Uber Technologies – A brilliant company now trading at a discount

In this post, we examine Uber's Q1 results and the investment case.

Uber UBER 0.00%↑ is among the most recent companies to report earnings and sell off in the following trading session over these last few weeks. This is often driven by poor sentiment and not necessarily due to the results themselves.

Uber reported earnings yesterday and managed to beat the revenue and EBITDA consensus (EPS is not representative and, therefore, not relevant). While its guidance might have been a bit light, there certainly was no reason for a 6% drop in the share price, especially as management left its longer-term guidance unchanged. This is just another undeserved sell-off, potentially creating an opportunity.

We have been aggressively buying Uber shares in recent years when these traded closer to the $30-$40 range. Wall Street and the investment community were so worried about the company ever reporting a profit that it completely missed the bull case for Uber, driven by its significant global presence, brand popularity, and the promise of the industry in which it operates.

And guess what? Uber quickly started reporting profits, and the share price ballooned to recent highs in the $80s, leading to our position growing to account for a high-single-digit percentage in our portfolio.

Recent quarters, including the most recent one, show that Uber is firing on all cylinders, gaining traction globally, and significantly growing its number of users, user engagement, active drivers, and profitability. This was once more highlighted in the most recent quarterly report.

The company just has a lot going for it, and with its industry-leading ride-hailing and food-delivery platforms, it is positioned for significant growth for many more years. For reference, during the recent investor event, management guided revenue growth at a 3-year (through 2026) CAGR of mid- to high-teens and adjusted EBITDA growth in the high 30s to 40%, with FCF as a percentage of EBITDA being over 90%.

This sounds very promising and, above all, realistic. The company still has relatively low penetration across key markets, sees growing demand for its services, has plenty of cross-selling opportunities between its platforms, has a rapidly growing advertising business, and, thanks to its size, has had no trouble fighting off the competition.

For reference, Uber management claims that only 5% of the population aged over 18 in the countries in which it operates use its mobility and delivery services. Even in its most saturated countries, including the U.S., the mobility segment still only sees 20% penetration, leaving a lot of room for Uber to grow.

Besides increasing its reach, Uber also still sees plenty of growth opportunities within its existing user base through, for example, offering new transportation formats like Reserve, Taxi, Moto, Uber for Business, and Shared Rides, which has already seen great adoption and plays into the needs of many.

Add to this the company rapidly adding taxi drivers around the globe to its platform and the company’s opportunities to cross-sell between its delivery and mobility segments, and it shouldn’t be hard to visualize the bullish growth outlook.

Meanwhile, the company has had little trouble fighting off the competition within either of its segments. In mobility, its only real competitor is Lyft, which is located in the U.S., but that one is finding it increasingly difficult to compete with Uber’s size.

In delivery, the company faces more competition in the form of industry leader Doordash in the U.S., Grubhub, and a number of smaller players. In Europe, it has to compete with the likes of Just Eat, Deliveroo, DeliveryHero, and more. Still, it holds the #1 position in 7 of its top 10 markets and has been gaining market share in each of these, also fueling growth.

So, don’t make the mistake of thinking Uber has most of its growth behind it – data says otherwise. It should be able to keep growing user numbers strongly. It is just exceptionally well-positioned, and we are very bullish.

We last covered the shares in February following its Q4 results and investor event. We then argued that shares traded at quite a hefty price tag, arguably justified by management's impressive medium-term guidance.

Positively, shares have come down almost 20% since, including yesterday’s post-earnings sell-off, meaning shares now trade at a much more reasonable valuation, potentially making it quite an attractive buy.

In this post, we’ll examine Uber’s Q1 earnings report closely, make up the balance, and update our financial projections and target price, determining whether we are indeed looking at a great buying opportunity.

For those unfamiliar with the company and its long-term prospects, while we will touch or already touched on many aspects in this post, it could be valuable to check out our February post as well for a bit more of a deep dive!

Uber is still firing on all cylinders

Uber reported Q1 results yesterday, showing that it remains on a consistent trajectory. Growth across the board remained in line with prior quarters despite some economic weakness and cautious consumer spending.

Growth continues to be supported by a number of secular growth drivers, including a continued shift in consumer spending from goods to services and the secular trend towards on-demand transportation and delivery. This is well able to offset weakness elsewhere at the moment.

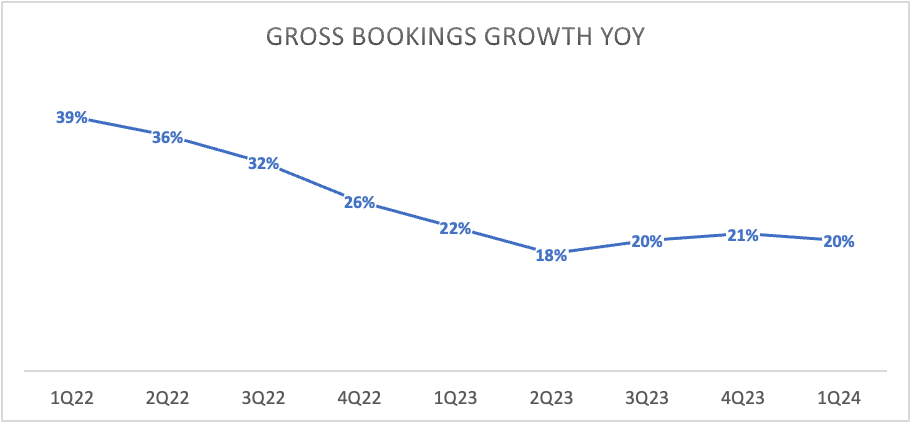

Uber reported gross bookings growth of 20% YoY for the quarter, which is impressive considering this laps 22% growth last year. This is also roughly in line with the prior two quarters, highlighting Uber's steady growth.

However, the $37.7 billion in gross bookings just about missed the consensus and the midpoint of management's guidance due to softer mobility activity in LatAm as it lapped strong demand for carnival last year and a shift in the holidays. Foreign exchange was an additional headwind of roughly $205 million or 70 bps in growth, easily explaining the slight miss. This was outside of Uber’s control and shouldn’t be a concern in any way.

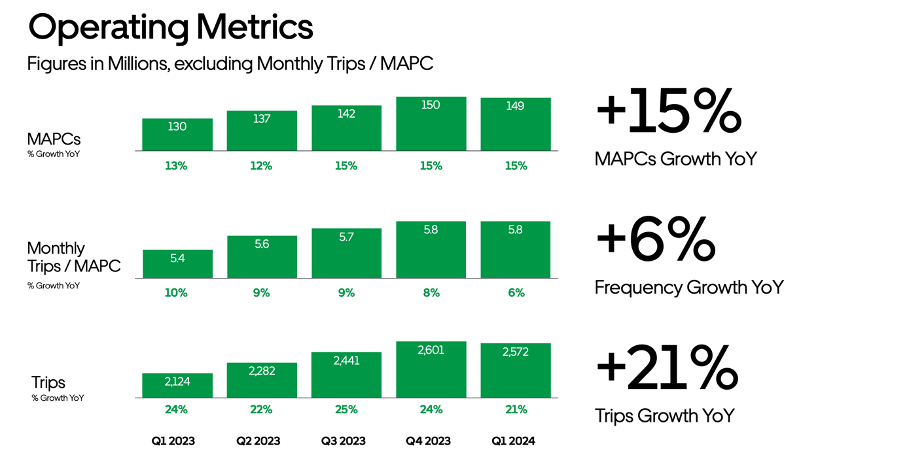

Gross bookings growth in Q1 was driven by 21% growth in trips, which in part was driven by strong growth in users (MAPCs), growing 15% YoY to 130 million. Also, user engagement continues to trend up strongly, with the number of trips per MAPC growing by 6% YoY. This is strong data, showing that the dual growth driver for Uber remains very much intact. The business is showing very little weakness on this front.

Eventually, this underlying growth translated into revenue growth of 15% YoY to $10.1 billion, beating the consensus by a thin margin. The discrepancy between gross bookings and revenue growth is explained by an 8 percentage point headwind from business model changes, impacting revenue by $742 million. This headwind will disappear gradually by the second half of the year.

Positively, excluding this impact, revenue would be up 23% YoY as Uber’s take rate improved. Also, excluding the underperforming freight segment, reported revenue was up 19% YoY, better reflecting the key aspects of the business.

Besides its three main segments, Uber is also seeing solid growth in other business areas, including its subscriptions and advertising. In terms of subscriptions, Uber is still seeing strong adoption of Uber One, with over 19 million consumers across 25 countries paying the $10 subscription fee.

As a result, subscription fees have already exceeded a $1 billion run rate and are growing fast as management continuously adds more benefits and expands the offering to more countries each quarter. This allows it to grow into a more significant revenue stream and a more stable one as well, with retention increasing by 200 bps in Q1.

Crucially, as with any comparable membership form, these members have a far higher lifetime value due to a higher usage frequency and higher spending, driving growth for Uber. Members now account for 32% of overall gross bookings. This will remain a significant growth driver.

In addition, Uber’s advertising business continues to grow strongly, exceeding a $900 million revenue run rate. This is what I wrote before:

“According to Uber, the advertising business continues to scale profitably and will remain a significant revenue growth driver. According to management, driven by the growing number of tools for advertisers and the integration of AI, advertising is a multi-billion dollar opportunity for the company. It is only scratching the surface at this point.

Moreover, it will also be an essential profitability driver, with this business carrying far higher margins than its main operations. For reference, Uber generates advertising revenue by showing ads in its app but also by mounting advertising screens on and in its drivers’ cars. This is still a rapidly growing business for Uber as the company is also expanding these operations into more and more regions.”

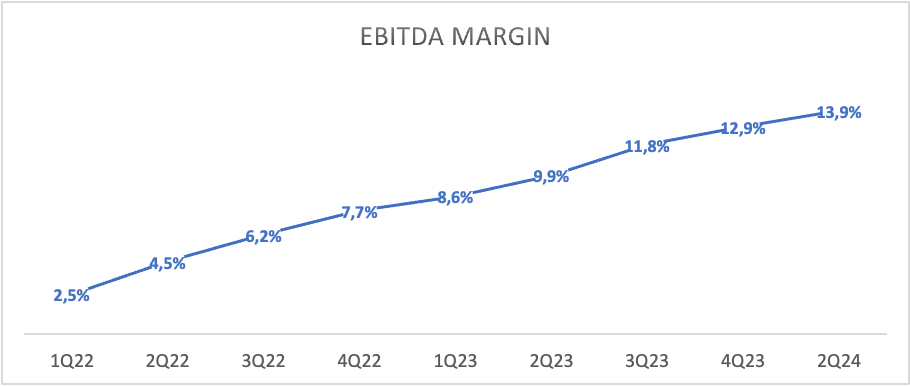

On the bottom line, Uber also performed very well, beating estimates. As clearly visible in the graph below, Uber has been rapidly improving its cash flows and profitability, with EBITDA margins hitting new highs in Q1.

Uber reported EBITDA of $1.4 billion, $60 million ahead of expectations, and up 82% YoY. The EBITDA margin improved by 400 bps YoY and 100 bps sequentially to 13.9%. This shows tremendous progress by Uber management and a much more profitable business.

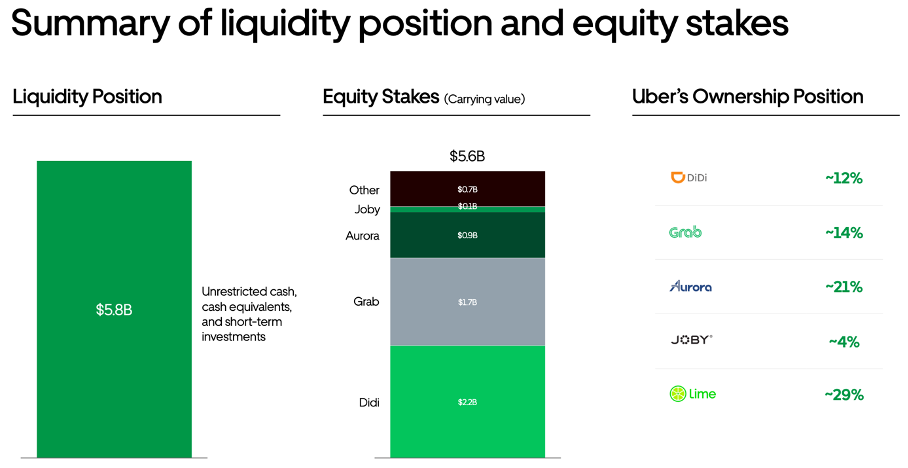

Net profits turned negative for Q1, at a loss of $654 million, mainly driven by a $721 million unrealized loss from its equity investments. This leads to EPS swings from quarter to quarter, making it an unimportant stat.

Finally, FCF in Q1 totaled $1.4 billion, representing an FCF margin of 14%. TTM FCF sits at $4.2 billion, showing Uber is very profitable and driving significant cash flows. This allowed it to maintain a healthy balance sheet with $5.8 billion in cash (outside of $5.6 billion in equity stakes) against $11 billion in debt.

With the company rapidly improving profitability and cash flows, this balance sheet looks healthy enough to fund future plans, possible M&A, and planned share buybacks.

Last quarter, management announced a $7 billion share repurchase program, which is supposed to offset SBC and eventually lower the share count. While I was skeptical at first about initiating a buyback with shares at an all-time high, this quarter, management confirmed that it will be thoughtful with the pace of these buybacks. Positively, shares have come down quite a bit now, making the buyback a bit better worth.

Overall, the business continues to be in excellent shape.

Mobility

The mobility segment continued to deliver in Q1, with gross bookings growing by 25% YoY to $18.7 billion, now accounting for 50% of total gross bookings. Growth was driven by 17% growth in users, driven by penetration into new regions and a healthy marketplace.

For reference, monthly active drivers grew by a very significant 29% YoY, leading to a very healthy supply-demand environment, driving profitability for Uber. Why? I explained this last time out:

“Well, apart from the fact that more drivers are always great for Uber, Uber’s platform also functions as a sort of marketplace. To satisfy trip demand by customers, the company is often forced to offer incentives to drivers, like during holidays. However, with a healthy marketplace in which driver supply growth outpaces growth in trip demand, Uber can cut on its incentives and improve its take rate, which is crucial for its actual revenue growth and margins.”

This led to revenue growth of 30% YoY to $5.6 billion, as the revenue take rate improved by 130 bps YoY. This strong top-line growth also allowed EBITDA to grow by 40% YoY to a record high of $1.5 billion.

Delivery

While growth in the delivery segment was less impressive, this still came in ahead of expectations as Uber continues to outgrow the underlying industry.

Delivery gross bookings increased by 18% YoY to $17.7 billion, driven by growth in audience and frequency as pricing growth eased. Order frequency reached an all-time high as this accelerated in many key markets, supported by Uber growing its offering on Uber Eats by 12% in terms of merchant numbers.

This led to revenue of $3.2 billion, up only 4% YoY as the segment faced a 13 percentage point headwind from business model changes and saw the take rate fall by 240 bps. Nevertheless, EBITDA reached an all-time high of $528 million, up 83% YoY.

Notably, Uber announced earlier this week that it will partner with Instacart, bringing Uber Eats restaurant delivery to Instacart, which could give the business quite a boost. It will give Uber exposure to new customers who are yet to be active on Uber, giving it a great opportunity, especially in key areas like suburbs, according to management.

Outlook & Valuation

With all of the most important Q1 developments out of the way, let’s shift our focus to the outlook, which arguably is most important to investors.

Sadly, management’s guidance wasn’t entirely in line with Wall Street’s expectations. The gross bookings guidance of between $38.75 billion and $40.25 billion, representing 18% to 23% YoY growth, fell short of the consensus of $40.04 billion.

Nevertheless, guidance is looking pretty good, considering this includes a 3 percentage point currency headwind. Guidance shows growth remains in line with prior quarters. Also, EBITDA guidance of $1.45 billion to $1.53 billion, representing YoY growth of 58% to 67% YoY, was roughly in line with the consensus.

Yes, whatever way you look at it, while there were some slight misses here and there, a sell-off of 6% on this report makes no sense, especially as shares had already come down quite a bit over the last month and management didn’t even really had to bring up its longer-term guidance it issued three months ago, which I referred to earlier.

For reference, this includes revenue growth at a 3-year CAGR of mid- to high-teens and adjusted EBITDA growth in the high 30s to 40%, with FCF as a percentage of EBITDA being over 90%.

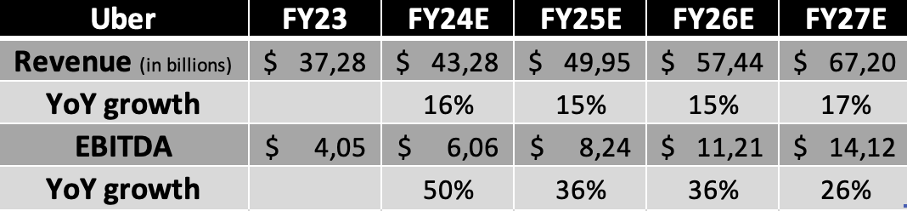

Considering the Q1 results and management’s guidance and commentary, as well as current economic developments, I have slightly lowered my FY24 and FY25 revenue forecast to account for some slower-than-expected economic growth globally. However, I do expect Uber to keep rapidly improving its profitability, helped by growth in subscriptions and advertising, so I have left my estimates here unchanged. This results in the following updated projections.

(Note that we use EBITDA in these estimates instead of EPS as this is the most predictable and representable in terms of profitability. Also, we have not included any discussion or potential of self-driving cars in this post and estimates as this, today, is not yet relevant to the investment thesis due to many uncertainties)

Based on these estimates, after the sell-off, Uber shares now trade at roughly 11x EBITDA, down from 13x back in February. Still, no matter which valuation method you pick, Uber is not cheap.

However, we still argue that this is one of the most unique and promising businesses available on the market, and with it now reporting solid and rapidly improving profitability, current multiples might not be that ridiculous. As we argued last time out, “The company has a clear, long, and promising runway of growth ahead of it, which should be obvious after reading this post. Meanwhile, profitability should continue to improve over the coming years due to growth in advertising and Uber One, as well as greater operating leverage.”

With the company reporting a solid profit today and still growing strongly, we don’t expect it to return to the prices and valuation levels it traded at in recent years. We strongly believe this company is a buy on any weakness. This company is firing on all cylinders, and so shares deserve to come at a premium.

For now, we still believe an 11x EBITDA multiple is fair here, but to be somewhat more conservative with a lot of global uncertainty today, we will assume a 10x multiple in our calculations. Using this, we end up with an end-of-2025 price target of $82.40, which, from a current share price of right around $66 per share, leaves investors with potential returns exceeding 13% annually.

Based on this, we conclude that shares have become much more attractive after the pullback in recent weeks and that current prices present an excellent opportunity for investors to add or initiate a position in this brilliant business.

Therefore, we upgrade our rating on Uber to buy. We are active buyers of Uber at current levels.

Let us know your thoughts in the comments! Also, please leave a like if this post was of value to you!

Please remember that this is no financial or investment advice and is for educational and informative purposes only. We are simply sharing our views, actions, and opinions, which we hope will be insightful!