NIKE, Inc – A fiscal Q3 earnings review (Hold rating)

Nike reported its Q3 earnings one week ago and shares are down quite significantly since, and for good reasons. While financials were solid, the company is facing significant headwinds.

I covered Nike in one of my first posts here on Substack in January and explained why I was quite bullish on the company’s long-term prospects in the face of management’s cost savings program and plenty of growth potential. For those slightly unfamiliar with Nike and its growth prospects, I recommend reading that post first through the link below.

Last week, Nike reported Q3 results. While shares went up aftermarket by over 5% on strategic pricing actions and a top and bottom line beat, they fell by close to 7% in the following trading session due to sluggish demand trends and guidance.

Nike reported revenue of $12.4 billion, which was roughly flat YoY on a reported basis, and beat the consensus by $130 million. Growth in the Nike brand remained solid but was offset by weakness in Converse.

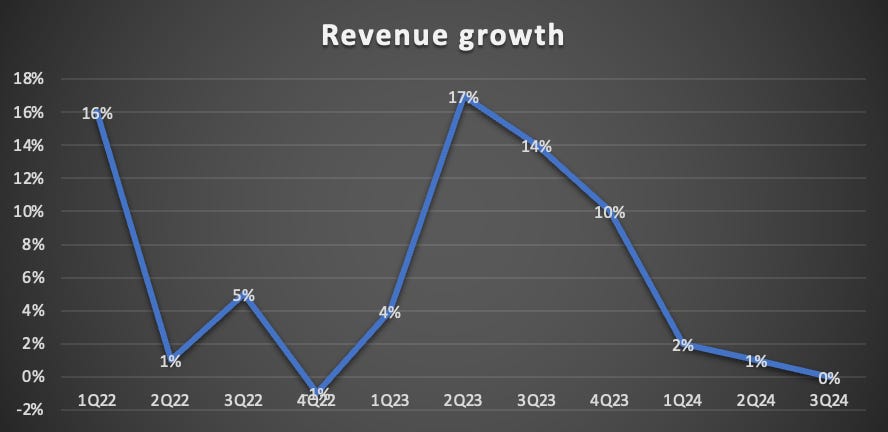

As a result, growth kept slowing down further from prior quarters as Nike started off the fiscal year reporting growth of 2%, which has now slowed to close to no growth. However, this did come on top of 14% growth in the same quarter last year and reflects a challenging operating environment in which consumers are less willing to spend on discretionary items, Nike continues to bring down inventories, and inflation eases. Therefore, this in itself is no reason for worry, and this slowdown was anticipated.

By sales channel, Nike stores performed the best, with revenue up 6%. Wholesale growth was 3%, but this growth was partially offset by a 4% decline in digital sales. Inventories were down by double digits, which indicated Nike is making great progress on this front.

Positively, Nike saw its women’s product sales grow strongly by double digits in Q3, with notable strength in key apparel franchises such as $100-plus leggings. Women’s apparel remains a big growth opportunity for Nike, so I am glad to see this segment continue to perform. With regard to this growth opportunity, this is what I wrote before:

“Another lever Nike plans to pull to boost growth in apparel and footwear is an increasing focus on investments in the women’s segment. Today, about 40% of Nike members are women consumers, so they make up a significant portion of the Nike member community, and this group is outgrowing men.

Despite this, Nike’s product offering for men remains more extensive. Just check out the Nike website and look at their Air Force sneakers. 9/10 times, you’ll find that the men’s offering is far more extensive, with more colors and patterns.

However, Nike has now decided to turn this around and is introducing new products to serve their female customers better. Women’s is a roughly $9 billion business for only the Nike brand, accounting for approximately 18% of fiscal FY23 revenue, clearly still leaving much room for growth. Just consider that women globally account for 60% of activewear purchases. This highlights that this is a largely underpenetrated market for Nike, leaving it with a significant upside across its business.

Nike is already making moves to increase its women’s offering by expanding products in its existing product lines but also introducing new markets, penetrating an entirely new market by, for example, introducing a collection of bras and leggings across different price points.”

Geographically, the company’s largest revenue region—North America—continued to perform relatively well. Revenues were up 3% YoY, driven primarily by 5% growth in wholesale. This exceeded expectations with strong holiday sales and unit growth YoY.

Growth in China also remained positive, with revenues up 6% YoY, which is in line with guidance. Again, wholesale drove the majority of this growth, with wholesale revenue up 12% YoY.

However, growth in these two regions was largely offset by weakness in the EMEA region due to increased macro volatility and softening consumer demand. Revenue was down 4%, driven by a 10% decline in Nike’s digital channels.

Overall, focusing on the top line, the quarter was not really surprising as Nike’s financials continue to reflect a challenging operating environment. However, management was very clear in its earnings call that it is far from satisfied with its recent performance, as it believes the Nike brand is capable of much more.

Management has acknowledged that it needs to adjust its strategy and has decided to focus on four areas: sports, product innovation, marketing, and brand elevation through its wholesale partners.

Starting with the latter, whereas Nike has been entirely focused on growing its direct channels like its website and stores over wholesale, mainly to control its brand image and to reel in the entire profits, management now acknowledges that wholesale continues to be an essential channel for the company and wants to make significant investments in wholesale to elevate the brand through those channels as well.

Nike continues to depend on wholesale as many consumers prefer buying shoes in a physical store, but Nike’s store footprint is somewhat limited. As a result, wholesale channels like JD Sports or Foot Locker remain important sales channels. Therefore, the refocus in its strategy does not come as a surprise and seems like the right one.

In addition, Nike is highly committed to driving a multiyear cycle of innovation, refreshing its product line-up, and reattracting consumer attention. In other words, management will renew its product portfolio and expects to start this in the next few quarters, ahead of the summer Olympics, which will bring a bolder marketing strategy with it.

Overall, these strategic initiatives offer some positivity for investors in the face of headwinds. Nike remains a top fashion and apparel brand globally and has an incredible moat. However, recent growth has not been impressive, and management hopes to drive a new growth cycle through this new focus and investments.

In addition to these focus areas, management is also positioning the company for the future operationally, which includes a major restructuring, including the layoff of 1,600 employees or 2% of its workforce. As discussed in my prior post on Nike, the company still aims to achieve $2 billion in cumulative cost savings over the next three years through “cost savings up and down the P&L and across the value chain. This also includes simplifying the product assortment and focusing investments on the best-performing product segments, as well as improving supply-chain efficiency, leveraging scale to lower the marginal cost of operations, increasing automation and speed from data and technology,” as per my latest post.

This restructuring is already well underway. This is what management stated during the earnings call:

“This quarter, we began streamlining support and operating functions, reducing management layers, and shifting more of our resources towards consumer-facing activities.”

However, while management’s efforts are great, it could still take some time for these restructuring efforts to start paying off and for this shift to be completed. Product innovation and development, especially, could take some years to materialize fully, which could lead to some sales sluggishness in the coming period as the company goes through a transition period.

I am somewhat more cautious about the company than I was a few months ago, as the outlook is quite uncertain in the near term.

In the longer term, the company remains well-positioned, and management's restructuring and re-focus efforts are definitely a big positive. However, in the short term, we think a growth recovery could take some time, potentially putting its premium valuation under more pressure.

The bottom-line development is looking better

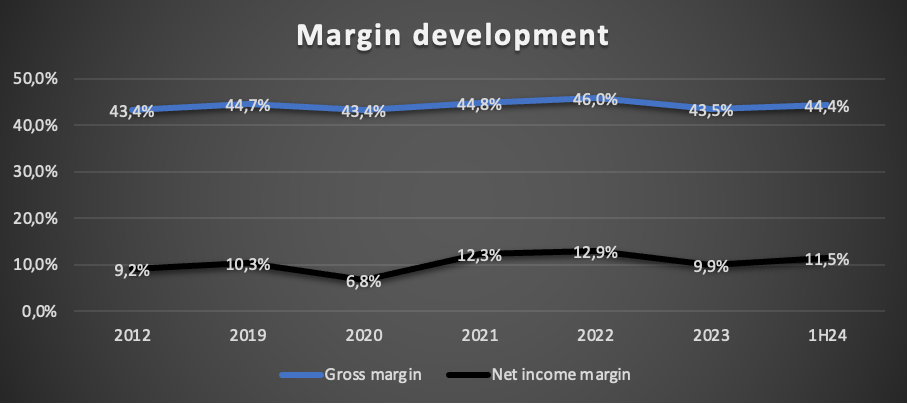

On the bottom line, the company did quite a bit better in Q3, impressing Wall Street. Gross margins improved by 150 bps YoY to an industry-leading 44.8%, also up 40 bps from the first half of the year. This margin expansion was driven by strategic pricing initiatives, lower ocean freight rates, and improvements in supply chain efficiency.

Margin gains were partially offset by higher input costs and restructuring charges (a 50 bps headwind), but nevertheless, they were impressive, considering the relatively weak top line. Meanwhile, SG&A costs were up 7% due to increased investment in demand creation, offset by disciplined cost management, limiting the bottom line pain.

Still, the net income margin fell by 60 bps YoY to 9.4% due to growing costs but a stagnant top line. This resulted in an EPS of $0.77, down 3% YoY but beating the consensus by $0.02. Moreover, excluding the restructuring charges, EPS would have been $0.98, up 24% YoY.

Overall, these are solid results, although also definitely not impressive. Again, Nike’s most recent financials reflect a struggling company dealing with a tough operating environment and a strategic shift.

Outlook & Valuation

Moving to guidance, Nike is quite optimistic about its fiscal Q4. Revenue is expected to be up slightly, reflecting some timing benefits but also lower digital growth due to franchise lifecycle management. Furthermore, the gross margin is projected to expand by 160 to 180 bps YoY, reflecting an operating margin of 45.3% at the midpoint.

Based on these expectations, management still expects fiscal FY24 revenues to be up 1% YoY and EPS growth to match management’s start-of-year guidance, excluding the impact of restructuring charges, which in reality negatively impacts the full-year gross margin by 15 bps. This means management now expects the full-year gross margin to come in right around 44.7%.

Management also shared some early insight into its next fiscal year guidance, indicating that it expects both revenue and EPS to grow YoY in fiscal FY25. This includes the expectation for revenue to be down in the first half of the year, driven by “near-term headwinds from lifecycle management of our key product franchises, more than offsetting the scaling of new products as we shift our product portfolio toward newness and innovation,” according to management.

Ultimately, the Q4 guidance is roughly what we had incorporated in our financial projections before. However, management’s rough FY25 guidance looks to point toward somewhat disappointing fiscal FY25 growth, which is below our expectations.

As a result, and also taking into account a couple of years of restructuring and strategic shifts, we have lowered our financial projections for FY25, FY26, and FY27. We strongly believe Nike remains a company with incredible long-term potential but also view the near to medium-term outlook as uncertain. You can find these upgraded projections below.

Based on these projections, Nike shares now trade at roughly 25.5x this fiscal year’s earnings or 23x the next fiscal year, which in any situation is quite a premium to pay, even as it is a 25% discount to the company’s 5-year average.

However, we believe Nike deserves to continue trading at a premium. It is a premium brand and should still be able to grow EPS by double digits for the foreseeable future. While the company might be facing some headwinds and uncertainties, Nike is still one of the highest-quality compounders out there. Furthermore, the company is in excellent financial health, which should help it weather the storm.

The company ended the most recent quarter with $9 billion in cash, up $1.6 billion from 9 months ago. Meanwhile, long-term debt has remained steady at $8.9 billion, leaving the company in a very healthy financial position. Its 1.6% dividend yield is also still well-covered and 50% above the 5-year average yield. The payout ratio now stands at 40%, which leaves plenty of room for raises, especially considering the EPS growth outlook.

All in all, we believe Nike continues to earn a premium but nowhere near where it used to trade. We now assume a 24x P/E multiple as fair, calculating a target price of $109 using our fiscal FY26 EPS projection. This reflects potential returns of just 7% annually or 8.5%, including the dividend, which is simply not enough to warrant a buy rating at this time.

We move our rating to hold and stay on the sidelines for now. We believe shares could fall under the $90 threshold in the near term, considering the current bearish view of the apparel sector and company-specific struggles. Currently, we are aiming for prices below $88 per share before considering buying Nike shares.

Let us know what you think of Nike shares below!

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

Disclosure: I/we do not have a beneficial long or short position in the shares of NKE, either through stock ownership, options, or other derivatives. This article expresses my own opinions, and we are not receiving any sort of compensation for it.

No recommendation or advice is being given as to whether any investment is suitable for a particular investor. The information provided in this analysis is for educational and informational purposes only. It is not intended as and should not be considered investment advice or a recommendation to buy or sell any security.

Investing in stocks and securities involves risks, and past performance is not indicative of future results. Readers are advised to conduct their own research before making any investment decisions.

Yes Daan! Great write up and what a brand.

Great write-up. Still love Nike. Gotta be one of the greatest brands in the world