PayPal is a no-brainer right now (Stock Analysis)

PayPal is nailing it, yet still given zero recognition. This has made it a bargain right now. Let me show you why!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

Last Tuesday, digital payments leader PayPal released its first quarter results and pretty much nailed it on all fronts, although it saw little reaction from investors with shares trading up a meager 2%. Meanwhile, PayPal delivered a Q1 consensus beat and issued strong guidance above consensus estimates.

Also, the company’s strategy under Alex Chriss is taking shape and already showing positive results. Underlying fundamental growth metrics, like user numbers, user activity, multi-product usage, and new feature adoption (the type of metrics that showcase business health and indicate future growth), are strong and showing improvement, weakening PayPal's bear case.

Under Alex Chriss, PayPal has made all the right moves, in my opinion. It is becoming increasingly competitive in the highly competitive payment processing landscape, steadily becoming a digital payments one-stop shop for both consumers and merchants. I believe this allows it to fight off the competition on all fronts.

Meanwhile, even as the company is low-key restructuring, shifting its strategy, and investing in new products, it is delivering excellent profitability improvements and cash flows, allowing it to maintain a strong margin profile and a pristine balance sheet.

No matter how you look at it, PayPal remains a FCF machine. And I am not even mentioning PayPal’s brilliant guidance for EPS growth accelerating into the double digits by 2027 and reaching 20%+ in the long run, an outlook I am increasingly more confident in.

Ultimately, I believe the PayPal investment case is only getting better, yet the market still doesn’t give it any credit. Shares are still trading at just 13x this year’s earnings, which is mind-blowing to me.

PayPal is still a golden opportunity, and the last quarterly results proved this. These results only increased my confidence in my long-term investment thesis. With a current market cap of roughly $65 billion, PayPal is a potential multi-bagger by the end of the decade.

Let me take you through the most important quarterly numbers, developments, and commentary, putting it all into perspective, while explaining why I am so bullish on PayPal. Let’s delve in!

PayPal’s new strategy is a long-term winner and is already showing promising results in Q1 numbers

Q1 TPV (Total Payment Volume) grew 3% YoY to $417 billion.

PayPal’s take rate dropped 6 bps to 1.68%.

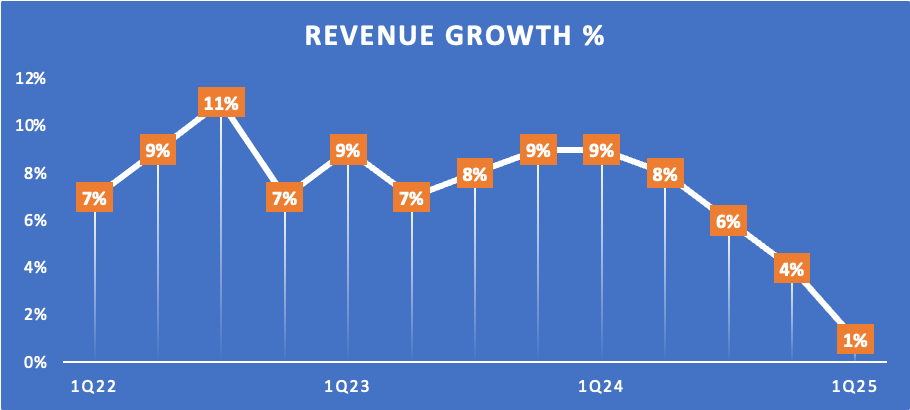

Q1 revenue was up 1% YoY to $7.79 billion, missing consensus estimates by $40 million.

While at first glance these top-line growth numbers look far from impressive, even missing consensus estimates by a very small margin, PayPal actually delivered a really strong quarter. 2025 is still somewhat of a transition year for PayPal as the company is shifting its strategy and long-term focus to better position it for the future, somewhat at the cost of near-term TPV and revenue growth. At the same time, underlying growth looks excellent, and PayPal is already showing rapid bottom-line improvements as part of its new strategy, as will become apparent as we dive deeper into the numbers. So, let me get back to these headline numbers in a bit.

First, let me quickly touch on PayPal’s renewed long-term strategic focus and ambitions.

You see, whereas the company has struggled considerably in recent years as emerging payment platforms have been taking away users (like Apple Pay, Google Pay, Adyen, Stripe, etc), under new CEO Alex Chriss, PayPal is going in a new and much more promising direction.

In simple terms, slowly but steadily, Chriss is evolving PayPal from a traditional payments processor into a comprehensive global commerce platform, focusing on AI-driven personalization, omnichannel integration, and enhanced merchant services.

Simply put, PayPal wants to become a much more substantial player in the payments value chain. It doesn’t just want to be consumers' preferred online payment method; it wants to allow users to use PayPal both online and in-store, massively expanding its TAM and customer relationships, as well as its attractiveness to consumers. Apart from growing its TAM and usefulness by expanding into offline solutions, PayPal is also once again focused on innovation to make the platform more attractive to users by improving the experience. This includes features like Fastlane (emoves login barriers and pre-fills shipping/payment info) and CashPass (AI-personalized offers), which both lead to a better user experience and faster checkout.

These efforts should allow it to compete again with more seamless, engaging options like Apple Pay, Cash App, and buy-now-pay-later (BNPL) services.

With this, it also aims to shift from being purely a payments processor to an end-to-end strategic commerce partner for merchants, allowing it to compete much more closely with competitors such as Adyen and Stripe. PayPal recently introduced a single PayPal platform, which offers all of PayPal’s advanced merchant features in a single platform and dashboard, reducing complexity for merchants. This infrastructure-first approach makes PayPal harder to displace, especially as merchants look for bundled, scalable, and integrated solutions.

So, ultimately, PayPal aims to become a much more comprehensive platform for both consumers and merchants, making it more relevant than ever.

In my view, Alex Chriss is nailing this strategy. The company already has by far the largest and most active user base in the industry on both sides of the equation—consumers and merchants—to which it can easily introduce all these new features and functionalities. This puts PayPal in a highly competitive position. If executed correctly, this strategy should re-establish its competitive relevance, which it has been losing in recent years due to a lack of innovation.

Looking at the first quarter results, we can already see this shift in strategy pay off.

For example, branded experiences TPV, which comprises volume from PayPal and Venmo online checkout, as well as branded in-store payment methods like debit and tap-to-pay, grew 8% in Q1, outgrowing overall TPV and showing solid, accelerating growth amid solid adoption, even though it is still very early days. This growth is 200 bps ahead of the growth we saw for this same TPV category in 2024.

Supporting growth here is the success of Pay with Venmo, which is a feature that allows consumers to use their Venmo account as a payment method at online or in-app merchants, effectively extending Venmo’s usability beyond peer-to-peer payments. In Q1, Pay with Venmo TPV grew 50% YoY, and monthly active accounts grew 30% YoY, helped by increased merchant availability (JetBlue became the first airline to accept Venmo in Q1).

Meanwhile, highlighting traction in PayPal’s omnichannel strategy, debit card users grew 90% YoY and by 2 million in Q1, which drove a 64% YoY growth in debit card TPV. Furthermore, Venmo debit card monthly active accounts grew nearly 40%, already reaching 6% penetration in a very short time.

This is really excellent and critical progress. As pointed out before, allowing users to use PayPal both online and offline is massively growing PayPal’s TAM and usefulness to consumers. For reference, as pointed out by management, “users who adopted the PayPal debit card transacted nearly six times more and generated more than two times the average revenue per account compared to those who used online branded checkout only.”

I expect growing debit card penetration to be a solid growth driver for PayPal over time. It is a perfect way to maximize the opportunity per user, and PayPal seems to be executing well.

On the other hand, as part of this new strategy, PayPal has also been reducing its focus on less profitable operations, which is a drag on overall TPV growth. For example, with PSP, which spans both large enterprise and SMB processing, volume grew by only 2% YoY in Q1, down from 6% in Q4. Within its Braintree business, PayPal prioritizes healthy, quality growth, moving away from unprofitable volume. This hurts the top-line performance in the near term, but as we will see later on, it is leading to rapid margin improvement.

Overall, this resulted in TPV growth of 3% YoY or 4% in constant currency, which is a further slowdown from prior quarters, as expected considering the strategic change and somewhat challenging macro environment.

Meanwhile, PayPal saw its transaction revenue take rate decline by another 6 bps YoY to 1.68%, driven by product and merchant mix. Ultimately, this led to revenue growth of just 1% YoY to $7.79 billion. This includes flat transaction revenue growth YoY to $7 billion and strong 17% growth in value-added services revenue to $775 million.

Similar to TPV, this also reflects a further slowdown in growth due to the same dynamics combined with a further decline in take rate.

On a very positive note, in part driven by PayPal’s new strategy and the loads of innovative features introduced over recent months, user numbers are trending back in the right direction after a challenging 2023 and H1 2024. You see, coming out of the COVID-19 pandemic, when a lot of e-commerce activity brought loads of new users to PayPal, user growth plummeted and turned negative in 2023, as PayPal could not retain all these new users and faced very stiff competition.

This raised serious concerns over PayPal’s ability to compete with other platforms that reported solid user growth simultaneously. However, PayPal seems to be turning the ship around now, with total active accounts reaching a new all-time high in Q1 at 436 million, surpassing the previous high from Q4 2022. In Q1, active accounts grew by 2%, which is in line with Q4. Monthly active accounts also grew by 2% to 224 million.

I view this active account growth as a big positive, as it shows that the PayPal platform is once again able to attract new users to an already massive user base, fueling long-term growth and offsetting concerns over competitiveness. At PayPal’s already massive size, 2% growth is more than respectable under normal conditions, although I hope to see this growth accelerate further, driven by new features. For reference, this 2% YoY growth reflects an addition of 1.5 million users compared to Q4 and 8 million YoY.

Meanwhile, PayPal also reported continued growth in transactions per account, up 4% YoY (excl. PSP), showing growing engagement on top of user growth, which is precisely what investors should be looking for.

These are strong and healthy numbers that deserve more recognition.

On that note, let’s move to the bottom line results, which didn’t disappoint.

As pointed out before, under its new strategy, PayPal has prioritized profitable volumes while moving away from unprofitable volumes. While this was a drag on total TPV growth, it led to solid margin and cash flow improvements.

For these exact reasons, the transaction margin grew by 270 bps YoY, allowing for 8% growth in transaction margin dollars, which is an acceleration from Q4 despite slower top-line growth. As a result, operating income grew 16% YoY to $1.6 billion, reflecting a 20.7% operating margin, up 260 bps YoY, showing great improvement after a tougher 2024.

Crucially, there is still a lot more of this to come in the years ahead.

Further down the line, this resulted in an EPS of $1.33, up 23% YoY, also showing strong improvement. The difference between operating income and EPS growth is mainly explained by share repurchases.

Finally, PayPal delivered a solid adjusted free cash flow of $1.4 billion, reflecting an 18% FCF margin. This brings TTM FCF to $6.2 billion, showing PayPal remains a FCF machine.

This is what has allowed it to keep rewarding shareholders, repurchasing $1.5 billion worth of its own shares in Q1 and for $6 billion over the last 12 months, which remains fully covered by FCF. This means PayPal was able to retire roughly 9% of its outstanding shares over the last year, while maintaining its healthy balance sheet.

PayPal ended the quarter with $15.8 billion in cash and $12.6 billion in debt, leaving it in a healthy net cash position. Also, its ROIC remains well over 20%. This great financial profile and strong cash flows earn it an A- credit rating from Fitch.

Ultimately, PayPal just remains in excellent financial health, and with margins now expanding again and PayPal expected to accelerate top-line growth further in the years ahead, fueled by this new strategy, I expect metrics like EPS and FCF to keep growing rapidly.

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe if you like our content! Want to receive even more of our investment insights and show even more appreciation? Please consider upgrading to our paid tier (only $7.50 monthly or just $70 annually).

In addition to all the free stuff, this also gets you access to even more premium analyses (a total of 3-7 per month), full access to my own (outperforming) portfolio, immediate trade alerts in the subscriber chat, and a full overview of all my price targets and ratings, and even more!

This includes immediate access to recent premium posts like:

Outlook & Valuation

Q2 revenue to grow by low to mid single digits, likely showing a mild acceleration from Q1.

Q2 transaction margin dollars to grow by 6.5% at the midpoint of the guided range (excl interest on customer balances), suggesting minor to no margin improvement YoY.

Q2 EPS to be in the range of $1.29 to $1.31, reflecting YoY growth of 9% due to a combination of mildly improving margins and buybacks.

FY25 transaction margin dollars to grow by 5-7%

FY25 EPS to be in the range of $4.95 to $5.10, reflecting 8% growth at the midpoint (includes a negative impact from lower interest rates)

FY25 FCF of $6 billion to $7 billion, of which $6 billion is anticipated to be spent on buybacks.

As laid out above, PayPal reaffirmed its FY25 guidance, which might have been a bit of a disappointment for investors. However, management added that it now assumes first-half results to exceed prior expectations. Whereas this would typically translate into a guidance raise, PayPal management remains conservative for now because of the current level of macro uncertainty amid an ongoing trade war and recession risk.

So far, PayPal indicates that consumer spending and the labor market remain resilient, with the company seeing little change in consumer spending habits. If the situation doesn’t worsen further, we can safely assume PayPal to beat its current guidance. However, the situation remains extremely uncertain with regard to global economic activity and consumer spending. Current guidance now accounts for some worsening of the situation in H2.

I must say I prefer this conservative approach.

Meanwhile, PayPal also issued some very bullish longer-term guidance during its investor day in February, which remains unchanged. The company now expects solid EPS growth through 2027 and a constant acceleration in growth as current actions translate into margin gain in the coming year. By 2027, management expects EPS to grow at a low teens rate at least. Furthermore, long-term, management aims for EPS growth to accelerate to over 20%, which is extremely bullish, though sounding a bit like a long shot and a best-case scenario.

Nevertheless, it shows management is confident in their current transition, which is showing excellent progress, making me somewhat confident in this outlook.

The biggest positive was a return to healthy growth in users and transaction activity. Growing competition and a loss of users are the biggest bear case drivers and the reason PayPal has been out of favor for so long. Yet, all the numbers we get right now point to fundamental usage improvements that enable long-term growth. At the same time, a focus on higher-margin volumes, cost efficiencies, and scale advantages should allow for rapidly expanding margins.

At this point, I see no reason not to be bullish, even as the fight with significant competition in the payments arena will still be challenging, and the primary risk to any bullish thesis.

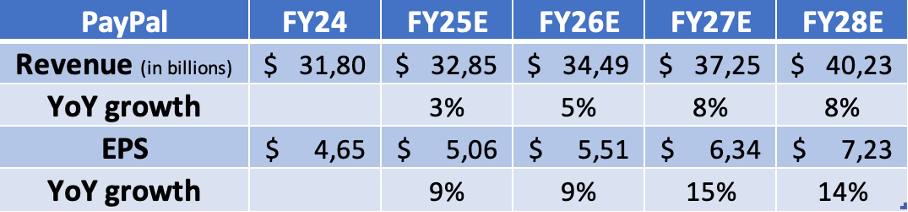

For now, assuming only a mild worsening in macroeconomic conditions in 2025 and some economic and consumer spending weakness in 2026, I expect FY25 results toward the high end of management’s guided range and only a very mild acceleration of growth in 2026. However, for the years after, I expect growth to accelerate considerably and improve further toward the end of the decade.

This is my baseline scenario, assuming some macroeconomic weakness in 2025 and 2026 and continued competitive pressures. These estimates have some upside if PayPal management nails its strategy and accelerates active account numbers from current levels. Of course, a better-than-anticipated economy also presents upside potential.

Below you’ll find my fully updated financial estimates.

Based on the estimates above and a current share price of $65, PayPal shares now trade at just below 13x this year’s earnings, which right now is nothing short of ridiculous. This translates into a growth-adjusted PEG of 1.1x, which suggests PayPal is on the brink of deep value territory. Also, this is a 37% discount to its own 5-year average and a 7% discount to the financials sector median, which is mind-blowing.

Meanwhile, the company remains in excellent financial health, has a bullet-proof balance sheet, strong reinvestment metrics, and, most importantly, is seeing strong traction with its new strategy. With active accounts growing steadily again and underlying metrics all pointing to fundamental improvement under Alex Chriss, the bear case is falling apart here.

PayPal is executing well on all fronts, delivering strong results, yet still getting zero recognition from Wall Street. Furthermore, with an outlook for mid to high single-digit revenue growth and double-digit EPS growth through the end of the decade, there is just no way of justifying current valuation multiples, not even considering the risk of considerable competition.

Amid significant fundamental improvement to the business, the discount awarded to PayPal shares over the recent months/years is no longer justified.

For reference, even if we use a still very conservative earnings multiple of 16x, which I believe still doesn’t fully reflect the current state of the business and its solid outlook, I calculate an end-of-2027 target price of $101. This reflects potential returns of over 17% annually (CAGR), which should be easily enough to beat the market by some margin.

Ultimately, at these levels, PayPal is a no-brainer for me. The risk-reward here is excellent. My current financial projections are below the Wall Street consensus and already account for weakness in 2025 and 2026, yet potential returns look excellent, with loads of room for upside.

Below $70 per share, I believe PayPal is a no-brainer.

If PayPal is able to buy back 9% of its shares last year and you expect them to continue this plus 3 and 5% in revenue growth, why is your projected EPS only 9% for the next 2 years?

I was going through the terms and condition at paypal.com, I agree that it is becoming digital commerce platform for both consumers and merchants. The terms & condition for personal, consumer and merchant transaction are refined more. I tried to make a summarize tool on these for paypal users onlinegebuehrenrechner.de but still it is not covering all the terms and condition.