Texas Instruments Inc. – An absolute gem in the semiconductor industry (A Deep Dive)

After reporting third-quarter results last Tuesday, it is about time to take a real close look at this uniquely positioned giant in the semiconductor industry

The earnings season has kicked off again, and there is plenty to look closely at!

In case you missed it, my analysis of the following earnings reports has come out recently! Make sure to check those out as well, with plenty of valuable insights and top buying opportunities.

ASML Holding N.V. – Here is my take after the Q3 earnings and a 20%+ sell-off [FREE]

I am buying LVMH shares today, and here’s why! (Q3 Earnings Analysis)

The Procter & Gamble Company – A brilliant business at a hefty price tag (Earnings Analysis)

Introduction

That the semiconductor industry is still a tremendous long-term investment opportunity is common knowledge by now.

Considering the rising use and integration of electronics across applications such as networking communication devices, data processing, industrial automation systems, consumer electronics, and automotive, as well as the rapid rise of AI, IoT, and ML technologies, we can safely say the industry's future is exceptionally bright.

Especially with the AI boom looking to be here to last, the industry’s prospects have only improved in recent years. As a result, according to Fortune Business Insights, the global semiconductor market should continue to compound well into the next decade at a 15% CAGR, which is blinding!

At this point, for those willing and able to deal with the industry's cyclicality and volatility, of which there is plenty, I would argue that the semiconductor industry is without a doubt one of the best industries to invest in for both value—and growth-oriented investors, thanks to the many different companies across the entire value chain and the sheer growth ahead thanks to secular growth drivers.

This is why I personally allocated just over 20% of my portfolio to the semiconductor industry, spread across a range of top businesses.

Among those is Texas Instruments, one of my absolute favorites in the semiconductor industry and a must-own in my book.

Why? Well, let me show you!

After the company reported Q3 results earlier this week, I figured now was the perfect moment to take a real close look at this gem, discussing its fundamentals and operations and diving into its financials, recent results, and prospects.

Should you buy TXN shares, and should you buy them today? Let’s find out!

But let’s start with the basics.

Don’t underestimate the analog industry – This is what you need to know!

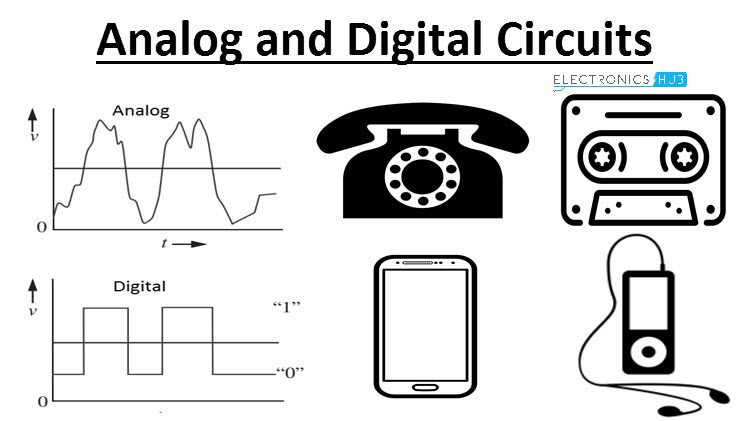

Before getting into the company, it is important to superficially understand the difference between digital and analog semiconductors. This will show you how Texas Instruments is uniquely positioned and very different from AMD, Nvidia, Intel, and other much-discussed semiconductor peers.

I promise; I’ll try and keep the technical details to a minimum.

You see, analog and digital semiconductors differ in how they process signals and information. Analog semiconductors deal with continuous signals, where data can take any value within a certain range. These are used to handle real-world information, like sound, light, or temperature, which naturally vary over time in a smooth, uninterrupted manner.

Digital semiconductors, on the other hand, work with discrete signals, which means data is represented in binary form—either 0s or 1s. Instead of processing a continuous range of values, they switch between two states, making them ideal for computational tasks requiring logic operations, arithmetic, and data storage.

Digital semiconductors are the foundation for most modern computing devices, such as microprocessors, memory chips, and digital communication systems. The main advantage of digital systems is that they are less sensitive to noise and can perform complex calculations efficiently, making them more popular in a world that is going digital.

However, while more critical and discussed in the digital age, like all the fuss and hype around Nvidia GPUs, these are no replacement for analog semiconductors - digital semiconductors cannot function entirely without analog semiconductors in most practical applications because real-world signals, like sound, light, and temperature, are inherently analog. To process or interact with these signals, digital systems often rely on analog-to-digital converters (ADCs) to translate analog information into a digital format.

For example, in a smartphone, the microphone captures sound as an analog signal, which is then converted into digital data that the phone's processor can manipulate. Similarly, when the phone plays audio, the digital signal must be converted back to analog so the speakers can reproduce the sound.

Digital semiconductors are highly efficient in handling binary data and computations, but they depend on analog components to interface with the physical world.

As a result, as the world goes digital, the analog semiconductor industry is heavily benefitting as well, and while maybe not growing as fast, it is also a much more stable and predictable industry. This is how Texas Instruments puts it on its website:

“Every time a system is “digitized,” there is growing need and opportunity for analog chips.”

So, yes, when thinking of the semiconductor industry, the first companies that come to mind are the ones that grab a lot of headlines and tend to be in the spotlight a lot, like Nvidia, AMD, and Intel. These are all focused on digital semiconductors and are much more popular due to their drive for innovation and exposure to exciting, high-growth industries.

However, I would argue that the analog part of the industry, which is very often overlooked due to a lack of headlines or excitement, is at least as exciting and promising. In investing, boring most certainly isn’t a bad thing, and the analog semiconductor industry is the perfect example of this.

Investors can still safely expect the industry to keep compounding nicely thanks to the push into digital and the growing need for semiconductors, both digital and analog. As a result, Global Market Insights projects the industry to grow at a mid-to-high single-digit rate (6-8% CAGR) well into the next decade and probably well beyond.

Moreover, while the digital semiconductor industry is volatile and innovation-driven, leading to big fluctuations in winners and losers (Look at the dynamics between Intel, AMD, and even Nvidia over the years), the analog industry is much duller, more predictable and less driven by innovation.

I mean, the average product life of an analog semiconductor product is well over a decade. In other words, when TXN or any peer releases a product, it can sell it for 10-15 years, which is insane and translates into terrific ROIC and ROI levels.

As a result of these dynamics, the analog industry has actually outperformed its digital counterpart over the last decade, resulting in terrific returns for investors. Industry leaders Analog Devices and Texas Instruments have returned 359% and 306%, respectively, over the last decade, well outpacing global benchmarks.

I personally really favor the analog part of the industry, and in particular, Texas Instruments, the undisputed leader in the analog industry and one of the safest yet most promising long-term investments in the sector.

Without further ado, let’s delve into the business!

A quick introduction - This is Texas Instruments Incorporated!

It is unlikely you have never heard of semiconductor giant Texas Instruments. The company has been around since 1930, and from its headquarters in Dallas, Texas, it has grown to become the largest supplier of analog semiconductors globally, with a $184 billion market cap and generating just under $20 billion in revenue annually.

You at least know its popular calculators, right?

Over the last decade, revenue has grown at a 7% CAGR, with profits growing slightly faster due to expanding margins. For reference, FCF, often the best measure of growing value for investors, has grown at an 8% CAGR from 2012 through 2022.

Interestingly, Texas Instruments’ business model is built around four competitive advantages: manufacturing and technology, broad product portfolio, reach of our market channels, and diverse and long-lived positions.

Probably, the company’s most significant competitive advantage is its manufacturing infrastructure, which is 90% in-house. In other words, TXN owns its entire supply chain, giving it significant advantages.

In-house manufacturing not only limits the company’s dependence on third parties like TSMC or Samsung, but it also provides tangible benefits such as lower manufacturing costs and greater control of the supply chain, which is becoming increasingly important amid geopolitical pressures and unpredictable economic conditions.

Notably, the company is also one of the few with limited manufacturing exposure to Asia and close to no exposure to China. Even more important, the company is one of the largest manufacturers in the U.S., with multiple manufacturing facilities in the country, significantly lowering geopolitical risks and making it a top beneficiary of tax credits.

As a result, TXN is one of the least risky semiconductor investments out there. Its in-house manufacturing infrastructure is unparalleled in the industry, and the company continues to invest heavily in capacity expansion in the U.S., but I’ll dive more into that later on!

Let’s just say its positioning itself extremely well for the coming upcycle!

In terms of portfolio breadth, TXN also leads the industry, with approximately 80,000 products, well ahead of any competitors. As a result, the company claims it has access to more customers, which also means it has the opportunity to sell more chips to each customer application.

When it comes to diversification, TXN also excels. The company has more than 100,000 customers globally, and the top 100 customers account for no more than 40% of its revenue, meaning it is not dependent on a number of large customers, making its revenue much more durable and less sensitive to disruption.

Taking a closer look at revenue exposure, the company operates in two primary semiconductor markets today: Analog and embedded, which together account for over 90% of revenue.

Analog is the company’s largest segment, accounting for roughly 75% of total revenues as of FY23. In this market, TXN is the industry leader by some distance to second place Analog Devices. Per illustration, as of 2021, the company held a 19% market share, and management is confident it will be able to keep growing this market share thanks to its competitive edge, which should allow it to keep outpacing the underlying industry.

Meanwhile, in embedded processing, the company also holds a commendable industry position with an 11% market share, which management again is confident it can grow. This part of the business accounts for some 19% of revenue.

Furthermore, the company focuses on six end markets, which are industrial, automotive, personal electronics, communications equipment, enterprise systems, and other.

Among these, industrial and automotive are by far the largest, together accounting for some 75% of 2023 revenue, up from just 40% in 2014 after revenue from these segments has been growing at a double-digit CAGR over the last decade.

Positively, management expects these end markets to remain among the fastest-growing ones, positioning them well for future growth.

Ultimately, I will argue Texas Instruments is one of the best-positioned semiconductor businesses out there, not for stellar growth but to remain a stable long term compounder for many more decades. One thing that is certain is that TXN is one of the least risky picks in the sector, thanks to its in-house manufacturing and great revenue diversification, and its moat and competitive position make it hard to disrupt.

This is just a brilliant business.

On that note, let’s delve deeper into the financials by reviewing the company’s Q3 results, which were released last week!

Before we move on, just a quick word…

Rijnberk InvestInsights is a reader-supported publication. We appreciate you being here! Want to support our work a little bit more and show your appreciation? Consider upgrading to paid (only $5 monthly).

This allows me to push out even more content and gets you premium access to even more content, including my full insight into my personal portfolio!

Texas Instruments delivers solid Q3 results with signs of a recovery

Earlier this week, on Tuesday, Texas Instruments released its third-quarter results, which pleased investors and analysts. Shares gained some 4% during Wednesday’s trading session and ended the week up some 5%, even as TXN’s results showed very clear lingering demand weakness in key end markets amid a cyclical downturn in the semiconductor industry.

According to TXN management, the market environment remains weak, with shipments still below 2019 levels. As a result, guidance also fell well short of the Wall Street consensus, but it still couldn’t pressure investor sentiment.

Crucially, while weakness remained pronounced throughout the results, there were also plenty of positives to find, and the first signs of a recovery are starting to appear, which drives optimism.

Starting with the top-line numbers, TXN reported Q3 revenue of $4.2 billion, topping the Wall Street consensus by $30 million and representing an 8% YoY revenue decline. Crucially, it also shows a 9% sequential increase and the start of a top-line recovery.

As highlighted below, TXN has had a number of really tough quarters, with revenue declining double digits. However, this now seems to be easing again as the company is finally able to report sequential growth in some of its end markets and regions, which is a big positive—at least a bottom seems to be in.

Looking at the numbers in greater detail, analog drove the recovery, now down only 4% YoY, while embedded revenue was still down 27% YoY. Looking at the end markets, industrial revenue was down low-single digits sequentially, showing continued weakness and no real signs of a recovery yet, mostly due to TXN customers still reducing their inventory levels. The industry is late cyclical, so overall, this is no massive surprise.

In contrast, automotive, which also tends to be late cyclical, was a big surprise to analysts and myself in Q3. Yes, the industry is still down YoY, but the reported sequential uptick of some 7-8% was a positive surprise as continued weakness was anticipated.

Strength in China was well able to offset lingering weakness in Western regions like North America and Europe. In China, automotive revenues were up 20% sequentially after already improving by 20% in Q2 as well, showing really impressive strength thanks to a rapidly growing number of EVs in the country and TXN gaining market share.

Meanwhile, in the more consumer-facing markets, a recovery was much more pronounced. Sequentially, Personal Electronics grew by 30%, Enterprise Systems grew by about 20%, and Communication Equipment grew by about 25% as the cyclical recovery continued in these three markets.

Moving to the bottom line, a recovery is also clearly underway. Still, cash flow weakness does persist, especially as TXN continues to invest heavily in capacity expansion ahead of the next upcycle.

For Q3, the gross profit was $2.5 billion, representing a 60% gross margin. Sequentially, this is up 180 bps, primarily due to higher revenue. Meanwhile, operating expenses were flat YoY at $920 million as TXN is tightly managing its expenses. This resulted in an operating profit of $1.6 billion, down 18% YoY and reflecting a 37.4% operating margin, still down 430 bps YoY but also up 470 bps sequentially.

This translated into a net income of $1.4 billion, or EPS of $1.47, which beat estimates by $0.10 and down 21% YoY. Again, yes, weakness remains, but we can also clearly see a recovery starting to occur, as shown below. This is an improving trend, which is what investors were looking for to signal a bottom is in!

Finally, due to high capex spend and still depressed revenues and cash flows, FCF remains relatively low at just $1.5 billion on a TTM basis at a 9% FCF margin, way down from a much healthier 3Q22 level of 29%.

You see, even as it has been going through a considerable downcycle and double-digit declines in cash flows and revenue, TXN management has stayed committed to its planned investments and CapEx cycle, as it is entirely focused on long-term trends and positioning itself for the next upcycle in the industry.

In my view, this can only be complemented—management isn’t worried about short-term cash flows but rather about its long-term growth runway and positioning itself favorably, which can only please long-term investors, right?

In terms of capital management and a focus on investor value, TXN is one of the best out there, without a doubt.

Capital expenditures (CapEx) last quarter were $1.3 billion, bringing the 12-month total to $4.8 billion, roughly flat YoY and still around an all-time high as TXN is committed to its long-term investment plan, which requires significant infrastructure investments today to benefit in the years ahead.

As visible below, while revenue declined in 2023 and 2024, CapEx spending kept rising quickly and has still barely eased off as TXN is still very much working on expanding production capacity in the U.S. by building new state-of-the-art 300mm fabs in Texas.

However, this investment cycle is now coming to an end with the company more than 60% through a six-year elevated cycle that, when completed, will uniquely position it for the next 10 to 15 years to deliver on growing demand and be able to produce over 95% of products in-house.

As a result, management indicates Capex is likely to drop in the coming years. In recent years, annual capex averaged $5 billion, and management now guides for annual capex of $2-5 billion through 2026, with capex for the years beyond depending on the revenue trajectory.

This drop in CapEx will then significantly boost FCF again. Also, Texas Instruments expects to receive an estimated $6 billion to $8 billion from the U.S. Department of Treasury's Investment Tax Credit for qualified U.S. manufacturing investments, relieving some of the cash flow pressure. Over the last 12 months, it already received just over $0.5 billion.

Ultimately, this kind of commitment to long-term growth opportunities, even when at the cost of near-term cash flows, is why I really like TXN and why the company will maintain its edge and ability to deliver long-term growth.

Meanwhile, another reason to like this business as an investor is its capital return programs, which handsomely reward investors.

TXN has been growing its dividend for 21 consecutive years now at a 24% CAGR. Growth has also held up well in recent years, with the dividend growing at a CAGR of 11% over the last 5 years. As a result, investors today receive a very sweet 2.6% yield.

Alright, due to earnings being down significantly in recent quarters, the payout ratio for this year is likely to exceed 100%, which is far from great. However, once earnings and FCF recover aggressively in the quarters and years ahead, the payout ratio will normalize to between 40-60%. It will allow TXN to keep growing this at a high single-digit rate without having to take on any additional debt. Usually, FCF easily covers dividend obligations.

As a result, I continue to view TXN as a great dividend growth pick!

Meanwhile, the company also likes to buy back its own shares, further growing shareholder value. Since 2004, TXN has lowered its share count through repurchases by some 47%, which is staggering!

Now, in closing, I just want to discuss the company’s financial health, and unsurprisingly, this also looks pretty good. As of the end of the most recent quarter, the company held a total cash position of $8.8 billion, leaving it with plenty of cash to spend against a total debt position of $14.6 billion with a weighted average coupon of 3.8%.

Yes, this does leave it in a net debt position, which has also doubled since the end of 2020, but considering the company will easily be able to generate at least $6-7 billion in FCF annually once demand normalizes, this isn’t too worrying at all. I expect that once cash flows recover, TXN will work on bringing down debt again. This is part of operating in a highly cyclical industry.

Also, it receives an A+ credit rating from S&P Global, so there isn’t too much to complain about!

Outlook & Valuation

Regarding the outlook, there is a lot to be excited about for investors.

Looking at near-term guidance, TXN actually disappointed a bit last week as management’s Q4 guidance was well short of the consensus. However, it does show a continued recovery, which nevertheless spurred some enthusiasm.

For Q4, management now expects to deliver revenue in the range of $3.7 billion to $4 billion, which came in short of a $4.08 billion consensus, but it also reflects a YoY revenue decline of only 5%, which is a big and rapid improvement.

Moreover, on the bottom line, management now guides for EPS in the range of $1.07 to $1.29, again, short of a Wall Street consensus of $1.41, but at the midpoint “only” down 21% YoY, which is similar to Q3, and a lot better compared to previous quarters.

This indicates that TXN could return to reporting revenue growth as we enter 2025 and that a recovery is well underway and likely to be quite aggressive in 2025. At the current rate and considering the dynamics in automotive and industrial end markets, double-digit revenue growth in 2025 is likely, which is excellent news for investors.

Meanwhile, longer-term, management has provided a range of scenarios based on industry health and the pace of the current recovery, ranging from a 0-7% CAGR from 2022 through 2026. Growth will most likely accelerate further in the years after, with TXN well positioned to maintain growth through the cycles in the high single digits, considering continued market share gains and solid growth in the analog semiconductor market.

Bottom-line growth should be even more impressive in the coming years. As I laid out before, CapEx will trend down in coming years as TXN exits a cycle of heightened CapEx, meaningfully benefiting cash flows and margins, which should reach new highs by the end of the decade. This should translate into EPS growing very strongly through the end of the decade, likely averaging a CAGR in excess of 20%, which is plenty to be excited about.

All things considered, Wall Street now points to the following financial results through FY27.

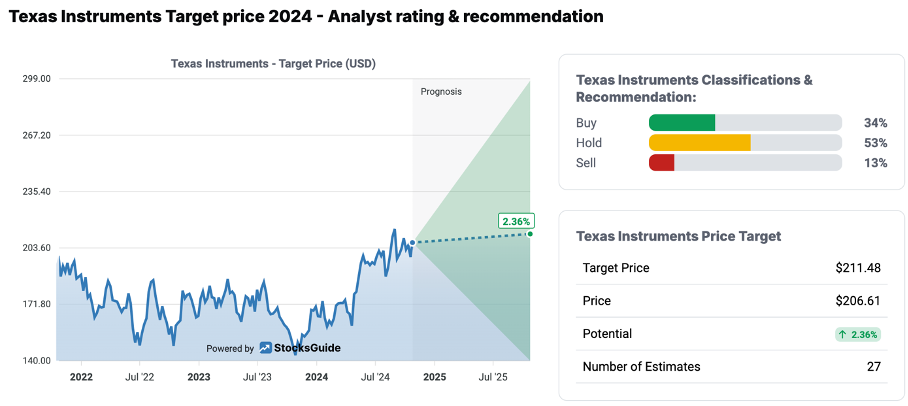

While TXN is a brilliant business with a promising growth outlook, this growth and earnings recovery also seem very much priced in, with shares in no way cheap.

Using these current projections by Wall Street, after last week’s gains, TXN shares are currently trading at a whopping 40x this year’s earnings, though this obviously isn’t the best representation of value with earnings at depressed levels. Yet, using FY25 or FY26 projections, shares continue to look richly priced at 34x and 27x earnings, respectively.

However, taking growth expectations better into consideration, we can use a PEG multiple, and indeed, shares suddenly look a lot more attractive with a PEG of 1.7, which is a 6% discount to the sector median and looking relatively attractive.

Although, still, I would argue this growth recovery ahead is very much anticipated and priced in at current levels. While I believe TXN definitely deserves to trade at a premium, considering its relatively low-risk profile and great market position and outlook, I can’t see enough room for upside or downside protection at current levels.

For reference, using the current FY27 EPS consensus and the 5-year average earnings multiple of 25.5x, I calculate an end-of-2026 target price of $240, translating into potential annual returns (CAGR) of just 4.5% or just over 7%, including dividends, which is in no way enough to warrant buying shares. You’d be better off buying an S&P500 ETF, and the risk would be far lower.

Now, this is just per indication and no valuation model worked out in great detail, but I don’t have to in order to conclude that at current valuation levels, the only way TXN shares are a good buy today is if medium-term results manage to blow away the consensus, but I see very limited room for this.

As a result, I am currently not looking to pick up additional shares, nor am I selling any shares. I currently hold a small number of TXN shares at far more attractive price levels, and I am happy to hold onto these, considering the company’s room for many more decades of growth.

Long-term, I absolutely adore TXN and its business model. This is one of the highest-quality businesses in the semiconductor sector.

However, at current prices, I don’t consider the investment case and potential returns attractive enough. Personally, at current projections, I am waiting for a pullback in the share price toward the $190 per share range.

For reference, here is what Wall Street thinks!

Looking to do your own stock analysis? Consider using StocksGuide, my go-to stock and business analysis tool. Check it out! Many of its features are free. (Note: this is an affiliate link)

If you enjoyed this format and would like to see similar posts in the future, please hit the like button, share your comments, and be sure to subscribe.

Really good and interesting deep dive, thanks.

I'm a big fan of TXN, but (as we've discussed before), given the automotive industry presence, I prefer companies with a stronger SiC / GaN foothold (despite the lower gross margins for these companies).

Your CapEx assessment is interesting to me. Are you aware of the stance Elliott Management took when they approached TI?

https://www.cnbc.com/2024/05/30/texas-instruments-txn-activist-elliott-fcf-alignment.html

My perception of this dialogue is that TI wanted to continue to invest bucketloads in CapEx, Elliott said, "are you sure you want to do this?", and TI then said, "maybe you're right, perhaps a FCF target is better". And dropped their CapEx plans.

As it happens, TI's CapEx was one of the things I called out in my deep dive of the Analogue Semiconductor industry, so I am glad to see this moderation, but it does make me wonder about the strategic direction of the TI BoM (if they can be persuaded to change their approach quite quickly by an activist).

Nonetheless, you are absolutely right - TI has been a titan for decades and is an incredibly strong company that I would be happy to hold if they had more SiC / GaN, were cheaper, and if I didn't already have holdings in the industry.