Which stocks to buy today? I am loading up on these two (+2)! – Sept. 2024 Edition

With global markets hovering around all-time highs, these are the stocks I find most attractive today and which I am actively buying!

Hi everyone! Thank you for stopping by here once more and taking the time to check out our content/analysis. I try my best to make it as valuable and insightful as possible!

Today, I want to introduce you to an all-new monthly recurring post format here on Rijnberk InvestInsights. Each month, I’ll be lining up the top 2 stocks/companies I am currently buying, hopefully putting some undervalued opportunities on your radar, some you might be familiar with and others that aren’t so well-known.

In other words, I’ll give you the two stocks I deem most compelling from a long-term investor’s view at the time (I have been buying these shares in the week prior and the week ahead, roughly)

These are stocks trading on European and U.S. markets – the ones I invest in.

This spans across different categories, from technology and semiconductors to consumer staples and utilities.

Note that these are long-term ideas and no short-term trades.

These stocks are on this list because I deem shares very attractively priced today.

Also, I just want to clarify these aren’t my top 2 buys in general, but stocks I think are a great buy today. While there might be more undervalued opportunities out there, which I have pointed out before, for me, the stocks on this list offer a particularly attractive buying opportunity today based on historical value, fair value, recent price levels, sentiment, recent developments, growth prospects, etc.

In other words, while they may not be the most compelling opportunities at first sight compared to some of the value traps/opportunities out there, these are the stocks I am buying these days for particular reasons. Of course, I will tell you exactly why I am buying these shares today based on valuation, business fundamentals, recent developments, and prospects.

As always, this is not investment advice but a detailed insight into what I am buying and deem compelling. Always make sure to do your own (in-depth) research before buying!

Interested in my complete InvestInsights portfolio – my personal portfolio, which I actively manage with a long-term view – then consider upgrading to paid and get full access to my monthly portfolio updates.

Now, without further ado, let’s get going!

Celsius Holdings Inc. (Ticker: $CELH)

Let me start by saying that a challenging recent few weeks for global stock markets has resulted in quite a few attractive bargains, even as the general markets themselves aren’t even that far from all-time highs. For example, the S&P 500 still trades only 5% below its all-time high.

However, certain sectors and certain stocks have been butchered much more severely, mainly due to poor sentiment. As a result, limiting this list to two stocks wasn’t that easy (which is why you’ll find four;))

Starting with the first one, Celsius CELH 0.00%↑ might immediately be one of the standouts on this list, especially for those following my work for longer, as it is a business I haven’t covered on InvestInsights so far since I started writing in January.

However, I have recently been building a position in Celsius across multiple portfolios after its shares hit one low after another in recent months, bringing its share price down to much more reasonable and compelling levels despite excellent quarterly results. For reference, a current share price of around $30 hasn’t been seen since early 2023 for this growth darling.

You see, Celsius shares have lost a staggering 63% of their value in the last six months alone, and while analyst projections have also come down somewhat, the share price decline has led to a massive normalization of its earnings multiples, bringing these to value territory considering the growth prospects for Celsius.

As a result, Celsius has now become an incredibly attractive long-term growth play with multi-bagger potential. Therefore, the company is a must on this list, and I am buying aggressively at a current share price of around just $30.

For those unfamiliar with this business, Celsius is a global energy drink company known for its health-focused, functional beverages. Established with a mission to provide products that enhance fitness and wellness, Celsius offers a range of drinks that are designed to accelerate metabolism, burn body fat, and improve endurance. Its beverages are made with ingredients such as green tea, ginger, and guarana and are free of artificial preservatives, flavors, and high-fructose corn syrup.

As a result, the brand caters to health-conscious consumers, athletes, and fitness enthusiasts seeking an energy boost without compromising on clean ingredients. Celsius has gained popularity for its commitment to combining performance benefits with great taste and has expanded its reach through both online channels and partnerships with major retailers around the world, including PepsiCo and Amazon.

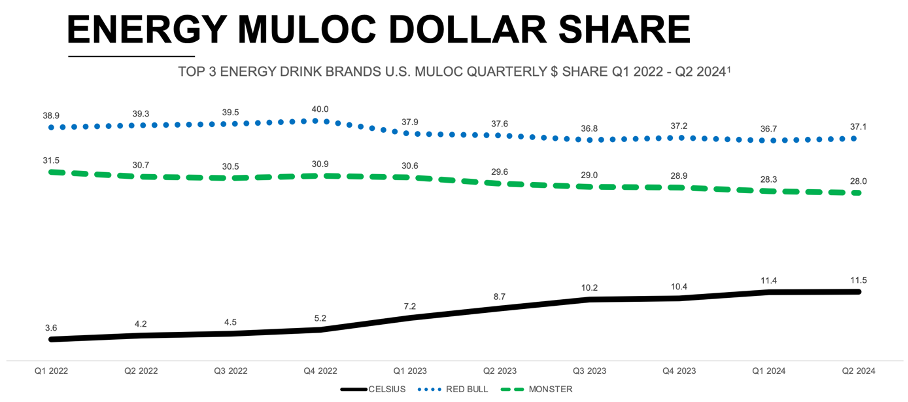

With this differentiated approach, Celsius has rapidly gained market share in the U.S., attracting new customers to the Energy Drink category and taking customers away from its two larger peers.

Today, the brand has become the #3 largest in the U.S., having grown its market share from around 5% two years ago to over 11% today.

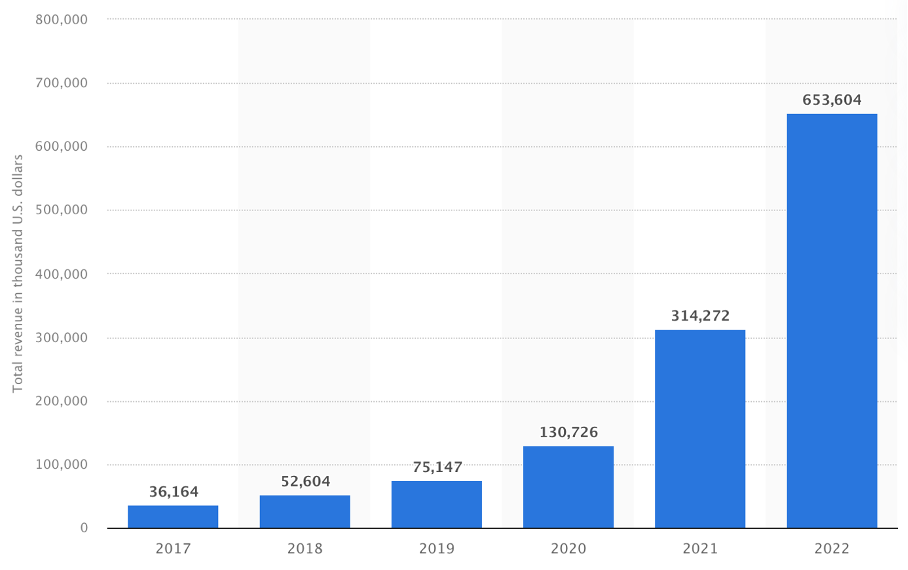

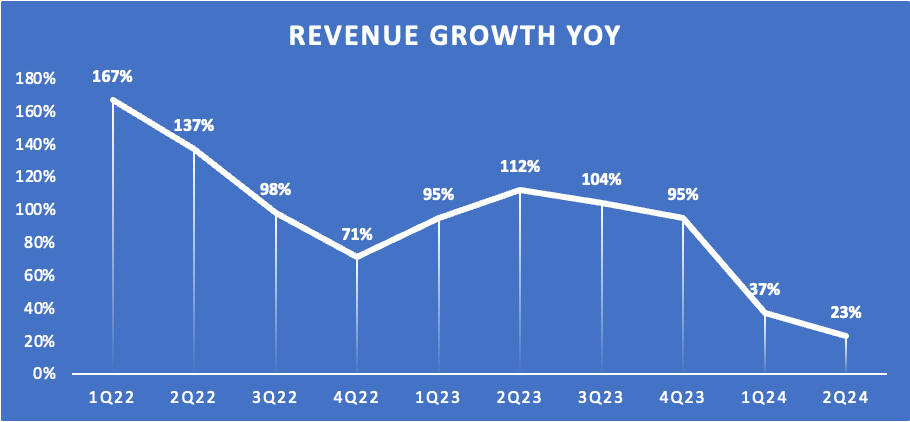

The company has been disrupting the energy drink market in recent years, rapidly taking market share and outpacing industry leaders Red Bull and Monster, having grown revenue at an 80% CAGR since 2017.

However, growth has been slowing down in recent quarters, which is the biggest reason for the YTD sell-off. Investors seem to be increasingly concerned about the revenue slowdown here. However, this can be explained at least in part by PepsiCo’s inventory reset, which led to a temporary drop in demand for Celsius.

However, the company’s prospects remain strong, with it still taking market share in the U.S. and starting to expand more aggressively outside of the U.S., which remains a massive growth opportunity for the company. So, while growth might slow down in the near term and might not return to the growth rates we have witnessed in recent years any time soon, it remains a compelling long-term investment thanks to its massive runway of growth ahead. Crucially, the company doesn’t need to grow by triple digits to be a compelling investment.

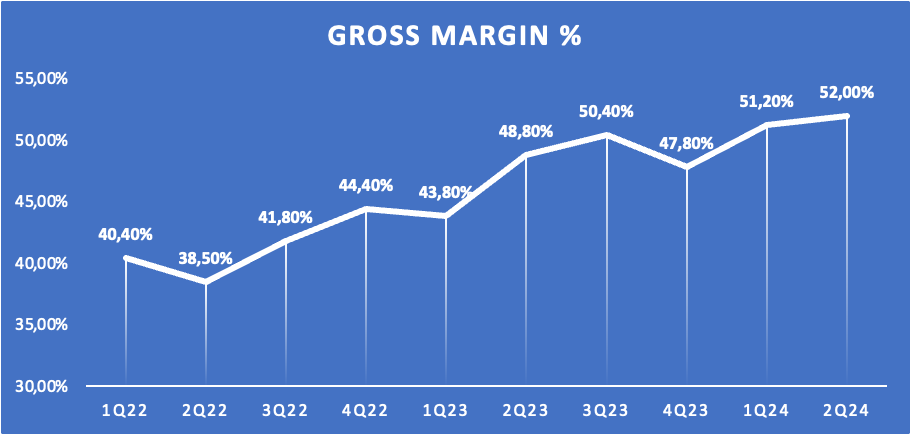

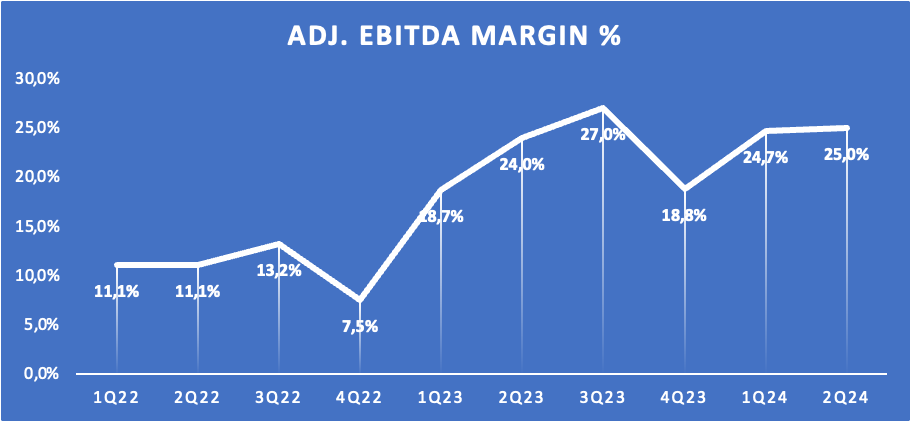

Furthermore, Celsius has shown a fantastic ability to grow while maintaining profitability as well, and while growth might be slowing down, margin gains remain strong, as highlighted below. Both the gross margin and EBITDA margin have been expanding nicely, a trend expected to persist.

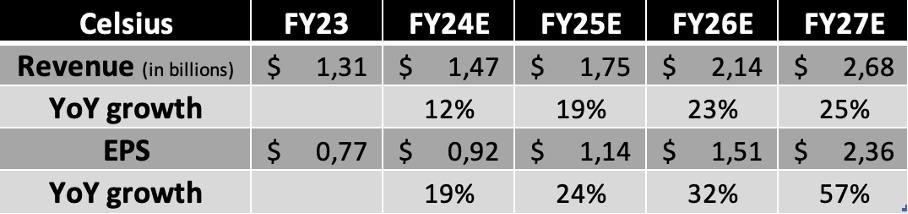

As a result, the company’s long-term prospects remain compelling. Below, you can see the current Wall Street consensus for revenue and EPS, showing expectations for top and bottom-line growth to accelerate again in coming years and remain nicely in double-digit territory.

Yet, despite these solid growth projections, which I deem somewhat conservative with room to outperform, Celsius shares have gotten completely butchered in response to slowing growth and doubts over its growth story.

As a result, shares today trade at just 35x this year’s earnings and just 13x expected FY27 EPS. This also translates into a PEG ratio of only just over 1x, which can be seen as a real value territory. For reference, its larger but far slower-growing peer, Monster, has consistently traded at a multiple of over 30x and a PEG of around 2.5x on average.

Overall, at prices of around $30 per share, I view Celsius as extremely attractively priced, offering a favorable risk-reward ratio. While its growth prospects aren’t set in stone in any way, the current share price and valuation multiples make absolutely no sense.

Therefore, I continue to actively buy shares as these trade lower. I expect I will continue to do so as long as shares trade below $40 per share, assuming no changes to the estimates above and my thesis.

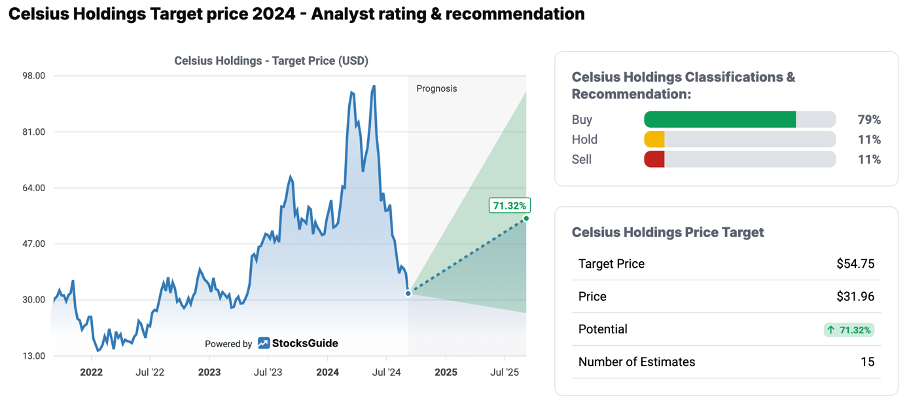

This is one of the best-priced stocks out there now, and Wall Street seems to agree, projecting 71% upside in the 12 months ahead.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Many of its features are free. (Note: this is an affiliate link)

Infineon Technologies AG (Ticker: $IFX or $IFNNY)

Now, at this point, the whole semiconductor sector looks quite attractively priced, with shares of these businesses being butchered for no apparent or at least no justified reason. Notably, the analyst consensus remains unchanged in most instances, making shares more attractive.

Yet, I don’t just want to put the entire sector as a top buy here today (although I could), but I want to highlight a company that really stands out to me as a real bargain, and this is Infineon Technologies, a German giant focused on analog semiconductors.

Its shares have been among the more significant underperformers so far this year, down 24%, and the last month hasn’t been much more impressive, with shares down 5%, as well as down another 22% since I rated shares a buy in a more extensive analysis in May (found below).

As a result, Infineon shares have now become even more of a bargain, and below a share price of €30, this is pretty much a no-brainer for me.

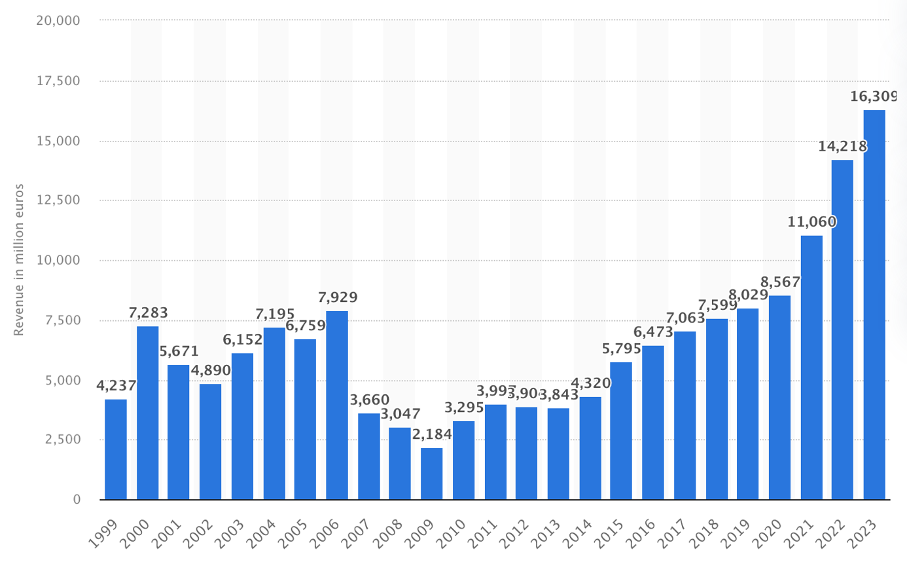

You see, while Infineon is in no way one of the most exciting businesses in its sector, it is a steady compounder, growing its revenue by double digits through the cycle. For reference, over the last decade, revenue has grown at a very impressive CAGR of 15.5%.

And looking ahead, management remains committed to its financial goals, which include growing revenues at a CAGR of over 10% through the cycles, a segment result margin of over 25%, and an adjusted FCF margin of 10-15%, which is just excellent overall.

Growth here is driven by the company’s focus and incredible market position in high-growth industries such as renewable energy, automotive, and SiC and GaN technologies.

In automotive semiconductors, Infineon is the undisputed #1, driven by its #1 position in Asia, #2 position in Europe, and #3 position in the U.S. It now holds a market share of 13.7%, up 130 bps YoY and 290 bps ahead of second place NXP.

Crucially, whether we are in a bull or bear market, Infineon shows it can outperform peers, gaining market share quite significantly thanks to its superior products and strong product development. This is what I wrote before as well:

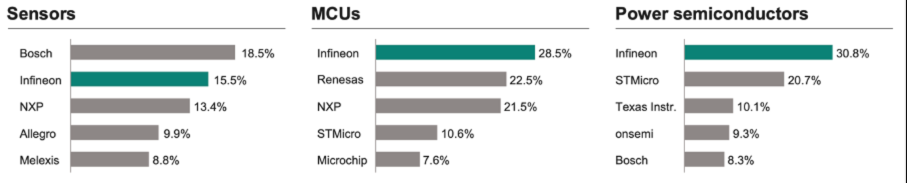

“The company is doing tremendously well, especially in automotive microcontrollers. In just the last 12 months, it gained 510 bps in market share to an incredible 28.5%, allowing it to jump to the #1 position. Meanwhile, it also remains the undisputed leader in automotive power semiconductors with a market share of 30.8%, over 10 percentage points ahead of its closest competitor.”

A demanding market position, indeed, and in a high-growth industry.

Meanwhile, Infineon is also the market leader in green energy analog semiconductors, partly thanks to its dominance in power semiconductors. Highlighting its dominance, Infineon’s power semiconductors are present in a staggering 50% of currently installed solar and wind capacity and are used for 2/3 of the electricity grid infrastructure.

And finally, the company also has a strong presence in emerging technologies, holding a leading position in the SiC market, which is one of the fastest-growing verticals of the semiconductor industry and is projected to grow at a stellar 23.8% CAGR through 2030. This is what I wrote last time out:

“The technology is superior to silicon and excellently suited for sustainability, electrification, and power semiconductor applications, so the fact that Infineon is also pushing this new technology is promising. For reference, its market share is estimated to be around 30%, which management aims to maintain through 2030.”

Now, there is even more to be excited about, like exposure to AI, IoT, or edge computing, but I think I have made my point so far.

Investors can expect this analog leader to deliver double-digit or at least a high-single-digit revenue growth CAGR through the end of the decade and EPS growth at a CAGR of closer to the mid-teens, if not higher.

Moreover, you get all of this at a pretty low-risk profile, especially for semiconductor standards. Most notably, Infineon is not very dependent on external manufacturing, with it manufacturing most of its products in-house through its 22 manufacturing sites located primarily in Europe and the U.S., through which it is also benefitting from state funding. Especially with current geopolitical tensions, this is absolutely brilliant.

Besides this, Infineon also has solid global revenue exposure, with no over-exposure to China and a healthy revenue mix in terms of end customers and end markets.

Come on now, this is incredible!

And yet, shares trade at only 20x depressed current year earnings and 16x next year’s earnings, which easily is a 30% discount to the sector and its own 5-year average.

Furthermore, better reflecting the earnings recovery ahead, shares trade at a PEG of just below 1, which is proper value territory. Considering its growth potential, the current share price and valuation just don’t make sense.

So far this year, the company is getting punished for going through a transition year, in which revenue and margins are struggling, something management had clearly communicated beforehand as Infineon’s markets are late cyclical, and the company is positioning itself for the next upcycle.

Crucially, even as the company is going through a rough patch, it is still taking market share across the board, outpacing peers. I mean, what more can you ask for? The industry is cyclical, no surprises there, but it is still taking market share amid industry weakness, which is brilliant.

What also remains a drag on the share price and sentiment currently is poor visibility on a recovery, which is expected to be slow and gradual, which isn’t helping. However, a rebound in the semiconductor industry is a matter of time, and with Infineon gaining market share and investing in upcoming technologies and new manufacturing plants, it is exceptionally well positioned.

Therefore, I believe the YTD sell-off is nowhere near justified, even as the company is struggling financially in the near term. This is the time to look through short-term weaknesses and focus on the long-term potential present.

Even if the company would continue to trade at a 10% discount to the sector and its own averages, I can easily see Infineon shares deliver annual returns in the high teens, potentially exceeding 20% through the end of 2026.

In other words, I believe shares are at least 37% undervalued based on fundamentals and growth expectations. Therefore, I am aggressively buying shares right now on weakness.

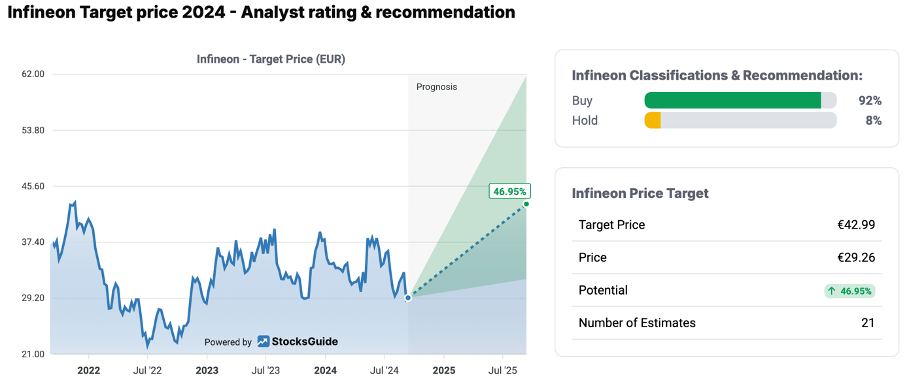

For reference, you can see the Wall Street analyst projections below. 92% of analysts have a buy rating on the shares with close to 50% upside to the average 12-month price target.

Rijnberk InvestInsights is a reader-supported publication. We try to keep all our analysis free for all of you to enjoy and benefit from!

Want to support our work a little bit more and show your appreciation? Consider upgrading to paid (only $5 monthly).

Two more picks (Paid-only)

Interested in even more bargains, investing ideas, or stocks to put on your radar in today’s heated market?

For premium subscribers, here are two more stocks I am actively buying these weeks (and why)!