LatAm, superior strategy, and growing e-commerce adoption, MELI has grown the platform at a staggering pace, more than doubling unique buyers and growing GMV at a 28% CAGR since 2016.

As a result, it is now the undisputed leader in LatAm, with a market share hovering around the 21-22% mark and growing in recent years. Meanwhile, the industry still has significant growth ahead thanks to e-commerce penetration, which is still at a very low 10% on the continent. For example, only about 50% of the LatAm population has a smartphone, compared to 81% in the U.S., where e-commerce penetration currently sits at 25%.

As a result, according to PCMI estimates, growing adoption and digitalization should allow the LatAm e-commerce industry to continue compounding at a projected growth CAGR of 22%, which is over twice as fast as expected for North America.

MELI is brilliantly positioned to benefit!

However, that is not all, as the company also has an impressive FinTech platform called Mercado Pago, which has quickly become one of LatAm's leading digital wallets and payment processors. Today, it offers a comprehensive suite of financial services, including mobile point-of-sale systems, QR code payments, credit and debit cards, and digital wallet functionalities, enabling users to conduct online and offline transactions.

After rapid growth and expansion in recent years, Mercado Pago now has over 56 million users, more than double that of two years ago. Transaction volume has also doubled.

This has resulted in the company having become a leading fintech player, holding the #1 position in Mexico, Chile, and Argentina and the #2 position in Brazil, some of the largest markets in LatAm.

Notably, similar to its e-commerce platform, its presence in fintech positions it favorably to benefit from the shift to digital. You see, the digital payments system isn’t anywhere near as advanced as in the U.S., Europe, and even Asia. According to a report by McKinsey, “Latin America is still predominately a cash-based market with a high rate of informal labor. Many people are still paid in cash and use it for a lot of transactions, as many small merchants take only cash.”

As a result, this is another industry bound for significant growth. It is projected to grow at a 10-15% CAGR through the end of the decade, and mobile payments will grow even faster.

Can you see why I am so bullish on MercadoLibre right now? You can’t be much better positioned toward secular growth drivers, and that in an emerging region.

In recent years, this excellent positioning and management’s tremendous execution have resulted in significant growth. Revenue has grown at a CAGR of 41% over the last ten years and 26% over the last five years. And growth isn’t really slowing today, either!

Meanwhile, similar to what we are seeing from Amazon today, the company is rapidly expanding margins. This is helped by a rapidly growing advertisement business and its own delivery and fulfillment network, which gives it a massive moat.

Although the company was only marginally profitable in 2021, with a net income margin of 1.2%, this expanded to 4.6% in 2022 and 6.8% in 2023 and is hitting new highs so far in 2024.

Oh, yes, this also comes with best-in-class financial and growth metrics.

ROE = 34%

ROIC = 24%

To me, all this makes it by far the most compelling emerging markets pick. It is just a sublime business that is executing extremely well and has a very long runway of growth ahead. At this pace, MELI will undoubtedly become a multi-bagger in 5-10 years. This should eventually become a trillion-dollar business, the way I see it.

Now, this is just a very short summary of the business. For those unfamiliar with it, I wrote a deep dive earlier this year, delving much deeper into the business and its operations. You can read it using the link below. This can give you a far better sense and understanding of the company and the investment thesis.

Today, I want to examine the company’s most recent financial performance more closely to update my investment thesis, assess its performance, and update my financial projections and buying range.

MELI announced Q3 results last week, which weren’t particularly well received by investors. Last Thursday, MELI shares sold off a whopping 17.5% and ended the week 10% lower, as Wall Street focused on the company’s big profit miss amid higher investments in technology and its delivery network.

However, this isn’t a miss on any guidance, as MELI never provides concrete guidance to hold on to. On top of that, management indicated earlier that it would be investing significantly in 11 new fulfillment centers, of which 5 were realized in Q3 already. Wall Street seems to have underestimated these investments in its projections, but crucially, these aren’t unexpected costs and not a lasting weakening of margins whatsoever.

In other words, last week’s sell-off lacked any foundation and, in my opinion, is nothing but a terrific chance for investors to pick up shares at more attractive levels. Indeed, I was a happy buyer of MELI shares last week.

In the remainder of this post, I will discuss the results, underlying trends, and all of last quarter’s important developments.

Let’s go!

MercadoLibre posted impressive top-line results

MercadoLibre posted its Q3 results last Wednesday after market close and delivered what looked like mixed results as the company beat on revenue but significantly missed the EPS consensus, which sent its shares down double digits.

Starting with the top-line performance, we can quickly see investors have little to complain about. The company performs very well across all regions and operations, continues to gain market share, and sees healthy underlying growth metrics.

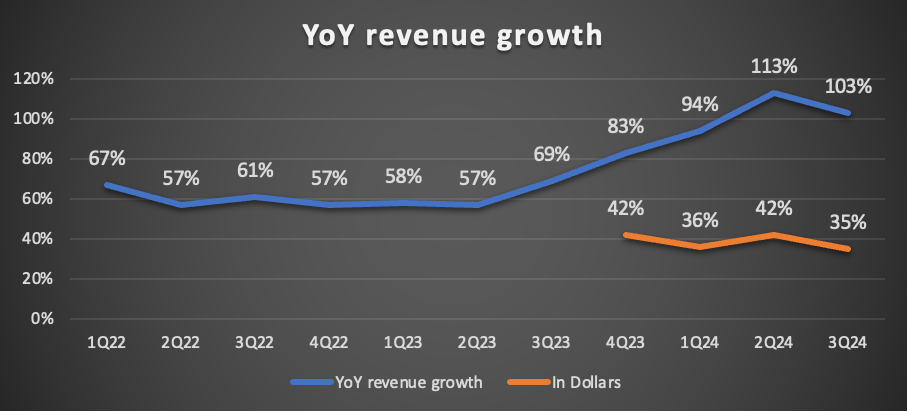

Revenue grew 35% YoY in dollars to $5.3 billion. Yes, this is a slowdown from prior quarters with growth in the low-40s, but this is mainly due to MELI facing significant FX headwinds in key markets such as Argentina, Brazil, and Mexico, with local currencies weakening against the dollar. Corrected for FX headwinds, YoY revenue growth was 103%, which, in turn, is a number boosted by extreme inflation in Argentina.

Revenue growth was particularly strong in Brazil and Mexico, both delivering FX-neutral growth of 60% YoY. Revenue in dollars grew 41% in Brazil, 44% in Mexico, and only 14% in Argentina. However, a big part of this slowdown in growth in Brazil and Mexico can be attributed to these FX headwinds, while the recovery in growth rates in Argentina is due to easing inflationary pressures.

It is a challenging dynamic in LatAm currently.

The company not only performed well across regions but also continues to see strong growth in both its operating segments, with commerce revenue up 48% YoY and FinTech up 21% YoY, again including FX headwinds. Growth was driven by strategic investments in its platform paying off, and the company is still gaining market share across the board.

Taking a closer look at e-commerce, we can see that GMV (Gross Merchandise Volume) in dollars grew 14% YoY, as growth rates in Argentina accelerated to 4% thanks to easing inflation, but this was offset by slowing growth in Mexico and Brazil as these regions faced growing FX headwinds, with growth slowing to only 14% and 17%, respectively. Meanwhile, on a currency-neutral basis, growth remains largely stable.

Currency fluctuations created a bit of a mixed picture here.

Amid these currency headwinds, total items sold are probably a better indicator of commerce growth, and here, growth seems to remain broadly stable. Total items sold grew 28% year over year in Q3, compared to 29% in Q2 and 26% in the same quarter last year.

This shows that commerce demand remains strong, and MELI isn’t experiencing any slowdown. Yes, there is some weakness in Mexico and Brazil, with growth slowing down a bit, but this is more than offset by growth in Argentina and expansion into other regions.

As a result, the company set a new high in Q3 regarding total items sold.

Meanwhile, adoption of MELI’s commerce platform also remains strong, with the company adding a record 7 million buyers on the platform in the last quarter alone, bringing unique buyers to a record high of 61 million.

Last quarter’s 21% growth was the highest number since 2Q21, when the company continued to see a boost from the COVID-19 pandemic. This tells me that e-commerce adoption in LatAm continues to grow nicely, even as tailwinds from the COVID-19 pandemic have eased. It even seems to be accelerating again, which is terrific.

Also, while some feared that market share gains made during the COVID-19 pandemic could disappear again, these have proven to be sticky for MELI, which is still seeing the most impressive growth among peers and growing market share.

This platform strength can’t be understated. This is how management put it during the earnings call:

“So let me be clear on that, not even during the explosion of demand that we experienced in the pandemic, we saw a number of new users at this level.”

As for the company’s e-commerce business, the company’s performance can only be described as strong across the board, with stable growth, market share gains, and rapidly growing usage and user numbers.

Again, nothing to complain about.

Meanwhile, MELI’s fintech business also performs well, with revenue growing 21% YoY and total payment volume (TPV) growing 34% YoY in dollars, mostly stable compared to previous quarters, though again also impacted by FX headwinds.

As for some more impressive metrics, the company issued another 1.5 million credit cards, credit card TPV grew 166% YoY, and AUM (Assets Under Management) grew 93% to $8 billion.

Its FinTech business continues to grow by impressive numbers!

According to MELI management, “marketing campaigns in Brazil and Mexico have led to a positive cycle of greater awareness, more users, and higher balances, all of which drive higher NPS.”

As a result, MAU, or Monthly Average Users, grew 35% in Q3 to over 56 million. Meanwhile, engagement is also rising, with total transactions growing even faster at 47% YoY.

Similar to its commerce business, MELI continues to see strong growth in adoption and usage, which helps the segment grow strongly across the board. Growth remains very healthy despite headwinds.

Ultimately, across the board, in terms of top-line growth and underlying metrics like users and engagement, everything continues to point in the right direction.

MELI is performing really well!

Significant investments led to a bottom-line miss

As laid out very clearly in the introduction of this post, MELI still has a long runway of growth ahead of it, thanks to a number of secular growth drivers.

However, in order to optimize these opportunities, strengthen its moat, and realize more market share gains, management continued to invest heavily in the business, particularly in its delivery and fulfillment network.

This was no different in Q3, though investments far exceeded Wall Street expectations as higher investments created a short-term margin and profit headwind.

A reason for a concern? Absolutely not.

You see, back in September, MELI announced its plans to more than double the number of fulfillment centers in Brazil by the end of 2025, which would require 11 new locations. Obviously, this ambition would impact near-term cash flows. Though, what wasn’t expected is the rate at which MELI invested in these new facilities.

In Q3, MELI opened six new fulfillment centers, five in Brazil (out of 11) and one in Mexico. These investments put significant pressure on Q3 profitability, which came as a surprise.

However, this isn’t a reason for concern, as it will only be a temporary investment cycle headwind. It isn’t an underlying issue. However, Wall Street seems to have ignored this and shares sold off based on this profit miss.

Where have we seen this before? Oh, yes, Amazon. MELI is in the same situation Amazon was in a few years ago. It heavily invested in the business for long-term gain, though Wall Street sold off shares nonetheless, not considering the long-term benefit.

MELI is simply following this same playbook, heavily investing in its logistics network to maintain its moat and improve the customer experience. Being able to ship more volume from its own fulfillment facility simply results in a better user experience for both buyers and sellers due to more convenience and faster and more reliable delivery speeds.

This is a critical part of MELI’s moat, and I am, therefore, more than pleased to see management continuously investing a lot of cash into its network. In Brazil, doubling its number of fulfillment centers will increase the number of cities where it offers same-day delivery by 40%, which is a massive boost for buyers.

In addition, controlling and operating your own fulfillment network also grows your moat. This makes it harder for the competition to compete, especially in LatAm, where delivery networks are not always optimal; this is a massive benefit for MELI.

Therefore, I do not mind the short-term margin impact, nor should you.

Moving to the actual bottom line results, operating income was $557 million, reflecting a 10.5% margin, down a whopping 9.5 percentage points YoY, which was predominantly from these strategic investments explained above, which led to a doubling in Capex YoY and 112% growth in operating expenses.

This operating margin decline also led to a decline in the net income margin to 7.5%, down only 110 bps, translating into net income growth of 11% and EPS growth of 9% YoY, which isn’t all too bad, though MELI did miss the EPS consensus by 21%.

Nevertheless, YTD, MELI is still realizing YoY net income margin gains, with a YTD margin of 8.6%, up from 7.9% in FY23. Excluding these short-term investments, MELI is still showing impressive margin gains.

Of course, higher investments also impacted YTD FCF, which was down 40% year over year to $635 million. Positively, the company did maintain a healthy balance sheet with total cash and investments of $4.4 billion and $6.3 billion in total debt.

Also, in October, Fitch upgraded its credit rating to an investment-grade BBB-, which is excellent for future loans.

All in all, I do not view the Q3 margin and profit decline as a material impact on the investment thesis here, and it most certainly is no reason to sell any shares. Beyond these necessary investments, MELI will continue to rapidly improve margins.

Ignore the short-term noise.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to the occasional premium analyses and full insight into my personal portfolio!

Outlook & Valuation

After last week’s earnings miss, a reset in FY24 and FY25 earnings expectations was unavoidable. Higher investments in coming quarters are expected to keep putting pressure on short-term profitability.

However, this isn’t expected to persist, and cash flows should improve rapidly again as 2025 progresses. Also, the long-term investment thesis for MELI is unchanged, and Wall Street continues to project significant long-term growth on both the top and bottom lines. This is driven by continued market share gains and strong growth in underlying markets, thanks to a push for digitalization and growing e-commerce and digital payments adoption.

In fact, since my last coverage of MELI back in May, medium-term financial expectations have actually improved significantly, even after last week’s reset. While shares are up only 7% since my last post, FY25 revenue projections are up 9%, and EPS expectations are up 6.4%. Again, that is after last week’s expectations reset.

Below, you can see what Wall Street currently expects in terms of MELI’s financial results. Personally, I would argue that the EPS expectations beyond 2025 are somewhat conservative. Based on these projections, analysts expect the following net income margin development.

2024 = 8.3%

2025 = 9.4%

2026 = 10.3%

2027 = 11.4%

Personally, I believe there is upside to these estimates. Wall Street might be too conservative right now.

With shares up only 9% since May 2024 after last week’s reset and expectations up similar levels, shares haven’t become much more expensive since. Shares still trade at roughly 55x this year’s earnings and 40x next year’s earnings.

I know that sounds rather demanding, but considering the runway of growth and significant opportunities ahead, as well as the growth rates MELI is posting right now, it isn’t that expensive at all. For example, it translates into a PEG of only 1.5x, which is a 10% discount to the sector median.

Honestly, paying 40x next year’s earnings for a business compounding revenues at a 20%+ CAGR and EPS at an even higher rate isn’t expensive at all, in my opinion. Most of the businesses growing at this rate consistently are far more expensive.

Therefore, after last week’s overreaction sell-off, I continue to view shares as favorably priced. I still believe MELI is one of the most interesting long-term opportunities out there and a likely multi-bagger. In fact, this could very well be a 10-bagger in a decade’s time when considering its dominant market position, superior platform, and significant runway of growth ahead thanks to its supreme exposure to secular trends such as growing digitalization in LatAm.

At prices below $2000 per share, I am still comfortable buying MELI shares. This remains one of my high-conviction long-term picks.

Community Spotlight - Here are some great publications to check out now!

Money Machine Newsletter - 6,000+ investors start their week with Money Machine Newsletter's insights to get smarter about investing in stocks. It's free, it's fast, it's a no brainer-just your weekly dose of market-beating stocks in a 5-minute read.

- - Concepts of Finance is a weekly newsletter that breaks down financial and investing concepts into plain English, so you can make better financial decisions.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Great article, Daan! Thanks, buddy!

Great spotlight on MELI. I would just warn that the stock is near the 200 day moving avg. It has served as support in past with only minor violations. But if it truly loses the 200, you may be able to buy it lower. The selling volume was very big in relation to daily avg. On balance volume is falling and TSI looks bearish.