Uber Technologies – A brilliant business executing to perfection (Quarterly Update)

Q3 earnings, a potential Expedia acquisition, and autonomous driving reaching a turning point. Plenty to delve into!

The Q3 earnings season has kicked off again, and there is plenty of exciting stuff to discuss and examine! In case you missed it, my analysis of the following earnings reports have come out recently!

I am buying LVMH shares today, and here’s why! (Q3 Earnings Analysis)

The Procter & Gamble Company – A brilliant business at a hefty price tag (Earnings Analysis)

Texas Instruments Inc. – An absolute gem in the semiconductor industry (A Deep Dive)

Lam Research Corp. – Now undervalued and poised for outperformance!

Introduction

Let me just start this quarterly update by pointing out that, after all of last quarter’s developments and the company’s Q3 results, Uber remains my largest position, and my bull case is only getting stronger by the day.

Meanwhile, Uber shares have given up all their gains from the last three months. Uber released its third-quarter earnings last Thursday, and while it beat on top and bottom lines, slightly conservative guidance sent the share price down some 11% in the following trading session and over 17% below an earlier October high.

Meanwhile, if anything, Uber's Q3 results only accentuated its excellent ability to rapidly improve cash flows and margins while maintaining impressive, healthy, and sustainable top-line growth across the board, supported by strong underlying metrics (growth in both users and engagement)

Indeed, I view last week’s sell-off as a ridiculous overreaction to slightly soft guidance, which doesn’t even really force current estimates to be revised downward. The company is executing well on all fronts.

Additionally, last quarter was full of really positive developments for the business and investors, solidifying the long-term thesis and potential growth ahead. Most notably, Uber seems to have emerged as the big beneficiary of the push into autonomous driving and the so-called “robotaxis,” with Wall Street finally convinced it is a beneficiary of the AV (autonomous vehicle) revolution instead of being a threat.

I’ll discuss all the details later, but I can already tell you that this is great news and a potential growth booster.

Ultimately, these developments, the strengthening of my long-term investment thesis for Uber, and last week’s sell-off urge me to keep growing my position, approaching a double-digit weight in my portfolio.

In the end, irrational share price reactions and panic sell-offs, like we saw last week, are nothing short of an opportunity for long-term-oriented investors. This time is no different.

In my opinion, Uber shares remain underappreciated by Wall Street and investors. I claimed it back at a share price of $30 and remain of this opinion today, with shares having cooled off a bit.

Today, it remains one of the best stocks to own with a long-term horizon, as this business is bound for immense success thanks to its notable industry dominance and exposure to exciting growth opportunities, including autonomous driving, the continued proliferation of the ride-hailing and food delivery markets, and possible further expansion of its platform into other end-markets (like travel).

Yes, I am bullish – it is my largest position for obvious reasons.

For a deeper dive into the business and my investment thesis, you can check out my previous post on Uber, which can be found below. However, in today’s post, I want to take a close look at the most recent financial results and the most critical developments for investors and update my financial projections.

So, without further ado, let’s dive in!

Uber’s growth engines are still firing on all cylinders

As I said, Uber released its Q3 financial results last Wednesday and, at first glance, delivered really excellent results with another top and bottom line beat and healthy underlying metrics. I must say I am quite pleased with the results as Uber is executing surprisingly well across the board, even as consumers globally face economic pressures.

Nevertheless, shares sold off by 11% and ended the week down 5.8% after recovering somewhat on Friday. In my opinion, this was completely unjustified. Let me show you why!

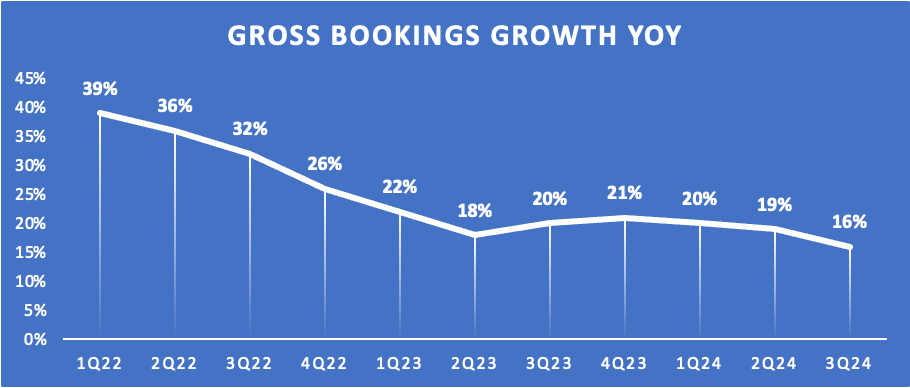

Let’s start with the most important metric for measuring Uber’s growth: Gross Bookings. You see, gross bookings remains the best measure of growth for Uber as it captures the total dollar amount of services ordered through Uber's platform, which directly reflects user demand and engagement without distortions from temporary changes in pricing, fees, or geographic mix, making it an invaluable metric for Uber’s trajectory.

There is no better representation of business growth and health.

And positively, Uber impressed on this front in Q3. It reported total Q3 gross bookings of $41 billion, up 20% YoY in constant currency and 16% on a reported basis. This was in line with the midpoint of management’s guidance and with the growth we have seen for most of the last year, which I would say is pretty impressive considering the economic headwinds Uber is facing globally with somewhat depressed consumer spending, especially in the U.S. and Europe.

For reference, despite poor consumer spending (I mean, look at McDonald’s most recent report), Uber still saw gross bookings growth of 17% in the U.S., which is just brilliant, all things considered (i.e., inflation, interest rates, geopolitical pressures, etc.)

Oh yes, the gross bookings growth rate also still includes a 400 bps headwind from foreign exchange, amounting to $1.4 billion. This was primarily driven by the devaluation of the Argentine peso, Brazilian real, and Mexican peso against the US dollar, which hit the Mobility segment quite hard.

As a result, all things considered, Uber's ability to keep gross bookings growth stable in the low twenties is already quite impressive, in my opinion. Uber is simply still seeing impressive and rapidly growing demand for its services in both its Mobility and Delivery segment.

Looking a little deeper at the growth drivers, we can see this continues to be driven by both growth in users and booking frequency, with these dynamics remaining top-notch and very healthy. First of all, MAPCs, or users, grew 13% in Q3 to 161 million. Even though this shows somewhat of a slowdown in growth compared to previous quarters, this remains healthy and rather impressive. Clearly, Uber is still well able to attract new users to its platform.

Meanwhile, all these users also continue to show growing engagement in the form of a rise in booking frequency, mostly due to Uber's ability to cross-sell between Delivery and Mobility and its platform becoming more popular. Last quarter, monthly trips or bookings per MAPC grew 4% YoY to 5.9.

These are two powerful organic growth engines for Uber. It is simply growing both its audience and engagement, translating into impressive growth in total trips. Last quarter, the number of trips grew 17% YoY to 2.9 billion or roughly 31 million a day.

Yes, as shown above, trip growth did hit a three-year low, but considering underlying dynamics, I would say this is still very strong and impressive growth. Most importantly, Uber shows that both its growth engines are still working well, and it continues to see plenty of room to keep growing.

As I have described before, Uber still has a lot of room to increase consumer penetration, which, even in key markets, remains remarkably low, and to further expand internationally and into non-urban regions. There really is no lack of potential growth here.

Ultimately, turning to the actual financial results, as a result of this strong underlying performance, Uber reported a total Q3 revenue of $11.2 billion, which was up a very solid 21% YoY and beat the consensus by $200 million. This shows revenue outpaced gross bookings growth due to lower supply incentives and refunds and higher high-margin advertising revenues, which translated into a higher take rate.

For reference, advertising revenues grew a whopping 80% YoY and are well over a $1 billion run rate. Advertising is turning into a real growth driver and a significant revenue stream for Uber.

Overall, honestly, Uber is executing just really well and still growing strongly. What is there to complain about?

Growth was strong across both segments

Quickly giving you the performance by each of the company’s two leading segments, within the Mobility segment, gross bookings grew 24% YoY to $21 billion or 17% in dollars, with the difference here explained by the earlier-mentioned FX headwinds.

This represents a further slowdown in growth for this segment, although this would be less pronounced on a currency-neutral basis. Also, I expect this to stabilize a bit from here on out as global economic weakness stabilizes and eases.

Meanwhile, Uber can still grow this segment at a good pace thanks to its expansion into less dense suburban areas, geographical expansion, and the introduction of new segments or products.

Uber also continues to make good progress on its goal of getting every taxi to the Uber platform, lowering legislative pressures, and growing its platform.

Positively, Uber was able to improve its Mobility take rate further thanks to a healthy driver supply and lower driver incentives, driving the take rate up 220 bps YoY to 30.5%. This resulted in Mobility revenue growth of 26% YoY or 29% on constant currency, which is faster than prior quarters.

Moving to the Delivery segment, we can see growth is just as solid, with a good overall performance. Delivery gross bookings grew 16% YoY in Q3 to $18.7 billion, stable compared to last quarter. On a constant currency basis, gross bookings grew 17% YoY for the fourth consecutive quarter, mostly thanks to resilient trip growth, 16% growth in active merchants, and a further expansion into the grocery and retail segment.

Notably, management also reported that MAPC growth continues to accelerate, particularly in North America, showing the food delivery industry still had plenty of growth ahead of it, even as COVID headwinds are now really entirely out of the picture. Meanwhile, booking frequency also hit an all-time high.

Again, Uber was also able to expand its take rate for the Delivery segment, improving 40 bps YoY and hitting 18.6%. This led to revenue growth outpacing gross bookings, growing 18% YoY.

Margins continue to improve steadily

Moving to the bottom-line performance, there is once more a lot to like for investors. Uber is able to significantly improve margins while maintaining top-line growth.

Last quarter, adjusted EBITDA hit $1.7 billion, up 55% YoY as the EBITDA margin improved 340 bps YoY to 15.2%. The graph below says it all – the company is improving margins and profitability rapidly, driven by operating leverage and rapidly growing advertising revenues.

This translated into an EPS of $1.20, beating estimates by $0.79, although to be honest, this is an absolutely useless metric at this time. You see, these non-GAAP metrics also include unrealized gains from Uber’s equity stakes, which has absolutely nothing to do with its actual performance.

For reference, Uber reported $2.6 billion in non-GAAP net income, of which $1.7 billion can be attributed to net unrealized pre-tax gain related to the revaluation of its equity investments.

Therefore, EPS is not the best metric to focus on currently. You would be better off focusing on EBITDA numbers.

Positively, Uber also reported a record-high $1.1 billion GAAP operating income, something many believed to be impossible for Uber not so long ago. Lower stock-based compensation helped the performance a lot here! Last quarter, SBC fell to only 3.9% of revenue, down from 5.3% one year ago. A great improvement for investors!

Additionally, Uber generated an impressive $2.1 billion in FCF, up 133% YoY. On a TMM basis, this amounts to $6 billion, representing a conversation of 100%+, demonstrating significant earnings power and cost efficiency.

Finally, Uber's balance sheet also looks great. The company ended the quarter with $9.1 billion in total cash and an additional $7.9 billion in equity stakes, compared to a total debt position of $12.7 billion.

Amid improving cash flows and margins, I believe this leaves Uber with plenty of liquidity and in great financial health. S&P Global seems to agree. Uber was awarded an official investment-grade credit rating of BB+, which is significant as it can help lower borrowing costs.

Again, this is excellent news for investors and a testimony to the company’s rapidly improving margins and improving financial health.

Clearly, financial health and profitability are no longer reasons to stay away from Uber shares.

Uber will be a massive beneficiary of the AV/Robotaxi revolution

Last quarter was full of really positive developments for the business and investors, solidifying the long-term thesis and potential growth ahead. Most notably, Uber seems to have emerged as the big beneficiary of the push into autonomous driving and the so-called “robotaxis.”

However, I would argue this should come as no surprise. Uber has always been best positioned as the enabling platform for large-scale robotaxis. Wall Street seems to be realizing this now, with the company announcing several AV (autonomous vehicle) partnerships in recent months and Tesla’s robotaxi event being simply disappointing.

Surprisingly (sarcasm, that is), it turns out setting up your own AV network on a large global scale isn’t that easy after all. How about using a globally popular platform with 160 million registered users to build your infrastructure and reach?

Indeed, Uber is extremely well-positioned to be the enabler of the AV revolution. The result? Well, AVs seem to be no longer a threat to Uber but rather a big potential growth driver.

In the words of Uber management, leveraging the Uber marketplace “offers faster access to marketplace tech, pricing, marketing, and demand generation” to leading AV players.

What is more likely? A person using the Uber app to get a ride, whether with a driver or AV or using a specific app with longer wait times and poor availability to catch an AV. Indeed, these AV players can get massive exposure through the Uber app without the fuss of building up a platform and convincing consumers – those who are already on the Uber platform and growing by double digits.

In other words, the more the AV competition globally heats up, and the more large players invest in the technology, including Tesla, the higher the demand for the Uber platform will become for these AV players.

Last quarter, Uber announced five new AV partnerships, including Cruise, Coco, Wayve, WeRide, and Avride. These partnerships significantly expanded Uber's global AV offering and brought the total number of AV partnerships to 14.

Regarding most notable deals, the company extended its partnership with AV leader and Google subsidiary Waymo to bring autonomous ride-hailing to Austin and Atlanta in early 2025, available only through the Uber app.

It also announced a notable deal with GM-backed AV business Cruise to deploy autonomous vehicles on the company's platform in 2025. And it signed a multiyear strategic partnership with U.S.-based autonomous vehicle startup Avride to bring its delivery robots and vehicles to Uber and Uber Eats further expanding its AV offering.

However, probably the biggest needle mover in the AV story for Uber was Tesla’s Robotaxi event failure, with the EV company unable to impress with its self-driving abilities and promises. According to Jefferies analyst John Colantuoni, “the event was a best-case outcome for Uber given the Elon Musk-led company did not provide verifiable evidence of progress toward L3 autonomous driving or quantify the number of robotaxis planned,” as reported by SA.

Not only did the event minimize the ongoing overhang on Uber’s stock price, as investors have been worried about AV disruption for years now, especially coming from Tesla, but it also simply convinced most people out there Uber is actually the enabler or the technology on a large scale, with even Tesla most likely looking to partner with existing rideshare platforms to pursue its robotaxi ambitions.

Meanwhile, Uber plans to remain as pure play as possible while fully benefitting from this revolution, an approach I love. You see, Uber isn’t looking to build its own fleet or anything like that. It simply wants to be the enabler and gateway to consumers globally. It wants to be as capita light as possible, so operating its own AV fleet is out of the question. With its current moat and importance, it just doesn’t have to.

Take the recently resigned Waymo deal. Waymo will continue to be responsible for the testing and operating of the Waymo Driver, including roadside assistance and certain rider support functions. Meanwhile, Uber will manage and dispatch a fleet of Waymo’s fully autonomous, all-electric Jaguar I-PACE vehicles in these cities, which will grow to hundreds over time.

In other words, Uber has limited responsibilities but earns billions, making its platform even better with more availability. This only grows Uber’s moat further. Business models don’t get much better.

With its 150+ million users and highly recognized platform, Uber is perfectly positioned to become the platform and distributor for most AV operators over the next decade.

I believe AV will be a growth driver for Uber as a result.

And, finally, let’s not forget that a massive portion of Uber’s earnings go to its driver marketplace. With the push into AVs, Uber has a lot of room to improve its take rate, even as significant portions of revenue will still head to the company operating the AV.

Could/Should Uber acquire Expedia?

Apart from all the AV news I just discussed, the biggest news for Uber investors last quarter was the rumor that Uber could acquire OTA giant Expedia in the chase of building a so-called super app.

Earlier this month, the Financial Times reported that Uber has reportedly been talking to advisors in recent months about putting a bid out for travel booking company Expedia. Expedia has a $20 billion market cap, just under $14 billion in annual revenue, and is a leader in a travel industry.

Making the news and potential deal even more interesting is the fact that current Uber CEO Dara Khosrowshahi served as Expedia CEO between 2005 and 2017 and remains a non-executive director until today. So, we can safely say he knows the business and what he would be acquiring.

Now, Uber's interest is said to be at a very early stage, and the chance of a deal coming to fruition is relatively low at this time. For now, the business isn’t having any discussions yet.

However, the news still led to quite some speculation with mixed emotions.

So, what should investors think of this potential deal?

Initially, as an Uber shareholder, I would say the deal is extremely interesting and got me a little excited. You see, the promise of a “super app” that allows users to do many different things on a single platform is compelling, for sure. With the addition of Expedia to the Uber ecosystem, we could get such an app for travel purposes with extremely interesting synergy and cross-selling opportunities.

I believe the actual value of a potential deal would lie in combining Uber’s high-frequency, low-cost engagement and 160 million user base with Expedia’s Expedia’s low-frequency, high-value transactions, and 45 million user base.

I mean, the cross-selling opportunities are apparent. You can easily expose travelers to Uber services and Uber users to travel services. Above all, you could expand the Uber platform to allow you to do everything on a single platform, from booking your vacation and stay, to arranging your transportation.

At the same time, Truist Securities analysts argued that a deal would be unlikely for several reasons. For starters, it would go against Uber’s aim for M&A to contribute to growth, with Expedia’s business growing slower than Uber’s. Also, the analysts argue that potential synergies would be hard to extract with the acquisition being large and complex with significant risk, something I can’t argue against.

Ultimately, Uber's desire to have a significant presence in the travel industry and build a super app is extremely compelling. Still, weighing off the execution risk, Uber’s healthy growth today, and the fact that there is plenty of room to grow organically, I am not convinced this would be the way to go.

Meanwhile, CEO Dara Khosrowshahi stated during the earnings call that the company is not looking for big or transformational deals right now. Hence, a deal or at least a bid is highly unlikely any time soon.

On that note, let’s finally move to the outlook and valuation, wrapping everything up!

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. I try to keep most of my content free for everyone, but I can’t do this without your support!

So please subscribe and if you like our content and if you want to show even more appreciation for our work, please consider upgrading to paid (only $5 monthly).

In addition to all the free stuff, this also gets you access to the occasional premium analyses and full insight into my personal portfolio!

Outlook & Valuation

Starting with the short-term outlook, management now guides for Q4 gross bookings of between $42.75 billion and $44.25 billion, up 16% to 20% YoY in constant currency. This reflects a further growth slowdown in Q4 and falls just short of the consensus at the midpoint.

I agree it might be somewhat underwhelming guidance, but this did not come as a massive surprise with everything going on. Also, trip growth is expected to remain stable from last quarter, which reflects underlying growth to remain quite solid.

Further down the line, Uber management expects to report an adjusted EBITDA of $1.78 billion to $1.88 billion, which represents 39% to 47% YoY growth and continued margin expansion.

For the full year 2024, this should result in gross bookings growth of some 20% YoY and adjusted EBITDA growth of around 60% YoY, leaving it well on track to deliver on its investor-day growth commitments. Through 2026, management still expects to realize a 3-year revenue growth CAGR in the mid-to-high teens and adjusted EBITDA growth in the high 30s to 40%, with FCF as a percentage of EBITDA being over 90%.

In the medium term, this translates into the following financial projections.

Now, even after shares took back some of Thursday’s sell-off losses on Friday, shares are still left trading 15% below their recent all-time high, even as the business is doing everything right and continues to fire on all cylinders.

Honestly, what more can I say here? This is just a brilliant business executing to perfection under the lead of a brilliant and extremely well-suited CEO, and one that is bound for significant long-term growth and success.

Meanwhile, based on the projections above, shares now trade at 24x EV/EBITDA, which, in all honesty, I think is not too crazy for a company like Uber, considering the projected EBITDA growth ahead. While far from cheap, I do think the premium is justified. Also, this is roughly what shares traded on last time I discussed the company in August, with any share price gains well offset by higher growth estimates.

As a result, I will argue Uber shares remain attractively priced today. For example, using a more normalized long-term EBITDA multiple of 18x, which I believe this business more than deserves considering the growth ahead and its moat, I calculate an end-of-2026 target price of $98 per share, translating into potential annual returns (CAGR) of 14%, which should be more than enough to beat the market. Also, I believe current estimates leave plenty of room for upside and good downside protection.

Therefore, I am still happy to keep picking up more Uber shares as long as these trade below $76 per share. At current share price weakness, I would say Uber is pretty much a no-brainer for me.

I remain bullish and buy-rated.

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Many of its features are free. (Note: this is an affiliate link)

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Super in depth. Well done! I’ve been buying a lot of this over the past 10 trading days.

One thing I’d add which we’re not able to quantify yet is the effect of share repurchases. Dara made it a point to call out they will begin aggressive share buybacks starting in 2025 and expect total share count reduction going forward. This will become a compounding machine.