Starbucks Corporation – One of its worst quarters ever, but still a buy

Let's take a look at the quarterly results that caused Starbucks shares to drop by over 15% in a single day to new 52-week lows.

Let’s start by pointing out that Starbucks’ SBUX 0.00%↑ Q2 earnings report offered very few positives and that the post-earnings sell-off is not surprising at all. Shares sold off by roughly 16% post-earnings, meaning shares are now down 35% over the last twelve months, 23% YTD, and another 20% since our last coverage in February, hitting their lowest point since June 2022.

The company reported financial results that missed expectations across all metrics, from revenue and earnings to guidance, which comes after already lowering its FY guidance in January. This was easily one of Starbucks's worst quarters in my many years of following the company closely, driven by a unique mix of headwinds; though it wasn’t necessarily company-specific issues that caused this terrible quarter, and long-term, I remain confident.

Nevertheless, management started the earnings call in a similar negative but clear tone, stating the following:

“Let me be clear from the beginning. Our performance this quarter was disappointing and did not meet our expectations.”

Before we continue our analysis of Starbucks, we have something exciting to share!

Exclusive giveaway!! This is an opportunity you don’t want to miss!

Yesterday, we posted our second Monthly Portfolio Update for our paid subscribers, sharing a detailed overview of all our stock ratings, investing strategy, and portfolio.

Today, we are giving away five free premium subscriptions. All you have to do to enter is respond to this email or send a private message in the Substack app. The first five to do so will receive a free upgrade!!

The winners will hear from us within an hour of their response!

Our low-risk portfolio has returned 26.1% since January 2022, against a 5.7% return from the S&P500. Make sure to subscribe to our paid tier for full access!

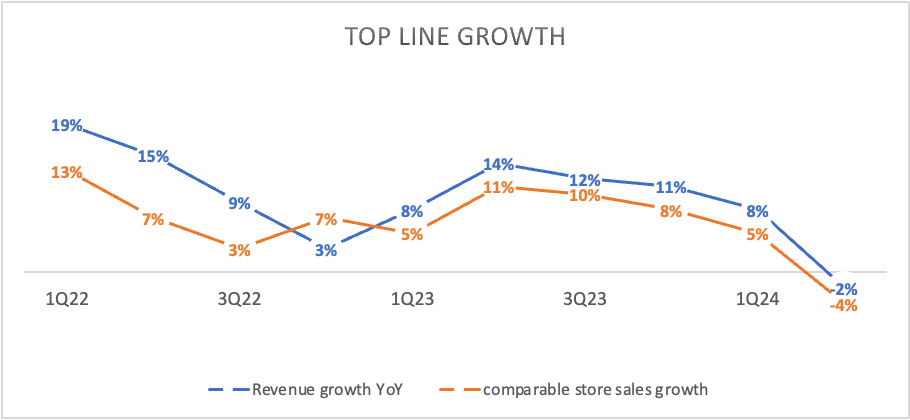

Moving back to Starbucks, it reported revenue of $8.56 billion, down 1.8% YoY and missing estimates by $600 million, or a significant 7%. Starbucks' growth has been slowing down, from 12% in Q2 last year to negative growth in the most recent quarter, as highlighted below.

Now, while a further slowdown in growth might have been expected considering the challenging operating environment originating from a cautious consumer, growth turning negative came as quite a surprise.

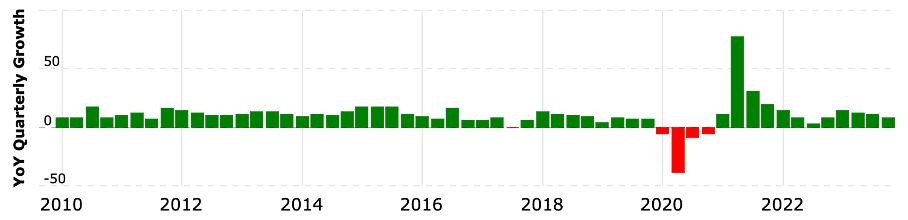

I mean, over its history, Starbucks has always been pretty resilient, highlighted by the fact that it only reported a revenue contraction in four quarters over the last decade, and this was during the first COVID-19-impacted quarters.

However, today, it faces another unique combination of headwinds that caused this surprisingly weak performance, and management didn’t see it coming. See, whereas the headwinds we saw in Q1 were expected to ease in Q2, these persisted and worsened, surprising Wall Street and management alike.

The leading headwind here is a deteriorating economic outlook, which has led to a cautious consumer. This has also impacted McDonald’s and KFC, as highlighted in their recently announced quarterly earnings.

For Starbucks, this continued to weigh on the business, as occasional Starbucks customers lowered their visiting frequency, leading to quite a significant contraction in customer traffic, though unsurprisingly. No matter how strong the brand’s customer loyalty and global presence, coffee remains a discretionary item.

Not helping customer traffic is the Middle East conflict from which Starbucks experienced quite some pushback. About this, this is what I wrote in February:

“Now, I am not going to discuss the entire story, but the short-term result was that Starbucks became the center of Pro-Palestine campaigns and faced boycott efforts, which led to a notable decline in U.S. traffic numbers. Ultimately, this turned out to be quite the headwind for Starbucks last quarter.”

Whereas this headwind was expected to ease in Q2 as management removed some misconceptions, leading to a slight rebound in traffic in December, the company did still feel the impact linger in Q2, still impacting store traffic worldwide.

Over the last quarter, management continued investing in its brand and addressing misinformation. This included a $3 million donation to the World Central Kitchen and its humanitarian efforts to provide food aid in Gaza.

Meanwhile, a recovery in China also continues to be slower than expected, holding back growth, and severe weather impacted Starbucks’ business in the U.S. by about 3% in comparable sales, according to management.

Even though some of these factors are out of management’s control and transitory, the performance was lackluster and far below expectations. I am surprised management didn’t have better visibility of many of these issues in February. Such a big miss is rare.

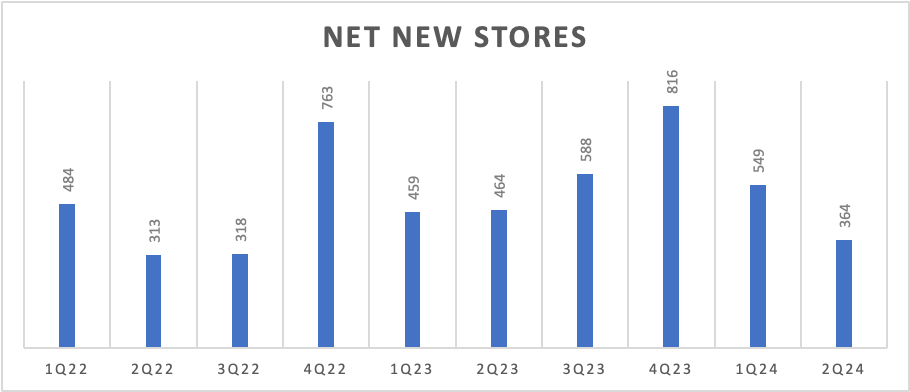

The toxic combination of headwinds caused a 4% YoY decline in comparable store sales, driven by a 3% contraction in the U.S. and an 11% contraction in China, both driven by lower traffic. Whereas in prior downturns global expansion was able to offset headwinds, this time, 8% growth in store count wasn’t quite enough.

Looking closer at the regions, we can see that the performance in the U.S. remained pretty resilient considering all circumstances. North American revenue came in at $6.4 billion, flat YoY, as 5% net new company-operated store growth was able to offset a 3% decline in comparable store sales, driven by a 7% decline in transactions, reflecting lower traffic.

Internationally, revenue was also flat YoY at $1.8 billion as net new company-operated store growth was once more able to offset a decline in comparable store sales of 6%.

However, weakness in China was more pronounced, with revenue declining by 3%, reflecting the slower-than-expected recovery. Comparable store sales decreased 11% YoY, with an 8% and 4% decline in average tickets and transactions, respectively. This, again, reflects disappointing traffic numbers. Net new store growth of 14% could only partially offset this weakness.

On the margin front, the company also showed struggles, mainly originating from a weaker top line and continued investments. Even as operating expenses were roughly flat YoY and the company achieved 150 bps in cost savings through reinvention-related in-store operational efficiencies, the operating margin contracted by 140 bps to 12.8%. This meant the operating margin hit the lowest level in over two years.

In greater detail, this decline was driven by deleveraging, partner wages, benefit investments, and promotional activities. This also led to a decrease in EPS to $0.68, missing the consensus by $0.12 or 15% and representing a 7% YoY decline.

Yes… this isn’t looking good, and we can safely say the company is navigating some challenging headwinds that could persist for longer than anticipated.

The long-term investment thesis is not broken

Now, while I agree it is time for a much-needed expectation reset, let’s not act like this terrible quarter destroys the entire investment thesis. As noted before, Starbucks is not the only one dealing with these headwinds, and it is not a company-specific issue. Also, a single quarter is rarely an indication for the next 5-10 years, and the company does remain on the right track.

The company’s triple shop with two pumps reinvention strategy remains well on track, realizing 150 bps in productivity gains in the latest quarter, and expansion plans remain well on track. While Starbucks had intended its latest development and growth plan to boost growth instead of offsetting weakness, it does position the company well for a recovery in the economy and its overall operating environment.

Yes, we might have to acknowledge that growth will come in at the lower end of management’s longer-term guidance, but this should still position it well to outperform. We should not forget that despite its global reach, Starbucks still has plenty of room to grow and that while it is now dealing with several headwinds, the business remains very solid.

Starbucks remains one of the most recognizable brands worldwide, a leader in the coffee industry, and has a solid base of loyal customers and a solid inflow of occasional customers, in part thanks to its recognizable and well-regarded brand.

Reward members continue to drive growth

Positively, despite a downturn in revenue, Starbucks loyalty members growth remained positive, growing 6% in the last quarter to almost 33 million. Granted. This is quite a slowdown from the mid-teens growth we have gotten used to in recent years, but obviously, as consumers spend less time at Starbucks due to tight budgets, they are also less likely to sign up for its rewards program.

I view the fact that this number kept on growing in this environment as quite positive, and it solidifies Starbucks’ moat. These customers generally visit Starbucks stores much more frequently and tend to spend more, so they are also a great revenue growth driver.

Meanwhile, Starbucks is also working hard to make its rewards program more attractive, especially in this challenging operating environment, offering more significant discounts and personalized offers. Furthermore, Starbucks will open its app up to non-reward members later this year, offering exclusive in-app offers to better connect with customers and draw them to its stores more often, an effort that could offset some traffic weakness and drive additional long-term growth.

In this digital era, these are the efforts that matter.

Opportunities lie in store count expansion and store optimization

Meanwhile, Starbucks also continues to see plenty of growth opportunities through more traditional methods like global expansion, optimizing store operations, and expanding its opening hours.

Now, the latter two are quite interesting. It is no secret that most of Starbucks’ revenue is booked in the morning. According to Starbucks, the morning hours are its peak hours, and it realizes about half of its revenues in these hours.

However, management acknowledges that it has trouble meeting demand during these hours, which leads to longer wait times and lesser availability. Starbucks has seen this translate into a poor order completion percentage among its rewards members, which account for 60% of the morning business. In the most recent quarter, this led to an order completion rate of mid-teens.

In other words, consumers choose not to finish their order due to the noted long wait times and poor product availability during these hours, according to management. Clearly, this offers opportunities to maximize its business.

To solve this issue, Starbucks is developing multiple systems, including the siren system, which it is rolling out already. The system leads to an increase in peak throughput as waiting times are lower, which management estimates should drive comparable sales growth up at least 1% across its business while also offering additional efficiency gains. This means this system alone could add roughly 2% to revenue growth in any given quarter if fully rolled out. Quite promising indeed.

However, the idea of extending store opening hours is even more promising. Over recent weeks, Starbucks has run a pilot program to serve customers overnight between 5:00 p.m. and 5:00 a.m., and it has shown great potential.

Remarkably, during these weeks, sales doubled in these stores, and management is now planning on building a $2 billion business using these additional hours to add incremental revenue.

This is just an example of how Starbucks is still able to get more out of its existing business model, so do not underestimate the growth potential.

Meanwhile, the most significant growth driver for Starbucks, of course, remains its global expansion efforts, particularly in China. Management still aims for 55,000 stores by 2030, up from 38,000 today, and it remains well on track.

In Q2, it added 364 stores, and it continues to see plenty of room to expand, particularly in regions where it still has little presence, like India (400 stores) and Indonesia (600 stores), but also Honduras and Ecuador, to which the company expanded very recently, making it active in 88 markets now.

As it continues to grow its store count, focusing on expansion outside of North America, so will revenue.

However, management once more stated that all these developments and efforts will take time to develop and be fully realized, and considering current headwinds, some patience from investors might be needed here.

On that note, let’s move on to the outlook and consider what’s ahead.

Outlook & Valuation

Unsurprisingly, after the miss this quarter and considering these headwinds aren’t particularly expected to disappear soon, or at least not all of them, management was forced to lower its FY24 guidance, and quite significantly.

Management now expects revenue growth of just low single digits, down from a prior range of 7% to 10%. This is driven by comparable sales flat to declining by low single digits and global net store growth revised down from 7% to 6%.

This is also expected to impact the operating margin, which is now guided to remain at a similar level to last year, compared to a previous expectation for progressive expansion thanks to management’s reinvention efforts. This is expected to result in EPS growth to be flat or up in the low single digits, down significantly from a previous expectation for growth of 15% to 20%.

This isn’t the lightest of guidance revisions, to say the least, and has led to quite some panic among investors, fully explaining the post-earnings sell-off. However, on a slightly positive note, with this revised guidance, I expect Starbucks has guided very conservatively, taking a lot of pain right now and positioning itself for raise and beat quarters in its fiscal Q3 and Q4.

Therefore, I see some room for some slight optimism here. Investors can now buy Starbucks shares at the lowest level since mid-2022, while the long-term outlook shouldn’t be too damaged. However, of course, there is still a lot of uncertainty involved here, with economic growth slowing down and interest rates remaining high, pushing on consumer confidence.

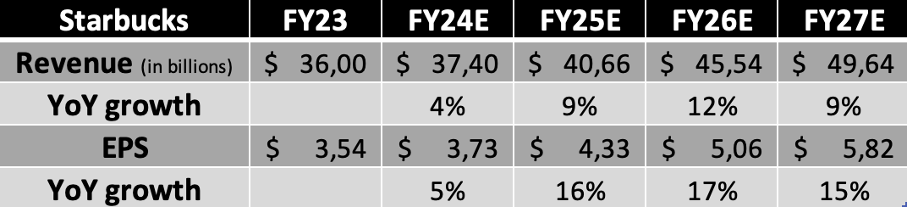

We now project Starbucks to grow revenue by roughly 3.9% this fiscal year and EPS by 5.1%, driven by its efficiency gains offsetting lower revenue levels.

Furthermore, we expect revenue growth to steadily improve throughout fiscal FY25 and a more meaningful recovery by FY26, though far below prior expectations. Meanwhile, EPS should grow more strongly, driven by efficiency gains and improved revenue growth, sitting at the low end of management’s guidance. This results in the following projections.

Based on these projections and yesterday's post-earnings sell-off, Starbucks shares are now trading right around 20x this year’s earnings, which is far from expensive and makes me believe shares might be slightly oversold. We should not forget that Starbucks is still one of the strongest brands globally and has a long runway of impressive growth ahead of it, even as it currently deals with a number of headwinds.

Also, shares now trade at a PEG of just 1.5x, roughly in line with the sector median and far below the 2.5x 5-year average.

Therefore, we view this recent sell-off as an excellent opportunity to buy shares at a 52-week low. Historically, Starbucks has traded at a multiple of over 30x, while in recent years, this has been closer to the high to mid-20s.

Considering its growth outlook, moat, and brand power, we continue to believe it very much deserves to trade at such a premium. For reference, a recent Piper Sandler survey showed that Starbucks remains one of the most recognized and popular brands among Gen Z, positioning it favorably for the future.

Still, we have to consider current uncertainty and lower growth levels. Therefore, we now view a conservative 22x multiple as more than fair while offering a decent margin of safety.

Based on this, we now calculate a target price of $95 per share, which translates into potential returns of 17.5% annually, which should be more than enough to beat global benchmarks.

In addition, Starbucks shares now yield 3%, which is 50% above the 5-year average. This is based on a sustainable 59% payout ratio, which is based on depressed earnings. We do not expect significant dividend growth from Starbucks in the next few years, but long-term investors can expect Starbucks to remain an excellent dividend growth option, with a great starting yield.

Add this to the projected annual returns, and total returns exceeding 20% annually are not out of the question. As a result, we continue to view Starbucks as a tremendous long-term investment despite its current headwinds.

We maintain our buy rating and have added some shares to our own portfolio following this dip as well!

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!

I enjoyed this piece. I didn't look into $SBUX earnings, so this was a good summary of the fundamentals. Technical chart looks oversold and approaching 2022 lows. Should bounce, however if that 2022 low breaks down, something more structurally with the GLOBAL consumer may have changed with paying premium for a coffee. In Manhattan, even with the work crowd tue/wed, the locations here are less crowded. But I am by wall st. I am sure midtown is busier just by nature of concentration of commuters. PS I switched to a Nespresso machine years ago. It tastes better and is only 70 cents per cup. So much so I can't bring myself to pay $9 anywhere. Give it a taste test. Cheers ☕️

Starbucks has it is well-known brand and a huge company, however I don’t like how they been losing operating cash flow in the recent years.

However I still have Starbucks in my portfolio let’s see what happens in the following quarters and years