Here are 3 stocks I am buying today!

Let me give you a quick introduction to three potential terrific long-term compounders now trading at very attractive valuations.

The Nasdaq breached the 20,000 level this week, and the S&P500 set new all-time highs as well amid investor optimism that seems inevitable, unbreakable, and entirely without reason. I have said it way too many times by now, but amid all that is going on around the world—geopolitical tensions at all-time highs, a new Trump administration bringing a lot of global uncertainty, and economies far from firing on all cylinders—I am really not that optimistic.

By now, I am comfortable saying the U.S. indexes and many global ETFs are overvalued, in most cases due to the overvaluation of heavyweights. As a result, I believe index investing, which has generally proven to be the right approach, is no longer the best solution, at least not for now.

This is increasingly beginning to look like a stock-picker’s market. While the indexes are generally trading at very demanding valuations for the projected growth ahead, there are plenty of attractive opportunities with great potential for long-term outperformance to be found, either because these businesses are overlooked or mispriced or, for other specific reasons, undervalued.

It is just a matter of finding them. Though, that is easier said than done.

In today’s post, something a bit different from my normal one-stock in-depth analysis, I want to give you three valuable investment ideas, businesses I am personally buying today, and my full reasoning for why I view these businesses as promising long-term investments at current levels.

Don’t get me wrong; I am not here to tell you what to buy. Instead, I want to introduce you to three valuable investment ideas so you can examine them more closely yourself!

Without further ado, let’s delve in!

Uber Technologies, Inc. – A bargain amid poor sentiment

Let’s just start with the most unsurprising stock on this list, shall we? Uber UBER 0.00%↑ is the second largest position in my InvestInsights portfolio and one of my most bullish investments. This is one of my absolute favorite companies.

Let me explain!

In recent years, Uber has been absolutely firing on all cylinders, proving all its critics wrong and fulfilling all investors’ wishes. This includes becoming highly profitable, something many believed for a long time would never happen. And, in the meantime, it has continued to consistently deliver staggering growth.

As I explained last time out, “Uber is growing its top line by a very consistent high teens to low twenties percentage, EBITDA is rocketing higher in the 40% range, the company is GAAP profitable, sees rapid FCF growth, and amongst all this performs excellently, developing in all the right directions, growing its moat and market share in the ride-hailing and food delivery industry.

For those who don’t know Uber as well, the company is globally known for its ride-hailing and good delivery platforms. Today, Uber is pretty much the only real player in the global ride-hailing market, only dealing with competition from Lyft in the U.S. market, which is finding it increasingly difficult to compete with Uber’s size and financial strength, which has become one of Uber’s greatest moats – due to the low margin business it operates in, its financial strength and cash flows make it close to impossible for smaller competitors to compete due to Uber’s attractive pricing and greater availability, as well as brand.

Also, with over 150 million monthly users and a well-recognized brand and platform, its moat is pretty strong. As a result, the company is the undisputed leader in the global ride-hailing and taxi market, with a 25% global market share, far ahead of Lyft’s 8%.

This makes Uber the biggest beneficiary of the industry's growth, which is estimated to grow at roughly a 13% CAGR through the end of the decade. However, with Uber still gaining market share each quarter, I believe the mobility segment should be able to outgrow the industry, remaining in the mid- to high teens.

In the delivery industry, the situation is not much different, with similar market dynamics. While Uber does face more competition in the form of industry leader Doordash in the U.S. and the likes of Just Eat, Deliveroo, DeliveryHero, and more in Europe, it still holds the #1 position in 7 of its top 10 markets and has been gaining market share in each of these in recent years.

Again, with Uber continuously gaining market share, it should outgrow the industry’s projected 9% growth CAGR through the end of the decade, most likely achieving double-digit growth.

And you can add to this that the company still has plenty of room for expansion, with relatively low penetration across key markets, growing demand for its services, plenty of cross-selling opportunities between its platforms, and a rapidly growing advertising business.

For reference, Uber management claims that only 5% of the population aged over 18 in the countries in which it operates use its mobility and delivery services. Even in its most saturated countries, including the U.S., the mobility segment still only sees 20% penetration, leaving a lot of room for Uber to grow.”

So, don’t make the mistake of thinking Uber has most of its growth behind it—data says otherwise. Uber management also confirmed this during the investor day earlier this year when it released a very bullish medium-term outlook. It projected revenue growth at a 3-year (through 2026) CAGR of mid-to-high teens, driven by both continued growth in users (currently growing mid-teens) and these users using the Uber app more, as highlighted by steady low twenties growth in quarterly trips.

In addition to this, management guides for adjusted EBITDA growth in the high 30s to 40%, with FCF as a percentage of EBITDA being over 90%. Uber has been rapidly expanding margins in recent years already and this isn’t expected to slow down.

This is absolutely terrific guidance and points to very impressive growth in the years ahead. I hope that by now, it is pretty apparent why I am bullish on Uber and have the company as one of my largest positions. This is a true one-of-a-kind industry leader with a solid moat and terrific long-term growth prospects.

Here are my current financial projections.

So, why are shares a great buy today?

A lot has been said about Uber in recent weeks as the company has been in the news a lot, although mostly due to announcements from others, but not resulting in a really positive share price reaction.

You see, the future of the Robotaxi industry and Uber's role in it are at the center of all this news, and they are causing a lot of fear, which in turn has been weighing on its share price in recent weeks.

The whole robotaxi emergence and promise has been a point of discussion for Uber shareholders for quite some time already. Is Uber a beneficiary or about to be disrupted?

Well, for a discussion on that, I recommend you check out my last post on Uber from early November, found here, where I concluded that Uber is likely to benefit from this revolution as the go-to platform for ride-hailing and unlikely to be disrupted by the likes of Waymo and Tesla.

However, it seems like investors are still weighing off this future, with any robotaxi news leading to negative share price reactions for Uber, even as the company is firing on all cylinders, actually benefitting from these announcements right now, and any potential negative impact would be far away in the future.

In other words, shares are currently discounted due to uncertainty and fear about something that is at least 3-4 years away and might even turn out to be a great positive. All these robotaxi news items putting pressure on shares right now are nothing more than noise.

As a result, despite delivering absolutely pristine and flawless financial results YTD, reflecting stable growth and improving margins and cash flows, its share price is now flat YTD after losing 15% over the last month. And this has resulted in valuation multiples trading down as well.

Currently, at prices of around only $61, shares trade at just a 17x EV/EBITDA multiple, which is just cheap considering the growth runway ahead and the sheer quality and dominance of this business.

This also reflects a discounted forward P/E multiple of only 26x the current 2025 Wall Street projection and a stunning PEG of just below 1x, which is absolute value territory.

Long story short, recent poor sentiment has driven the Uber share price down to absolute bargain levels, making it a great time to start aggressively buying Uber shares, in my opinion.

I am loading up right now, especially as long as shares remain below $65 per share, but I would say that below $70 per share, shares remain a solid buy as well.

Want to learn more about Uber? You can find my latest coverage of the business below!

MercadoLibre, Inc. - An emerging markets gem

MercadoLibre is an absolute emerging markets gem.

MercadoLibre is uniquely positioned as the dominant e-commerce and fintech player in Latin America, a region poised for rapid digital transformation. With a market capitalization of around $100 billion, MELI is the largest company in Latin America and operates across 18 countries, with key markets being Brazil, Argentina, and Mexico.

At the core of the business sits its e-commerce platform, akin to Amazon, which has leveraged early-mover advantages and a well-executed strategy to capture approximately 21-22% of the region's market share, making it the undisputed e-commerce leader in this emerging region. The company has its own distribution centers and delivery network, giving it a strong moat, again, similar to Amazon in the U.S.

However, the big difference maker here is that Latin America's e-commerce penetration remains low at just 10%, compared to 25% in the U.S., highlighting a significant runway for growth as internet access and smartphone adoption accelerate, and this is driving incredible growth for MELI, with GMV growing rapidly at low-twenties. Notably, this isn’t expected to slow down any time soon, either, thanks to the digital transition still going on.

And that is not all. Complementing its e-commerce platform is Mercado Pago, MELI’s fintech arm, which has rapidly become one of the region’s leading digital payment ecosystems. Offering services like mobile payments, credit and debit cards, and QR-based transactions, Mercado Pago has more than doubled its user base in the past two years, reaching over 56 million active users and TPV continues to grow at a mid-thirties percentage.

Again, with Latin America still heavily reliant on cash transactions, Mercado Pago is well-positioned to benefit from a secular shift towards digital payments, projected to grow at a double-digit CAGR through 2030. As one of the FinTech leaders in the region, MELI is well positioned to benefit.

I hope you can see how extremely favorable MELI is positioned here! The company is fully benefitting from the ongoing digital revolutions in LatAm through a leadership position in both FinTech and e-commerce, which are driving very impressive growth, as shown below, expected to persist well into the next decade.

This makes it one of the most exciting growth stories out there. Yes, it already has a market cap approaching $100 billion, but I still see MELI as a potential 10-bagger—a $1 trillion business - thanks to this long runway of signicant growth.

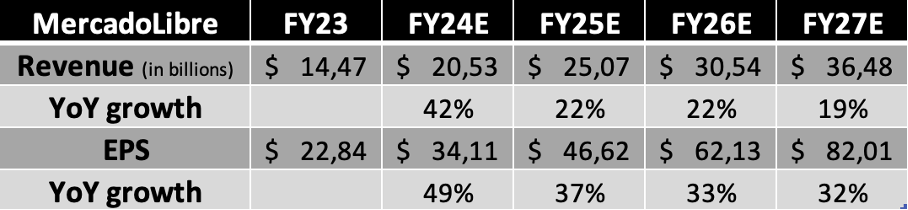

Here are my current medium-term growth projections.

Pretty impressive, right?

So, why are shares a great buy today?

In the case of MELI, there hasn’t been any recent news that has really moved its share price considerably, but notably, its shares have underperformed quite a bit over the last year despite the company delivering pretty brilliant growth across the board.

Shares are now up only 20% YTD and 17% over the last 12 months, well short of the S&P500 and resulting in valuation multiples falling a bit as well.

Alright, I know 42x next year’s earnings is never a low multiple to pay, but considering the runway of growth and significant opportunities ahead, as well as the growth rates MELI is posting right now, it isn’t that expensive at all. For example, it translates into a PEG of only 1.5x, which is a 10% discount to the sector median. This shows me that the company long runway of significant growth isn’t fully priced in at all.

Ultimately, paying 42x next year’s earnings for a business compounding revenues at a 20%+ CAGR and EPS at an even higher rate, likely well into the next decade, isn’t expensive at all, in my opinion.

Honestly, I don’t need to explain much more here. MELI is an absolute must-own due to its terrific growth runway and extremely favorable positioning. It is one of the most exciting businesses out there and it has a great moat as well, unlikely to be disrupted.

If you get the chance to buy a business of this quality at a fair multiple, I am not passing on the opportunity. Below $2,000 per share, I will argue that MELI shares remain very attractively priced, with market-beating and multi-bagger potential.

Want to learn more about MercadoLibre? You can find my latest in-depth coverage of the business below!

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to the occasional premium analyses and full insight into my personal portfolio!

Mondelez International, Inc. – An undervalued defensive leader

While the previous two had compelling long-term growth stories to drive compelling investment thesises, Mondelez is very different. It does not grow revenues or EPS at a staggering rate and does not have an exciting business model.

No, Mondelez is a ‘boring’ consumer staples business. It grows revenues in the low-to-mid single digits and EPS in the mid-to-high single digits, offering little excitement. However, it does so consistently throughout the cycles, taking market share and outgrowing peers.

Add to this a sweet dividend and undervalued shares, and we end up with a really compelling investment thesis, nonetheless. Mondelez is a top defensive pick today.

But before moving to its valuation, let me tell you something about the business first.

Mondelez International is a global powerhouse in the consumer staples sector, specializing in snacks like biscuits, chocolate, and baked goods. With a portfolio of iconic brands, including Oreo, Cadbury, Milka, and Ritz, Mondelez commands strong positions in its core categories.

It is the global leader in biscuits with a 17.5% market share and holds the number two position in chocolate with 13%. Additionally, Mondelez competes effectively in faster-growing segments like snack bars and cakes, leveraging its robust brand equity and scale.

Setting it apart from its peers and benefitting the company is its geographically diverse footprint, with 39% of revenue coming from emerging markets, which are growing at double-digit rates. Mondelez has prioritized these regions, where rising incomes and increasing snacking trends support long-term growth. Over the last five years, emerging markets have grown at a compound annual growth rate (CAGR) of 13%, far exceeding growth in developed regions.

Meanwhile, in developed markets, its brands offer resilience through consumer loyalty and established market leadership. The company owns many household $1 billion brands.

Research highlights that 88% of consumers snack, with brand loyalty playing a critical role—76% of snackers prefer familiar brands. Mondelez’s billion-dollar brands, such as Oreo, Milka, and Cadbury, provide a durable competitive advantage in this environment.

Ultimately, with its specific focus on these faster-growing snacking segments, favorable geographical exposure, and excellent execution over recent years, which has translated into market share gains, the company has a pretty solid growth outlook.

Here are the current financial projections.

Additionally, Mondelez combines this stable growth with strong shareholder returns. The company has a consistent track record of returning cash through dividends and share buybacks, retiring 18% of outstanding shares over the last five years. Its dividend has grown at a high single-digit rate, supported by a payout ratio under 50%, ensuring sustainability.

And with a current yield of over 3%, it is definitely compelling.

So, what makes shares attractive today?

Well, I can be pretty straightforward here. MDLZ shares have underperformed significantly YTD, with shares down 13.5% and now up only 18% over the last 5 years. Meanwhile, the company has reinvented itself over the last four or so years to become much more streamlined and focused on its core categories.

As a result, the company trades at a ridiculous discount to fair value right now, presenting us with an opportunity to acquire a high-quality defensive consumer staples giant that has the potential to outperform in the long term.

Now, this share price pressure over the last year can be explained by some general pressure on the consumer staples sector in recent quarters as investors move to more offensive, high-growth stocks and the cocoa price headwinds the business has to deal with.

The inflationary supercycle we have experienced in recent years has hit chocolate producers like Hershey and Mondelez especially hard. Cocoa prices surged to a high of above $11,000 early this year, up 341% from January 2022 levels. This forced Mondelez to raise prices significantly in recent years.

This then puts pressure on sales volumes as consumers buy fewer Mondelez products as prices rise quickly, and it puts pressure on the company’s margins. While this explains why investors are hesitant, especially with cocoa prices still very high today, the share price correction amid these lingering headwinds has been well overdone.

As a result of this underperformance, Mondelez shares now trade at only 18.5x next year’s earnings, which is a 15% discount to the company’s 5-year average and a 10% discount to the sector median, even though Mondelez is expected to outgrow most of its peers. Furthermore, this translates into a PEG of only 2x, a 25% discount to the sector median.

In other words, Mondelez shares are now straight-up cheap, and I am buying.

Even if shares were to only return to a 21x earnings multiple by 2026, when cocoa headwinds should be well out of the way, this would translate into an end-of-2026 target price of $83, or annual returns (CAGR) of 13% and over 16% when including dividends.

That is absolutely brilliant.

While growth stocks are great, don’t ignore those value opportunities out there that are starting to appear.

Cheers!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Most of its features are free.

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Long Uber here. Let the panic sellers sell. Institutional investors were accumulating Uber stock all the way up to $78. There's upside.

Interesting points. thank you.