InvestInsights Portfolio Update - April 2024

Here is an updated look at my portfolio after a very chaotic March.

Last month was the worst month for the S&P500 since December 2022, with the index erasing over $3 trillion in value. Since mid-February highs, both the S&P500 and Nasdaq have entered correction territory as of the last day of March, losing more than 10% of their value.

The cause? Well, this is exactly what we started to see by the end of February… Most of it can be attributed to three factors:

President Trump is pushing ahead with his tariff plans, which are likely to cause a significant trade war, with trade partners eager to hit back. The result? Everyone comes out worse, with global trade declining, inflation edging higher, and economic growth slowing (Yeah, not a great backdrop for investors). However, it might be the uncertainty that hurts the worst. With tariffs changing by the day, nobody knows how to act accordingly, creating tons of uncertainty.

Subsequently, there are mounting worries over economic health. Lower trade activity, higher and more sticky inflation (due to higher prices from tariffs), and a struggling consumer… the economic outlook seems to be worsening by the day, especially the U.S. economic outlook. However, a poor U.S. economy most often translates into a poor world economy. Again, not a great backdrop.

Some sentiment gauges are showing their worst numbers since the 2008 financial crisis. (Bears are now clearly getting the upper hand in an overheated market.)

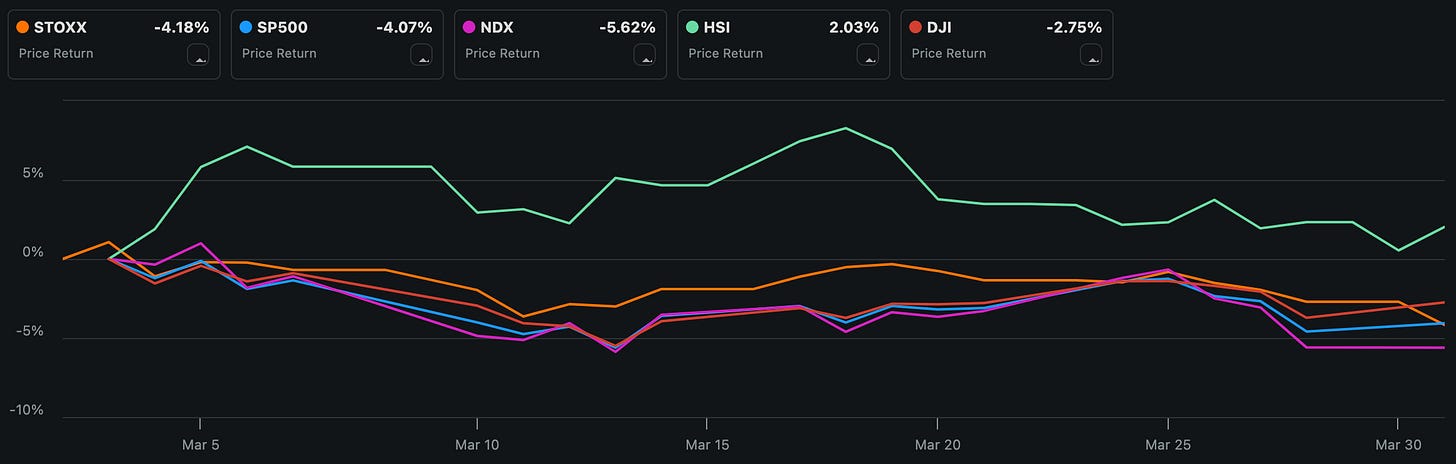

All things considered, the sell-off over the last 1.5 months is easy to explain and even easier to justify. Markets were already overheated, driven by over-optimism, and this has now come back to bite us in the ass. Here is how global indices performed in March:

Quite a tough month, especially for those heavily invested in tech. Here is the YTD performance:

S&P 500 → -4.59% 🔴

Nasdaq → -8.25% 🔴

Dow 30 → -1.28% 🔴

Stoxx Europe → 5.18% 🟢

Hang Seng → 17.67% 🟢

As clearly visible above, U.S. investors are having the hardest time so far in 2025, which is explained by the U.S. economy facing the most pressure right now. For once, investors in Europe and China are actually far better off. Especially China is doing really well YTD, driven by government stimulus and plenty of investors fleeing away from U.S. stocks.

Yet, as seen last month, European stocks also no longer seem to be immune to current concerns, as the European consumer will also be hit by upcoming tariffs, and European businesses are likely to feel pain from slowing global trade.

Furthermore, even though we have already seen quite a big sell-off over the last 1.5 months, with multiple indices in correction territory, at this point, if Trump and his trade partners move ahead and implement these announced and upcoming tariffs in full force, I can tell you there is still much more downside ahead for U.S. and European stocks, which are still trading at elevated levels.

A real worsening of the economy, higher inflation, and higher interest rates are still not fully priced in, let alone the growing odds of a U.S. recession. According to current calculations, a full-on trade war could lead to a 7% decline in the world economy.

Yes, I am really quite downbeat and cautious.

And yet, I have been a massive net buyer in March. In fact, my net buying activity was the highest in over 2 years, as I have deployed a significant portion of my cash pile.

Yes, I am not too positive on the economic outlook and prospects of the broader market, but as we see with every broader market sell-off, there are always plenty of great businesses being dragged down with it despite having very solid fundamentals or trading at attractive multiples.

In other words, driven by the broader sell-off, I fully benefitted from share price weakness in some of my core positions, picking up shares at prices I deem extremely attractive from a long-term perspective.

You see, I am not panicking, I am not selling, I am not instantly changing my approach or allocation strategy (you are generally behind the curve already, paying premiums). I am just buying up beaten-down shares in businesses I believe are great long-term investments, not matter whether a bottom is already in or not.

Don’t start overthinking, don’t panic, and stick to your strategy. As long as you have done your due diligence on all your holdings, you have nothing to worry about.

If done right, sell-offs are nothing but an opportunity.

On that note, let me get into my portfolio performance!

Alright, before getting to my portfolio performance, here is an overview of all my February posts, in case you missed any:

Taiwan Semiconductor ($TSM) – This is now an absolute bargain

Crowdstrike Holdings, Inc – Are shares finally a buy after a 30%+ drop?

Broadcom Inc. – Impressive but also heavily reliant on AI and hyperscaler CapEx

Here are two under-the-radar stocks that may be worth buying today!

Lam Research Corp. – I have just tripled my position in this brilliant compounder

Make sure to subscribe using the button above, and do not miss any future analyses.

March was my worst month since portfolio inception in January 2022

Indeed, my portfolio suffered in March, with a combination of a broader market decline, a tech sell-off, significant U.S. exposure, and a strengthening Euro leading to the worst month for my portfolio since its inception in January 2022.

For the month, my portfolio lost 11.77% of its value, a significant underperformance compared to the S&P 500, which is tough but not surprising. I have considerably more tech exposure and also endured the impact from a strengthening Euro.

You see, a considerable part of my investments is tied up in U.S. stocks and in dollars. Meanwhile, I calculate my returns in Euro’s, since I am located in Europe. Last month, this was a roughly a 400 bps headwind, with my portfolio in neutral FX losing just over 7%, performing much closer to the S&P 500, Europe, and outperforming the Nasdaq.

On top of this, my focus on tech didn’t help either, with some heavyweight tech holdings performing really poorly. Here are the biggest losers of last month:

The Trade Desk → -22%

Monday.com → -18%

Starbucks → -15%

Adyen → -15%

These were the best performers (yes, only two ended the month green):

AMD → +3%

Deutsche Telekom → +2%

Here is a performance overview by month and year for my portfolio, of which every detail is disclosed in these updates:

As shown above, this really poor month has also led to me now underperforming the S&P 500 by about 250 bps so far in 2025, of which most can be attributed to FX. For reference, excluding FX, my portfolio is only down 0.5% so far in 2025, 400 bps ahead of the S&P 500. Sometimes FX helps, like in 2024, but so far in 2025, it is not so great.

On a positive note, the longer-term performance of my portfolio does remain excellent, outpacing the S&P 500 by 19 percentage points since January 2022, which I think is still rather good. Even when accounting for a dark red 2022 and a red year so far in 2025, my portfolio still averages a 10% annual return (CAGR) at a very low risk profile.

On that note, let’s move to the actual portfolio.

The remainder of this article, including my portfolio allocation and monthly transactions, is for paid subscribers only. To access this and many more premium analyses and insights, please consider upgrading to our paid subscription tier (only $7.50 monthly or $70 annually).

In addition to all the free stuff, this also gets you access to:

Even more premium stock analyses (at least three per month).

Full access to my own portfolio allocation, transactions, and thoughts, including immediate trade alerts in the subscriber chat.

Receive a weekly Financial Market Briefing post on every monday to update you on last week’s biggest developments.

A full overview of all my price targets and ratings at the bottom of this article, updated monthly.

And even more!