monday.com Ltd. - Still a Rule of 40 business (Quarterly Review)

Another quarter of outperformance amid extremely high-level execution and stable demand despite headwinds. Monday did everything right in Q3, yet shares sold off as much as 20% in recent days.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Monday.com, or Monday, shares took a rough beating last week after the company released its Q3 results on Monday (Ironically). Did they miss expectations? Issue poor guidance? Are there any underlying issues?

The answer is no to all these questions. Monday management continues to execute to perfection, the business is firing on all cylinders, growth remains strong, retention rates are improving, and margins are expanding. As a result, with its Q3 results, Monday beat the Wall Street consensus on top and bottom lines and raised its FY24 guidance to above consensus estimates.

In other words, the company is doing everything right and is performing well above expectations.

Yet, shares declined a whopping 20% in two trading days and did so for the simple reason of shares being insanely overpriced at a pre-earnings valuation of 93x earnings and 16x sales. Just outperforming expectations at that point isn’t sufficient enough to warrant a positive share price reaction – you need to blow the consensus out of the water, but it didn’t.

As a result, Monday shares are back trading at similar levels to when I last covered the business in August, at around $270 per share, which is not that far away from my previous buying range of sub-$250.

In the meantime, the business has, in fact, performed exceptionally well and outperformed my expectations, forcing me to raise FY24 and medium-term financial projections. The company is simply delivering better margins and more resilient growth as demand for its low code-no code work collaboration platform remains significant.

So, where does that leave us today? Is now the right time to buy again, or should you wait for a further slump?

Let’s find out by closely examining the Q3 results and updating the financial projections!

But first… for those unfamiliar with Monday.com…

If you are unfamiliar with Monday, in very simple terms, it operates a low code-no code Work OS platform that allows organizations and users to build work management tools to fit their needs with incredible customizability. It offers access to this platform through subscription-based and seat-based pricing.

Monday.com was originally a work collaboration tool in 2014 but has expanded into many other enterprise software verticals, including CRM, human resources, and software development. Today, Monday.com offers a dynamic and versatile platform designed to streamline teamwork and project management processes for businesses of all sizes and industries. At its core, Monday.com revolves around customizable workflows, allowing customers to create tailored workspaces that suit their specific needs and preferences, streamlining business processes.

With this platform, Monday has grown into one of the most innovative and popular newish enterprise software platforms and stocks. It has averaged a 35% growth CAGR over the last three years, and despite its much larger size today, growth doesn’t seem to be slowing. At the same time, margins have expanded rapidly, and the company is profitable today.

Oh, yes. With an FCF margin consistently around 30%, it is also a rule of 40 business—or, rather, a rule of 60. Indeed, this is a brilliant business, executing at a very high level, which, at least up to a point, more than justifies a premium valuation.

Now, in the remainder of this post, I’ll just be focusing on the company’s Q3 results and last quarter’s developments, updating my financial expectations and target price, but for those interested in more of a deep dive into Monday and its business, you can find that below!

On that note, let’s delve into the Q3 results!

Q3 results show impressive growth amid stable demand

The introduction of this post probably already made it evident that I was impressed by Monday’s Q3 results. The company simply outperformed all my expectations as growth and demand remained fairly stable, where somewhat of a slowdown was anticipated, and operating metrics across the board are improving.

Monday reported total Q3 revenue of $251 million, just ahead of the Wall Street consensus and up 33% YoY. Most notably, this shows that growth remains fairly stable compared to previous quarters in the low to mid-30s, which is absolutely terrific, showing barely any weakness in a somewhat challenging operating environment.

Driving this impressive growth and outperformance is stable underlying demand, even as the company is facing some weakness in customer additions or acquisitions, partly due to a sluggish operating environment with IT budgets still under some pressure. Also, Monday recently increased prices and shifted toward a focus on enterprise customers, whereas the company previously mostly focused on SMBs, adding additional customer acquisition headwinds.

Positively, the company did perform better within its existing customer base, offsetting weakness elsewhere and resulting in net demand remaining stable and above expectations.

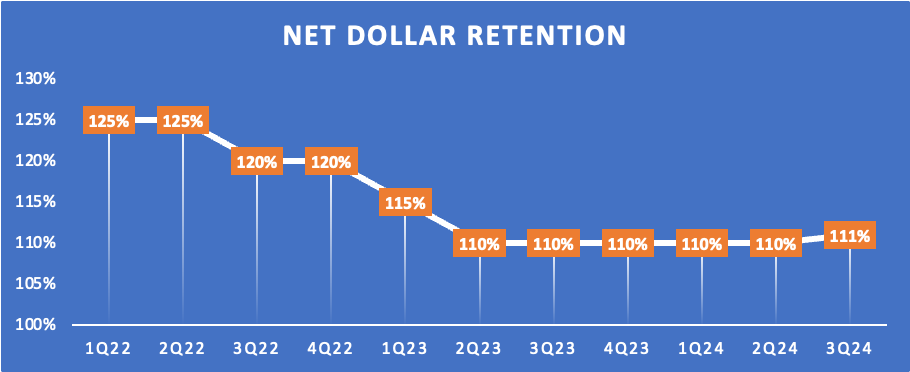

Most importantly, the company saw a great uptick in its net retention rate to 111%, up from 110% in previous quarters, thanks to better retention with both small and large customers. This indicates that the additional revenue from expansions and upgrades among current customers more than offsets any revenue lost from customers who either reduced their spending or left altogether.

This indicates healthy underlying dynamics, customer satisfaction, and effective cross-selling or upselling strategies. It implies that customers find ongoing value in the products or services and are willing to invest more as their needs grow.

Clearly, customers like Monday’s platform, which, in line with its strategy, leads to great value growth for its existing user base.

You see, Monday used a land-and-expand strategy, which means it aims to initially "land" a small deal with a new customer, often by providing a single product or service at an entry-level scale. Once this initial relationship is established, Monday focuses on expanding its presence within the customer's organization by offering additional products, services, or upgrades over time. For Monday, this means cross-selling its work collaboration, CRM, and Dev tools, as well as growing the seat count or total number of users within the organization.

This strategy allows Monday to grow its revenue from that single account by gradually increasing the scope and depth of the relationship.

This gives Monday two growth engines today: adding new customers through acquisition and increasing revenue from every user by adding products and seats. Both of these are performing fairly well today.

For example, Monday reported that its second-largest customer more than doubled its seat count last quarter to 60,000, which is great news! Because of this kind of seat and product growth within its customer portfolio, Monday’s number of large customers is growing faster than its top line, growing 40% in Q3.

This indicates that customers like Monday’s products, and in response, they are adding more products and seats. This is a terrific growth driver!

In the meantime, Monday is also still adding new products to its offering and adding additional cross-sell and revenue opportunities, focusing on innovation and staying ahead of the curve. This is what management said during the earnings call:

“As the landscape of work evolves, we are determined to stay ahead of the curve by continuously investing in technology, exploring new markets, and fostering a culture of agility. monday.com is not just keeping pace with the industry; we are shaping its future.”

Over the last several years, Monday has been introducing several new products within its tech stack and work OS platform, adding several new products every quarter.

Allowing this is the unique and innovative structure of the Monday.com platform. You see, all of the company’s software stacks are built on top of its Work OS platform, sharing 80% of the same code. This has allowed Monday to rapidly roll out new features and functionalities over the years with limited resources, meanwhile offering optimal customizability to its users, one of its strongest selling points.

For reference, the first version of the company’s blockbuster CRM and Dev tools were built by just four and three developers, respectively. This is insane and speaks to the company’s abilities and superior infrastructure.

Currently, the company is fully focused on adding AI features to its platform, including no-code AI building blocks that customers can tailor to their specific business needs. Even though still in the beta phase, Monday AI has seen strong adoption, with the use of these AI blocks growing a whopping 150% between Q2 and Q3. Over time, this strong AI adoption and usage is expected to give Monday another great cross-sell opportunity and additional revenue stream.

Also, its latest software stack, Monday Service, is expected to be fully released by the end of this year and will likely see great adoption. It will likely have a more aggressive cross-sell cycle than its CRM software, which was already a great addition.

There surely is no lack of innovation here, and the revenue opportunity is only growing further.

Ultimately, Monday management continues to do everything right and execute at a very high level. Highly anticipated product releases and innovation continue, and strong financial performance driven by above-expected demand remains.

Investors have nothing to complain about, and Monday's performance continues to demonstrate why the company deserves its high multiples and its image as a best-in-class SaaS business.

Margins remain strong, and cash flows impress

Besides maintaining impressive growth rates amid high demand and great product innovation, Monday has also been rapidly improving margins and cash flows, improving its financial health and appeal.

Monday reported a gross margin of 90% last quarter, stable from prior quarters and ahead of management’s long-term target range of the high 80s.

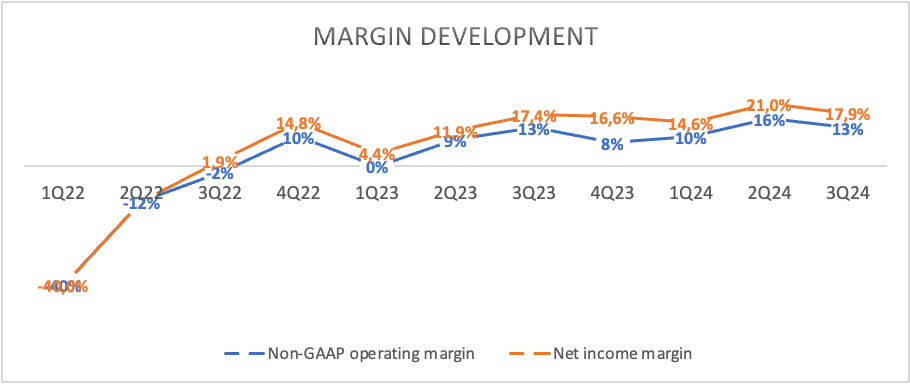

Further down the line, Monday has been doing really well, consistently expanding operating and net income margins. However, last quarter’s progress stalled a bit as margins ticked down slightly and were roughly stable YoY, as operating expenses grew slightly faster amid higher R&D investments.

This in itself isn’t too notable, though. As shown above, the margin developments haven’t been a straight line as investments are inconsistent quarter to quarter.

Last quarter, investments in R&D came in quite a bit higher than last year, hitting $43 million, up to 17% of revenue compared to 15% last year. Positively, this was somewhat offset by lesser growth in SG&A expenses, declining as a percentage of revenue YoY.

As a result, non-GAAP operating income was up 34% YoY to $32 million, reflecting a flat operating margin.

Moving further down the line, non-GAAP net income came in at $45 million, up a slightly more significant 36% YoY, reflecting a net income margin improvement of 50 bps. This also translated into 35% YoY EPS growth to a diluted $0.85, beating expectations by a whopping $0.22 or 35%.

Meanwhile, GAAP EPS remained negative, mainly due to SBC (Share-Based Compensation). SBC was down from a high last quarter and came in at 14.1% of revenue, which I find just about acceptable for a business growing as fast as Monday’s, especially since this number has been going down over recent years.

Finally, all this translated into Q3 FCF of $82.4 million, reflecting an impressive 33% FCF margin, which is just sublime and puts Monday in a unique group of Rule of 40 businesses (or rule of 60 in the case of Monday). The company’s ability to report solid cash flows in combination with rapid growth remains impressive.

As a result, the company also still maintains a healthy balance sheet with a growing cash pile. At the end of Q3, the company held a total cash of $1.34 billion on the balance sheet against practically no debt.

Terrific!

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to the occasional premium analyses and full insight into my personal portfolio!

Outlook & Valuation

After delivering very impressive Q3 results that came in above expectations, a FY24 guidance raise was to be expected and announced.

Management now expects Q4 revenue to be between $260 million and $262 million, representing growth of 28% to 29% year over year. This, combined with a non-GAAP operating income of $29 million to $31 million and an operating margin of 11% to 12%, reflects a solid year over year margin improvement!

For FY24, this translates into revenue between $964 million and $966 million, representing growth of approximately 32% year over year. The operating margin is expected to be between 12% and 13%, and FY FCF should be around $286 million to $289 million, with an FCF margin of roughly 30%.

All of this is meaningfully above my prior expectations and results in a raise in my short—and medium-term financial expectations, especially with Monday management indicating that its move upmarket continues to progress well. IT budgets will likely improve next year, and industry choppiness will likely ease. This, combined with strong momentum for Monday specifically, should allow it to deliver another year of strong growth in 2025. The release of Monday Service and its likely strong adoption should offer some upside in 2025 as well.

Due to these dynamics, I have updated my FY24 estimates and raised my FY25 and FY26 financial expectations.

We also shouldn’t forget that Monday continues to take market share in a highly fragmented market, which is expected to continue growing at a 14% CAGR from a TAM of $100 billion today. Indeed, with an annual revenue of not even $1 billion, Monday is still barely scratching the surface.

Ultimately, I now expect the following financial results through FY27!

Incorporating last week’s share price reset and raised financial projections, the valuation for Monday shares has come down quite a bit from pre-earnings levels. For reference, we’re now looking at a 14x sales multiple compared to a previous 16x and an earnings multiple of 84x compared to 93x pre-earnings.

Of course, paying 73x next year’s earnings is a hefty price to pay, but considering the growth ahead, solid cash flows, and management’s tremendous execution, it might not be that ridiculous. Better incorporating growth, we can use a PEG multiple and, at just over 2x, shared don’t look ridiculously expensive.

Like I said before:

“I firmly believe Monday is an absolute top pick in the software industry and best-in-class. As a result, I don’t mind paying a premium here, especially as Monday has proven that it can easily outperform expectations and has an exceptionally long runway of growth ahead of it. A company like this never trades at a real discount.”

So, what is the best course of action today?

Well, with shares now trading at around $270 per share after a rebound in recent days, I am still not too eager to buy, considering my cost base and the fact that Monday already is a considerable position in the portfolio.

Personally, I am now considering picking up some shares if these dip below $260 per share or closer to $250. If these prices never occur, then it is what it is, and I will wait out. In the end, I already have solid exposure.

For those of you who don't own any shares and want to initiate a position in this tremendous business, DCAing your way into a position might not be such a bad plan. At around $270 per share, it seems like an acceptable entry point when leaving room to buy any dips.

Ultimately, for now, I maintain my Hold rating.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.