Monday.com – Q2 results prove it remains a best-in-class software pick

Time to revisit Monday.com again, my absolute #1 software pick, taking a closer look at the Q2 results, revised expectations, and this brilliant business as a whole.

Hi everyone,

Thank you for stopping by once again!

I know; I already briefly discussed Monday.com shares last week in a collaboration post with

, but this time, I want to get a little deeper into the business, taking a close look at Monday’s Q2 results and recent developments to update my expectations and thesis.For those not entirely familiar with Monday but looking for a quick business summary, check out this post from last Wednesday if you missed it. There, I give a quick and short explanation of Monday and my bullish thesis.

Also, if you are looking for a real deep dive into Monday, its products, and prospects, check out my Deep Dive from a few months ago!

For now, let me just focus on the Q2 results, which were posted a little over a week ago, on Monday, ironically. One thing is for sure: the company did not disappoint in the slightest, delivering absolutely tremendous quarterly results, fully justifying the double-digit share price jump that followed.

Eventually, Monday shares ended the week 8% higher, bringing the YTD gain to 40% and putting shares at a new all-time high mid-week.

In big part, this was thanks to Monday outperforming expectations on all fronts once again last quarter as it beat the top and bottom line consensus, beating the revenue consensus by 3% and EPS by a whopping 68%, as profitability improvements were much better than anticipated.

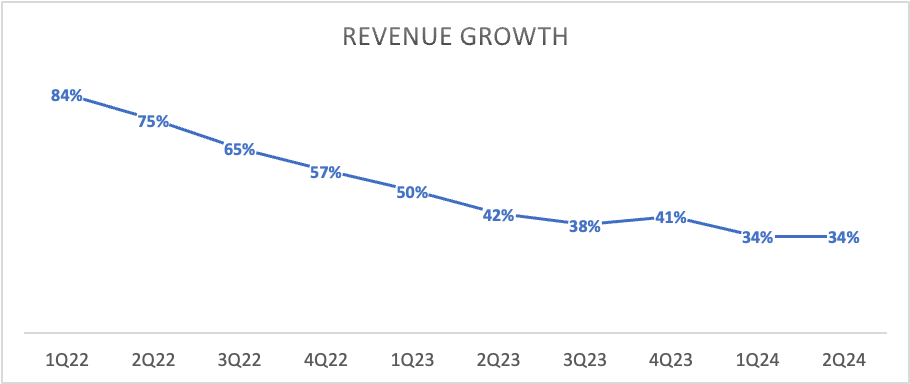

Starting with the top line, Monday reported revenue of $236.1 million, up 34% YoY, which is nicely ahead of expectations and a pretty exceptional performance considering a somewhat challenging macro environment. This shows growth is somewhat stabilizing after trending down quite a bit since the start of 2022, highlighting demand actually remains pretty healthy for Monday.

Monday has been rapidly expanding its offering and business over recent years, growing from a single-product platform to multiple software products. This has allowed Monday to nearly double its customer base and triple its annual recurring revenue in the span of three years.

Even today, as the operating environment is somewhat weaker than before due to cautious enterprise budgets, Monday continues to show impressive growth. In fact, I would argue that the top-line numbers don’t fully reflect this business's underlying health and growth.

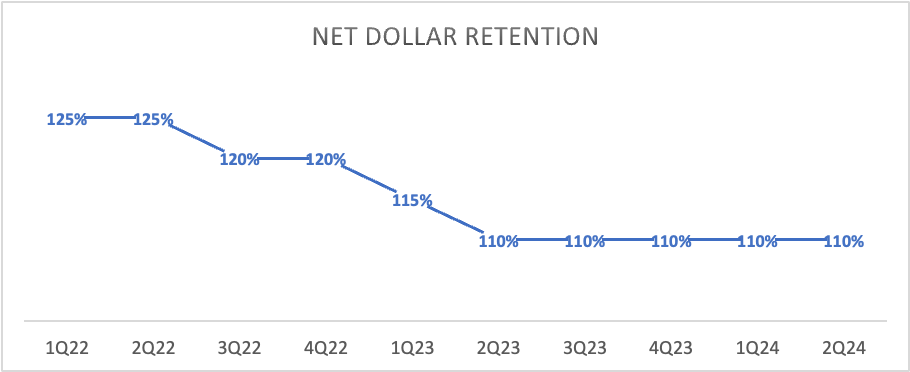

In the most recent quarter, the company added a record number of 100,000 users, which shows improved net expansion metrics and indicates that Monday isn’t seeing any demand weakness. Net dollar retention also remained healthy at 110%, stable from previous quarters.

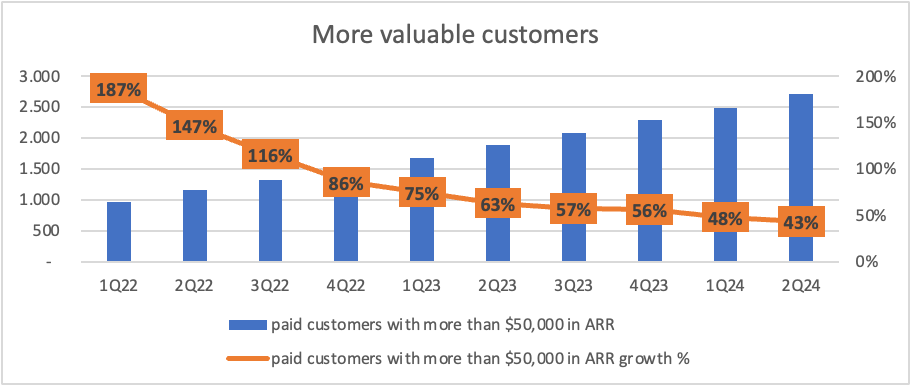

According to Monday management, most of this growth we see today isn’t driven by new customers but by strong traction in larger existing customers, who are rapidly growing their number of seats. This indicates that the Monday platform is highly valued. Usage within these enterprises is simply growing strongly, which is a very healthy indicator and growth driver.

You see, Monday uses a seat-based subscription format and a land-and-expand strategy, which means it charges customers per individual user. Typically, customers expand the number of products they use from Monday over time and the number of users as they start using the software more frequently and intensively.

Using this strategy, Monday has become a popular choice among SMBs thanks to its affordability and easy scaling. Seat-based pricing allows companies to scale their costs according to their needs. If a company hires more employees, it can simply purchase additional seats, and this is what is driving growth for Monday right now.

Meanwhile, Monday has also been rapidly expanding its product offering, adding CRM and Dev software packages. This adds an additional growth driver as these new services are seeing rapid adoption among existing work management customers.

This strategy choice has been excellent for Monday in recent years and extremely successful, even today. It is another way Monday differentiates itself from many peers. It simply nails its growth strategy without spending too much on marketing, which is perfectly shown in the numbers.

Moving back to the Q2 results, Monday continued to see solid progress and adoption among each of its software packages. Since its launch in 2022, Monday CRM has already hit 20,000 accounts, and Monday is still expanding its CRM offering, adding email engagement tracking and timeline reminders in Q2.

Meanwhile, its original work management software also is still seeing good adoption, with Monday now focusing on addressing the needs of larger accounts as its focusing its efforts on growing its presence among enterprises. You see, due to its strategy explained before, Monday has a strong presence among SMBs, but it still has a lot of ground to gain in the enterprise segment. This is what management is now focused on, and some traction here could give it a nice growth boost, especially by the time enterprise software budgets start growing again.

Positively, we can already see recent efforts pay off, with Monday reporting a significant increase in its largest customer by seats, now hitting 80,000. This is up tenfold from three years ago, meaning Monday’s largest customer is now 10x bigger compared to three years ago, showing impressive adoption and growth.

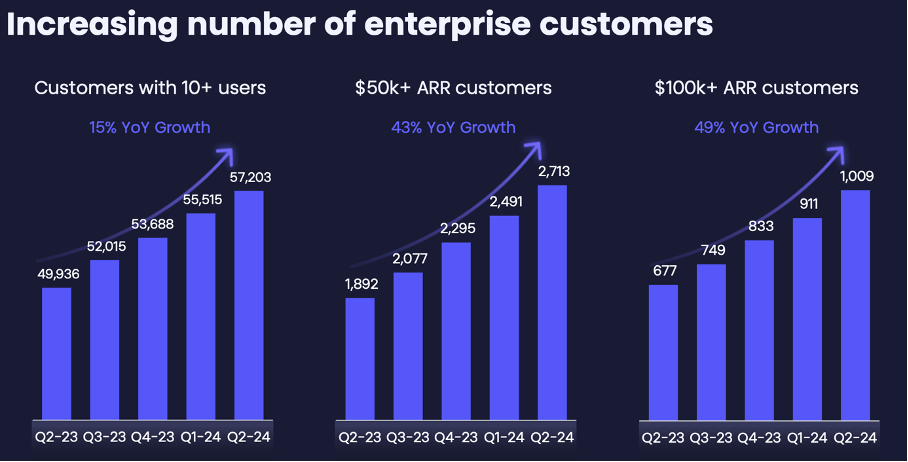

In the graph below, we can see that growth among larger customers remains very healthy. Growth in customers with over $100,000 ARR grew by an even faster 49%.

Meanwhile, Monday Dev performs nicely as well, with exciting new features coming later this year. Also, the very new “Monday Service” software package is now in the beta phase and planned for full release by the end of 2024, adding even more functionalities to Monday’s OS platform.

Finally, Monday is also actively leveraging GenAI to improve the user experience through advanced automation and tax management collaboration. Last quarter, Monday introduced “new GenAI features to the Monday platform, including auto-generated action items, threat summaries, and enhanced text extraction capabilities.”

Overall, looking at the top-line and underlying growth trends and developments, I am incredibly positive. Monday’s business is still firing on all cylinders, delivering beat-and-raise quarters, one after another.

Looking at underlying trends, Monday is easily outperforming many of its peers. With its differentiated platform, it continues to impress customers, reporting rapid expansion as a result.

I expect Monday to keep growth stable above 30% from here on out and to accelerate again once software budgets grow again. Monday is well-positioned to benefit. We shouldn’t forget that its TAM currently sits at around $101 billion but should continue to grow at a CAGR of 14% to $150 billion by 2026, presenting it with solid underlying growth in its existing markets, while still entering new markets consistantly as well.

As Monday has by far the best offering, I expect it to continue outpacing peers and taking market share in this highly fragmented market.

On a final note here, before looking at the bottom line performance and guidance, this is what I wrote before:

“Monday.com is the best project management platform across the board. From Forbes, the Monday.com platform receives a staggering 4.9/5 compared to a 4.6/5 for Asana.

Meanwhile, it also receives a remarkable 4.7/5 on G2.com out of over 10,000 reviews and is ranked the best project management platform by Tech.co, receiving the highest score out of the ten major providers with a 4.7/5.”

Monday impresses everyone with its brilliant margins.

While the top-line performance was already brilliant, what really impressed Wall Street were the company’s bottom-line results. This is where Monday is truly unique. I mean, how many companies can you find that are this early in their growth stage, growing this quickly, but at the same time can report GAAP profits? Not that many, I can tell you. This is just exceptional.

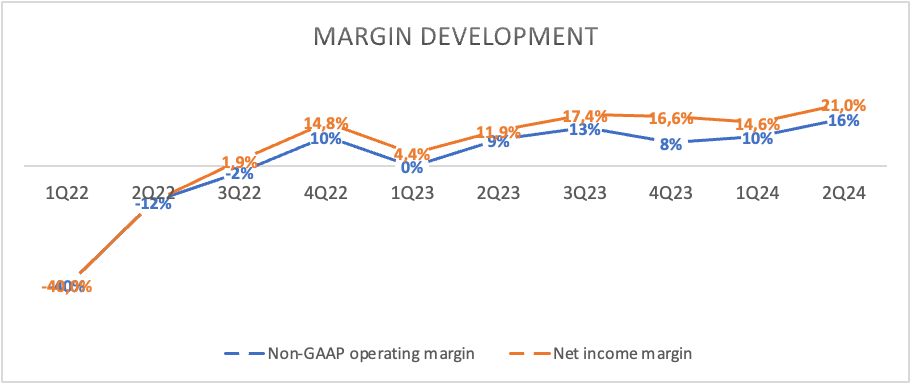

For perspective, Monday reported a non-GAAP net income margin of -42% in 2021 but has since turned this positive for eight quarters in a row now, hitting a high of 21% in the latest quarter.

How does it manage to do this? The answer is a superior and unique platform infrastructure (and a bit of AI)

As I explained last time, Monday’s unique and superior platform and software approach allows it to rapidly expand its offering with relatively few resources. Thanks to its low-code, no-code Work OS platform approach, which focuses on allowing organizations and users to build work management tools themselves to fit their needs with incredible customizability, Monday can build all its Work OS products on top of its existing platform, sharing a whopping 80% of the same code.

As a result, much less manual labor is needed to write the code for new software features. To put this into perspective, the first version of the company’s blockbuster CRM and Dev tools were built by just four and three developers, respectively, which is insane and speaks to the company’s abilities and superior infrastructure.

In addition, last year, the company also invested in an AI chatbot to manage chat-based customer service tickets, yielding impressive results. The chatbot has resolved around 50% of customer service tickets automatically, requiring less manual effort and, therefore, manpower.

Last quarter, Monday reported a record operating profit and notably attained GAAP operating profitability for the first time in the company's history. Looking at the numbers, the gross margin came in at an impressive 91%, and as operating costs grew slower than revenue, Monday reported a record-high 16% operating margin, expanding 700 bps YoY.

In terms of costs, R&D was stable as a percentage of revenue at 16%, but sales and marketing expenses declined from 56% last year to 51% this year. Meanwhile, Monday continues to grow its headcount steadily, adding 122 employees or 6% since Q1 to a total of 2,110. Management expects to keep growing this number for the remainder of the year as it continues to scale.

In the end, this allowed Monday to report a net income of $49.3 million, up 135% YoY, translating into a record-high 21% non-GAAP net income margin and an EPS of $0.94. On a GAAP basis, this was $0.27.

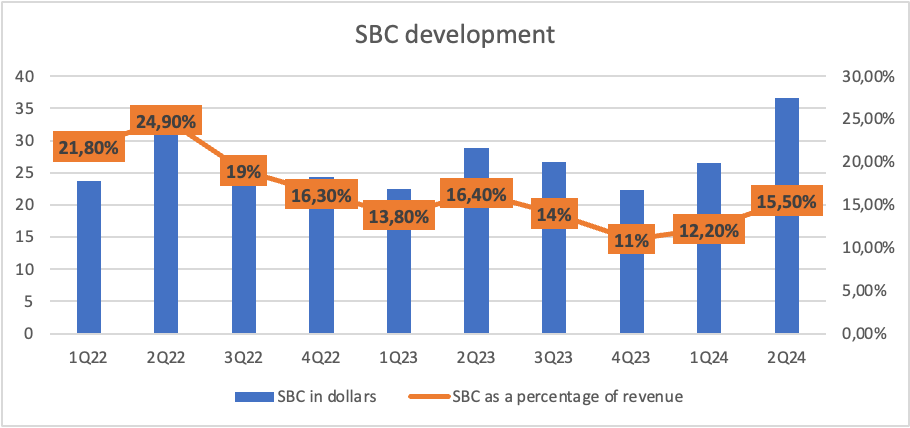

The difference between the two is mainly explained by SBC, which amounted to 15.5% of revenue, up quite a bit from previous quarters. In actual dollars, this was a two-year high. Of course, I would prefer to see this trend down more strongly, but considering Monday's early growth stage, I find SBC as a percentage of revenue at 15% more than acceptable and not overly worrying.

Finally, in terms of financial health, Monday is looking brilliant. It is GAAP profitable, with $1.3 billion in cash and equivalents and practically no debt. In Q2, the company generated $51 million in FCF, translating into an FCF margin of 22%.

This means Monday is still a rule of 50 company.

Rapid growth, GAAP profitability, and a pristine balance sheet; we can’t ask for much more as a shareholder!

On that note, let’s move to valuation and outlook next, but first…

We try to keep all our analysis free for all of you to enjoy and benefit from! Want to support our work a little bit more and show your appreciation? Consider upgrading to paid ($5 monthly).

This allows us to push out even more content and gets you access to our exceptionally performing portfolio and premium subscriber chat!

Outlook & Valuation

As with everything this quarter, Monday’s guidance also came in ahead of the consensus, guiding for Q3 revenue of between $243 million to $247 million, representing growth of 28% to 31% YoY. Furthermore, management expects an operating income of $19 million to $23 million and an operating margin of 8% to 9%. Finally, FCF is expected to come in between $70 million to $74 million, translating into a margin of 29-30%.

After a strong first half of the year, Monday management also updated its FY24 outlook, now guiding for revenue to be in the range of $956 million to $961 million, representing growth of 31% to 32% year-over-year, which is sublime and far ahead of the consensus. On a full-year basis, the operating margin is expected to be around 10-11%, and FY FCF should be around $275 million, translating into a sublime FCF margin of 28-29%.

Absolutely brilliant guidance if you ask me, showing management remains very confident.

Also, after this guidance update, I can safely say my projections earlier this year were far too conservative, with Monday showing far better margin development and demand. As a result, I have significantly increased my FY24 revenue and EPS estimates.

However, I have not improved my FY25 estimate as much, as I expect at least some macro weakness to form a drag on Monday’s business. Positively, in the long term, I have turned more bullish, expecting top and bottom-line growth to remain strong.

Based on these estimates and after shares have gained significantly so far this year, shares now trade at roughly 13.5x sales and an EPS multiple of over 92x, translating into a PEG of just over 2x, which I think isn’t overly rich for a company this early in its growth stage and with fundamentals as strong as Monday’s.

I firmly believe Monday is an absolute top pick in the software industry and best-in-class. As a result, I don’t mind paying a premium here, especially as Monday has proven that it can easily outperform expectations and has an exceptionally long runway of growth ahead of it. A company like this never trades at a real discount.

Nevertheless, I do think shares have run up a bit too high today. Personally, I prefer to pick up shares on a bit of a dip, which has proven a successful strategy so far in recent years. I am currently eyeing a share price below $250, ideally below 230-240, as this drops the sales multiple back below 12x and its PEG below 2x.

As a result, I am now rating Monday shares a hold, looking for a dip in the share price before adding once again. However, long-term, Monday remains a top pick for me.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

If you enjoy Rijnberk InvestInsights, it would mean the world to me if you invited friends to subscribe and read with us. If you refer friends, you will receive benefits that give you special access to Rijnberk InvestInsights.

Who doesn’t like some free premium content, right?

How to participate

1. Share Rijnberk InvestInsights. When you use the referral link below or the “Share” button on any post, you'll get credit for any new subscribers. Simply send the link in a text, email, or share it on social media with friends.

2. Earn benefits. When more friends use your referral link to subscribe (free or paid), you’ll receive special benefits.

Get a 1-month FREE premium subscription for 3 referrals

Get a 3-month FREE premium subscription for 8 referrals

Get a 12-month FREE premium subscription for 20 referrals

Thank you for helping get the word out about Rijnberk InvestInsights!

Cheers!