Oracle Corporation – Its cloud computing edge is finally materializing

In this week's post, we revisit Oracle after it reported a mixed fiscal Q4 earlier this week.

Oracle shares hit a new all-time high this week after it released fiscal Q4 earnings last Tuesday. While the top-line numbers were far from impressive, with a miss on both earnings and revenue, its shares gained a whopping 12.5% in the following trading session. This is for good reasons, as investors were right to focus on something other than these headline numbers to define this as a great quarter.

You see, investors might now finally realize Oracle actually has a great and very significant cloud infrastructure. It is perfectly suited for running AI models or LLMs thanks to its close relationship with Nvidia and top-notch security and pricing, allowing it to compete with Microsoft, Google, and AWS. This was accentuated during the quarter by Oracle announcing massive cloud deals fueled by AI.

Whereas Oracle is still a legacy software provider and has more than half of its revenues coming from slow-growing or even shrinking business segments, it is rapidly becoming a cloud computing powerhouse, and there is plenty to be excited about.

Oracle is a global technology company with an impressive suite of enterprise software products, database software, and an incredible cloud infrastructure. With its headquarters in Redwood City, California, Oracle has expanded its reach worldwide, boasting a presence in over 175 countries and over 340,000 customers.

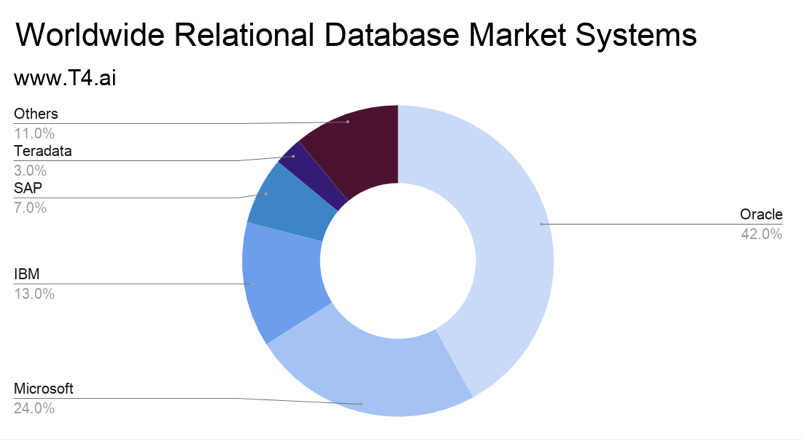

Today, Oracle remains the undisputed leader in relational databases and one of the leading providers of enterprise software solutions, including customer relationship management (CRM), enterprise resource planning (ERP), human capital management (HCM), and supply chain management (SCM) software.

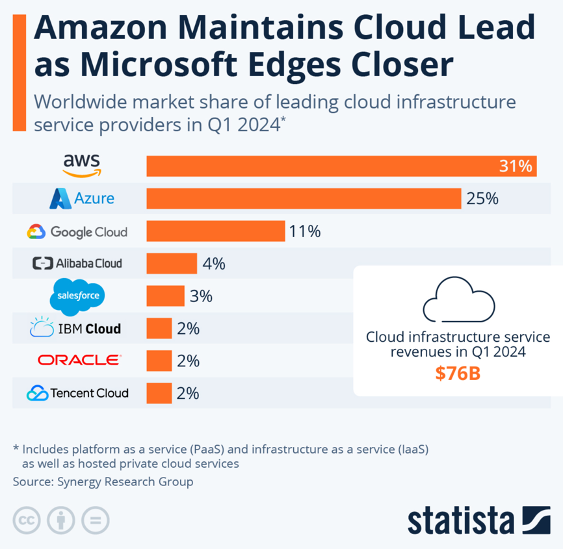

Meanwhile, it holds a 2% market share in the cloud industry, and while this might not sound impressive, it makes it the 7th largest cloud vendor globally and one of the fastest-growing!

In other terms, while Oracle has been far from a great investment over the last decade, it is better positioned than ever before today. However, this alone doesn’t make it worth an investment, so let’s delve into the Q4 results, update our financial projections, and determine a fair valuation.

Despite the miss, Q4 was a brilliant quarter for Oracle

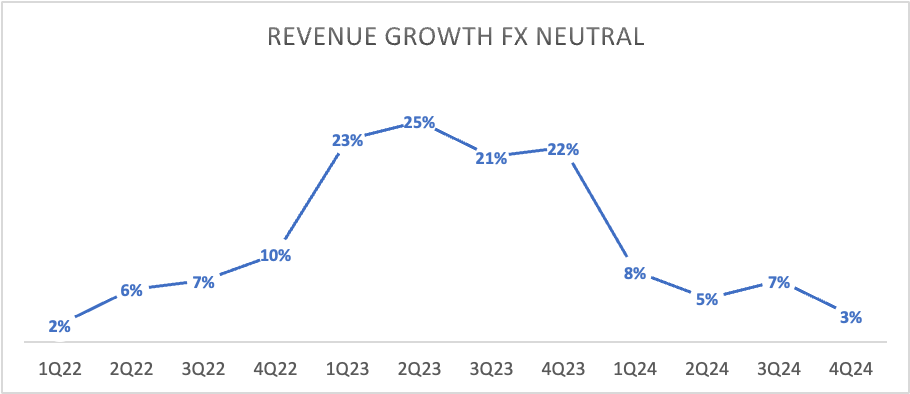

Oracle absolutely failed to impress with its headline numbers last Tuesday, reporting revenue of $14.29 billion, up only 3%, which is a further slowdown from prior quarters. However, some background is important here. In the graph below, you can see pretty impressive growth for Oracle in 2023, which was thanks to the acquisition of Cerner. However, over its fiscal FY24, this turned into a headwind as Cerner was still very much being integrated into the business and not in growth mode. This was quite a drag on revenue.

In addition, Oracle is capacity-constrained in its cloud business, which it is trying to expand rapidly to satisfy demand. It also still has quite a big legacy software business that isn’t growing as strongly, though this is shrinking as a percentage of revenue.

This, at least partially, explains the revenue trend shown above. Nevertheless, Oracle did miss revenue by $280 million, which is far from great. It simply wasn’t a great quarter in terms of top-line growth, similar to what we have seen throughout the year. For reference, FY24 revenue eventually was up only 6% to $53 billion, which isn’t all that exciting considering the growth reported by software peers.

However, this also isn’t really what investors should and are focused on. The bullish thesis here for Oracle is its cloud business, which is growing rapidly, although it is still relatively small overall. You see, Oracle is a significant competitor in the cloud industry with its 2% market share, leadership position in cloud-based enterprise software applications, and rapidly growing infrastructure business.

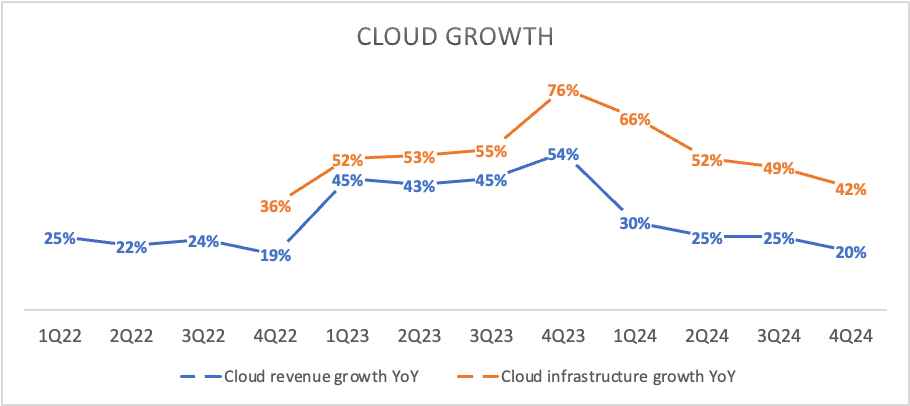

In Q4, total cloud revenue grew by 20% to $5.3 billion, or roughly 1/3 of revenue. Excluding Cerner, which remains a headwind for Oracle as it continues to integrate it into its operations, this was up 23%, a much more impressive growth rate than its top line.

This has also been growing strongly and steadily, above 20% for most of the last three years. Yes, we can see this slowing down over recent quarters in part due to the rule of large numbers. Still, Oracle is rapidly working on getting capacity online and is seeing demand for its cloud infrastructure boom, and management expects Cerner to return to growth mode in fiscal 2025.

As a result, this trend is expected to reverse next fiscal year, with growth accelerating again.

As also highlighted in the graph above, the largest growth driver of Oracle’s cloud revenue is OCI, the company’s infrastructure business. In Q4, OCI revenue came in at $2 billion, up 42% YoY despite lapping 77% growth from last year. Oracle realized this growth even as it was still capacity-constraint, and management indicated that excluding these constraints, it would have been able to grow OCI revenue by an even faster 53%.

Again, growth has been slowing down over the last year, yes. Still, management is closing massive cloud deals. It continues to build capacity, which it believes should allow it to accelerate growth again in fiscal FY25, growing faster than the 50% in 2024, despite a significantly larger business size, which is impressive and a big positive.

We can safely say OCI is firing on all cylinders and bringing in massive cloud deals, but more on that in a bit.

The other part of Oracle’s cloud business is cloud applications (SaaS), which mainly consists of Oracle’s cloud-based enterprise software applications. Revenue here was $3.3 billion, up 10% YoY. This is driven by Oracle migrating many of its legacy customers to its cloud-based applications, but don’t expect these operations in themselves to remain or become fast-growing operations for Oracle.

However, a big positive for Oracle is that by transitioning these enterprise software customers to the cloud, it is also able to convert many of these enterprises to OCI customers, increasing customer value for many of its 340,000 customers, which is a big advantage for Oracle and supports cloud revenue growth.

Meanwhile, Oracle also remains the undisputed leader in relational database management with its Oracle database, whose revenue grew by 6% in Q4, driven mainly by its cloud database services, which grew by 26% YoY and now have an annualized revenue run rate of $2 billion.

Oracle is still by far the leader in this industry, with a market share of roughly 42%, comfortably ahead of Microsoft’s 24% market share. With the growing importance of data generation and the integration of AI and ML for data analysis, this is still a solidly growing market. Market Research Future projects this market to grow at a CAGR of 12.5% through 2032, which is significant.

Positively, Oracle is again well positioned with its transition to the cloud, not only as it pushes customers to OCI but also because its focus on multi-cloud allows its database users to use its software through Microsoft’s Azure or Google Cloud.

Oracle acknowledges that many of its customers might be using other cloud platforms. It doesn’t want to lose its many software and database customers, so it is very much focused on allowing its cloud applications to run on other cloud services. This should allow it to retain customers and grow further, thanks to its incredibly flexible offering.

I believe Oracle has the best approach from this perspective, which will benefit it in the coming years, as it did in Q4! With its current portfolio of products and services, Oracle looks pretty well positioned for the future, even though Q4 hasn’t fully reflected this yet due to the headwinds discussed, and Oracle is still in the middle of its cloud transition and built-out.

RPO was the real Q4 highlight

Overall, Q4 looks pretty solid in terms of growth but not impressive in any way. However, the real highlight this quarter and the best indicator of future success was RPO or Remaining Performance Obligations.

Remaining performance obligations refer to a company's obligations under its contracts with customers to transfer goods or services that have not yet been fulfilled as of the reporting date. In essence, remaining performance obligations provide a forward-looking view of the revenue that a company expects to earn from its current contracts, indicating the backlog of work to be completed and the associated future earnings.

Simply put, a rapidly growing RPO indicates significant revenue growth ahead as the company can win significant contracts. Last quarter, this number grew by a whopping 44% or an even more insane 60% excluding Cerner, which better reflects the booming demand for OCI. RPO came in at $98 billion, up $18 billion from last quarter.

This is due to Oracle's ability to close massive cloud infrastructure contracts thanks to the edge OCI has over the competition in terms of processing speed, security, and pricing. Now, I am not going to bore you with a lot of technicalities, but let’s just say Oracle has a unique approach to cloud computing with a focus on security and processing speed to benefit AI computing, which allows it to run LLMs several times faster and therefore also at a fraction of the price of its competitors. For reference, OCI is a whopping 75% cheaper than Microsoft’s Azure, even as it has an edge in LLMs.

This is what Larry Ellison said during the earnings call:

“We have the most secure, complete, and cost-effective set of enterprise applications and infrastructure cloud technologies of any vendor. Not only are our cloud technologies vertically integrated to work together, but we offer flexible deployment models like public cloud, multi-cloud, sovereign clouds, dedicated cloud or any other way our customers ask us to deliver.”

This edge, which we have pointed out before, is now becoming more apparent as Oracle is able to win significant contracts with some of the largest computing and AI businesses. During the quarter, Oracle signed multiple of the biggest contracts in its history, thanks to massive demand for LLM’s and Oracle’s OCI cloud service.

In total, Oracle signed 30 AI contracts with a value of over $12 billion. Among these large customers signed in Q4 is OpenAI, the company behind LLM frontrunner ChatGPT, which is obviously a massive win. Other companies already leveraging Oracle’s OCI are some of the biggest names out there, such as Nvidia, Microsoft, Google, and X AI.

What should investors take away from this? Well, Oracle is seeing a massive influx of AI customers, which provides it with a bright future when it comes to revenue growth. Oracle’s cloud is perfectly suited for the next generation of computing, and this is now materializing. In other words, last quarter’s RPO growth highlights Oracle’s future success in cloud computing.

Management is working hard to build out cloud capacity worldwide to realize this growth, which is the driver of the Oracle bull case.

Oracle is rapidly improving its bottom line and balance sheet

While top-line growth will most certainly accelerate in FY25, Oracle is also reporting solid margin improvements, as its cloud computing business has high margins and is only improving further as new cloud capacity fills up.

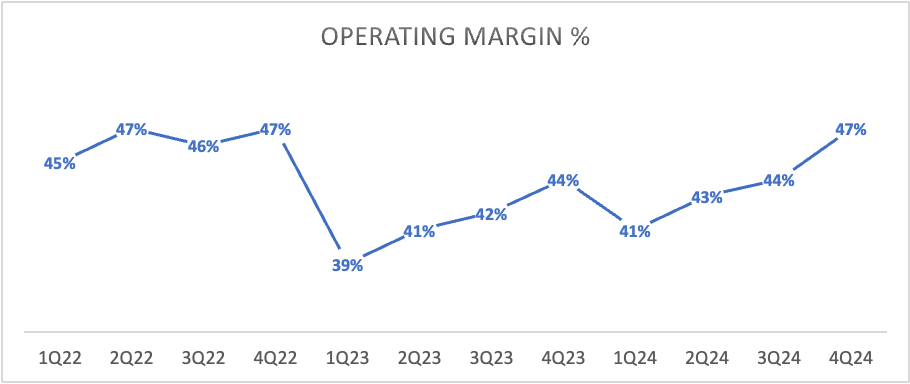

In Q4, Oracle reported an operating income of $6.7 billion, up 9% YoY. This reflects an operating margin of 47%, which is a roughly 300 bps improvement from last year, even as Oracle is going through a period of significant investments in its cloud infrastructure.

This is thanks to Oracle driving more efficiencies in its operations and cloud operating more efficiently as it scales. Management expects these same factors to keep benefitting it going forward as it continues to scale, which should help it further expand its operating margin, together with accelerating top line growth.

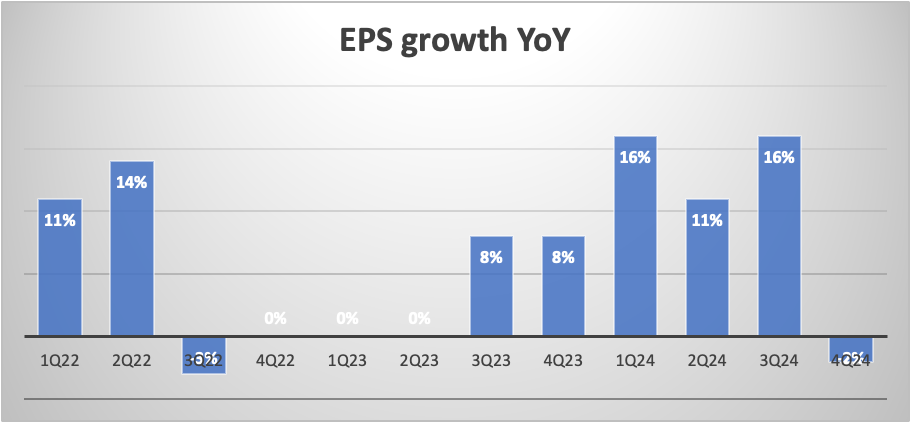

In Q4, this, however, resulted in an EPS of $1.63, down 2% YoY and missing the consensus by $0.02. Now, this might seem odd with margins expanding, but this can be attributed to a significantly higher (double) tax rate compared to last year. Excluding this impact, EPS would have grown a much more respectable 14% YoY.

Finally, these improving cash flows are also reflected further down the line, with TTM FCF up 39% to $11.8 billion. This has also helped Oracle significantly improve its balance sheet over the last year. However, this is still far from pretty due to Oracle’s acquisition spree over the last decade, in which it spent a total of $110 billion.

As of the end of Q4, Oracle held a total cash position of $10.5 billion, up close to $1 billion from one year ago, against a total debt of $76 billion, down $10 billion YoY. As a result, Oracle now has a net debt position of roughly $66 billion, down $11 billion from last year.

Now, while this is still far from great, especially with the company having to spend significant capital on infrastructure expansion and a dividend worth over $4 billion annually, it shows it can improve its balance sheet rather quickly, which should inspire at least some confidence.

While still far from ideal, I am not as worried about its financial health as I was before, especially as the company is rapidly improving its bottom line and cash flows.

Outlook & Valuation

That then brings me to the outlook, which also looks pretty optimistic. A couple of years back, management set the target for at least $65 billion in revenue in FY26, an operating margin of 45%, and EPS growth at a CAGR of 10%. However, management is now indicating that these targets might be pretty conservative, looking at the growth ahead.

Management believes growth should continuously accelerate throughout fiscal FY25 as new cloud regions come online and Oracle realizes more revenue. As a result, according to management, growth should accelerate in each successive quarter, which is incredibly bullish.

This will mostly be driven by the rapidly growing demand for OCI, which Oracle projects to grow faster than the 50% reported in FY24, which is pretty insane. Eventually, management believes growth should easily accelerate to the double digits, while RPO growth will most likely remain far higher.

This includes the expectation for Q1 revenue to grow 6-8%, driven by cloud revenue growth of 21-23%, and with EPS growth of 11-15%.

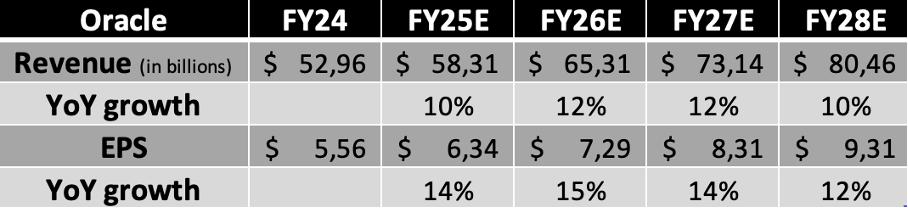

Overall, I believe there is plenty of reason to become more optimistic about Oracle. The company is in a far better position than it has been in over the last decade, and this is reflected in our financial projections. We strongly believe the company’s push into cloud computing will benefit it in the medium term, which results in the following financial projections.

Based on these projections, Oracle shares now trade at roughly 22x this year’s earnings, which isn’t cheap, especially considering Oracle traded at an average of 17x earnings over the last five years. However, as it said a second ago, the company is looking better than ever, which deserves to be reflected in its multiple.

It still sits at a 7% discount to the sector median and isn’t as expensive on a PEG basis, with a PEG of 1.57, an 11% discount to its 5-year average, and 21% to the sector median. From this perspective, shares don’t look as expensive but fairly valued.

Overall, a 22x multiple is rather fair for Oracle based on its current outlook and financial health. Using our FY26 financial projection, this translates into a target price of $160, similar to our $159 target in March, and reflecting annual returns of roughly 7.7% after the recent share price increase.

As a result, we do not believe shares are as attractive as three months ago when we rated these a buy. At current prices, we do not see enough downside protection, which results in an unfavorable risk reward. We’d prefer Oracle’s share price to drop back to below $130 at this time, as this should give investors a better long-term entry point.

As for now, we rate Oracle a hold despite us turning more bullish on the company. Shares are fully priced.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Love it Daan…favourite software stocks for you are…?