InvestInsights Portfolio Update - May 2025

Here is an updated look at my portfolio after a very chaotic March.

Good morning, InvestInsights owners,

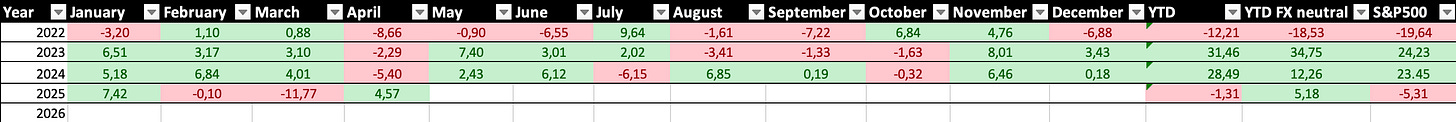

Welcome to another monthly portfolio update! Here is some key data to start with:

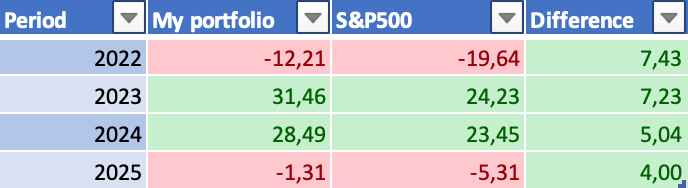

My portfolio averages an 11.2% CAGR since January 2022 (compared to 4.8% for the S&P 500).

Outperformed the S&P 500 by almost 600 bps in April

Outperforming the S&P 500 by 400 bps YTD.

My portfolio has a 0.7% dividend yield and a 5/10 risk profile (medium risk).

My portfolio is long-term oriented - no trading. Ideally, I buy and hold with some active management to control allocation and diversification.

Alright, everyone. I am going to keep it short today and focus purely on my portfolio, transactions, and thoughts (what you are likely here for, anyway). I will also give you some more detailed portfolio and performance data so you can more closely follow my moves and get a better sense of my long-term performance.

Obviously, after last month, there is still plenty to go over, with volatility offering up a load of opportunities (so it won’t be that short today after all). During the considerable weakness we experienced in early April, I made sure to make some larger, long-awaited changes to my portfolio, with brilliant businesses arguably coming on sale. Meanwhile, I still have plenty on my watchlist on which I am prepared to pull the trigger soon. So, like I said, plenty of portfolio-specific thoughts and changes to go over.

But first…

What. A. Month.

After the first 9 days of April, the S&P 500 was down another mindblowing 11.5% for the month, sitting well within correction territory in response to significant macroeconomic pressures and a potential global trade war (with special thanks to the Trump administration).

And yet, somehow, we ended the month with only a marginal loss. Suddenly, it turns out we might (or are likely to) avoid a trade war and the subsequent recession. Woohoo, we might have really been given a perfect buying opportunity in early April, as the correction might turn out to be short-lived.

Anyway, below, you can see the monthly performance of some of the largest global indices.

S&P 500 → -1.28% 🔴

Nasdaq → 0.56% 🟢

Dow 30 → -3.48% 🔴

STOXX Europe → -2.69% 🔴

Hang Seng → -4.94% 🔴

Following another month of negative performance, although not as bad as it was about to become, here is how these same benchmarks stack up YTD.

S&P 500 → -5.31% 🔴

Nasdaq → -8.62% 🔴

Dow 30 → -6.21% 🔴

Stoxx Europe → 3.91% 🟢

Hang Seng → 11.96% 🟢

Indeed, YTD U.S. benchmarks continue to trade in negative territory. Obviously, with the U.S. itself facing the most considerable headwinds from tariffs under the new Trump administration, European and Chinese stocks are still performing considerably better, although March and April have shown us these aren’t immune either.

Macroeconomic conditions remain highly uncertain, and with U.S. economic growth now visibly slowing down, there is no quick recovery in sight. At the same time, Trump is pulling back on some of his earlier actions, with his appetite for a trade war easing and the U.S. reaching a crucial mineral deal with Ukraine.

The positives and negatives outweigh each other. Volatility will likely remain high.

Alright, before getting to my portfolio performance, here is an overview of all my February posts, in case you missed any:

Lululemon Athletica ($LULU) – Earnings review + thesis update

Thermo Fisher Scientific – A MedTech giant now available at a discount

American Express – A must-own for long-term investors (Deep Dive)

Make sure to subscribe using the button above, and do not miss any future analyses.

My Portfolio - Another month of outperformance after a tough March

After considerable underperformance in March, my portfolio showed a strong recovery in the second half of April, ending the month with a gain strong gain of 4.57%, even amid continued currency headwinds.

For those new here, it is worth noting that I am located in Europe and calculate my returns in Euro’s, while a considerable portion of my investment is in U.S. Dollars. As a result, I face some FX exposure, which often fluctuates between being a positive and a negative. For full transparency, going forward, I will report both my constant currency and Euro returns.

Last month, similar to March, FX was a negative impact of about 120 bps. Excluding any FX impact, my portfolio returned 5.8% in April. Either way, my portfolio did much better than all global benchmarks, outpacing the S&P 500 by almost 600 bps in Euros (720 bps excl. FX), which is remarkably strong.

Yet, after a very touch March, this was a much needed recovery.

However, YTD, this still means my portfolio is down by 1.31%. Positively, this is also still well ahead of the S&P 500. As shown below, in Euro’s my portfolio is still outperforming the S&P500 by 400 bps so far in 2025, while FX-neutral this is a whopping 10.5%, showing my stocks are outperforming the U.S. benchmark by quite a wide margin. For the record, in Euro’s, my portfolio has outperformed the S&P 500 in each of the last 4 years (since inception).

Since January 2022, this translates into the following total returns:

So far, I am rather pleased with this performance, especially considering this includes a very challenging 2022 and 2025 so far. Long-term I continue to aim for a double digit return CAGR and an S&P 500 outperformance, both in Euro’s and FX-neutral.

On that note, let’s move to the actual portfolio.

The remainder of this article, including my portfolio allocation and monthly transactions, is for paid subscribers only. To access this and many more premium analyses and insights, please consider upgrading to our paid subscription tier (only $7.50 monthly or $70 annually).

In addition to all the free stuff, this also gets you access to:

Even more premium stock analyses (3-7 per month).

Full access to my own portfolio allocation, transactions, and thoughts, including immediate trade alerts in the subscriber chat.

A full overview of all my price targets and ratings at the bottom of this article, updated regularly.

And even more!